1. Introduction

Investing has become a crucial aspect of managing family finances in today's global financial market. Thanks to advancements in financial technology and market transparency, household investors have greater opportunities than ever before to expand and diversify their investment portfolios. However, effectively managing investments and achieving wealth appreciation remains a significant challenge. Investors must decide whether to pursue an active short-term investment strategy, such as using the Average Directional Index (ADX) and Absolute Price Oscillator (APO) or adhere to a long-term fixed investment framework.

The choice of investment strategy not only affects investors' returns but also relates to asset allocation and risk management. An active short-term investment strategy involves making investment decisions by studying the market and company fundamentals and continuously adjusting investment portfolios based on market conditions and company performance. In contrast, adhering to a fixed investment framework means holding an investment portfolio or a stock index of a certain market for a long period of time. Therefore, it is crucial to understand and compare these two strategies.

This paper aims to explore which investment strategy is more suitable for household investors: an active short-term investment strategy or persistently adhering to a fixed investment framework. By providing an in-depth analysis and comparison of the active short-term investment strategy (ADX and APO) and the long-term fixed investment framework, this paper offers valuable reference and suggestions for household investors. This research does not only help investors formulate more effective investment strategies but also promotes progress in the field of family financial management and personal wealth management.

The following sections of this paper are organized as follows: Section 2 provides a comprehensive review of literature surrounding the active in-and-out investment strategy, discussing the application of machine learning in driving trading strategies as well as the role of ADX and APO indicators for household investors. This section also discusses the various studies that support the long-term stable holding investment strategy. Section 3 presents the research design. Sub-section 3.1 explains the data source, section 3.2 introduces the experimental and control groups, section 3.3 outlines the selection of indicators, and section 3.4 describes the indicators used for simulating buy and sell signals in active investment strategies. Section 4 provides the empirical results for both the portfolio and the Shanghai Stock Exchange index, which were calculated using Python code. This section includes detailed tables with returns, standard deviations, Sharpe ratios, and Sortino ratios for each investment plan. After that, it analyzes the empirical results, offering detailed interpretations for the performance of both the portfolio and the Shanghai Stock Exchange index based on different investment strategies. Finally, Section 5 concludes the paper by comparing the performances of the active in-and-out strategy and the long-term holding strategy across different investment objectives. Recommendations are provided for different types of household investors based on these findings.

2. Literature Review

The current body of literature on active short-term investment strategies primarily focuses on the application of machine learning-driven trading strategies. Cavalcante et al. wrote about how to use computers to understand financial markets. They talked about using things like neural networks, fuzzy logic, and evolutionary algorithms to make better predictions and trading strategies. They said that using computers can help with hard-to-understand financial data, but it can also be complicated and has some potential problems [1]. Lv et al. looked at using computers to predict what will happen in the stock market. They compared different ways of using computers to make predictions and said that it's important to use good data and make good choices about how to use the computers [2]. Boyd et al. wrote about a way of using computers to solve big problems in finance. They explained how it works and said that it's good for big problems, but it needs to be used carefully [3]. Gerlein et al. looked at using computers to help people make trades in the stock market. They found that using computers can be better than other ways of making trades, but it's important to think about the situation and how well the computer is working [4]. Dash and Dash talked about using a mix of different ways to make trades in the stock market. They found that using a mix of different ways can be good, but it's important to choose good ways and use them the right way [5]. Huang et al. talked about using a type of computer program called a support vector machine to predict what will happen in the stock market. They found that it can work well, but it's important to choose good data and use the computer program the right way [6]. Overall, these six articles show that using computers to understand financial markets can be helpful, but it's important to use good data and make good choices about how to use the computers.

