1 Introduction

The traditional financial industry takes a cautious wait-and-see attitude towards mobile payment, because it does not sure what role tech giants play in the financial service industry and worries that they are only temporarily linking up bank accounts or further developing their unique financial services. The traditional banking industry is forced to carry out digital transformation to cope with the fierce competition [1]. Three crucial groups are driving the adoption of mobile payments in China: Chinese innovators who are on par with those in Silicon Valley, a government that encourages technological innovation, and Chinese Internet users who trust new technologies and are resilient. Chinese regulators’ granting banking licenses for Alibaba and Tencent, two unofficial technology giants, an open regulatory environment conducive to the development of mobile payment, and people's expectations and support of innovative way of life, all contribute to China's tech giants' confidence and efforts to break the traditional patterns and make themselves thoroughly practice the development of mobile payment business [2]. Mobile finance technology was originated in the USA but the frequency of adoption in the USA was much lower than that in China. An essay from Financial Times argued that the mobile payments market in China had reached 38 trillion yuan, almost 50 times the scale in the U.S. in the year 2016 [3]. The coronavirus pandemic has led to the rise of new services offered by online and digital payment companies. Still, fees for US consumers remain high, with Square's average transaction fee at 2.6% and Stripe's nearly 3%. China's big fintech companies charge less than 0.5 %, due to fierce price wars among participants. The U.S. fintech companies were heavily relying on America’s duopoly credit-card networks to approach merchants, banks, and consumers. They were charged by credit card companies at highly about 2% in accessing the card system. The good news is that CBDC may be carried out shortly, with the Federal Reserve launching a fast payment system called FedNow in 2023 that will allow efficient payment pipes to connect to digital wallets, with consumers simply tapping, clicking, or scanning a QR code [4]. Over 50 monetary authorities worldwide are exploring digital currencies. The reason is that if personal financial transactions flow from banks into third-party digital realms, it is difficult for central banks to monitor the economic cycle, especially during a crisis [5]. Although digital currency mainly replaces M0 (money circulation) cash, if the digital currency wallet is entirely independent of third-party payment institutions and does not open its interface to third-party payment institutions, some or even most of the functions of third-party payment institutions are likely to be replaced in the future. By launching DCEP, The Chinese government can take back some of the financial power that Ant Group and Tencent possessed while giving the government greater and easier insight into citizens' daily micro-financial activity. Meanwhile, the decentralized product, Bitcoin, has achieved $ 1 trillion asset volume worldwide, fintech companies have been granted BitLicense by the U.S. government[6]. Given the difference between China and the U.S. in macro economies for entrepreneurship, domestic infrastructure, and regulations, as well as people’s consumption level and preference, we are interested in how mobile payment development differ in both countries. This paper will conduct a thorough case study between Alipay and Apple Pay to investigate the following question further:

RQ1: If both CBDC and bitcoin can replace cash in the future, how can Chinese and American mobile payment companies prepare themselves for a changing environment with multivariate forms of money and people's switchable choice and style of purchasing and investing?

2 Literature Review

Mobile payment refers to a bank transfer, payment, and other transaction activities through mobile communication terminals such as mobile phones, mobile computers, and tablet devices through the mobile networks and near-field wireless communication technology. Mobile payments launched less than 20 years ago, have upended businesses and lifestyles worldwide. In the 1990s, the founding of Amazon, eBay, and Alibaba set off a wave of online shopping. E-commerce companies that seized the advantages of the Internet and the needs of international trade flourished, giving birth to niche markets for online payment and cross-border currency exchange. In 1994, DigiCash, a company founded by David Chaum, developed e-Cash, and implemented an unconditional and anonymous electronic Cash payment system, trialed by Mark Twain Bank in the US and Merita Bank of Finland,and DigiCash went bankrupt in 1998[7].

In 1999, PayPal was officially launched to process online payment services for e-commerce enterprises, charging a certain commission for each transaction. Alipay was founded in 2004 as a payment tool for Taobao. In 2004, Japanese operator NTT DoCoMo launched a smartphone card based on SONY FeliCa RFID technology to realize a mobile payment under the 3G network. It also developed ATM with mobile payment function and pioneered mobile payment. Two years later, it launched mobile phone credit card DCMX with an overdraft limit [8]. Moneta, a smart chip developed by SKT, a South Korean telecom operator, could also provide early financial services with online banking that can be used internationally [9]. In March 2006, PayPal launched PayPal Mobile, a Mobile SMS payment service. The fees charged by small merchants are much lower than those charged by credit card companies [10]. In 2009, Starbucks in the US launched the first App that allowed consumers to store value e-gift cards, which later became available in 2011 with credit cards and PayPal. NFC technology was born in 2004, which enabled mobile devices to establish point-to-point near field communication quickly and safely, breaking traditional payment modes, such as SMS and WAP, and providing a new breakthrough for the development of mobile payment [11]. In 2013, Tencent launched the WeChat Payment platform based on NFC technology, and Alipay became a mobile payment provider in 2014. In February of the same year, mobile phones users can reach Visa and Mastercard terminals to make payments through NFC technology [12][13]. Apple also launched Apple Pay. Asia's payments market was maturing faster than the US and Europe, benefited from the 5G infrastructure, government support for innovation and relatively low tax pressures, the explosion of e-commerce due to the mature convergence of Internet of Things and the mobile Internet in Asia, and the large population of mobile phone users and Internet users, who tended to save money rather than run up credit cards. In the U.S., by contrast, credit cards and personal checks are prevalent, merchants pay hefty fees to use mobile payment companies' products, and small stores often prefer cash to avoid paying taxes. In addition, U.S. telecom operators have less clout than the credit card giants, so they can't drive the growth of the U.S. mobile payment industry.

According to a McKinsey report, by 2025, 4.3 billion remaining people wait to be connected to the mobile web, and 2-3 billion new Internet users will be harnessing the mobile web [14], which means that they will all have a mobile device that can connect to the Internet, together forming a substantial potential mobile payment market. Every scientific and technological innovation in history has led to changes in the business model of the financial industry. With the increasingly fierce competition in mobile payment, tech giants are constantly thinking about how to lay out their business strategies for the following digital war.

