Evaluation of the Business Models of Uber Eats and Ele.me, and the Reasons for their Differences

Richard Wu*

American International School of Guangzhou, Guangzhou, 510063, China

*Corresponding author: Email: 11wur@aisgz.org

ABSTRACT. Amidst the thriving food delivery platforms, stand two of the largest food delivery corporations: Uber Eats and Ele.me, in which are two of the two leading food delivery industries in the U.S and China. Due to the geographical and societal differences between the two countries, their business models deviate from each other. Uber Eats’ core value is to provide quality food and service, while Ele.me’s core value is to provide cheap and valuable discounts for its customers. Uber Eats’ targets the food deliverers while Ele.me does not. The reasons for these distinctions are mainly because of the differences between the customers of the U.S market and China’s market, and the infrastructural differences as well. The business model of the companies are successful mainly when accompanied by the right market and right conditions, however, they may not be as successful when under divergent circumstances. This paper shall investigate the differences between the U.S and China to account for their unalike business models.

KEYWORDS: Business Model; Food Delivery; Market Distinctions

1. Introduction

Due to “the growing American middle-class” being “content to stay at home” to “[watch] their new television, and to [make] their food in their own kitchens” [1], restaurant industries began to collapse, urging the need for food deliveries to salvage their business. Becoming a necessity for many corporations, food deliveries, with their current system, were finally established as a result of the disintegration of restaurants and the rapid development in technology. Amongst the flourishing food delivery companies rose two of which are considered the two of the most well-known in our modern society: Uber Eats and Ele.me.

Uber Eats, founded by Travis Kalanick and Garrett Camp, enables its users to order food from local restaurants and allows them to do other tasks including reading through the reviews, ratings, and menu online. Since the original launch in Santa Monica in 2014, Uber Eats immensely expanded from only operating in Santa Monica, California to operating in 45 countries and over 6000 cities.

Ele.me is founded by Mark Zhang and Jack Kang in Shanghai and was also acquired by Alibaba in 2018. The app allows customers to purchase groceries, pharmaceuticals, movie tickets, and a variety of goods and services as well. Although it only operates in China, Ele.me has greatly impacted the lives of people in China, especially during the pandemic, allowing people to safely stay home while still having their necessities.

Being the two most substantial food delivery companies in the U.S and China, Uber Eats and Ele.me each operate under similar yet different business models to accompany the geographical and market distinctions between both enterprises. This article will showcase the business models of the two businesses, accounting for their differences and explaining why one business model is more successful in a specific market than the other.

2. Different Starting Countries: Uber Eats and Ele.me

The vehicles they chose to operate and the areas they chose to begin are largely accounted for by the differences between the U.S and China.

