Introduction

Elon Musk was born in 1971, his childhood had shown that he was different from others in being extremely intelligent and memorable. He was considered both a genius and a madman. His first two start-up companies, Zip2 and Paypal, which were both considered as technology frontier companies at that time. After selling those two companies, Musk shifted into the electric car industry, which is known today as Tesla.

In 2003, Musk was fascinated by another new field - electric cars. At the same time, there were too many challenges to overcome for a mass-produced electric car. The biggest stumbling block was the storage of energy, a conventional battery usually had to be built so big and bulky that once it was in the car and also the majority of the energy required by the car was spent on towing them.The batteries were expensive and not safe enough. Moreover, he was competing with all the oil companies and fuel car manufacturers that had already invested trillions of dollars and had hundreds of years of experience in research and development this time.

Around the same time, Musk met a Stanford-trained engineer named JB Straubel, who was trying to turn old Porsches into electric cars [1]. However, even with all these difficulties, When Musk came to the conclusion that Straubel's vision was right, he invested $6.5 million and joined the company a few months later. With his $6.5 million investment, he became its largest investor and eventually took it over. Tesla, controls two-thirds of the multibillion-dollar electric-vehicle market it pioneered and is valued at a cool $1 trillion [1].

Even though Musk has a large amount of fortune, but the future is unforeseeable if the money he earned was thrown into the business of building cars. So his plan was to target those billionaire and build an electric supercar, the Roadster, that they wanted pay for them, and then attempted to launch a cheaper electric car to reach the mass market.

Unsatisfactorily, in 2008 Musk had to raise the selling price, which caused him to be swarmed by their purchasers In order not to lose too much money for Tesla. The media went on a rampage against Tesla. An automotive blog was running a regular "Tesla Death Watch" feature[1]. The Silicon Valley gossip media began to break the story that Musk had been kicked out of the companies several times as CEO, it had been the cause of Musk's credibility nosedived.

After the success of Tesla, he decided to discover a second habitat for humanity-Mars, and built his own rockets which he founded in 2008, SpaceX. Working 120 hours a week catching up on rockets, he just kept at it for a year. Although the desire to launch a rocket was like a black hole that sucked Musk's energy and funds dry, the probability of him to succeed in both building rockets and electric cars is extremely low, comparing to the two companies he made before.

Different form the past, Musk's previous ventures were built from nothing by using investor’s money to expand, and even if he failed, he would not lose anything himself. But unlike Tesla and SpaceX, Musk has invested his entire fortune in these two industries which had only few hope for both. For this incredibly risky decision, Straubel says." In Elon, there was this complete opposite mindset."Not only the wealth he has accumulated would be wiped out overnight, he would also be deeply in debt.

Therefore, it's no exaggeration to say that the success of all his companies are linked to his neurosis, his childish naivety, his tweeting of strange and childish words, for example the event of "porcelain throne". And now, Musk has made all his previous bragging come true.

Throughout his entrepreneurial history, Musk has been accused thousands of times for his adventurous ideas and impersonal character, but you can see his uniqueness and adventurous characteristic are different from others. He started from the Internet industry and shifted into electric vehicles and aerospace industries without any experience, and kept plucking away the future of the world to see the uncertainty.

The company itself

Tesla is at the forefront of the innovation in the market of electric vehicles and has successfully maintained its status of pioneering full-electric vehicles. As the leader of the entire market, Tesla’s success does not come from nothing. The reason It stands out from so many other auto companies is its advanced technology. There are generally 5 biggest comparative technological advantages Tesla has upon other auto companies: Tesla’s battery supply chain, supercharger network, The OVA system (over the air) and self-driving. But the most influential one is Tesla’s battery development. At the very beginning, Tesla’s battery supply mainly came from the company Panasonic. However, as what Elon musk[2] expected,“Panasonic will be the major obstacle for the development and production of Tesla ” since it’s productivity is unable to satisfy Tesla’s goal for mass production of Model 3. “We intend to increase, not reduce battery cell purchases from Panasonic, LG & CATL (possibly other partners too). However, even with our cell suppliers going at maximum speed, we still foresee significant shortages in 2022 & beyond unless we also take action ourselves.”[2] So,in the purpose of increasing production volume and reducing costs, Tesla initiated its own battery developing research called Roadrunner .This secret project was first revealed by Electrick [3]:“Tesla built a “Tera battery manufacturing facility” in its facilities on Kato Road next to its factory in Fremont to house the project.” According to INSIDEEVs [4], it’s estimated that the cost savings for Tesla’s new battery line at approximately 20%. But this project wasn’t even the start of Tesla’s research on self-producing batteries.Tesla had been working on this since 2015,in which it successively made three power battery related investments: a five-year sponsorship program with Jeff Dahn Research Group, the acquisition of Maxwell, a battery-technology company, and Hibar, a battery-manufacturing equipment company. In May, Tesla completed its acquisition of Maxwell Technologies, the developer of an innovative “dry electrode” technology that could save loads of money, time and factory space in the battery-making process.”said charles Morris[5].Tesla has gradually transformed its battery supplying chain from purchasing from other batteries companies to its own self-supplied batteries,which place a significant impact on itself and even the whole industry.

