Volume 178

Published on May 2025Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

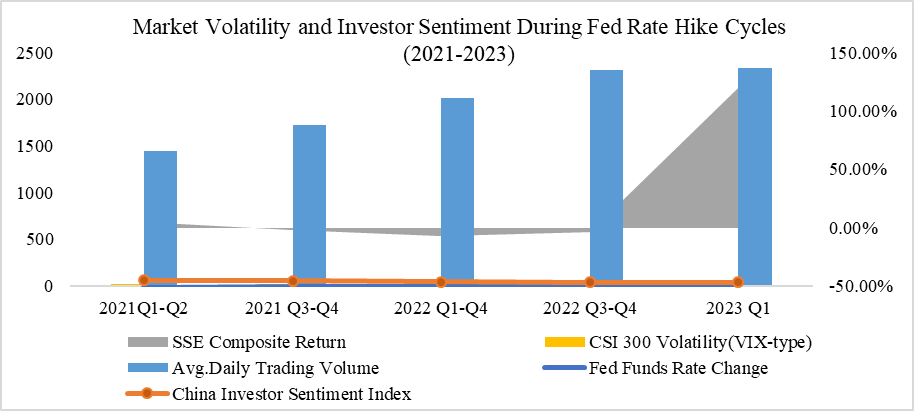

In recent years, the Federal Reserve's monetary policy decisions, especially changes in interest rates, have had profound spillover effects on global financial markets. The Chinese capital market also showed some fluctuations during this period. With the development of behavioral finance, the theory of psychological accounts has been proven to play an important role in the capital market. At the same time, psychological accounts influence market decisions by influencing investor psychology, causing changes in the market. Based on this, this article adopts a literature review method and focuses on exploring the impact of changes in the Federal Reserve interest rate on the performance of investors in the Chinese market from the perspective of psychological accounts. In addition, by reviewing existing research findings, this article evaluates the response of Chinese investors to the US interest rate hike, with a focus on how psychological biases such as loss aversion and psychological accounting affect investment decisions. This study examines the results of various studies to understand the broader impact of interest rate changes on the Chinese financial market, with a particular focus on behavioral finance theory. Finally, this article provides recommendations for Chinese investors and offers insights into future research on the intersection of global monetary policy and investor psychology.

View pdf

View pdf

In recent years, with the continuous advancement of science and technology, emerging technologies such as artificial intelligence have led to significant breakthroughs. At the enterprise level, the digitalization of work and production processes has consequently improved. However, the increase in digitalization has brought new challenges and difficulties to enterprise management. This paper takes Haier as an example to study the challenges brought by digitalization in management organization and the ways to improve. The challenges of digitalization lie in the surge in personalized demands and the higher requirements for employees. Through an analysis of the "Rendanheyi" model, it is revealed that enterprise management models should focus on flexibility, stimulate employee initiative, and emphasize communication with customers.

View pdf

View pdf

The rapid development of financial technology has promoted the digital transformation of rural commercial banks, which is crucial to enhance competitiveness, support "agriculture, rural areas and farmers" as well as rural revitalization. Therefore, this paper attempts to explain the impact of digital transformation on rural commercial banks, and provides optimization measures. Based on the financial data of rural commercial banks from 2013 to 2023, this paper uses a multiple linear regression model to explore the impact of digital transformation on them. It is found that digitalization and cost-income ratio have negative effects on ROA in the short term, but in enterprises with good cost control, digitalization can improve profitability. Non-interest income has had a significant negative impact on ROA in recent years, and reliance on a single source of income may weaken earnings. The findings suggest to strengthen cost control, promote income diversification and government support, and provide guidance for the digital transformation of rural commercial banks.

