1. Introduction

The luxury goods market is rapidly growing worldwide and has become an important economic sector. Since the gradual recovery from the pandemic, the luxury goods market has shown a trend of consumption recovery and the significant increase in sales. Particularly noteworthy is the rising trend in the Chinese market, with luxury giants such as LVMH and Kering Group reporting double-digit revenue growth in the Asia-Pacific region in their 2023 Q1 financial reports, driven by the recovery effect brought about by the reopening of the Chinese market. According to Forbes' 2023 Global Billionaires List, Bernard Arnault, the head of France's LVMH group, became this year's newly crowned global richest person with a personal wealth of approximately $211 billion. Previously, the world's richest individuals mainly came from traditional fields such as financial services, technology, and real estate, without involvement in the luxury goods industry. Therefore, it is shocking news that LVMH's leader surpassed traditional fields to become the world's richest person in 2023, breaking traditional rankings, which is not an easy feat. LVMH is indeed a very powerful entity.

LVMH has had a DNA of mergers and acquisitions since its establishment. LVMH is composed of three major companies: Moët & Chandon, Hennessy, and Louis Vuitton. Mergers and acquisitions are an important component of corporate strategy, involving issues related to corporate governance, market competition, and organizational culture. The academic community has conducted extensive research on corporate mergers and acquisitions and has achieved rich theoretical and empirical research results.

As one of the most well-known and influential luxury goods conglomerates globally, LVMH's mergers and acquisitions cases are representative and significant. This article utilizes case analysis and comparative analysis to thoroughly examine the merger cases of Tiffany & Co. and Dior. It reveals the strategic thinking and execution process behind these mergers, contributing to a deeper understanding of merger activities in the luxury goods industry and providing valuable insights for other luxury brands.

2. Overview of LVMH

2.1. Group History and Brand Story

LVMH, which stands for Louis Vuitton Moët Hennessy, is a French conglomerate formed by the merger of the globally renowned leather goods company Louis Vuitton and the wine and spirits family Moët Hennessy in 1987. The group owns 75 prestigious brands, including 31 historic brands and six newly established ones. Its major brands include Louis Vuitton, Dior, Givenchy, Hennessy, Moët & Chandon, Sephora, Bulgari, and Tiffany & Co., making it the largest luxury goods conglomerate in terms of global scale.

2.2. Business Scope and Main Business Lines

The group's main businesses cover five sectors: wines and spirits, fashion and leather goods, perfumes and cosmetics, watches and jewelry, and selective retailing. In the wines and spirits sector, LVMH's brands, such as Moët & Chandon, Krug, Veuve Clicquot, and Hennessy are renowned for their exceptional quality and rich history. The fashion and leather goods sector brings together well-established brands with valuable heritage as well as young emerging labels, including Louis Vuitton and Celine. The perfumes and cosmetics division encompasses globally recognized century-old brands as well as promising newcomers, such as Givenchy and Parfums Guerlain. The watches and jewelry division includes internationally acclaimed brands like TAG Heuer, Hublot with its innovative spirit, Zenith with its craftsmanship heritage, and Dior with its creative flair.

2.3. LVMH’s Position in the Global Luxury Goods Market

French luxury giant LVMH Group has a market value of over $500 billion, becoming the first European company to achieve this milestone and briefly entering the list of the world's top ten companies. In terms of sales, market value, and influence in the luxury goods market, LVMH holds the top position globally. According to LVMH's first-quarter financial report for 2023, sales grew by 17% compared to the same period last year, reaching €21.04 billion (approximately RMB 159 billion), far exceeding market expectations of 8.97% growth. In comparison, although Kering and Richemont are also well-known luxury conglomerates, they still have a significant gap compared to LVMH. According to Kering's first-quarter financial report for 2023, its sales reached only €5.077 billion, with a year-on-year growth of 2%. Richemont's financial report for the first quarter of 2023 revealed a sales growth of 19%, reaching €5.322 billion. Comparing these quarterly sales figures, it is evident that LVMH has a significant advantage and demonstrates overwhelming superiority in terms of data.

3. Merger and Acquisition Case Analysis A: Tiffany & Co. Acquisition

3.1. Case Background and Motivation

3.1.1. Merger Background

In 2017, Tiffany & Co. welcomed a new brand CEO, Alessandro Bogliolo. Under his leadership, Tiffany & Co. gained a deeper understanding of the Asian market. Through efforts, Tiffany & Co. achieved a growth of 7% in 2019 and increased its annual revenue to $4.4 billion. This sustained sales growth caught the attention of LVMH. Therefore, in 2019, LVMH announced its acquisition of Tiffany & Co. for $16.2 billion, making it not only the largest acquisition in LVMH's history but also the largest deal in the global jewelry industry to date. At the end of December 2020, this highly anticipated acquisition was successfully completed.