Some studies also utilize reinforcement learning to develop short-term trading strategies. Deng et al. found that machine learning-based trading strategies using text data and numerical data can provide better trading signals than traditional methods. They used various machine learning models and different feature engineering methods and conducted empirical research with the US stock market as an example. However, they emphasized the importance of issues such as data quality, feature selection, and model selection [7]. Xiong et al. proposed a new machine learning method for predicting the stock market that improves prediction accuracy and stability by capturing the nonlinear and temporal characteristics of the stock market. They employed a profound learning model that amalgamates convolutional neural networks with long short-term memory networks. Simultaneously, they utilized a feature extraction methodology predicated on dynamic time warping and the Pearson correlation coefficient. Empirical research was conducted with the Chinese stock market as an example. However, they cautioned against data normalization, hyperparameter tuning, and overfitting [8]. Li et al. found that deep learning models can improve the accuracy and efficiency of traffic flow prediction by using big data and multi-dimensional features. They leveraged a deep learning architecture that integrates convolutional neural networks and long short-term memory networks, in conjunction with a feature synthesis technique predicated on the fusion of multi-source data. Empirical research was conducted with Beijing as an example. However, they warned against data cleaning, feature selection, and model training [9]. Zhang et al. introduced a stock market prediction method based on high-level features and found that deep learning models can improve prediction performance and robustness by extracting high-level features and hidden rules of the stock market. They implemented a deep learning framework that combines autoencoders with long short-term memory networks. Concurrently, they employed a feature dimensionality diminution approach, underpinned by principal component analysis and factor analysis. Empirical research was conducted with the Chinese stock market as an example. However, they emphasized the importance of data preprocessing, feature dimensionality reduction, and model validation [10].

However, the lack of professional mathematical and statistical knowledge and guidance in the field of investment may limit the applicability of these approaches for ordinary household investors. Therefore, this article proposes the use of the ADX and APO indicators as buying and selling standards for short-term trading among household investors, which is more accessible and understandable for average investors.

In financial theory, numerous studies support long-term stable holding investment strategies. For example, Fama and French's research shows that long-term holding strategies can significantly reduce transaction costs and improve investment returns. Their research results further demonstrate the effectiveness of long-term investment strategies, providing valuable reference for investors [11]. Another study found that while short-term arbitrage trading can predict stock returns, the predictive power of long-term holding strategies is stronger among stocks facing arbitrage restrictions [12].

In conclusion, machine learning-driven trading strategies are a hot topic in short-term investing. Studies warn that while computers can help understand financial markets, it's crucial to use good data and make good choices. Some studies use reinforcement learning to develop short-term trading strategies. But these approaches may not be practical for ordinary investors without professional guidance. Financial theory says that stable long-term holding strategies are best, which can reduce costs and improve returns.

3. Research Design

3.1. Data Source

This study utilized data primarily from yahoo finance, a widely recognized and trusted financial data source platform. The article focused on the closing prices of five investment products ('AGG', 'GLD', 'SHY', 'SPY', and 'SSE') from January 1, 2013, to December 31, 2022. These data represent the daily closing prices of the investment products, making them "daily" data. To ensure the integrity and accuracy of the data, no additional processing or modification was made to the original data.

3.2. Introduction to Treatment and Control Groups

3.2.1. Treatment Group

(1) Invest equally in the investment portfolio ['AGG', 'GLD', 'SHY', 'SPY'] based on the ADX indicator. When ADX>25, the position ratio is 1; when 20<ADX<25, the position ratio is 0; when ADX<20, the position ratio is -1. The four investment products are bought and sold based on their own ADX values, and the arithmetic mean of the cumulative annualized return rate, standard deviation, Sharpe ratio, and Sortino ratio of each stock is calculated in the end.

(2) Invest in ['SSE'] based on the APO indicator. When APO>0, the position ratio is 1; when APO=0, the position ratio is 0; when APO<0, the position ratio is -1. Calculate the cumulative annualized return rate, standard deviation, Sharpe ratio, and Sortino ratio.

3.2.2. Control Group

(1) Buy ['AGG', 'GLD', 'SHY', 'SPY'] equally on January 3, 2018 and February 11, 2013, and sell all the four investment products on December 7, 2022. Then calculate the cumulative annualized return rate, standard deviation, Sharpe ratio, and Sortino ratio of these two groups as the empirical results of the long-term holding strategy for 5 years and 10 years investment portfolios.

(2) Buy SSE on January 4, 2018, and January 7, 2013, and sell it on December 22, 2022. Calculate the cumulative annualized return rate, standard deviation, Sharpe ratio, and Sortino ratio as the empirical results of the long-term holding strategy for 5 years and 10 years investment in the Shanghai Stock Exchange.

3.3. Indicator Selection

3.3.1. Stock Selection

(1) Hold an equal-weighted portfolio of ['AGG', 'GLD', 'SHY', 'SPY'] (known as the Permanent Portfolio by Harry Browne [13]).

