1. Introduction

The concept of loss aversion is one of the important contributions of psychology to behavioral economics [1]. Loss aversion means that when people are faced with the same amount of profit or loss, they think that the loss is more difficult for them to bear. The negative utility of the same amount of loss is about twice the positive utility of the same amount of gain [2,3]. Loss aversion reflects an inconsistent appetite for risk. The theory of loss aversion reflects the truth reflected in life, and it makes many theories unable to explain it. Loss aversion explains the irrational behavior of people when facing risks. When facing potential gains, people exhibit risk disgust, and when facing potential losses, people show risk chase.

As the population ages, the number of people who are retired and no longer earning income increases, placing a greater strain on social security and pension systems. This can lead to concerns about the sustainability of these programs and the ability of future generations to support retirees. At the same time, many younger people are delaying or opting out of having children due to factors such as financial pressures, career aspirations, and changing social norms. This can further exacerbate the aging population trend by reducing the number of younger people who will be available to support the elderly in the future.

Overall, the issue of saving for a comfortable retirement life is becoming increasingly important as populations age and traditional support systems such as family networks become less reliable. It is important for individuals and policymakers to plan and prepare for these demographic changes in order to ensure a secure and sustainable future for all.

People assess potential gains and losses differently, and their decisions are influenced by multiple cognitive biases and heuristics [2]. The pension savings with loss aversion was explained, and proposed save more tomorrow to solve this problem [4]. Focusing on potential gains rather than potential losses is recommended as a way to mitigate the impact of loss aversion on decision-making [2].

For such reason, this paper focuses on retirement savings in China. China’s pension savings policy is still defined benefit plan. First, the aging population has led to an increase in the social pension burden. Second, the defined benefit plan cannot satisfy people’s ability to maintain their original living standards after retirement. Therefore, this article analyzes the impact of loss aversion on retirement savings. Then this paper proposes to include tomorrow more savings and annuity into pension savings. Emphasize the benefits of retirement savings. Additionally, simplify the process of adding pension savings and choose difficulty of retirement savings rate, advice for savers, diversification of investment portfolio and so on.

Therefore, the second section analyzes the background of China’s pension savings, the impact of loss aversion on pension savings, and explains the principle of saving more tomorrow and the concept of annuities. The third section puts forward some suggestions for the problems analyzed in the second section, and the fourth section summarizes the article.

2. Analysis on Retirement Savings in China

2.1. Background Description

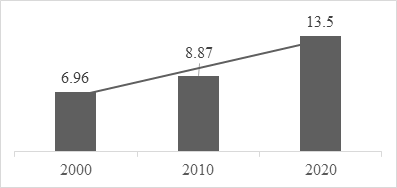

China’s population aging process started to speed up in the late 1970s, and then climbed at an annual rate of about 3.2%. China’s aging process is far faster than developed countries. Addressing the challenges posed by population aging has emerged as a crucial national strategy [5]. According to the findings of the seventh national census in China, the mainland population aged 0-14 amounts to approximately 253 million individuals, representing 17.95% of the total population. The population aged 15-59 comprises around 894 million people, accounting for 63.35% of the total population. The elderly population aged 65 and over makes up about 191 million individuals, representing 13.50% of the total population. China’s population aging is characterized by a large base, high proportion, and rapid growth of the elderly population. Based on information from the National Health Commission of China, it is projected that China’s elderly population aged 60 and above will surpass 400 million by around 2035, indicating a significant increase in the aging population.

It is shown in Figure 1 that the proportion of China’s elderly population aged 65 and above exhibited an upward trend from 2000 to 2020, doubling in 2020 compared to 2000.

Figure 1: Proportion of the elderly population in China from 2000 to 2020 (%, Source of data: National Bureau of statistics of China, http://www.stats.gov.cn/).

As the population ages, saving for retirement becomes more important for both individuals and society as a whole. In many countries, the aging of the population is putting pressure on retirement systems and increasing the need for individuals to save for their own retirement. As people live longer, they require more financial resources to support themselves in retirement. This can be a challenge for individuals who have not saved enough for retirement, as well as for governments and other institutions that provide retirement benefits.

Defined benefit plans are pension plans that guarantee a fixed amount of retirement benefits to employees based on their salary history and length of employment. These plans are usually funded by employers and are designed to provide employees with a guaranteed income upon retirement [6].

