1. Introduction

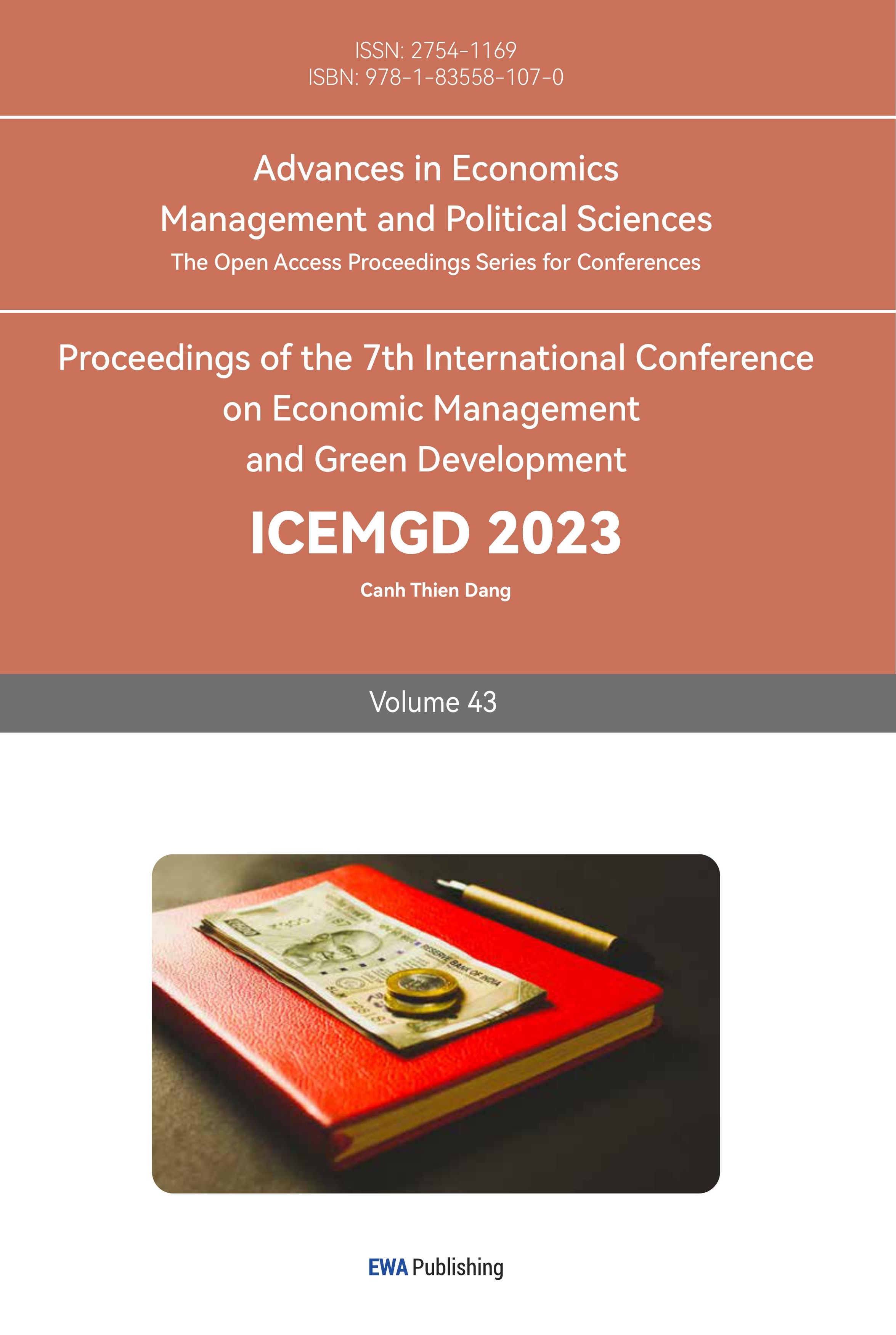

The latest data from China's National Bureau of Statistics shows that China's R&D expenditure reached RMB 3,087 billion in 2022, up 10.4% from the previous year, and 8.0% at constant prices; the ratio of R&D expenditure to gross domestic product (GDP) reached 2.55%, up 0.12 percentage points from the previous year. It shows that the state's attention and importance to R&D are rising all the time, as Figure 1 shown.

Figure 1: 2016-2022 national R&D investment.