Comparison

Tesla is apparently not the only auto company that has been working on the electric vehicle filed. So how come Tesla’s market cap is greater than the other auto companies? This paper will provide 4 typical auto companies as examples —Ford, Volkswagen, Toyota and Nio — for the comparison to better illustrate the advantage Tesla has. Ford is one of the biggest conventional company that mainly produces petrol cars. But recent years it has shifted its focus since electric vehicles are being the mainstream of the auto market. According to SMM news [6], Ford Motor sales in the United States in 2021, second only to Tesla, jumped to the second place, and surpassed General Motors. “Ford's electric vehicle sales grew 36% faster than the entire market segment in 2021 and set new sales records in December and for the whole of 2021.” volkswagon also has a leading role in the automobile market.Volkswagen announced that sales of electric vehicles doubled in 2021, selling over 369,000 EVs globally out of the nearly 4.9 million vehicles sold[7].

The evaluation between Tesla, Ford and Volkswagen will be based on their price earnings ratio and price book value ratio. The price-to-earnings ratio (P/E) is one of the most widely used tools by which investors and analysts determine a stock's relative valuation. A stock’s P/E ratio reflects the expectations that investors have on this company and how much they are willing to pay for every dollar of earnings they have placed on investment. Generally, P/E ratio offers a great insight and understanding to the potential future growth of a stock’s and more often the higher the P/E ratio, the higher the expected returns for an investor. The Price-to-book ratio is another valuation that is used by investors to identify potential investments. The P/B ratio provides a valuable reality check for investors seeking growth at a reasonable price and is often looked at in conjunction with return on equity (ROE), a reliable growth indicator [8].

Table 1. Valuation statistics from 2021[9,10]

|

Tesla |

Ford |

Volkswagen |

|||||

|

Valuation ratio |

|||||||

|

Gross revenue |

538.23 |

1363.41 |

289.16 |

||||

|

Market cap |

9057.14 |

702.35 |

128.57 |

||||

|

PB |

29.34 |

1.49 |

0.87 |

||||

|

PE |

160.48 |

4.03 |

6.92 |

It can be clearly seen from the data in Table1 that Tesla has a absolute advantage in every metric over Ford and Volkswagen.The price earnings ratio of Tesla (160.48) is much greater than that of both Ford and Volkswagen(4.03 and 6.92 respectively),indicating a higher expectations investors placed on Tesla and the greater potential it has.Tesla also has a dominating value in PB ratio which is greater than the aggregate of that of the rest of two companies. Generally, a PB ratio over 3 means that the the stock price is selling above the book value of the company,which suggests that Tesla is overvalued. To explain Tesla’s extremely high PB ratio ,it might because that Tesla has lots of intangible assets such as technology,and as what Elon musk said,Tesla shoud not be compared with the conventional auto companies but to those technology companies.

Tesla and NIO are both large-cap auto companies,but which is better stock?We will compare the 2 companies based on the strength of their institutional ownership risk, valuation,profitability,media-sentiment.,community ranking,earnings,analyst recommendations and dividends.

As shown in table 2,Tesla has higher revenue and earnings than NIO.NIO is trading at a lower price-to-earnings ratio than Tesla,indicating that it is currently the more affordable of the two stocks.

Table 2. Statistics of some financial indicators of Tesla and NIO[11]

|

Company |

Gross Revenue |

Net profit |

Earnings per share |

Earning ratio |

|

Tesla |

$31.54billion |

$690 million |

$3.09 |

273.90 |

|

NIO |

$2.49billion |

-$812.13million |

-$0.99 |

-21.11 |

Tesla has a beta of 1.98,which means its share price is 98% more than the S&P 500.We can also see the correlation in figure 1.Comparatively,NIO has a beta of 2.37,meaning that its share price is 137% more volatile than S&P 500

Figure 1. Tesla stock market and S&P500 correlation [12]

Financial

In terms of the financial part, six aspects of important relevant information will be mentioned in this paper.

