1. Introduction

Coca-Cola is a multinational beverage company founded in 1886 in Atlanta, Georgia. Its products are sold in more than 200 countries. Some of the popular products in its portfolio include Coca-Cola, Fanta, Sprite, Stoney, Schweppes, amongst other soft drinks. Some of the hydration, sports, coffee and tea brands comprise Dasani, Topo Chico, Costa, and Body Armour. On nutrition, Coca-Cola has Minute Maid, Del Valle, Simply, and Ades [1]. This paper seeks to analyse Coca-Cola’s global strategy and offer insights into its market position and competition. The report provides an overview of the beverages industry, then proceeds to an analysis of Coca-Cola’s global strategy and provides recommendations based on the findings.

2. Global Market Analysis

2.1. Overview of the Global Beverage Industry

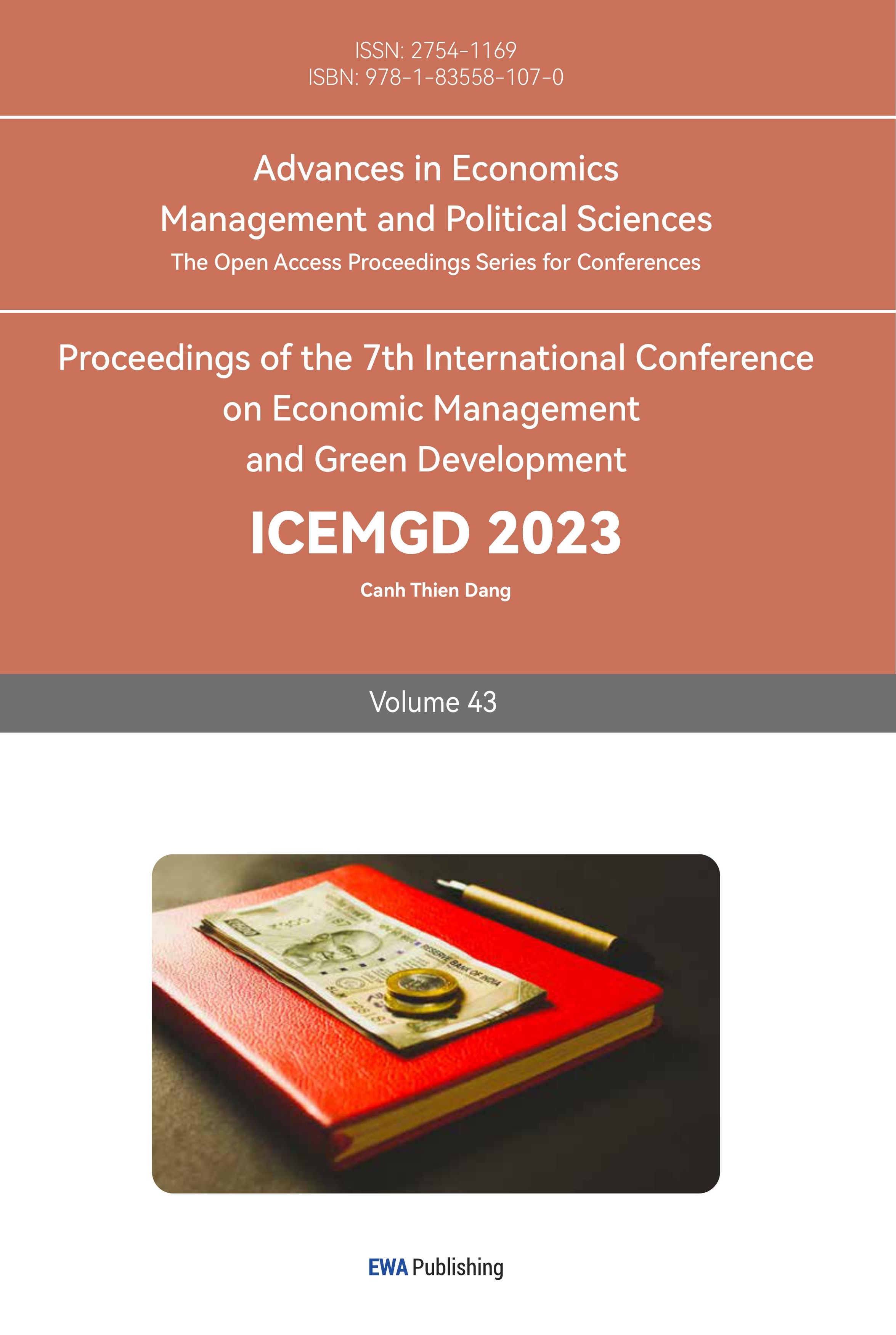

According to Statista, the value of the global carbonated drinks market rose from US$293.6 billion in 2020 to US$333.9 billion in 2022, Figure 1, and is expected to grow to $425.00 billion in 2026 [2]. Technology attributes the high demand for carbonated drinks among Gen X and Gen Y consumers are expected to be a major growth factor [3]. Carbonated drinks are traditionally popular due to their refreshing taste, and a pleasant tingling feeling. Further, Sky Quest Technology states that some of the soft drinks have fruit flavours which appeal to younger consumers such as children and Gen Z [3].

Figure 1: Revenue of the beverages industry. (Data Source:https://www.statista.com/outlook/cmo/non-alcoholic-drinks/softdrinks/carbonated-soft-drinks/worldwide.)

Despite the popularity of carbonated drinks, the rise of health-conscious consumers is expected to have significant ramifications on market growth. According to Thusanthy, health-conscious consumers are more conscious about the ingredients used to make their favourite beverages [4]. They pay attention to those perceived as ‘unhealthy’, ranging from food colours, and artificial sweeteners to energy-boosting ingredients [4]. As a result, many consumers are shunning carbonated drinks, opting for healthy ones instead. This is an issue that the soft drinks industry must consider, reformulating their products so that they can win back their consumers. Many beverage brands, including Coca-Cola, are introducing reformulated products that are deemed healthy such as those with functional ingredients, probiotics, and using natural sweeteners [5].

2.2. Competition Analysis

Coca-Cola operates in a highly competitive market alongside big players such as PepsiCo, Red Bull and Nestle. Nestle holds a distinction for being the most valuable brand of the three competitors. Both Coca-Cola and PepsiCo use competitive pricing, which involves setting prices for their products based on the prices charged by their competitors [6]. The competitive pricing strategy allows them to remain competitive and enhance their market share.