R&D expenses are slightly different from other expenses in nature, and are production costs used for the investment and support of funds required for research and innovation activities. Some scholars even define R&D activities as investment activities, but R&D activities are more risky than traditional investment activities. If the final R&D results do not meet the market demand or the R&D project stalls in the middle of the project, the project is a failed project, and all the expenditures incurred in these failed projects will be expensed and become the sunk cost of the enterprise, which brings huge financial and operational risks to the enterprise. However, if the project is successfully developed, the enterprise will usually apply for a patent, and during the patent protection period, the enterprise will occupy an absolute market advantage. In addition, due to the high initial R&D investment in the new product, the enterprise will price the product at a higher price in order to gain a lucrative profit.

As a high-tech industry with R&D-intensive enterprises driven by scientific and technological innovation, the R&D activities of pharmaceutical enterprises are mainly the research and development of innovative and generic drugs. The development of R&D activities is based on the enterprise's investment of large amounts of capital, human and material resources, involving a long period and a wide range, so it is very important for pharmaceutical enterprises to have an accurate accounting of R&D expenditures [1]. Therefore, for pharmaceutical high-tech enterprises, R&D expenses are a very important and special part, and the level of R&D expense management of an enterprise determines its operation and future development, and has an extremely important impact on enterprise performance. At the same time, in the new era, China's pharmaceutical enterprises have become an emerging strategic industry for China's economic development, and the state has introduced a series of policies to encourage and promote the development of the pharmaceutical industry, which brings opportunities and motivation for the development of China's pharmaceutical enterprises [2]. The state must strengthen the management of R&D expenditures if it wants pharmaceutical high-tech enterprises to run normally and orderly.

At present, there is still no international consensus on the treatment of development expenditures, and basically, three different regulations have been formed: (1) In countries using GAAP standards, represented by the United States, R&D expenditures must be fully cost and carried forward to current profit or loss. This is because they believe that there is too much subjective judgment in the capitalization criteria, which can lead to a loss of comparability between the financial statements of companies. In order to solve this non-comparability, investors have to spontaneously reconcile the financial statements, either by simulating full expense or full capitalization, and then use it as a reference basis for investment; (2) Some European countries represented by the Netherlands and Sweden, R&D expenditures are fully capitalized, because most of them are in the middle of the industrial chain, and the enterprises' R&D efforts are relatively large, and the capitalization of R&D expenditures can They believe that whether the enterprise's R&D is successful or not, it can bring favorable influence to the future development of the enterprise, and even if it fails, it will accumulate talents and technology for the enterprise; (3) The countries represented by the UK and China, which use IFRS logic, implement conditional capitalization treatment, also called "two-paragraph method". The first is to distinguish between so-called "successful" and "failed" R&D projects, i.e., projects that can enter the development stage and are theoretically very close to success and have a high probability of generating future revenues, and failed projects so that stakeholders can distinguish them through the financial statements. financial reports. Secondly, it is considered that these projects with a high probability of success can generate future revenue for the company, which satisfies the definition of "asset" under IFRS, i.e., it is expected to generate future economic benefits for the company and is more in line with the matching principle.

This article focuses on the "two-paragraph method" of Chinese accounting standards. In order to capitalize on R&D expenditures, the following five conditions need to be met: feasibility, purpose, usefulness, and measurability. Due to the lack of strict and objective implementation criteria for the conditions of capitalization of R&D expenditures, the capitalization of R&D expenditures depends to a certain extent on the subjective judgment of enterprise management, i.e., it may be subject to artificial manipulation to a certain extent, which results in the degree of capitalization of R&D expenditures not fully reflecting the success or otherwise of enterprise R&D activities [3]. Due to the persistent information asymmetry between enterprises and stakeholders, the subjective nature of capitalization conditions as a non-quantitative indicator and the inadequacy of the regulatory system, as well as the need for a tax deduction and surplus management, enterprises tend to use the manipulation of the capitalization ratio of R&D expenditures to whitewash their financial statements. Specifically, R&D expenditures are charged to current profit and loss and affect the current year's profit. Some industries and enterprises with high tax rates can lower the capitalization ratio of R&D expenditures to inflate expenses and obtain tax benefits; while capitalized R&D expenditures are charged to assets and amortized over the years, affecting the profit of future years. By increasing the capitalization rate of R&D expenditures, enterprises can implement surplus management, smooth out the profits of each accounting year, maintain stable growth of profits, enhance investment confidence and market recognition, and achieve higher corporate value [4]. Especially for pharmaceutical and high-tech R&D-intensive enterprises, their R&D expenditures are huge, and if the accounting treatment is not in line with the actual situation, it will have a significant impact on the enterprise's profit, or even "turn a loss into a profit". Allowing pharmaceutical companies to choose the amortization method for R&D expenditures classified as assets largely increases the scope for surplus manipulation by the management of pharmaceutical companies [5]. It is found that such enterprises also release pseudo-innovation signals to obtain government subsidies, which is related to the information asymmetry in the process of high-tech enterprise recognition, where government departments are unable to accurately judge the qualification of enterprises, and the time cost and resource cost of information collection are high, which provides a germinating ground for enterprises to manipulate R&D expenses, and therefore such enterprises are more likely to manipulate the capitalization rate of R&D expenses to achieve the purpose of surplus management [6]. Some scholars even argue that how R&D expenditures are treated has become a common tool for companies to implement surplus management. This poses a great challenge to both the truthfulness of financial statements and the principle of prudence.