First of all,the topic needs to be discussed is why we need to know something related to Tesla’s financial situation. There are 3 main reasons,which are firstly,grasping the internal logic of industry development from a financial perspective.Secondly, Improve the ability to analyze the value of listed companies in automobile industry.Moreover, financial indicators not only reflect the management quality in the past period, but also the future development policy and business focus of enterprise.

Second part is the overview of Tesla deduced from its financial statements. Utill 2017 tesla could finally have positive gross margin and until the third quarter of 2019 that Tesla managed to achieve steady profitability,around 15% to 20% gross margin.The working capital was mainly spent on sales and R&D.Roughly to say,the sales cost accounted for almost 10 to 20 dollars every 100 dollars revenue. However, from 2017 onwards, there has been a gradual decrease year by year, which may be related to brand effectiveness, as well as a corresponding change in R&D expenses. Tesla's net loss after depreciation, amortization and impairment of subjects such as the adjusted, the deferred income, operating cash flow is positive, the company's business, especially for companies in the net loss is a relatively safe signal, especially the tesla's net operating cash flow is approximately 10% of the income scale, 7-8% of the assets (pure digital relative standard).[13]

For the third part,the performance of Tesla’s stock market will be analyzed.

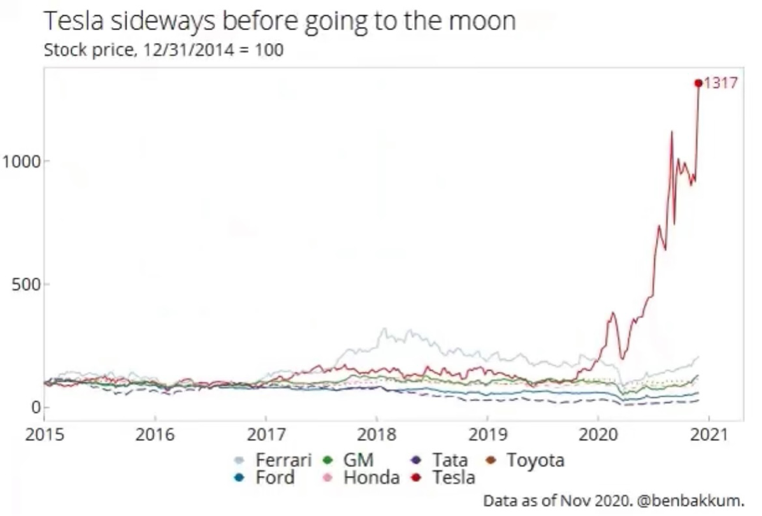

It’s fair to say that Tesla is one of the most popular stocks in the entire stock market in recent years.According to its 10 years annual returns,we could calculated its annualized rate of return and daily return as well as comparing it with other notable companies’ performances according to the figure2,figure 3 and table 3.

Figure 2. Stock market comparison[14]

Table 3. Comparison of annualized rate between several big companies[11]

|

Apple |

Amazon |

|

Tesla |

|

|

Annualized rate of return |

16.3% |

37.4% |

24.9% |

40.56% |

|

Daily return |

0.000044657 |

0.00102466 |

0.00068219 |

0.00111 |

Next part would be the market capitalization,which is one of the ways to measure a company’s value.

Firstly, changes in growth model and profit model bring changes in valuation. The new economy has broken the linear growth model and brought the exponential growth model.Secondly, Once the market bought into the idea of electric and smart cars, the story became very valuable, and the market began to value cars based on revenues plus tech margins.

Thirdly. Low interest rates have made it easier for valuations to rise as interest rates have generally fallen in recent years, and the pandemic has concentrated high valuations in specific areas (such as technology and healthcare), and Tesla fits one of those criteria. Although there is no comparison in the past two years, Until July 2020,the market value of Tesla now exceeds the combined value of Toyota and Volkswagen.It can also be proved by figure 4.Tesla's market cap is about 22.4 NIO cars when compared to a sample of China's new homegrown power.

However, others call such a high market value a bubble, which is why Tesla ranks among the top three shorted stocks in the U.S.