3 The Success of Alipay

China has the most significant number of mobile netizens globally, and the country's encouragement of innovation suits Alipay’s development. In the beginning, Alipay was a third-party intermediary of the online shopping platform and injected into early customer groups with the help of Taobao’s e-commerce resources. In 2008, Alipay entered the mobile payment market. Based on B2B experience, technical background, and brand strength, it introduced merchants and banks to jointly create a mobile payment ecosystem, hoping to attract more new users to use the Alipay platform. Between 2012 and 2015, Alipay began promoting digital payments with small business owners, charging no fees and only 0.6 percent of cash withdrawals [15]. During the promotion period, small merchants will get random rewards of 0.1-1000 yuan for each transaction. They did not need to buy POS machines but could open stores if they had the QR codes and mobile phones, which saved the cost of store owners and accumulated many loyal users and fans. At that time, the P2P industry was not popular, and it was difficult for these small and micro enterprises to get high threshold bank loans. Alipay solved the problem of online payment in their business for free and improved the payment convenience of consumers. In China, after the reform in 2016, the total POS machine fees includes a fee of 0.45 percent on each credit transaction charged by card issuers plus 0.065 percent UnionPay network service and 0.1 percent acquiring bank fee for each payment [16], while Alipay currently makes money by charging merchants fees of 0.6 to 1.2 percent for the platform and keeping the withdrawal fee at 0.1 percent, providing liquidity to merchants.

Ant and Tencent have made significant overseas investments, expanding their overseas business footprint by acquiring or merging local startups and unicorns in Japan, South Korea, Thailand, Singapore, Malaysia, Africa, the United States, and Europe [17]. In India, Alipay has invested in PayTM, a local business, while in Thailand, it has invested in Ascend Money [18]. These partnerships allow Alipay to better integrate with local consumer groups. In 2019, Alipay and WeChat Pay can be linked with Visa and Master bank cards, providing Chinese tourists traveling overseas with a fast payment option for shopping. Chinese tourists can also use Alipay to take a ride by Uber. In North America, Citcon and Veea worked with Alipay and WeChat Pay to get more merchants and retailers to accept these two payment methods [19]. The partnerships can stimulate Chinese tourists' overseas consumption and satisfy their shopping preferences.

In June 2010, the People's Bank of China issued the Measures for the Administration of Payment Services for Financial Institutions, which pointed out that it is necessary to obtain a third-party payment license to engage in payment business [20]. In 2016, The General Office of the State Council issued the Notice of The General Office of the State Council on Distributing the Implementation Plan of the Special Rectification of Internet Financial Risks [21]. The Clearing Department of the Central Bank also issued a document requiring payment institutions to accept all online payment businesses involving bank accounts through the official online platform [22]. In 2020, the Bank for International Settlements unveiled its 20201/22 work plan, which included regulating technology and cyber security, and promoting infrastructure for the next generation of financial markets and encouraging digital finance [23]. Strong government regulation has intensified competition in the payment industry, with more companies acquiring digital finance qualifications through mergers and acquisitions after the central bank tightened license issuance. The payment industry is gradually diversifying, and new payment tools are embedded in product and service scenarios and ecological payment platforms. Alipay aims at the personal digital wallet in the C-side, with Ant Forest social interactive games to optimize the user experience and enhance customer engagement and expand more service scenarios through connecting merchants in the B-side. Alipay's important competitor in China is WeChat Wallet, which forms a relatively stable duopoly market. As the first movers, they create a high market entry barrier for new entrants. The transaction volume of Alipay is more than that of WeChat. The offline payment amount of WeChat is smaller, and the number of transactions is frequent. Alipay has more comprehensive financial services and profitable cash management financial products. It is a comprehensive financial platform with data advantages.

4 The Innovation of Apple Pay

Different from the situation in China, the United States has a mature credit card system, high market saturation, abundant credit card rewards, and consumers are accustomed to overdraft consumption with little deposit and high overall credit investigation level. Personal income tax accounts for less than 10 percent of total tax revenue in China and 40 to 50 percent of total tax revenue in the United States [24]. Individual business tax rates in China range from 5 to 35 percent, while those in the U.S. range from 10 to 35 percent [25]. Americans advocate freedom, and they will subjectively exclude mobile payment for privacy security concerns and practical tax avoidance purposes. One problem holding back the U.S. mobile payment market is the high cost of merchant entry. It is costly to switch credit card lovers to use mobile payment methods and to persuade a few merchants to be the pioneers accepting mobile payments if most of the merchants only allow traditional credit cards. PayPal has been playing a leading role in online payment. As a new player in offline payment, Apple Pay makes full use of the volume of iPhone users and quickly enters the market to seize shares. Us credit card giants Visa and Master have also been the top choice for Americans to use their credit cards, which are free and charge 1-2% for cash withdrawals [26]. To entice credit card customers to use Apple Pay, Goldman Sachs and Apple have launched co-branded credit cards that offer a 2 percent cashback bonus, while Apple Pay charges 0.15 percent on each transaction [27]. Apple started with 220,000 merchants supporting Apple Pay. By the end of 2015, Apple expects 110,000 merchants to support Apple Pay [28]. Phoenix Marketing International recently released the results of a new study on Apple Pay, the online payment service. Apple Pay has an 18 percent market share in the U.S. compared to Android Pay's 11 percent and Samsung Pay at 12 percent. Apple is still ahead but rivals Samsung Pay and Android Pay are clearly catching up. It shows that 38 percent of all Apple Pay transactions are in-app purchases, while 62 percent are made in stores [29]. Aiming to collect and study the big data of consumer behavior more easily, O2O businesses in physical stores have connected with third-party payment, such as Apple Pay, to optimize services to match and meet consumer needs. Paying with an Apple Watch may be easier than paying with a mobile phone. After setting up their usual credit card, users can double-tap the button on the side of the watch to call up the credit card option, which can be identified and completed at the POS terminal. Horace Dediu, an analyst at Market research firm Asymco, said Apple sold 15 million Apple Watches in 2017, bringing its total sales since the product's launch to 33 million and its total revenue to $12 billion [30]. Apple Pay's penetration in the international market is rising, and the transaction volume of Apple Pay would show exponential growth. Morgan Stanley's 2019 report predicted that the transaction volume of Apple Pay will reach $190 billion in 2022 [31]. Digital wallet apps like Apple Pay are finally becoming a channel for competition and collaboration between companies and other players in the space. Digital technology is used by Apple Pay to make it easier and faster to create and capture business value through interactions with other companies or customers. Using Apple Mobile Pay could lead to new business models that capture new business opportunities with products and services from other industries that share common interests and create mutual benefits.

