1 Introduction

This project is to research what is portfolio theory and analysis how useful it is. And then find what can provide some insight into investor behavior through this theory. This theory’s pioneer is an American economist called Harry Markowitz. It creates a new frontier for investment theory. This considerable theory is presented in his paper “Portfolio Selection”. In 1952, this paper was published in the Journal of Finance. He also won a Nobel Prize for his work on Portfolio Theory [1]. On top of that, we need to know what is a portfolio. The Portfolio likes a box, it can contain any number of assets with differing proportions [2]. In addition, the portfolio theory is a method for selecting investments to maximize the overall returns within an acceptable level of risk. Portfolio theory is also known as the Modern portfolio theory. The key strategy is to utilize diversification to minimize or avoid idiosyncratic risk. Abhinav Angirish, managing director of Abchlor Investment Advisors, says that if you want to diversify your portfolio, look for unrelated stocks or funds. Avoid duplicate assets or assets that are related to the performance by measuring the assets currently owned by the fund [3]. This proves that the more uncorrelated an asset is, the more it can hedge against risks other than market risk. For example, buying fixed income, assets and non-fixed income assets to achieve the effect of hedging. While investing in fixed-income assets may reduce income, it can reduce risk and volatility [4]. This theory more focuses on the risks and returns of the overall portfolio of assets, not a single particular asset [1].

What’s more, this has been a topic of interest in economics for nearly half a century. Many experts have developed other theories and models based on this theory, such as the post-modern Portfolio Theory (PMPT) and Goal-based Investing (GBI). Also, include the analysis of the indifference curve. This article will introduce the portfolio theory and the other related theory to provide some implements for the stakeholders such as investors when they decide on what kind of portfolio. The remaining paper is structured as follows.

2 Implication for investors

2.1 Two usefulness

First of all, this theory uses diversification, which is the portfolio allocation strategy to decrease the volatility, or to be specific, reduce the return change that is influenced by idiosyncratic risk by using the negative correlation asset [5]. In addition, decrease the correlation of assets that are in the portfolio in order to realize diversification [6]. Idiosyncratic risk is the risk that is specific to a particular asset, rather than the risk of the entire portfolio. This risk is also known as unsystematic risk [7]. This can be best evidenced by the fact that happened in the energy sector. Especially, the risk for the oil company. The oil pipeline may be damaged, so the company needs to repair it, which leads to an increase in the company's costs. Moreover, this causes a decrease in the shareholders' potential benefits, further driving down the company's stock price [8]. Overall, this tactic is to gain a more stable rate of return. Because the negative correlation asset can offset one loss from another asset. Negatively correlated assets mean two assets tend to move in opposite directions, it is simply one stock loss and one stock gain during the same period. Thus, those two stocks can be hedging the risk. Unfortunately, this also means the potential return will decrease.

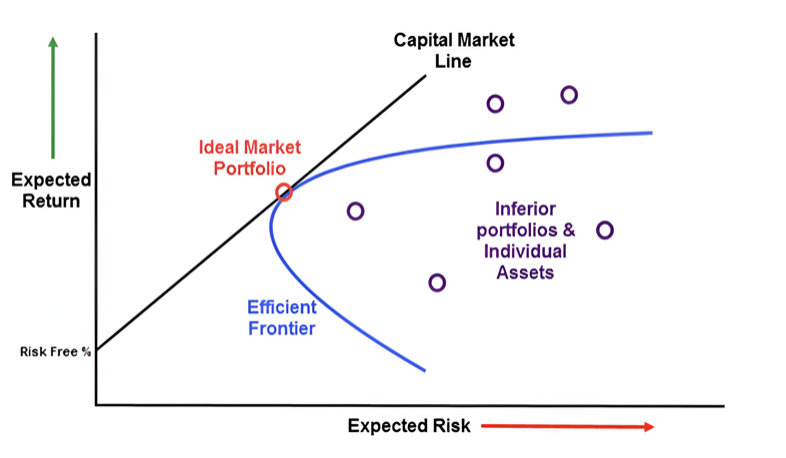

On top of that, portfolio theory can represent graphically. Using the graph to find the optimal portfolio, which depends on the investor’s tolerance for the level of risk. The main objective of this theory is to have an optimal portfolio also known as the efficient portfolio. The optimal portfolio is a collection of assets that can reach the investor’s financial goal. This consists of the risk-free asset and optimal risky asset portfolio. The Risk-free asset is an investment that can guarantee no financial loss during a period [9]. However, this is an assumption. In real life, every investment will have risk. The optimal risky portfolio is found at the point where the capital allocation line (CAL) is tangent to the efficient frontier. This is schematically shown in Fig. 1.