3.1.2. Motivation for the Acquisition

Expanding in the Watches and Jewelry Market: LVMH's financial reports show that in the first half of 2019, its operating income reached over €25 billion, a 15% year-on-year growth. Net profit was over €3.2 billion, a 9% increase compared to the previous year. The profit from recurring operations grew by 14%, reaching over €5.2 billion. In terms of revenue structure, leather goods are the main source of income for LVMH, accounting for approximately 41% of total revenue at €10.4 billion. On the other hand, the revenue from watches and jewelry was only €200 million, accounting for only 8% of total revenue, making it a relatively small portion. According to official information on their website, LVMH has six brands in the watches and jewelry sector and sought to achieve rapid expansion in this segment through acquiring Tiffany & Co. [1].

To Counter Competitors: LVMH holds a leading position in the luxury goods industry globally, but in recent years, the strength of its competitors has been growing. The Richemont Group and the Kering Group have been continuously developing and expanding. Compared to these competitors, LVMH has a gap in revenue in the watches and jewelry sector. Brands like Van Cleef & Arpels and Cartier under the Richemont Group are European century-old jewelry brands with significant influence and high brand recognition, which gives them an advantage over LVMH's brands. According to the 2018 annual report data, the value created by just Cartier and Van Cleef & Arpels exceeded the total revenue of LVMH's watches and jewelry business. If LVMH does not take action through acquisitions, it would be at a long-term disadvantage if competitors seize the opportunity to successfully acquire Tiffany & Co. This would make it difficult for LVMH to catch up in the jewelry sector and allow other competitors to gain an advantage that could negatively impact their future business development.

Gaining the Brand Advantage of Tiffany & Co.: The nature of the luxury goods industry makes the brand a crucial intangible asset, and acquisitions serve as an important means to quickly gain the brand advantage. Founded in 1837 in the United States, Tiffany & Co. has gained a reputation in the field of jewelry and watches, being hailed as the queen of the jewelry industry and a well-known luxury brand with a century-long history. Its iconic blue gift box is widely recognized and associated with romance and happiness. Tiffany & Co.'s jewelry perfectly expresses emotions between lovers, capturing hearts worldwide. Additionally, the movie "Breakfast at Tiffany's" starring Hollywood actress Audrey Hepburn has brought more attention and admiration to Tiffany & Co. Known for its "classic designs," Tiffany & Co. has always insisted on original creations in product design rather than following mass-market or trendy trends. Compared to products that blindly pursue trends, Tiffany & Co.'s products have a longer lifecycle. Furthermore, Tiffany & Co. has a wide market presence in the United States and incorporates strong American characteristics into its designs. With clean and bold lines, their products exude an atmosphere of grandeur and elegance. In many people's minds, Tiffany & Co.'s jewelry holds an irreplaceable position with undeniable brand influence. This acquisition will rapidly expand LVMH's market share and influence in the watches and jewelry sector [2].

3.2. Acquisition Process and Key Steps

3.2.1. Acquisition Process

The acquisition of Tiffany & Co. by LVMH went through a series of twists and turns. It began with reaching a preliminary agreement in early November 2019 and was finally formalized in November 2020, taking a total of one year to complete. In the end, LVMH successfully acquired Tiffany & Co. and incorporated it into its watches and jewelry division. The specific steps of the acquisition process are illustrated in Table 1.

Table 1: Acquisition timeline of key steps.

Date | Stage | Details |

01-Nov-19 | The two sides have reached a preliminary agreement | LVMH Group to formally acquire Tiffany & Co.for $16.2bn in all-cash terms |

01-Sep-20 | LVMH abandons acquisition plans | Tiffany & Co. lost a lot of cash after the new crown epidemic hit the luxury market. |

Tiffany & Co. sues LVMH | Tiffany & Co. sues LVMH for failing to complete a $16.2bn acquisition on time. | |

01-Oct-20 | LVMH sues Tiffany & Co. | LVMH is using delaying tactics while the other side claims Tiffany & Co. Is mismanaging its business |

01-Nov-19 | Reaching a final agreement | LVMH's Tiffany & Co. acquisition falls to $15.8bn as new price is finalized |

3.2.2. Key Steps

LVMH had been waiting for an opportune moment to complete the acquisition, especially with the uncertainty brought about by the outbreak of the COVID-19 pandemic in 2020, which had a significant impact on the luxury goods market. In the first quarter of 2016, LVMH experienced a sharp decline in performance by 7.4%, and global same-store sales continued to decline throughout 2017. According to reports from the second quarter of 2019, global same-store sales decreased by 3% compared to the previous year when converted at fixed exchange rates, which was approximately twice as much as expected. These continuous declines in brand sales demonstrated that the group was going through a challenging period and needed to make significant strategic changes.