In 2016, Apple Pay launched Apple Pay in China in a strategic partnership with UnionPay, allowing users to pay instantly by holding an iPhone close to an Apple Pay-enabled POS terminal. Apple Pay is less trendy in China than Alipay and WeChat Pay because, to a great extent, Apple’s spot in a market with a large number of Android phone users who do not have access to Apple Pay. In addition, Apple Pay is a simple payment and transportation card binding function. Still, there is no transfer between bank accounts, cash withdrawal, living expenses, and red envelope function, while China's duopoly has the platform to provide these services. There are hundreds of stores in China that support Apple Pay nowadays, including many American brands such as McDonald's, KFC, and Starbucks. However, the penetration rate is not as deep as Alipay and WeChat Pay.

Mobile payments have also spawned new, legal, and regulatory systems overseas. On December 15, 2020, the European Commission published a draft of the Digital Market Act on its website, which also proposed regulatory directions on in-app payments, stating that device manufacturers and app market providers should not set up monopolies and restrict other mobile payment providers from participating in the competition in the payment market [32]. In 2009, part five of the Dodd-Frank Act in the United States reaffirmed the minimum personal data protection standards for financial institutions [33]. Regulation D, Regulation E, Regulation Z of the Fed [34], and the federal Electronic Funds Transfer Act protects consumers from unauthorized transactions. However, the United States does not have an explicit unified mobile payment law provision, only defining mobile payment as money transmitters and extending the existing law’s scope of application.

5 The Mobile Payment Competition and Digital Money

Fig. 1. Global Mobile Payment Scale, Data source: IDC Financial Insight [35].

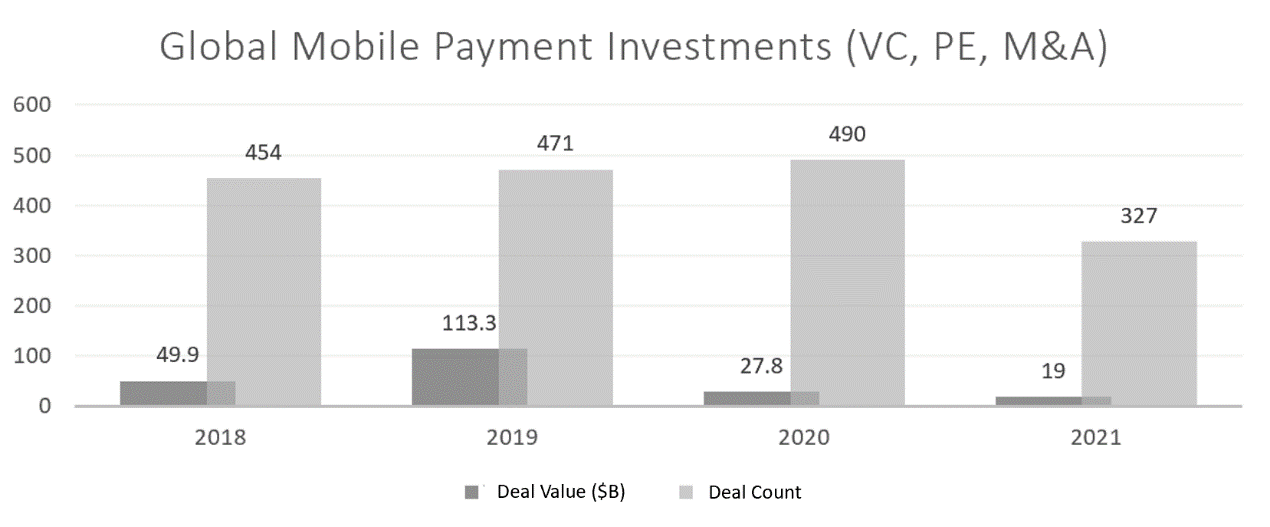

Fig. 2. Global mobile payment investments, Data source: KPMG International, PitchBook [36].

As shown in Fig. 1., in 2017, the amount of global mobile payment reached $1.1T, of which NFC technology achieved 25%. From Figure 2 we have come to a point of view that investment and financing activities in the global mobile payment sector were also widespread, with the transaction volume reaching $113.3b in 2019 and 490 transactions in 2020. In today's mobile payment field, there are competitors from other industry backgrounds, and the competition pattern is apparently diverse in different countries. In China, WeChat Pay and Alipay account for 90% of the market share, a duopoly [37]. Alipay covers a broader range of offline public services and life scenes, while most of the active users of WeChat Pay are users of WeChat social software. Many Chinese tech companies have applied for digital finance licenses and opened e-wallet services.

As shown in Table 1, newcomers from various backgrounds had revealed their interests in the field of mobile payment and launched their digital payment method products. The mobile payment industry in Japan and South Korea originated earlier than the rest of the world and was dominated by mobile communication companies [38]. Later, the Japanese Convenience Store Association launched Konbini [39], and Japanese social software Line [40] and South Korean social software KakaoTalk also developed mobile payment services [41]. The first NFC- enabled mobile payment service in the US was Apple Pay. Google launched Android Pay to compete with Apple a year later. These electronic wallets can be bundled with credit cards since the US credit card giants have launched their own mobile payment brands [42]. Fintech startups like Stripe and Square have carved out niches in mobile payments. Traditional automobile enterprises are also eager to try their hand and have cooperated with third-party payment companies to develop applications in vehicle-mounted mobile payment scenarios, such as China's Xpeng Automobile and Alipay's research and development projects [43], and Germany's Mercedes-Benz and Visa's research and development projects [44]. Apple Pay, which comes with the Apple Watch, was the first mobile payment feature in a wearable device, followed by imitators such as the SONY Wena [45] and Jawbone UP4[46]. Lyle & Scott apparel has built BPay chips into the cuffs of its new jackets, allows users to pay with a wave of their hand [47]. Worldpay, a multinational electronic payment solution company, developed a VR payment solution in 2017, opening the business layout of the meta-universe [48]. Chinese electronics manufacturer Xiaomi also applied for a patent for VR mobile payment in 2021 to build a payment method for the Meta-universe [49]. Using advanced biometrics technology, Alibaba's new supermarkets do not require consumers to carry any mobile devices and can quickly pay through two electronic gates [50].

