1. Introduction

Three years have passed since the outbreak of COVID-19. Looking back at the beginning of COVID-19 in 2020, as the most famous Black Swan event in the past five years, COVID-19 had an unprecedented impact on the development of the United States and the world economy. In March 2020, the US stock market experienced four circuit breakers in 10 days, and the economies of various countries reached a standstill in the first half of 2020. To repair the impact of COVID-19 on the economy, we can see that governments around the world have also adopted unprecedented policies to control COVID-19. Whether it is fiscal policy or monetary policy, the scale and speed of formulation and implementation are rare in history. For example, on March 11th, after the Bank of England announced a 50 basis point cut in its benchmark interest rate to 0.25%, the British government announced a £30 billion fiscal stimulus plan on the same day. The Federal Reserve has lowered its benchmark interest rate by 100 basis points to 0%–0.25% since March 15th. On March 23rd, the Federal Reserve launched unlimited quantitative easing (QE) [1].

Therefore, this research introduces QE and transmission channels through literature research, and focuses on analyzing the impact of the portfolio rebalancing channel in QE on the US economy and potential problems. The article will also conclude by analyzing the role of the portfolio rebalancing channel and possible future measures. This paper hopes to provide some ideas and insights for solving future economic problems.

2. Literature Review

2.1. QE Transmission Channels

Analyzing policy effectiveness from the perspective of QE transmission channels is one of the more mainstream research angles. Occhino used the dynamic general equilibrium model to evaluate the effectiveness of the three channels of QE, namely the liquidity premium, volatility premium, and credit risk premium. Through the model, the liquidity premium is the most important in terms of quantity. Due to the current larger bank reserves and weaker liquidity premium channels, the effectiveness of QE is also poor [1].

2.2. Asset Purchase Programs

Rashid et al. mainly discussed the achievements of central banks in asset purchase programs (APPs), as well as the risks and side effects of asset purchase programs [2]. While APPs provide huge liquidity to the market by purchasing bonds, they also lead to a significant increase in asset prices, leading to a disconnect between the financial market and the real economy and thereby increasing uncertainty in the future. At the same time, it will also lead to an increase in the wealth gap, as wealthy households hold a higher proportion of financial assets. Finally, it is concluded that developed countries cannot maintain fiscal expenditure by maintaining interest rates close to the lower bound of zero. It is necessary to find other financing channels to promote economic development, such as through macroprudential measures to solve the negative effects of APPs and better supervise the market. Others focus on the corporate bond purchase programs. Nozawa and Qiu focused on the reaction of the U.S. corporate bond market to the Fed’s corporate bond purchase program [3]. Meanwhile, they studied the channels through which QE affects corporate credit spreads, especially through variance decomposition, and concluded that the reduction of default risk in the short term explains the change in the structure of credit spreads after the policy announcement. On the other hand, the change in corporate bond liquidity does not seem to explain the credit spread reaction. Because COVID-19 first affected the prospects of the real economy, and then affected the financial market.

2.3. Exchange Rate

Aloui found that the response of the EUR/USD exchange rate to monetary policy shocks changes over time through the TVP-BVAR-SV model [4]. However, during COVID-19, the QE policy did not have the expected impact on the exchange rate. In addition, the response of commercial credit to QE policies is relatively low. Controlling investor-oriented monetary policies through financial markets and exchange rates will lose effectiveness. Therefore, in the face of unpredictable investor behavior and future uncertainty, policymakers should rethink how to formulate economic policies.

2.4. Insights for the COVID-19 Pandemic and The QE Policy

Clarida et al. reviewed monetary policies such as interest rate policies, open market operations, and asset purchases [5]. It is the decisive and rapid conventional policies of the Federal Reserve, as well as a series of innovative measures on providing liquidity to households and businesses, combined with fiscal policy, that have provided key support for the economy in 2020 and will continue to promote a strong economic recovery in 2021. Thorbecke analyzed the stock returns of 125 industries to study the impact of COVID-19 on them [6]. It divided the factors that affect returns into specific factors and macroeconomic factors. Among them, the recovery of the aviation and tourism industries requires the end of the COVID-19 pandemic, as the pandemic is a key factor driving their downturn. However, other sectors require more macroeconomic recovery to stimulate sector recovery, such as the production equipment, machinery, and electronic and electrical equipment industries.

3. The Impact of Portfolio Rebalancing Channel on U.S. Economy

The portfolio rebalancing channel refers to the fact that investors will adjust the proportion of different assets in the portfolio according to the market situation to achieve returns that meet their goals. Ugai and Tsuyoshi et al. believe that the central bank can change the balance sheet structure by purposefully providing large amounts of funds to financial institutions or markets, or by increasing long-term securities purchases [7]. It can adjust the Risk premium of assets in the market and its corresponding prices to change the asset allocation structure of the private sector to effectively stimulate enterprise production and consumer consumption.