See figure 5,The world‘s three largest new energy vehicle markets are China, Europe and the USA. Tesla's market share is 12%, 8% and 63%, respectively. This is because Tesla has the advantages of industrial chain integration and stage first-mover advantage at the same time, which is in different stages in different regions. With planned production growth of more than 50% in 2022, 6 percentage points higher than China’s planned 44% EV growth rate, Tesla is likely to continue to increase its market share, and not just in China.

In the future

Elon Musk’s future plan

Musk scribbled a list of his goals for 2030. Elon Musk has a number of additional projects in the works for 2030 and beyond that don't have a defined timeframe or haven't been made public yet. The Hyperloop is the most crucial, and Musk has chosen that Tesla or SpaceX will be more involved in it. Neuralink, Musk's attempt to integrate the human brain with artificial intelligence, is another project in the early stages of development) [18].

Are there new improvements coming to Tesla?

Tesla is owned by Elon Musk and is dedicated to the development of electric autonomous vehicles (EAVs) and renewable energy solutions. Musk anticipates Tesla's Gigafactory in China to be completed around 2020, with production beginning in 2021 [19]. China's proposal to develop a manufacturing factory coincides with the country's goal of having more electric vehicles on the road by 2030. Tesla aims to install 1,000 superchargers in China in addition to the Gigafactory [20].

What will happened in the future?

Musk says he intends to create 1,000 starships over the next ten years, referring to the massive, apparently entirely reusable vehicle being developed by SpaceX in South Texas. That works up to 100 ships every year. The ultimate objective is to launch three starships every day on average, allowing everyone to visit Mars [19]. Musk has stated that he intends to take advantage of the limited time frame in which the Earth's and Mars' orbits meet, which occurs every 25 months [20]. This permits the spaceship to escape the rotation of the Earth and go to Mars on a low-fuel mission.

Estimation for stock price

Since achieving an all-time high of $1,243 in early November, Tesla shares have dropped more than 14% [18]. "We believe part of the selloff is due to the market altering its long-term expectations for the firm amid growing competition," said Seth Goldstein, senior stock analyst at Morningstar. Tesla's stock has taken a knock as the company's anticipated electric pickup truck has been delayed. The Cybertruck was supposed to be built in late 2022, but that date has been pushed back until at least the first quarter of 2023[20]. Tesla's stock dropped 7% to $1,018 as a result of the announcement. While some believe the firm will continue to thrive, others fear it is becoming overpriced. The fact that Tesla continues to innovate and is driven by maverick entrepreneur Elon Musk is the most evident driver driving the stock price [19]. The globe will accept electric automobiles in the next decades.

Conclusion

In conclusion, as things stand now, Tesla hasn’t disappointed not only in terms of financial performance, but also the major technological breakthroughs and the efforts of its chief executive, Elon Musk, to deliver the promised production capacity. The success of all this has come from the construction of the Gigafactory, efforts to develop entirely self-producing batteries, such as Roadrunner and Dry Electrode, and the performance of other companies in the same field at the same time, as well as changes in valuation methods in the new economy. There are others, of course, who argue that Tesla's sky-high market value is a bubble driven by idolatry. So Tesla's future depends more on whether it can achieve the target of mass production, which will also be affected by the global epidemic and economic changes. And in the process of Tesla's efforts to achieve the target of mass production, whether other companies will have new major research and development and break through the existing profit model, so as to break through Tesla.

References

[1]. Published on 《TIMES》 TIME names Elon Musk 2021 Person of the Year, #TIMEPOYhttps://t.co/8Y5BhIldNs pic.twitter.com/B6h6rndjIh—TIME(@TIME) December 13, 2021

[2]. Twitter. (n.d.). https://twitter.com/elonmusk. [online] Available at:https://twitter.com/elonmusk?s=20&t=8QFJDr2psJ4gGokypANDIg

[3]. Lambert, F. (2020). First look at Tesla’s new battery cell produced in-house with Roadrunner. [online] Electrek. Available at: https://electrek.co/2020/09/16/tesla-battery-cell-in-house-roadrunner-first-look/

[4]. InsideEVs. (n.d.). We Estimate Cost Savings for Tesla’s New Battery Line. [online] Available at: https://insideevs.com/news/378928/tesla-new-battery-line-cost-savings/.

[5]. Charged EVs. (2019). Tesla’s acquisition of battery manufacturer Hibar points to new plans to build battery cells. [online] Available at: https://chargedevs.com/newswire/teslas-acquisition-of-battery-manufacturer-hibar-points-to-plans-to-build-battery-cells/.