As shown in Fig. 3., the field of mobile payment has undergone tremendous innovation both in technology and content. In the US, where cryptocurrencies are prevalent, bitcoin startup Circle, mobile payments company Square and PayPal's Venmo have all received New York State Bitlicense, which allow them to offer cryptocurrency services in the state [51-53]. The anarchist push for decentralization comes at a time when many countries around the world are experimenting with the issuance of central bank digital currencies, such as the digital euro and yuan [54,55]. Although Bitcoins were designed to decentralize the power of money issuers and to seize the freedom of currency, they are often used by villain to launder money or by speculators to gamble on false price. Noticing the vulnerability, high risk and lack of regulation on the Bitcoin market, the central banks attempt to strengthen its power as an issuer and release the CBDC as a legal tender of cash. And because people already get used to mobile payment methods in their daily lives, it is way easier for them to accept CBDC to make payments giving that CBDC is much safer, and more trustworthy to some extent. In 2023, digital dollars could be flourishing on the FedNow system. Are these changes around the world a threat or an opportunity for third-party mobile payment companies?

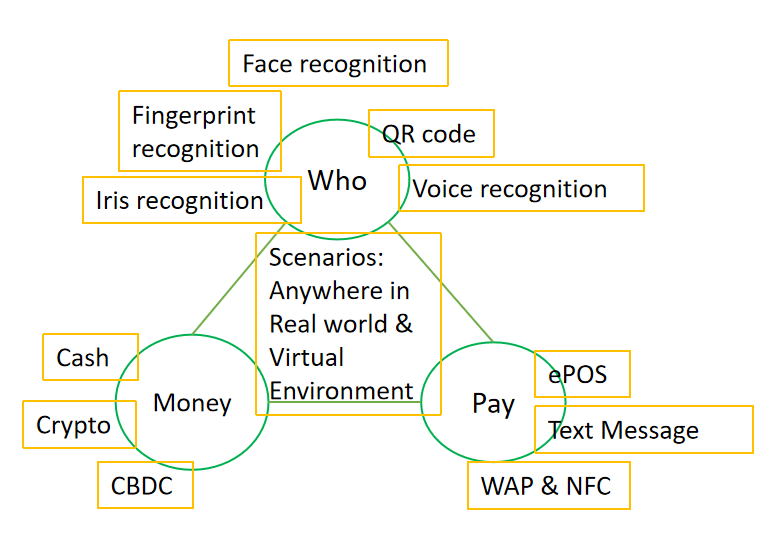

Fig. 4. Who-pay-money triangle.

As can be seen from Fig. 4., the key in the field of mobile payment lies in three aspects: “Who-pay-money.” The question of "who" is to solve the problem of user identity. In this aspect, we have the QR code technology, fingerprint recognition, face recognition, iris (eye control) recognition, voice recognition that several technologies, which are essential to the big data Internet technology companies and can help them to analyze new users and repeat purchase, and then further explore the user viscosity, user requirements, and customer purchasing power and other important business indicators. As for the "payment" technology, before the popularization of mobile payment, people used bank cards to purchase goods through POS machines. Later, SMS payment and web payment have dominated people’s daily life until the introduction of NFC technology truely opened the door to mobile payment. As for "money," the oldest is physical cash, then cryptocurrencies, and then digital currencies backed by central banks. Digital finance companies can combine these three, enabling payment methods to be applied to all scenarios of real-life anytime, anywhere, and in the future to be widely used in the virtual reality world of the metaverse. In this way, mobile payment companies function as digital wallets, which can hold bank deposits, cryptocurrencies, and central bank digital currencies if permitted by law. If third-party payment companies have relevant licenses and exchange services among the above currencies, they can meet the increasing payment needs of global consumers. In China recently, Alipay, WeChat, and Apple all have digital RMB interfaces, which will also be available for the 2022 Winter Olympics [56]. Third-party payment companies and central bank digital currency are in a mutualistic symbiotic relationship. The promotion of digital currency can rely on the coverage rate of mobile payment companies. Digital currency will increase the security and credibility of mobile payment companies, improve user experience, and promote the rate of return of the industry. At the same time, third-party payment companies can be actively close to the future monetary policy, prevent money laundering and terrorist financing activities, and solve the liquidity problems of small and medium-sized enterprises.

6 Conclusion

6.1 Main Idea

A Mobile payment is an innovative application based on mobile Internet terminal, which has become a necessary payment platform to build a mobile Internet business model. In the future, more netizens will participate in the consumption scene of mobile payment worldwide. Electronic payment, an important means of transferring funds, is gradually being accepted by more bank card users, who can easily conduct transactions by binding their bank cards to mobile payment platforms. Based on the in-depth elaboration of mobile payment, this paper reviews the development of mobile payment, compares the similarities and differences between the business models of mobile payment enterprises in both China and the United States from the aspects of credit investigation environment, user consumption habits, national policies, and tax rates, analyzes the global competition pattern of mobile payment, and puts forward suggestions for the future development layout of mobile payment enterprises. In the future, mobile payment companies will integrate more different and upgraded consumption scenarios, provide diversified and high-quality products and services, better-fit consumers' purchasing power and purchasing intention, and meet consumers' better-quality lifestyles.

6.2 Limitations

Although the research content of this paper has reference significance for the development of the mobile payment industry in China and the United States, there are inevitably some improvements in this paper due to the limitations of objective conditions and other factors. This paper only does a comparative analysis of the two mobile payment businesses, Alipay and Apple Pay, without giving too much description of other competitive mobile payment enterprises in the industry, nor conducting an in-depth analysis of outstanding mobile payment enterprises in other countries and regions in the world. There is little literature about mobile payment as an emerging industry, therefore some of the research arguments in this paper need to be supplemented, making future research in this field more worthy of expectation. It is expected that a more comprehensive study on mobile payment can be carried out in combination with the development of the meta-universe in the future.

References

[1]. Jay D.Wilson and Jr. “What is financial technology?”, Creating Strategic Value Through Financial Technology, pp. 29-30 (2017).

[2]. Zak Dychtwald “China’s New Innovative Advantage”, Harvard Business Review May-June 2021, pp. 56-57 (2021).