To effectively improve brand performance and market share in the global luxury goods market, LVMH needed to accelerate the update and implementation of core business strategies.

LVMH started considering acquiring the company's stocks at a lower price on the public market, which made Tiffany & Co. feel threatened and concerned about the possibility of the acquisition. Subsequently, LVMH proposed abandoning the acquisition plan, leading to months of public litigation between the two parties. However, at this turning point, LVMH seized the opportunity and engaged in negotiations with Tiffany & Co., ultimately reaching a new price agreement. After twists and turns, Tiffany & Co. eventually accepted the new price, allowing LVMH to save approximately $425 million, only 3% lower than the original offer. This key step paved the way for the final acquisition at a relatively lower price.

From this process, it can be seen that LVMH did not genuinely intend to abandon the acquisition of Tiffany & Co. but rather sought to strengthen its market competitiveness in the hard luxury sector and counterbalance its competitor, Swiss-based Richemont Group, through this acquisition.

3.3. Merger Effects and Impacts

3.3.1. Group Financial Performance

Financial performance is the most important factor in a merger transaction as it provides direct indicators of the impact and rationality of the deal. According to data analysis, considering the challenging times of the COVID-19 pandemic throughout 2020 and the first two quarters of 2021, most percentage changes on the income statement were negative. However, following the merger with Tiffany & Co., minority interest pre-tax profit and net profit for the first half of 2021 increased by 12%. This indicates that the merger with Tiffany & Co. had a positive impact on company performance and demonstrates that the transaction was wise and has potential [3].

Table 2: 2021vs 2020 organic revenue change by business group and by quarter.

2021vs2020 | Q1 2021 | Q2 2021 | H1 2021 | Q3 2021 | 9M 2021 |

Wines&Spirits | 36% | 55% | 44% | 10% | 30% |

Fashion&Leather goods | 52% | ×2.2 | 81% | 24% | 57% |

Perfumes&Cosmetics | 18% | 67% | 37% | 19% | 30% |

Watches&Jewelry | 35% | ×2.2 | 71% | 18% | 49% |

Selective Retailing | -35% | 31% | 12% | 15% | 13% |

Total LVMH | 30% | 84% | 53% | 20% | 40% |

Tiffany & Co. has performed exceptionally well since the acquisition and has made significant contributions to the watch and jewelry segment. As shown in Table 2, which depicts the organic revenue changes by business group and quarter, the revenue from watches and jewelry grew by 49% within nine months in 2021, second only to fashion and leather goods [3].

Table 3: 2021vs 2019 organic revenue change by business group and by quarter.

2021vs2019 | Q1 2021 | Q2 2021 | H1 2021 | Q3 2021 | 9M 2021 |

Wines&Spirits | 17% | 7% | 12% | 7% | 10% |

Fashion&Leather goods | 37% | 40% | 38% | 38% | 38% |

Perfumes&Cosmetics | -4% | -1% | -3% | 0% | -2% |

Watches&Jewelry | 1% | 9% | 5% | 1% | 4% |

Selective Retailing | -30% | -19% | 25% | -19% | -23% |

Total LVMH | 8% | 14% | 11% | 11% | 11% |

2020 was an unusual year, widely regarded as a year of collapse for most industries due to the impact of the COVID-19 pandemic. However, with the emergence of more vaccines and the relaxation of citizen social distancing regulations, organic revenue has seen significant growth. This may be attributed to retaliatory consumption by consumers, demonstrating a market rebound. According to Table 3, the organic revenue change between 2021 and 2019 is more significant compared to that between 2021 and 2019. Following the approval of the LVMH-Tiffany & Co. transaction on November 24, 2019, the watch and jewelry division saw a 4% increase in organic revenue within nine months. Considering that Covid-19 has not completely disappeared, and consumers remain cautious about luxury purchases, Tiffany & Co.'s ability to maintain stability or even achieve positive growth demonstrates its strong sales capabilities.

3.3.2. Impact: Expanding into the Global Market

Tiffany & Co., a renowned American luxury brand and iconic jeweller, is particularly known for its sterling silver jewelry and diamonds. The acquisition of Tiffany & Co. will help LVMH expand its business in the United States and further promote the geographical expansion of both companies.

Table 4: 2021vs 2020 organic revenue change by region and by quarter.

2021vs2020 | Q1 2021 | Q2 2021 | H1 2021 | Q3 2021 | 9M 2021 |

United States | 23% | ×2.1 | 60% | 28% | 48% |

Japan | 8% | ×2.1 | 42% | 15% | 31% |

Asia(excl.Japan) | 86% | 55% | 70% | 12% | 47% |

Europe | -9% | 87% | 25% | 23% | 24% |

Total LVMH | 30% | 84% | 53% | 20% | 40% |

The data chart in Table 4 shows that the United States had the highest percentage increase in organic revenue during the first nine months of 2021, with a growth rate of 48%, surpassing the levels of 2020. Asia (excluding Japan) also experienced significant growth, with a 47% increase. Overall, LVMH's performance grew by 40%. These data clearly indicate a significant breakthrough in the US market, which can be attributed to Tiffany & Co.'s excellent position and influence in the American jewelry industry.

