1. Introduction

Real estate refers to various houses built on land, while real estate includes land and various underground infrastructure. The development of the real estate industry requires high capital requirements, and it is a capital intensive and highly indebted industry [1]. In the process of real estate development, a large amount of capital injection is often required, making it highly dependent on financial leverage. The current development of the real estate industry is facing a prominent problem, i.e., high financial leverage, which has adverse effects on the industry's health, stability, and sustainable development [2].

Before the arrival of the novel coronavirus, the investment in real estate development in 2019, the cumulative investment growth rate in China's real estate development, and the cumulative investment growth rate in real estate housing. However, under the impact of the COVID-19 in 2020, the severe and complex international situation, and the huge pressure of domestic reform and development, the real estate industry experienced a decline in sales and capital turnover compared with 2019. China's macroeconomic policy adjustments have provided strong support for social and economic development. In 2021, fiscal policies will improve quality and efficiency, while monetary policies will maintain continuity, stability, and sustainability [3].

REITs, also known as Real Estate Investment Trusts, are a financing model in which real estate investment trust companies publicly issue income vouchers, consolidate investors' corresponding contributions into trust assets of a certain scale, and entrust them to professional investment management institutions for management. The profits obtained are shared by fund holders in proportion to their contributions, while also sharing risks. Such companies will distribute the profits (usually more than 90% of taxable income) obtained from real estate sales and leasing activities to shareholders in the form of dividends. REITs avoid the shortcomings of traditional financing systems that are relatively single by aggregating funds from multiple investors, reducing financial risks while reducing the impact of bank regulation on the real estate market [4].

In the context of deleveraging policies in the real estate industry, since 2021, based on the risk exposure of individual large real estate development enterprises, the risk preference of financial institutions towards the real estate industry has significantly decreased, and the domestic financing of real estate enterprises has shown consistent contraction behavior. At the same time, international rating agencies have downgraded the credit ratings of Chinese real estate companies in batches, causing overseas financing for real estate companies to almost come to a halt. Affected by this, the pressure on corporate capital turnover continues to intensify. Real estate financing can be used in various ways, with internal and external financing being the sources of funds for China's real estate development [5]. From three aspects of bank loans, REITS and trusts, this paper compares the cash flow differences, total value differences and leverage ratio differences of the same period horizontally between 2020 and 2021 through a vertical comparison of a single company.

2. Case Descriptions

With the economic development since the reform and opening, the real estate economy has become one of the important economic pillars of China and the ballast of the national economy. However, since the outbreak of the epidemic in 2019, the overall global economic level has declined, and the real estate industry is also facing new crises and challenges. At present, China has the world's largest real estate market, but due to the lack of a sound market system and operating mechanism, there are still many development problems and contradictions. In addition, the overall economic situation under the impact of the epidemic has been sluggish, resulting in multiple real estate enterprises experiencing supply-demand structural imbalances, fund shortages, and increased debt, which has led to overall financial systemic risks. Therefore, the author selected Vanke and China Merchants Shekou Industrial Zone as representative cases for the mid to late stages of the epidemic in 2020 and 2021, and conducted a comparative analysis of the financing models of the two companies. The author explored the differences in the two real estate enterprise models within the two years and proposed new financing models for real estate enterprises based on the model.

China Vanke Co., Ltd. (hereinafter referred to as China Vanke) was founded in 1984. After more than 30 years of development, it has now become a leading enterprise in urban and rural construction and life services in China. Its business is concentrated in the three most dynamic economic circles and [6], the key cities in the central and western regions. As a leading real estate enterprise in China, Vanke is mainly engaged in residential property development and has obvious competitive advantages. Comprehensive competitiveness, market share and high brand value. The innovation of the financing method of the financing method of the enterprise saves the financing cost of the securitization of the enterprise, the solvency, operating ability, and profitability have been improved [7].

