1. Introduction

Digital inclusive finance is one of the current hot topics in China's financial market, which uses emerging technologies such as the Internet and big data to provide a full range of financial services to small and medium enterprises, thus promoting innovation among them. Small and medium-sized businesses (SMEs), which include medium-sized businesses, small businesses, and micro businesses, are those that are legally recognized in the People's Republic of China and have relatively small workforce sizes and operational scales [1]. Financing is needed for SMEs to innovate, and the most crucial route is to borrow money from commercial banks. Commercial banks' interest rate policies will be impacted by the government's regulatory strategy under the wave of digital inclusive finance. This will have an impact on commercial bank loans. This may limit SMEs' access to reliable loans, which may limit their capacity for innovation. Therefore, it's crucial to research how interest rate policies of commercial banks affect small and medium enterprise innovation in the context of digital inclusion finance and to examine the impact of the government.

The literature related to commercial banks' interest rate policies is generally divided into two categories: the macro impact and the micro impact of commercial banks' interest rate policies. The legislation relating to commercial bank interest rate policy generally falls into two categories: the macro impact and the micro impact of commercial banks' interest rate policies. The macro-level related literature is relatively small and focuses on the analysis of market risk management. Studies agree that a decrease in lending rates increases market risk [2]. There are more relevant studies at the micro level, focusing on the analysis of commercial bank performance and risk management. In terms of commercial bank performance, on the one hand, studies have generally concluded that interest rates contribute to commercial bank profits [3, 4], and on the other hand, most studies agree that commercial bank lending rates have a significant positive effect on commercial bank share prices [5, 6]. In the context of commercial bank risk management, studies have found that commercial bank interest rates affect non-performing assets and thus bring about credit risk [7, 8]. However, the commercial banks studied in the relevant literature are foreign banks, and the impact of commercial interest rates on firms is less analyzed. In addition, fewer studies have addressed the influence of government interest rate policies on commercial banks. Therefore, the study needs to analyze the micro impact of commercial banks' lending rates on SMEs, while introducing the government as a subject.

Previous paper related to innovation in SMEs focuses on analyzing the tripartite game among banks, enterprises, and venture capital institutions (VC) to achieve win-win cooperation. On this basis, the relevant recommendations are divided into two categories: those for banks and those for VCs. The first category of recommendations focuses on reducing banks' innovation requirements for SMEs to optimize the utility of banks and firms [9]; the second category of recommendations focuses on encouraging VCs to cooperate with SMEs to better promote SME innovation [10, 11]. However, none of the related literature visually expresses the specific impact of commercial bank interest rates on SME innovation. In addition, some literature also studies the relationship between government and business innovation but focuses on green innovation [12, 13], while the literature focuses on analyzing government resource support [14] and tax incentives [15], and the related studies on the impact of government regulatory policies on business innovation are not clear. In contrast, government regulatory policies play a role in both commercial bank interest rate policies and SME innovation, so the main role of government in influencing SME innovation needs to be emphasized.

Studies on the impact of commercial banks' interest rate policies on SMEs' innovation have been less common than studies on how those policies have affected SMEs' development. These studies also tend to be more dated and prefer study on the role that commercial banks have played in the expansion of SME in nations like Pakistan [16], Malawi [17], and Nigeria [18, 19]. It is crucial to concentrate on China and investigate how the interest rate practices of commercial banks impact innovation among SMEs.

In summary, the literature involving commercial banks' interest rate policies is more analytical of the micro impact and more focused on studying commercial banks' own returns and risks; the literature involving SMEs' innovation does not clearly analyze the role of commercial banks' interest rates and the government's digital inclusion financial regulatory policies on them; the link between the two is more related to foreign banks' development of enterprises. In addition, the literature does not cover much impact analysis in the context of digital inclusion finance. In order to provide a thorough analysis of the relationship between commercial banks' interest rate policies and SMEs' innovation and to make pertinent recommendations for promoting SMEs' innovation as well as balancing the roles of commercial banks and the government in digital inclusive finance, we build a three-party evolutionary game model with a focus on China.