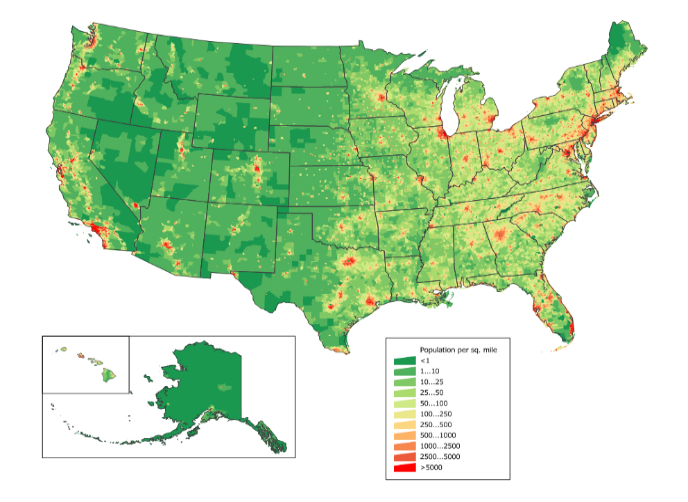

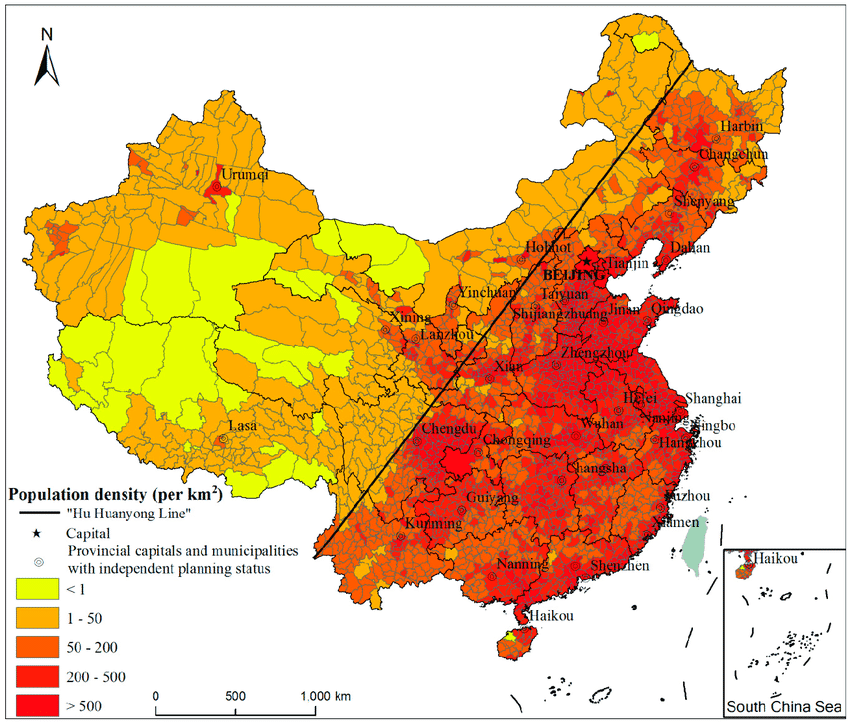

Uber Eats, as a branch of its parent company Uber, began food delivery with its main transportation for deliverers as cars. Eleme, on the other hand, began operating these deliveries with bicycles and motorbikes. The distinction is mainly caused by the variation in the population density between both countries. America’s population is more scattered and evenly distributed throughout the country, while China’s entire population is denser and less disseminated. Although China’s land area is ranked 3rd largest globally, a majority of its citizens reside on the right side of the country due to the harsh and cruel weather conditions of the left that make it inhabitable to many people (See Figure 1). Compared to China, America’s population is better allocated (See Figure 2).

Figure 1 China’s Population Density Map

Figure 2 U.S’s Population Density Map

China’s geographical features led to the creation of more densely populated cities. As a result of that, Ele.me began with motorbikes as they were more convenient to park in the rustling city, reducing the time wasted on finding parking lots. However, Uber Eats began with cars instead. As indicated before, America consists of many suburban areas, and because of that, public transportation isn’t as common, which causes more people to rely on cars to take them around. In China, public transportation is so pervasive that many of its residents do not have a strong necessity for cars. This then leads to the fact that not many people own cars in China due to its expensiveness and because they have a cheaper alternative: public transportation.

Moreover, the areas in which they chose to start are also different. Uber Eats commenced in Santa Monica, a suburban, while Ele.me commenced in Shanghai, a city. Because Uber Eats’ drivers deliver by car, traffic becomes more of an issue than compared to bikes or motorcycles. Uber chose Santa Monica due to its short average commuting time of 26.2 minutes, shorter than the U.S average commuting time of 26.4 minutes. Due to the differences in the vehicles used to deliver, Uber Eats would not be as successful as Eleme in starting in a big city, as the long commuting time would be a major problem and reduce the efficiency in delivering the orders, thus causing customer dissatisfaction. Take New York, for example, the average commuting time is 33.3 minutes, with about 17.9% of its commuters having the time surpass one hour. Also, it is “the longest commute among the states that Coverage.com studied in an analysis using pre-covid data.” [2] Thus, if Uber Eats started in a big city with long commuting times, they could potentially lose a lot of money on the time wasted for delivery as they could lose customers as a result of the slow orders.

3. Target Customers

Uber Eats targets the “Fulfillers” segment, who are career and success-oriented as they “tend to look for new chances and opportunities in business.” [3] These people tend to not have much time to cook, or even learn how to cook, due to the heavyweight they place on their achievements in business. Fulfillers also like to switch between different brands and treat shopping as something that allows them to ease their stress and mood. Furthermore, quality is their top priority when shopping, and they are willing to pay extra to gain better quality goods. One other interesting thing about them is that they use the internet a lot, allowing them to catch on to the latest updates. The unique characteristics of these fulfillers correspond to the goals and values of Uber Eats, making them the main target customer for the company.

