1. Introduction

The trade war is started by US President Donald Trump in 2018 to compete with China. The trade war includes many restriction measures and changes in the business market, and it influences the whole world in the economy [1].

In the trade war, the US government has added tariffs on some of China’s goods that are imported into America. Most of the goods affected are products of daily use, including tools, food, toys, and decorates [2]. 25% additional tariffs are imposed on these goods to resist the dumping of China’s cheap products. Also, some top technologies are forbidden to transfer to China to protect their intellectual properties. [3]. Many Chinese corporations including ZTE, Huawei, and Byte dance are influenced to stop technology communication [4]. Also, some companies are suspected to have a relationship with the Chinese military and government, and they are investigated and punished to sell their subsidiary corporation in America [5].

China also has some counterattacks on the actions of America. It has imposed the same amount of additional tariffs on American goods. Meanwhile, China has been trying to negotiate with the US to relax the conflict with several visits with the delegates. However, this has little effect. China is also trying to open other markets in the world other than the US [6]. The trade amount is increasing greatly in China-Europe and China-Southeast-Asia market. And the China government is trying to subsidy the influenced industry to develop more in the domestic market.

This paper begins with the discussion of the China–United States trade war had a large economic impact on US and China.

2. An Overview of China-US Trade War

2.1 The impact of China–United States trade war on economics

The trade war between China and the US has been in flux for more than a year and has been the most significant uncertainty between China and the US since the turn of the 21st century. Several factors have shaped the course of the trade war. Economic and political issues are the most important of them. These two elements not only directly influenced the course of the US-China trade war but also portended new dynamics in the relationship between the two nations [7].

The immediate financial implications of a trade conflict between the US and China come first. Both parties of a trade spat between the US and China would suffer economic losses. These expenses may generally be quantified by their effect on a nation's gross domestic product (GDP), international trade, employment, taxation, and different industries [8]. Theoretically, if the financial costs of a trade war are too high for one side to bear, that side may be compelled to make concessions in talks to satisfy the other side's demands and therefore end the trade war. However, while the apparent economic costs can be estimated, the ability and willingness to bear them are challenging to measure and is highly dependent on a country's strategic tolerance and political maneuverability.

The combined affordability of both nations must be considered, provided that such economic consequences are not disastrous. The challenge is that tolerance is assessed not just in terms of economics but also in terms of political will. Second, there are other economically significant considerations. Given the size of the economies of the US and China, a direct trade war would not be financially devastating for either, and its overall adverse effects would be tolerable.

The analysis of economic variables outside the trade war's immediate financial impact becomes required. The following two signs, in particular, are particularly crucial. The US and China's respective short-term economic growth rates come first. Trump will have a more significant motivation to fight the trade war if the US economy is still multiplying in the midst of it, as opposed to a less incentive if economic growth is drastically slowing. The United States holds the initiative in trade wars.

2.2 Predicting future trends in the US-China trade war

The United States is a superpower, significantly larger than China in terms of the economic scale, technological strength, and military capability, and is the rule-setter and maintainer of the international order after World War II. In this position of strength, the US has taken the initiative in trade wars and initiated the largest trade war in economic history to date. On the other hand, trade wars are "two-edged swords," and the damage caused by an escalation of a trade war is much more significant [9]. Therefore the US will not participate in a trade war with China without dread. Second, whether the US can survive the pressures of increasing prices, growing unemployment, and recession caused by a trade war escalation; and third, if the current overpriced stock market bubble will be shattered by the impact of a trade war escalation [10]. The trade war between China and the United States will not last forever, and in the long term, it will affect both nations' economies and even world economic progress.

However, the settlement of the trade war between the US and China is temporary. The US and China see each other as their number one strategic rivals. In the future, China and the United States will compete in many domains, including the economic, military, science and technology, culture, and diplomacy. The primary area of competition among them is the economic realm, particularly in developing industries, with the direct conflict between China and the US in new fields such as communications, information, sophisticated manufacturing, and new energy vehicles.