[3]. Anonymous “Chinese third-party mobile payments reached $5.5t in 2016”, China Daily, Feb 27th, (2017). http://www.chinadaily.com.cn/bizchina/tech/201702/27/content_28359080.htm

[4]. Anonymous “Fintech comes to America at last”, The Economist, Mar 27th 2021, pp. 10-11 (2021)

[5]. Anonymous “The digital currencies that matter”, The Economist, Mar 8th 2021, pp. 13 (2021).

[6]. Gladstein “Financial freedom and privacy in the post-cash world,” Alex Cato Journal Washington, Vol. 41, Issue. 2, Spring-Summer 2021: pp.271-293 (2021).

[7]. Stock Helen, Digicash Idea Finds New Life in More Flexible eCash,EBSCO (2000).

[8]. SP Bradley,M Egawa,A Kanno,TR Eisenmann, “NTT DoCoMo, Inc.: Mobile FeliCa”, Cambridge: Harvard Business School Case (2006).

[9]. Gi Mun Kim, Sang Hoon Lee, Seung Chang Lee, Ho Geun Lee, Oh Byung Kwon, MONETA Services of SK Telecom: Lessons from Business Convergence, Software Technologies for Future Embedded and Ubiquitous Systems,IEEE, pp.160 (2004).

[10]. Wolfe, Daniel, PayPal Service For Mobile Devices, American Banker; New York, N.Y. (2007).

[11]. Coskun, V., Ozdenizci, B. & Ok, K. A Survey on Near Field Communication (NFC) Technology. Wireless Pers Commun 71, 2259–2294 (2013)

[12]. Wolfe,Daniel,Report: Visa to Test iPhone NFC Case. EBSCO

[13]. Adfonic, “Cashcloud makes mobile payment a reality through the new NFC label cashcloud MasterCard Paypass”, ACCESO

[14]. James Manyika, Michael Chui, Richard Dobbs, Peter Bisson, Alex Marrs, “Disruptive technologies: Advances that will transform life, business, and the global economy” McKensey Global Institute (2013).

[15]. Luo Jinli (2015), “Alipay’s offline battle”, Financial Technology Times, 2015 (2)

[16]. Zhu Xinmiao (2017), “Analysis of the impact of the reform of the fee rates on credit card industry”, Chinese Credit Card, 2017 (12)

[17]. Alice Han Siqi (2021). “Chinese Fintech Companies and Their ‘Going Out’ Strategies”, Journal of Internet and Digital Economics. Vol.1 No.1, pp.47-63 (2021).

[18]. Arnold, M., Murgia, M. Alipay seals Europe deals for China payments: Financial services. Financial Times Retrieved from https://www.proquest.com/newspapers/alipay-seals-europe-deals-china-payments/docview/1856034620/se-2?accountid=13625 (2016).

[19]. Anonymous. Veea and CITCON partnership enables retailers and restaurants in the United States to accept Alipay and WeChat pay: Integration accommodates payment preferences of Chinese tourists, driving traffic to participating businesses and optimizing customer experiences. PR Newswire, May 15, 2018. https://www.proquest.com/wire-feeds/veea-citcon-partnership-enables-retailers/docview/2038624628/se-2?accountid=13625 (2018).

[20]. Ren Gaofang “The enlightenment of American third-party payment regulatory system to China”, Financial Development Review, 2012 (10).

[21]. Chinese National Bureau of Statistics http://www.stats.gov.cn/wzgl/ywsd/201610/t20161014_1409482.html (2016).

[22]. Anonymous, “The People's Bank of China requires all third-party payment institutions to access the network”, Finance and Accounting, 2017 (10).

[23]. BIS Annual Economic Report, https://www.bis.org/publ/arpdf/ar2020e.pdf (2020).

[24]. Wang Di, Zhong Ting, “China's individual income tax reform proposals from the perspective of comparing Income tax in China and the United States”, Industrial Innovation, CNKI (2016).

[25]. Li Jian, Wang Yue, “Analysis and reference of differences between Chinese and American individual income tax systems”, Modern Economic Information, CNKI (2012).

[26]. Armstrong, Robert, and Federica Cocco, "Credit Cards Offer $6bn Settlement: Visa and Mastercard Seek Deal on 'Swipe Fees' Case Related to Fight Over Network Rules [USA Region]." Financial Times, Sep 19, pp. 11. ProQuest, https://www.proquest.com/newspapers/credit-cards-offer-6bn-settlement/docview/2122927286/se-2?accountid=13625. (2018).

[27]. Tett, Gillian. "The New Bankers: Cuddly, Cool, with a Passion for Dance Music." FT.Com, 2019. ProQuest, https://www.proquest.com/trade-journals/new-bankers-cuddly-cool-with-passion-dance-music/docview/2198291891/se-2?accountid=13625 (2019).

[28]. Goldstein, Phil. "Apple's Cook Open to Partnering with e-Commerce Behemoth Alibaba." FierceWireless, 2014. ProQuest, https://www.proquest.com/trade-journals/apples-cook-open-partnering-with-e-commerce/docview/1618003334/se-2?accountid=13625 (2014).

[29]. Greg Weed, “Apple Pay: The first year”, Phoenix Marketing International 2015, www.phoenixmi.com (2015).

[30]. Horace Dediu, “A small-screen iPod, an Internet Communicator and a Phone”, Asymco 2018, http://www.asymco.com/author/asymco/page/8/ (2018).

[31]. Market Mad House, “Apple Pay could be worth $190 billion by 2022”, Medium, https://medium.com/the-capital/apple-pay-could-be-worth-190-billion-by-2022-market-mad-house-edc08ee4a4b7 (2019).

[32]. Anonymous, “EU Digital Markets Act and Digital Services Act explained”, News European Parliament, https://www.europarl.europa.eu/news/en/headlines/society/20211209STO19124/eu-digital-markets-act-and-digital-services-act-explained (2021)

[33]. The Federal Government, “Final Rules, Guidance, Exemptive Orders & Other Actions on Dodd-Frank Act”, https://www.cftc.gov/LawRegulation/DoddFrankAct/Dodd-FrankFinalRules/index.htm (2009).

[34]. The Fed, “Federal Reserve’s Regulations”, Federal Reserve, https://www.federalreserve.gov/supervisionreg/reglisting.htm

[35]. Anonymous, Business Strategy: Results from the 2012 Consumer Payments Survey, IDC Financial Insights, https://www.idc.com (2012).

[36]. Anonymous, The Pulse of Fintech 2021H1, KPMG International. https://home.kpmg/xx/en/home/insights/2021/08/pulse-of-fintech-h1-2021-global.html; https://www.pitchbook.com (2021).