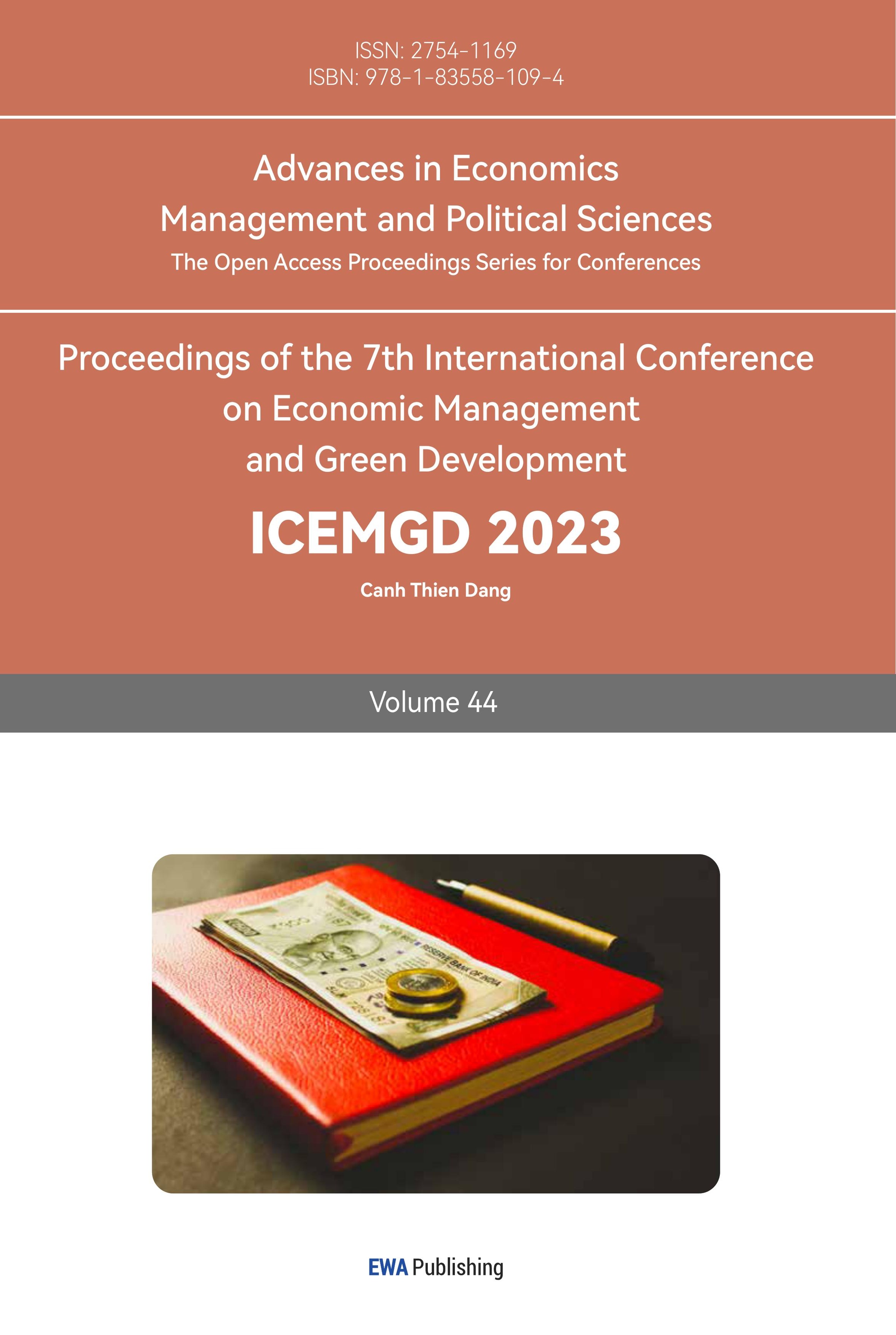

In Figure 1, when the Federal Reserve implemented QE policy in March 2020, the yield of ten-year Treasury bonds approached 0.5%. At this time, investors cannot profit from buying Treasury bonds. Therefore, to obtain higher returns, they will choose to sell government bonds and purchase corporate bonds and stocks with good credit ratings and relatively high yields. At this point, the supply of corporate bonds and stocks is less than the demand, prices rise, and yields decrease. After the company obtains funds, it will expand its business to hire more employees, thereby promoting economic recovery.

Figure 1: 10-year government bond yields.

