Volume 192

Published on June 2025Volume title: Proceedings of ICMRED 2025 Symposium: Effective Communication as a Powerful Management Tool

China has been a case study of economic success based on recent rapid economic growth, which, according to the GIS mapping data, has shown huge disparities in the regional development of healthcare facilities. The eastern coastal regions disproportionally share the benefit of the developments, while the western and central regions remain relatively underserved. This study proposes to investigate the dynamics influencing this relationship as they affect the availability of specialty professionals, hospital bed capacity, and state-of-the-art diagnostic equipment. The study uses national health statistics and peer-reviewed studies in a mixed-method approach to undertake a correlation analysis and make sense of the data. The study will rely on source materials using a literature review to understand what drives investment in healthcare resources and how to overcome barriers creating unequal access to healthcare resources. The study also intends to use the results to inform on strategies that could be adopted in these unique circumstances for China as a case study for improved infrastructure balance and equitable access to healthcare.

View pdf

View pdf

At present, in China, the registration confrontation model is commonly used to address the issue of property rights changes in special movable properties. However, through the analysis of practical cases and the argumentation in legal theory, it is obvious that the property rights change model of "delivery effectiveness + registration confrontation" has flaws. In China's academic circle, there are currently four mainstream viewpoints regarding the change of special movable property rights: the coexistence of registration and delivery, the delivery theory, the registration theory, and the contract theory. The delivery theory fails to distinguish between special movable property and general movable property well, the registration theory fails to distinguish between special movable property and immovable property well, and the contract theory confuses the basic principle of distinction between property rights and creditor's rights. By analyzing its rationality and existing flaws, and drawing on the comparative law experience of Japan and Germany in good faith acquisition, a more complete rule for the change of special movable property rights has been explored. That is, both delivery and registration can be regarded as the effective conditions for the change of property rights, and when there is a conflict between the two, registration takes precedence over delivery. Such rules can not only clarify the ownership of property rights, but also improve transaction efficiency, and at the same time better balance the interests among all parties involved in the transaction.

View pdf

View pdf

New generation employees generally feel overqualified, but how this impacts their knowledge sharing intention is unclear. This study combines resource conservation theory, self-determination theory, and job crafting theory to create a dual - path model of "perceived overqualification → promotion focus/job crafting → knowledge sharing intention". It also uses innovation climate as a moderating variable to explore organizational situational effects. A structural equation model from 306 new generation employee questionnaires and Bootstrap method for effect testing show: 1 Perceived overqualification indirectly boosts knowledge sharing intention via promotion focus and job crafting, with no direct effect. 2 Innovation climate strengthens perceived overqualification’s impact on promotion focus and job crafting, enhancing indirect effects in high - innovation climates. The findings go beyond the "resource shortage" view, offering a way to solve the "high qualifications - low sharing" paradox and giving businesses theoretical and practical guidance for unlocking knowledge potential through innovation climate building.

View pdf

View pdf

With the rapid advancement of science and technology and the widespread adoption of the Internet, the network economy, emerging as a novel economic paradigm, has exerted a profound influence on the traditional industry market. This paper seeks to investigate the effects of the network economy on the competitive landscape of the traditional industry market structure, the transformation of the internal industrial architecture, and the evolution of policy. By employing case analysis, the paper elucidates the constructive contributions of the network economy in expanding market share, fostering market competition, and driving industrial upgrading. Conversely, it also highlights the adverse consequences, including increased market concentration, unfair competition, and the disruption of traditional industries. Building on these insights, the paper proposes targeted solutions, aiming to offer guidance for the transformation and development of traditional industries within the context of the network economy. The study reveals that the network economy presents both unprecedented opportunities and challenges to traditional industries, necessitating their proactive adaptation to the network economic environment, reinforcement of technological innovation, and pursuit of industrial upgrading to achieve sustainable development.