Fig. 1. Optimal portfolio formation [10]

From this graph, the CAL is the same as the capital market line and the optimal portfolio is the same as the ideal market portfolio. The vertical axis is the expected return. The horizontal axis is the expected risk or standard deviation of returns. The capital market line is a line that shows the risk-and-reward circumstance of assets. It is used to find the optimal portfolio. In addition, the efficient frontier consists of all optimal portfolios which have the highest return at a different level of risk. But the portfolios that the underneath part of the efficient frontier, the investor will not choose due to it being inefficient that can’t supply the highest return at this level of risk.

2.2 Practical example

The Yale Endowment is a perfect example of diversification in action. David F. Swensen, the investment director of Yale University in the mid-1980s, has publicly stated that the excess returns of the Yale Endowment fund mainly come from diversified asset allocation [11]. Based on the investment principle of "Don't put all your eggs in one basket", it can be concluded that assets directly affect the return rate of the entire portfolio. The use of negative correlation assets for multiple assets minimizes losses and does not affect the rate of return. The data displayed that in the 10 years ending June 30, 2021, Yale’s Endowment returned 12.4% a year. And the total value increased from $19.4 billion to $42.3 billion, adding $12.1 billion to the school's operating budget. This achievement is not only better than the average annual return of other university funds but also at a good rank among the global institutional investors [12].

In addition, there is another classic example that happened in Costa Rica. This country has traditionally relied on coffee and bananas, which together account for 90% of its export sales. Additionally, the output of these two commodities is not guaranteed and may decrease due to some unavoidable natural disasters. But the country's government later used a diversified approach to reduce much of the risk and protect Costa Rica's economic development. Now the export market of this country has increased a lot, such as medical equipment, fruit, and so on [13].

3 Limitation

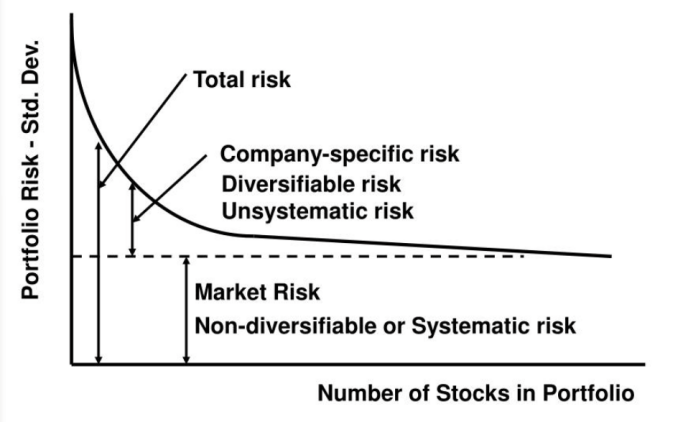

There is value in this research, but nonetheless recognized limitations. Firstly, the portfolio allocation strategy is diversification which can only decrease the idiosyncratic risk that is also known as an unsystematic risk rather than the market risk [14]. The components of risk are clearly shown in Fig. 2. The total risk is equal to the sum of unsystematic risk and systematic risk.

Fig. 2. The components of risk [15]

The market risk is a risk for the entire market which can’t eliminate due to unpredictable events happening. The market risk is also known as the systematic risk. For instance, the war and economic sanctions [16]. Nevertheless, the idiosyncratic risk is a small part of the market. Also, this risk will not affect the entire market, it only affects a specific asset, such as a corporation’s stock. For example, In 2018, the Lending Club Corporation was accused of fraud the borrowers the number of fees. Also, it's going to be deducted directly before the borrower agrees which caused the company's share price to drop rapidly by 15 percent [7].

Secondly, the expected return was calculated by the historical data [14]. This will cause uncertainty about the return. In addition, this will also affect the data that shows on the Sharpe ratio. This ratio is to the risk-adjust return. This will affect the investors’ decision when choosing the optimal portfolio. What’s more, the modern portfolio theory(MPT) will not conclude the extra costs. For example, the taxes. This will affect the final decision too.