View pdf

View pdf

In the context of global economic fluctuations and financial market transformations, this paper discusses how changes in the macroeconomic environment systematically affect the dynamic adjustment mechanism of the actuarial interest rate of the insurance market. The study found that macroeconomic variables affect actuarial interest rates by changing inflation, factor markets, etc., and significantly affect the pricing decisions of insurance companies. In the major fields of economy and finance, people have never stopped macroeconomic research and deeply discuss actuarial interest rates. With the diversification of today's market, some tiny macroeconomic factors will also cause major changes in insurance market. For example, the decline in unemployment and inflation will lead to an increase in actuarial interest rates, and exchange rate fluctuations and economic policies will also cause changes in actuarial interest rates. Furthermore, the reserves, product pricing and risk management in the insurance market will also change accordingly. With these conclusions, we have a theoretical basis for the accurate control of the insurance market, so as to make more favourable decisions.

View pdf

View pdf

The electronic game is a diverse and wide-influence industry since the first model was developed by Magnavox Corporation in 1972. With new technology advancement and demands from emerging game market, first generation of console (Color TV-Game 6 in 1977, PlayStation 1 in 1994, SG-1000 in 1983 and Xbox in 2001) came out at the end of 20th century. This paper explores the multifaceted approaches and strategies Sony Interactive Entertainment (SIE) has employed to maintain and expand PlayStation's market share globally. Key elements of the strategy include leveraging exclusive game titles, fostering a strong brand community through events like the PlayStation Experience, and capitalizing on innovative technology with each console iteration. Additionally, the study examines PlayStation's adapt use of digital marketing tools, such as social media engagement, influencer partnerships, and strategic collaborations for cross-media exposure. The paper also delves into PlayStation's approach to market segmentation, targeting diverse demographics through varied gaming experiences, and adapting to the evolving landscape of digital distribution and cloud gaming. Through the application of SWOT and STP theories, this study analyzes these strategies and concludes that PlayStation should sustain its strengths in exclusive games, cloud gaming, and console performance. Additionally, it is imperative for PlayStation to mitigate over-reliance on exclusive game studios, with a heightened focus on game playability and the cultivation of its brand ecosystem.

View pdf

View pdf

Behavioral finance combines disciplines such as psychology, behavior, and sociology to reveal the irrational behavior of investors in the decision-making process and its impact on the financial market. This article explores the impact of behavioral finance on investment decisions from the perspectives of cognitive biases, emotional fluctuations, and market anomalies. Mainly using qualitative research methods, relying on the synthesis and analysis of existing literature and theoretical frameworks to draw conclusions and propose future research approaches. It analyzes key concepts such as overconfidence, anchoring effects, loss aversion, and psychological account theory, and points out the shortcomings and future directions of current research. Research has shown that investors' psychological biases and emotional fluctuations significantly affect their decision-making behavior, leading to market anomalies and price fluctuations. This article also explores the interactive relationship between financial literacy and behavioral finance, emphasizing the importance of improving financial literacy and correcting behavioral biases to promote stability and efficiency in financial markets.

View pdf

View pdf

With the continuous growth of China's economy and the upgrading of residents' consumption, the demand for spiritual and cultural consumption has significantly increased. As an emerging consumption form, trendy toy blind boxes leverage the marketing model of "uncertainty of unboxing" andhave achieved a market scale of more than 40 billion yuan in 2023, with an annual compound growth rate of over 30%. Pop Mart, the leading enterprise in the industry, has achieved 12 million annual active users and a repurchase rate of 50% in 2024 through IP operation and scene innovation. However, the deep-seated motives behind consumers' behavior of purchasing blind boxes have not been fully explored. Taking Pop Mart as a case study, this research uses the questionnaire survey method to collect valid sample data, and combines the 4P marketing theory and the PEST analysis framework to systematically explore the core driving factors of blind box consumption. The research findings indicate that the core driving factors for consumers to purchase blind boxes are numerous. In terms of products, the rich and diverse IP images and unique designs meet the needs of personalized aesthetics. The stratified pricing stimulates the desire to buy. The integration of online and offline channels expands the convenience of purchasing. Promotion strategies such as limited editions and co-branded products trigger a rush to buy. In the macro environment, policy support, economic growth, society's demand for novel entertainment, and technological assistance jointly drive the growth of blind box consumption.