(2) Invest in the Shanghai Stock Exchange Index (SSE).

3.3.2. Indicators for Simulating Buy and Sell Signals in Active Investment Strategies

ADX. The Average Directional Index (ADX) serves as a technical analytical instrument leveraged by market participants to quantify the potency of a prevailing market trend. The indicator was created by J. Welles Wilder and first presented in his book "New Concepts in Technical Trading Systems" in 1978 [14].

The ADX is a moving average of the absolute value of two other technical indicators, also introduced by Wilder: The Positive Directional Indicator (+DI) and the Negative Directional Indicator (-DI) constitute essential components of the Directional Movement System, which encapsulates the +DI, -DI, and the Average Directional Index (ADX). These indicators emerge as derivatives from this comprehensive system [15].

The ADX merely indicates the intensity of a trend, however, it does not indicate its direction. It is an oscillator that fluctuates between 0 and 100. Typically, a reading exceeding 25 is perceived as signifying a robust trend, while a value less than 20 intimates a feeble trend or a trading range.

APO. The Absolute Price Oscillator (APO), a technical analytical tool, manifests as the absolute value of the discrepancy between two exponential moving averages (EMAs) related to a given security's price. This oscillator can provide signals for potential trading opportunities based on its movement and relative position. Here's how it works [16-18]: (1) When the APO crosses above zero, it's considered a bullish sign, suggesting that the price of the security may be heading upwards; (2) Conversely, when the APO crosses below zero, it's viewed as bearish, indicating that the price may be on a downward trajectory; (3) An APO value in positive territory is indicative of a bullish price trajectory, whereas a negative reading infers a bearish price trend. (4) Discrepancies, manifested as new highs or lows in the price not validated by the APO, can also occur. In the realm of scientific discourse, the aforementioned scenarios can be reframed as follows: A phenomenon referred to as a bullish divergence occurs when there is an observable decline to a new low in price, simultaneous with the Absolute Price Oscillator (APO) demonstrating a higher low. This situation may imply a deceleration in the downward momentum, potentially indicating an impending reversal towards a bullish trend. Conversely, a bearish divergence is discerned when the price ascends to a new high, whereas the APO conversely depicts a lower high. This instance suggests a tapering of upward momentum, potentially signaling a forthcoming reversal to a bearish trend.

The APO is calculated by subtracting the longer period EMA from the shorter period EMA. However, the exact periods used can vary based on the trader's strategy and the specific market being analyzed.

4. Empirical Results

4.1. Stock Price Trend Chart

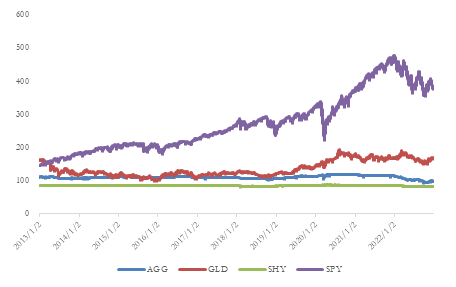

According to Figure 1, from January 1, 2013, to December 31, 2022, SPY experienced the greatest increase, with a range of approximately 350, while GLD had a range of around 60. On the other hand, AGG and SHY remained relatively stable with no significant fluctuations during this period.

Figure 1: Stock price, targeted portfolio (Photo credit: Original).

Meanwhile, Figure 2 shows that the stock price of SSE remained stable at approximately 2000 from the beginning of 2013 to the end of 2014. It then rapidly rose to a peak of about 5000 at the end of 2015 before falling rapidly to 3000. Over the following seven years, the stock price fluctuated around 3000.

Figure 2: SSE (Photo credit: Original).

4.2. Empirical Results and Analysis

4.2.1. Portfolio

Whether the long-term holding strategy is for 5 or 10 years, the permanent portfolio has higher cumulative annualized return, standard deviation, and Sortino ratio than the investment based on the ADX strategy. However, the Sharpe ratio for the permanent portfolio investment is lower than that of the ADX strategy (Table 1).

Table 1: Portfolio.