2. Model Analysis of the Evolutionary Game Between Commercial Banks, Government, and SMEs

2.1. Page Setup Problem Description and Model Construction

Commercial banks are concerned with maximizing profits while needing to balance risk. In setting interest rate policies, commercial banks need to consider credit demand, credit risk, and market competition. The government is concerned with economic growth, social stability, and the safety of the financial system. The government may promote economic growth and maintain economic stability by adjusting its digital inclusive finance regulatory policy, requiring commercial banks to lower interest rates, and regulating SME innovation. SMEs are concerned about the cost of financing and the return on innovation inputs. Therefore, SMEs will weigh factors such as interest rates, speed, and difficulty of financing from different channels when making innovation decisions, and compare them with the returns obtained from the project. Therefore, in this game mode, the objectives of the three parties may conflict, for example, commercial banks may prefer to raise interest rates to increase their returns; the government may want to make commercial banks lower their interest rates through regulation to promote SMEs' innovation; and SMEs want to obtain low-cost financing to realize the return on innovation inputs and reduce government regulation on them. On the basis of this, we create a three-party evolutionary game model based on commercial banks, the government, and SMEs in the context of digital inclusive finance. We study the evolutionary game equilibrium and stabilization strategies of commercial banks' lending rates, government regulation, and other factors in order to examine the effects of commercial banks' interest rate policies on SMEs' innovation and the role that government regulation policies play in it.

2.2. Parameter Setting and Payoff Matrix

In this study, we specify the pertinent settings and examine the advantages from the viewpoint of three participants who each select a different strategy. The benefits matrix of the evolutionary game model of commercial banks, government, and SMEs is displayed in Table 2, and the parameters of the model are established in Table 1.

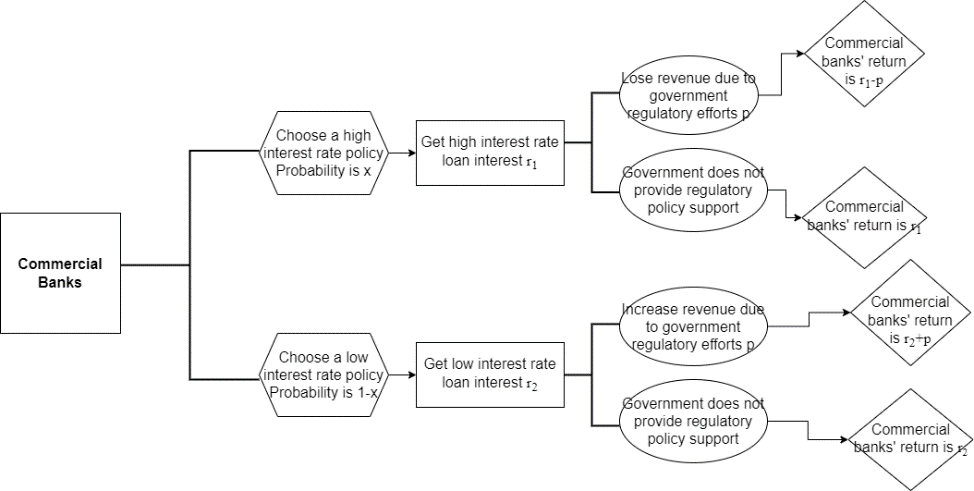

On the commercial bank (B) side, commercial banks have two options: high-interest rate policy (H) and low-interest rate policy (L), and the analysis of the benefits of the different options is shown in Figure 1:

As shown in Figure 1, in the first case, the probability that a commercial bank chooses a high-interest rate policy is \( x \) . The benefits are influenced by the following factors: the commercial bank's own loan interest rate and the government's regulatory policy support. Therefore, on the one hand, when commercial banks choose a high-interest rate policy, commercial banks will get loan interest \( {r_{1}} \) through high loan interest rate; on the other hand, if the government provides regulatory policy support, commercial banks' credit risk problem is solved to a certain extent, so commercial banks should reduce the interest rate to accept SME loans, and when commercial banks choose high-interest rate, SMEs will think that credit is undervalued to turn to other institutions to apply for loans, and thus commercial banks will reduce the p gain, that is, the loss of revenue from the government's regulatory effort \( p \) . In summary, commercial banks' gain is \( {r_{1}}-p \) . If the government does not provide regulatory policy support, it does not affect the revenue gained by commercial banks due to the high-interest rate policy, and in summary, commercial banks gain is \( {r_{1}} \) .