View pdf

View pdf

In the context of the boom in blockchain technology since 2008, the range of applications for smart contracts, which were first introduced in 1995, has been expanding. Their development, however, has been hampered by legal issues. The legal research on smart contracts is of great significance. Theoretically, it challenges and enriches the traditional contract theory and legal system. From a practical point of view, it helps regulate its application and protect the rights of parties in various fields such as finance and supply chain. This article delves into the legal nature of smart contracts, analyzing their relevance to traditional contract elements such as offers and acceptance. It also discusses the protection difficulties such as the difficulty of contract modification, the difficulty of contract rescission and the difficulty of contract validity. Suggested solutions include incorporating it into the existing legal system and using soft law for regulation. In summary, although smart contracts face challenges, with the development of technology and the improvement of laws, their intelligent development prospects are broad, and will drive social innovation.

View pdf

View pdf

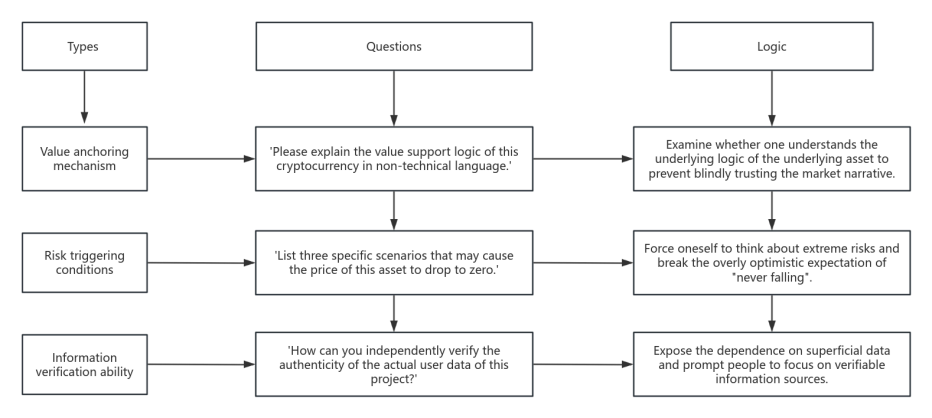

Behavioral finance suggests that overconfidence leads investors to overestimate their capabilities and misjudge market noise; the herd effect triggers group irrationality through social media emotional contagion, exacerbating decision-making failures. This study explores the decision-making bias of individual investors due to overconfidence and herd effect in retail-dominated markets, analyses its mechanism of action, and proposes non-quantitative intervention tools. This paper reviews a lightweight toolkit: a cognitive self-assessment scale enforcing pre-trade answers to core risk questions reduces average LUNA event losses by 52%; an emotional firewall that monitors social platform buzzwords and triggers a cooling-off period improves measured trade cancellation rates by 72%; and a decision review template comparing buy rationale with actual results reduces repeat error rates by 61%. The toolkit significantly reduces the frequency and volatility of irrational trades (28% annualized reduction). The research constructs a ‘cognitive-emotional-behavioral’ three-stage intervention model, which transforms behavioral finance theory into a practical decision-blocking tool, providing investors with self-help solutions and regulators with a basis for optimizing market regulations.

View pdf

View pdf

The integration of Environmental, Social, and Governance (ESG) factors into investment decision-making has gained significant attention in recent years. This paper investigates the impact of ESG factors on financial decision-making through the methods of literature review and theoretical analysis. It reviews the theoretical foundations of ESG investment, exploring its relationship with some financial models such as Modern Portfolio Theory (MPT) and multi-factor asset pricing models, and examines the role of ESG disclosures in shaping investor behavior, with a focus on both individual and institutional investors. Furthermore, the study analyzes the mechanisms through which ESG factors influence corporate financial performance and risk management, highlighting their impact on cost of capital, credit ratings, and firm valuation. In addition, the paper discusses regulatory frameworks and government policies that drive ESG adoption in global financial markets. As a result, this thesis finds that ESG factors generally have a positive correlation with corporate management decisions and investors' investment behaviors. The findings underscore the growing importance of ESG in corporate strategy and investment practices, reinforcing its role in promoting sustainable and responsible financial markets.

View pdf

View pdf