1. Introduction

1.1. Background

ChatGPT, a chatbot program released on November 30, 2022 by OpenAI, an artificial intelligence research institute, is a natural language processing (NLP) model capable of continuous dialogue and integrated contextual content for communication.

The full name of ChatGPT is Chat Generative Pre-trained Transformer, which consists of four main components: Chain of Though; Ultra-large scale pre-trained models; Prompt/Instruction learning; and Prompt/Instruction learning); and RLHF (Reinforcement Learning from Human Feedback). ChatGPT can not only support high-frequency quantitative trading in the financial field, but also be applied to investment research and assist investment decisions. The combination of artificial intelligence and quantitative research can improve research efficiency and reduce error rates, while also effectively enhancing the credibility of research results.

It can be concluded that the explosion of new concepts has a profound impact on the stock prices of listed companies. By improving productivity, understanding customer needs and behavior, managing risk and innovating for growth, companies can increase profitability, revenue and stock prices. As a result, more and more public companies are applying ChatGPT to their business to improve competitiveness and innovation.

1.2. Purpose and Significance

With the continuous development of technology in China, the stocks of both state-owned and private companies related to the technology industry have been favored by many investors in recent years, and the stock market of technology companies has also been subject to considerable fluctuations with the introduction of some products that promote the development of the technology industry. In this paper, we take the impact of Chatgpt, a separate concept, on the stock prices of two companies, KDDI and CloudTech, as an example, and compare the trends of the two companies' car values before and after the chatgpt concept exploded in China for a period of time. Meanwhile, concept stocks like chatgpt, due to their special nature, are usually considered as hype type stocks in China in recent years, and the share prices of companies associated with these concept stocks mostly skyrocket for a period of time and then fall. In addition, investors tend to become very sensitive under the influence of such factors and are prone to blindly change the wind, coupled with the fact that some companies' announcements on whether they will carry out statements related to emerging technology industries are vague and easily mislead investors, so this article will explore the impact of the emergence of artificial intelligence products like chatgpt on the share prices of related industries from a factual and objective perspective, with the significance of helping investors and companies to make more reasonable decisions.

2. Literature Review

2.1. A Study of the Impact of Stock Prices of Artificial Intelligence Technology Companies

Xue Yanjie found through the results of measuring the level of technology absorption of listed companies in AI sector that AI technology absorption would promote the increase of R&D investment, which would promote the increase of company's share price [1]. Zhiwei Shen found that financial information has a significant effect on the stock price of AI sector and profitability indicators have the most significant effect on stock price volatility [2]. K.H. Lui. concluded that there is a negative impact of AI investment on the market value of the company through event study method The results of the study showed that investors perceive Al investment announcements as unwelcome news for most companies [3]. Adam M. Mahmood investigated how cloud computing adoption affects the stocks of 26 publicly traded cloud computing adoption companies study shows that cloud computing adoption companies experience positive cumulative abnormal returns during event announcements [4]. Zou Lu explored that the stock prices of FinTech concept stocks are influenced by investor attention and have a large growth potential [5]. Ao Rongze concluded from an empirical study that the enactment of relevant policies attracts increased investor interest in a sector, which leads to an increase in the share price of this sector, indicating that policy information causes some share price volatility [6].

2.2. Research on the Factors Influencing Stock Price Volatility

Wang found that stock heterogeneity has a dampening or facilitating effect on the ability of stock ownership ratio of securities investment funds to affect stock price volatility through the analysis of stock holdings affecting stock price volatility [7].

Huang used an event study approach to examine the effect of stamp duty on market return volatility and used a GARCH model on stock volatility to conclude that stock price volatility was greater with an increase in stamp duty on securities transactions than with a decrease in stamp duty on securities transactions [8]. Paul and Frank found through their study that growth was associated with stock market booms and was positively correlated [9]. Xie, Xia and Gao found that investor sentiment is a key factor influencing large fluctuations in stock prices, while asset prices affected by investor sentiment always overreact [10]. Mbutor found that: exchange rate fluctuations have a strong impact on the all-stock index, and a decline in the volume of bank loans can also cause a decline in stock prices [11]. The study by Mbanga et al. found that changes in investor sentiment are related to changes in attention, and that for medium and large stocks, the effect of attention on sentiment is transient, and that investor attention changes the predictability value of sentiment in total future returns, generally increasing market efficiency [12].