In the second case, the probability that a commercial bank chooses a low-interest rate policy is \( 1-x \) . The gain is influenced by the following factors: the commercial bank's own lending rate and the government's regulatory policy support. Therefore, on the one hand, when commercial banks choose a low-interest rate policy, commercial banks will get loan interest \( {r_{2}} \) through low loan rates; on the other hand, if the government provides regulatory policy support, the moral hazard problem brought about by low-interest rates of commercial banks is solved to a certain extent, thus commercial banks increase p returns, that is, the increase in returns brought about by the strength of government regulation \( p \) . In summary, commercial banks gain \( {r_{2}}+p \) . If the government does not provide regulatory policy support, and does not affect the commercial banks due to the low-interest rate policy gains, the sum of commercial banks' return is \( {r_{2}} \) .

Figure 1: Benefit analysis of different options for commercial banks.

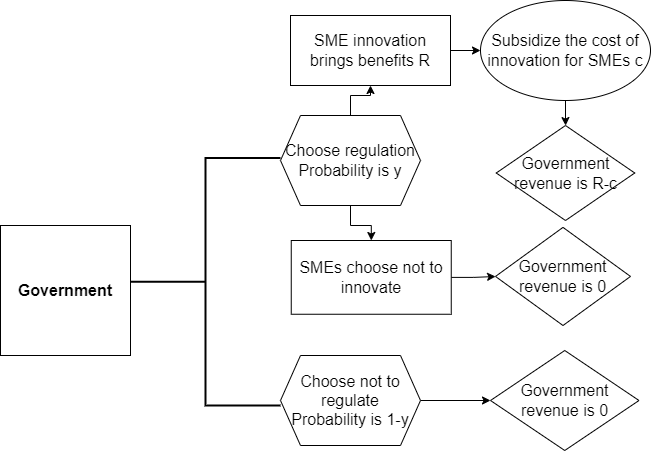

On the government (G) side, there are two options: regulation (S) and no regulation (NS), and Figure 2 illustrates the benefits of each option.

Figure 2 illustrates the probability that the government will decide to regulate in the first scenario. The benefits are influenced by the following factors: the benefits of SME innovation and the costs of SME innovation. Therefore, if the SME chooses to innovate, on the one hand, the benefits \( R \) brought by SME innovation makes government regulation gain more utility; on the other hand, SME innovation brings cost \( c \) , and government regulation needs to be subsidized, thus the benefit is reduced, and in summary, the government benefit is \( R-c \) . If the SME chooses not to innovate, the government benefit is 0.

In the second scenario, there is a \( 1-y \) chance that the government decides not to regulate. Whether or not the SME innovates has no bearing on the government's gain, which is 0.

Figure 2: Benefit analysis of different options for government.

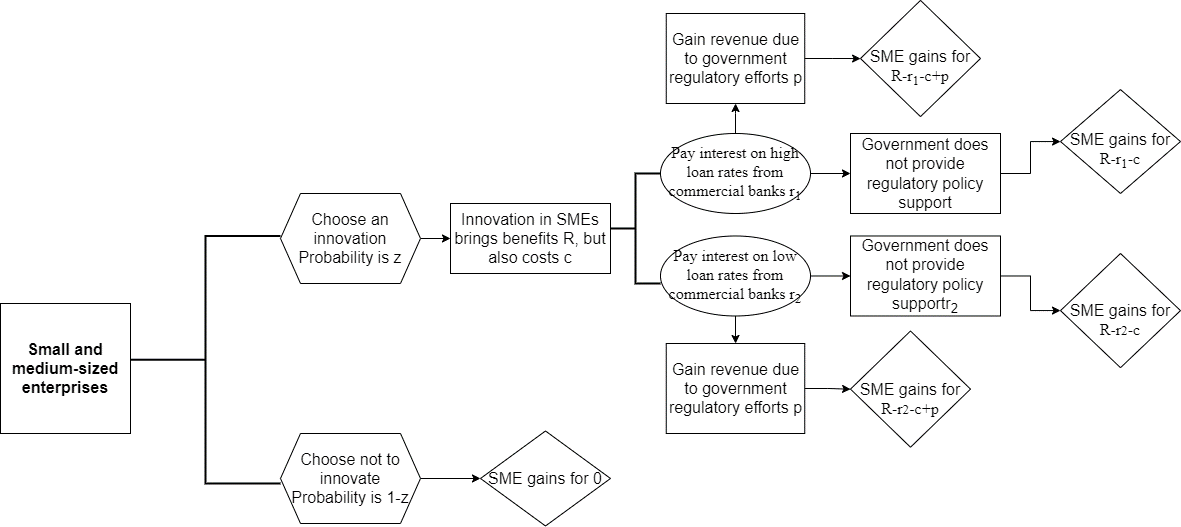

In the case of SMEs (SME), SMEs have two choices: innovate (I) or not innovate (NI), and the analysis of the benefits of different choices is shown in Figure 3:

