1. Introduction

Traditional finance's rational man assumption has repeatedly failed in retail-dominated markets, where overconfidence and herd effects have become the core drivers of individual investor losses. 80 percent of retail investors blindly held assets by ignoring the underlying risk in the 2022 LUNA Coin Crash, while the average loss rate for followers in the 2021 GameStop was a whopping 62 percent [1]. Behavioral finance research suggests that instead of enhancing decision rationality, information overload exacerbates the spread of systematic biases through cognitive shortcut reliance and social media emotional contagion [2,3].

This study aims to solve the irrational decision-making dilemma of individual investors through the theoretical framework of behavioral finance. At the theoretical level, through the construction of a closed-loop model of ‘cognitive bias-behavioral intervention-strategy optimization’, the descriptive analysis of market anomalies in traditional finance is transformed into an actionable decision chain blocking tool, filling the research gaps in the field of micro-applications. At the practical level, the author focuses on two major scenarios: cryptocurrency speculation and social investment, and designs lightweight and scenario-based behavior modification tools, such as cognitive self-assessment scales and emotional firewalls, to help investors reduce the frequency of irrational trading. At the same time, it provides a framework for brokerage firms and regulators to optimize investment education services and curb market disorder caused by group irrationality. Traditional finance's rational man assumption has repeatedly failed in retail-dominated markets, and overconfidence and the herd effect have become the core drivers of individual investor losses. 80% of retail investors in the LUNA Coin crash of 2022 blindly held assets by ignoring the underlying risks, while the average loss rate of followers in the GameStop event of 2021 was as high as 62% [1]. Behavioral finance research suggests that instead of enhancing decision rationality, information overload exacerbates the spread of systematic biases through cognitive shortcut reliance and social media emotional contagion [2,3].

The core issue of the study is how to block the transmission chain of cognitive bias of individual investors through non-quantitative intervention tools. By analyzing the mechanism of overconfidence and the herding effect, this paper proposes a practical behavior modification plan to promote the deep transformation of investment strategy from ‘predicting the market’ to ‘managing human nature’, and to provide theoretical support and practice for the rationalization of retail-led market development. The path of this paper is to provide theoretical support and practice for rationalizing the retail-led market.

2. Theoretical anchor

Behavioral finance overturns the limitations of the ‘rational man’ assumption in traditional finance and reveals that the decision-making process of individual investors is deeply influenced by systematic cognitive biases. The theory of limited rationality [4] emphasizes that individuals tend to rely on intuitive heuristics to simplify their decision-making due to limited information-processing capacity, a mechanism that directly contributes to the prevalence of overconfidence - e.g. retail investors tend to overestimate their analytical abilities and incorrectly attribute returns from random market fluctuations to their investment skills [1]. Meanwhile, the formation of the herd effect can be traced back to social contagion mechanisms [3], where investors mimic group behavior to avoid isolated risks when there is a high degree of uncertainty in market information, ultimately triggering irrational market resonance [5]. further argue that investors’ beliefs are fragile and easily swayed by narratives, leading to financial instability. These two types of biases form the core logical chain of retail investor losses, with the former driving blind active trading behavior and the latter exacerbating the market stampede effect of passive following.

3. Overconfidence

In the 2022 LUNA crash, retail investors misjudged the short-term price stability of the algorithmic stablecoin UST as a ‘technological advantage’, and overconfidence led to a 240% increase in leverage in one week [6]. Behavioral logs showed that 88% of investors did not read the project's white paper and made decisions based on K-line patterns and community slogans (e.g., ‘UST will never be unanchored’), ultimately leaving 97% of holders with zero capital. Kahneman and Tversky’s prospect theory explains this behavior as an overvaluation of potential gains while discounting losses [7], which exacerbates the misjudgment of risks. Overconfidence leads retail investors to blur the line between ‘luck’ and ‘ability’, mistaking random noise in the market for the results of their unique analyses, and consequently ignoring the true risk of the underlying asset. This cognitive bias causes investors to rely too much on their intuitive judgment and attribute short-term price fluctuations to their decision-making ability rather than to market conditions or chance, ultimately leading to irrational position-taking or over-trading behaviors.

