1. Introduction

In finance, credit risk is an important concept that refers to the possibility that a borrower may fail to repay their debts or obligations. This possibility presents significant risks to financial institutions, especially banks, which are exposed to this type of risk every day. To mitigate these risks, banks typically use various credit risk models for forecasting and analyzing credit risks. What’s more, Credit risk can be defined as the likelihood that a borrower will default on their debt obligations or fail to make timely payments due on their loans or other forms of credit. The increasing complexity of modern financial markets has made it more challenging for financial institutions to effectively identify and manage potential sources of credit risk, two models being raised scenes the credit risk flowing through to a high up factor in the financial market.

2. Accounting-Based Models for Credit Risk Forecasting

Accounting-based models rely heavily on historical accounting data such as balance sheets, income statements, and cash flow statements when evaluating potential borrowers’ creditworthiness. These models utilize ratios such as net worth-to-debt and interest coverage ratios, which are considered essential predictors in determining creditworthiness.

Now, let’s examine the effectiveness of two types of models in elucidating and forecasting credit risk. These models fall into two categories: accounting-based models and market-based models. The use of accounting variables to understand and predict credit risk has a rich historical background. Initially, Altman’s Z-scores [1] significantly contributed to this domain. However, these models have frequently faced criticism for their perceived lack of a robust theoretical basis.

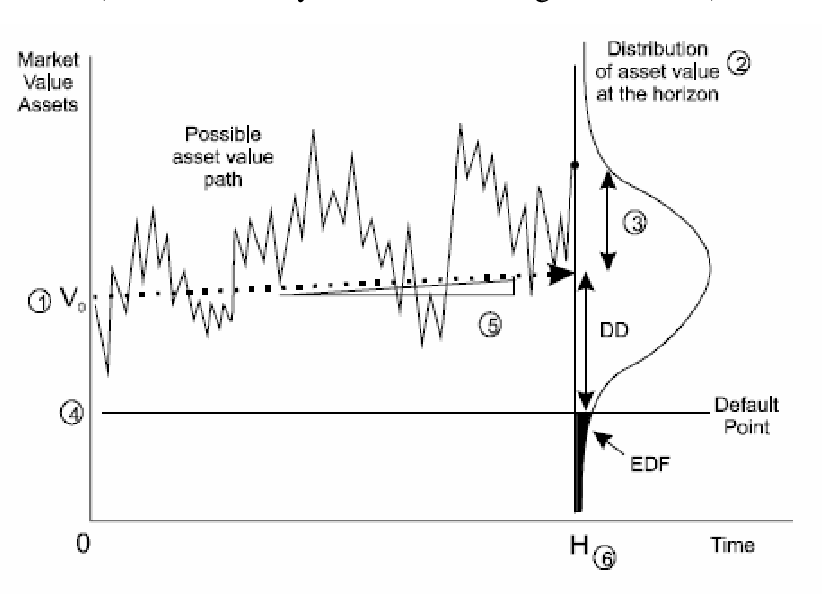

During the 1970s, an alternative contingent claims approach was developed to model a company’s liabilities. In contrast to accounting-based scoring models, structural models typically rely on market information, particularly stock market prices. An influential contribution in this field was made by Merton, who introduced a “structural model” for analyzing defaultable bonds. This model incorporates assumptions about stochastic processes related to the company’s assets and utilizes information about the terms and conditions of the company’s liabilities. The market-based structural approach forms the basis of the KMV model [2,3], which has gained popularity among banks and financial institutions due to its solid theoretical foundation and utilization of real-time market information. This approach, known as a “structural model,” considers the company’s capital structure, including asset and debt values. Another approach to credit risk has emerged since the 1990s. This alternative approach assumes that a firm’s default timing is influenced by default intensity, which is determined by the market price of credit securities. Referred to as a “reduced form model,” this approach simplifies all information to latent state variables. The advantage of the reduced form model is its computational feasibility and effectiveness in pricing redundant assets. Variables in the market model can be regarded as leading indicators of financial distress, while variables commonly used in accounting-based credit models are also significant indicators of pain. Accounting-based models utilize variables from a company’s financial reports, such as the balance sheet, income statement, and cash flow statement. As these reports reflect the company’s recent performance, accounting-based models assess its historical reputation.

On the other hand, market-based models focus on the evolution of asset market values. The market value of assets, often reflected through the market value of equity, indicates market participants’ expectations regarding a company’s future performance. Thus, the information utilized in market-based models is considered a forward-looking indicator of a company’s reputation. In this study, we aimed to determine whether both sets of models performed equally well in explaining and predicting credit risk.