Figure 3 illustrates the probability that the SME will opt to innovate in the first scenario. The following variables have an impact on the benefits: the advantages of SME innovation, the costs of SME innovation, the interest rate of commercial bank loans, and the support of governmental regulatory regulations. Therefore, on the one hand, SME innovation brings benefits \( R \) and also costs \( c \) . At the same time, SMEs need innovation financing and commercial banks' interest rates have a certain impact on their innovation benefits; on the other hand, if the government provides regulatory policy support, SME innovation is supported to a certain extent and benefits increase \( p \) . In conclusion, the return for SMEs under commercial banks' high-interest rate policies is \( R-{r_{1}}-c+p \) , whereas the return for SMEs under their low-interest rate policies is \( R-{r_{2}}-c+p \) . The SME's return, which is \( R-{r_{1}}-c \) under the high-interest rate policy of commercial banks and \( R-{r_{2}}-c \) under the low-interest rate policy of commercial banks, is unaffected if the government does not support regulatory policy.

In the second case, the probability of SMEs deciding not to innovate is \( 1-z \) . The commercial bank interest rate and whether the government regulates it or not will not affect the SME return, and the return is 0.

Figure 3: Benefit analysis of different options for SMEs.

Table 1: Parameter setting of the evolutionary game model among commercial banks, government and SMEs.

Parameters | Implications |

\( {r_{1}} \) | Interest on loans with high-interest rate policy of commercial banks |

\( {r_{2}} \) | Interest on loans with low-interest rate policy of commercial banks |

\( x \) | Probability of commercial banks choosing a high interest rate policy |

\( 1-x \) | Probability of commercial banks choosing a low interest rate policy |

\( p \) | Government regulatory policy support efforts |

\( y \) | Probability that the government will decide to regulate |

\( 1-y \) | Chance that a government decision to forgo regulation |

\( c \) | SME innovation cost |

\( R \) | SME innovation benefits |

\( z \) | Probability of SMEs deciding to innovate |

\( 1-z \) | Probability that SME will decide against innovating |

Table 2: The payoff matrix of the tripartite game model of commercial banks, government, and SMEs.

Government G | ||||||||

Regulation S (y) | No regulation NS (1-y) | |||||||

Small and medium-sized enterprises SME | Small and medium-sized enterprises SME | |||||||

Innovation I (z) | No innovation NI (1-z) | Innovation I (z) | No innovation NI (1-z) | |||||

Commercial banks B | High interest rate L (x) | ( \( {r_{1}}-p \) , \( R-{r_{1}}-c+p \) , \( R-c \) ) | ( \( {r_{1}}-p \) ,0,0) | ( \( {r_{1}} \) , \( R-{r_{1}}-c \) ,0) | ( \( {r_{1}} \) ,0,0) | |||

Low interest rate H (1-x) | ( \( {r_{2}}+p \) , \( R-{r_{2}}-c+p \) , \( R-c \) ) | ( \( {r_{2}}+p \) ,0,0) | ( \( {r_{2}} \) , \( R-{r_{2}}-c \) ,0) | ( \( {r_{2}} \) ,0,0) | ||||

3. Analysis of the Game's Equilibrium Between the Government, Commercial Banks, and SMEs

Replicative dynamic equations are established according to the classification of participants because replicative dynamic equations are used in this paper's evolutionary game analysis:

3.1. Commercial Banks' Stabilization Strategy

In this study, it is calculated that commercial banks that choose high or low interest rate policies will earn expected returns denoted as E(H)x and E(L)1-x, respectively. The average expected return E(B)x is given by the formulas below.