All the brands under review have a global presence, although Coca-Cola stands out with the largest market share (43.7%) in the carbonated drinks market. Red Bull follows closely behind with a market share of 35.1% [7]. Nonetheless, most of these brands have been criticised over their large portfolio of unhealthy products that have high sugar content [7].

Table 1 summarises the key competitors for Coca-Cola:

Table 1: Competitor analysis (Summarised by report).

Brand | Coca-Cola | PepsiCo | Red Bull | Nestle |

Revenues | $43 billion | $86.39 billion | $10.2billion | $99.32 billion |

Market share/growth | 43.7% | 20.5% | 35.1% | 9.2% |

Strategies | Competitive Pricing | Competitive Pricing | Premium Pricing | Price skimming |

Weaknesses | -Health concerns -Unsustainable operations (Food Business news, 2022) | -Over-reliance on food and beverages -Some of the products are unhealthy -Controversial adverts (Food Business news, 2022) | -A lack of variety -Unhealthy products -Patent issues since it did not create ingredients (Nasdaq, 2023) | -High prices -Water controversy -Criticisms on mislabeling, child labour, deforestation and farmer -Racially insensitive product names |

3. Analysis of Coca-Cola’s Global Strategy

3.1. Global Market Entry Strategy

According to Hollensen, the three fundamental objectives of a firm’s global strategy are to acquire new customers (market seeking), cut product costs (efficiency-seeking), access resources that are not available at the home market (resource-seeking) and obtain strategic assets (strategic-seeking) [8]. Coca-Cola’s global strategy begins with the decision about the entry mode. However, Coca-Cola uses Root’s pragmatic rule in entering foreign markets [8]. According to the pragmatic rule, a firm uses a workable entry mode for each market. Some of the typical entry strategies that Coca-Cola uses include franchising, licensing, joint ventures, and exporting.

Largely, joint ventures and licensing are the most popular entry strategies that Coca-Cola uses while entering foreign markets. A joint venture strategy involves shared ownership of a firm located in a host nation by two partnering firms [6]. In contrast, licensing refers to the act of authorizing the licensee by the licensor to utilize intellectual property (IP) rights, such as brand names, trademarks, or technology, based on predetermined terms and conditions [6]. Coca-Cola has mostly used a joint venture strategy when entering culturally distant markets or markets characterised by higher levels of bureaucracy with excessive licensing requirements. For example, Coca-Cola and Mengniu, a Chinese dairy firm, registered a joint venture to tap into Chinese consumers’ growing desire for value-added and better-tasting dairy products [8]. The JV will support Coca-Cola’s transition to a total beverage firm, offering a diverse portfolio of consumer-centric beverages and showcasing its long-term commitment to the local market. Markedly, the choice is justified by the resource-based theory that argues that when entering foreign markets, firms need to determine how to utilise their resources and develop and acquire new ones [4].