If trade frictions between China and the US intensify, it will directly or indirectly change the international economic and political landscape. The World Trade Organization has many shortcomings and dilemmas in resolving trade disputes, and China, as a member of the WTO, also has to promote the development and improvement of WTO rules to reduce the damage caused by trade frictions, and at the same time, the constant trade frictions require the WTO to address these frequent trade frictions urgently

3.Why did WTO fail to assist China and the US in settling trade dispute?----How to Help the Appellate Body start to function again

International organizations, especially WTO in this case, should have played a positive role in helping China and the US settle the trade dispute, but in reality, the two parties resorted to self-help without recourse to the rule and procedure of the WTO dispute settlement system [11]. Like many other disputes between WTO members, the US-China trade dispute is left in a state of limbo largely due to the “appellate body crisis”----the US administration blocked the appointment of new members to the appellate body and made it lack a quorum to function. How to help the appellate body start to function again thus becomes a crucial step not only to solving the US-China trade dispute but also in dealing with other disputes between WTO members. To restore the appellate body, we should first try to reform the appellate body in a way compatible with the US interests so that the US would voluntarily unblock the reappointment of the appellate body members. Restoring the appellate body while leaving the US administration unsatisfied should only serve as a backup solution and short-term expedient.

3.1 The Appellate Body and Appellate Body Crisis

Usually a dispute is settled in three steps and the first step is consultation, where countries in dispute try to talk to each other to see if they could settle the problem themselves. If the complaining countries failed to solve the dispute themselves, they will then ask for the appointment of the panel, which will provide a final report within six months. If either country is unsatisfied with the adjudication, it can then appeal to the appellate body, which will make a final verdict [12]. The appellate body is a standing body within the WTO dispute settlement system that can uphold, modify, and reverse the legal conclusion of the WTO dispute settlement panel [13]. It usually consists of seven people, and each appeal is heard by three of the seven judges. But when two out of its three remaining members’ four-year terms came to an end, the Trump administration blocked the appointment of new members to the Appellate Body for more than two years, which makes the Appellate Body literally defunct as it lacks a quorum to hear appeals since December 2019 [14]. Without the Appellate Body functioning, the losing party now will appeal into a legal limbo [15]. As a result, governments could impose any measures because the dispute settlement system now is unable to give permission to the complaining side to retaliate [16], and a trade dispute could more easily turn into a trade war. For example, on April 4, 2018, China requested a consultation with the US regarding certain tariff measures on Chinese goods. After several rounds of consultation, China requested the panel establishment on December 6, 2018 and on September 15, 2020, the panel report was issued and circulated to members. The US then decided to appeal to the appellate body certain issues concerning the legal interpretations in the panel report [17]. But after the US appealed to the appellate body, there’s no longer any update about this case, and the US literally appealed into the void.

3.2 The conflict between the US and the Appellate Body

This is not the first time the US blocked the appointment of the appellate body members. During the Obama administration, the US blocked the reappointment of two appellate body members about whom it had concerns and insisted on a replacement [18]. This repeated action of the US administration is driven by the conflict between the US and the appellate body that has been gradually built up over decades.

In the late 1980s, the primary tool that helped the US to deal with international import competition was Voluntary Export Restraints (VERs), through which the US government could pressure other countries to limit their exports to the US. While after joining the WTO, the US agreed to turn to tariffs instead [19]. Under the WTO rules, only under some exceptional circumstances could WTO members use trade remedies, including raising tariffs above a certain level. The percent of US imports covered by trade remedies peaked at 5.5% in 1999 but then fell to a low of 1.9% in 2013 [20]. USTR’s report implicitly shows that this significant reduction in the use of trade remedies is closely related to the WTO appellate body. Many countries are very resistant to trade remedies the US uses and filed disputes against it. So the US has to defend its use of trade remedies in front of the appellate body, which was often unsuccessful when the appellate body repeatedly reversed the findings of the WTO panel. The conflict between the US and the Appellate Body is thus built.

The main concern the US administration has is the issue of judicial activism by the appellate body. As the Appellate Body allows WTO members to appeal against adverse rulings, the US administration claims that the Appellate body is exercising arbitration power beyond its original mandates [21]. For example, in the Argentina-Financial Services, the US administration argued that the appellate body unnecessarily added to their analysis by reinterpreting the provisions of GATS [22].