\( {E(H)_{x}}=yz({r_{1}}-p)+y(1-z)({r_{1}}-p)+(1-y)z{r_{1}}+(1-y)(1-z){r_{1}}=y({r_{1}}-p)+(1-y){r_{1}} \) (1)

\( {E(L)_{1-x}}=yz({r_{2}}+p)+y(1-z)({r_{2}}+p)+(1-y)z{r_{2}}+(1-y)(1-z){r_{2}}=y({r_{2}}+p)+(1-y){r_{2}} \) (2)

\( {E(B)_{x}}=x[y({r_{1}}-p)+ (1-y){r_{1}}]+(1-x)[y({r_{2}}+p)+(1-y){r_{2}}] \) (3)

The replicated dynamic equation for commercial banks' decision to adopt a high-interest rate policy is derived from the aforementioned three equations as follows:

\( F(x)=dx/dt=x(1-x)({E(H)_{x}}-{E(L)_{1-x}})=x(1-x)[y({r_{1}}-{r_{2}}-2p)+(1-y)({r_{1}}-{r_{2}})] \) (4)

The replica dynamic equations' partial derivatives are simultaneously generated in the manner described below:

\( f \prime (x)=dx/dt=(1-2x) [y({r_{1}}-{r_{2}}-2p)+(1-y)({r_{1}}-{r_{2}})] \) (5)

The stability theorem for differential equations states that commercial banks must meet \( F(x)=0 \) and \( f \prime (x) \lt 0 \) in order to obtain the evolutionary stability strategy for linear stability analysis. Equations (4) and (5)-based calculations demonstrate that a high-interest rate policy by commercial banks is a stable one under government oversight. Although the government provides regulations that will require commercial banks to reduce loan interest rates, but also regulate SME financing, there is still a certain credit risk, commercial banks still choose high-interest rate policy to protect their interests, but will appropriately reduce the upper limit of loan interest rates to promote SME financing.

3.2. Stabilization Strategy of Government

This study calculates the expected returns to the government's decision to regulate or not to regulate and displays them as E(S)y and E(NS)1-y, respectively. Calculating the expected return E(G)y is done as follows:

\( {E(S)_{y}}=xz(R-c)+(1-x)z(R-c)=z(R-c) \) (6)

\( {E(NS)_{1-y}}=0 \) (7)

\( {E(G)_{y}}= yz(R-c) \) (8)

The replication dynamic equation for the government selecting regulation is derived from the three equations mentioned above as follows:

\( F(y)=dy/dt=y(1-y)({E(S)_{y}}- {E(NS)_{1-y}})=y(1-y)[z(R-c)] \) (9)

Partial derivatives of the replica dynamic equations are simultaneously produced as follows:

\( f \prime (y)= (1-2y)[z(R-c)] \) (10)

The stability theorem of differential equations states that for linear stability analysis, the government needs to satisfy \( F(y) = 0 \) and \( f \prime (y) \lt 0 \) to get the evolutionary stability strategy.

Government regulation is the stability strategy when SMEs exhibit creative behavior, according to the calculations of equations (9) and (10). SME innovation will bring a positive impact on the society and economy, and the government's utility mainly comes from economic growth, and the government will provide corresponding support, i.e., guarantee the benefits of quality SME innovation through regulation.

3.3. Stabilization Strategy of SMEs

The expected returns of SMEs choosing to innovate or not innovating are calculated in this study and are indicated as E(I)z and E(NI)1-z, respectively. The formulas below provide the average expected return E(SME)z.

\( {E(I)_{z}}=xy(R-{r_{1}}-c+p)+(1-x)y(R-{r_{2}}-c+p)+x(1-y)(R-{r_{1}}-c)+(1-x)(1-y)(R-{r_{2}}-c) \) (11)

\( {E(NI)_{1-z}}=0 \) (12)

\( {E(SME)_{z}}= z[xy(R-{r_{1}}-c+p)+(1-x)y(R-{r_{2}}-c+p)+x(1-y)(R-{r_{1}}-c)+(1-x)(1-y)(R-{r_{2}}-c)] \) (13)

Based on the three equations above, the replication dynamic equation for SME selection innovation is obtained as follows:

\( F(z)=dz/dt=z(1-z)[xy(R-{r_{1}}-c+p)+(1-x)y(R-{r_{2}}-c+p)+x(1-y)(R-{r_{1}}-c)+(1-x)(1-y)(R-{r_{2}}-c)-0]=z(1-z)[x(R-{r_{1}}-c)+(1-x)(R-{r_{2}}-c)+yp] \) (14)

Simultaneously, the partial derivatives of the replica dynamic equations are calculated as follows:

\( f \prime (z)=(1-2z)[x(R-{r_{1}}-c)+(1-x)(R-{r_{2}}-c)+yp] \) (15)

For linear stability analysis, the differential equations stability theorem states that SMEs need to satisfy \( F(z)=0 \) and \( f \prime (z) \lt 0 \) to get an evolutionary stable strategy. When \( (R-{r_{2}}-c+yp)/({r_{1}}-{r_{2}}) \gt 1 \) , equations (14) and (15) calculate that \( x \lt (R-{r_{2}}-c+yp)/({r_{1}}-{r_{2}}) \) is constant and SMEs pick innovation as a stable strategy, i.e., the innovation revenue \( R \) of SMEs increases, the innovation cost \( c \) decreases, the government regulation \( p \) strengthens, and the high interest rate \( {r_{1}} \) of commercial banks decreases. It follows that lowering the loan interest rate ceiling of commercial banks' high interest rate policy, increasing government regulation and increasing the net benefits of their own innovation will make SMEs choose innovation as a stable strategy.