[37]. Xie, Stella Y. "Using Smartphones to Pay? that's so Yesterday in China; Chinese Consumers can Pay at some Retail Stores by Simply Looking into Facial-Recognition Machines at Checkout." Wall Street Journal (Online), Jun 11, 2019. ProQuest, https://www.proquest.com/newspapers/using-smartphones-pay-thats-so-yesterday-china/docview/2237712201/se-2?accountid=13625 (2019).

[38]. Shin, Bongsik, and Geun L. Ho. "Ubiquitous Computing-Driven Business Models: A Case of SK Telecom's Financial Services." Electronic Markets, vol. 15, no. 1, pp. 4-12. ProQuest, https://www.proquest.com/scholarly-journals/ubiquitous-computing-driven-business-models-case/docview/216888985/se-2?accountid=13625 (2005).

[39]. Anonymous, "Finance and Economics: Banking at Your Convenience." The Economist, vol. 354, no. 8154, Jan 22, pp. 69-70. ProQuest, https://www.proquest.com/magazines/finance-economics-banking-at-your-convenience/docview/224065780/se-2?accountid=13625 (2000).

[40]. Anonymous, "Press Release: Boku Partners with LINE Pay Japan to Enable eWallet Payments to Merchants." Dow Jones Institutional News, Jun 25, ProQuest, https://www.proquest.com/wire-feeds/press-release-boku-partners-with-line-pay-japan/docview/2417195289/se-2?accountid=13625 (2020)

[41]. Anonymous, "Ant Financial to Invest $200 Million in South Korea's Kakao Pay." Dow Jones Institutional News, Feb 20. ProQuest, https://www.proquest.com/wire-feeds/ant-financial-invest-200-million-south-koreas/docview/1870164160/se-2?accountid=13625 (2017).

[42]. Reportlinker. “Mobile and alternative payments in the U.S., 3rd edition.” PR Newswire, https://www.proquest.com/wire-feeds/mobile-alternative-payments-u-s-3rd-edition/docview/1267251313/se-2?accountid=13625 (2013).

[43]. Xpeng Motor, “Xpeng Motors and Alipay jointly develop in-car payment functions, with first implementation due on Xpeng P7”, Xpeng Motor, https://en.xiaopeng.com/news/news_info/3357.html (2019).

[44]. Mick Chan, “Mercedes-Benz partners with Visa for in-car payments; service to be available in Germany, UK from 2022”, Paultan, https://paultan.org/2021/11/11/mercedes-benz-partners-with-visa-for-in-car-payments/ (2021).

[45]. Anonymous (2019), “ Germany : Traditional watches made smart with sony and wirecard's digital payment technology.”. MENA Report, https://www.proquest.com/trade-journals/germany-traditional-watches-made-smart-with-sony/docview/2181971305/se-2?accountid=13625 (2019)

[46]. Anonymous, “Jawbone puts mobile payments into new Up4 fitness band.” 2015. Dow Jones Institutional News, Apr 16, 2015. https://www.proquest.com/wire-feeds/jawbone-puts-mobile-payments-into-new-up4-fitness/docview/2068324281/se-2?accountid=13625 (2015).

[47]. Anonymous, “The cutter blog: Will wearables disrupt the financial sector?” Newstex Trade & Industry Blogs , https://www.proquest.com/blogs-podcasts-websites/cutter-blog-will-wearables-disrupt-financial/docview/1792594593/se-2?accountid=13625 (2016).

[48]. Anonymous, "STUDY: 65 Percent of U.S. Consumers Expect Virtual Reality Will Change the Way People Shop: Worldpay's "the 360 Consumer: How VR is Reshaping the Buying Experience" Report Predicts VR Adoption Will Increase Across the Globe, Delivering Major Benefits to the Retail Industry in the U.S." NASDAQ OMX's News Release Distribution Channel, May 25, 2017. ProQuest, https://www.proquest.com/wire-feeds/study-65-percent-u-s-consumers-expect-virtual/docview/1902070694/se-2?accountid=13625 (2017).

[49]. Paramjeet Verma, “Meta universe payment is coming!Mobile payment patent authorized under Xiaomi VR environment”, Gamingsym, https://gamingsym.in/meta-universe-payment-is-comingmobile-payment-patent-authorized-under-xiaomi-vr-environment/

[50]. Anonymous, “Smile to get discounts in Tmall's unmanned supermarket”, China Daily, https://www.chinadaily.com.cn/bizchina/4thwic/2017-12/05/content_35215865.htm (2017).

[51]. Anonymous, “First NY BitLicense Issued to Circle Mobile Payments Company”, Newsbtc, https://www.newsbtc.com/news/first-ny-bitlicense-issued-to-circle-mobile-payments-company/ (2016)

[52]. Kate Rooney, “Square shares jump to a record after company gets regulatory green light for cryptocurrency trading in New York”, CNBC, https: //www.cnbc.com/amp/2018/06/18/square-customers-can-now-trade-cryptocurrency-in-new-york.html (2018).

[53]. Anonymous, “Customers can now buy, hold and sell cryptocurrency directly within the Venmo app with as little as $1”, PRNewswire, https://newsroom.paypal-corp.com/2021-04-20-Introducing-Crypto-on-Venmo (2021).

[54]. Anonymous, “A digital Euro”, The European Central Bank, https://www.ecb.europa.eu/paym/digital_euro/html/index.en.html (2021).

[55]. Anonymous, “China central bank launches digital yuan wallet apps for Android, iOS”, Reuters, https://www.reuters.com/markets/currencies/china-cbank-launches-digital-yuan-wallet-apps-android-ios-2022-01-04/ (2021).

[56]. Anonymous, “China Offers Digital Yuan at Olympics to Test Overseas Appeal”, Bloomberg News, https://www.bloomberg.com/news/articles/2022-01-10/china-offers-digital-yuan-at-olympics-to-test-overseas-appeal (2022).

Cite this article

Lin,B. (2023). A Sino-US case study of the mobile payment fintech companies. Advances in Economics, Management and Political Sciences,3,88-99.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 6th International Conference on Economic Management and Green Development (ICEMGD 2022), Part Ⅰ

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Jay D.Wilson and Jr. “What is financial technology?”, Creating Strategic Value Through Financial Technology, pp. 29-30 (2017).