Further, the transaction cost theory states that a firm can only use costly modes when it expects to generate enough profit [5]. Owing to high costs and risks in certain markets such as India, transaction cost theory recommends high flexibility and low control modes of entry for Coca-Cola such as licensing or exporting. For example, in India, Coca-Cola has entered into a licensing agreement with partners to produce and sell its products in their local markets, using the Coca-Cola name and branding to market the products [7]. Coca-Cola also entered into a licensing deal to allow Minute Maid and Simply, to be used on selected products distributed by Frutura’s Dayka and Hackett brands [8]. This licensing agreement enables Coca-Cola to obtain product recognition in the fresh fruits section and boost sales of its original juice offering. Additionally, Coca-Cola chooses licensing since it presents very low political and economic risk conditions, and high return on investment (ROI). Crucially, licensing offers a more cost-effective and expeditious alternative compared to the firm independently developing a product. It enables both the licensor and licensee to leverage the advantages of one another, such as brand name, distribution network, and market expertise [6]. However, despite its effectiveness, licensing has limitations. According to Pinho, de Rocha and Pinho [1], licensing reduces potential profits, impacts brand perception due to limited control, fosters potential competition, and carries a risk of intellectual property theft, especially for innovative products.

3.2. Global-Integration and Local-Responsiveness Framework

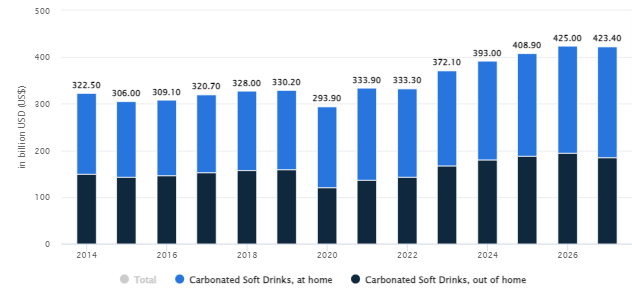

The global integration and local responsiveness framework show how an MNC approaches a global market. According to the framework, an MNC can adopt four key strategies as provided on figure 2 below. In the case of Coca-Cola, a global organisation approach is used. The global organisation strategy is characterised by low levels of local responsiveness and high forces for global integration [7].

Figure 2: Global integration and local responsiveness framework. ( Data Source:https://www.cnbc.com/2019/03/18/harvard-researchers-say-soda-sports-drinks-increase-risk-of-dying.html)

The firm has a unified product structure, wherein the Coca-Cola brand and its core product offerings are consistent globally, as shown in figure 3. This approach enables Coca-Cola to attain economies of scale through mass production, procurement, and distribution, resulting in cost efficiencies and enhanced global competitiveness. Regardless of the market it serves, Coca-Cola provides this complete set of brands and competes in various verticals. The uniformity of brand architecture enables Coca-Cola to establish a strong and recognisable brand [6]. In addition, Coca-Cola ensures that consumers can easily associate their products with the brand’s core values and messaging, regardless of their geographic location [8].

Figure 3: Coca-Cola brand architecture.( Data Source: Peng, W.: Global Business. New York: Cengage (2016).)

However, the recent rise of value-driven consumers, as well as heightened competition and a need for global responsiveness have forced Coca-Cola to adopt a ‘glocal’ approach in its global strategy. The glocal approach is an interplay of merging the two extremes i.e. globalisation and localisation, see figure 4, create a product that is responsive to the needs of the local population while still helping the firm to maintain its global image.