This is due to the fact that SMEs frequently fall into the category of higher risk borrowers, so under the same interest rate policy, the loan interest rate of SMEs generally tends to be the loan interest rate's upper limit; in the event that the loan interest rate's upper limit does not change, the high interest rate policy of commercial banks increases the cost of financing for SMEs, which is detrimental to their ability to innovate and grow; Due to the government's strict regulation of digital inclusive finance and commercial banks' reduction of the upper limit of loan interest rates to a certain extent, SMEs can now access lower cost financing under commercial banks' high interest rate policies, allowing them to focus more on how to lower the costs of innovation, increase the benefits of innovation, and increase the likelihood of successful innovation. Therefore, by opting to develop under governmental control, SMEs can improve their own benefits.

4. Conclusion

Through the equilibrium analysis of the above three-party game model, commercial banks choose high-interest rate policy, the government chooses regulation, and SMEs choose innovation as the evolutionary stabilization strategy. When the three-party game reaches equilibrium, SMEs can obtain more resources for innovation, commercial banks can maintain their own interests, and the government can promote the sustainable stability and development of the economy.

For the stabilization strategy of commercial banks, when the government and commercial banks reach a consensus, setting appropriate interest rate policies can promote SMEs' innovation while protecting their own interests. For the government's stabilization strategy, providing regulatory support for digital inclusive finance can promote better innovation by SMEs and increase their own interests when SMEs show innovative behavior. For the stabilization strategy of SMEs, under the high-interest rate policy set by commercial banks and government regulation, the reduction of loan interest rate cap by commercial banks and the reasonable operation of SMEs themselves to increase the net income of innovation can promote the innovation development of SMEs and achieve win-win cooperation among the three parties.

The loan interest rate ceiling of commercial banks' high interest rate policy is inversely connected with the possibility of SME innovation; the more government regulation, the higher the likelihood of SME innovation; and the greater the net benefit of SME innovation, the higher the probability of SME innovation. Therefore, under the government regulation of digital inclusion, commercial banks should fulfill the cooperation with the government to lower the loan interest rate cap, thus promoting SME innovation, while commercial banks maintain the high interest rate policy to protect their own interests. Therefore, the government should coordinate and act as an intermediary, so that commercial banks can introduce a balanced interest rate strategy for both sides to protect the interests of SMEs as well as their own interests, and thus the government can also benefit from it.

To sum up, in the context of digital inclusive finance, the government and commercial banks should seek cooperation to develop an interest rate policy that is conducive to SMEs' innovation, thus promoting stable economic development. In the cooperation, the government should not ask commercial banks to lower their interest rates too much and harm their interests. At the same time, SMEs should strive to improve their own strengths and seize the opportunities brought by digital inclusive finance, so as to better obtain loans and promote innovation and development.

Acknowledgements

The author honestly thanks the seniors for their patient teaching and parents for their continued encouragement.

References

[1]. Chinese government website, http://www.gov.cn, last accessed 2023/06/22.

[2]. Huy, D. T. N., Thach, N. N., Chuyen, B. M., Nhung, P. T. H., Tran, D. T., & Tran, T. A. (2021) Enhancing Risk Management Culture for Sustainable Growth of Asia Commercial Bank-ACB in Vietnam under Mixed Effects of Macro Factors. Entrepreneurship and Sustainability Issues, 8(3), 291.

[3]. Kingu, P. S., Macha, S., & Gwahula, R. (2018) Impact of Non-performing Loans on Bank’s Profitability: Empirical Evidence from Commercial Banks in Tanzania. International Journal of Scientific Research and Management, 6(1), 71-79.

[4]. Ngumo, K. O. S., Collins, K. W., & David, S. H. (2020) Determinants of Financial Performance of Microfinance Banks in Kenya. arXiv preprint arXiv:2010.12569.