View pdf

View pdf

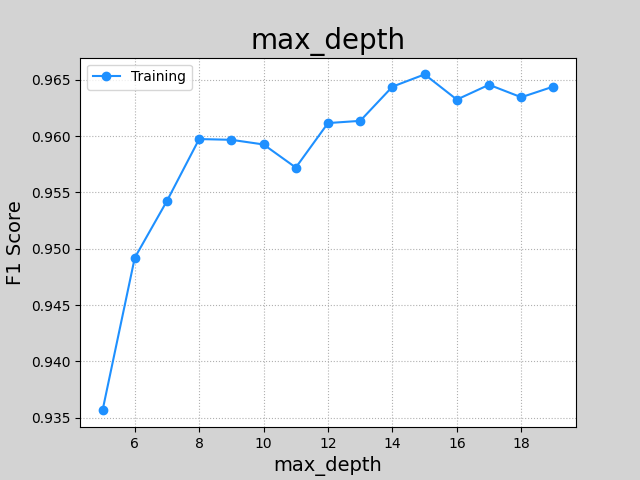

The advanced materials industry is a key driver of technological innovation, making accurate enterprise valuation essential for investment and market analysis. Traditional valuation methods like DCF, PE, and PB struggle with high-growth companies due to volatile cash flows and market dependencies. To address these challenges, this study applies a random forest algorithm to enhance valuation accuracy by leveraging financial data, market indicators, and industry-specific factors. By using bootstrap aggregation to randomly select samples and features, the random forest model, which is based on an ensemble learning approach with decision trees—improves predictive performance and minimizes overfitting. In order to quantify important valuation determinants, build a predictive model, and assess its performance using common error measures, this study gathers financial and market data from about 100 publicly traded businesses in the new materials sector. When compared to conventional techniques, the empirical study shows that the random forest model increases valuation accuracy and stability. The findings show that the model delivers a more accurate estimate of enterprise value, lessens sensitivity to market swings, and successfully captures nonlinear linkages in valuation.

View pdf

View pdf

In the context of increasing global economic volatility, digital transformation has become a vital approach for improving enterprise economic efficiency. Drawing on dynamic capability theory and principal - agent theory, this paper empirically investigates the effects of digital transformation and executive shareholding ratio and absorptive capacity on corporate resilience as well as the heterogeneity performance of different types of firms using Chinese Shanghai and Shenzhen A-share firms from 2013-2023 as research objects. This research reveals that digital transformation exerts a notable positive influence on firm resilience. Specifically, digital transformation bolsters firm resilience through the mechanism of increased executive shareholding. Moreover, absorptive capacity acts as a significant moderator, reinforcing the relationship between digital transformation and firm resilience. Additionally, the contribution of digital transformation to firm resilience is more pronounced in non - state - owned enterprises. These discoveries furnish theoretical underpinnings and empirical learning for a more extensive study on the routes by which digital transformation impacts the resilience of listed enterprises.

View pdf

View pdf

In the context of integrating digital economy and sustainable development, the role of digital transformation in enhancing corporate ESG performance remains a critical research focus. Using panel data from China’s A-share listed companies (2013–2023), this study employs a two-way fixed-effects model to demonstrate that digital transformation significantly improves corporate ESG performance. Endogeneity checks (multi-period DID, instrumental variables) and robustness tests (alternative variables, adding control variables) confirm the validity of the findings. Mechanism analysis identifies ESG disclosure quality as a mediating factor, while the shareholding ratio of ESG investors exhibits a "double-edged sword" effect. Behaviors such as "greenwashing" and conflicting objectives can weaken the positive impact of digital transformation on corporate ESG performance. Heterogeneous analysis further reveals that the ESG-enhancing effect is more pronounced in state-owned enterprises (SOEs) and industries with high environmental sensitivity, with SOEs benefiting from policy incentives and resource advantages, and environmentally sensitive industries achieving emission reductions and process optimization through digital technology. This study provides theoretical and practical evidence for policymakers to promote technological innovation, refine the ESG institutional framework, and guide the sustainable allocation of capital.