Eleme’s target customers, however, are more varied and come from different social age groups. Their main target customers can be classified into 3 categories: high schoolers, working-class, and homebodies. Firstly, there are high schoolers who order delivery because of “surfing the web or video-gaming in their dorms” [4] and also their picky taste towards cafeteria food. Food deliveries can solve these problems due to its wide selection of food and its convenience, as it allows people to take on other tasks while waiting for the food to arrive. For the working-class, Ele.me can solve their problem of not having enough time to cook as most workers tend to waste a lot of their time each day commuting because they tend to consider more about their salaries and future job developments when choosing a job, and less about the distance from the workplace to their house. Lastly, there are homebodies. These people tend not to go out often, meaning that they will have to rely on these food deliveries to satisfy their daily needs. Although this group is smaller than compared to high schoolers and city workers, their characteristics cause them to have a consistent demand for food delivery. These target consumers can also be explicitly shown from the labels (See Figure 3) when choosing the type of address the food is being sent to.

Figure 3 Ele.me’s Address Labels

Adding on to that, there is also one significant difference between the target customers of the two companies. Unlike Eleme, Uber also targets the couriers of these deliveries. To Uber, the couriers are owners of cars that want an additional source of income. These targeted deliverers choose to work part-time, as they can benefit from the extra income and flexible hours. However, the same cannot be said for Eleme where most of their drivers are full-time couriers. Although Eleme does provide the option to work part-time, this is not as common as most of its workers come from rural areas that don’t have job opportunities, thus most of these couriers choose to work full time. This is also evident in another Chinese food delivery platform, Meituan, where “75% of its deliverers come from the countryside, most of whom originate from Henan, Anhui, Sichuan, Jiangsu and Guangdong provinces.” [5]