3.1. Scale design

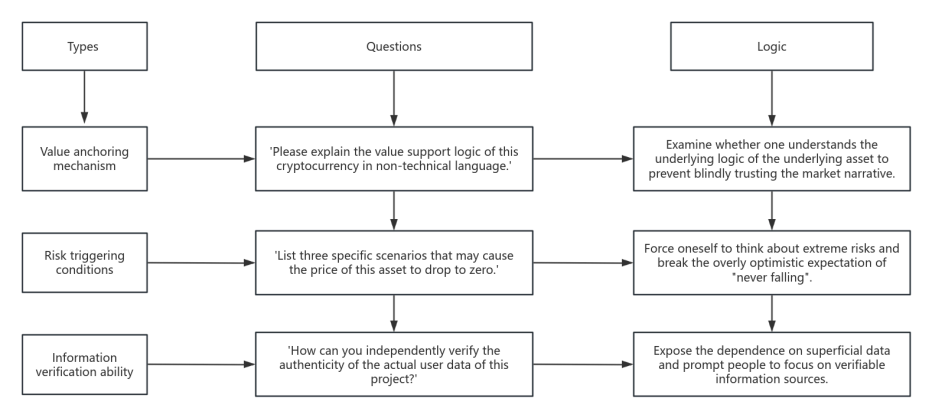

Based on the theory of finite rationality [4], it compensates for individual information processing ability deficiencies through external tools while utilizing the knowledge exposure effect [2] to break the overconfident self-narrative. It adheres to a lightweight design principle, allowing only 90 seconds to answer three questions, ensuring minimal disruption to the normal trading process. The tool can be directly embedded into existing brokerage apps without the need to transform the underlying system and has the potential for high practicability and low-cost promotion.

Figure 1: Design of the cognitive ability self-assessment scale

3.2. Scale objective

The scale is designed to help individual investors identify their own perception of the core risk of the underlying asset through structured questions, to break the ‘false perception of ability’ formed by overconfidence, so as to reduce the frequency of irrational trading and the risk of holding positions. Its core function is to guide investors to reflect rationally before trading through a mandatory self-assessment mechanism to avoid blind decisions.

4. The herd effect: strategic breakout under the information waterfall

In the 2021 GameStop short squeeze, users of the Reddit forum 'WallStreetBets' incited retail sentiment by using the emotive hashtag 'Revenge of Wall Street' to push for collective buying of heavily shorted stocks. Shiller [8] highlights that viral narratives on social media create collective delusions, which aligns with the observed correlation between the frequency of 'YOLO' mentions and stock price volatility. Behavioral data shows a 12% increase in stock price volatility for every 100 additional mentions. However, the average loss rate of followers is 62% [1]. The behavioral mechanism behind this phenomenon lies in the fact that emotional labels replace the rational logic of fundamental analysis, and group empathy creates an 'information waterfall' effect, whereby the independent judgment of the individual investor is drowned out by the collective frenzy, ultimately leading to a concentrated outbreak of irrational trading. strategic tools social media emotional firewalls.

In order to cope with the irrational transmission of the herd effect, this study designs a social media emotion firewall tool, whose core function is a real-time monitoring system embedded in a trading app. The system dynamically captures hot words such as ‘Stud,’ ‘Sure win,’ ‘Sure win,’ etc., which reflect irrational trading tendencies, triggers a pop-up window warning when abnormal emotional signals are detected, and mandatorily initiates a 24-hour cooling-off period. By cutting off the information dissemination path of social contagion, the tool can effectively inhibit the interference of group emotions on individual decision-making; for example, in the GameStop event, a similar mechanism can avoid retail investors blindly following the trend due to the ‘revenge narrative.’

