1. Introduction

Through the use of online platforms, crowdfunding is a type of financing that enables people or organizations to gather money from many diverse sources. as a way to determine whether there is a market for their products before making sizable investments. What is novel about this idea of intermediation, which is made possible by technological advancements, is how it is used [1]. By using crowd-funding, businesses can lower their production and storage expenses while also determining the level of user interest in their goods. Typically, intermediaries are crowdfunding platforms, which link and match fundraisers with the crowd as their primary goal [2].

The concepts of "crowdsourcing" and "collaborative finance" are at the foundation of the growth of crowdfunding. According to the World Bank's forecast, the industry is anticipated to generate up to USD 90-96 billion annually by 2025. During the 2008 financial crisis, banks became more cautious about lending, which led companies to seek out alternative sources of funding. Additionally, declining interest rates prompted investors to search for new investment opportunities that could generate higher returns [3,4].

The six basic theories of finance are fundamental concepts that are widely used in financial management. These theories include the time value of money, risk and return, diversification, asset allocation, market efficiency, and behavioral finance. Each of these theories has important implications for crowdfunding projects.

The purpose of this study is to examine the influencing factors of crowdfunding project financing performance: Based on the Six Basic Theories of Finance Specifically, we will investigate whether these theories are associated with the success or failure of crowdfunding projects.

2. Literature Review

Recent years have seen a lot of interest in crowdfunding as a fresh source of capital for entrepreneurs, start-ups, and small enterprises. A 2017 research from fundly.com shows that between 18,000 and 22,000 projects are launched each day, with a new crowdfunding campaign being initiated every three minutes. There are already 191 platforms in the US, and that number is extending rapidly at a pace of 350% annually. Thus far, crowdfunding has developed into several substantial businesses, including listed companies such as Segway-Ninebot, Anker, etc., for market validation of new products or concepts.

2.1. Review of Existing Research on Crowdfunding and Financial Theory

Over the past ten years, a lot of research has been done on crowdfunding, with scholars from numerous fields investigating different facets of this fundraising mechanism. The motivations of crowdfunding backers, the variables that impact the success of crowdfunding, and the effects of crowdfunding on entrepreneur-ship and innovation have all been the subject of studies. But not much research has looked at the relationship between financial theory and crowdfunding.

This section summarises the literature published on crowdfunding and financial theory, examines how these theories relate to crowdfunding initiatives and points out any gaps in the body of knowledge.

2.2. Research Examining the Relationship Between Financial Theory and Crowdfunding Projects

The connection between financial theory and crowdfunding has been the subject of numerous research. For instance, Belleflamme et al. looked at the effect of information asymmetry on the success of crowdfunding. According to the study [5], there is a higher chance of crowdfunding success when the information is of excellent quality. Cumming et al. looked at the effect of investor heterogeneity on the success of crowdfunding in a different study [6]. In the light of the report, crowdfunding initiatives are more likely to receive funding from different groups of investors, which emphasizes the importance of diversification in investment portfolios. Lukkarinen, A. et al. centered a separate study on the function of investor networks in crowdfunding [7]. The study found that investors who are part of a network are more likely to invest in crowdfunding campaigns and that the success of a campaign is positively correlated with the size and variety of the investor network.

Similarly, Lee and Kim found that social capital has a beneficial effect on the success of crowdfunding campaigns [8,9], while Kuppuswamy and Bayus found that past business experience can have a favorable impact on the success of crowdfunding [10]. These findings suggest that financial theory, which emphasizes the importance of social networks and founder expertise in markets, can also be applied to crowdfunding projects.

However, Hornuf and Schwienbacher argue that financial theory is not always essential for successful crowdfunding campaigns [11]. Their research implies that other elements, such as the project's quality and marketing strategy, maybe more crucial to success.

In addition to examining the impact of financial theory on crowdfunding campaigns, Agrawal et al. explored the relationship between crowdfunding and traditional financial models [12]. They found that crowdfunding can be a viable alter-native to traditional financing methods, such as venture capital, as it provides entrepreneurs with greater control over their projects and can lead to more di-verse funding sources.

2.3. Identify gaps in the literature

Despite these studies, there are still significant gaps in the literature on the relationship between financial theory and crowdfunding. For example, there has been little research on the impact of financial concepts such as the time value of money, risk and return, diversification, asset allocation, market efficiency, and behavioral finance on crowdfunding projects. Additionally, most of the studies reviewed have focused on rewards-based crowdfunding, where backers receive non-financial rewards such as products or services in exchange for their contribution.