China Merchants Shekou Industrial Zone Holding Co., Ltd. is the flagship enterprise of the urban comprehensive development and operation sector of China Merchants Group. In recent years, China Merchants Group has achieved outstanding performance and service in the real estate industry. At present, it is a comprehensive development and operation service provider of the city and the park with great potential, operating income ability and operation service ability, and has good headquarters strategic guidance, risk management and control and comprehensive service functions. Up to now, China Merchants Shekou covers more than 110 cities and regions around the world, and invests to promote the economic development of small cities in China. In the comprehensive strength of national industry and city developers in 2021. In terms of property asset management and operation, China Merchants Shekou has developed a complete land and water transportation and passenger transport system for comprehensive operation, and has built a health industry service platform based on family health care. In 2021 lower leverage environment, China merchants Shekou has been used heavy assets development model, but in today's macro background, China merchants Shekou financing is more and more difficult, the model may hinder the development in the future, because the real estate industry high demand for capital, the future company will face larger funding gap [8].

3. Analysis

3.1. Comparative Analysis of Bank Loans

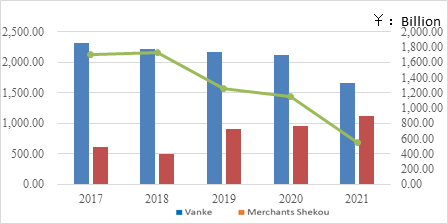

Bank loan has always been the first choice of real estate financing, and it is favored by real estate enterprises for its diverse loan types and maturity and high convenience. In terms of maturity length, bank loans can be divided into short-term credit and long-term credit, while mortgage loans can be divided into construction loans and land loans. Bank loans have been playing a pillar role in the real estate financing in our country [9]. As shown in Fig. 1, from the analysis of the bank loan amount from 2017 to 2018, the average five-year bank loan amount of Vanke Real Estate is more than 200 billion yuan, and the loan amount is relatively stable, but there will be a significant decline in 2021. The average bank loan amount of China Merchants Shekou Real Estate is much lower than that of Vanke. In 2021, the loan quota gap between China Merchants Shekou Real Estate and Vanke will be greatly narrowed. Overall, Vanke's loans are much higher than those of Shekou.

Figure 1: Comparative analysis of bank loans between Vanke and China Merchants Shekou.

The reason for the formation of data in the current national "Three Red Lines" real estate macro-control background, to the bank loan has brought a negative impact. The tightening of financing channels has indeed caused a certain effect on Vanke real estate company. Policies such as purchase restrictions have gradually cooled down the property market and raised financing costs. In addition, Vanke equity disputes have a great impact on the company's daily governance, and have a certain effect on the company's normal business activities. Shekou merchants will reduce the supply of new houses in a short period of time, accelerate the consumption of industry inventory, gradually change the state of blind development and serious inventory backlog in the past, and promote the supply balance and demand. At the same time, it is also conducive to real estate enterprises to better examine their own capital needs and adopt appropriate financing methods to reduce excessive financing. In addition, in addition to the policy factors, the supply and demand of our national real estate development enterprises are gradually tending to balance. The growth rate of investment in completed residential development has slowed down nationwide.

3.2. Comparative Analysis of Leverage Ratio

In fact, the real estate industry is a typical capital-intensive industry and the main pillar of China's economy. The industry has the characteristics of large financing funds and high risks. Leverage ratio is an important indicator to measure the risk of the real estate industry.

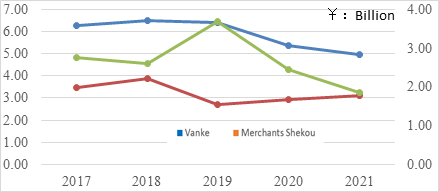

From Fig 2, one can intuitively see the change of leverage ratio of Vanke and Shekou. In general, Vanke's leverage ratio is higher than Shekou's. In 2019, Vanke's leverage ratio was about twice as high as Shekou's. The leverage ratio of the two companies has different trends: for Vanke, its leverage ratio is in a downward trend year by year from 2017 to 2019, although there was a slight increase from 2017 to 2019. For Shekou, its leverage ratio experienced a process of first increasing and then decreasing from 2017 to 2019, and then slowly rising.

Figure 2: Comparative analysis of bank loans between Vanke and China Merchants Shekou.