[6]. News.metal.com. (n.d.). Ford ranks second in US electric car sales in 2021, and its share price soars 136%._SMM | Shanghai Non ferrous Metals. [online] Available at: https://news.metal.com/newscontent/101718657/Ford-ranks-second-in-US-electric-car-sales-in-2021-and-its-share-price-soars-136/#:~:text=In%202021%2C%20Ford%20sold%201.9%20million%20vehicles%20in.

[7]. AutoIndustriya.com. (2022). Volkswagen doubled their EV sales in 2021 - Auto News. [online] Available at: https://www.autoindustriya.com/auto-industry-news/volkswagen-doubled-their-ev-sales-in-2021.html.

[8]. Investopedia. (n.d.). What the Price-to-Book (P/B) Ratio Tells You? [online] Available at: https://www.investopedia.com/terms/p/price-to-bookratio.asp#toc-what-the-pb-ratio-can-tell-you

[9]. Macrotrends Volkswagen AG Revenue 2006-2021 | VWAGY[online]Available at https://www.macrotrends.net/stocks/charts/VWAGY/volkswagen-ag/revenue.

[10]. Windstock.com.cn. (2019). [online] Available at: https://www.windstock.com.cn/about.html

[11]. Yahoo Finance (2022). Yahoo Finance - Business Finance, Stock Market, Quotes, News. [online] Yahoo Finance. Available at: https://finance.yahoo.com/.

[12]. Tesla,INC.Annual Report On Form 10-K The Year Ended December 31,2019[online]Available at https://www.sec.gov/Archives/edgar/data//1318605/000156459020004475/tsla-10k_20191231.html

[13]. (Tesla Earnings Analysis 2022) Bibliography: Zhihu Column. 2022. Tesla results analysis. [online] Available at: < https://zhuanlan.zhihu.com/p/344690166 >

[14]. Ben,Bakkum ,(2020).Tesla sideways before going to the moon .[online]Available at https://twitter.com/benbakkum/with_replies

[15]. Netcials. (n.d.). What If I invested 1000$ in Tesla Inc (TSLA) 10 years ago? [online] Available at: https://www.netcials.com/invested-1000-in-stocks-10-years-ago-nasdaq/TSLA-Tesla-Inc/

[16]. Richter, W. (2021). Tesla’s Market Cap (Gigantic) v. Next 10 Automakers v. Tesla’s Global Market Share (Minuscule). [online] Wolf Street. Available at: https://wolfstreet.com/2021/10/26/teslas-market-cap-gigantic-v-next-10-automakers-v-teslas-global-market-share-minuscule/.

[17]. www.zhihu.com. (n.d.). Why domestic cars cannot compete with Tesla ?. [online] Available at: https://www.zhihu.com/question/362788804/answer/2327835039?utm_source=wechat_session&utm_medium=social&utm_oi=1006214524768292864&utm_content=group3_Answer&utm_campaign=shareopn .

[18]. CleanTechnica·Source:Tesla|Troy Teslike|CleanTechnica·Created with Datawrapper Galeon, D. (2022). Here’s a List of Everything Elon Musk Says He’ll Do by 2030. https://futurism.com/heres-list-everything-elon-musk-2030 . Retrieved 17 February 2022, from https://futurism.com/heres-list-everything-elon-musk-2030.

[19]. Tully, S. (2022). Elon Musk’s ‘science fiction’: Top analyst calculates Tesla’s true worth is just $138 a share. Fortune. Retrieved 17 February 2022, from https://fortune.com/2022/02/02/tsla-stock-valuation-predictions-2022/.

[20]. Griffin, R. (2022). Tesla’s EV revolution: Where will the TSLA stock price be in five years?. Capital.com. Retrieved 17 February 2022, from https://capital.com/tesla-stock-price-in-5-years.

Cite this article

Gong,X.;Yang,J.;Shi,Z.;Jiang,X. (2023). How Come Tesla’s Market Cap is Greater than other Companies?. Advances in Economics, Management and Political Sciences,3,695-702.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 6th International Conference on Economic Management and Green Development (ICEMGD 2022), Part Ⅰ

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Published on 《TIMES》 TIME names Elon Musk 2021 Person of the Year, #TIMEPOYhttps://t.co/8Y5BhIldNs pic.twitter.com/B6h6rndjIh—TIME(@TIME) December 13, 2021

[2]. Twitter. (n.d.). https://twitter.com/elonmusk. [online] Available at:https://twitter.com/elonmusk?s=20&t=8QFJDr2psJ4gGokypANDIg

[3]. Lambert, F. (2020). First look at Tesla’s new battery cell produced in-house with Roadrunner. [online] Electrek. Available at: https://electrek.co/2020/09/16/tesla-battery-cell-in-house-roadrunner-first-look/

[4]. InsideEVs. (n.d.). We Estimate Cost Savings for Tesla’s New Battery Line. [online] Available at: https://insideevs.com/news/378928/tesla-new-battery-line-cost-savings/.