Given the importance of financial theory in traditional finance, it is likely that these concepts also play a significant role in crowdfunding. Further research in these areas could help to better understand the dynamics of crowdfunding and inform best practices for crowdfunding project creators and backers.

In conclusion, while there has been significant research on crowdfunding, there is still much to be done in terms of exploring the relationship between financial theory and crowdfunding. Research has shown that factors such as information asymmetry, investor heterogeneity, social capital, and founder experience can impact crowdfunding success. However, there has been limited research on the impact of financial concepts on crowdfunding. Future research in this area could provide valuable insights into the dynamics of crowdfunding and help to inform best practices for crowdfunding project creators and backers.

3. Methodology

3.1. Description of the dataset and data collection process

This study collected data on a sample of 5,270 successfully funded Kickstarter crowdfunding projects from the creative arts or technology categories, with a funding goal between $10,000 and $1,000,000. The dataset was obtained from the official Kickstarter website using web scraping techniques to extract the relevant information. Also conducted interviews with the project creators to gather additional information.

3.2. Operationalization of the six basic theories of finance in relation to crowdfunding projects

To investigate the impact of the six basic theories of finance on Kickstarter crowdfunding projects, we operationalized these theories as follows:

Time value of money: The concept of the time value of money states that the value of money changes over time due to inflation and the opportunity cost of investment. This study aims to measure the relationship between the time value of money and the number of backers by calculating the net present value (NPV) of the project’s expected cash flows. The backer number can reflect the popularity and market demand of the project, which indirectly reflects the time value of money. A 12% discount rate will be used in this study.

Risk and return: The theory suggests that higher returns are associated with high-er risk. In this study, risk was measured as the financing target amount, while return was measured as the ratio of the difference between the target return and the actual return.

Diversification: This theory suggests that spreading investments across different assets can reduce risk. In this study, measured diversification as the number of reward tiers offered by each project creator.

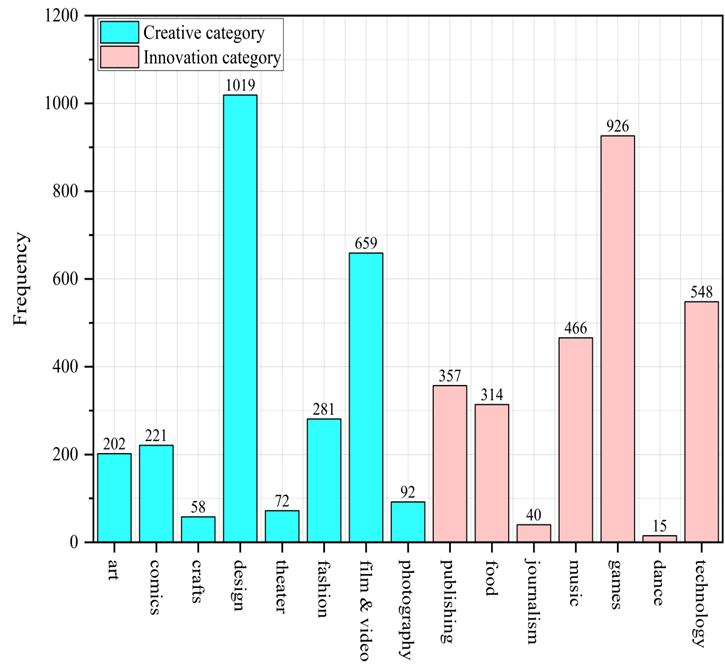

Asset allocation: This theory states that the mix of assets in a portfolio should be selected based on the investor's risk tolerance and investment objectives. In this study, the total 15 categories were divided into creative and innovative categories. The creative category includes art, comics, crafts, design, fashion, film and video, photography, publishing and theatre. The innovative category includes projects in dance, food, games, journalism, music and technology.

Market efficiency: This theory suggests that financial markets are efficient and that it is difficult to consistently beat the market. In this study, the popularity of each project was measured by calculating the ratio of the target return to the number of supporters.