Defined contribution plans are retirement savings plans that allow both employees and employers to contribute funds. In defined contribution plans, the employee usually allocates a percentage of their income towards the plan, and the employer may also make contributions to the account. The amount of retirement benefits an employee receives is dependent on the amount of money in their account and how well those investments perform over time. Unlike defined benefit plans where investment risks are borne by the employer, with defined contribution plans, the investment risk is transferred to the employee.

While defined benefit plans were once the norm, they have become increasingly expensive for employers to maintain due to increasing life expectancies and longer retirement periods. As a result, many employers have shifted to defined contribution plans to reduce their financial obligations and shift the investment risk to employees.

Defined contribution plans offer employees greater control over their retirement savings and investment decisions, but they also require employees to take on more responsibility for their retirement planning. It is important for employees to educate themselves on the investment options available and to regularly review and adjust their retirement savings strategy to ensure they are on track to meet their retirement goals.

Additionally, without investment planning, early retirement savings may lose their purchasing power over time due to inflation. Inflation refers to the gradual increase in prices for goods and services over a period of time, and it can erode the value of money held in savings accounts or other low-yield investments. To combat the effects of inflation on retirement savings, it is important to develop an investment plan that takes into account inflation risk and seeks to generate returns that outpace inflation over the long term. This may involve diversifying the investment portfolio across various asset classes, including inflation-protected securities, and regularly monitoring and adjusting the portfolio to ensure it remains well-positioned to withstand inflation risk. By taking these steps, savers can help ensure that their retirement savings maintain their purchasing power over time and are better able to support their lifestyle needs in retirement [7].

2.2. Loss Aversion and Save More Tomorrow

Loss aversion can lead people to focus more on the potential loss of their savings rather than the potential gain of having a comfortable retirement. As a result, they may be less willing to save for retirement or increase their savings rate, even if they know that doing so would be in their best interest in the long term. One way in which loss aversion affects retirement savings is through the decision on the retirement savings rate. People who are highly loss-averse are more likely to choose a retirement savings rate with lower risk and lower return. This can lead to lower returns on their overall savings and reduce the likelihood that they will meet their retirement savings goals.

The fact that retirement savings cannot be used for immediate consumption can also exacerbate loss aversion [4]. Saving already earned wages for retirement increases people’s loss aversion to retirement savings. People may feel that they are giving up something in the present for an uncertain future benefit, which can be difficult to accept emotionally. Furthermore, the process of selecting a savings rate and setting up a retirement account can be daunting for some people, which can further increase their reluctance to save for retirement.

Additionally, it is worth noting that inflation is an important factor to consider in retirement planning because it can reduce the purchasing power of retirement savings over time and increase people’s loss aversion to retirement savings.

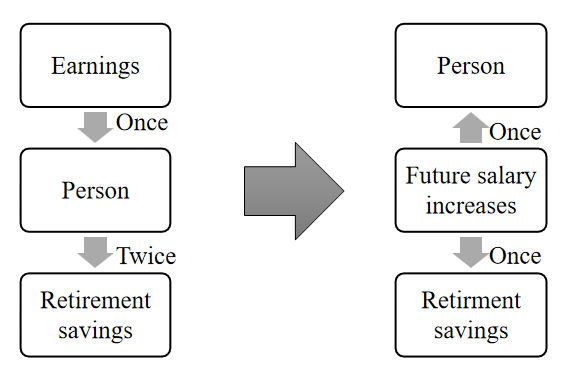

Save more tomorrow links higher savings rates with higher salaries to reduce loss aversion. In other words, transforming “paid pension with salary already received” into “pension paid with future salary increase” reduces the number of lost trips, resulting in a one- loss in the future and reducing people’s loss avoidance [8]. It should be noted that the number of ways refers to the number of times the same possession (such as money) passes through the owner between the initial state and the final state.

People may experience stronger loss aversion when they think about their retirement savings as a separate account that is distinct from their regular income. Figure 2 is adapted from scholars’ research on the role of behavioral economics in boosting retirement savings [8]. As shown in Figure 2, a salary undergoes a process from scratch, which is equivalent to a journey. Then, part of the salary earned is invested in pension savings, and this part of the salary undergoes the process of “from scratch” and then “from there to nothing”, which is equivalent to two journeys. This can result in a stronger psychological feeling of loss aversion than earning a salary, thus producing loss aversion. Save More Tomorrow requires employees to plan a part of their pension savings before receiving a salary increase, allowing the loss to flow directly from the salary to the pension savings account, resulting in a one-way loss in the future. Employees will not really experience the two journeys loss and will be more willing to save for retirement [4,8].