Thirdly, this theory is only suiting for the investor who is concerned with the variance rather than downside risk when accessing the portfolios [14]. The variance can be defined as a method for calculating the volatility of return. The downside risk means the financial loss for investors, maybe this loss is permanent or not.

On top of that, this theory assumes all investors are risk-averse and rational [14]. However, in real life, investors can’t be totally rational. Maybe their emotion changed when they chose the portfolios. For instance, many investors have irrational behavior during Covid-19. People made a mistake for muddle up the Zoom Technologies and Zoom Video Communications. This caused the Zoom Technologies’ stock to increase for a while. Also, this happen in 2019 when Zoom Video Communications have its own IPO too [17].

4 Comparison with other models

4.1 Comparison with Post-modern portfolio theory(PMPT) and Goal-based investing(GBI)

Following table summarizes the difference and same point by those two distinct theory.

Table 1. The same and difference for the MPT and PMPT

Same | Difference | |

/ | Modern portfolio theory, MPT | Post-modern portfolio theory, PMPT [18] |

Both of them emphasize the crucial status of diversification, and use this strategy to achieve portfolio optimization. | Use the variance when accesses the efficient portfolio. | Use the return’s downside risk when accessing the efficient portfolio The downside risk is calculated by the downside deviation which is the square root of the target semivariance [19]. |

Use the standard deviation of return to measure the risk. | Use the standard deviation of negative returns to measure the risk. | |

Both theories show how to value risky assets. Additionally, both of their results’ are more higher more better. The reason is that return will be more higher at the different levels of risk. | Measure risk-adjusted returns by using the Sharpe ratio \( Sharpe Ratio=\frac{Return− Risk Free Return}{Standard Deviation} \) \( Sharpe Ratio=\frac{{R_{p}}−{R_{f}}}{{σ_{p}}} \) | Measure risk-adjusted returns by using the Sortino ratio. Also the Sortino ratio is a variance of the Sharpe ratio. \( Sortino Ratio=\frac{Average Realized Return−Expected Rate of Return}{Downside Risk Deviation} \) \( S=\frac{R−T}{DR} \) |

The differences in risk: This theory assumes the symmetrical risk. | The differences in risk: This theory assumes the asymmetrical risk. The asymmetrical risk is the potential gains and losses on an investment that are out of balance. This risk can be positive or negative. The positive is that the investor will only lose a small amount of money than the potential reward. By contrast, if it is negative, the investor could lose more money or assets than the potential positive return [20]. | |

4.2 Methods to deduce limitation for MPT

Previous studies of Modern portfolio theory have not dealt with those limitations.

4.2.1 Using GBI

Goal-based investing (GBI) is a relatively new approach to wealth management that aims to achieve specific life goals by using investment. In particular, investors are not focused on the highest return for their portfolio, but the achievement of their life goals. As an illustration, fund investments’ goal is the preparation of their children’s education fees [21]. Use goal-based investing to avoid client worry and irrational behavior due to short-term volatility in riskier portfolios. This focuses on achieving long-term goals, and short-term fluctuations do not affect the goals [22].

This method can reduce the part of irrational behavior caused by the fluctuation of the market. Because this theory wants to achieve the investors’ life goals rather than the clients’ risk tolerance. For instance, investors try to use this method to gain retirement fees. Depending on different situations, the investor will choose a different type of investment strategy. More conservative or aggressive [23].

4.2.2 Using PMPT

The PMPT is a portfolio optimization methodology that is improved based on MPT. This theory is created by two software designers who called Brian M. Rom and Kathleen Ferguson in 1991 [23]. Two years later, Rom and Ferguson improved and published the PMPT in an article in the Journal of Performance Management [18].

The third limitation which the MPT only suits the investor who is concerned about the variance rather than downside risk when accessing the portfolios can be solved by using the PMPT. Because the PMPT is suited for the investor who is worried about the downside risk [18].

4.2.3 Unchanged

There are two drawbacks that can’t be eliminated. One of them is the market risk which can’t be eliminated. Because MPT is a theory that is not completely real. And the market risk can’t eliminate. For example, war and recession will cause market risk. In addition, the final decision will encounter some problem that is unavoidable due to ignoring the potential cost.