[5]. Phuong, N. T. T., Huy, D. T. N., & Van Tuan, P. (2020) The Evaluation of Impacts of a Seven Factor Model on Nvb Stock Price in Commercial Banking Industry in Vietnam-and Roles of Discolosure of Accounting Policy in Risk Management. International Journal of Entrepreneurship, 24, 1-13.

[6]. Huy, D. T. N., Loan, B. T. T., & Pham, T. A. (2020) Impact of Selected Factors on Stock Price: a Case Study of Vietcombank in Vietnam. Entrepreneurship and Sustainability Issues, 7(4), 2715.

[7]. Hang, H. T. T., Trinh, V. K., & Vy, H. N. T. (2019) Analysis of the Factors Affecting Credit Risk of Commercial Banks in Vietnam. In Beyond Traditional Probabilistic Methods in Economics 2 (pp. 522-532). Springer International Publishing.

[8]. Nivetha, P. (2023) Influence Between Bank Spread Rate and NPA. Shanlax International Journal of Management, 10(3), 45-50.

[9]. Wu, H. B., & Yao, H. X. (2014) A Study on the Limitations of the Evaluation System of Exogenous R&D Investment and Enterprise Innovation Capability in Bank-enterprise Credit--Based on Dynamic Game Perspective. Science and Technology Progress and Countermeasures, 31(16), 136-140.

[10]. Xu, G., & Hua, B. Q. (2016) Evolutionary Game Analysis of Cooperative Innovation between Innovative Firms and Venture Capital Institutions. Enterprise Economics, No.434(10), 62-70.

[11]. Xu, Y. L., Zhang, S. Q., & Guo, S. Q. (2022) Research on the Evolutionary Game of Cooperation of Science and Technology Finance Network Subjects--Based on the Tripartite Analysis of Banks, Venture Capital and Technology Enterprises. Financial Theory and Practice, No.519(10), 26-35.

[12]. Xu, L., Ma, Y. G., & Wang, X. F. (2022) A Study on Environmental Policy Choice of Green Technology Innovation Based on Evolutionary Game: Government Action vs. Public Participation. China Management Science, 30(03), 30-42.

[13]. Bian, C., Chu, Z. P., & Sun, Z. L. (2022) Policy Simulation of Environmental Regulation, Green Credit and Corporate Green Technology Innovation - An Evolutionary Game Perspective Based on Government Intervention. Management Review, 34(10), 122-133.

[14]. Yin, H., Liu, J. X., & Zeng, N. M. (2022) Study on the Strategy Evolution of SME Business Model Innovation under the Role of Venture Capital Guidance Fund. Systems Engineering Theory and Practice, 42(08), 2139-2159.

[15]. Liu, X. C. (2019) A Study on the Evolutionary Game of Government-enterprise under Financial and Tax Incentive Policies--Technology-based SMEs as an Example. Technology Economics and Management Research, No.279(10), 16-21.

[16]. Rasool, S., Dars, J. A., Shah, B. (2013) The Role of Commercial Banks in Production of Small and Medium Enterprises (SMEs) in Pakistan[J]. Available at SSRN 2495796.

[17]. Zidana, R. (2015) Small and Medium Enterprises (SMEs) Financing and Economic Growth in Malawi: Measuring the Impact between 1981 and 2014. Journal of Statistics Research and Reviews, 1(1), 1-6.

[18]. Imoughele, L. E. I. (2014) The Impact of Commercial Bank Credit on the Growth of Small and Medium Scale Enterprises: An Econometric Evidence from Nigeria (1986-2012). Journal of Educational Policy and Entrepreneurial Research, 1(2), 251-261.

[19]. Ovat, O. O. (2016) Commercial Banks’ Credit and the Growth of Small and Medium Scale Enterprises: the Nigerian Experience. Journal of Economics and Finance, 7(6), 23-30.

Cite this article

Wang,Y. (2023). The Impact of Commercial Banks' Interest Rate Policies on SME Innovation under Digital Inclusive Finance. Advances in Economics, Management and Political Sciences,46,184-192.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Chinese government website, http://www.gov.cn, last accessed 2023/06/22.

[2]. Huy, D. T. N., Thach, N. N., Chuyen, B. M., Nhung, P. T. H., Tran, D. T., & Tran, T. A. (2021) Enhancing Risk Management Culture for Sustainable Growth of Asia Commercial Bank-ACB in Vietnam under Mixed Effects of Macro Factors. Entrepreneurship and Sustainability Issues, 8(3), 291.