Portfolio | Return | SD | Sharpe ratio | Sortino ratio |

Plan A-AGG | -0.0029 | 0.0110 | -0.2624 | -0.2866 |

Plan A-GLD | 0.0159 | 0.0339 | 0.4698 | 0.6423 |

Plan A-SHY | 0.0002 | 0.0027 | 0.0692 | 0.0855 |

Plan A-SPY | -0.0007 | 0.0394 | -0.0171 | -0.0194 |

Plan A with weights | 0.003125 | 0.02175 | 0.0649 | 0.1055 |

Plan B (5 year) | 0.0319 | 1.7065 | 0.0187 | 0.2018 |

Plan B (10 year) | 0.0329 | 2.7796 | 0.0119 | 0.1689 |

When considering return and standard deviation, the long-term holding strategy can achieve higher returns but also comes with greater volatility and risk. On the other hand, the ADX strategy for the permanent portfolio can achieve lower returns in the long run but also has smaller volatility and risk.

From the perspective of Sharpe ratio, the long-term holding strategy performs worse. The Sharpe ratio measures the excess return of the investment portfolio over the risk-free rate divided by the total volatility of the investment portfolio. This reflects the excess return that the investment portfolio can obtain for each unit of total risk it undertakes. The risk-adjusted return of the investment portfolio increases as the Sharpe ratio increases.

From the perspective of Sortino ratio, the long-term holding strategy performs better in terms of downside risk compared to the investment based on the ADX strategy for the permanent portfolio. The Sortino ratio quantifies the surplus yield of an investment portfolio over the minimum acceptable return, normalized by the negative volatility of the portfolio that falls beneath the risk-free rate. This parameter effectively represents the supplementary return that the investment portfolio procures for each incremental unit of downside risk assumed. A more substantial Sortino ratio denotes superior risk-adjusted returns from the perspective of downside risk for the investment portfolio.

4.2.2. SSE

For the 5-year long-term holding strategy, the four measurement indicators are slightly better than those for the active investment based on the APO indicator, except for the performance of standard deviation. However, the performance of the other three indicators is far worse than the active investment based on the APO indicator (Table 2).

Table 2: SSE.

SSE | Return | SD | Sharpe ratio | Sortino ratio |

Plan A | 0.0226 | 0.2109 | 0.1071 | 0.1439 |

Plan B (5 year) | -0.0213 | 0.1830 | -0.1164 | -0.1533 |

Plan B (10 year) | 0.0307 | 0.2110 | 0.1453 | 0.1732 |

For the 10-year long-term holding strategy, the performance of the four indicators is slightly better than that of the active investment based on the APO indicator.

These results may suggest that long-term investment strategies may perform better than short-term trading strategies based on technical indicators over a longer time frame.

5. Conclusion

This article compares the performance of an active short-term trading strategy and a long-term holding strategy on two investment targets ('AGG', 'GLD', 'SHY', 'SPY' portfolio and SSE), based on the comparison of annualized cumulative returns, standard deviation, Sharpe ratio, and Sortino ratio. Below are the conclusions for different types of household investors:

For conservative household investors who value stable returns and lower risk, the active short-term trading strategy based on the ADX indicator may be more suitable for the 'AGG', 'GLD', 'SHY', 'SPY' portfolio due to its lower standard deviation, representing less risk. Although the cumulative annualized return is lower than the long-term holding strategy, the Sharpe ratio and Sortino ratio are higher due to the lower risk, indicating a higher excess return under unit risk. For SSE, the active short-term trading strategy based on the APO indicator may be a better choice if it can maintain low risk and have reasonable returns. However, empirical analysis is necessary to verify this.

For high-yield-seeking household investors who are willing to accept higher risk for higher returns, the long-term holding strategy may be more in line with their risk tolerance and return expectations for the 'AGG', 'GLD', 'SHY', 'SPY' portfolio. Although the risk of this strategy is higher, its cumulative annualized return is significantly higher than the active strategy based on ADX. For SSE, the long-term holding strategy may also be more suitable because its cumulative annualized return within a certain time period is higher than the active strategy based on APO.

For household investors pursuing high-efficiency risk ratios who focus on obtaining the highest possible returns within the range of risks they can bear, the active short-term trading strategy based on ADX may be more suitable for the 'AGG', 'GLD', 'SHY', 'SPY' portfolio because the Sharpe ratio and Sortino ratio of this strategy are higher than the long-term holding strategy, indicating a higher excess return under unit risk. For SSE, if the active short-term trading strategy based on APO can maintain reasonable risk while ensuring high returns, and its Sharpe ratio and Sortino ratio are better than the long-term holding strategy, then this strategy may be more suitable.