Figure 2: Pension with earned salary (left: double journey loss); pension with future salary increase (right: one journey loss).

2.3. Annuities

An annuity is a financial product that provides a regular stream of income payments to the holder over a specified period of time, typically during retirement. An annuity can be purchased from an insurance company or other financial institution. Annuities are often used as a retirement income tool, as they provide a guaranteed stream of income payments over a specified period of time. This can be particularly valuable for individuals who are concerned about outliving their retirement savings. Annuities can be used as a retirement savings tool as they provide a guaranteed stream of income payments during retirement. When individuals purchase an annuity, they typically make a lump sum payment to an insurance company or financial institution in exchange for a series of periodic payments over a specified period of time, often for the remainder of their life.

However, annuities can also be expensive and complex financial products, and it is important to carefully consider the costs and benefits before purchasing an annuity. Annuities may have high fees and charges, and the payments may be subject to tax or other penalties if withdrawn early. Additionally, annuities may not be suitable for everyone, as they may not provide the flexibility or liquidity required by some individuals. It is important to carefully evaluate one’s financial goals and needs before deciding whether an annuity is an appropriate retirement savings tool.

3. Suggestions

3.1. Save More Tomorrow and Reducing the Impact of Loss Aversion

Emphasizing the benefits of retirement savings can be an effective way to help people overcome loss aversion and focus on the potential gains of saving. By highlighting the positive outcomes of saving for retirement, such as the ability to travel, spend time with family, or pursue hobbies and interests, people can be motivated to save more for their future.

There are two additional suggestions for reducing loss aversion in retirement savings. Simplifying the process of joining and choosing retirement plans can help overcome the barriers that prevent people from saving for retirement, such as the complexity of the enrollment process or the difficulty of calculating the appropriate savings rate. Automating enrollment in retirement plans can make it easier for employees to participate in savings without having to take any action. By defaulting employees into a retirement plan, companies can increase the number of people who save for retirement without requiring them to make any decisions or take any action [8].

Another suggestion is to set up financial advisors to recommend and analyze retirement savings rates directly to employees [9]. Instead of requiring employees to calculate their own savings rate, companies can provide personalized recommendations based on their age, income, and other factors. This can help employees understand how much they need to save for retirement and make it easier for them to make informed decisions about their savings.

These suggestions can help reduce loss aversion in retirement savings by simplifying the process and making it easier for people to participate. By reducing the barriers to saving for retirement, more people can overcome their loss aversion and start saving for a more secure financial future.

Additionally, Save More Tomorrow can be incorporated into retirement savings, which can be an effective way to reduce people’s loss aversion to retirement savings, increase participation rates and savings rates, and lay the foundation for a more secure retirement.

3.2. Annuities and Reducing the Impact of Inflation

There are several measures that can be taken to reduce the risk of inflation on retirement savings. One effective measure is investing in inflation-protected securities like Treasury Inflation-Protected Securities (TIPS), which adjust their value in response to changes in the Consumer Price Index (CPI) and ensure that investors’ savings keep pace with inflation [10]. Another measure is to diversify the investment portfolio across various asset classes, as different asset classes have different inflation sensitivities. It is also important to regularly monitor and adjust the portfolio to ensure it can withstand inflation risks, as the inflation rate can fluctuate at any time. Finally, seeking professional advice can assist in formulating an investment portfolio that reduces inflation risk.

By providing a guaranteed income stream, annuities can help alleviate the fear of running out of money in retirement and reduce the impact of loss aversion on investment decisions. This can be particularly valuable for individuals who are risk-averse or who have experienced market losses in the past. Annuities can also provide a degree of predictability and stability in retirement income, which can help individuals better plan and manage their retirement expenses. This can be particularly valuable for individuals who are concerned about the impact of inflation or other economic factors on their retirement income.

It is important to consider one’s individual financial goals and needs before deciding whether an annuity is an appropriate tool for reducing loss aversion in retirement savings. In addition, it is crucial to take into account the financial stability and strength of the insurance firm providing the annuity. By following these measures, investors can help ensure their retirement savings maintain their purchasing power over time, even in the face of inflation.