2.3. Comment

The above section provides a review of the research conducted by domestic and foreign scholars on the factors influencing stock price volatility.

Combining the above combinations, there is one aspect that influences the share price of AI technology companies respectively:

Firstly, Technology factors. Artificial intelligence companies through the development of their own technology and technology absorption, will lead to the improvement of the company's technology level, which will have a positive effect on the company's share price.

Secondly, Financial factors. The profitability indicators and financial information of a company have a significant impact on the share price of the company. If profitability indicators and financial information are positive, the company's share price will increase; if profitability indicators and financial information are negative, the company's share price will decrease.

Thirdly, Policy factors. When the country promulgates policies on technology companies, it will attract a large number of investors' attention and the share prices of related technology companies will fluctuate.

There are various factors that affect share price volatility, and this paper has summarized the main factors that affect the volatility of a company's share price by referring to the literature as follows:

Firstly, the company's operating conditions. Company operating conditions joint-stock company's business status and future development is the cornerstone of the stock price. Theoretically, the company's operating conditions are positively correlated with the stock price, with good operating conditions and rising stock prices;

Secondly, Company competitiveness. In any period and in any industry, the stocks of competitive companies are usually more likely to be recognized by investors; conversely, the prices of stocks of companies lacking competitiveness will fall.

Thirdly, exchange rate changes. If the trend of exchange rate changes has a more favorable impact on the country's economic development, the stock price will increase; on the contrary, the stock price will decrease. Just like Mbutor found that: exchange rate fluctuations have a strong impact on the all-stock index [11].

Fourthly, Investor sentiment. Investor sentiment and attention have a significant impact on stock price movements. Investor attention changes the predictability value of sentiment in future total returns and generally increases market efficiency.

3. Analysis of the Impact of ChatGPT on the Stock Price of KDDI and Yun Cong Technology

3.1. Analysis of KDDI

3.1.1. KDDI's Research Methodology

For the analysis of ChatGPT on KDDI stock price, this paper examines through short-term events. The cumulative abnormal returns (CAR) are used to reflect how ChatGPT affects KDDI. If we observe an increase in CAR directly around the date of a new event, we can directly indicate that the new event has a positive effect on KDDI; conversely, it is a negative effect.

3.1.2. KDDI Selection Period

The event period contains ex ante estimation window period and event window period. The estimated window period selected in this paper is 180 days, and the event window period is ±10 days (see Table 1).

Table 1: Estimation period and window period of ChatGPT emergence events.

Event Number | Ex-ante estimation period | Date of incident | Stock Trading Day | Event Window Period |

2 | March 7, 2022 - September 7, 2022 | January 20, 2023 | January 20, 2023 | January 6, 2023 - February 10, 2023 |

3.2. Analysis of Data Results

3.2.1. Regression Relationship between KDDI Stock Return and Shenzhen Component Index Composite Return

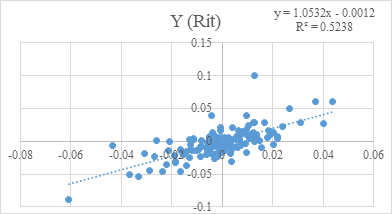

In this paper, we download the return of KDDI in the estimation window from the WAND database. The independent variable (X) is the daily return of the Shenzhen Component Composite Index, with the dependent variable (Y) being the daily return of KDDI, was subjected to linear regression analysis, resulting in the formula for the estimated period: y= 1.0532x - 0.0012 as follows:

Figure 1: KDDI expected return.

As shown in Fig.1, from the linear regression analysis, it can be concluded that there is a clear relationship between market risk and KDDI's individual stock returns, and there is a positive correlation.

3.2.2. Analysis of Excess Return (AR) and Cumulative Excess Return (CAR) Results

Shown in Table2 and Table 3: ChatGPT concept emerged on the CAR, AR results generated by KDDI stock price.

Table 2: KDDI Excess Return (AR).