Table 5: 2021vs 2019 organic revenue change by region and by quarter.

2021vs2019 | Q1 2021 | Q2 2021 | H1 2021 | Q3 2021 | 9M 2021 |

United States | 15% | 31% | 23% | 22% | 23% |

Japan | -3% | -4% | -3% | -6% | -4% |

Asia (excl.Japan) | 26% | 34% | 30% | 26% | 29% |

Europe | -18% | -15% | -16% | -6% | -13% |

Total LVMH | 8% | 14% | 11% | 11% | 11% |

To provide a more informative comparison, it is reasonable to use 2019 as a baseline after the outbreak of the COVID-19 pandemic. From Table 5, we can see that Japan and Europe experienced a decrease in organic revenue changes of 4% and 13%, respectively. However, the United States and Asia (excluding Japan) still maintained strong growth, increasing by 23% and 29%, respectively, resulting in an overall performance growth of 11% for LVMH. By reorganizing the data chart, it is evident that Tiffany & Co. possesses significant strength in the market.

4. Merger and Acquisition Case Study B: Dior Acquisition

4.1. Case Background and Motivation

4.1.1. Merger Background

From 1987 to 2013, LVMH conducted a total of 63 mergers and held stakes in 74 companies. It can be said that LVMH's business empire was largely formed through continuous acquisitions. In the early 21st century, the global luxury brand industry witnessed a wave of transformation, with the Italian luxury brand GUCCI emerging in the late 19th century. Although LVMH had intended to acquire GUCCI, after several challenging merger disputes and complex operations, it ultimately ended in failure and had to turn to other brands for opportunities. However, in early 2017, the luxury business began to recover, and at this time, LVMH shifted its focus towards Dior.

4.1.2. Motivation for the Acquisition

Changes in the luxury goods market: The acquisition of Dior's fashion division took place in an environment of luxury market downturn and retail market sluggishness. In the challenging economic climate, LVMH had concerns about future development and performance, leading them to decide on the acquisition of Dior's fashion division. Dior, as a globally renowned brand with a high reputation, particularly holds significant influence in the Asian market. Through this acquisition, LVMH can further consolidate its leading position in the global market and strengthen its penetration and expansion into the Asian market. Additionally, it helps the group to expand its market share and facilitate overall development. By acquiring Dior, LVMH can offset some of the impacts caused by the downturn in the market.

In June 2016, Dior appointed Maria Grazia Chiuri, the former creative director of Valentino, as the brand's creative director. The new collections she designed played a crucial role in the fashion division's recovery at Dior. Under her leadership, sales for Dior's fashion division continued to rise. According to data, in 2016, the fashion division of Dior achieved sales revenue of 1.9 billion euros. This figure is impressive and can be compared with many luxury brands.

Dior's outstanding performance has inspired LVMH's confidence in the future development of the brand and strengthened the motivation for its acquisition. Additionally, Dior is a brand with a rich history and unique design style, excelling in fashion, accessories, perfumes, and more. Through synergistic collaborations with other brands under LVMH, such as Louis Vuitton and Chanel, there can be resource sharing and synergistic effects between the brands, ultimately enhancing overall performance and profitability.

As early as the 1960s, LVMH had already acquired Dior's perfume and cosmetics division, and the Arnault family had previously held over 74% of the shares in Dior. Now, LVMH has bought Christian Dior Couture, the fashion line business of Dior, from the Arnault family, merging it with the perfume and cosmetics business. This essentially achieves a complete acquisition of Dior by LVMH and provides support for streamlining the market demand structure for LVMH. Additionally, this will greatly drive growth in LVMH's Fashion & Leather Goods sector and bring new vitality to it. Complete ownership of the brand also allows for better integration of all resources at Dior and provides assurance for its development and innovation based on its brand characteristics.

4.2. Merger and Acquisition Process and Key Steps

4.2.1. Merger and Acquisition Process

On April 25, 2017, Bernard Arnault, the founder and CEO of French luxury group LVMH, suddenly announced the acquisition of the remaining nearly 26% stake in Dior for a price of 12.1 billion euros, thereby achieving full control over the brand. At the same time, LVMH also acquired Dior's fashion line business, Christian Dior Couture, from the Arnault family and merged it with the previously owned Dior perfume and cosmetics business. This acquisition is considered to be one of the largest brand ownership changes in the global luxury industry in recent years.