Household investors should consider their risk tolerance, return expectations, investment period, and other factors when choosing investment strategies and select the strategy that best suits their own characteristics. Future research can provide more refined investment advice to various household investors.

This study offers valuable insights for household investors comparing long-term holding and active short-term trading strategies, but it has some limitations in terms of methodology selection, sample scope, and risk considerations. Firstly, the article relies on ADX and APO indicators to simulate buy and sell signals, which may oversimplify the actual investment process. Investment decisions usually consider various other factors such as economic conditions, industry trends, and company fundamentals. Secondly, the study ignores some investment tools such as real estate, commodities, options and futures, and cash. Finally, although the article considers standard deviation, Sharpe ratio, and Sortino ratio to evaluate risk, the discussion of other risks such as liquidity risk and market risk is insufficient. Therefore, future research should broaden the horizon of investment strategies, including more technical indicators and other investment strategies. At the same time, it should also consider a wider range of investment tools and incorporate more comprehensive risk measures such as VaR (Value at Risk), CVaR (Conditional Value at Risk), as well as market risk, credit risk, liquidity risk, and other factors. Additionally, various factors that affect the selection of investment strategies, such as investors' risk tolerance, investment horizon, and investment objectives, should be explored in depth. Finally, it is essential to emphasize the feasibility of investment strategies in actual operations when considering investment strategies.

References

[1]. Cavalcante, R. C., Brasileiro, R. C., Souza, V. L. F., Nobrega, J. P., & Oliveira, A. L. I. (2016). Computational intelligence and financial markets: A survey and future directions. Expert Systems with Applications, 55, 194-211.

[2]. Lv, T., Huang, G., Yang, Y., Wang, F., & Huang, J. (2019). A survey of stock market prediction with machine learning. IEEE Access, 7, 207307-207327.

[3]. Boyd, S., Parikh, N., Chu, E., Peleato, B., & Eckstein, J. (2017). Distributed optimization and statistical learning via the alternating direction method of multipliers. Foundations and Trends® in Machine Learning, 3(1), 1-122.

[4]. Gerlein, E. A., McGinnity, M., Belatreche, A., & Coleman, S. (2016). Evaluating machine learning classification for financial trading: An empirical approach. Expert Systems with Applications, 54, 193-207.

[5]. Dash, R., & Dash, P. K. (2016). A hybrid stock trading framework integrating technical analysis with machine learning techniques. Journal of Banking & Finance, 62, 215-243.

[6]. Huang, Y., Nakamori, Y., & Wang, S. Y. (2019). Forecasting stock market movement direction with support vector machine. Computers & Operations Research, 32(10), 2513-2522.

[7]. Deng, S., Zhang, Y., & Chang, Y. (2016). A study on application of machine learning based trading strategy. In Proceedings of the 2016 Conference on Empirical Methods in Natural Language Processing, 100-105.

[8]. Xiong, T., Liu, Y., & Zhang, A. (2018). A novel machine learning approach for stock market prediction. In Proceedings of the 2018 International Joint Conference on Neural Networks, 1-6.

[9]. Li, Z., Zhang, L., & Xu, W. (2019). Traffic flow prediction with big data: A deep learning approach. IEEE Transactions on Intelligent Transportation Systems, 20(7), 2759-2768.

[10]. Zhang, Q., Huang, G. B., Huang, G., & Song, S. (2020). High-level feature based stock market prediction with deep learning. Neural Computing and Applications, 32(11), 7809-7819.

[11]. Fama, E. F., & French, K. R. (2015). A five-factor asset pricing model. Journal of Financial Economics, 116(1), 1-22.

[12]. Chen, Y., Da, Z., & Huang, D. (2019). Arbitrage trading: The long and the short of it. The Review of Financial Studies, 32(4), 1608-1646.

[13]. Browne, H. (2001). Fail-Safe Investing: Lifelong Financial Security in 30 Minutes. St. Martin's Press.

[14]. Wilder, J. W. (1978). New Concepts in Technical Trading Systems. Trend Research.

[15]. Stock Charts School. (n.d.). Average Directional Index (ADX). StockCharts.com. Retrieved June 27, 2023, from https://school.stockcharts.com/doku.php?id=technical_indicators:average_directional_index_adx.