Figure 4: Glocal-approach.[5]

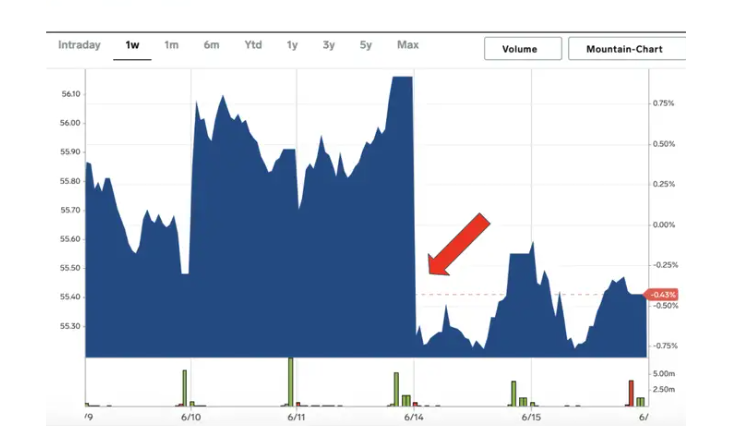

While Coca-Cola maintains a global strategy as evidenced by its brand architecture, there are some forms of localisation regarding its messaging, distribution, and production. For example, in India, marketing efforts of Coca-Cola typically feature Bollywood and cricket celebrities. This is because, in this market, Bollywood movies and cricket are highly popular and influential cultural elements. For instance, in 2019, Coca-Cola chose MS Dhoni, a famous cricketer, to be the face of the brand [9]. In Africa, where football is popular, Coca-Cola uses soccer celebrities such as Marcus Rashford, Alex Oxlade and Didier Drogba to endorse its products. In the US, Coca-Cola uses pop stars, socialites and celebrity golfers to popularise its drinks. However, a recent snub by Christiano Ronaldo at a post-match event in Euro 2020 highlighted the complexities of celebrity endorsements the incident [7], see figure 5.

Figure 5: Coca-Cola’s market value dropped after Ronaldo snubbed the drink (Nagarajan, 2021).

Apart from localizing messaging and advertisement, Coca-Cola has also started to use locally sourced ingredients to make its products. For example, a wide range of ingredients such as water and sugar are sourced locally to reduce the costs of sourcing these items from a foreign market. At the same time, Coca-Cola uses local distributors to distribute its products to retailers. Most of the workforce is also comprised of locals to enhance operational efficiency and strengthen a deeper connection with the local communities [7].

4. Recommendations

Based on the analysis presented above, Coca-Cola faces a significant licensing risk due to the possibility of IP theft and licensees turning out to be competitors. To address this problem, Coca-Cola needs to adopt a selective licensing process. Partners should be vetted rigorously to identify potential licenses with a history of IP violations or unethical practices. There is also a need to conduct regular audits and monitoring to ensure compliance with contractual obligations and trade secret protection. Other methods that Coca-Cola can use to enhance the effectiveness of licensing agreements include embracing robust confidentiality agreements, and implementing training programs that sensitise licensees about the importance of trade secret protection [10].

Secondly, Coca-Cola can enhance its global appeal by mainstreaming the transition to healthy products. The main ingredient for Coca-Cola globally is artificial sweeteners, additives and food colouring. As health-consciousness increases, Coca-Cola is expected to switch progressively to natural sweeteners, minimise additives and eliminate artificial food colouring [1, 3, 7]. The transition to healthier products would need to be done in a phased manner as not all customers have the same perspectives on Coca-Cola’s products. Therefore, this may mean that Coca-Cola should add new product lines that satisfy the needs of health-conscious consumers. These products should use natural sweeteners, and food colours, and should be free of any chemicals. In addition, Coca-Cola might need to enhance transparency in communication, such as ingredient labelling to build trust and assurance among consumers.

Third, Coca-Cola needs to embrace a transnational strategy because it has a high level of global integration and local responsiveness. To implement this strategy, Coca-Cola needs to create a strong global coordination framework while enhancing flexibility at the local level. This may mean maintaining a consistent brand messaging and identity across different markets. It can also tailor its pricing to align with the socioeconomic status of the markets it serves. For example, it can use competitive pricing in developed countries, and low-cost pricing in poor/emerging economies. Doing so will ensure that Coca-Cola remains competitive and accessible in diverse markets while enhancing its global brand presence [10].

5. Conclusion

Coca-Cola’s success in the global market is reliant on its choice of joint venture and licensing strategies. These strategies have enabled Coca-Cola to access strategic resources and distribution networks in global markets. The company also uses a mix of global and local strategies to ensure that it becomes responsive to local market needs while maintaining its global appeal. It is recommended that Coca-Cola can streamline the production of healthy products to satisfy the needs of health-conscious consumers, comply with due diligence procedures when looking for a JV or a licensing partner, and use optimal pricing strategies that suit the socio-economic status of each market.