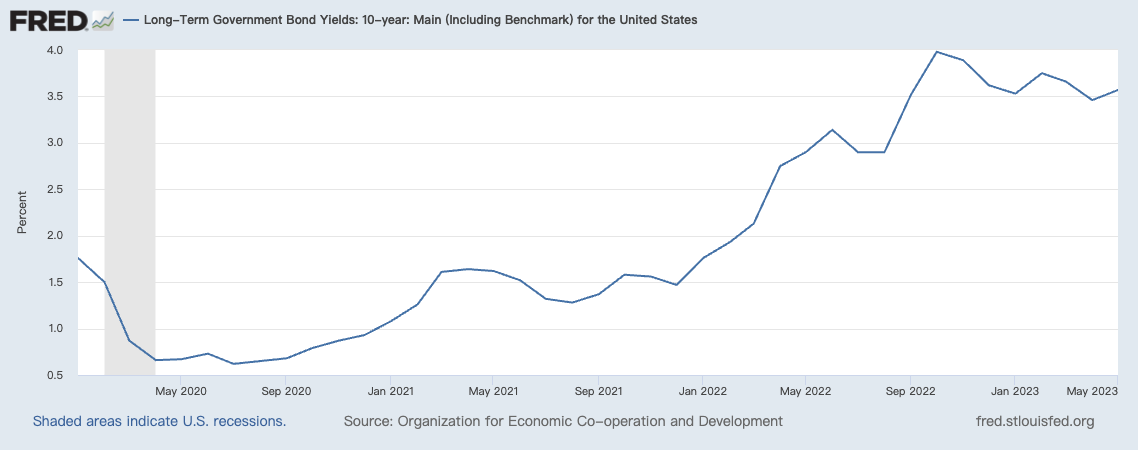

When investors take action to begin rebalancing their investment portfolios, GDP will react. From Figure 2, after the implementation of QE, although the U.S. GDP fell by about 8.8% from the first quarter to the second quarter, the GDP in the third quarter rose by 8.7%, basically the same as that in the first quarter. The portfolio rebalancing theory helped the economic recovery to some extent.

Figure 2: U.S GDP.

4. Issues in the Portfolio Rebalancing Channel

Although portfolio rebalancing can lead to economic recovery, there are also many issues involved. Investors are one of the most important components of the market. In economics, there is a Rational Choice theory, which states that economic entities pursue the maximization of their own interests and the minimization of losses. Faced with the highly uncertain Black Swan event of COVID-19, economic entities are no longer able to objectively judge the economic trend. Even if the Federal Reserve implements QE, it hopes to encourage investors to consume and invest in the capital market through low interest rates. But after experiencing four circuit breakers in the US stock market in March 2020 and COVID-19 worsening, investors cannot easily make judgments about the uncertain future situation of the market. In the short term, the market situation is uncertain. Individual investors are more inclined to hold cash because having it in their hands gives them a sense of security, and they are unwilling to invest their money in any risky assets. So, rebalancing the investment portfolio through channels may not be effective.

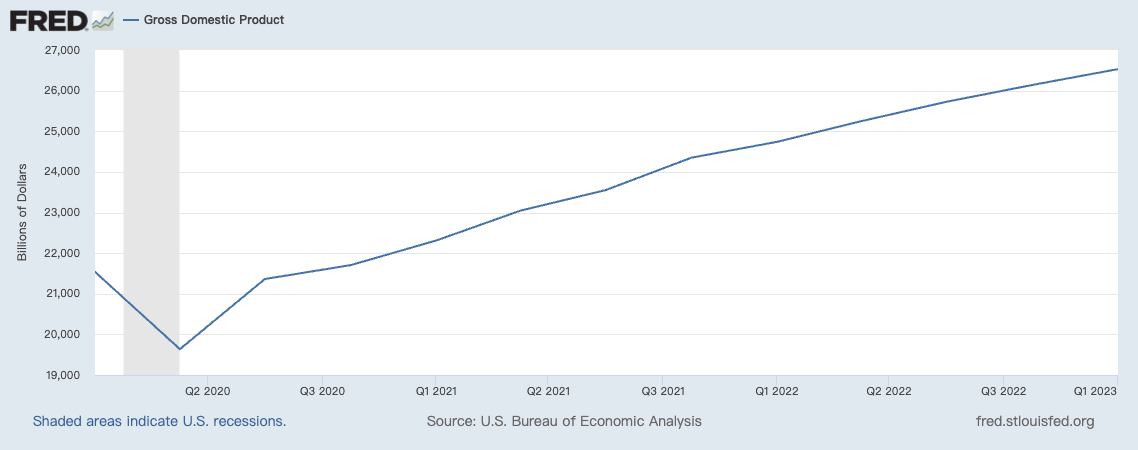

So, Figure 3 shows that the CPI of the United States showed a downward trend from March to May 2020. Meanwhile, the personal savings rate in the United States has rapidly increased from 9.3% in February 2020 to 33.8% in April, indicating that individuals lack confidence in the economic situation and are more willing to save to give themselves a sense of security compared to consumption and investment (Figure 4).