2. Accounting Analysis

In this paper, HISUN Pharmaceutical is chosen as a representative of pharmaceutical R&D-intensive companies because HISUN is a leading listed API manufacturer in China, focusing on R&D, with a complete production chain and a wide range of products. Its main business is the research and development of preparations and chemical raw materials, and it has a group of senior and highly educated R&D teams. In 2015, HISUN received a query from the Shanghai Stock Exchange due to excessive capitalization of R&D expenditures.

In 2015, HISUN achieved operating revenue of RMB 8,767 million, down 13.17% year-on-year, and net profit of RMB 1,263 million, down 77.2% year-on-year. However, the company's book balance of R&D expenditure at the end of 2015 was 3340 million yuan, a significant increase of 452% from the beginning of the period. In response to a query from the Shanghai Stock Exchange on this issue, HISUN said that the starting point for HISUN to define the capitalization phase is when a project can enter clinical trials or enter the filing period. This means that the company's generic drug R&D starts capitalizing on R&D expenditures when it has not received clinical approval. Whereas generic drugs are normally capitalized in clinical phase III, HISUN capitalization when R&D enters clinical phase I is clearly too aggressive in the industry.

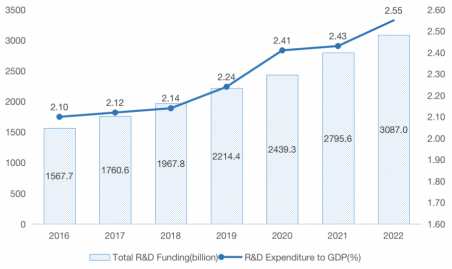

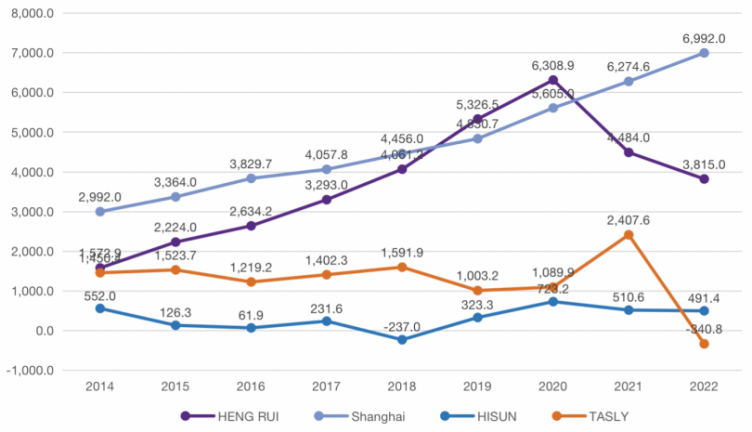

Figure 2: 2014-2022 Operating Profit of HISUN (in billion).

When a company has good sequential profitability it usually does not choose to overcapitalize R&D expenditures; on the contrary, it is more likely to choose to adopt a relatively aggressive accounting treatment for R&D expenditures if its sequential profitability is relatively poor. In order to test the hypothesis that this behavior of HISUN is for the purpose of surplus management, this paper collects and compares the data of operating profit and R&D expenditure of HISUN from 2014 to 2022.

As can be seen from Figure 2, HISUN has performed poorly since 2015 because of reduced supply and declining sales, and the fluctuations in operating profit have been particularly large, with a precipitous decline, with operating profit in 2015 being only 10% of that in 2014. HISUN urgently needed to beautify its statements and stabilize investors' confidence, so the company began disclosing the specifics of its R&D expenditures in the company's annual report in the fourth quarter of 2014 and successfully turned its losses into profits by capitalizing 46.17% of its development expenditures in its 2015 annual report and only charging the remaining 53.83% to current profit and loss.