Behavioral finance: This theory suggests that investors’ behavior deviates from rational expectations, leading to market inefficiency. In this study, we measured behavioral finance by analyzing the number of questions and answers in the creators’ comments sections during funding campaigns, as well as the interactions between creators and users. These measures can provide insights into the behavioral biases of investors and creators, which can affect the efficiency of the crowdfunding market.

3.3. Statistical methods used to analyze the data

STATA was used for regression analysis. Descriptive statistics were also calculated to provide an overview of the data set and the class distribution of the sample.

Figure 1: Class distribution of samples.

The analysis showed that majority of the projects (49%) were in the creative category, the success of these projects usually depends on the talent and creativity of the artist or creator, as well as their ability to attract and sustain the interest of the investors. And about 51% were in the innovation category. The most popular categories for on kickstarter are design and games, followed by film and technology. The success of these projects usually depends on the technology and innovation of the project, as well as its ability to meet market demand and attract investor interest.

Table 1: The descriptive statistics for the variables are presented in the table Decriptive statistics.

Heading level | mean | sd | min | max | skewness | p50 |

Comment_count | 95.40 | 174.7 | 0 | 991 | 2.703 | 16 |

Behavioral_finance | 3.094 | 5.904 | 0 | 54 | 3.089 | 0 |

Funding_lastdays | 32.59 | 8.987 | 1 | 60 | 1.162 | 30 |

Is_video | 0.0112 | 0.105 | 0 | 1 | 9.292 | 0 |

Image_number | 26.36 | 21.33 | 1 | 207 | 1.351 | 21 |

Time_value_of_money | 106,889 | 308,262 | 9,041 | 8.975e+06 | 12.45 | 32,439 |

Investors_count | 677.0 | 1,902 | 4 | 79,794 | 19.02 | 252 |

Diversification | 10.74 | 7.131 | 1 | 107 | 3.109 | 9 |

Risk | 43,507 | 78,440 | 10,095 | 1,000,000 | 7.525 | 25,000 |

Return | 1.937 | 6.083 | 0 | 170.2 | 10.12 | 0.252 |

Market_efficiency | 592.9 | 2,533 | 15.18 | 110,259 | 20.49 | 139.4 |

Asset_allocation | 0.438 | 0.496 | 0 | 1 | 0.249 | 0 |

There are 11 variables. The standard deviation of Time value of money, Investors count, and Risk is large, indicating that the data distribution of these variables is relatively dispersed. However, the mean and median (p50) of these variables are similar, suggesting that their data distribution is close to a normal distribution.

Next, ran a multiple regression model to investigate the relationship between the six basic theories of finance and crowdfunding success. The independent variable is the six basic theories of finance, and the dependent variable is the number of investors. In calculation, the financing performance is mainly measured by the number of investors. The multiple regression model used in this study is as follows:

\( {Investors\_count_{i}}=α+{β_{1}}D_{i}^{ \prime }+{β_{2}}C_{i}^{ \prime }+{ε_{i}} \)

Where represents the dependent variable, which is the number of supporters for crowdfunding projects. represents the independent variables related to financial theory, while represents the control variables. represents the random disturbance factor, which is assumed to follow a normal distribution, i.e.,~N(0,1).

The table of phase relation number of main variables is shown, and most independent variables show small correlation.

Table 2: Correlation analysis.

Investors_count | Comment_count | Funding_lastdays | Is_video | Image_number | Time_value_of_money | Risk | Return | Diversification | Asset_allocation | Market_efficiency | Behavioral_finance | |

Investors_count | 1 | |||||||||||

Comment_count | 0.217*** | 1 | ||||||||||

Funding_lastdays | 0.041*** | 0.013 | 1 | |||||||||

Is_video | -0.020 | 0.012 | 0.045*** | 1 | ||||||||

Image_number | 0.183*** | 0.364*** | 0.055*** | 0.049*** | 1 | |||||||

Time_value_of_money | 0.556*** | 0.172*** | 0.091*** | 0.004 | 0.185*** | 1 | ||||||

Risk | 0.096*** | 0.013 | 0.073*** | 0.030** | 0.042*** | 0.522*** | 1 | |||||

Return | 0.556*** | 0.287*** | 0.095*** | -0.007 | 0.268*** | 0.561*** | -0.008 | 1 | ||||

Diversification | 0.055*** | -0.071*** | 0.016 | -0.048*** | -0.007 | -0.009 | -0.007 | -0.008 | 1 | |||