Time t | Events | Time t | Events |

-10 | -0.016 | 0 | -0.024 |

-9 | -0.003 | 1 | 0.091 |

-8 | -0.002 | 2 | -0.017 |

-7 | -0.020 | 3 | 0.047 |

-6 | 0.002 | 4 | 0.001 |

-5 | -0.013 | 5 | 0.031 |

-4 | 0.042 | 6 | 0.106 |

-3 | 0.009 | 7 | -0.025 |

-2 | -0.003 | 8 | 0.000 |

-1 | 0.083 | 9 | -0.015 |

10 | 0.040 |

Table 3: KDDI Cumulative Abnormal Returns (CAR).

Time t | Events | Time t | Events |

-10 | -0.016 | 0 | 0.056 |

-9 | -0.020 | 1 | 0.147 |

-8 | -0.021 | 2 | 0.131 |

-7 | -0.041 | 3 | 0.177 |

Table 3:(continued).

-6 | -0.039 | 4 | 0.178 |

-5 | -0.052 | 5 | 0.209 |

-4 | -0.009 | 6 | 0.315 |

-3 | 0.000 | 7 | 0.290 |

-2 | -0.003 | 8 | 0.290 |

-1 | 0.080 | 9 | 0.275 |

10 | 0.315 |

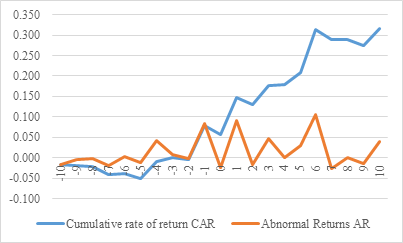

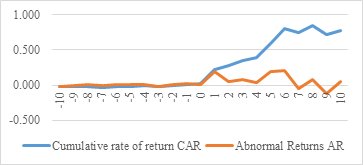

During the event window, a line graph is plotted based on the CAR and AR values of the stock price of KDDI at day t, with the values accumulated for the previous t days. As shown in Fig. 2:

Figure 2: ChatGPT concept emerged after the emergence of KUAR and CAR value trend.

3.3. Impact on Cloud from Technology

3.3.1. Research Methodology of Cloud From Technology

ChatGPT's impact on the stock price of CloudTech is studied in this paper through short-term events. The cumulative abnormal return (CAR) is used to reflect how ChatGPT affects Cloudflare. If we observe an increase in CAR directly around the date of a new event, we can directly indicate that the new event has a positive effect on Cloud Computing, and the opposite is true.

3.3.2. Analysis Steps

Cloud from Technology Selection Date. The estimated window is 123 days and the event window is ±10 days (see Table 4).

Table 4: Estimation period and window period of ChatGPT emergence events.

Event Number | Ex-ante estimation period | Date of incident | Stock Trading Day | Event Window Period |

2 | July 5, 2022 - November 7, 2022 | January 20, 2023 | January 20, 2023 | January 6, 2023 - February 10, 2023 |

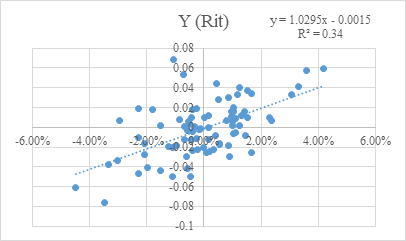

The regression relationship between the stock return of CloudTech and the composite return of Sci-Tech 50. In this paper, we downloaded the return of KDDI in the estimation window from investing.com. The independent variable (X) is the daily return of Techtron 50 and the dependent variable (Y) is the daily return of Techtron, and a linear regression analysis is performed to derive the formula for the estimation period: y = 1.0295x - 0.0015 as follows (shown in Fig.3):

Figure 3: Expected return from cloud computing.

Shown in Table5&6: Analysis of excess return (AR) and cumulative excess return (CAR) results. ChatGPT concept emerged on the CAR,AR results generated by the stock price of Cloud Computing.

Table 5: Cloud computing excess return (AR).

Time t | Events | Time t | Events |

-10 | -0.023 | 0 | 0.011 |

-9 | 0.000 | 1 | 0.199 |

-8 | 0.003 | 2 | 0.058 |

-7 | -0.007 | 3 | 0.073 |

-6 | 0.005 | 4 | 0.044 |

-5 | 0.006 | 5 | 0.200 |

-4 | 0.010 | 6 | 0.211 |

-3 | -0.015 | 7 | -0.049 |

Table 5:(continued). | |||

-2 | 0.010 | 8 | 0.087 |

-1 | 0.017 | 9 | -0.119 |

10 | 0.048 | ||

Table 6: Cloud Computing Cumulative Abnormal Returns (CAR).