4. Their Business Models and Core Values

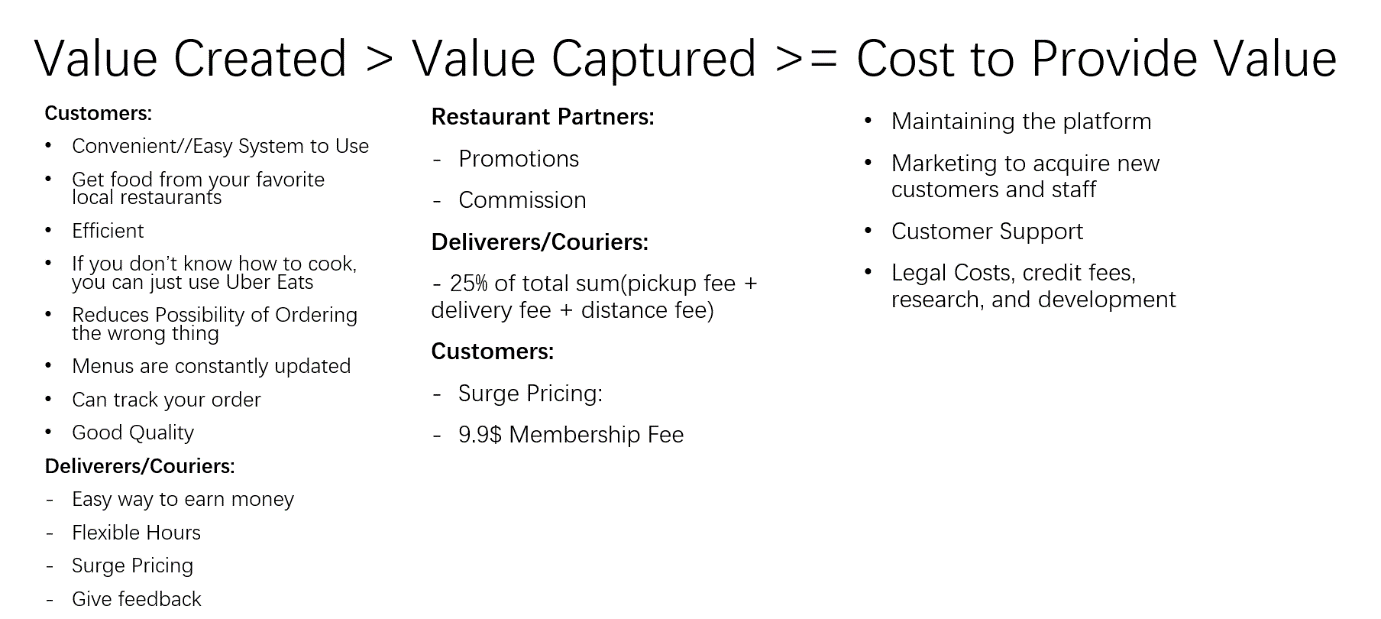

Figure 4 Uber Eats’ Business Model

In the business model for Uber Eats (See Figure 4) the value they create for their consumers can be divided into two segments: customers and deliverers. The important values that make Uber Eats a top choice for the customers is that it is convenient to use, is efficient, allows non-cookers to have food at home without going to restaurants for every meal, and most importantly, people can obtain quality service and food. An additional benefit for customers is that they can file complaints on both the food or the delivery; also, giving feedback online perhaps would also be much easier online than in person. One other additional thing that makes Uber Eats stand out from its competitors is their customer retention so when a “delivery is late, they offer additional coupons to be used next time” [6] And now, because of covid, people can track the names of their deliverers and also their temperatures for safety purposes. For its couriers, Uber Eats provides people with an easy way to earn money, an additional source of income, and flexible hours; on top of that, these drivers are also able to make more when there is heavy demand (surge pricing).