Asset_allocation | 0.060*** | 0.171*** | -0.065*** | 0.033** | 0.010 | 0.018 | 0.0120 | 0.002 | -0.029** | 1 | ||

Market_efficiency | -0.058*** | -0.061*** | 0.053*** | 0.037*** | -0.008 | 0.278*** | 0.547*** | 0.009 | -0.066*** | -0.029** | 1 | |

Behavioral_finance | 0.272*** | 0.270*** | 0.089*** | 0.062*** | 0.382*** | 0.236*** | 0.053*** | 0.293*** | -0.027** | 0.087*** | -0.037*** | 1 |

The results show that time value of money (β= 0.003, p < 0.01), return (β = 85.966, p < 0.01), diversification (β = 15.302, p < 0.01), behavioral finance (β = 25.757, p < 0.01), and asset allocation (β = 140.206, p < 0.01) have a significant positive impact on the success of crowdfunding. Risk (β = -0.002, p < 0.01) and market efficiency (β = -0.105, p < 0.01) have a significant negative impact on the success of crowdfunding.

Furthermore, the active information disclosure behavior of financiers is conducive to reducing the information mismatch between investors and financiers and promoting the participation of investors in the project. This finding is consistent with previous studies that have reported the significant impact of behavioral finance on crowdfunding success [13,14]. However, further research is needed to explore the factors that contribute to successful crowdfunding campaigns and the role of behavioral biases in the process.

4. Results

4.1. Presentation of the findings related to the impact of the six basic theories of finance on Kickstarter crowdfunding projects

The study found a significant positive correlation between the number of backers and NPV (β= 0.003, p < 0.01), indicating that as the number of backers increases, the popularity and market demand of the project also increase, thereby increasing the time value of the funds. Therefore, the conclusions of this study support the time value theory of money, which suggests that the value of money increases over time.

In terms of risk and return, projects with higher expected returns were more likely to be successfully funded, but this relationship was moderated by risk. Projects with higher expected returns and lower risk were more likely to be successful, while projects with higher expected returns and higher risk were less likely to be successful.

Diversification has a positive relationship with successful Kickstarter projects. Specifically, successful Kickstarter projects usually provide diversified rewards and incentives, which attract more supporters and increase the probability of project success.

Research has shown that innovative projects are more likely to attract investors on Kickstarter and receive funding on the platform. These projects offer novel, interesting and unique experiences that satisfy investors’ curiosity and desire to explore.

Behavioral finance suggests that investors’ behavior can be influenced to in-crease their willingness to participate, reduce information asymmetry. For in-stance, social media can be used to engage supporters in high-frequency interaction or advertising can be utilized to attract more supporters and increase the likelihood of project success.

The study found that when the ratio of target return to the number of supporters is higher, the popularity and market efficiency of a project are lower. This is be-cause when the ratio of target return to the number of supporters is higher, the return rate of the project is higher, but supporters need to pay a higher price for it. This may reduce the popularity of the project because fewer people are willing to pay a higher price for a high return. In addition, when the ratio of target return to the number of supporters is higher, the success rate of the project may also decrease because a higher target return may make the project more difficult to achieve.

4.2. Discussion of significant results and their implications

The findings of this study provide important insights into the factors that con-tribute to the success of Kickstarter crowdfunding projects. The results suggest that investors are influenced by the time value of money, risk and return, and market efficiency when making funding decisions. This highlights the importance of considering these factors when developing and promoting crowdfunding projects.

In terms of practical implications, project creators should consider offering re-wards that provide higher expected returns to investors, while also managing risk through diversification and careful asset allocation. They should also aim to out-perform the market through innovative and unique project ideas.

Furthermore, these findings can inform the development of crowdfunding plat-forms and policies. Platforms can provide tools and guidance to project creators on how to incorporate the time value of money, risk and return, and market efficiency into their projects. Policymakers can use these insights to create regulations that promote transparency and accountability in crowdfunding projects, thereby increasing investor confidence and participation.

4.3. Comparison of findings to existing research

The findings of this study are consistent with previous research on crowdfunding and finance. For example, studies have shown that investors are influenced by the time value of money and risk when making investment decisions [13-14]. However, the results of this study differ from the previous study by Belleflamme, Lambert, & Schwienbacher [5]. This may be due to the use of different methods and datasets in this study, or because the focus of this study is on the relationship between market efficiency and project popularity, rather than other factors. Therefore, although the results of this study different,but does not mean that there is a contradiction between the two studies.