From the data on the leverage ratio of the two real estate enterprises, we can easily find that, although Shekou has a slight upward trend in the last two years, the leverage ratio of the two companies has basically met the central bank's "housing is used for living, not for speculation", and the "deleveraging" in the "three removal, one reduction and one compensation", especially Vanke, has been in the trend of deleveraging. At the same time, the central bank has also introduced the "three red lines" policy, which has accelerated the process of deleveraging. From the micro level, the change trend of the leverage ratio of the two real estate enterprises is caused by the change of their respective operating conditions. Firstly, Vanke's assets are higher than those of China Merchants Shekou, especially its current assets. Vanke's monetary capital and inventory are significantly higher than those of Shekou, due to its much larger business scale. Meanwhile, the amount of Vanke's interest-bearing bonds is also much higher than that of Shekou. This has led to the phenomenon that Vanke's leverage ratio is higher than Shekou's. In addition, the growth rate of Vanke's assets is lower than that of its liabilities, which has led to the constant reduction of its leverage ratio, which indicates that Vanke has been deleveraging. In addition, Shekou's business is in the stage of continuous expansion, with fast debt financing and great flexibility, which has led to a slight increase in the leverage ratio of Shekou in the next two years.

3.3. Comparative Analysis of Cash Flow

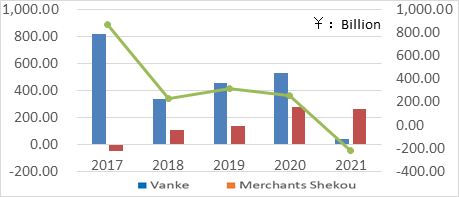

Cash flow records the cash flow in the daily business activities of enterprises. In recent years, China's real estate enterprises began to increase the attention to the cash flow, in view of the financial expenditure of enterprises reflected in the cash flow statement found negative cash flow and capital shortage and other problems proposed scientific system solutions [10]. According to the annual report data of cash flow from 2017 to 2021 intercepted by Vanke and Shekou in Fig. 3, the operating cash flow change trend of Shekou showed a steady growth and then a slight decline. In 201, the two companies had the biggest difference in cash flow, and in the same year, Shekou faced the working capital caused by the rapid expansion demand. Increasing usage and other problems, making the operating cash flow down to a negative value. In 2021, Shekou surpassed Vanke in its operating cash flow, and Vanke faced the first decline in net profit in the following year in recent years.

Figure 3: Comparative analysis of leverage ratio between Vanke and China Merchants Shekou.

Compared with the steady growth of the two companies in 2018-2020, the total cash flow in the starting and ending years is more intuitively different. Around 2017 for China merchants Shekou land development, large land purchase and the early project occupy capital led to the cash flow is negative, but at the same time through the strengthening early real estate development means to lay a solid foundation, subsequent speed up the REITs research and production platform construction, innovation financing, financing of financing ideas, step by step to improve cash flow. In contrast, Vanke in 2021, with pre-sale capital regulation in execution level tightening is closely linked, open to booking money is part of the source of cash flow, help the rapid expansion of enterprises, issued in 2020 of the State Council on resolutely curb some city prices rise too fast notice bring the government directly to booking money tightening, caused the problem of cannot return [11].

4. Discussions, Suggestions & Implications

Vanke continuously innovates financing methods through the capital market, explores new financing methods with low cost, low risk, and high return, and actively expands financing channels. Vanke has implemented financing models such as real estate trusts and overseas financing, reducing the company's dependence on bank loans, which is beneficial for reducing financing costs and alleviating the financial pressure on enterprises. At the same time, it is also beneficial for real estate companies to better examine their own funding needs, adopt appropriate financing methods, and reduce excessive financing. However, the profitability of merchants in Shekou has weakened, and the operational efficiency of enterprises has significantly decreased. The ability to repay debts has weakened, and the asset liability ratio has remained stable. Overall, the growth of enterprises has rebounded.

Leverage ratio is one of the important indicators to measure the risk level of a business. According to MM theorem, due to the tax shield effect, increasing debt and increasing the leverage ratio can increase the market value of the company and reduce the financing cost of the enterprise. However, with the increase of debt, the risk of falling into financial difficulties continues to increase, and the greater the risk is. Therefore, high leverage means that the greater the risk, but the greater the profit; low leverage means that the smaller the leverage, the less the risk, but the lower the profit. According to the balance theory, different industries adapt to different leverage ratios, and for the real industries, a lower leverage ratio should be adopted. For capital-intensive industries such as real estate, a high leverage ratio can be adopted, but it should not be too high, because too high leverage will make the financial system very fragile and lay hidden dangers for the financial crisis.