5 Insights into different types of investors behave

For risk-averse more suitable for the MPT. The risk-averse is the people who don’t like risk. If they have two types of portfolios that have the same expected return but different risks, they will prefer the one have a lower risk. This theory is very useful, it can reduce volatility due to diversification. Although there are some limitations, there are some of them that can use the PMPT or GBI to improve.

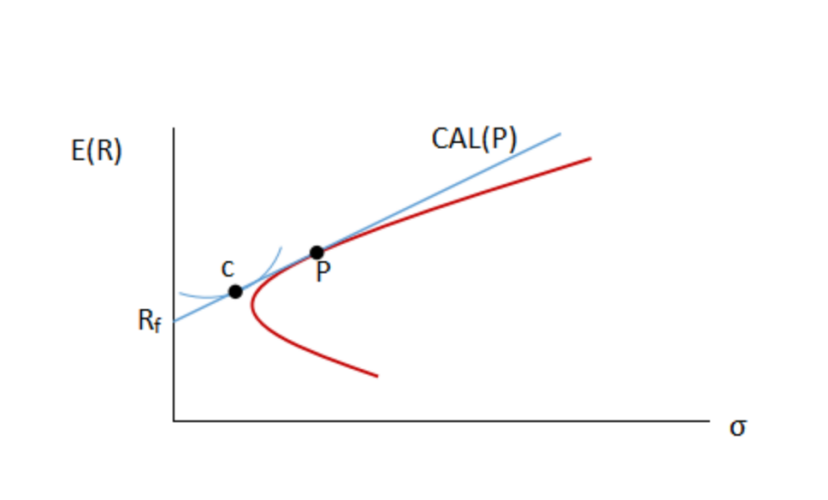

Also, this theory can help the investor to match the suitable portfolio to their acceptable level of risk in order to gain the maximum return. Overall, it depends on investors’ desires and their attitudes when they chose the portfolio. What’s more, there has a second curve that can help the investor to find the optimal investor portfolio. This curve is called the indifference curve. The indifference cure is discovered by Francis Isidro Edgeworth, who is an Irish-born British economist. This curve is also known as the ISO-utility curve [24]. And then the investor can make a decision about choosing which point. As seen in Figs.3. The blue curve is the indifference curve. The red curve is an efficient frontier. Two points are both on the capital allocation line (CAL). The vertical and horizontal axes are the same as the figure one which is the expected return and expected risk.

Fig. 3. The indifference curve and the efficient frontier intersect the capital allocation line [25]

If investor what to find the optimal portfolio, it depends on their personal risk preference. If investors don’t like risk, they will choose point C. But this curve has considerable criticism which curve is an assumption. Investors’ preferences may change at two different times. This curve can’t give any support as a consequence. The indifference curve is a curve that shows a series of combinations that make consumers equally satisfied. Moreover, this is composed of any given portfolio according to investors' preference for the expected rate of return and risk [26].

6 Conclusion and suggestion

In a nutshell, the most significant observation of this study is the usefulness of the portfolio theory which can supply some help when different investors chose the optimal portfolio. This research has contributed to the research of portfolio theory and some related methods. Using the other methods to improve some part of the modern portfolio theory’s limitation. Such as, using goal-based investing to reduce the investors’ irrational behavior due to the market fluctuation. What’s more, use post-modern portfolio theory to explore a different portfolio for the new type of investors flexibly. Those new types of investors care about the downside risk. Can bring other researchers new ideas about how to find or innovate a theory to help more different types of investors to complete the best and most favorable investment portfolio selection. This research only compares two approaches to gain insights into different investors’ behavior. One aspect that could be done in future research is the second limitation which is using historical data to calculate the expected data. In addition, both PMPT and MPT do not conclude the extra cost when they calculate the risk-adjusted returns. If future research could find a way to fill the gaps, then the investors’ decisions can be accurate when they chose the optimal portfolio. Some risks can be avoided too.

References

[1]. The Investopedia Team, https://www.investopedia.com/terms/m/modernportfoliotheory.asp, last accessed 2021/09/10.

[2]. Spaulding, W. C. (n.d.). https://thismatter.com/money/investments/modern-portfolio-theory.htm

[3]. IT world network, https://news.hnce.org/vr/202103/104552.html?ivk_sa=1024320u, last accessed 2021/03/11.

