1. Introduction

The Science and Technology Innovation Board (STAR market) began trading in July 2019, marking a significant step in China's IPO landscape. Initial public offering (IPO) underpricing is the phenomenon that IPO stock issue price is significantly lower than the closing price of the first day, which broadly exists in global mature capital markets and emerging capital markets. There has been a long-held problem of IPO underpricing in China's A-share market. In the case of the STAR market, the average IPO underpricing rate for the 504 listed companies as of January 1, 2023, stood at a staggering 131.81%. Among them, Nanomicrotech's first-day closing price increase reached 1,273.98%, which was the highest of its kind. On the whole, IPO underpricing rate is more than 100%, far exceeding the average level of 10%-20% in mature capital markets [1], which reflects the high cost of financing for equity offerings by Chinese companies and the low maturity of the market.

This paper focuses on the STAR market as the subject of study, examining IPO underpricing within the context of listing system innovation. Firstly, the paper adopts the stochastic frontier model [2] to deconstruct IPO underpricing into two components: primary market underpricing and secondary market premium, thereby analyzing the primary drivers behind IPO underpricing. Secondly, building upon the findings from the first part, the paper investigates the influence of R&D investment—a theoretically significant factor—on IPO underpricing.

2. Methodology

Previous research has discovered a correlation between the measurement of IPO pricing efficiency and the measurement of production efficiency [3]. The stochastic frontier model is used to investigate the deviation [4] between the IPO price and the stock’s intrinsic value, and then evaluate the IPO pricing efficiency in the primary market. The performance of the secondary market can be estimated by the stochastic frontier model of the cost function.

2.1. Modeling Process

In contrast to other sectors of the Chinese stock market, the STAR market does not impose a maximum limit on the price increase or decrease within five days after listing. This issuance rule just avoids the untrue IPO underpricing rate due to the existence of price limits, so the IPO underpricing rate can be directly expressed by the first-day excess return rate:

\( UR=1+(CP-OP)/OP \) | (1) |

where, \( CP \) denotes the closing price of the first day of stock issuance while \( OP \) represents the offering price. In order to make \( UR \) positive, add one to the original formula.

The author sets the intrinsic value of the company as the maximum frontier of the production function, and the offering price of the stock is empirically lower than its intrinsic value. This paper defines the stock pricing function as:

\( {OP_{i}}=f({X_{i}},α)×{ξ_{i}}×{e^{{μ_{i}}}} \) | (2) |

where, \( {OP_{i}} \) is the offering price of company \( i \) , \( {X_{i}} \) is the set of explanatory variables, and \( α \) is the set of parameters to be estimated. \( {ξ_{i}} \) represents the pricing efficiency level satisfying 0 < \( {ξ_{i}} \) ≤ 1. When \( {ξ_{i}} \) = 1, it means that the offering price of company \( i \) reaches the pricing frontier precisely, which means there is no IPO underpricing regarding company \( i \) . \( {e^{{μ_{i}}}} \) is a random shock, which means that the frontier of the pricing function is random.

Taking the logarithm on both sides of equation(2) to get equation(3):

\( {lnOP_{i}}={α_{0}}+\sum _{i=1}^{n}{α_{i}}{x_{i}}+{v_{i}}-{μ_{i}} , {μ_{i}}=ln{ξ_{i}} \) , \( {ε_{i}}={v_{i}}-{μ_{i}} \) | (3) |

where \( {v_{i}} \) is referred to as idiosyncratic error and \( {μ_{i}} \) represents the inefficiency term. Firstly, we assume that \( μ \) and \( v \) are i.i.d. and independent of each other, and they are independent of the explanatory variable \( X \) . Secondly, suppose the distribution of \( μ \) and \( v \) as equation(4) where \( μ \) obeys the normal distribution with expectation of \( μ \) and the tail is broken on the left side of the origin, so it is called “truncated-normal distribution”.

\( {μ_{i}}~{N^{+}}(μ,σ_{μ}^{2}) , {v_{i}}~N(0,σ_{v}^{2}) \) | (4) |

It can be proved that the density function of \( {ε_{i}} \) is[3] :

\( f({ε_{i}})=\frac{2}{σ}φ({ε_{i}}/σ)Φ(-{ε_{i}}λ/σ) \) | (5) |

where, \( σ=\sqrt[]{σ_{μ}^{2}+σ_{v}^{2}} \) , \( λ={σ_{μ}}/{σ_{v}} \) , \( φ(∙) \) denotes the density function of normal distribution and \( Φ(∙) \) denotes the cumulative distribution function of normal distribution.