3.3 How can we help to restore the Appellate Body

In this case, helping the appellate body start to function again becomes a crucial task that might end the trade war between the US and China. The appellate body must be reformed either by making it more compatible with the US interests or by working around the United States. Since the crisis originated from the conflict between the US and the appellate body, we should prioritize meeting the US’ concern to break this impasse so that the US could voluntarily unblock the appointment of new members. This has to deal with the judicial activism of the appellate body the US is unsatisfied with. For one thing, as the US administration has concerns about the appellate body’s discretion on how to interpret some terms or provisions, claiming that they are sometimes “creating laws”, the appellate body could be required to rely on more objective facts including concrete economic statistics to make decisions [23]. On the other hand, a compliance body might be set up to monitor the functioning of the appellate body, which may build up the US confidence in the appellate body as the adjudication of it is now less likely to be unfairly detrimental to US interests. Additionally, regarding the US’s complaint about the appellate body’s taking more than 90 days to give a final verdict, the number of appellate body judges and staff in Secretariat assisting in translation, drafting, review, and revision might be increased so that for the more complicated cases or some situations where there is overlapping, the appeals could stay within the 90-days time frame [24, 25].

One advantage of taking actions consistent with the US objectives to reform the appellate body is that this is the way we could solve the problem at its source. If the US is left unsatisfied after the appellate body reformation, the grievances of the US administration will always be a potential risk threatening the stability of the dispute settlement system. Another advantage of this solution is that the reformations compatible with the US interests promote the accountability, fairness, and impartiality of the appellate body, which will also benefit other countries in the future. That is to say, tackling the US concerns about judicial activism should also increase all the other WTO members' confidence in the appellate body at the same time. Nevertheless, one notable thing is that when asking the US officials what should be done to restore the appellate body, they always deflect the question and turn to the broader issues of the dispute settlement system [26]. Regarding this, keep pressing the US officials to explicitly offer concrete proposals that would assuage the US concerns requires the efforts of all the other WTO members. Meanwhile, considering the underlying reasons why US officials avoid discussing specific proposals remains a crucial part of the problem. One Geneva-based diplomat argued that the US is quite happy with the status quo (the paralysis of the appellate body) which “allows them to have ample leeway on trade policy”.

If the US is not satisfied with the reformation that improves the overall impartiality of the appellate body adjudication, or its underlying intent is just to go back to the time of protectionism or the might-makes-right era, working around the US and enabling the appellate body to start functioning again without the approval of the US administration should be considered, but this is just a backup solution and short-term expedient. This may include setting up rules that stipulate that the appointment of a new member should be automatically launched within a certain period of time after the expiry of the term. While based on the consensus rule of WTO, every WTO member is conferred veto power in WTO decision-making [27]. This is exactly how the United States repeatedly blocks the appointment of appellate body members, and it's predictable that the US will continue to reject any decision detrimental to its interest by exercising its veto power in the future. So the consensus rule becomes the center of the issue and needs revision so that decisions can be made without the agreement of the US. One possible direction might be changing the consensus-based decision-making principle to majority rule, that is, a decision is made if more than half of the members vote for it. But this reformation can be dangerous because it's possible that a WTO member will quit WTO when decisions that harm its interests are made through the majority rule. What’s more problematic is that Trump once threatened to pull the US out of the WTO [28]. If the appellate body is restored without the US voluntarily unblocking the reappointment, there is the possibility that the US will quit WTO. The WTO excluding major economies including the US will be severely eroded as multilateralism is greatly threatened [29]. Following the return of more trade barriers and the loss of credible venues to mediate trade disputes, the diminishing of the global economy will be foreseeable.

4. Analysis and Resolution of Major Issues in Sino-US Trade War: Anti-dumping, Intellectual Property and Most Favored Nation

4.1 trade policy and conflicts in these 3 aspects

Us anti-dumping policy towards China The United States has begun the most serious anti-dumping investigations and levied the most severe final anti-dumping sanctions against China in accordance with the guidelines established by the WTO. The amount of anti-dumping investigations and ultimate anti-dumping actions taken against other big trading firms is far lower than this. The repeated anti-dumping measures taken by the United States against China have had a significant severe effect on China's exports to the United States. This is especially true when one considers the massive trade deficit that exists between China and the United States [30].