4.2.2. Key Steps

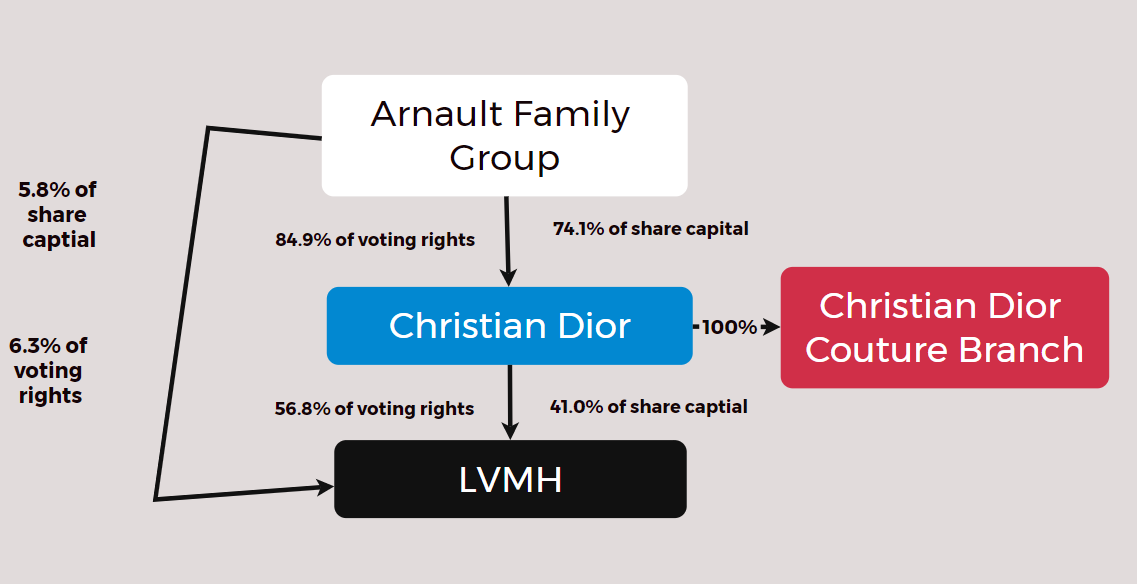

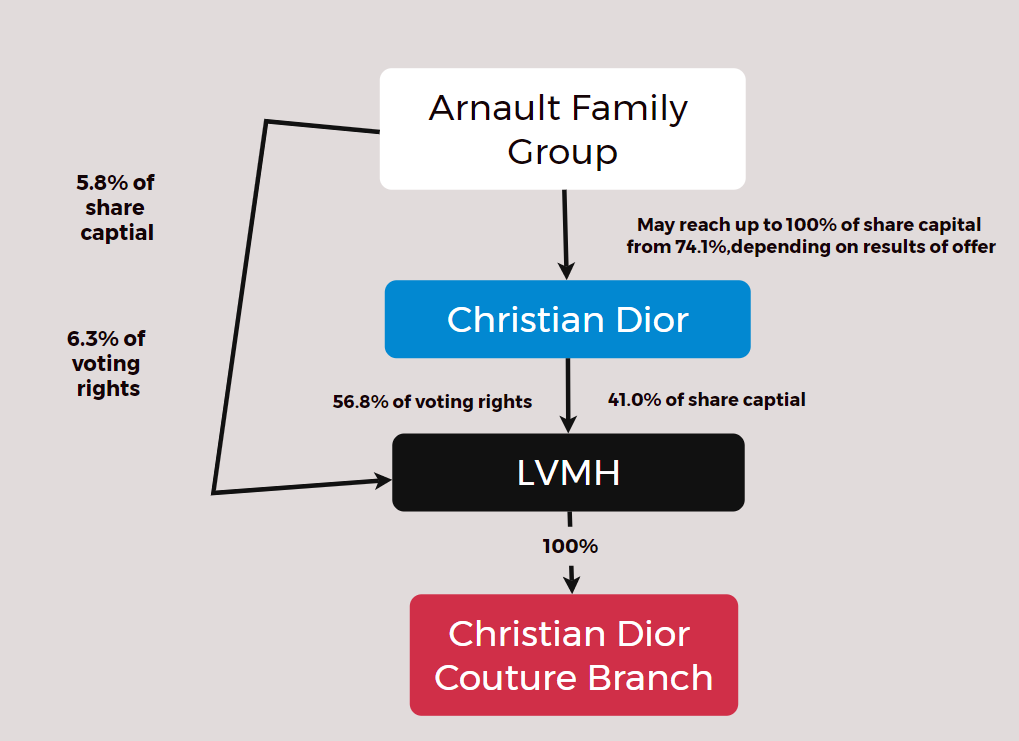

This acquisition involves three companies: Arnault Family Group, Christian Dior, and LVMH. Before and after the acquisition, there have been changes and adjustments in terms of equity and rights for these three companies. The specific changes are shown in Figure 1 and Figure 2.