Applying the log-likelihood function of company \( i \) , assuming that the sample is i.i.d., the sample likelihood function with a sample size of \( N \) can be expressed as :

\( ln L=-Nlnσ-NlnΦ(-μ/{σ^{2}})-\frac{1}{2}\sum _{i=1}^{N}{(\frac{{ε_{i}}+μ}{σ})^{2}}+\sum _{i=1}^{N}lnΦ(\frac{μ}{σλ}-\frac{{ε_{i}}λ}{σ}) \) | (6) |

The MLE estimation of the semi-normal model is obtained by maximizing equation(6).

2.2. Variables Design

Concerning variable selection and construction, the reasonable issue price of known new shares is related to the intrinsic value and development potential of the company, including company operation ability, debt paying ability, research and development ability, asset scale, etc. Therefore, four company characteristic variables are selected. At the same time, the primary market indexes and the secondary market indexes are selected as control variables. table 1 presents the explanatory variables used in the model with reference to previous literature [5].

Table 1: Variable symbols and definitions.

symbol | definition | unit |

volume | new share issuance | 10000 shares |

fee | underwriting and sponsorship fee | 100 million CNY |

subscription | subscription ratio | % |

turnover | turnover rate on the first day of listing | % |

indPE | industry price-earnings ratio | / |

roa | return on equity 1 year before IPO | % |

asset | total asset 1 year before IPO | 100 million CNY |

rdinv | R&D investment 1 year before IPO | 100 million CNY |

liquid | liquidity ratio 1 year before IPO | % |

2.3. Data Cleaning

504 companies listed on the Science and Technology Innovation Board between July 22, 2019, and January 1, 2023, were included in the study. Data was collected from the Wind financial terminal and company prospectuses. After removing entries with missing values, the dataset consisted of 480 companies.

3. Results and Analysis

3.1. Results of SFA Model

The stochastic frontier analysis of the constructed model is carried out by using the sfa method in Benchmarking package of RStudio. The variables are manually converted into logarithms to fit in the model. lnx6=ln(roa+200) is set because the minimum roa value is -195.9. In this paper, four explanatory variables related to company characteristics are selected, They are (1) roa; (2)asset; (3)rdinv; (4)liquid [6]. The higher the liquidity ratio, the stronger the asset realization ability of the company. Based on four explanatory variables and other control variables, we solves the sfa model to find the frontier side of the primary market pricing. The results of table 2 are obtained.

Table 2: SFA model redults.

estimate | Pr(>|t|) | variable specification | |

(Intercept) | -240.3555 | 0.0000 | |

lnx1 | -0.9018 | 0.0000 | \( ln(volume) \) |

lnx2 | -0.0935 | 0.2390 | \( ln(fee) \) |

lnx3 | 0.9471 | 0.0000 | ln(subscription) |

lnx4 | -0.4323 | 0.0000 | \( ln(turnover) \) |

lnx5 | -0.0426 | 0.4780 | \( ln(indpe) \) |

lnx6 | 25.8393 | 0.0000 | \( ln(roa+200) \) |

lnx7 | 0.0939 | 0.0030 | \( ln(asset) \) |

lnx8 | 0.1349 | 0.0000 | \( ln(rdinv) \) |

lnx9 | 0.0575 | 0.0590 | \( ln(liquid) \) |

\( λ \) | 0.0508 | 0.9150 | |

\( {σ^{2}} \) | 0.11263 | ||

\( σ_{v}^{2} \) | 0.1123423 | ||

\( σ_{u}^{2} \) | 0.0002903505 | ||

log likelihood | -156.6188 |

Table 3: Estimate efficiency for each company.

te | teJ | teBC | |

Min. | 0.9851 | 0.9850 | 0.9851 |

Max. | 0.9880 | 0.9880 | 0.9880 |

Mean | 0.9865 | 0.9865 | 0.9865 |

The estimator of λ is 0.0508, so idiosyncratic error \( v \) dominates the composite error term \( ε=v-μ \) . The results demonstrate that \( μ \) is statistically significant at a 1% level, indicating that systematic underpricing in the primary market of the sample stocks evidently exists, yet this underpricing is not numerically large.

Calculation of technical efficiencies for each unit can be done by the method te.sfa as shown in table 3. Efficiencies estimated by minimizing the mean square error are represented as te and teBC. Efficiencies estimates using the conditional mean approach are represented as teJ. The average value of technical efficiency is 98.65 %, indicating that the issue price can reflect the intrinsic value at the average level of 98.65 %.

The \( UR \) is decomposed into two parts : primary market underpricing and secondary market premium as shown is formula (7).

\( UR=\frac{(VALUE-OP)}{OP}+\frac{(CP-VALUE)}{OP}+1 \) | (7) |

Where, \( VALUE \) represents the intrinsic value of the stock, which is calculated as the frontier value obtained by the SFA model.

The efficiency of the first day closing price \( CP \) and intrinsic value \( VALUE \) isevaluated using formula (7) , and the average underpricing rate of the secondary market is 31.42 %. By measuring the contributions of the primary market and the secondary market to the IPO underpricing rate, results showsthat 95.76% of the IPO underpricing rate comes from the secondary market premium and 4.24% from the primary market underpricing.