3. Market-Based Models for Credit Risk Forecasting

Market-based models rely primarily on market information, such as stock prices, bond yields, and other indicators found in capital markets, to assess the ability of potential borrowers to fulfill their payment obligations. The global financial system considers non-bank institutions as a significant vulnerability. Instances like the global financial crisis, the COVID-19 pandemic, and periods of asset price volatility have revealed how the non-bank sector can magnify stress in financial markets. Consequently, central banks and governments, including the UK, have intervened to restore stability in these markets. An example of such intervention was witnessed in the UK pension fund sector at the end of 2022. Recognizing the inherent fragility and the expanding scale of the global non-bank industry, international organizations like the Financial Stability Board (FSB), the Bank for International Settlements, and national regulators actively work towards better comprehending and overseeing this sector to enhance its resilience.

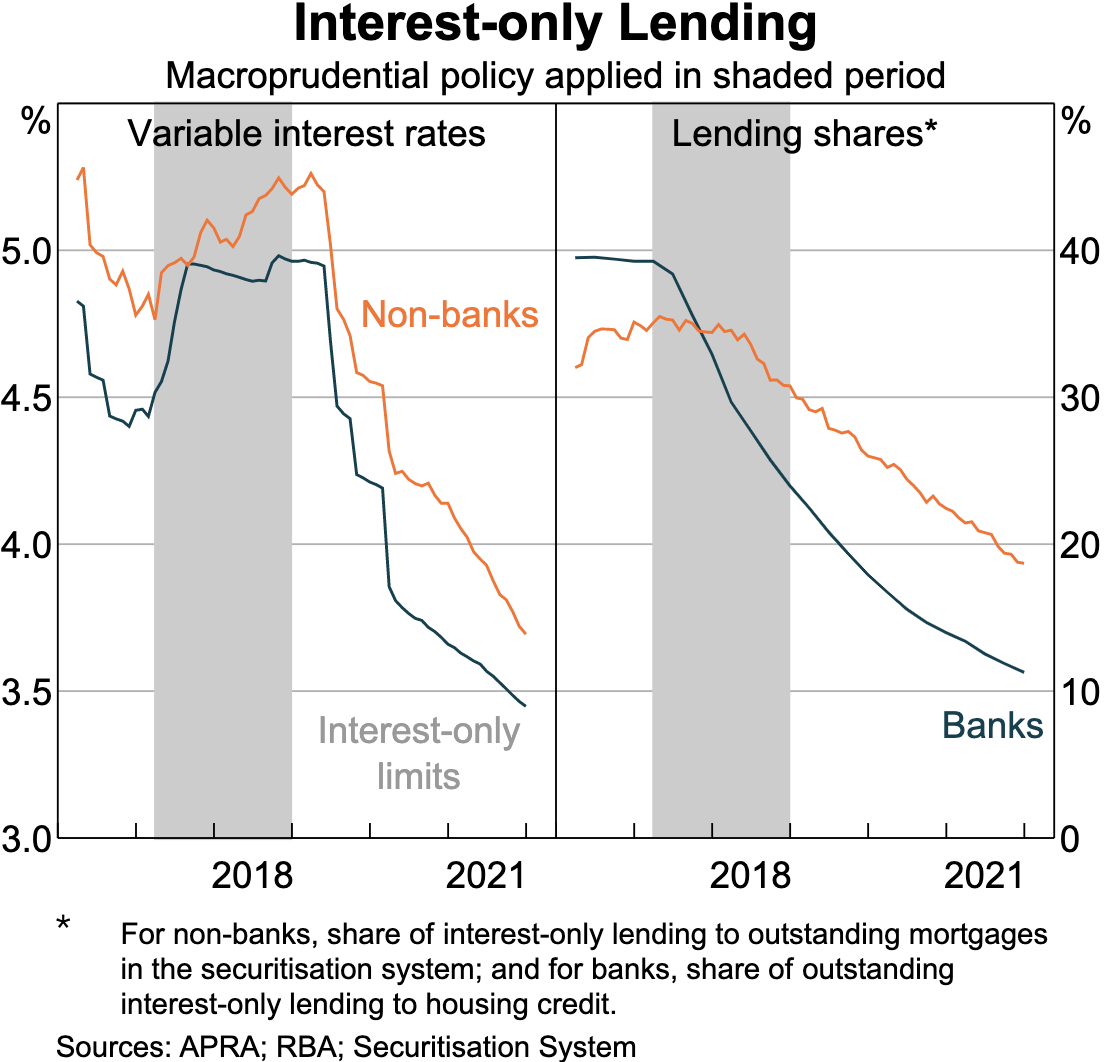

During a period when bank lending posed a risk to financial system stability, APRA (Australian Prudential Regulation Authority) implemented macroprudential policies. However, concerns have been raised that these policies may shift risky lending from banks to less regulated non-banks. International research has discovered some evidence supporting this claim. Nevertheless, it should be noted that APRA possesses reserve powers to regulate the non-bank sector if it threatens financial stability in Australia. The subsequent section discusses the impact of APRA’s macroprudential policies on broader credit trends in recent years. It will take more time to fully assess the full effects of APRA’s 2021 macroprudential policy changes on non-bank lending. However, examining the Reserve Bank’s securitization dataset reveals that the overall quality of non-bank housing loans has generally remained stable or even exhibited improvements in certain aspects since APRA’s 2017 macroprudential policies were implemented.

In early 2014, restrictions on investor lending were introduced, and loan-to-value ratio (LVR) loans were subsequently added. Since then, bank and non-bank mortgage rates have risen, although the initial increase for non-bank rates was relatively minor. Moreover, there has been a decline in the proportion of interest-only (IO) housing loans in both sectors, indicating a decrease in the share of new loans granted to international organizations. However, the reduced percentage of non-bank IO loans was less significant. The share of IO loans continues to decline even after removing A.