Time t | Events | Time t | Events |

-10 | -0.023 | 0 | 0.017 |

-9 | -0.022 | 1 | 0.216 |

-8 | -0.019 | 2 | 0.274 |

-7 | -0.027 | 3 | 0.347 |

-6 | -0.022 | 4 | 0.391 |

-5 | -0.016 | 5 | 0.591 |

-4 | -0.006 | 6 | 0.801 |

-3 | -0.021 | 7 | 0.752 |

-2 | -0.011 | 8 | 0.839 |

-1 | 0.006 | 9 | 0.721 |

10 | 0.769 |

During the event window, a line graph is plotted based on the CAR and AR values of the stock price of KDDI at day t, with the values accumulated for the previous t days. As shown in Fig. 4:

Figure 4: ChatGPT concept appeared after the cloud from the technology AR and CAR value trend chart.

3.4. Analysis of the Car Value Trend of the Two Companies

3.4.1. Trend Analysis of KDDI Car Value

The analyzed chart shows that KDDI CAR is greater than zero and is on a continuous upward trend. It indicates that the fermentation of ChatGPT concept has positive implications for the stock price of KDDI.

The reason why ChatGPT concept has a boost to KDDI's cumulative rate of return (CAR) may be related to KDDI's own technology accumulation in AI companies for many years. It has deep technical accumulation in the field of Transformer neural network algorithm and AI algorithm needed for ChatGPT; KDDI also has a deep foundation in the application and data needed for ChatGPT, chip and arithmetic power and data arithmetic platform needed for ChatGPT. The combination of the above advantages, KU XUNFE released a statement shortly after the ChatGPT concept came out: "Chatgpt-like technology will be the first to land on AI learning machine products in May this year." The hot concept of ChatGPT combined with KU XUNFE's technical advantages in the field of artificial intelligence made investors pay more attention to KU XUNFE's stock. A large number of investors joined the market to raise the share price of KDDI.

Analysis shows that the ChatGPT concept has a positive contribution to KDDI's stock price.

3.4.2. Trend Analysis of the Car Value of Cloud Computing

From the trend of excess return (AR) and cumulative excess return (CAR) in the figure, we can see that the trend of CAR is relatively flat and fluctuates around the value of 0 before the event day t=0 of Cloud from Technology, but after the event day (t=0), there is an upward trend, and at t=13, CAR has a faster upward trend until t=17 when it gradually decreases slowly and stays at 0.800 fluctuation. In the period of t = [0,17], the AR value is higher than 0 and CAR still maintains the previous sharp upward trend, but after t=18, the AR value quickly drops below 0 and the CAR trend also gradually flattens out, and this good market reflection lasts for 7 days. After that, AR and CAR start to remain flat again. From the overall CAR trend before and after the event date in the figure, we can judge that the event brought a positive market effect.

A possible explanation for this effect is as follows:

For a period of time after the event may be due to various reasons such as information asymmetry, on the one hand, many investors may not have been informed of the event in a timely manner. On the other hand, investors still have uncertainty about the future of ChatGPT after its emergence.

(2) However, as more time passes after the disclosure, investors have more time to interpret the ChatGPT information. On the one hand, many investors believe that the emergence of ChatGPT concept can reverse the declining trend in terms of artificial intelligence segment, so they increase their investment in CloudTech AI segment, on the other hand, CloudTech company itself has a strong expectation of natural language processing (NLP) and strong human-machine collaboration layout similar to ChatGPT, investors have a strong expected ROI and expectation value for CloudTech and start to to increase their investment in CloudTech. As a result, a positive market effect was reflected only in the latter days of the event.

Analysis shows that the ChatGPT concept has a positive contribution to the stock price of Cloud Computing.

3.4.3. Comparative Analysis

Comparing the car values of KDDI and CloudTech, the car values of both companies are greater than 0. This means that the chatgpt concept has attracted a lot of capital for both companies after 3 months of fermentation, and around January 20, the event date, is a period when the chatgpt topic really exploded in China, while nearing the Chinese New Year in 2023, since then After the event day both companies have been showing an upward trend in car value and the upward trend curve is similar, with the previous smooth fluctuation showing different results.