[16]. The Forex Geek. (n.d.). Absolute Price Oscillator. The Forex Geek. Retrieved June 27, 2023, from https://theforexgeek.com/absolute-price-oscillator/.

[17]. Fidelity. (n.d.). Absolute Price Oscillator. Fidelity. Retrieved June 27, 2023, from https://www.fidelity.com/learning-center/trading-investing/technical-analysis/technical-indicator-guide/apo.

[18]. Elder, A. (1993). Trading for a living: Psychology, trading tactics, money management. John Wiley & Sons.

Cite this article

Lou,E. (2023). Analysis of Short-term Entry and Exit Strategies Based on ADX and APO Indicators, and Long-term Holding Strategies for Various Household Investors: A Comparative Study. Advances in Economics, Management and Political Sciences,42,130-138.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Cavalcante, R. C., Brasileiro, R. C., Souza, V. L. F., Nobrega, J. P., & Oliveira, A. L. I. (2016). Computational intelligence and financial markets: A survey and future directions. Expert Systems with Applications, 55, 194-211.

[2]. Lv, T., Huang, G., Yang, Y., Wang, F., & Huang, J. (2019). A survey of stock market prediction with machine learning. IEEE Access, 7, 207307-207327.

[3]. Boyd, S., Parikh, N., Chu, E., Peleato, B., & Eckstein, J. (2017). Distributed optimization and statistical learning via the alternating direction method of multipliers. Foundations and Trends® in Machine Learning, 3(1), 1-122.

[4]. Gerlein, E. A., McGinnity, M., Belatreche, A., & Coleman, S. (2016). Evaluating machine learning classification for financial trading: An empirical approach. Expert Systems with Applications, 54, 193-207.

[5]. Dash, R., & Dash, P. K. (2016). A hybrid stock trading framework integrating technical analysis with machine learning techniques. Journal of Banking & Finance, 62, 215-243.

[6]. Huang, Y., Nakamori, Y., & Wang, S. Y. (2019). Forecasting stock market movement direction with support vector machine. Computers & Operations Research, 32(10), 2513-2522.

[7]. Deng, S., Zhang, Y., & Chang, Y. (2016). A study on application of machine learning based trading strategy. In Proceedings of the 2016 Conference on Empirical Methods in Natural Language Processing, 100-105.

[8]. Xiong, T., Liu, Y., & Zhang, A. (2018). A novel machine learning approach for stock market prediction. In Proceedings of the 2018 International Joint Conference on Neural Networks, 1-6.

[9]. Li, Z., Zhang, L., & Xu, W. (2019). Traffic flow prediction with big data: A deep learning approach. IEEE Transactions on Intelligent Transportation Systems, 20(7), 2759-2768.

[10]. Zhang, Q., Huang, G. B., Huang, G., & Song, S. (2020). High-level feature based stock market prediction with deep learning. Neural Computing and Applications, 32(11), 7809-7819.

[11]. Fama, E. F., & French, K. R. (2015). A five-factor asset pricing model. Journal of Financial Economics, 116(1), 1-22.

[12]. Chen, Y., Da, Z., & Huang, D. (2019). Arbitrage trading: The long and the short of it. The Review of Financial Studies, 32(4), 1608-1646.

[13]. Browne, H. (2001). Fail-Safe Investing: Lifelong Financial Security in 30 Minutes. St. Martin's Press.

[14]. Wilder, J. W. (1978). New Concepts in Technical Trading Systems. Trend Research.

[15]. Stock Charts School. (n.d.). Average Directional Index (ADX). StockCharts.com. Retrieved June 27, 2023, from https://school.stockcharts.com/doku.php?id=technical_indicators:average_directional_index_adx.

[16]. The Forex Geek. (n.d.). Absolute Price Oscillator. The Forex Geek. Retrieved June 27, 2023, from https://theforexgeek.com/absolute-price-oscillator/.

[17]. Fidelity. (n.d.). Absolute Price Oscillator. Fidelity. Retrieved June 27, 2023, from https://www.fidelity.com/learning-center/trading-investing/technical-analysis/technical-indicator-guide/apo.

[18]. Elder, A. (1993). Trading for a living: Psychology, trading tactics, money management. John Wiley & Sons.