Figure 1: Pre-acquisition.

Figure 2: Post-acquisition.

According to Table 6, it can be observed that there was a significant increase in sales after the acquisition of Dior in 2018 compared to 2017. The data shown in Table 5 indicates a substantial growth rate in the Fashion & Leather Goods division, which increased by 15 percentage points in the first half of 2018 compared to the previous year. This growth can be attributed to the contribution made by Dior. In 2018, Christian Dior Couture demonstrated excellence and creativity across its various divisions compared to 2017.

Table 6: 2018vs vs. 2017 organic revenue change by business group and by quarter.

2018vs2017 | H1 2018 | Q3 2018 | 9M 2018 |

Wines&Spirits | 7% | 7% | 7% |

Fashion&Leather goods | 15% | 14% | 14% |

Perfumes&Cosmetics | 16% | 11% | 14% |

Watches&Jewelry | 16% | 10% | 14% |

Selective Retailing | 9% | 5% | 8% |

Total LVMH | 12% | 10% | 11% |

4.3. Acquisition Effects and Impacts

Christian Dior's haute couture fashion has been integrated into LVMH's financial reporting since July 2017. According to the data, LVMH's sales of fashion and leather goods increased by 22% on an organic basis in the third quarter, exceeding analysts' previous estimate of 16% growth. From the second half of 2017 onwards, all regions and product categories have maintained vitality. Sales of leather goods, ready-to-wear clothing, shoes, and jewelry have all recorded strong growth. Maria's fashion show showcased excellence and creativity.

The complete merger of Dior has brought significant benefits to LVMH. Not only did it have an impact in the year of the acquisition, but Dior also injected new vitality into LVMH and provided continued upward momentum. According to analysts' estimates, Dior's sales reached 6.28 billion euros in 2021, contributing 10% to LVMH's total revenue and 13% to its group profit. This result exceeded analysts' previous forecast of "approaching 6 billion euros." With Dior integrated into the group, it has become a cash cow, continuously providing funding and sales support for the group, as well as offering opportunities for sustained growth in the Fashion & Leather Goods division. In addition to Louis Vuitton, Dior also leads this division in exploring new growth areas.

5. LVMH's Acquisition Strategy Analysis

5.1. Selection Criteria for Acquisition Targets

After Bernard became the decision-maker of LVMH, he began to build a world-leading luxury goods group. Some people describe him as someone who "puts beautiful brands into his pocket." LVMH's logic is to spend a lot of money to acquire superstars and invest less money in nurturing future stars. Through their acquisition strategy of targeting the most prestigious brands globally, they have achieved revenue diversification and effectively hedged business risks and exchange rate risks. Brands like Dior and Tiffany & Co., which have a strong influence in the luxury goods market, are successful examples. LVMH also does not miss opportunities for brands that have the potential to expand their business footprint.

LVMH has formal acquisition criteria that need to align with the right timing. Therefore, they conduct research analysis and strategic planning for brands that have potential acquisition possibilities. They are skilled at seizing opportunities during economic downturns to acquire undervalued luxury brands at a lower cost. Additionally, they exercise patience and wait for the perfect moment to secure the lowest possible price.

5.2. Integration and Management after Acquisition

5.2.1. Brand Integration Strategy

In terms of post-acquisition integration, LVMH utilizes its unique "LV Integration Formula" to improve the operations of struggling brands [3]. This formula involves delving into the brand's history, outlining its characteristics, finding suitable designers to express the brand's DNA, streamlining sales channels, and creating a market image. In essence, this formula aims to improve brand management and enhance the benefits of acquisitions. It encourages designers to be proactive in their creativity, inspires inspiration, and grants them significant autonomy during the integration process [4].

As the parent company, LVMH primarily manages and coordinates the upstream manufacturing processes. By integrating the value chains of various brands, they have constructed a complete "raw materials - design - production - retail" value chain. In terms of upstream manufacturing, LVMH has implemented the consolidation of production systems for its brands, streamlining many common processing procedures to ensure consistent product quality and save internal marketing costs. Additionally, they provide unified management services in areas such as legal, financial, and taxation to improve efficiency. It is estimated that the consolidation of upstream raw materials and manufacturing processes alone can save approximately 19% of internal funds. In terms of downstream channels, LVMH's subsidiary brands can share retail channel resources [5].

5.2.2. Post-acquisition Management

Brand Management: LVMH stands out in the industry with its unique brand management approach. Bernard Arnault adheres to a distinctive brand management philosophy that revolves around granting brand managers significant autonomy [6]. To achieve this, managers are authorized to hold a portion of the shares in the companies they oversee and have access to the necessary support and resources from the group. This approach aims to unleash the talents of managers and prevent excessive intervention from the group that could hinder their managerial freedom. It is worth mentioning that many renowned brands were initially established and operated by different families. By maintaining a family-style operating model, these brands can operate successfully based on their own characteristics while achieving successful corporate management [7].