4. Conclusion

4.1. KDDI's Opinion

From the results of the above analysis, it is concluded that KDDI CAR is greater than zero and is in a continuous upward trend. So the fermentation of ChatGPT concept has positive implications for the stock price of KDDI. Although the stock price of KDDI is rising, there are many problems with its company.

Problem 1: Marketing is raw and the experience is chicken-hearted. In the product launch of KDDI, KDDI often uses advanced technology as the selling point of the product, and consumers think that KDDI has come out with some king bomb level products again. But unfortunately, there are many products after consumers use them, the user experience is not satisfactory.

Problem 2: The ability of science and technology research and innovation has declined, and there are not enough technical barriers formed. It is undeniable that KDDI had a high moment of innovation in its history, but right now, the most critical problem besetting KDDI is that it has not formed enough technical barriers. In recent years, KDDI has been relatively lacking in product innovation and technical innovation, and there are no surprise single products.

Problem 3: Lower profit income, failure to find a brand new profit growth breakthrough, and over-reliance on government subsidies.

4.2. Recommendations for KDDI

(1) Study Microsoft, the key to Microsoft's ability to maintain strong profitability lies in its irreplaceable technological innovation power. Therefore, KDDI should improve its technological innovation, especially in the core technology of human-computer interaction interface. The high technical barriers not only contribute to the long-term profit growth rate of the company, but also form its own sufficient technical barriers to improve its profitability.

(2) Improve the product power, adopt more opinions and suggestions from consumers to enhance the experience power of the product. KDDI should actively listen to the comments made by users and actively correct and improve these comments.

(3) Establish a good brand image so as to form a brand effect. Use good products, advanced technology, and increase the publicity of the brand to establish a good brand image, so as to form a brand effect.

4.3. Cloud from Technology's Comments

Through the above analysis of the CAR value of Cloud Computing, the analysis shows that the ChatGPT concept has a positive contribution to the stock price of Cloud Computing.

ChatGPT concept has a significant short-term abnormal impact on the stock of Cloud from Technology, which is reflected in: 1. The stock price trend, ChatGPT concept has a positive promotion effect on the short-term abnormal of Cloud from Technology stock; 2. ChatGPT concept has a greater impact on the stock price of Cloud from Technology concentrated in the period from July 21, 2022 to August 4, 2022. It can be initially judged that the stock is more influenced by ChatGPT concept, and the company should focus on developing ChatGPT business instead of focusing mainly on traditional business. Based on the short term abnormal impact of ChatGPT concept on Cloud from Technology, Cloud from Technology has the potential to develop ChatGPT business.

Although this round of surge in CloudTech's share price cannot be separated from the market's hype on the ChatGPT concept, the company itself is not involved in the related business.

This shows that the whole industry is still in the early stage of growth, and the enterprises have invested heavily in R&D in the early stage, but the technology is still not mature enough, resulting in low user acceptance and small market scale, and the company has not achieved corresponding results in the NLP concept.

Through the current profitability challenges faced by cloud from the technology concluded that the company also needs to optimize the process, compress key costs, improve technology and sink the market.

4.4. Recommendations for Cloud Computing

(1) Strengthen the introduction and cultivation of talents: talents in the field of artificial intelligence are very scarce, and Cloud from Technology Ltd. can improve the technical strength and competitiveness of the company by strengthening the introduction and cultivation of talents.

(2) Expanding application scenarios: Cloud from Technology Co., Ltd. can consider expanding application scenarios, such as smart home, smart medical, smart transportation and other fields. And it can be combined with ChatGPT to broaden the application scenarios.

(3) Strengthen cooperation with other companies and organizations: In the current era of rapid information dissemination, companies should focus on developing ChatGPT business. There are not many companies with quality ChatGPT technology in the current market. When ChatGPT technology is not yet mature, it can take advantage of its own technology to provide better services, attract more customers and realize the sinking of products while ensuring service quality.

(4) Cloud from the technology needs to adjust its own financial situation. The company should make financial planning according to the actual situation of the company itself. At present, there are still more problems in CloudTech, the company needs to continue to improve its business system, improve its R&D capability, broaden its financing channels, enhance its profitability and other measures to improve its strength, and make future development plans according to its own development situation.