This study expands the research on crowdfunding by examining the impact of six basic financial theories on crowdfunding success. The results show that diversification, asset allocation, and behavioral finance may have less influence in crowdfunding than in traditional finance, highlighting the unique characteristics of crowdfunding as another source of financing.

Overall, the results of this study provide valuable insights for project creators, crowdfunding platforms, and policy makers, and contribute to the literature on crowdfunding and finance.

5. Conclusion

The implications of this study are twofold. First, those results provide valuable insights for crowdfunding platforms, project creators, and investors, as they can use the knowledge of behavioral biases to improve their decision-making pro-cesses. Second, our study contributes to the existing literature on the intersection of finance and crowdfunding by providing empirical evidence on the impact of basic financial theories on crowdfunding.

The main findings of this study indicate that the time value of money, risk and return, and behavioral finance have a significant impact on the success of Kick-starter crowdfunding projects. Projects that offer higher expected returns and manage risk through diversified investments and cautious asset allocation are more likely to receive successful funding. Additionally, projects that offer re-turns higher than the market average and outperform the market are more likely to attract investors. However, market efficiency is not a significant predictor of crowdfunding success, and risk factors of the project need to be considered.

The results of this study have important theoretical and practical implications. In terms of theory, this study contributes to the growing literature on crowdfunding and finance by providing insights into the unique factors that influence crowd-funding success. The study emphasizes the importance of considering the time value of money, risk and return, and behavioral finance in crowdfunding pro-jects, as these factors are important predictors of project success.

In terms of practice, the findings of this study can inform the development and promotion of crowdfunding projects. Project creators can use these insights to design projects that offer higher expected returns, while also managing risk through diversification and careful asset allocation. Crowdfunding platforms can provide tools and guidance to project creators, thereby increasing the likelihood of project success. Policymakers can use these insights to create regulations that promote transparency and accountability in crowdfunding projects, thereby in-creasing investor confidence and participation.

One limitation of this study is that it focused solely on Kickstarter crowdfunding projects. Future research could examine the impact of the six basic theories of finance on other crowdfunding platforms, such as Indiegogo or GoFundMe, as well as specific markets where there is a bias in local user buying behavior, such as Japan/Taiwan/South Korea. Additionally, the study relied on self-reported data from project creators, which may be subject to bias. Future studies could use objective measures of project success, such as actual investment amounts or the number of backers, to confirm the findings of this study. Finally, future research could also examine the impact of other factors on crowdfunding success, such as creator experience.

Overall, this study adds to the growing body of research on crowdfunding by shedding light on the importance of six basic idea of financial in shaping crowd-funding outcomes.

References

[1]. Cumming, D. J., & Zhang, Y.:Are crowdfunding platforms active and effective intermediaries? Journal of Business Venturing, 33(1), 1-22. (2018).

[2]. Kim & Moor: The case of crowdfunding in financial inclusion: A survey. Strategic Change, 26(2), 193-212. (2017)

[3]. Delivorias, A:Crowdfunding in Europe: Introduction and state of play. Briefing, European Parliamentary Research Service, European Parliament, 1-8. (2017).

[4]. Senadjki, A., Mohd, S., Bahari, Z., & Hamat, A. F. C:Assets, risks and vulnerability to poverty traps: A study of northern region of Malaysia. The Journal of Asian Finance, Economics and Business (JAFEB), 4(4), 5-15. (2017).

[5]. Belleflamme, P., Lambert, T., & Schwienbacher, A:Crowdfunding: Tapping the right crowd. Journal of Business Venturing, 29(5), 585-609. (2014)

[6]. Cumming, D., Hornuf, L., & Schweizer, D:Crowdfunding, angel investing, and the venture capital market: A simultaneous analysis of investor heterogeneity in equity crowdfunding platforms. Entrepreneurship Theory and Practice, 38(4), 635-657. (2014)

[7]. Lukkarinen, A. – Teich, J. E. – Wallenius, H. – Wallenius, J. : Success drives of online equity crowdfunding campaigns. The Journal of Science Direct, 87(2), 26-38. (2016)

[8]. Kim, P. H. – Buffart, M. – Croidieu, G.: TMI: Signaling Credible Claims in Crowdfunding Campaign Narratives. Group and Organization Management, 41(6): 717–750. (2016)

[9]. Ladson, N. – Lee, A. M.: Persuading to Pay: Exploring the What and Why in Crowdfunded Journalism. JMM International Journal on Media Management, 19(2): 144–163. (2017)

[10]. Kuppuswamy, V., & Bayus, B. L:Crowdfunding creative ideas: The dynamics of project backers in Kickstarter. Management Science, 63(3), 585-603. (2017).