The original intention of the importing country imposing anti-dumping duties on the exporting country is to curb the dumping behavior of the exporting country, maintain the domestic market order, and provide fair competition opportunities for manufacturers. However, by studying the anti-dumping cases suffered by China since its accession to the WTO, it has been discovered that importing nations do not use anti-dumping duties only for the aim of preserving market order, but gradually evolved into a trade protection mechanism for domestic manufacturers by importing countries. Among the anti-dumping cases that have been filed and investigated since China joined the world trade organization, the highest anti-dumping tax rate is more than 40%. Such a high tax rate will inevitably lead to an upward trend in the export sales price of products, thus losing the price advantage of products, enhancing the price competitiveness of imports, so as to achieve the purpose of protecting the interests of manufacturers in importing countries.

China has maintained its position as the nation with the highest number of anti-dumping investigations for the 22 years running (as of 2017). There are often hundreds of anti-dumping lawsuits filed each month on average. China's frequent anti-dumping investigations and high anti-dumping duties have not only formed great resistance to domestic exporters' expansion of overseas markets, but also affected domestic related industries.

The US has adopted anti-dumping policies against China for the following reasons:

(1) The purpose of us anti-dumping measures against China is to protect the living environment of us enterprises. (Chinese products are good in quality and cheap in price and are very popular in the United States, which is a big blow to American enterprises and regional economic protectionism)

(2) China's exports have been expanding at a high pace during the last 20 years, with an average annual growth rate of more than 10%. This is roughly twice the growth rate of world commerce over the same time period. The export quantity and growth trend of some commodities have aroused the concern and dissatisfaction of some producers in importing countries.

(3) With the dual advantages of labor force and raw materials, Chinese products are in an obvious advantageous position in international competition.

(4) Several nations, including the United States and the European Union, are of the opinion that China does not have a market economy, and the cost and price of enterprises are not determined by the market. Therefore, "substitution method" is usually adopted in calculating "normal price", which is obviously unfair.

(5) The long-standing sino-US trade deficit is the main reason for the US to implement anti-dumping trade policy against China.

(6) The overall added value of China's exports is relatively low, which is mainly achieved by volume. Some enterprises even compete at low prices to serve as a pretext for others.

(7) Most Chinese enterprises lack the relevant knowledge of anti-dumping, and do not know enough about anti-dumping countermeasures, so they are often "slaughtered by others". After the continuous success of the United States anti-dumping, more and more arbitrary and bold abuse of anti-dumping means.

On May 14, 2018, in response to the application submitted by CambriaCompany LLC on April 17, 2018, the U.S. department of commerce initiated an anti-subsidy and anti-frequency marketing investigation against stone turntable products from China. The provisional imposition of countervailing duties on quartz countertop items imported from China was announced by the Department of Commerce of the United States of America on September 17, 2018. 14 November 2018, the US Commerce Department announced a preliminary anti-dumping finding against imports of quartz countertop products from China. On the 15th of May, 2019, the United States Department of Commerce made the announcement that it will be imposing definitive anti-dumping and countervailing taxes on imports of quartz countertop goods from China.

On June 11, 2019, USITC voted to approve the import of Quartz countertop products from China Surface Products) make final affirmative determination of anti-dumping and countervailing industry injury. The conclusion reached by the International Trade Commission (ITC) was unanimously approved by all five of its commissioners. The United States Department of Commerce will apply anti-dumping and countervailing taxes on imports of stone countertop goods from China after a judgement that was favorable from the United States International Trade Commission. During the same time period, the United States International Trade Commission issued a decision that found anti-dumping and countervailing charges should be imposed on imports of stone countertop items from China. As a result, there will be no imposition of anti-dumping or countervailing duties on the items at issue in the case.

Intellectual property conflict between China and the United States The intellectual property system is a legal framework that ensures the owner of intellectual accomplishments has the ability to benefit from exclusive rights to such achievements for a certain amount of time while also being shielded from legal liability. No one is permitted to utilize his intellectual accomplishments in any way, shape, or form without the prior consent of the owner of the rights to do so. The establishment of an intellectual property system has the potential to foster innovation, safeguard the results of intellectual work performed by individuals, and encourage the translation of these fruits into actual productive forces. It is a method for providing incentives and safeguards, with the goals of fostering scientific and technical advancement, economic growth, and cultural flourishing [31].

Following the establishment of a legal framework for intellectual property rights, owners of copyrights will be able to make the content of their works available to the public through a licensing system. This will help accelerate cultural exchanges, popularize scientific and technological knowledge, improve the quality of workers, and foster the growth of the cultural market. Transferring or licensing one's intellectual accomplishments to other parties allows the owner of an industrial property to reap the financial benefits of such accomplishments.