The opposite cash flow trend of Vanke and Shekou is accompanied by the different focus of enterprise operation and the direction of capital operation, mixed with the different financing policies under the background of the current era. Enterprises should stabilize the capital chain in the operation and ensure the abundant use of operating funds in the turnover operation of enterprises.

Vanke Group's financing models are becoming more diversified, with main financing methods including bank loans, bond issuance, equity financing, and real estate trusts. Vanke's capital turnover speed is faster and the proportion of current assets is larger, which means that Vanke's debt paying ability is better than Shekou's. Therefore, Vanke has adopted a higher leverage ratio than Shekou, driving the growth of return on equity (ROE). At the same time, Vanke is also facing a shortage of operating cash flow. Vanke should appropriately reduce the asset liability ratio to reduce leverage ratio. Leverage ratio is an important indicator to measure the risk level of an enterprise. According to MM theorem, due to the tax shield effect, increasing debt and increasing leverage ratio can increase the market value of the company and reduce the financing cost of the enterprise. However, with the increase of debt, the risk of financial distress will continue to increase. Therefore, a high leverage ratio means that the greater the leverage ratio, the higher the risk, but the greater the company's profit. Low leverage ratio means that the smaller the leverage, the smaller the risk, but the lower the profit of the company. According to the tradeoff theory, different industries adapt to different leverage ratio ratios. For the real industry, a lower leverage ratio should be adopted. For the capital-intensive industry such as real estate, a higher leverage ratio can be appropriately adopted, but it should not be too high, because too high leverage will make the financial system very vulnerable, laying hidden dangers for the financial crisis.

As for Shekou, it should have diversified financing methods, stable financial structure, and high-quality growth of cash flow. Shekou's land bank is in the core city, especially Shenzhen. In the real estate environment is quite bad circumstances, or a room is difficult to find. The longer the land reserve, the greater the value, there is no need to worry about depreciation. Most importantly, the cost of Shekou's large land reserve in Shenzhen is extremely low, and no matter how the government regulates it, there is very little factor for its value. Although Shekou is a state-owned enterprise, the industry is very market-oriented, and the enterprises are more enterprising than the general state-owned enterprises. Finance is relatively stable, financing rates are relatively low, and economic growth is stable.

Management is constantly improved, transformation is accelerated, and talents are constantly introduced. The result of the transformation should also be patient, but the financial stability, land reserve and the cooperation of China Merchants Group make Shekou's transformation more likely and more successful. At present, in view of the government's stable land price and the company's own control, the gross profit margin will continue to increase in the future. In addition, the turnover rate of Shekou has also increased, which will have a large effect on the return on equity of real estate. Shekou is rich in business formats, including apartments, commercial complexes, industrial real estate, elderly care, etc. From the perspective of real estate transformation, Shekou still has its own genetic advantages, especially in the park. Without the cooperation of other industries, it is impossible to do well. However, Shekou has that advantage. Therefore, from the perspective of comprehensive development, Shekou should have great potential among all real estate companies. Enterprises can transform, the industry will usher in a better environment. This should take quite a long time. At present, the strategic transformation of Shekou is clearly visible. On the basis of balancing the scale, quality and efficiency of the company, we can consider a variety of financing channels, reduce financing costs and issue merger bonds.

5. Conclusion

In summary, this paper investigates the two real estate giants (i.e., Vanke and the real estate industry merchants Shekou), and combines the analysis of real estate data in recent years, including the epidemic situation. Starting from the background of the two companies, this paper compares and analyzes the bank loan, leverage ratio and cash flow, and summarizes the evaluation and financing suggestions of the different financing modes of the two companies. Through the data comparison, the capital flow analysis of Vanke and China Merchants Shekou in recent years is summarized. However, this paper only through the comparative analysis of two large real estate companies, failed to consider the financing strategies of small companies, so there is a certain one-sidedness for the whole Chinese real estate industry. These results shed light on guiding further understanding the real estate financing strategy.