LVMH is a corporate brand rather than a product brand. It operates brands from an investment portfolio perspective, managing and allocating resources to different brands as different types of investment risks. At the consumer level, it is sufficient to focus on individual product brands and purchase related products. However, at the corporate level, each brand's operators and employees should be aware that they belong to LVMH, the world's largest luxury goods conglomerate. LVMH positions itself as the owner of all these major brands, and this corporate image is key to its success.

Personnel Management: LVMH, as a massive luxury goods conglomerate, employs approximately 196,000 staff members across different brand categories and departments. In the context of group acquisitions, LVMH places great emphasis on talent cultivation and development, employing unique strategies and insights. Developing cross-brand management capabilities is a key focus of LVMH's human resources efforts. The group believes in nurturing "versatile talents," and thus, the training programs cover a wide range of subjects such as finance, marketing, law, and more [8].

Employees are required to have in-depth knowledge of all brands, including their history, culture, and value within LVMH. This is particularly important for newly acquired brands, where employees are expected to understand their cultural values and preserve their original style to retain their existing consumer base. Additionally, there is a strong emphasis on standardized service training. LVMH has developed a special training program called "GREATER," which includes detailed and comprehensive customer service standards and norms to achieve a unified and standardized level of service and shape the image of the group. Furthermore, the company promotes the improvement of service quality through various means such as training, manager mentoring, mystery shopper evaluations, and supervisory oversight.

5.3. M&A Strategy: Success Factors and Challenges

5.3.1. Success Factors

Accurate strategic positioning: LVMH emphasizes strategic planning and positioning in the M&A process, continuously analyzing its own strengths and weaknesses and seeking target companies that complement its existing brands and businesses to achieve strategic synergies for the entire group. With clear strategic objectives and positioning, LVMH can seize M&A opportunities and achieve growth. When selecting target companies for acquisition, LVMH adheres to the principles of being at the highest end and most individualistic, placing particular emphasis on the cultural heritage of the brands. Generally, the group conducts long-term investigations and tracking of these high-end brands, uncovering their historical stories and legends. Additionally, LVMH has also acquired some niche brands that have unique personalities despite being relatively new in the market [9].

5.3.2. Appropriate Timing for M&A

The timing of an acquisition is also crucial, as the prices can vary significantly at different times. LVMH has demonstrated a keen sense of timing in its M&A activities and often acts decisively. Particularly during periods of family business splits or declining market shares, these often-become opportune moments for LVMH to make acquisitions. For example, during the acquisition of Tiffany & Co., the sales plummeted due to the COVID-19 pandemic, which was completely unexpected compared to the original plans. LVMH acted decisively and, after some setbacks, managed to save approximately $425 million, only 3% lower than the initial offer price. Throughout its long history of acquisitions, LVMH has been known for its decisive actions and is willing to wait for years, if necessary, to seize the right opportunity.

5.3.3. Buy but not Merge

Post-acquisition strategy is of utmost importance. Different cultures and business operation models can pose significant challenges and workloads for the group, and any missteps can result in adverse effects. LVMH focuses on preserving the uniqueness and value of the acquired brands after the acquisition, making efforts to uncover their deep historical and cultural significance. Building upon the brand's foundation, LVMH infuses new vitality into the brand and supports its development through resource integration. In terms of brand management, there is a strong emphasis on granting autonomy to brand managers, providing them with space for creative freedom, allowing the brand to flourish while adhering to its original family traditions, and maximizing its brand value [7].

5.3.4. Challenges

LVMH currently owns 75 different brands, each with its unique corporate culture and brand style. These brands come from different countries and regions, with significant differences in behavior and habits. One important challenge is adapting to the working environment of a multinational company when it comes to employee development. It is necessary to manage these cultural differences, ensure cooperation and coordination after the acquisition, and avoid cultural conflicts [10].

In the luxury goods industry, brand value is crucial. When conducting mergers and acquisitions, LVMH needs to consider how to integrate the acquired company's brand with its own brand portfolio to achieve maximum synergies. Precisely positioning the future development of the brands is vital, as any deviation in positioning can have a devastating impact on both the group and the brand. In the integration process, it is necessary to conduct in-depth research, comprehensive analysis, and understanding of each brand. This involves aspects such as repositioning, product line integration, marketing strategies, and more.

6. Conclusion

This study primarily focuses on LVMH's merger and acquisition strategies and success factors. By analyzing the cases of the acquisitions of Tiffany & Co. and Dior, it explores their background, the process of the mergers, and key steps, revealing the strategies and characteristics of these acquisitions. Additionally, through analyzing relevant data, it provides a detailed analysis of the changes in sales figures after the acquisitions and evaluates their impact on LVMH. Through the summary of cases and data, unique merger and acquisition strategies and integration models employed by LVMH are identified, as well as an exploration of its success factors and challenges faced.

