1. Introduction

Ctrip was founded in 1999 in Shanghai and has over 30,000 employees so far [1]. With the operating principle of "insisting on customer-centeredness", Ctrip has successfully combined traditional tourism and the Internet to become an established online travel provider with over 100 million members. Ctrip has a wide range of businesses, including hotel booking, vacation, ticket booking, and business travel information. After more than a decade of development, its business has steadily risen and gradually become a leader in the travel industry and was listed on NASDAQ in December 2003. Ctrip ranks second in the online air ticket business and is among the top in hotel booking; it also has the distinct advantage of having more than 600,000 member hotels available for booking nationwide. Where to Go was founded in Beijing in February 2005, Go.com is an emerging online travel booker. It successfully pioneered the vertical search travel product model and quickly completed its first three rounds of financing within four years. It launched a national hotel search and comparison service in 2007 and a hotel review system in 2010, combining vertical travel search with online travel reviews, making it the premier mobile application client. In 2011, Go.com officially partnered with Baidu and went public in the U.S. in November 2013. Where to go.com has a clear advantage in terms of the largest mobile terminal user activity in similar competitive varieties, intelligent leading search technology and support for transferring airline reservations. The two online travel business company business form is different, but by hand to where the vertical search airline tickets, hotels to come fierce, different all sell up, will soon be another old in red travel website Yilong left behind, and Ctrip respectively become the second and the boss of online travel. The two families in the past few years to fight the price war war of words, the offensive is unusually fierce [2].

In the previous period, Ctrip had sent its intention to cooperate and merge with Where to go, but because the two companies did not seriously consider as well as negotiate, where to go refused to write into the request. At a later stage, both companies experienced losses. When events developed contrary to their own expectations, the senior leaders of both companies began to consider the merger. Eventually, after many considerations as well as negotiations, the two companies decided to enter into a cooperative relationship. Ctrip announced that it and GoWhere agreed to merge and after the merger Ctrip will own 45% of GoWhere shares. The merger will take the form of Baidu selling its shares in GoWhere and then taking a controlling stake in Ctrip, with Baidu owning 25% of Ctrip's shares. According to foreign media statistics, the combined market value of Ctrip and GoWhere reached $15.6 billion. According to the transaction, Baidu will exchange 178,702,519 shares of GoWhere's Class A common stock1 and 11,450,000 shares of GoWhere's Class B common stock for 11,488,381 additional shares of Ctrip's common stock through this transaction prior to its completion. Upon completion of the transaction, Baidu will own approximately 25% of the total voting power of Ctrip that can be represented by Ctrip's common shares, and Ctrip will own approximately 45% of the total voting power of GoWhere [3].

After the deal was completed, those two companies announced that they will continue to operate as two independent companies, but they will work together to provide better products and services for customers.

2. Purpose and Reasons for Strategic Cooperation

2.1. Purpose for Strategic Cooperation

Over-the-Air Technology (OAT) has a long history of spending huge amounts of money to quickly acquire users and burning a lot of money to quickly capture the market and become the industry leader. According to the 721 laws of the Internet, the industry leader occupies more than 70% of the market share, the second place occupies 20% of the market share, and the rest of the companies together occupy 10% of the market share [4]. However, this model is inherently unsustainable because it is not able to sustain output and achieve corporate profitability. The cooperation between Ctrip and Go.com can quickly put an end to the money-burning captive model, avoiding multiple consumption of resources and improving the core competitiveness of the companies.

In addition, Ctrip and Go.com, as the top two companies occupying market share in the online travel industry, both took the form of financial subsidies or large discounts in hotel booking and ticket booking to seize market share before the merger. After the merger, they can reduce investment in the face of highly overlapping businesses, which will reduce a lot of unnecessary cost loss for the companies and maximize the use of resources.

Ctrip to go through mergers and acquisitions, industry advantages to enhance, weaknesses to complement each other, through the effective integration of resources to achieve the maximum use of resources. Both companies' visibility is enhanced, and both companies can stabilize their positions and gain more turnover. At the same time, Ctrip is a larger and more established company, while Where to go is a newcomer, and they can integrate all kinds of information about travel with their search technology. After merging the advantages of the two companies, they can reduce operating costs and expand the market.