Non-bank lenders primarily rely on market-based financing or private investors to secure funding. The funding structures for these lenders can vary based on their specific business models. Securitizers, for instance, obtain funding primarily through warehouse facilities during the loan origination phase, then access the securitization market once the loans are packaged and sold to investors. Warehouse facilities serve as lines of credit that loans originated by securitization institutions collateralize. Since most of the loans are sold to investors, securitizers typically have minimal equity, with only a small portion of loans remaining on their balance sheets. In Australia, banks are the primary providers of warehouse facilities for non-bank lenders. These facilities directly link potential issues in the non-bank sector and banks. However, the exposure of Australian banks to non-banks through these facilities is relatively small, accounting for approximately 1 percent of banks’ assets.

Banks implement lending standards for loans originating from their warehouse facilities to mitigate risks, including restrictions on loan-to-value ratios (LVRs). APRA (Australian Prudential Regulation Authority) encourages banks to enforce these standards through their capital requirements. In 2018, APRA increased the mandatory capital reserves that banks must hold for loans held in warehouse facilities to be on par with those required for loans held directly by the bank. This measure helps minimize the risk of deteriorating lending standards and deviations from APRA’s prudential guidelines. Additionally, the quality of loans underlying securitization undergoes rigorous scrutiny from rating agencies and investors, imposing further market discipline. Investors in longer-term Residential Mortgage-Backed Securities (RMBS) typically’ expect the loans to align with APRA’s standards for “prime” loans.

4. Comparison

The critical difference between accounting-based and market-based models lies in the data types used by each model class. In contrast, accounting-based methods use historical accounting data underlining a firm’s fundamental operations. In contrast, market-based techniques rely instead on capital-market-derived information measuring perceptions about firms’ viability based upon publicly available securities prices.

Both approaches have been shown in research studies conducted over time as complementary and necessary for predicting default probabilities successfully -- with many papers concluding that combining both methodologies offers superior results when compared to using either one in isolation.

The primary advantage of accounting-based models is their ability to provide a standardized approach to predicting credit risk assessment, as the information required is often readily available from public financial statements. A potential limitation, however, is that such data may only sometimes reflect sudden adverse changes in macro or industry-level economic conditions.

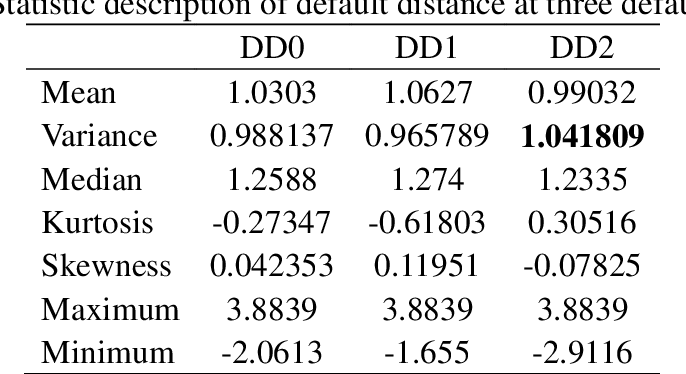

Table 1: Statistic description of default distance at three default points [4].

Figure 1: KMV Model’s Illustration for Default [5].

Figure 2: Interest-only Lending [6].