Figure 3: Consumer price index for all urban consumers in US.

Figure 4: Personal saving rate in US.

Investors are unwilling to invest in the capital market from the perspective of safeguarding their own interests. On the other hand, there are also some investors who are risk seekers and are willing to invest to obtain high returns. But in fact, the amount of corporate bonds and stocks that investors can purchase is limited, so the companies that benefit are also limited. Companies that can issue bonds and stocks are inevitably large companies, while small companies do not have sufficient scale to participate in the capital market and can only rely on bank loans to sustain their operations. At this time, the only channels that can be reached through portfolio rebalancing are large companies, which continue to expand production and have an increasing market share. However, due to the impact of the epidemic, small companies still face the risk of bankruptcy because they do not have enough working capital to maintain operations and hire labor.

5. Conclusions

Although QE policy can, to some extent, promote economic recovery, it is not a foolproof solution. The channel for portfolio rebalancing is theoretically feasible, but the economy and society face too much uncertainty. After the Russo-Ukrainian War, COVID-19, and the double killing of stocks and bonds, investors cannot predict the economic trend and even switch to consumption and investment because of low interest rates. Faced with the high inflation rate caused by the previous unrestricted QE policy and active fiscal policy, the Federal Reserve has raised interest rates 10 times as of June 2023, totaling 500 basis points. While solving the inflation problem, it has also caused the banking industry and physical enterprises to be overwhelmed. So, the grasp of policy implementation and the balance of economic development are still themes that the government should continue to explore.

This article is only based on the discussion of the specific performance of the QE policy in the United States. It does not involve the impact of globalization on other countries or other economic forms. The impact of the quantitative easing policy on the economy and finance will be further tracked and combined with more information for analysis and discussion.

References

[1]. Occhino, F. (2020). “Quantitative easing and direct lending in response to the COVID-19 crisis.” Federal Reserve Bank of Cleveland Working Paper, No. 20-29 (October).

[2]. Rashid, H., Pitterle, I., & Huang, Z. (2022). The monetary policy response to Covid-19: the role of asset purchase programmes. United Nations Department of Economic and Social Affairs.

[3]. Nozawa, Y., & Qiu, Y. (2021). Corporate bond market reactions to quantitative easing during the COVID-19 pandemic. Journal of Banking & Finance, 133, 106153.

[4]. Aloui, D. (2021). The COVID-19 pandemic haunting the transmission of the quantitative easing to the exchange rate. Finance Research Letters, 43, 102025.

[5]. Clarida, R., Duygan-Bump, B., & Scotti, C. (2021). The COVID-19 crisis and the Federal Reserve's policy response. Board of Governors of the Federal Reserve System.

[6]. Thorbecke, W. (2020). The impact of the COVID-19 pandemic on the US economy: Evidence from the stock market. Journal of Risk and Financial Management, 13(10), 233.

[7]. Ugai.H (2007)” Effects of the Quantitative Easing Policy: A Survey of Empirical Analyses. “Monetary and Economic Studies, 2007,(1),1-48.

Cite this article

Yan,Z. (2023). The Impact and Issues of Portfolio Rebalancing Channel in Quantitative Easing During COVID-19. Advances in Economics, Management and Political Sciences,44,227-231.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Occhino, F. (2020). “Quantitative easing and direct lending in response to the COVID-19 crisis.” Federal Reserve Bank of Cleveland Working Paper, No. 20-29 (October).

[2]. Rashid, H., Pitterle, I., & Huang, Z. (2022). The monetary policy response to Covid-19: the role of asset purchase programmes. United Nations Department of Economic and Social Affairs.

[3]. Nozawa, Y., & Qiu, Y. (2021). Corporate bond market reactions to quantitative easing during the COVID-19 pandemic. Journal of Banking & Finance, 133, 106153.

[4]. Aloui, D. (2021). The COVID-19 pandemic haunting the transmission of the quantitative easing to the exchange rate. Finance Research Letters, 43, 102025.

[5]. Clarida, R., Duygan-Bump, B., & Scotti, C. (2021). The COVID-19 crisis and the Federal Reserve's policy response. Board of Governors of the Federal Reserve System.

[6]. Thorbecke, W. (2020). The impact of the COVID-19 pandemic on the US economy: Evidence from the stock market. Journal of Risk and Financial Management, 13(10), 233.

[7]. Ugai.H (2007)” Effects of the Quantitative Easing Policy: A Survey of Empirical Analyses. “Monetary and Economic Studies, 2007,(1),1-48.