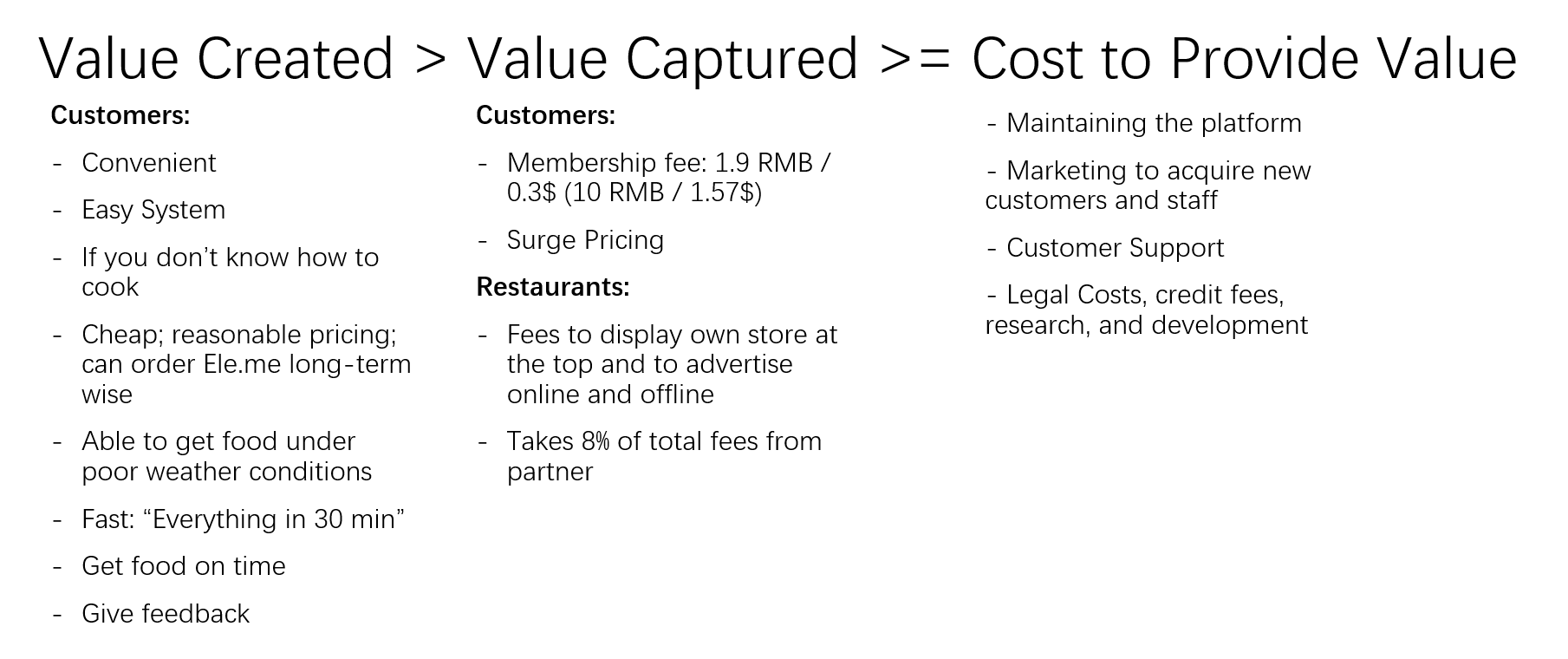

Figure 5 Ele.me’s Business Model

For Eleme’s business model (See Figure 5), this is less apparent, as part-time courier jobs aren’t as common, as mentioned previously. What makes Eleme unique is that Eleme focuses more solely on providing valuable discounts and good pricing for its customers and also delivering the foods faster than others, which is apparent by Eleme’s slogan “Everything 30 min”. Their slogan begun “12 years ago, [when] Eleme” or to be more specific their founder Mark Zhang “set “Everything 30 min” as their main goal and dedicated to using technology to create a local life service network,” [7] Another interesting value that arises from this cheap pricing is that people can rely on Eleme for long-term food delivery due to the good deals that it provides. Adding on to that, people can also have the option to get the food delivery either before or on time with a new option by paying a little extra money under 1 RMB to have the food delivered by the estimated time. If not, Eleme will have to pay customers money depending on the time surpassed the estimated arrival time.

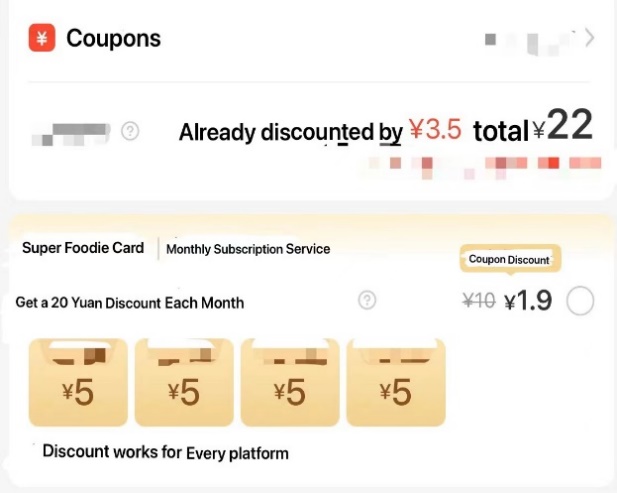

Figure 6 Ele.me’s Checkout Page

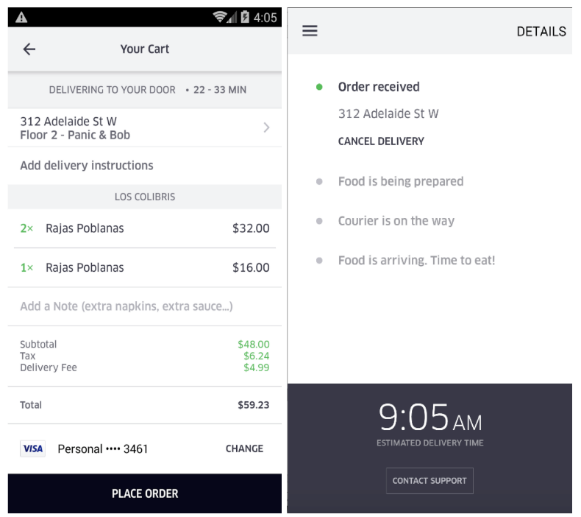

Figure 7 Uber Eats’ Checkout Page

Through the side-by-side comparisons of Eleme’s checkout page (See Figure 6) and Uber Eats’ checkout page (See Figure 7), it is apparent that Ele.me focuses more on providing better discounts for its customers. On Ele.me’s checkout page, not only are there coupons but there is also a membership card, which if bought, enables its users to save 20RMB per month.

The reason why Eleme’s core value is providing better discounts and also helping its users save money, while Uber Eats’ core value is providing better quality food and deliveries, is because of their target customers. Because Uber targets fulfillers, who are success-oriented, quality is their top priority. Whereas for Ele.me, whose target customers include high schoolers and city workers, inexpensiveness is their main goal as a majority of their customers are not super-rich and have to worry about their bills each month. The same can be said for homebodies, who like to stay home. Because of this, food deliveries are a necessity, and cheaper prices and discounts will enable them to order food deliveries long-term wise, than compared to better quality but more costly service.

The value captured, or the value charged by the corporations is split amongst the restaurants, customers, and deliverers. For Uber Eats, the company charges restaurants between 15% to 40% of the commission of each order and promotion fees to get more sales; and also an extra “delivery fee, generally between $2 and $8” [8] From their deliverers, Uber takes 25% of the total sum which includes the pickup fee, delivery fee, and distance fee per mile; however, for exceptions, for example when the order is cheaper than 12$, they will charge an extra 2 dollars. Because the customers and Uber share an indirect relationship as customers pay the money to the restaurant who then transfers a part of it to Uber, the company only directly charges the customers for surge pricing, which leads to an increase in a few extra dollars that the customers have to pay, when the drivers are busy and are unable to take care of all the orders in one small area.