Table 1 also shows the data on the capitalization of R&D expenditures of HISUN from 2014-2022. Since 2015, the capitalization ratio of R&D expenditures of HISUN almost doubled compared to 2014, after which it remained above 45% until 2020 when it returned to below 20%, and the ratio of total R&D investment to operating income also changed in parallel. From Figure 3, it can be concluded that the inverse relationship between R&D expenditure and the capitalization ratio of R&D expenditure will increase when the operating profit of HISUN decreases, which preliminarily argues the validity of the hypothesis.

Table 1: HISUN’s R&D expenses.

2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

Total R&D investment (mil) | 558 | 828 | 775 | 844 | 1034 | 814 | 459 | 440 | 442 |

Cost-based R&D investment (mil) | 418 | 446 | 411 | 439 | 503 | 429 | 376 | 373 | 429 |

Capitalized R&D investment (mil) | 140 | 382 | 364 | 405 | 531 | 384 | 827 | 68 | 14 |

Total R&D investment/ operating income (%) | 6 | 9 | 8 | 8 | 10 | 7 | 4 | 4 | 4 |

The proportion of R&D investment capitalized (%) | 25 | 46 | 47 | 48 | 51 | 47 | 18 | 15 | 3 |

Figure 3: 2014-2022 R&D investment of HISUN (in million).

3. Industry Comparison

To reflect that the capitalization treatment of R&D expenditures of HISUN is indeed abnormal and excessive, this paper compares the entire pharmaceutical industry, the percentage of companies that chose different treatments of R&D expenditures from 2010 to 2015 in Table 2.

Table 2: The proportion of various R&D expenditure treatment methods in the pharmaceutical industry.

2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

All cost | 46% | 38% | 54% | 46% | 48% | 51% |

All capitalized | 8% | 16% | 10% | 12% | 18% | 9% |

Partial capitalization | 46% | 46% | 36% | 42% | 34% | 40% |

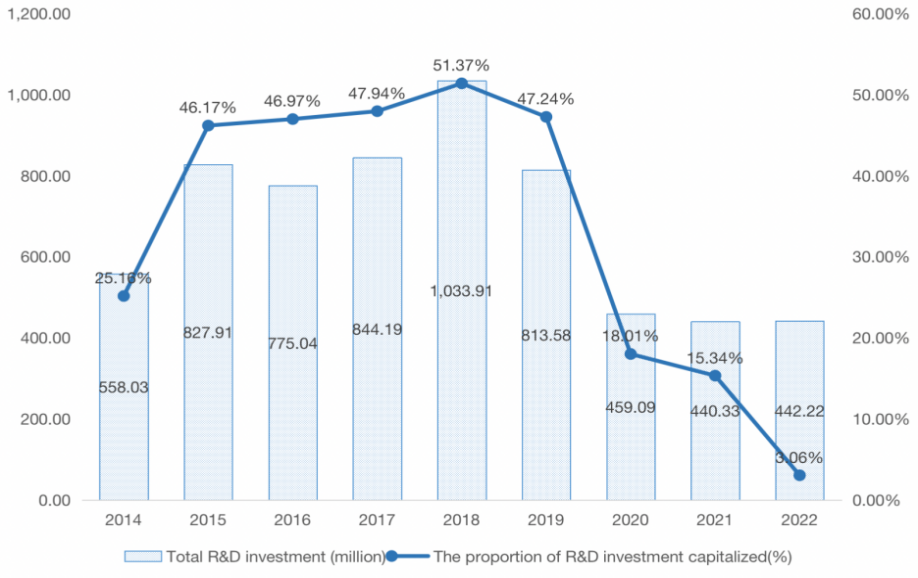

As can be seen from Table 2, during the period of 2010-2015, the pharmaceutical industry's choice of accounting treatment for R&D expenditures was dominated by full cost and partial capitalization, accounting for 50% and 40% of the total respectively, and only 10% of the enterprises chose full capitalization. This means that the pharmaceutical industry was mostly conservative and cautious in accounting treatment of R&D expenditures at that time. At the same time, a comparison with the same industry shows that the average capitalization rate of enterprises that choose partial capitalization is about 20% (see Figure 4). Therefore, HISUN Pharmaceutical, which has maintained a high capitalization rate of over 45% all year round, obviously has the problem of over-capitalization. For the large number of uncertainties in the R&D process of pharmaceutical companies, the premature capitalization of HISUN Pharmaceutical not only does not fully consider the possibility of failure in the later stages of R&D, but also inflates assets and has room for profit manipulation.

Figure 4: 2014-2022 capitalization rate comparison.

Figure 5: 2014-2022 net profit comparison.