[2]. Zak Dychtwald “China’s New Innovative Advantage”, Harvard Business Review May-June 2021, pp. 56-57 (2021).

[3]. Anonymous “Chinese third-party mobile payments reached $5.5t in 2016”, China Daily, Feb 27th, (2017). http://www.chinadaily.com.cn/bizchina/tech/201702/27/content_28359080.htm

[4]. Anonymous “Fintech comes to America at last”, The Economist, Mar 27th 2021, pp. 10-11 (2021)

[5]. Anonymous “The digital currencies that matter”, The Economist, Mar 8th 2021, pp. 13 (2021).

[6]. Gladstein “Financial freedom and privacy in the post-cash world,” Alex Cato Journal Washington, Vol. 41, Issue. 2, Spring-Summer 2021: pp.271-293 (2021).

[7]. Stock Helen, Digicash Idea Finds New Life in More Flexible eCash,EBSCO (2000).

[8]. SP Bradley,M Egawa,A Kanno,TR Eisenmann, “NTT DoCoMo, Inc.: Mobile FeliCa”, Cambridge: Harvard Business School Case (2006).

[9]. Gi Mun Kim, Sang Hoon Lee, Seung Chang Lee, Ho Geun Lee, Oh Byung Kwon, MONETA Services of SK Telecom: Lessons from Business Convergence, Software Technologies for Future Embedded and Ubiquitous Systems,IEEE, pp.160 (2004).

[10]. Wolfe, Daniel, PayPal Service For Mobile Devices, American Banker; New York, N.Y. (2007).

[11]. Coskun, V., Ozdenizci, B. & Ok, K. A Survey on Near Field Communication (NFC) Technology. Wireless Pers Commun 71, 2259–2294 (2013)

[12]. Wolfe,Daniel,Report: Visa to Test iPhone NFC Case. EBSCO

[13]. Adfonic, “Cashcloud makes mobile payment a reality through the new NFC label cashcloud MasterCard Paypass”, ACCESO

[14]. James Manyika, Michael Chui, Richard Dobbs, Peter Bisson, Alex Marrs, “Disruptive technologies: Advances that will transform life, business, and the global economy” McKensey Global Institute (2013).

[15]. Luo Jinli (2015), “Alipay’s offline battle”, Financial Technology Times, 2015 (2)

[16]. Zhu Xinmiao (2017), “Analysis of the impact of the reform of the fee rates on credit card industry”, Chinese Credit Card, 2017 (12)

[17]. Alice Han Siqi (2021). “Chinese Fintech Companies and Their ‘Going Out’ Strategies”, Journal of Internet and Digital Economics. Vol.1 No.1, pp.47-63 (2021).

[18]. Arnold, M., Murgia, M. Alipay seals Europe deals for China payments: Financial services. Financial Times Retrieved from https://www.proquest.com/newspapers/alipay-seals-europe-deals-china-payments/docview/1856034620/se-2?accountid=13625 (2016).

[19]. Anonymous. Veea and CITCON partnership enables retailers and restaurants in the United States to accept Alipay and WeChat pay: Integration accommodates payment preferences of Chinese tourists, driving traffic to participating businesses and optimizing customer experiences. PR Newswire, May 15, 2018. https://www.proquest.com/wire-feeds/veea-citcon-partnership-enables-retailers/docview/2038624628/se-2?accountid=13625 (2018).

[20]. Ren Gaofang “The enlightenment of American third-party payment regulatory system to China”, Financial Development Review, 2012 (10).

[21]. Chinese National Bureau of Statistics http://www.stats.gov.cn/wzgl/ywsd/201610/t20161014_1409482.html (2016).

[22]. Anonymous, “The People's Bank of China requires all third-party payment institutions to access the network”, Finance and Accounting, 2017 (10).

[23]. BIS Annual Economic Report, https://www.bis.org/publ/arpdf/ar2020e.pdf (2020).

[24]. Wang Di, Zhong Ting, “China's individual income tax reform proposals from the perspective of comparing Income tax in China and the United States”, Industrial Innovation, CNKI (2016).

[25]. Li Jian, Wang Yue, “Analysis and reference of differences between Chinese and American individual income tax systems”, Modern Economic Information, CNKI (2012).

[26]. Armstrong, Robert, and Federica Cocco, "Credit Cards Offer $6bn Settlement: Visa and Mastercard Seek Deal on 'Swipe Fees' Case Related to Fight Over Network Rules [USA Region]." Financial Times, Sep 19, pp. 11. ProQuest, https://www.proquest.com/newspapers/credit-cards-offer-6bn-settlement/docview/2122927286/se-2?accountid=13625. (2018).

[27]. Tett, Gillian. "The New Bankers: Cuddly, Cool, with a Passion for Dance Music." FT.Com, 2019. ProQuest, https://www.proquest.com/trade-journals/new-bankers-cuddly-cool-with-passion-dance-music/docview/2198291891/se-2?accountid=13625 (2019).

[28]. Goldstein, Phil. "Apple's Cook Open to Partnering with e-Commerce Behemoth Alibaba." FierceWireless, 2014. ProQuest, https://www.proquest.com/trade-journals/apples-cook-open-partnering-with-e-commerce/docview/1618003334/se-2?accountid=13625 (2014).

[29]. Greg Weed, “Apple Pay: The first year”, Phoenix Marketing International 2015, www.phoenixmi.com (2015).

[30]. Horace Dediu, “A small-screen iPod, an Internet Communicator and a Phone”, Asymco 2018, http://www.asymco.com/author/asymco/page/8/ (2018).

[31]. Market Mad House, “Apple Pay could be worth $190 billion by 2022”, Medium, https://medium.com/the-capital/apple-pay-could-be-worth-190-billion-by-2022-market-mad-house-edc08ee4a4b7 (2019).

[32]. Anonymous, “EU Digital Markets Act and Digital Services Act explained”, News European Parliament, https://www.europarl.europa.eu/news/en/headlines/society/20211209STO19124/eu-digital-markets-act-and-digital-services-act-explained (2021)

[33]. The Federal Government, “Final Rules, Guidance, Exemptive Orders & Other Actions on Dodd-Frank Act”, https://www.cftc.gov/LawRegulation/DoddFrankAct/Dodd-FrankFinalRules/index.htm (2009).