3.2. Multiple Linear Regression Analysis for Premium in Secondary Market

The results of SFA show that 95.76% of IPO underpricing of STAR market are from the secondary market premium. Based on the findings mentioned, the subsequent part of this research will focus on investigating the factors that influence IPO underpricing from the perspective of secondary market. \( effSec \) is used to represent the pricing efficiency of the secondary market, which is calculated by \( (CP-VALUE)/OP \) . The variables selected in the SFA model can also explain the premium rate in the secondary market, which can be demonstrated by formula (8) :

\( effSec={θ_{0}}+{θ_{1}}volume+{θ_{2}}fee+{θ_{3}}subscription+{θ_{4}}turnover+{θ_{5}}indPE +{θ_{6}}roa+{θ_{7}}asset+{θ_{8}}rdinv+{θ_{9}}liquid+γ \) | (8) |

\( lneffSec={ϑ_{0}}+{ϑ_{1}}lnx1+{ϑ_{2}}lnx2+{ϑ_{3}}lnx3+{ϑ_{4}}lnx4+{ϑ_{5}}ilnx5+{ϑ_{6}}lnx6+{ϑ_{7}}lnx7+{ϑ_{8}}lnx8+{ϑ_{9}}lnx8+δ \) | (9) |

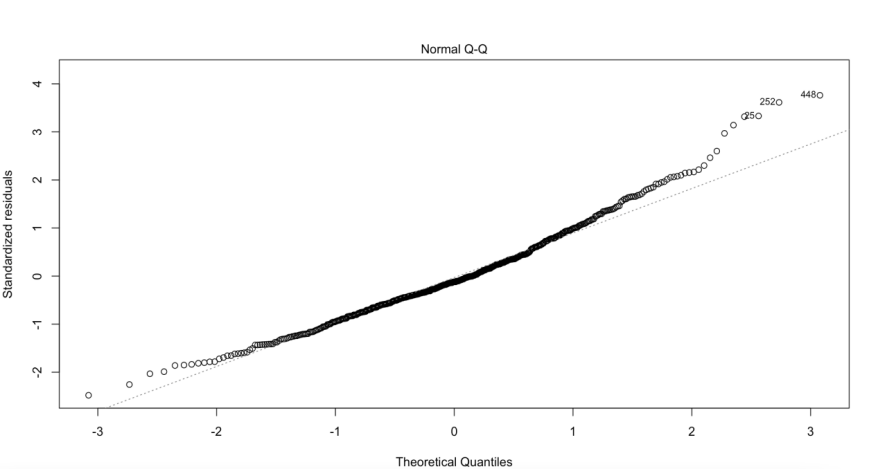

The results of the Quantile-Quantile plot test show that the error is right-biased and the model does not conform to the linear regression relationship. All variables are logarithmicized as in formula (9). The Q-Q plot result is shown in figure 1, which shows that the linear relationship is basically satisfied.

Figure 1: Normal Q-Q.

Table 4: Results of multiple linear regression.