In this paper, HENG RUI Pharmaceuticals, Shanghai Pharmaceutical and TASLY are chosen as the comparison companies for HISUN Pharmaceutical because they are all pharmaceutical companies listed around 2000 and their issue prices are basically the same. Most importantly, they represent the two types of Chinese listed companies that capitalize and expense R&D expenditures as much as possible, respectively.

As can be seen from the Figure 5, HENG RUI and Shanghai Pharmaceutical have maintained an upward trend in net profit since 2014 to 2020 after their listing, and their profitability and development are better, so there is no urgent need to beautify their statements. Therefore, as can be seen from the table, their R&D expense ratios are basically less than 20%, and HENG RUI even chooses to cost all R&D expenditures from 2014 to 2020, and the timing and financial treatment of capitalization of R&D expenditures are very cautious. As for HISUN and TASLY, both of them showed a declining trend in net profit from 2014 to 2016, with a small rebound in 2017, and HISUN even had a negative net profit in 2018, with great pressure on their statements. However, their R&D expenditures in these four years were high in both the amount invested and the capitalization ratio, with the obvious intention of over-capitalizing R&D expenditures to smooth profits while beautifying annual financial statements.

Therefore, through the above analysis, this paper argues that pharmaceutical companies choose earlier capitalization point of R&D expenditures or larger capitalization rate of R&D expenditures in the operation of capitalization of R&D expenditures, which is a kind of manipulation of profits and surplus management for the purpose of whitewashing statements under the pressure of loss of enterprises. The hypothesis that the over-capitalization of R&D expenditures by HISUN was for the purpose of surplus management was argued.

4. Causes & Impacts

There are three possible reasons why the pharmaceutical industry, represented by HISUN, has chosen to overcapitalize its R&D expenditures.

4.1. Turning Losses into Profits

It is found that companies with low profitability, unstable R&D investment and in the threshold of turnaround are more inclined to capitalize R&D expenditures [7]. Starting from 2015, HISUN experienced supply shortages due to production facility renovation and other issues, resulting in a significant decrease in operating income from 2015 to 2016. At the same time, HISUN was affected by the import ban on the company's products by the FDA and the EMA of the European Union, resulting in a significant decline in performance, which was estimated to bring a loss of nearly $620 million. At this time, HISUN faced a double crisis of continued losses and delisting. As seen in Table 3, if HISUN had continued to use the lower capitalization rate for R&D expenditures in 2015, HISUN's net profit for the year would have been RMB -29.41 million. At the same time, the amount transferred to current profit and loss by HISUN Pharmaceutical in 2015 and 2016 was more than RMB 20 million, accounting for about 17% and 13% of that year's profit (as Table 4 shown), indicating that the failure rate of R&D expenditure projects is high, while the impact on corporate profit is significant.

Table 3: HISUN Pharmaceutical's operating results in 2015 under different accounting models.

Accounting treatment | operation revenue (in mill) | Net profit attributable to the parent company (in mill) | Net income changed year-over-year |

The current way | 876.74 | 1.36 | -95.59% |

Full-cost treatment | 838.52 | -36.86 | -219.73% |

Table 4: HISUN Pharmaceutical's operating results in 2016 under different accounting models.

Accounting treatment | operation revenue (in mill) | Net profit attributable to the parent company (in mill) | Net income changed year-over-year |

The current way | 1,057.15 | 1.36 | 114.36% |

Full-cost treatment | 1,016.68 | -39.12 | 314.24% |

As a result, HISUN is in urgent need of increasing the capitalization rate of its R&D expenditures to beautify its figures, reduce losses, smooth profits, and even turn losses into profits. If HISUN Pharmaceutical does not capitalize its R&D expenditures at a high rate, the net profit loss for four consecutive years will inevitably expose it to a high risk of delisting, which is undoubtedly a huge blow to a pharmaceutical company like HISUN that relies on large amounts of financing. Therefore, HISUN has highly capitalized its R&D expenditures in order to retain its listing status, stabilize its financing sources and reduce shareholder turnover. Not only that, but it may even help HISUN win the trust of the market and attract more investors to invest and better tide over the difficult times in the overall poor market situation.

4.2. Increasing Asset Value

A high capitalization rate is inevitably accompanied by a lower expense rate, and with all costs held constant, the increase in corporate assets will result in more economic benefits, and the amortization of the increased intangible assets will also provide reasonable tax avoidance. At the same time, the study found that capitalized R&D expenditures would signal to outside investors that higher economic returns are available in the future, so increasing the capitalization rate would also increase corporate value [8]. Since the amount of R&D investment in HISUN from 2014 to 2017 is significant, for HISUN, both the capitalized and expense portion of R&D investment will have an impact on the company's assets and current profit, which in turn affects the company's financial reporting.