4. Conclusion

This paper mainly discusses the retirement savings problem and loss aversion in China. Population aging has increased the burden of social pensions. Defined benefit plans can no longer satisfy people’s ability to maintain their original standard of living after retirement. That is why it is all the more important to be able to save for retirement early to maintain your standard of living after retirement. This paper analyzes the impact of loss aversion on pension savings. Moreover, put forward a series of suggestions, such as saving more for tomorrow and annuity into pension savings, emphasizing the benefits of retirement saving. In addition, simplification of the process of increasing pension savings, the difficulty of choosing a retirement savings rate, advice for savers, and diversification of investment portfolios are also presented. These suggestions can reduce people’s loss aversion to pension savings and pension savings that may cause inflation, as well as the loss aversion problem of choosing pension savings rate and investment portfolio.

Since defined contribution plans have not yet been implemented in China, there is a lack of relevant data and model support. In addition, China has a large population base and the situation is more complicated, and there may be factors that have not been considered. Therefore, future research can be extended in terms of data, models, and more comprehensive considerations. Also, while data and models for defined contribution plans are lacking in China, there are still some resources and research that can provide valuable insights into retirement savings and investment strategies. Such as collecting and researching relevant data and information on the retirement savings and investment behavior of Chinese workers.

References

[1]. Kahneman, D. T: Thinking, fast and slow. Macmillan (2011).

[2]. Kahneman, D., Tversky, A.: Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), 263-291 (1979).

[3]. Tversky, A., Kahneman, D.: Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297-323 (1992).

[4]. Thaler, R. H., Sunstein, C. R.: Nudge: Improving Decisions About Health, Wealth, And Happiness. Yale University Press (2008).

[5]. Bao, J., Zhou, L., Liu, G., Tang, J., Lu, X., Cheng, C., Bai, J.: Current state of care for the elderly in China in the context of an aging population. BioScience Trends, 16(2), 107-118 (2022).

[6]. Benartzi, S., Thaler, R. H.: Heuristics and biases in retirement savings behavior. Journal of Economic perspectives, 21(3), 81-104 (2007).

[7]. Chen, Z., Li, Z., Zeng, Y., Sun, J.: Asset allocation under loss aversion and minimum performance constraint in a DC pension plan with inflation risk. Insurance: Mathematics and Economics, 75, 137-150 (2017).

[8]. Liu, H., Sui, X. Y., Huang, Y. N., Lin, R. P., Xu, M. X.: The nudging role of behavioral economics in retirement savings decisions: Current situation and future prospects. Advances in Psychological Science, 27(3), 418 (2019).

[9]. Blake, D., Wright, D., Zhang, Y.: Target-driven investing: Optimal investment strategies in defined contribution pension plans under loss aversion. Journal of Economic Dynamics and Control, 37(1), 195-209 (2013).

[10]. Sexauer, S. C., Peskin, M. W., Cassidy, D.: Making retirement income last a lifetime. Financial Analysts Journal, 68(1), 74-84 (2012).

Cite this article

Sun,E. (2023). Measures to Encourage Retirement Savings in China – The Role of Loss Aversion. Advances in Economics, Management and Political Sciences,38,6-12.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Kahneman, D. T: Thinking, fast and slow. Macmillan (2011).

[2]. Kahneman, D., Tversky, A.: Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), 263-291 (1979).

[3]. Tversky, A., Kahneman, D.: Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297-323 (1992).

[4]. Thaler, R. H., Sunstein, C. R.: Nudge: Improving Decisions About Health, Wealth, And Happiness. Yale University Press (2008).

[5]. Bao, J., Zhou, L., Liu, G., Tang, J., Lu, X., Cheng, C., Bai, J.: Current state of care for the elderly in China in the context of an aging population. BioScience Trends, 16(2), 107-118 (2022).

[6]. Benartzi, S., Thaler, R. H.: Heuristics and biases in retirement savings behavior. Journal of Economic perspectives, 21(3), 81-104 (2007).

[7]. Chen, Z., Li, Z., Zeng, Y., Sun, J.: Asset allocation under loss aversion and minimum performance constraint in a DC pension plan with inflation risk. Insurance: Mathematics and Economics, 75, 137-150 (2017).

[8]. Liu, H., Sui, X. Y., Huang, Y. N., Lin, R. P., Xu, M. X.: The nudging role of behavioral economics in retirement savings decisions: Current situation and future prospects. Advances in Psychological Science, 27(3), 418 (2019).

[9]. Blake, D., Wright, D., Zhang, Y.: Target-driven investing: Optimal investment strategies in defined contribution pension plans under loss aversion. Journal of Economic Dynamics and Control, 37(1), 195-209 (2013).

[10]. Sexauer, S. C., Peskin, M. W., Cassidy, D.: Making retirement income last a lifetime. Financial Analysts Journal, 68(1), 74-84 (2012).