While this study has examined LVMH's merger and acquisition strategies using a case study approach, there are limitations in the research process. Firstly, the data and sample size are relatively small, as only two merger and acquisition cases were analyzed. This limitation prevents a comprehensive analysis of LVMH's overall strategies in mergers and acquisitions. Secondly, due to the constraints of data and samples, the research results may be influenced by biases.

This study has provided a specific analysis of the background, process, and outcomes of two merger and acquisition cases by LVMH. Future research can address the limitations of this study by analyzing mergers and acquisitions in different business sectors within LVMH, tracking the timelines and strategies of these acquisitions, and supporting them with financial data and relevant case studies. Additionally, comparisons with other luxury goods conglomerate' divisions can be made to explore the advantages and disadvantages present in mergers and acquisitions. This comparative approach can increase the sample size, better avoid biases in research results, and bring more value to the study of mergers and acquisitions.

References

[1]. Li, X., Xu, Y., & Cui, C. (2020). A brief analysis of LVMH's acquisition of Tiffany & Co. Fortune Times, (03), 84.

[2]. Feng, Y. (2018). Research on the performance of high-quality enterprise mergers and acquisitions (Master's thesis, Shandong University).

[3]. Zheng, W. (2022, April). Analysis on the Impact of the Acquisition of LVMH and Tiffany & Co. In 2022 7th International Conference on Social Sciences and Economic Development (ICSSED 2022) (pp. 870-875). Atlantis Press.

[4]. Chen, J. (2014). Financial analysis and development strategy of LVMH Company (Master's thesis, Xiamen University).

[5]. Yu, Y. (2012). Unveiling the veil of LVMH Group. Textile and Apparel Weekly, (15), 8.

[6]. Kevin. (2005). Learning mergers and acquisitions from LVMH Group—Purchasing without merging and implementing highly decentralized management. Business School, (6), 54-56.

[7]. Zhong, J. (2013). LVMH: The luxury brand "predator." Directors & Boards, (10), 58-61.

[8]. Xin, X., Zheng, B., Duan, Y., Ma, J., & Zeng, Y. (2020). Insights into luxury brand strategic development: A case study of LVMH Group. Business and Exhibition Economy.

[9]. Chen, H. (2011). Money and poetic war—Understanding LVMH's mergers and acquisitions through its battle with Hermes. Journal of Jilin Provincial Institute of Education, (08), 120-122. doi:10.16083/j.cnki.1671-1580.2011.08.006.

[10]. Xin, H. (2019). A study on the continuous merger and acquisition behavior of LVMH Group (Master's thesis, Beijing University of Posts and Telecommunications).

Cite this article

Zhao,L. (2023). Analysis of LVMH Group's Business Operation Model and Marketing Strategy - A Case Study Based on Group Mergers and Acquisitions. Advances in Economics, Management and Political Sciences,53,25-36.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li, X., Xu, Y., & Cui, C. (2020). A brief analysis of LVMH's acquisition of Tiffany & Co. Fortune Times, (03), 84.

[2]. Feng, Y. (2018). Research on the performance of high-quality enterprise mergers and acquisitions (Master's thesis, Shandong University).

[3]. Zheng, W. (2022, April). Analysis on the Impact of the Acquisition of LVMH and Tiffany & Co. In 2022 7th International Conference on Social Sciences and Economic Development (ICSSED 2022) (pp. 870-875). Atlantis Press.

[4]. Chen, J. (2014). Financial analysis and development strategy of LVMH Company (Master's thesis, Xiamen University).

[5]. Yu, Y. (2012). Unveiling the veil of LVMH Group. Textile and Apparel Weekly, (15), 8.

[6]. Kevin. (2005). Learning mergers and acquisitions from LVMH Group—Purchasing without merging and implementing highly decentralized management. Business School, (6), 54-56.

[7]. Zhong, J. (2013). LVMH: The luxury brand "predator." Directors & Boards, (10), 58-61.

[8]. Xin, X., Zheng, B., Duan, Y., Ma, J., & Zeng, Y. (2020). Insights into luxury brand strategic development: A case study of LVMH Group. Business and Exhibition Economy.

[9]. Chen, H. (2011). Money and poetic war—Understanding LVMH's mergers and acquisitions through its battle with Hermes. Journal of Jilin Provincial Institute of Education, (08), 120-122. doi:10.16083/j.cnki.1671-1580.2011.08.006.

[10]. Xin, H. (2019). A study on the continuous merger and acquisition behavior of LVMH Group (Master's thesis, Beijing University of Posts and Telecommunications).