The amount charged to the development expenditure account by HISUN from 2014 to 2017 is 600 million, 3340 million, 6480 million and 10290 million respectively, which is a cumulative increase of nearly 10 times in four years [9]. The increase in assets generated by development expenditures for HISUN Pharmaceutical in the three years from 2015, 2016 to 2017 were 2740 million, 3140 million and 3810 million, respectively, which were largely obtained through early capitalization.

4.3. Debt Contracts

Creditors are the category of stakeholders with the strongest relationship with the enterprise, except for investors. Creditors can increase a company's financial leverage through borrowing and are a major source of capital for the company. However, at the same time, creditors also set restrictive covenants on the borrowing enterprise, such as requiring the borrowing enterprise to meet specific profitability levels and other constraints. The assessment of relevant financial indicators is directly related to the fulfillment of debt covenants, and if the borrowing enterprise's operation fails to meet the agreed requirements, the creditor will stop financial support or even withdraw funds. Therefore, HISUN, which itself relies on high debt to maintain its operations, is likely to continue to obtain funds and reduce covenant costs in order to boost creditor confidence, thus using excessive capitalization of R&D expenditures for surplus management and beautifying statements.

However, over-capitalization of R&D expenditures often does more harm than good, and can only be used as a temporary emergency solution when an enterprise is facing development difficulties, rather than a long-term solution. In order to enjoy more tax and preferences, high-tech enterprises write "cost expenses" as "capitalized expenses" to achieve the purpose of profit adjustment, which not only leads to untruthful accounting information, but also sows the hidden danger of fines for enterprises, which is a certain obstacle to the sustainable development of enterprises. This not only leads to untruthful accounting information, but also creates a potential penalty for the enterprise, which is a certain obstacle to the sustainable development of the enterprise [10].

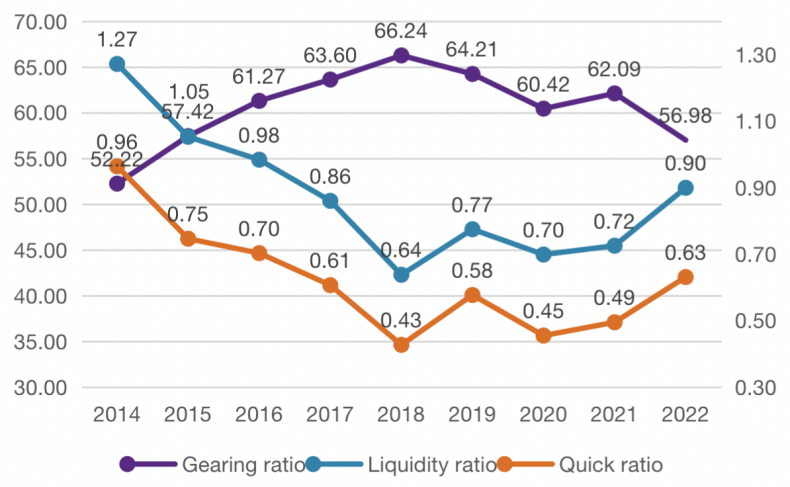

Generally speaking, high-tech enterprises are affected by many factors in the process of R&D, therefore, their R&D activities are characterized by high risk and uncertainty [11]. Premature capitalization of R&D expenditures is likely to affect the profits of future years, will cut the credibility and comparability of statements, increase the financial risk of the company, raise the asymmetry of information, influence investors to make rational decisions, and ultimately reduce market confidence in the company and affect the company's share price. In the Pharmaceutical industry, all types of companies tend to show higher financial leverage, better profitability and more R&D expenditures, and the more profitability of well-growing companies show stronger and more active R&D activities; the larger the size of the company, the more R&D investment (see Figure 6). The larger the company, the more aggressive its R&D activities. HISUN, however, has high financial leverage and high R&D expenditures, but its profitability is not as good as it should be [12].

Figure 6: 2014-2022 HISUN’s financial risk indicators.