It is important to note that the United States adopted obvious domestic protectionism in the intellectual property system during a historical stage when its capacity for technological and cultural innovation was lower than that of developed European countries. This is something that should be brought to your attention. For instance, in the early days of the United States patent system, applicants from other countries were not given the same consideration as those from the United States. The United States of America has, for a significant amount of time, maintained its stance that it would not take part in the worldwide intellectual property convention that was undertaken at that time by European nations. It was not until 1988 that the country became a party to the Berne Convention for the Protection of Literary and Artistic Works.

Since the middle of the 20th century, the United States has been steadily becoming the greatest power in the world, and concurrently, its domestic system for protecting intellectual property has been continually enhanced. The United States on the one hand, pay attention to for the right holder to provide effective protection of intellectual property rights, such as promoting the formation and expansion of the copyright industry, will be able to get to expand the scope of patent protection to the microorganism, business methods, etc., related to the computer program regulations, universities and research institutes to use the invention of the national investment to complete to be able to enjoy and independent disposition of the patent right, etc.; On the other hand, consideration is also given to achieving an acceptable equilibrium between the interests of those who have the rights to intellectual property and the interests of the general public. The United States is the first country in the world to establish antitrust system and use it to regulate the abuse of intellectual property rights. In addition, through a series of important decisions of its Supreme Court in the past 10 years, the United States has prevented the interpretation of patent right protection scope to be too broad, so as to avoid the danger that others may "hit the thunder" at any time when using advanced technology.

Since the 1980s, the United States has been actively participating in and promoting the formulation and adjustment of international rules on intellectual property rights from the perspective of safeguarding its own interests. The US has also been enforcing its own "intellectual property values" in bilateral exchanges, and has signed bilateral agreements with relevant countries, making them stricter and more stringent when it comes to the protection of intellectual property than the World Trade Organization's Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS). For example, Australia's new round of intellectual property law amendments began in 2005. That's what the Australia-US Free Trade Agreement of January 2005 called for. The United States government often invokes "Special Provision 301" of the Omnibus Trade Act and "Section 337" of the Customs Act in order to intimidate and penalize other nations and businesses that it considers to be violating the intellectual property rights of the United States. The United States of America has been the country with the most significant impact on the formulation and evolution of international standards concerning intellectual property.

Patent commerce accounts for a significant fraction of total U.S. international trade and plays a significant part in the process of preventing foreign products from entering the market in the United States. In reality, the issue of how much market share one may monopolize comes down to the breadth of patent protection. It is becoming more difficult for new businesses and researchers to join the market, and the potential for technological innovation in developing nations, in particular, is being stifled as a result. Many companies based in wealthy countries are now establishing patent supremacy. In order to achieve this goal, the United States put a lot of effort on developing patent trade, and they used this tactic to restrict the products of other countries from accessing the American market, and to provide convenience for American goods to occupy foreign markets. Revenue from patent transfers is one of IBM's fastest-growing sources of profit, according to the United States Patent and Trademark Office. Patent transfers accounted for $1.7 billion of IBM's total profit of $8.1 billion in 2000. More and more companies realize that patents have begun to appear in the international trade market as a kind of commodity. Particularly during the course of the last several years, a number of wealthy nations have been strongly advocating for the globalization of patent examination. There is no longer a restriction on patent examination based on geographic location; instead, only a select number of nations are in charge of conducting patent reviews and doling out patent rights. It is sufficient if other nations just acknowledge the conclusions of the investigation. The capacity of emerging nations to innovate will be severely hampered as a result of this circumstance. Because of their disproportionate dependence on foreign technology that have been granted patents, it even presents a risk to their national economic security.

The conflict between China and the United States manifests itself as a trade war, but the disagreement between the two countries over intellectual property rights remains the primary focus of attention. The trade conflict between China and the United States has its origins and primary focus on intellectual property [32], which is also the most crucial hedging point. The China–United States trade war cannot be effectively managed by China until the battle over intellectual property in China and the United States is resolved.