[4]. Nath, R., https://www.financialexpress.com/market/cafeinvest/how-diversification-can-help-investors manage-risk-and-reduce-volatility/2278454/#: ~: text=In%20simpler%20terms%2C%20diversification%20is%20the%20act%20of,because%20all%20assets%20be%ifferentl20over%20differently%20tenures,, last accessed 2021/06/26.

[5]. Corporate Finance Institute, https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/modern-portfolio-theory-mpt/#:~: text=The%20Modern%20Portfolio%20Theory%20focuses%20on%20the%, 0relationship,prices%20and%20airline%20stock%20prices%20are%20negatively%20correlated. Last accessed 2022/02/04.

[6]. Sean Ross, https://www.investopedia.com/ask/answers/030515/how-correlation-used-modern-portfolio-theory.asp, last accessed 2022/05/20.

[7]. Corporate Finance Institute, https://corporatefinanceinstitute.com/resources/knowledge/other/idiosyncratic-risk/#:~: text=Idiosyncratic%20risk%20is%20the%20risk%20that%20i, %20particular,affects%20all%20investments%20within%20a%20given%20asset%20class. Last accessed 2020/09/13.

[8]. Chen, J., https://www.investopedia.com/terms/i/idiosyncraticrisk.asp, last accessed 2022/05/12.

[9]. Cockerham, R., https://finance.zacks.com/portfolio-diversification-theory-6684.html, last accessed 2019/02/20.

[10]. Sohu, https://www.sohu.com/a/327582518_120055029, last accessed 2019/07/17.

[11]. New wealth known clubs, https://www.sohu.com/a/311167156_99971003, last accessed 2019/04/30.

[12]. Yale News, https://news.yale.edu/2021/10/14/yale-endowment-earns-402-investment-return-fiscal-2021, last accessed 2021/10/22.

[13]. Go4WorldBusiness, http://blog.go4worldbusiness.com/2017/10/16/how-to-minimize-risk-through-diversification/, last accessed 2021/09/16.

[14]. Adams,J., https//www.realized1031.com/blog/what-are-the-benefits-cons-and-limitations-of-modern-portfolio-theory, last accessed 2021/10/28.

[15]. Perrin,M., https://www.slideserve.com/mirielle/portfolio-theory-capital-market-theory-capital-asset-pricing-model, last accessed 2012/05/08.

[16]. Nordqvist, C.https://marketbusinessnews.com/financial-glossary/market-risk/, last accessed 2019/02/24.

[17]. Gunderson, G.Sttps://www.forbes.com/sites/garrettgunderson/2020/09/01/how-the-coronavirus-has-exposed-three-flawed-assumptions-of-modern-portfolio-theory/?sh=46dda83ef2b8, last accessed 2020/08/14.

[18]. Chen, J., https://www.investopedia.com/terms/p/pmpt.asp, last accessed 2022/05/30.

[19]. Gordon, J. https://thebusinessprofessor.com/en_US/investments-trading-financial-markets/post-modern-portfolio-theory-definition, last accessed 2022/04/17.

[20]. Cloudflare, https://asymmetricalrisk.com, last accessed 2020/09/30.

[21]. Chen, J., https://www.investopedia.com/terms/g/goalbased-investing.asp, last accessed 2020/06/28.

[22]. Demarco, J., https://www.thebalance.com/what-is-goal-based-investing-5202804, last accessed 2021/09/23.

[23]. Brian M. Rom, Kathleen W. Ferguson: "Post-Modern Portfolio Theory Comes of Age." International Actuarial Association (2021).

[24]. Wallstreetmojo Editorial Team, https://www.wallstreetmojo.com/indifference-curve/, last accessed 2022/05/23.

[25]. CFA, https://zhuanlan.zhihu.com/p/194172235, last accessed 2020/08/22.

[26]. Banton, C. https://www.investopedia.com/terms/i/indifferencecurve.asp#:%: E:text=1%20An%20indifference%20curve%20shows%20a%20, ombination%20of,origin%2C%20and%20no%20two%20indifference%20curves%20ever%20intersect, last accessed 2022/07/05.

Cite this article

Liu,Y. (2023). Modern Portfolio Theory: analysis and implication. Advances in Economics, Management and Political Sciences,4,158-164.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 6th International Conference on Economic Management and Green Development (ICEMGD 2022), Part Ⅱ

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. The Investopedia Team, https://www.investopedia.com/terms/m/modernportfoliotheory.asp, last accessed 2021/09/10.