A value that both companies share is surge pricing, which is calculated based on the demand, weather conditions, number of drivers available, etc. The fees that Eleme charges are fees to display their restaurant at the top, 8% of fees from restaurants, and also advertising online and offline, and participating in Eleme hosted events. Eleme also charges their customers a 1.9$ membership fee to “attain” customer loyalty. Overall, both of these companies are similar to each other, except for the lack of the charging of money on deliverers. However, there are exceptions where Eleme does charge its group of deliverers. When these deliverers distribute these deliveries later than the expected time, they could get poor ratings, thus Eleme penalizes them by charging a total of 1 – 20 RMB. Although it may seem trivial, being that this is their only income, deliverers do their best to not get negative ratings.

Last but not least, for the cost to provide value, these companies overall are the same. Both companies have invested in other data analyzing technologies, like the deliverer tracker that was added on during COVID-19 to ensure that the customers are and also that the virus wouldn’t spread any further.

5. Why I believe China is more successful: Societal Differentiations

One reason that allows for Ele.me to be so successful is their efficiency in delivery. Because of China’s high population density, the couriers could deliver multiple orders to the same location, thus increasing the efficiency of their entire system and allowing customers to receive their orders in a short time. And as mentioned previously, most of Eleme’s drivers deliver with motorbikes, which can be quickly parked, hence the deliverers would waste less time finding a parking spot. This benefit would not apply to many of the drivers in America and Uber Eats. America for one is not filled with highly dense cities, and second, most Uber drivers deliver by car.

Another factor that allows Eleme and China’s food delivery service, in general, to thrive is that China invests a lot in route planning that supports restaurant services. China’s investments in building more convenient roads save deliverers time while delivering the goods or services, which further reduces time wasted on Eleme drivers causing the food to be sent at a faster rate. The difference between the two countries’ treatment of infrastructure further illustrates the difference between the segments of their business model, and why one would work in a certain place and why it wouldn’t in another.

Finally, one other component has to do with the countries they reside in. For instance, one reason why Ele.me can earn a lot of revenue is because many restaurants and stores are open either late or 24/7. Accordingly, 9% of all of Ele.me’s orders are midnight snacks, or what Chinese people call “yexiao”, and that’s due to many people and restaurants staying up late in China. The same can be said for many Americans, but not exactly for their restaurants. In an article published by Jinghan Hao on medium.com, she said that “my choices are so scarce that only a few pizza restaurants are still open” [9] midnight in the upper west side of New York, which is also “known as the city that never sleeps.” The contrast thus conveys how China and the U.S are still quite dissimilar, which could explain why China’s food delivery industries are more successful.

6. Conclusion

Conclusively speaking, the business models of the U.S and China aren’t dissimilar for no reason. One model wouldn’t be as successful than the other if it were operated in another country due to the differences in each area such as their customers, infrastructure, and geographical features as well.

Being the two largest food delivery platforms in the modern society, both Uber Eats and Ele.me are growing increasingly ambitious and competitive. Although both take on the job of delivering food to its customers, Uber Eats focuses more on quality, while Ele.me focuses more on the “quantity.”

In the future, Uber Eats plans to enter more countries and expand their business. For Ele.me, though, although they have not specifically planned to expand internationally, they are striving to work towards Uber Eats values and provide more quality service to its customers. Besides that, “they, as a provider of daily services, hope to provide this for over 8 hundred million residents. Being the entire country’s just-in-time distribution network shall be the core strength of [Eleme’s] new retailing distribution system” [10] as stated by Eleme’s CEO Wang Lei in an interview.