View pdf

View pdf

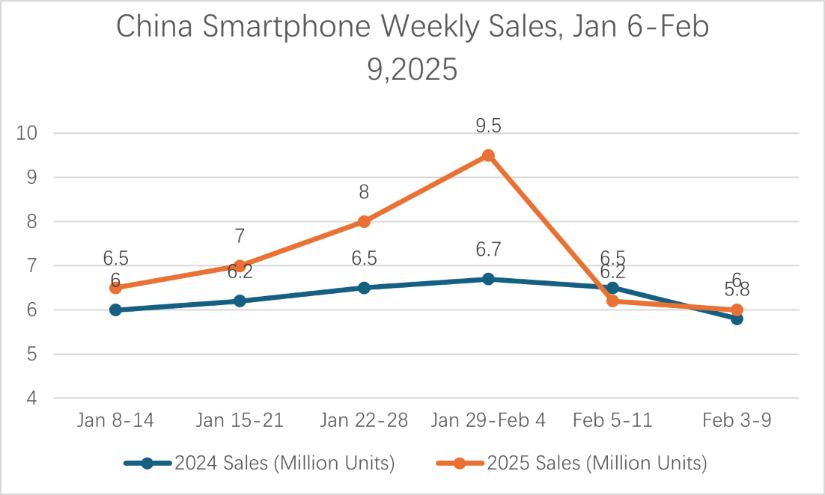

As the economy develops, the sales volume of the market will inevitably change with the changes in the economic cycle. The government hopes to use macroeconomic regulations to alleviate the negative impact of economic downturn on sales volume. Through literature research, data collection, and questionnaire surveys, this study examines the impact of national subsidy policies on the marketing strategies and consumer behavior of mobile phone industry companies. The results show that subsidies significantly affect market dynamics by stimulating short-term demand and reshaping the competitive advantages between brands. Mid-range and low-end smartphone brands such as Xiaomi, OPPO, vivo, and Honor benefited the most because most of their products were within the subsidized price range, which increased consumer enthusiasm and higher sales growth. Therefore, companies adjusted their marketing strategies to emphasize cost-effectiveness, promote eligible models, and use discounts to attract price-sensitive consumers. On the consumer side, subsidies clearly affected purchase decisions, increasing demand for subsidized models, while reducing interest in high-end devices that were not within the subsidy range, as well as products with a certain brand premium. The policy encouraged many consumers to speed up their purchase time and boosted overall market activity, but did not produce long-term sustained growth. This highlights the temporary nature of the subsidy-driven demand surge.

View pdf

View pdf

Based on the theoretical framework of global value chains (GVCs), this paper examines the mechanisms through which the digital economy reshapes global value chains. The study finds that the digital economy significantly alters the geographical distribution patterns of traditional GVCs by reducing transaction costs and enhancing the mobility of production factors. The application of digital technologies has increased the added value of midstream manufacturing segments, thereby transforming the "smiling curve" into a "shallow smiling curve." Moreover, the cross-border flow of data elements has given rise to new types of service-oriented value chains, offering developing countries a novel pathway to move up the value chain. This study provides a theoretical foundation for understanding the new characteristics of GVCs in the digital economy era and offers valuable insights for developing countries in formulating digital economy development strategies.

View pdf

View pdf

This study empirically examines the dual impact of capital structure on corporate green innovation, focusing on the "quantity-efficiency paradox" in Chinese A-share non-financial firms (2000–2023). Leveraging panel data and robust econometric models, we find that higher leverage ratios significantly increase green innovation output (measured by patent applications) but simultaneously reduce efficiency (patent-to-revenue ratio). This paradox arises because debt financing expands R&D scale yet distorts resource allocation, undermining commercialization efficacy. Mechanism tests reveal that R&D intensity mediates the positive effect of leverage on innovation output, while diminished financial flexibility exacerbates efficiency losses. Heterogeneity analysis shows state-owned enterprises (SOEs) experience stronger output gains but steeper efficiency declines compared to private firms, attributed to SOEs’ policy advantages but bureaucratic inefficiencies. Our findings advance green innovation theory by decoupling its dual dimensions and highlighting capital structure’s conflicting roles. Practically, the results urge firms to balance debt levels with financial flexibility to optimize green innovation. Policymakers should incentivize R&D investments while improving financing mechanisms to mitigate efficiency trade-offs. Robustness checks—including alternative proxies, fixed effects, and subsample analyses—confirm result reliability. This study bridges corporate finance and sustainability literature, offering actionable insights for achieving both scale and efficacy in green transitions.

View pdf

View pdf