Since 1996, when the United States launched the first Section 337 investigation against Chinese enterprises, by June 2006, companies in the United States had initiated 53 section 337 investigations against China. Among them, from 2002 to 2005 after China's accession to the WTO, the United States initiated 337 investigations in 34 cases. It accounted for 41.5% of 337 investigations in the United States during the same period. China has been the subject of the most section 337 investigations by the United States. This will continue as Chinese exports continue to grow. According to statistics, since China's accession to the WTO, Chinese enterprises have paid more than one billion US dollars in compensation for intellectual property issues, mainly involving mobile phones, MP3 players, color TV sets, DVDS and so on. The WTO case will be a trigger for more US companies to use section 337 to erect technical barriers.

For example, in April 2006, The first software copyright case brought by Adobe in South China was won in the Tianhe District Court of Guangzhou at the first instance. Adobe has the copyright of the world famous drawing tool Photoshop and other software. In November 2005, after the Tianhe District Court formally accepted the infringement lawsuit filed by Adobe, the court found that a technology company in Guangzhou had installed 8 sets of pirated Adobe software in the company's computers even after being punished. The defendant compensates the plaintiff with 110,000 yuan for economic loss and 30,000 yuan for reasonable expenses incurred by the plaintiff to stop the infringement.

Because China is increasingly substituting resources and money in the context of a new phase of technological revolution and industrial transformation, the United States has decided to focus its attention on China's intellectual property rights (IPR). It has developed into a key strategic resource for China and a fundamental advantage in the country's ability to compete internationally. The United States and China have never been able to come to an agreement about the subject of intellectual property rights. Since the 1990s, the United States has never ceased blaming and criticizing China in an unfavorable manner regarding the protection of intellectual property rights (IPR). Since the list's inception in 1991, the United States has had China on the restricted country list for the purpose of protecting intellectual property. China has been put on the priority watch list of the Special 301 Report that has been released by the Office of the U.S. Trade Representative under Section 306 during the course of the last several years. In addition, the United States Intellectual Property Rights holders continue to confront significant challenges in China, as revealed by the Special 301 Report on a continuous basis. These include difficulty in securing intellectual property rights (IPR) protection that is appropriate and effective, as well as difficulties in gaining market access that is fair and equitable for those in the United States who depend on IPR protection. China has to come up with new guidelines and regulations. First, ensure that intellectual property rights are protected in a manner that is both more robust and more efficient. Second, make it possible for goods, services, and technology that rely heavily on IP to access the market. In addition to this, and in addition to other things, we will work to increase the efficiency of civil enforcement in Chinese courts.

Most favored nation treatment policy in China–United States The so-called most favored nation treatment is a kind of treaty concluded between countries. According to the terms of the treaty, the two states that are parties to the agreement are obligated to provide each other with the same level of preferential, privileged, or exempt treatment as is provided to any third country, either now or in the future. This includes trade, navigation, customs duties, legal status of citizens, and other aspects of international law. The tariff treatment of import and export commodities between the two nations is the primary focus of this treatment. However, it is clear that this treatment may be used to a broad variety of situations. This most favored nation treatment, also known as "non discriminatory treatment", is an effective legal means to eliminate trade discrimination and develop normal international trade exchanges. The mutual granting of MFN treatment by China and the United States and China have come to an accord that will benefit both of their economies by signing the United States-China Trade Agreement (US-China Trade Agreement). It serves as the foundation upon which regular commercial relations between the United States and China may be built. The U.S. Congress approved the Sino US trade agreement on January 24, 1980 and began to give China MFN treatment. In 2021, the U.S. Senator proposed to revoke China's MFN treatment. The U.S. President and his administration are very clear that it is in their national interests to continue to extend the MFN treatment for Sino US trade, but they are still uncertain in the formulation and implementation of specific policies.

On March 18, 2022, three Republican SENATORS -- Tom Cotton, Jim Inhofe and Rick Scott -- introduced The China Trade Relations Act. The bill calls for revoking the permanent Normal trade relationship status (formerly most-favoured-nation status) that China received in September 2000, restoring us-China trade relations to their pre-2001 model and requiring the US President to approve an extension of China's preferential trade status every year. Changes in trade status are more essential and profound than tariffs. Once the MOST-favoured-nation treatment is abolished, the subsequent annual review by the US President is required, and the process is more complicated, which will be stuck in the neck of trade by the US and seriously affect china-us economic and trade relations.

On Tuesday (March 22), New Jersey Congressman Smith said "revoke the Chinese Communist Party's permanent normal business relations status to punish horrific human rights abuses, especially including the ethnic minorities in the regime of Uyghurs and other ongoing genocide and forced labour" [33].