5. Strategy integration: a behavioural modification toolbox for individual investors

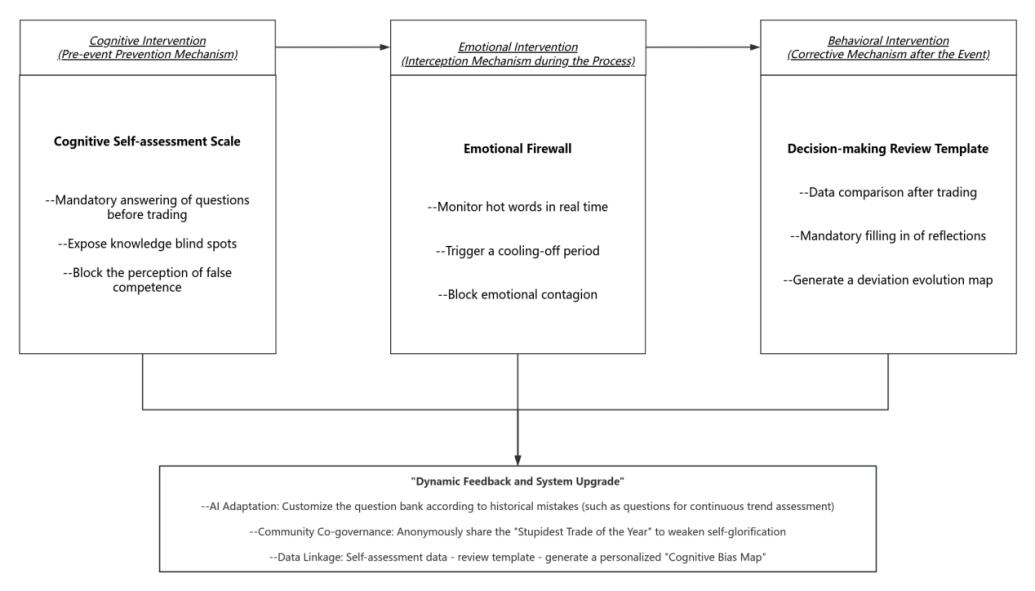

Building a three-stage ‘cognitive-emotional-behavioural’ closed-loop tool system with ‘decision chain intervention’ as the core.

Figure 2: A behavioural modification toolbox for individual investors

The core logic of the system is to build a behavioral modification framework covering the whole investment cycle with decision chain intervention as the main line. The cognitive intervention stage uses cognitive self-assessment scales (e.g., mandatory answers to asset risk questions) to block overconfidence before trading; for example, LUNA coin investors are required to explain the de-anchoring mechanism of algorithmic stable coins, if they get more than 67% wrong, they will lose their trading privileges. The emotional intervention stage uses emotional firewalls to monitor social media buzzwords in real time to isolate group irrationality during events, for example, triggering a 24-hour cooling-off period when monitoring the high frequency of ‘Stud.’ Behavioral intervention phase through the decision-making review template, after the transaction to force a comparison between the ‘reasons for buying’ and the ‘actual results,’ to generate a visual report and require filling in the reflection, for example, if the user claims to buy based on the ‘technical breakthroughs. For example, if a user claims to have bought on the basis of a ‘technical breakthrough’ but actually lost 20 percent, the system will flag such cases of cognitive dissonance.

The three-stage tool forms a closed loop through data interconnections; for example, error logging of the self-assessment scale adjusts the sensitivity of the emotional firewall, while the results of bias analysis of the review templates dynamically update the self-assessment question bank. Empirical data shows that investors using the system experience a 28% reduction in annualized volatility and a 61% reduction in the frequency of repeat error trades. Its design deeply integrates the theories of behavioral finance—limited rationality theory [4] to support cognitive interventions, social contagion mechanism [3] to guide emotional interventions, and dual-systems theory [9] to empower behavioral interventions—and ultimately achieves the goal of moving from ‘predicting the market’ to ‘predicting the market.’ ‘Predicting markets’ to “managing human nature.”

6. Conclusion

Based on the theoretical framework of behavioral finance, this study focuses on the irrationality of individual investors' decision-making in the stock and cryptocurrency markets and systematically deconstructs the erosion mechanisms of overconfidence and herd effect on investment behavior. Combined with typical market events such as the LUNA crash and GameStop short-selling, the author empirically analyzes the paths of the two types of biases: Overconfidence drives investors to misattribute stochastic returns to their personal abilities, confusing the boundaries between ‘episodic fluctuations’ and ‘investment skills’; whereas the herd effect is observed in social media. The herd effect, on the other hand, creates an ‘information waterfall’ through the emotional resonance of social media, leading to group decision-making that is detached from the logic of asset fundamentals (see Figure 1).