2.2. Reasons for Strategic Cooperation

With the development of China's online travel market, competition between companies is becoming more and more intense, users are demanding more and more products and services, product quality needs to be improved, and both companies are in a poor financial position, with both companies experiencing a general downward trend in revenue, which was much worse before the merger. In the fierce price war, both Ctrip and GoWhere are facing losses and are in a difficult situation.

Ctrip is under pressure from the continued decline in profits brought about by the industry's price wars and is facing the prospect that it will be difficult to achieve profitability without increasing its M&A efforts. Therefore, after continuing to acquire a number of companies including Yilong, it filed a merger application to Go.com in 2015. Where to go in 2014 to achieve a year-on-year growth in operating income of more than 100%, but the same year the total expenditure expenses year-on-year growth rate of more than 300% [5], is obvious to low prices to seize the market, profit for market share policy, but also led to where to go continued unprofitable, the root cause of increasingly serious losses. In order to maintain normal ongoing operations, Go.com needs to obtain new sources of funding to ease the pressure on cash flow.

At the same time, Baidu, as an investor in Ctrip and the de facto controller of Where to Go, played a significant role in the partnership. Ctrip has the advantage of offline resources that GoWhere can't match, so when Ctrip proposed a merger and acquisition through an equity swap, Baidu, as the controlling party of the capital operation, actively stepped in to coordinate and facilitate the merger [6].

3. Market Competition Pattern

3.1. The Competitive Landscape of Travel App Before the Merger

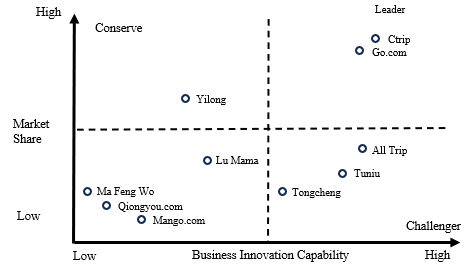

China's online tourism industry gradually developed and grew with the rise of the Internet, and after 1997, Huaxia Travel, Ctrip and Yilong.com were established one after another, which was the beginning of China's online tourism industry. Ctrip was listed in the United States in 2003 and became the first listed online travel company in China. With the listing of Ctrip, the rapid growth of online tourism companies in China was accelerated. With the continuous expansion of the market scale, Where to go, Tuniu, Yilong, etc. have also been listed. The involvement of capital has opened up a price war in the tourism industry chain. China's online tourism industry has gradually formed a situation of "two levels and many strong", with Ctrip and Go.com occupying more than 50% of the market share [7]. According to the data of Eview Intelligence, a four-quadrant diagram of online tourism competitor analysis in China was drawn, with the vertical axis being market share and the horizontal axis being business innovation ability, as shown in Figure 1.

Figure 1. Four-quadrant diagram of China's online travel competitor analysis (Photo credit: Smart Cities and Tourism Statistics [8]).

As can be seen, there are currently many travel companies in our country. These companies are uneven in their business. On the axis, it can be seen that among these mainstream travel websites, only Ctrip and GoWhere are in the area of leaders, and both companies are far ahead of the others in terms of market share as well as business innovation capabilities.

3.2. Competitive Prospects after the Merger

The OTA market itself has very strong instrumental attributes, and relatively speaking, the stickiness of users is not high. As the leading companies in the online travel industry, Ctrip and GoWhere.com have conducted mergers and acquisitions to integrate various resources and jointly play their respective advantages, which greatly reduces the operating costs required to provide products and services to users and quickly completes the expansion of market share. According to the industry data report at the end of 2015, the market share of Ctrip and Go.com was nearly 70% [9], turning the domestic online tourism industry into a new pattern of "one super and many strong". The merger of the two has increased the scale advantage of the companies, enhanced the barriers to entry in the industry, and has obvious operational synergies.

The merger of Ctrip and Go.com has resulted in a close alliance in the hotel and vacation sectors, while remaining relatively independent in the airline ticket business. Such a management adjustment is its way to better complement each other in terms of the products they offer, the services they provide and the innovation of their business models, to reduce the consumption of resources brought about by competition and to improve their bargaining power in the entire travel industry chain upstream and downstream. The systemic effect is evident in both management and financial aspects [10].