[34]. The Fed, “Federal Reserve’s Regulations”, Federal Reserve, https://www.federalreserve.gov/supervisionreg/reglisting.htm

[35]. Anonymous, Business Strategy: Results from the 2012 Consumer Payments Survey, IDC Financial Insights, https://www.idc.com (2012).

[36]. Anonymous, The Pulse of Fintech 2021H1, KPMG International. https://home.kpmg/xx/en/home/insights/2021/08/pulse-of-fintech-h1-2021-global.html; https://www.pitchbook.com (2021).

[37]. Xie, Stella Y. "Using Smartphones to Pay? that's so Yesterday in China; Chinese Consumers can Pay at some Retail Stores by Simply Looking into Facial-Recognition Machines at Checkout." Wall Street Journal (Online), Jun 11, 2019. ProQuest, https://www.proquest.com/newspapers/using-smartphones-pay-thats-so-yesterday-china/docview/2237712201/se-2?accountid=13625 (2019).

[38]. Shin, Bongsik, and Geun L. Ho. "Ubiquitous Computing-Driven Business Models: A Case of SK Telecom's Financial Services." Electronic Markets, vol. 15, no. 1, pp. 4-12. ProQuest, https://www.proquest.com/scholarly-journals/ubiquitous-computing-driven-business-models-case/docview/216888985/se-2?accountid=13625 (2005).

[39]. Anonymous, "Finance and Economics: Banking at Your Convenience." The Economist, vol. 354, no. 8154, Jan 22, pp. 69-70. ProQuest, https://www.proquest.com/magazines/finance-economics-banking-at-your-convenience/docview/224065780/se-2?accountid=13625 (2000).

[40]. Anonymous, "Press Release: Boku Partners with LINE Pay Japan to Enable eWallet Payments to Merchants." Dow Jones Institutional News, Jun 25, ProQuest, https://www.proquest.com/wire-feeds/press-release-boku-partners-with-line-pay-japan/docview/2417195289/se-2?accountid=13625 (2020)

[41]. Anonymous, "Ant Financial to Invest $200 Million in South Korea's Kakao Pay." Dow Jones Institutional News, Feb 20. ProQuest, https://www.proquest.com/wire-feeds/ant-financial-invest-200-million-south-koreas/docview/1870164160/se-2?accountid=13625 (2017).

[42]. Reportlinker. “Mobile and alternative payments in the U.S., 3rd edition.” PR Newswire, https://www.proquest.com/wire-feeds/mobile-alternative-payments-u-s-3rd-edition/docview/1267251313/se-2?accountid=13625 (2013).

[43]. Xpeng Motor, “Xpeng Motors and Alipay jointly develop in-car payment functions, with first implementation due on Xpeng P7”, Xpeng Motor, https://en.xiaopeng.com/news/news_info/3357.html (2019).

[44]. Mick Chan, “Mercedes-Benz partners with Visa for in-car payments; service to be available in Germany, UK from 2022”, Paultan, https://paultan.org/2021/11/11/mercedes-benz-partners-with-visa-for-in-car-payments/ (2021).

[45]. Anonymous (2019), “ Germany : Traditional watches made smart with sony and wirecard's digital payment technology.”. MENA Report, https://www.proquest.com/trade-journals/germany-traditional-watches-made-smart-with-sony/docview/2181971305/se-2?accountid=13625 (2019)

[46]. Anonymous, “Jawbone puts mobile payments into new Up4 fitness band.” 2015. Dow Jones Institutional News, Apr 16, 2015. https://www.proquest.com/wire-feeds/jawbone-puts-mobile-payments-into-new-up4-fitness/docview/2068324281/se-2?accountid=13625 (2015).

[47]. Anonymous, “The cutter blog: Will wearables disrupt the financial sector?” Newstex Trade & Industry Blogs , https://www.proquest.com/blogs-podcasts-websites/cutter-blog-will-wearables-disrupt-financial/docview/1792594593/se-2?accountid=13625 (2016).

[48]. Anonymous, "STUDY: 65 Percent of U.S. Consumers Expect Virtual Reality Will Change the Way People Shop: Worldpay's "the 360 Consumer: How VR is Reshaping the Buying Experience" Report Predicts VR Adoption Will Increase Across the Globe, Delivering Major Benefits to the Retail Industry in the U.S." NASDAQ OMX's News Release Distribution Channel, May 25, 2017. ProQuest, https://www.proquest.com/wire-feeds/study-65-percent-u-s-consumers-expect-virtual/docview/1902070694/se-2?accountid=13625 (2017).

[49]. Paramjeet Verma, “Meta universe payment is coming!Mobile payment patent authorized under Xiaomi VR environment”, Gamingsym, https://gamingsym.in/meta-universe-payment-is-comingmobile-payment-patent-authorized-under-xiaomi-vr-environment/

[50]. Anonymous, “Smile to get discounts in Tmall's unmanned supermarket”, China Daily, https://www.chinadaily.com.cn/bizchina/4thwic/2017-12/05/content_35215865.htm (2017).

[51]. Anonymous, “First NY BitLicense Issued to Circle Mobile Payments Company”, Newsbtc, https://www.newsbtc.com/news/first-ny-bitlicense-issued-to-circle-mobile-payments-company/ (2016)

[52]. Kate Rooney, “Square shares jump to a record after company gets regulatory green light for cryptocurrency trading in New York”, CNBC, https: //www.cnbc.com/amp/2018/06/18/square-customers-can-now-trade-cryptocurrency-in-new-york.html (2018).

[53]. Anonymous, “Customers can now buy, hold and sell cryptocurrency directly within the Venmo app with as little as $1”, PRNewswire, https://newsroom.paypal-corp.com/2021-04-20-Introducing-Crypto-on-Venmo (2021).

[54]. Anonymous, “A digital Euro”, The European Central Bank, https://www.ecb.europa.eu/paym/digital_euro/html/index.en.html (2021).

[55]. Anonymous, “China central bank launches digital yuan wallet apps for Android, iOS”, Reuters, https://www.reuters.com/markets/currencies/china-cbank-launches-digital-yuan-wallet-apps-android-ios-2022-01-04/ (2021).

[56]. Anonymous, “China Offers Digital Yuan at Olympics to Test Overseas Appeal”, Bloomberg News, https://www.bloomberg.com/news/articles/2022-01-10/china-offers-digital-yuan-at-olympics-to-test-overseas-appeal (2022).