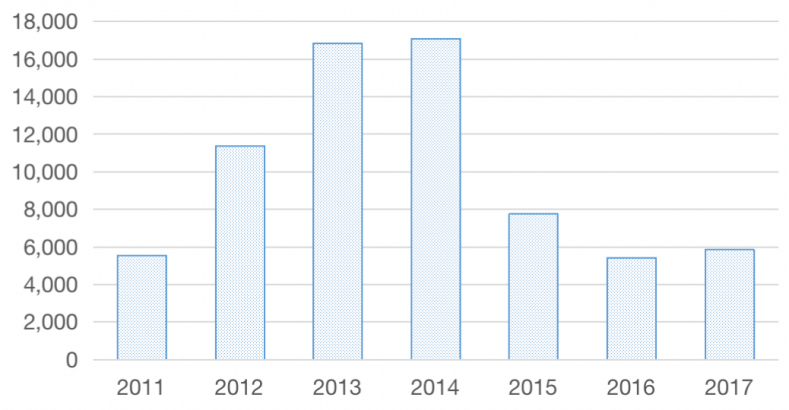

Figure 7: 2011-2017 government subsidies to HISUN.

From Figure 7, it can be seen that HISUN's R&D expenditures from 2015 to 2018 were above RMB 5000 million each year, and its capitalization ratio for R&D expenditures was higher than 40% from 2015-2018, yet, HISUN's profits and revenues have been declining since 2015. Then HISUN maintains such large R&D expenditures despite poor profits, relying on only government grants, free funds and external liabilities. As we can see from HISUN's gearing ratio, quick ratio and current ratio indicators in recent years, HISUN's debt repayment capacity is decreasing while the pressure to repay debt is gradually increasing from 2015 to 2018, which means that there is a great financial leverage, which means that HISUN has a great financial risk.

5. Suggestion & Conclusion

By analyzing the rationality of capitalization treatment of R&D expenses and the degree of capitalization of R&D expenditures of HISUN, this paper finds that compared to its comparable companies, HISUN has a more advanced capitalization point and a higher degree of capitalization of R&D expenditures. The reason why HISUN adopts a more aggressive capitalization of R&D expenditures is mainly to reduce the volatility of profits, to manage surplus, and to increase the value of assets so as to maintain the confidence of investors and creditors. This paper argues that the possible economic consequences of over-capitalization of corporate R&D expenditures are: firstly, it will increase the profit and tax pressure as well as tend to lead to excessive corporate R&D in the future amortization period, which increases the financial risk of the company. Second, the inconsistency of capitalization timing makes the accounting information less comparable among enterprises, which increases the difficulty and risk of investors' analysis. In view of these results, this paper makes the following recommendations:

First, for the government, this paper helps the government to assess the impact of implementing separate presentation of R&D expenditures in the income statement on the capital market and grasp the focus of future work. The relevant government departments need to strengthen the supervision on the use of R&D expenditures by listed companies to whitewash financial statements, improve the relevant standards on the accounting treatment of capitalization of R&D expenditures, and make higher requirements on the audit quality of accounting firms to further improve the reliability of information in the capital market and protect the relevant interests of investors. At present, the requirement of separate presentation of R&D expenditures in China is only limited to the format, and there are no hard and fast rules on the comparison of capitalization degree among the same industry and the logical explanation of the enterprises' choice of capitalization degree, which has caused great limitation to the information disclosure and provided opportunities for enterprises to manipulate profits. In order to visualize the specific data on the R&D expenditures, this paper suggests that enterprises should add industry comparisons and explanations for the choice of capitalization point in their statements. In addition to the amount that has been invested at different stages should be clearly disclosed, the nature of R&D projects, technical advantages, R&D progress and application prospects after the success of the project should also be revealed in detail, and a reasonable assessment of the R&D and later economic benefits of the project should be made to comprehensively evaluate its benefits and risks, so that investors can decide how to invest in the project and make a reasonable analysis to protect their own interests.

Secondly, for listed companies, this paper alerts that listed companies should establish a perfect measurement system, evaluate each key point of each project, strengthen the whole process of project management and assessment, improve the project evaluation mechanism, strengthen the strategic management of intellectual property rights, and protect the innovation of drugs. Thus, the development risk of projects can be reduced and the efficiency of R&D can be improved. It is recommended to strengthen the training of professionals and improve their professional quality, so that R&D personnel can make reasonable judgments on the division of R&D stages by combining years of R&D experience and professional understanding of accounting standards and research projects, and from the perspective of the industry. This is not only in consideration of the principle of prudence, but also a sign of responsibility to the enterprise. At the same time, enterprises should also strengthen internal auditing, sound internal control, and conduct multiple rounds of evaluation and combing of the various stages of R&D projects to see whether the measurement of the book amount is true, and to promptly confirm the later accounting treatment and R&D direction for projects with signs of impairment and high R&D risks. Enterprises should take the enhancement of corporate competitiveness as the core strategy to reduce the act of whitewashing financial statements. Enterprise management should have a long-term view and be committed to sustainable development of the enterprise and the pursuit of long-term value enhancement of the company.