At the same time, the two merged to cooperate with other online travel platforms to jointly maintain the healthy development of the travel market and ease the competitive pressure in the market. After the merger, Ctrip and GoWhere will increase their investment in technology, improve the level and stability of technology, and realize the intelligent operation of online travel. At the same time, to improve the quality of service, to provide consumers with better quality, more appropriate service. The merger of Where to go and Ctrip can lead to data interoperability between the two companies and better access to user profiles, which can promote the use of big data to capture user needs more accurately.

4. Conclusion

This paper studies the strategic merger of Ctrip and Where to go and analyze the event in order to understand the many ways of deserving benefits in business. In addition to this, 10 Internet business mergers and acquisitions took place in China's Internet industry in 2015, which shows that in the process of the rapid development of Internet businesses driven by the Internet, the development of businesses from hostile competitive relationships to mergers and the gradual formation of new market patterns is also a growth process in the development of the Internet business market. This paper takes the merger of Ctrip and Go.com as a case study, outlines the corporate profiles of Ctrip and Go.com and their operations before the merger; focuses on the strategic cooperation purpose and reasons for the merger, and examines the impact of the merger on the online tourism market landscape before and after the merger, and draws insights into the advantages of strategic choices based on synergy effects for Internet companies. At the same time, it is important to note that enterprises should ensure the improvement of product and service quality on the basis of expanding market share, and only by guaranteeing users' offline consumption experience can they always be invincible.

References

[1]. Qi Cha Cha. https://www.qcc.com/firm/78189c7d652ac1934affde427ac991a0.html

[2]. Yi You Ku Trip.com (2022), https://m.1youku.com/guangzhoulvyou/76262.html

[3]. Ctrip homepage. https://www.ctrip.com/

[4]. Xiekch (2017), Definition of 721 in IT, https://blog.csdn.net/xiekch/article/details/78540116

[5]. X. Wang, (2015) Go.com's full-year revenue increased more than 100% last year, http://app.why.com.cn/epaper/qnb/html/2015-03/18/content_246698.htm

[6]. W. Tao (2015), Ctrip and Where to go announced a marriage Baidu became the largest shareholder of Ctrip, https://m.huanqiu.com/article/9CaKrnJQVKJ

[7]. X. Yu, (2015) OTA market concentration increased, Ctrip accounted for more than 50%.

[8]. B. Han, (2016) Analysis of the impact of the merger of Ctrip and Where to go on China's online travel industry.

[9]. Phoenix Tech, (2015) Ctrip to Where merged to account for more than 70% of the domestic hotel and airline booking market share

[10]. Business Travel Insights, (2016) Where to go, Ctrip vacation business merger: security inside and outside to accelerate the listing

Cite this article

Zhang,X. (2023). Strategic Analysis of the Merger Between Ctrip and Go.com: Motivation, Market and Outlook. Advances in Economics, Management and Political Sciences,46,159-163.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Qi Cha Cha. https://www.qcc.com/firm/78189c7d652ac1934affde427ac991a0.html

[2]. Yi You Ku Trip.com (2022), https://m.1youku.com/guangzhoulvyou/76262.html

[3]. Ctrip homepage. https://www.ctrip.com/

[4]. Xiekch (2017), Definition of 721 in IT, https://blog.csdn.net/xiekch/article/details/78540116

[5]. X. Wang, (2015) Go.com's full-year revenue increased more than 100% last year, http://app.why.com.cn/epaper/qnb/html/2015-03/18/content_246698.htm

[6]. W. Tao (2015), Ctrip and Where to go announced a marriage Baidu became the largest shareholder of Ctrip, https://m.huanqiu.com/article/9CaKrnJQVKJ

[7]. X. Yu, (2015) OTA market concentration increased, Ctrip accounted for more than 50%.

[8]. B. Han, (2016) Analysis of the impact of the merger of Ctrip and Where to go on China's online travel industry.

[9]. Phoenix Tech, (2015) Ctrip to Where merged to account for more than 70% of the domestic hotel and airline booking market share

[10]. Business Travel Insights, (2016) Where to go, Ctrip vacation business merger: security inside and outside to accelerate the listing