[5]. Charged EVs. (2019). Tesla’s acquisition of battery manufacturer Hibar points to new plans to build battery cells. [online] Available at: https://chargedevs.com/newswire/teslas-acquisition-of-battery-manufacturer-hibar-points-to-plans-to-build-battery-cells/.

[6]. News.metal.com. (n.d.). Ford ranks second in US electric car sales in 2021, and its share price soars 136%._SMM | Shanghai Non ferrous Metals. [online] Available at: https://news.metal.com/newscontent/101718657/Ford-ranks-second-in-US-electric-car-sales-in-2021-and-its-share-price-soars-136/#:~:text=In%202021%2C%20Ford%20sold%201.9%20million%20vehicles%20in.

[7]. AutoIndustriya.com. (2022). Volkswagen doubled their EV sales in 2021 - Auto News. [online] Available at: https://www.autoindustriya.com/auto-industry-news/volkswagen-doubled-their-ev-sales-in-2021.html.

[8]. Investopedia. (n.d.). What the Price-to-Book (P/B) Ratio Tells You? [online] Available at: https://www.investopedia.com/terms/p/price-to-bookratio.asp#toc-what-the-pb-ratio-can-tell-you

[9]. Macrotrends Volkswagen AG Revenue 2006-2021 | VWAGY[online]Available at https://www.macrotrends.net/stocks/charts/VWAGY/volkswagen-ag/revenue.

[10]. Windstock.com.cn. (2019). [online] Available at: https://www.windstock.com.cn/about.html

[11]. Yahoo Finance (2022). Yahoo Finance - Business Finance, Stock Market, Quotes, News. [online] Yahoo Finance. Available at: https://finance.yahoo.com/.

[12]. Tesla,INC.Annual Report On Form 10-K The Year Ended December 31,2019[online]Available at https://www.sec.gov/Archives/edgar/data//1318605/000156459020004475/tsla-10k_20191231.html

[13]. (Tesla Earnings Analysis 2022) Bibliography: Zhihu Column. 2022. Tesla results analysis. [online] Available at: < https://zhuanlan.zhihu.com/p/344690166 >

[14]. Ben,Bakkum ,(2020).Tesla sideways before going to the moon .[online]Available at https://twitter.com/benbakkum/with_replies

[15]. Netcials. (n.d.). What If I invested 1000$ in Tesla Inc (TSLA) 10 years ago? [online] Available at: https://www.netcials.com/invested-1000-in-stocks-10-years-ago-nasdaq/TSLA-Tesla-Inc/

[16]. Richter, W. (2021). Tesla’s Market Cap (Gigantic) v. Next 10 Automakers v. Tesla’s Global Market Share (Minuscule). [online] Wolf Street. Available at: https://wolfstreet.com/2021/10/26/teslas-market-cap-gigantic-v-next-10-automakers-v-teslas-global-market-share-minuscule/.

[17]. www.zhihu.com. (n.d.). Why domestic cars cannot compete with Tesla ?. [online] Available at: https://www.zhihu.com/question/362788804/answer/2327835039?utm_source=wechat_session&utm_medium=social&utm_oi=1006214524768292864&utm_content=group3_Answer&utm_campaign=shareopn .

[18]. CleanTechnica·Source:Tesla|Troy Teslike|CleanTechnica·Created with Datawrapper Galeon, D. (2022). Here’s a List of Everything Elon Musk Says He’ll Do by 2030. https://futurism.com/heres-list-everything-elon-musk-2030 . Retrieved 17 February 2022, from https://futurism.com/heres-list-everything-elon-musk-2030.

[19]. Tully, S. (2022). Elon Musk’s ‘science fiction’: Top analyst calculates Tesla’s true worth is just $138 a share. Fortune. Retrieved 17 February 2022, from https://fortune.com/2022/02/02/tsla-stock-valuation-predictions-2022/.

[20]. Griffin, R. (2022). Tesla’s EV revolution: Where will the TSLA stock price be in five years?. Capital.com. Retrieved 17 February 2022, from https://capital.com/tesla-stock-price-in-5-years.