References

[1]. Tang, H.: Comparative analysis of financial strategies between Vanke and Poly Real Estate (Doctoral dissertation, Xiamen University) (2014).

[2]. Application Analysis of Financial Leverage Analysis Method in Vanke Company https://card.weibo.com, last accessed 2023/4/21.

[3]. Wang, P.: Analysis of REITs from a Financing Perspective - Case Study of REITs in China Merchants Real Estate (Doctoral dissertation, Nankai University) (2011).

[4]. Wang, Y.: Risk Assessment and Prevention of Real Estate Investment Trusts (REITs) (Doctoral dissertation, Zhejiang University) (2019).

[5]. Zhang, L., Wang, L.: Risk application research on risk warning mechanism in organizational crisis management–taking Vanke Real Estate Co. Ltd., as an example. Chaos, Solitons & Fractals, 89, 373-380 (2016).

[6]. Zhu, Y.: Research on the effect of working capital management of real estate enterprises under asset light operation mode: taking Vanke as an example (Doctoral dissertation, Donghua University) (2018).

[7]. Kong, Y.: Research on the Effect and Risk of Asset Securitization of Final Payment for House Purchase by Vanke Real Estate. Nanjing University of Posts and Telecommunications (2022).

[8]. Zhang, J.: Analysis of the Financing Motivation and Effect of REITs in China Merchants Shekou Industrial Park (Master's Thesis, Guangdong University of Technology) (2022).

[9]. Zheng, K.: Research on Diversified Financing Strategies of Real Estate Enterprises in China-Taking Vanke Company as an Example (Doctoral dissertation, Southwest University of Finance and Economics) (2022).

[10]. Tian, J., Liu, Y.: The problems and countermeasures of cash flow in real estate enterprises. Financial and Accounting Communication: China 9, 2 (2012).

[11]. Yao, J.: Analysis of Cash Flow Quality in Real Estate Enterprises - Taking Vanke Enterprise Co., Ltd. as an Example University of International Business and Economics (2013).

Cite this article

Bai,J.;Wang,J.;Xue,J. (2023). Comparative Analysis of Financing Strategy Differences Between Vanke and Merchants Shekou Real Estate Companies. Advances in Economics, Management and Political Sciences,36,24-30.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Tang, H.: Comparative analysis of financial strategies between Vanke and Poly Real Estate (Doctoral dissertation, Xiamen University) (2014).

[2]. Application Analysis of Financial Leverage Analysis Method in Vanke Company https://card.weibo.com, last accessed 2023/4/21.

[3]. Wang, P.: Analysis of REITs from a Financing Perspective - Case Study of REITs in China Merchants Real Estate (Doctoral dissertation, Nankai University) (2011).

[4]. Wang, Y.: Risk Assessment and Prevention of Real Estate Investment Trusts (REITs) (Doctoral dissertation, Zhejiang University) (2019).

[5]. Zhang, L., Wang, L.: Risk application research on risk warning mechanism in organizational crisis management–taking Vanke Real Estate Co. Ltd., as an example. Chaos, Solitons & Fractals, 89, 373-380 (2016).

[6]. Zhu, Y.: Research on the effect of working capital management of real estate enterprises under asset light operation mode: taking Vanke as an example (Doctoral dissertation, Donghua University) (2018).

[7]. Kong, Y.: Research on the Effect and Risk of Asset Securitization of Final Payment for House Purchase by Vanke Real Estate. Nanjing University of Posts and Telecommunications (2022).

[8]. Zhang, J.: Analysis of the Financing Motivation and Effect of REITs in China Merchants Shekou Industrial Park (Master's Thesis, Guangdong University of Technology) (2022).

[9]. Zheng, K.: Research on Diversified Financing Strategies of Real Estate Enterprises in China-Taking Vanke Company as an Example (Doctoral dissertation, Southwest University of Finance and Economics) (2022).

[10]. Tian, J., Liu, Y.: The problems and countermeasures of cash flow in real estate enterprises. Financial and Accounting Communication: China 9, 2 (2012).

[11]. Yao, J.: Analysis of Cash Flow Quality in Real Estate Enterprises - Taking Vanke Enterprise Co., Ltd. as an Example University of International Business and Economics (2013).