[3]. Kingu, P. S., Macha, S., & Gwahula, R. (2018) Impact of Non-performing Loans on Bank’s Profitability: Empirical Evidence from Commercial Banks in Tanzania. International Journal of Scientific Research and Management, 6(1), 71-79.

[4]. Ngumo, K. O. S., Collins, K. W., & David, S. H. (2020) Determinants of Financial Performance of Microfinance Banks in Kenya. arXiv preprint arXiv:2010.12569.

[5]. Phuong, N. T. T., Huy, D. T. N., & Van Tuan, P. (2020) The Evaluation of Impacts of a Seven Factor Model on Nvb Stock Price in Commercial Banking Industry in Vietnam-and Roles of Discolosure of Accounting Policy in Risk Management. International Journal of Entrepreneurship, 24, 1-13.

[6]. Huy, D. T. N., Loan, B. T. T., & Pham, T. A. (2020) Impact of Selected Factors on Stock Price: a Case Study of Vietcombank in Vietnam. Entrepreneurship and Sustainability Issues, 7(4), 2715.

[7]. Hang, H. T. T., Trinh, V. K., & Vy, H. N. T. (2019) Analysis of the Factors Affecting Credit Risk of Commercial Banks in Vietnam. In Beyond Traditional Probabilistic Methods in Economics 2 (pp. 522-532). Springer International Publishing.

[8]. Nivetha, P. (2023) Influence Between Bank Spread Rate and NPA. Shanlax International Journal of Management, 10(3), 45-50.

[9]. Wu, H. B., & Yao, H. X. (2014) A Study on the Limitations of the Evaluation System of Exogenous R&D Investment and Enterprise Innovation Capability in Bank-enterprise Credit--Based on Dynamic Game Perspective. Science and Technology Progress and Countermeasures, 31(16), 136-140.

[10]. Xu, G., & Hua, B. Q. (2016) Evolutionary Game Analysis of Cooperative Innovation between Innovative Firms and Venture Capital Institutions. Enterprise Economics, No.434(10), 62-70.

[11]. Xu, Y. L., Zhang, S. Q., & Guo, S. Q. (2022) Research on the Evolutionary Game of Cooperation of Science and Technology Finance Network Subjects--Based on the Tripartite Analysis of Banks, Venture Capital and Technology Enterprises. Financial Theory and Practice, No.519(10), 26-35.

[12]. Xu, L., Ma, Y. G., & Wang, X. F. (2022) A Study on Environmental Policy Choice of Green Technology Innovation Based on Evolutionary Game: Government Action vs. Public Participation. China Management Science, 30(03), 30-42.

[13]. Bian, C., Chu, Z. P., & Sun, Z. L. (2022) Policy Simulation of Environmental Regulation, Green Credit and Corporate Green Technology Innovation - An Evolutionary Game Perspective Based on Government Intervention. Management Review, 34(10), 122-133.

[14]. Yin, H., Liu, J. X., & Zeng, N. M. (2022) Study on the Strategy Evolution of SME Business Model Innovation under the Role of Venture Capital Guidance Fund. Systems Engineering Theory and Practice, 42(08), 2139-2159.

[15]. Liu, X. C. (2019) A Study on the Evolutionary Game of Government-enterprise under Financial and Tax Incentive Policies--Technology-based SMEs as an Example. Technology Economics and Management Research, No.279(10), 16-21.

[16]. Rasool, S., Dars, J. A., Shah, B. (2013) The Role of Commercial Banks in Production of Small and Medium Enterprises (SMEs) in Pakistan[J]. Available at SSRN 2495796.

[17]. Zidana, R. (2015) Small and Medium Enterprises (SMEs) Financing and Economic Growth in Malawi: Measuring the Impact between 1981 and 2014. Journal of Statistics Research and Reviews, 1(1), 1-6.

[18]. Imoughele, L. E. I. (2014) The Impact of Commercial Bank Credit on the Growth of Small and Medium Scale Enterprises: An Econometric Evidence from Nigeria (1986-2012). Journal of Educational Policy and Entrepreneurial Research, 1(2), 251-261.

[19]. Ovat, O. O. (2016) Commercial Banks’ Credit and the Growth of Small and Medium Scale Enterprises: the Nigerian Experience. Journal of Economics and Finance, 7(6), 23-30.