Proposals to revoke China's most-favored-nation status have long appeared. In August 2010, Rep. Brad Sherman, the top Democrat on the International Terrorism and Nuclear non-proliferation panel of the House International Relations Committee, and John Rosley, a member of the House Foreign Affairs Committee, proposed to cancel China's "most-favored-nation status." Until the two countries could agree on a "more level playing field." The bill would remove China's most-favored-nation status for six months until the two countries could reach an agreement on "eliminating trade imbalances within four years." The bill, intended to accelerate talks on a new trade relationship with China, "seeks to reduce the trade deficit to zero within four years."

4.2. Solution

Launch WTO multilateral dispute settlement mechanism Both China and the United States are required to adhere to the multilateral trade system that is governed by the World Trade Organization (WTO). The World Trade Organization's Dispute Settlement Body is the most effective venue for resolving legal conflicts [34]. The United States of America began the World Trade Organization's dispute resolution procedure on March 23, 2018, in reference to China's protection of intellectual property. It was asked that consultations be held with China. Following this, on April 4th, China made a request for talks with the United States over the imposition of taxes on China in accordance with the "301 probe," while simultaneously initiating the dispute resolution process of the WTO [30].

Review and improve relevant domestic laws As a reaction to this large-scale economic game between China and the United States, China needs to learn how to apply international law and international regulations in order to deal with international issues. It is necessary for it to reflect on its own concerns, which are the cause of tension, and to refrain from falling into the shackles of the politicization of legal matters. As a member of the WTO, we are obligated to settle trade disputes in accordance with the WTO Agreement and international law, evaluate and improve our own laws, and construct our very own dialogue system in accordance with global regulations. The majority of nations throughout the globe have profited from the founding of the World Trade Organization (WTO) [31]. In the context of globalization as it exists now, the multilateral trade system is the highway to fast economic progress. The rule of law serves not only as a guide for the norms that govern a country's internal affairs but also as a guide for preserving the equity and transparency that underpin the international order. It is imperative that both the local rule of law and the international rule of law be upheld and adhered to at all times. The growth of the international rule of law is guided by the domestic rule of law in a manner that is more equitable and transparent.

Deepen cooperation and increase the overlap of interests of both sides The development of commerce between China and the United States goes back more than 40 years. The United States and China are working together economically, and as part of that effort, their respective commercial sectors are always looking for opportunities to make the most of tremendous resources available in international commerce. The general equilibrium of international commerce will be driven and altered as a result of the comparison of high-quality items in international trade. The strategic partnership that exists between the United States of America and China in terms of trade has been far more extensive than that of any other nation. The United States and China engage in a kind of commerce that is, for the most part, highly controlled and restricted. It also plays an effective function in the composition structure of international commerce, which is due to the fact that it imposes reciprocal constraints on both sides. Examples of this include mutual advancement, advantages derived from investments in assets, a rise in the proportion of gold included in cutting-edge technology, and an increase in employment across a variety of industrial sectors. In the condition of friendly, peaceful, and mutually beneficial commerce that exists between China and the United States, both countries are defined by the unity of complementary strengths as well as the rational allocation and exploitation of market resources. This situation is known as a win-win. However, despite the fact that there are more positives than negatives, there is no such thing as an ideal and faultless commercial partnership. In addition to its apparently average and adequate strength, it also has a very high conditionality. There are a lot of issues that aren't being spoken about, both in terms of the trade institutions and the tensions between the two sides. The impression of sexual commerce between the two parties is very skewed and unreliable. For instance, the export of some Chinese goods will have hidden issues such as an unknown brand degree, a poor grade, a tiny profit, a high turnover rate, high product quality, and high pricing. During the course of doing business in both directions, China and the United States may find themselves in a state of ongoing friction due to the occurrence of conflicts and disagreements.

5. Causes of the US-China Trade War

5.1 Institutions in International Trade Law

Institutions and treaties in the international legal system are designed to prevent the escalation of trade barriers, including tariffs and quotas. The General Agreement on Tariffs and Trade (GATT) was a treaty established in 1947, aimed at regulating and stimulating world trade to boost economic recovery after World War Two [35]. GATT’s policies were refined eight times and eventually became today’s World Trade Organization (WTO). The WTO has a set of legal procedures to settle trade disputes, including consultations, panel examinations, and potential rulings made by the Appellate Body, as shown in Figure 1.