References

[1]. The Vintage News (8 Jan. 2019). “Food Delivery: The Epic History of Humanity’s Greatest Convenience.” https://www.thevintagenews.com/2019/01/08/food-delivery/?chrome=1

[2]. The Center Square. (2 Nov. 2020). “Average One-Way Commute Time for New York Residents Reaches 33.3 Minutes”. https://www.thecentersquare.com/new_york/average-one-way-commute-time-for-new-york-residents-reaches-33-3-minutes/article_d37b99d4-18b0-11eb-830b-132ac7bdd8f5.html

[3]. The Social Grabber. (9 Dec. 2020) “Target Markets of Delivery Services, Uber Eats and Door Dash” https://thesocialgrabber.com/target-market-of-delivery-services-uber-eats-and-doordash/

[4]. Zhuanlan zhihu “Eleme’s Product Analysis Report” https://zhuanlan.zhihu.com/p/108591766

[5]. Progressive International (12 Oct. 2020) “Feeding the Chinese City.” https://progressive.international/wire/2020-10-12-feeding-the-chinese-city/en

[6]. Competitive Advantage Analysis (17 Feb. 2018) “Competitive Advantages of Uber Eats” https://competitiveadvantageanalysis.com/competitive-advantages-of-uber-eats/

[7]. Shanghai Haiju Talent Platform (16, Mar.) https://www.sotsw.cn/hot/hotEnterprisePost?company_id=3774

[8]. Forbes (6 Feb. 2019) “Uber’s Secret Gold Mine: How Uber Eats Is Turning Into A Billion-Dollar Business To Rival Grubhub” https://www.forbes.com/sites/bizcarson/2019/02/06/ubers-secret-gold-mine-how-uber-eats-is-turning-into-a-billion-dollar-business-to-rival-grubhub/?sh=549054461fa9

[9]. Hao, Jinghan. (2 Apr. 2019) “Why American on-Demand Delivery Companies Won't Be as Successful as Their Chinese Peers.”Medium, Medium, medium.com/@jinghanhao/why-american-on-demand-delivery-companies-wont-be-as-successful-as-their-chinese-peers-8440fdfccd97.

[10]. China News (26 Jul. 2018) “Eleme CEO Wang Lei: The core of future competition is the upgrade of new retail in local life services” https://baijiahao.baidu.com/s?id=1607018715585804177&wfr=spider&for=pc

Cite this article

Wu,T.Y. (2023). Evaluation of the Business Models of Uber Eats and Ele.me, and the Reasons for Their Differences. Advances in Economics, Management and Political Sciences,3,269-276.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 6th International Conference on Economic Management and Green Development (ICEMGD 2022), Part Ⅰ

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. The Vintage News (8 Jan. 2019). “Food Delivery: The Epic History of Humanity’s Greatest Convenience.” https://www.thevintagenews.com/2019/01/08/food-delivery/?chrome=1

[2]. The Center Square. (2 Nov. 2020). “Average One-Way Commute Time for New York Residents Reaches 33.3 Minutes”. https://www.thecentersquare.com/new_york/average-one-way-commute-time-for-new-york-residents-reaches-33-3-minutes/article_d37b99d4-18b0-11eb-830b-132ac7bdd8f5.html

[3]. The Social Grabber. (9 Dec. 2020) “Target Markets of Delivery Services, Uber Eats and Door Dash” https://thesocialgrabber.com/target-market-of-delivery-services-uber-eats-and-doordash/

[4]. Zhuanlan zhihu “Eleme’s Product Analysis Report” https://zhuanlan.zhihu.com/p/108591766

[5]. Progressive International (12 Oct. 2020) “Feeding the Chinese City.” https://progressive.international/wire/2020-10-12-feeding-the-chinese-city/en

[6]. Competitive Advantage Analysis (17 Feb. 2018) “Competitive Advantages of Uber Eats” https://competitiveadvantageanalysis.com/competitive-advantages-of-uber-eats/

[7]. Shanghai Haiju Talent Platform (16, Mar.) https://www.sotsw.cn/hot/hotEnterprisePost?company_id=3774

[8]. Forbes (6 Feb. 2019) “Uber’s Secret Gold Mine: How Uber Eats Is Turning Into A Billion-Dollar Business To Rival Grubhub” https://www.forbes.com/sites/bizcarson/2019/02/06/ubers-secret-gold-mine-how-uber-eats-is-turning-into-a-billion-dollar-business-to-rival-grubhub/?sh=549054461fa9

[9]. Hao, Jinghan. (2 Apr. 2019) “Why American on-Demand Delivery Companies Won't Be as Successful as Their Chinese Peers.”Medium, Medium, medium.com/@jinghanhao/why-american-on-demand-delivery-companies-wont-be-as-successful-as-their-chinese-peers-8440fdfccd97.

[10]. China News (26 Jul. 2018) “Eleme CEO Wang Lei: The core of future competition is the upgrade of new retail in local life services” https://baijiahao.baidu.com/s?id=1607018715585804177&wfr=spider&for=pc