References

[1]. Xue,Y.: Research on the impact of technology absorption on stock price of listed companies in artificial intelligence sector [D]. Donghua University (2022).

[2]. Shen,Z. :An empirical study on the factors influencing the stock price volatility of artificial intelligence sector [D]. Shanghai University of Finance and Economics (2021).

[3]. Ariel K. H. Lui,Maggie C. M. Lee,Eric W. T. Ngai.: Impact of artificial intelligence investment on firm value[J]. Annals of Operations Research, (2021) (prepublish).

[4]. MA Mahmood, F Arslan, J Dandu, G Udo.: Impact of cloud computing adoption on firm stock price.An Empirical Research , (2014) (prepublish).

[5]. Zou,L. :Research on the impact of investor attention on stock price volatility of fintech concept stocks [D]. Hunan University (2020).

[6]. Ao,R.: Research on the impact of artificial intelligence policy information on stock price fluctuation of related companies [D]. Guangdong University of Finance and Economics (2021).

[7]. Wang, H. X., Lin, J. Y.:Analysis of stock price volatility affected by securities investment fund holdings[J]. China Industry and Economics (06), 88-90 (2023).

[8]. Huang,D.: An empirical study on the impact of stamp duty on securities transactions on stock prices [D]. Capital University of Economics and Business, (2017).

[9]. Paul,B., Franck,P.: Stock Prices, News, and Economic Fluctuations[J]. The American Economic Review 96(4), (2006).

[10]. Xie,J., Xia,W.,Gao,B.: The sustainability of stock price fluctuations: Explanation from a recursive dynamic model [J]. PloS one 16(8), (2021).

[11]. Adeoti, J. O., Adebis, D. G.: Exchange Rate Volatility, Stock Prices Movement and Aggregate Output in Nigeria[J]. Advances in Social Sciences Research Journal 5(12), (2018).

[12]. Cedric,M., Ali F. D., Jung,C. P.: investor sentiment and aggregate stock returns: the role of investor attention[J]. Review of Quantitative Finance and Accounting 53(2), (2019).

Cite this article

Chen,Q.;Yang,Z.;Zhong,Y. (2023). The Impact of Chatgpt Concept on the Share Price of Listed Companies. Advances in Economics, Management and Political Sciences,33,61-72.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Xue,Y.: Research on the impact of technology absorption on stock price of listed companies in artificial intelligence sector [D]. Donghua University (2022).

[2]. Shen,Z. :An empirical study on the factors influencing the stock price volatility of artificial intelligence sector [D]. Shanghai University of Finance and Economics (2021).

[3]. Ariel K. H. Lui,Maggie C. M. Lee,Eric W. T. Ngai.: Impact of artificial intelligence investment on firm value[J]. Annals of Operations Research, (2021) (prepublish).

[4]. MA Mahmood, F Arslan, J Dandu, G Udo.: Impact of cloud computing adoption on firm stock price.An Empirical Research , (2014) (prepublish).

[5]. Zou,L. :Research on the impact of investor attention on stock price volatility of fintech concept stocks [D]. Hunan University (2020).

[6]. Ao,R.: Research on the impact of artificial intelligence policy information on stock price fluctuation of related companies [D]. Guangdong University of Finance and Economics (2021).

[7]. Wang, H. X., Lin, J. Y.:Analysis of stock price volatility affected by securities investment fund holdings[J]. China Industry and Economics (06), 88-90 (2023).

[8]. Huang,D.: An empirical study on the impact of stamp duty on securities transactions on stock prices [D]. Capital University of Economics and Business, (2017).

[9]. Paul,B., Franck,P.: Stock Prices, News, and Economic Fluctuations[J]. The American Economic Review 96(4), (2006).

[10]. Xie,J., Xia,W.,Gao,B.: The sustainability of stock price fluctuations: Explanation from a recursive dynamic model [J]. PloS one 16(8), (2021).

[11]. Adeoti, J. O., Adebis, D. G.: Exchange Rate Volatility, Stock Prices Movement and Aggregate Output in Nigeria[J]. Advances in Social Sciences Research Journal 5(12), (2018).

[12]. Cedric,M., Ali F. D., Jung,C. P.: investor sentiment and aggregate stock returns: the role of investor attention[J]. Review of Quantitative Finance and Accounting 53(2), (2019).