Finally, for investors, this paper enhances their understanding of the capitalization treatment and expense treatment of R&D expenditures, improves their knowledge of corporate financial statements, and to a certain extent alleviates the information asymmetry between investors and companies, which helps investors screen out the truly high-quality companies and better invest in them.

References

[1]. Feng, Q. S.: Research on the capitalization of R&D expenditure in biopharmaceutical enterprises. Changchun University of Science and Technology (2021).

[2]. Wang, X. J.: A study on the rationality of capitalizing R&D expenditure in the field of biopharmaceuticals. Accounting Learning (29), 98+100 (2019).

[3]. Wang, S., & Liu, Z. Y.: Analysis of the separate presentation of R&D expenses and the capitalization ratio of R&D expenditure: A comparison based on A-shares and H-shares. International Business Finance and Accounting (06), 3-9+17 (2023).

[4]. Landry, S., & Callimaci, A.: The effect of management incentives and cross-listing status on the accounting treatment of R&D spending. Journal of International Accounting, Auditing and Taxation 12(02), 131-152 (2003).

[5]. Zhang, X. F.: Research on the capitalization of R&D expenditure in biopharmaceutical enterprises. Accounting Learning (170), 90-91 (2017).

[6]. Wang, K.: The impact of tax incentives on R&D innovation efficiency of enterprises. Zhejiang University of Finance and Economics (2021).

[7]. Wang, Y. N., Zhang, S. J., & Wang, F.: Research on the influencing factors of R&D capitalization and expense policy selection. Scientific Research 31(04), 546-553 (2013).

[8]. Han, B. H., & Manry, D.: The value-relevance of R&D and advertising expenditures: Evidence from Korea. The International Journal of Accounting 39(02), 155-173 (2004).

[9]. Wang, C. L.: Research on the capitalization of R&D expenditure in Chinese pharmaceutical enterprises. Guangdong University of Foreign Studies (2019).

[10]. Ren, R. R.: Discussion on the improvement of accounting for R&D expenses in high-tech enterprises. National Circulation Economy (15), 189-190 (2020).

[11]. Shi, J. Y.: On the accounting issues and countermeasures of R&D expenses management in high-tech enterprises. Knowledge Economy (7), 80-81 (2021).

[12]. biopharmaceutical industry. Research on Public Economy and Policy (01), 129-145 (2018).

Cite this article

Wang,T. (2023). Excessive Capitalization of R&D Investment in the Pharmaceutical Industry: A Case Study of HISUN Pharmaceutical. Advances in Economics, Management and Political Sciences,43,197-207.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Feng, Q. S.: Research on the capitalization of R&D expenditure in biopharmaceutical enterprises. Changchun University of Science and Technology (2021).

[2]. Wang, X. J.: A study on the rationality of capitalizing R&D expenditure in the field of biopharmaceuticals. Accounting Learning (29), 98+100 (2019).

[3]. Wang, S., & Liu, Z. Y.: Analysis of the separate presentation of R&D expenses and the capitalization ratio of R&D expenditure: A comparison based on A-shares and H-shares. International Business Finance and Accounting (06), 3-9+17 (2023).

[4]. Landry, S., & Callimaci, A.: The effect of management incentives and cross-listing status on the accounting treatment of R&D spending. Journal of International Accounting, Auditing and Taxation 12(02), 131-152 (2003).

[5]. Zhang, X. F.: Research on the capitalization of R&D expenditure in biopharmaceutical enterprises. Accounting Learning (170), 90-91 (2017).

[6]. Wang, K.: The impact of tax incentives on R&D innovation efficiency of enterprises. Zhejiang University of Finance and Economics (2021).

[7]. Wang, Y. N., Zhang, S. J., & Wang, F.: Research on the influencing factors of R&D capitalization and expense policy selection. Scientific Research 31(04), 546-553 (2013).

[8]. Han, B. H., & Manry, D.: The value-relevance of R&D and advertising expenditures: Evidence from Korea. The International Journal of Accounting 39(02), 155-173 (2004).

[9]. Wang, C. L.: Research on the capitalization of R&D expenditure in Chinese pharmaceutical enterprises. Guangdong University of Foreign Studies (2019).

[10]. Ren, R. R.: Discussion on the improvement of accounting for R&D expenses in high-tech enterprises. National Circulation Economy (15), 189-190 (2020).

[11]. Shi, J. Y.: On the accounting issues and countermeasures of R&D expenses management in high-tech enterprises. Knowledge Economy (7), 80-81 (2021).

[12]. biopharmaceutical industry. Research on Public Economy and Policy (01), 129-145 (2018).