label | coefficients | Estimate | Std.Error | t-value | Pr(>|t|) |

Intercept | -52.2022 | 87.3476 | -0.598 | 0.5503 | |

volume | lnx1 | 0.1299 | 0.0360 | 3.605 | 0.0003*** |

subscription | lnx2 | -0.1081 | 0.0943 | -1.283 | 0.2000 |

fee | lnx3 | -0.3176 | 0.0395 | -9.040 | 0.0000*** |

turnover | lnx4 | 1.8881 | 0.1310 | 14.411 | 0.0000*** |

indPE | lnx5 | 0.1035 | 0.0568 | 1.821 | 0.0691 |

roa | lnx6 | 4.8411 | 9.3055 | 0.520 | 0.6031 |

asset | lnx7 | -0.0278 | 0.0317 | -0.877 | 0.3810 |

rdinv | lnx8 | 0.0794 | 0.0244 | 3.244 | 0.0012** |

liquid | lnx9 | -0.0059 | 0.0283 | -0.210 | -.8340 |

Multiple R-squared: 0.5225 | Adjusted R-squared: 0.5133 | ||||

F-statistic: 57.13 on 9 and 470 DF, p-value: < 2.2e-16 | |||||

The regression results, presented in table 4, reveal that the adjusted R-squared value is 0.5133. This indicates that the set of variables used in the analysis can account for 51.33% of the variation observed in the secondary market premium. It shows that the fitting effect of the model in the empirical research is good. F test is then carried out. The results show that the p-value is less than \( 2.2×{10^{-16}} \) , which means the original hypothesis is rejected. In the sample set, volume, fee, turnover and rdinv were all statistically significant at the 1% level. Specifically, every 1% increase in volume increases the IPO secondary market premium rate by 0.13%, which means that the size of new shares issued has a negative impact on the IPO pricing efficiency. Underwriting fee is negatively correlated with IPO underpricing rate at the significance level of 1%. The reason may be that the underwriting fee is the commission paid by the issuing company to the underwriter. The higher the commission, the larger the scale and financing amount of the IPO company, the more investors, mainly institutional traders, participate in the inquiry, the more information they provide, and the closer the closing price of the stock on the first day after its issuance in the secondary market is to its intrinsic value. For every 1% increase in the turnover rate on the first day of trading, the IPO secondary market premium increases by 1.9%. Because the turnover rate reflects investor sentiment, a high turnover rate indicates that there is a large divergence between the long and short sides, and there are many uncertain factors, so the pricing efficiency is naturally low. The R&D input index has a significant positive impact on the premium of the secondary market. When R&D input increases by 1%, IPO underpricing rate will increase by 0.0794%. Due to the high-tech nature of most companies on the STAR market, the R&D input data disclosed in their financial statements or prospectus holds significant importance as a reference index for investors when making investment decisions. Increased investment in research and development is perceived by investors as an indicator of greater growth potential, leading to positive expectations. Consequently, R&D input is negatively associated with IPO secondary market pricing efficiency.

4. Conclusion

This paper takes the phenomenon of IPO underpricing in China's Science and Technology Innovation Board as the research object, and studies the composition and influencing factors of IPO underpricing. First, the IPO underpricing rate is decomposed based on intrinsic value of the firm. The pricing efficiency of the primary market is analyzed by the stochastic frontier model to obtain the underpricing rate of the primary market, and then the premium rate of the secondary market is derived. Results show 95.76% of IPO underpricing came from secondary market premium. Then this paper construct multiple regression model for secondary market premium rate and analyze the main influencing factors. In this paper, four important factors affecting the secondary market premium are obtained, which are (1) the number of new shares issued, (2) the underwriting fee, (3) first day turnover rate, and (4) the R&D investment. This paper analyzes the regression results from the perspective of investment environment and investor sentiment. Future research can focus on investigating investor behavior in the secondary market of the Chinese stock market.

Acknowledgment

I would like to show my deepest gratitude to my teachers and professors in my university, who have provided me with valuable guidance of the writing of this thesis.

References

[1]. Li Shilin, Xiao Yu. Research on the Composition of IPO underpricing in Chinese Stock Market [J]. Financial Regulation Research, 2022.

[2]. Ma Yu,Liu Guiling,Qi Chaoping. IPO Pricing, Investor Behavior, and IPO Underpricing of High-Tech Companies: Evidence from SSE STAR Market and Nasdaq Market[J]. Discrete Dynamics in Nature and Society,2022.

[3]. Hunt-McCool J, Koh S C, Francis B B. Testing for deliberate underpricing in the IPO premarket: A stochastic frontier approach[J]. The Review of Financial Studies, 1996, 9(4): 1251-1269.

[4]. Kumbhakar S C, Lovell C A K. Stochastic frontier analysis[M]. Cambridge university press, 2003.

[5]. Huang Shunwu, Jia Jie, Wang Wenjun. IPO underpricing decomposition based on two-tier stochastic frontier Model: Evidence from chinext [J]. Chinese Journal of Management Science,2017,25(02):21-29.

[6]. Gui YuJuan. Science and innovation board listed company financial ability analysis [J]. Journal of business economics, 2019,No.519(11):170-172.

Cite this article

Wang,J. (2023). Research on IPO Underpricing Decomposition: Evidence from China's Science and Technology Innovation Board. Advances in Economics, Management and Political Sciences,43,25-31.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li Shilin, Xiao Yu. Research on the Composition of IPO underpricing in Chinese Stock Market [J]. Financial Regulation Research, 2022.

[2]. Ma Yu,Liu Guiling,Qi Chaoping. IPO Pricing, Investor Behavior, and IPO Underpricing of High-Tech Companies: Evidence from SSE STAR Market and Nasdaq Market[J]. Discrete Dynamics in Nature and Society,2022.

[3]. Hunt-McCool J, Koh S C, Francis B B. Testing for deliberate underpricing in the IPO premarket: A stochastic frontier approach[J]. The Review of Financial Studies, 1996, 9(4): 1251-1269.

[4]. Kumbhakar S C, Lovell C A K. Stochastic frontier analysis[M]. Cambridge university press, 2003.

[5]. Huang Shunwu, Jia Jie, Wang Wenjun. IPO underpricing decomposition based on two-tier stochastic frontier Model: Evidence from chinext [J]. Chinese Journal of Management Science,2017,25(02):21-29.

[6]. Gui YuJuan. Science and innovation board listed company financial ability analysis [J]. Journal of business economics, 2019,No.519(11):170-172.