[11]. Hornuf, L., & Schwienbacher, A:Should securities regulation promote equity crowdfunding? Small Business Economics, 49(3), 579-593. (2017).

[12]. Agrawal, A. K., Catalini, C., & Goldfarb, A: Crowdfunding: geography, social networks, and the timing of investment decisions. Journal of Economics & Management Strategy, 24(2), 253-274. (2015).

[13]. Lopes, T., & Moreira, A. C:Success factors in reward-based crowdfunding projects: A systematic literature review. Journal of Business Research, 88, 431-442. (2018).

[14]. Zhang, Y., & Liu, Y. Crowdfunding for entrepreneurship research: trends, opportunities, and challenges. Small Business Economics, 53(2), 297-312. (2019).

Cite this article

Gao,X. (2023). Research on the Influencing Factors of Crowdfunding Project Financing Performance: Based on the Six Basic Theories of Finance. Advances in Economics, Management and Political Sciences,37,81-90.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Cumming, D. J., & Zhang, Y.:Are crowdfunding platforms active and effective intermediaries? Journal of Business Venturing, 33(1), 1-22. (2018).

[2]. Kim & Moor: The case of crowdfunding in financial inclusion: A survey. Strategic Change, 26(2), 193-212. (2017)

[3]. Delivorias, A:Crowdfunding in Europe: Introduction and state of play. Briefing, European Parliamentary Research Service, European Parliament, 1-8. (2017).

[4]. Senadjki, A., Mohd, S., Bahari, Z., & Hamat, A. F. C:Assets, risks and vulnerability to poverty traps: A study of northern region of Malaysia. The Journal of Asian Finance, Economics and Business (JAFEB), 4(4), 5-15. (2017).

[5]. Belleflamme, P., Lambert, T., & Schwienbacher, A:Crowdfunding: Tapping the right crowd. Journal of Business Venturing, 29(5), 585-609. (2014)

[6]. Cumming, D., Hornuf, L., & Schweizer, D:Crowdfunding, angel investing, and the venture capital market: A simultaneous analysis of investor heterogeneity in equity crowdfunding platforms. Entrepreneurship Theory and Practice, 38(4), 635-657. (2014)

[7]. Lukkarinen, A. – Teich, J. E. – Wallenius, H. – Wallenius, J. : Success drives of online equity crowdfunding campaigns. The Journal of Science Direct, 87(2), 26-38. (2016)

[8]. Kim, P. H. – Buffart, M. – Croidieu, G.: TMI: Signaling Credible Claims in Crowdfunding Campaign Narratives. Group and Organization Management, 41(6): 717–750. (2016)

[9]. Ladson, N. – Lee, A. M.: Persuading to Pay: Exploring the What and Why in Crowdfunded Journalism. JMM International Journal on Media Management, 19(2): 144–163. (2017)

[10]. Kuppuswamy, V., & Bayus, B. L:Crowdfunding creative ideas: The dynamics of project backers in Kickstarter. Management Science, 63(3), 585-603. (2017).

[11]. Hornuf, L., & Schwienbacher, A:Should securities regulation promote equity crowdfunding? Small Business Economics, 49(3), 579-593. (2017).

[12]. Agrawal, A. K., Catalini, C., & Goldfarb, A: Crowdfunding: geography, social networks, and the timing of investment decisions. Journal of Economics & Management Strategy, 24(2), 253-274. (2015).

[13]. Lopes, T., & Moreira, A. C:Success factors in reward-based crowdfunding projects: A systematic literature review. Journal of Business Research, 88, 431-442. (2018).

[14]. Zhang, Y., & Liu, Y. Crowdfunding for entrepreneurship research: trends, opportunities, and challenges. Small Business Economics, 53(2), 297-312. (2019).