Market-based models are advantageous by providing timely, up-to-date information on borrower risk due to fast-moving capital-market indicators that reflect expectations about future cash flows. However, a disadvantage lies in these being susceptible to short-term market fluctuations, which may misrepresent long-term default probabilities.

5. Conclusion

Overall, the accurate prediction of bankruptcy probability plays an essential role in financial decision-making processes within banks since it directly translates into setting [7] aside sufficient reserves towards potential losses or opportunities foregone from investing only in high-risk borrowers with potentially superior returns.

Future research studies can further investigate what additional factors should be incorporated into credit risk analysis models other than traditional accounting metrics while designing a unified approach combining accounting and market-based methods toward modeling default probabilities more accurately, given current regulatory requirements stipulating prudent lending practices by financial institutions today.

In conclusion, effective management of credit risks through forecasting using reliable methodologies is essential to mitigate bank losses and maintain operational efficiency while promoting growth opportunities via informed lending decisions based upon defensible underwriting standards.

References

[1]. DEMIRBAS OZBEKLER, MERVE (2023) Essays on Credit Risk, Information Environment and Uncertainty. Doctoral thesis, University of Essex.

[2]. Kim, Young-Ah and Moffatt, Peter G and Peters, Simon (2022) Generalized additive modeling of the credit risk of Korean personal bank loans. Journal of Credit Risk, 18 (3). pp. 77-103. DOI https://doi.org/10.21314/jcr.2022.004

[3]. Liñares-Zegarra, José and Wilson, John OS (2014) Credit card interest rates and risk: new evidence from US survey data. The European Journal of Finance, 20 (10). pp. 892-914. DOI https://doi.org/10.1080/1351847x.2013.839461

[4]. He, K. (2012). Expected Default Measures in the KMV model and the Market-based model.

[5]. Wang, Y., Lin, L., Kuo, H. C., & Piesse, J. (2010). Detecting corporate failure. Handbook of quantitative finance and risk management, 1593-1606.

[6]. Hudson, C., Kurian, S., & Lewis, M. (2023). Non-bank Lending in Australia and the Implications for Financial Stability. 1. 1 Renters, Rent Inflation and Renter Stress 2. Fixed-rate Housing Loans: Monetary Policy Transmission and Financial 10 Stability Risks 3. 19 A New Measure of Average Household Size 4. 27 Non-bank Lending in Australia and the Implications for Financial Stability, 27.

[7]. Casu, Barbara and Clare, Andrew and Sarkisyan, Anna and Thomas, Stephen (2011) Does securitization reduce credit risk-taking? Empirical evidence from US bank holding companies. The European Journal of Finance, 17 (9-10). pp. 769-788. DOI https://doi.org/10.1080/1351847x.2010.538526

Cite this article

Xu,Q.;Zhang,X.A. (2023). Analyzing the Models of Financial Distress in Credit Risk. Advances in Economics, Management and Political Sciences,38,1-5.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. DEMIRBAS OZBEKLER, MERVE (2023) Essays on Credit Risk, Information Environment and Uncertainty. Doctoral thesis, University of Essex.

[2]. Kim, Young-Ah and Moffatt, Peter G and Peters, Simon (2022) Generalized additive modeling of the credit risk of Korean personal bank loans. Journal of Credit Risk, 18 (3). pp. 77-103. DOI https://doi.org/10.21314/jcr.2022.004

[3]. Liñares-Zegarra, José and Wilson, John OS (2014) Credit card interest rates and risk: new evidence from US survey data. The European Journal of Finance, 20 (10). pp. 892-914. DOI https://doi.org/10.1080/1351847x.2013.839461

[4]. He, K. (2012). Expected Default Measures in the KMV model and the Market-based model.

[5]. Wang, Y., Lin, L., Kuo, H. C., & Piesse, J. (2010). Detecting corporate failure. Handbook of quantitative finance and risk management, 1593-1606.

[6]. Hudson, C., Kurian, S., & Lewis, M. (2023). Non-bank Lending in Australia and the Implications for Financial Stability. 1. 1 Renters, Rent Inflation and Renter Stress 2. Fixed-rate Housing Loans: Monetary Policy Transmission and Financial 10 Stability Risks 3. 19 A New Measure of Average Household Size 4. 27 Non-bank Lending in Australia and the Implications for Financial Stability, 27.

[7]. Casu, Barbara and Clare, Andrew and Sarkisyan, Anna and Thomas, Stephen (2011) Does securitization reduce credit risk-taking? Empirical evidence from US bank holding companies. The European Journal of Finance, 17 (9-10). pp. 769-788. DOI https://doi.org/10.1080/1351847x.2010.538526