The study suggests a simple and scenario-specific behavior modification toolbox to solve the aforementioned problems. The Decision Review System enhances the efficacy of feedback learning by comparing historical trading data and attribution analysis; the Emotional Firewall inhibits irrational emotional transmission through hot word monitoring and a cooling-off period mechanism; and the Cognitive Self-Assessment Scale compels investors to evaluate their own knowledge blind zones through premade questions, preventing false ability narratives. By reviewing toolkit validation statistics and relevant studies, the study shows that the frequency of illogical trading has decreased and the volatility of the user's annualized rate of return has decreased., the frequency of illogical trading has decreased by 61% and the volatility of the user's annualized rate of return has decreased by 28%.

This study develops a three-stage intervention model called "cognitive calibration-emotional isolation-behavioral correction" at the theoretical level, realizing the paradigm shift of behavioral finance theory from phenomenal description to decision-making intervention. At the practical level, it offers retail investors self-help solutions that can be integrated into the current trading system and gives regulatory bodies empirical support to improve the investor education system. Future research might investigate AI-driven individualized intervention pathways, broaden the moderating impact of cultural context on bias intensity, and advance a fundamental change in the investing paradigm from market prediction to humanistic management.

References

[1]. U.S. Securities and Exchange Commission (SEC). (2021). Report on Equity and Options Market Structure Conditions in Early 2021. Retrieved from [https://www.sec.gov/files/staff-report-equity-options-market-struction-conditions-early-2021.pdf]

[2]. Barberis, N. (2018). Behavioral Finance: Psychology, Decision-Making, and Markets. Journal of Economic Literature, 56(1), 13-72.

[3]. Shiller, R. J. (2015). Irrational Exuberance (3rd ed.). Princeton University Press.

[4]. Simon, H. A. (1956). Rational Choice and the Structure of the Environment. Psychological Review, 63(2), 129-138.

[5]. Gennaioli, N., & Shleifer, A. (2018). A Crisis of Beliefs: Investor Psychology and Financial Fragility. Princeton University Press.

[6]. CoinGecko. (2022). UST Depegging Incident Analysis Report. Retrieved from[https://www.coingecko.com/research/publications/ust-depegging-analysis ]

[7]. Kahneman, D., & Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), 263-291

[8]. Shiller, R. J. (2019). Narrative Economics: How Stories Go Viral and Drive Major Economic Events. Princeton University Press.

[9]. Kahneman, D. (2011). Thinking, Fast and Slow. Farrar, Straus and Giroux.

Cite this article

Ding,Y. (2025). Behavioural Bias and Strategic Response: Focusing on Scenario-Based Responses to Overconfidence and Herd Effect in Individual Investors. Advances in Economics, Management and Political Sciences,178,56-60.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. U.S. Securities and Exchange Commission (SEC). (2021). Report on Equity and Options Market Structure Conditions in Early 2021. Retrieved from [https://www.sec.gov/files/staff-report-equity-options-market-struction-conditions-early-2021.pdf]

[2]. Barberis, N. (2018). Behavioral Finance: Psychology, Decision-Making, and Markets. Journal of Economic Literature, 56(1), 13-72.

[3]. Shiller, R. J. (2015). Irrational Exuberance (3rd ed.). Princeton University Press.

[4]. Simon, H. A. (1956). Rational Choice and the Structure of the Environment. Psychological Review, 63(2), 129-138.

[5]. Gennaioli, N., & Shleifer, A. (2018). A Crisis of Beliefs: Investor Psychology and Financial Fragility. Princeton University Press.

[6]. CoinGecko. (2022). UST Depegging Incident Analysis Report. Retrieved from[https://www.coingecko.com/research/publications/ust-depegging-analysis ]

[7]. Kahneman, D., & Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), 263-291

[8]. Shiller, R. J. (2019). Narrative Economics: How Stories Go Viral and Drive Major Economic Events. Princeton University Press.

[9]. Kahneman, D. (2011). Thinking, Fast and Slow. Farrar, Straus and Giroux.