References

[1]. Cocacola.com(2023)abouttheCoca-ColaCompany.https://investors.coca-colacompany.com/about#:~:text= The%20Coca%2DCola%20Copany%20(NYSE,and%20other%20sparkling%20soft%20drinks, last accessed 2023/6/15.

[2]. Statista (2022) Carbonated soft drinks worldwide. https://www.statista.com/outlook/cmo/non-alcoholic-drinks/soft-drinks/carbonated-soft-drinks/worldwide, last accessed 2023/6/15.

[3]. Skyquest Technology (2022) Global carbonated beverages market. https://www.skyquestt.com/report/carbonated-beverages market#:~:text=Global%20Carbonated%20Beverages%20Market%20Insights,period%20(2023%2D2030), last accessed 2023/6/15.

[4]. Thusyanthy, V.: Health consciousness and brand equity in the carbonated soft drink industry in Sri Lanka. International Journal of Business and Management, 13(3), 188-195 (2018).

[5]. Sinha, A., Chatterjee, P.: Coca Cola enter two new categories of health drinks. (2018). https://www.businessworld.in/article/Coca-Cola-Enters-Two-New-Categories-Of-Health-Drinks/03-05-2018-148148/, last accessed 2023/6/18.

[6]. Food Business News. (2022) Nestle holds top spot as world’s most valuable. brandhttps://www.foodbusinessnews.net/articles/21976-nestle-holds-top-spot-as-worlds-most-valuable-brand, last accessed 2023/6/18.

[7]. Lavito, A. (2019) Harvard researchers say soda and sports drinks increase the risk of dying from heart disease and breast and colon cancers. https://www.cnbc.com/2019/03/18/harvard-researchers-say-soda-sports-drinks-increase-risk-of-dying.html, last accessed 2023/6/20.

[8]. Hollensen, S.: Global Marketing. London: Pearson (2018).

[9]. Peng, W.: Global Business. New York: Cengage (2016).

[10]. Bapna, A.: Coca-Cola goes big bang with its marketing strategy this world cup. (2019). https://brandequity.economictimes.indiatimes.com/news/marketing/coca-cola-goes-big-bang-with-its-marketing-strategy-this-world, last accessed 2023/6/22.

Cite this article

Zheng,W. (2023). The Global Strategy of Coca Cola. Advances in Economics, Management and Political Sciences,43,185-191.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Cocacola.com(2023)abouttheCoca-ColaCompany.https://investors.coca-colacompany.com/about#:~:text= The%20Coca%2DCola%20Copany%20(NYSE,and%20other%20sparkling%20soft%20drinks, last accessed 2023/6/15.

[2]. Statista (2022) Carbonated soft drinks worldwide. https://www.statista.com/outlook/cmo/non-alcoholic-drinks/soft-drinks/carbonated-soft-drinks/worldwide, last accessed 2023/6/15.

[3]. Skyquest Technology (2022) Global carbonated beverages market. https://www.skyquestt.com/report/carbonated-beverages market#:~:text=Global%20Carbonated%20Beverages%20Market%20Insights,period%20(2023%2D2030), last accessed 2023/6/15.

[4]. Thusyanthy, V.: Health consciousness and brand equity in the carbonated soft drink industry in Sri Lanka. International Journal of Business and Management, 13(3), 188-195 (2018).

[5]. Sinha, A., Chatterjee, P.: Coca Cola enter two new categories of health drinks. (2018). https://www.businessworld.in/article/Coca-Cola-Enters-Two-New-Categories-Of-Health-Drinks/03-05-2018-148148/, last accessed 2023/6/18.

[6]. Food Business News. (2022) Nestle holds top spot as world’s most valuable. brandhttps://www.foodbusinessnews.net/articles/21976-nestle-holds-top-spot-as-worlds-most-valuable-brand, last accessed 2023/6/18.

[7]. Lavito, A. (2019) Harvard researchers say soda and sports drinks increase the risk of dying from heart disease and breast and colon cancers. https://www.cnbc.com/2019/03/18/harvard-researchers-say-soda-sports-drinks-increase-risk-of-dying.html, last accessed 2023/6/20.

[8]. Hollensen, S.: Global Marketing. London: Pearson (2018).

[9]. Peng, W.: Global Business. New York: Cengage (2016).

[10]. Bapna, A.: Coca-Cola goes big bang with its marketing strategy this world cup. (2019). https://brandequity.economictimes.indiatimes.com/news/marketing/coca-cola-goes-big-bang-with-its-marketing-strategy-this-world, last accessed 2023/6/22.