[2]. Spaulding, W. C. (n.d.). https://thismatter.com/money/investments/modern-portfolio-theory.htm

[3]. IT world network, https://news.hnce.org/vr/202103/104552.html?ivk_sa=1024320u, last accessed 2021/03/11.

[4]. Nath, R., https://www.financialexpress.com/market/cafeinvest/how-diversification-can-help-investors manage-risk-and-reduce-volatility/2278454/#: ~: text=In%20simpler%20terms%2C%20diversification%20is%20the%20act%20of,because%20all%20assets%20be%ifferentl20over%20differently%20tenures,, last accessed 2021/06/26.

[5]. Corporate Finance Institute, https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/modern-portfolio-theory-mpt/#:~: text=The%20Modern%20Portfolio%20Theory%20focuses%20on%20the%, 0relationship,prices%20and%20airline%20stock%20prices%20are%20negatively%20correlated. Last accessed 2022/02/04.

[6]. Sean Ross, https://www.investopedia.com/ask/answers/030515/how-correlation-used-modern-portfolio-theory.asp, last accessed 2022/05/20.

[7]. Corporate Finance Institute, https://corporatefinanceinstitute.com/resources/knowledge/other/idiosyncratic-risk/#:~: text=Idiosyncratic%20risk%20is%20the%20risk%20that%20i, %20particular,affects%20all%20investments%20within%20a%20given%20asset%20class. Last accessed 2020/09/13.

[8]. Chen, J., https://www.investopedia.com/terms/i/idiosyncraticrisk.asp, last accessed 2022/05/12.

[9]. Cockerham, R., https://finance.zacks.com/portfolio-diversification-theory-6684.html, last accessed 2019/02/20.

[10]. Sohu, https://www.sohu.com/a/327582518_120055029, last accessed 2019/07/17.

[11]. New wealth known clubs, https://www.sohu.com/a/311167156_99971003, last accessed 2019/04/30.

[12]. Yale News, https://news.yale.edu/2021/10/14/yale-endowment-earns-402-investment-return-fiscal-2021, last accessed 2021/10/22.

[13]. Go4WorldBusiness, http://blog.go4worldbusiness.com/2017/10/16/how-to-minimize-risk-through-diversification/, last accessed 2021/09/16.

[14]. Adams,J., https//www.realized1031.com/blog/what-are-the-benefits-cons-and-limitations-of-modern-portfolio-theory, last accessed 2021/10/28.

[15]. Perrin,M., https://www.slideserve.com/mirielle/portfolio-theory-capital-market-theory-capital-asset-pricing-model, last accessed 2012/05/08.

[16]. Nordqvist, C.https://marketbusinessnews.com/financial-glossary/market-risk/, last accessed 2019/02/24.

[17]. Gunderson, G.Sttps://www.forbes.com/sites/garrettgunderson/2020/09/01/how-the-coronavirus-has-exposed-three-flawed-assumptions-of-modern-portfolio-theory/?sh=46dda83ef2b8, last accessed 2020/08/14.

[18]. Chen, J., https://www.investopedia.com/terms/p/pmpt.asp, last accessed 2022/05/30.

[19]. Gordon, J. https://thebusinessprofessor.com/en_US/investments-trading-financial-markets/post-modern-portfolio-theory-definition, last accessed 2022/04/17.

[20]. Cloudflare, https://asymmetricalrisk.com, last accessed 2020/09/30.

[21]. Chen, J., https://www.investopedia.com/terms/g/goalbased-investing.asp, last accessed 2020/06/28.

[22]. Demarco, J., https://www.thebalance.com/what-is-goal-based-investing-5202804, last accessed 2021/09/23.

[23]. Brian M. Rom, Kathleen W. Ferguson: "Post-Modern Portfolio Theory Comes of Age." International Actuarial Association (2021).

[24]. Wallstreetmojo Editorial Team, https://www.wallstreetmojo.com/indifference-curve/, last accessed 2022/05/23.

[25]. CFA, https://zhuanlan.zhihu.com/p/194172235, last accessed 2020/08/22.

[26]. Banton, C. https://www.investopedia.com/terms/i/indifferencecurve.asp#:%: E:text=1%20An%20indifference%20curve%20shows%20a%20, ombination%20of,origin%2C%20and%20no%20two%20indifference%20curves%20ever%20intersect, last accessed 2022/07/05.