Fig. 1: WTO Dispute Settlement Mechanism [36]

5.2 US-China Trade Relationship

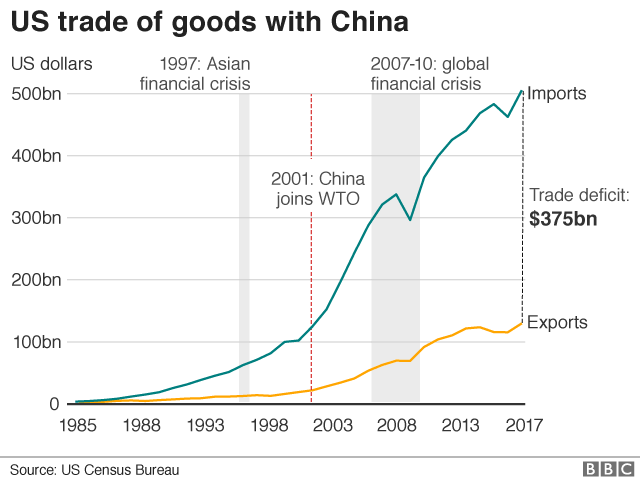

Following China’s entry into the WTO in 2001, international trade and global interconnectedness have grown at a rapid rate, especially between the United States, the world’s greatest economy, and China, a rising superpower. By 2020, bilateral trade between the two countries reached over $559.2 billion [37]. American consumers were able to obtain goods and services at cheaper prices, which led to increased consumer surplus. Meanwhile, China was able to obtain greater incomes for workers, improved technology, and a larger market for their manufactured goods. China’s economy is now thirteen times larger than it was in 2001 [38], and globalization helped lift over 400 million Chinese citizens out of extreme poverty [39].

Fig. 2: US Trade of Goods with China [40]

However, some benefits of the US-China trading relationship were unbalanced. The US current account deficit began growing at a rapid rate after China’s entry to the WTO. This led to Donald Trump using the Trade War as a prominent discussion topic during his 2016 US Presidential Campaign, promising to reduce the trade deficit in many speeches. On June 28, 2016 in Monessan, PA, he stated, “This wave of globalization has wiped out totally, totally, our middle class. It does not have to be this way. We can turn it around and we can turn it around fast.” [41]. Trump also accused China of having unjust and illegitimate trade practices, citing unfair subsidization of domestic industries and intellectual property theft.

Growing clashes in economic objectives and political agendas resulted in then-President Trump initiating the US-China Trade War on July 6, 2018, by imposing tariffs on imports from China. This was a violation of GATT’s ‘Most Favored Nation’ of Article 1.

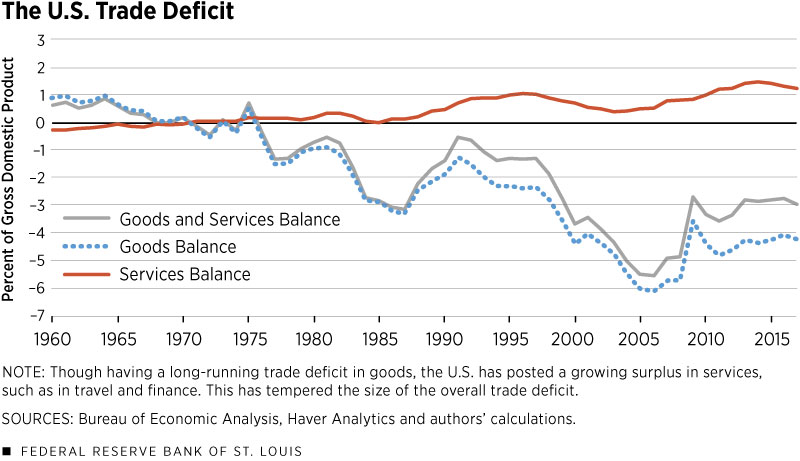

Fig. 3: US Trade Deficit [42]

China responded to the Trade War by raising retaliatory tariffs from an average of 7.2% to 18.3% [43] without obtaining approval from the WTO’s Dispute Settlement Body. This was also a violation of international law and the trade dispute settlement system, as shown in Figure 1.

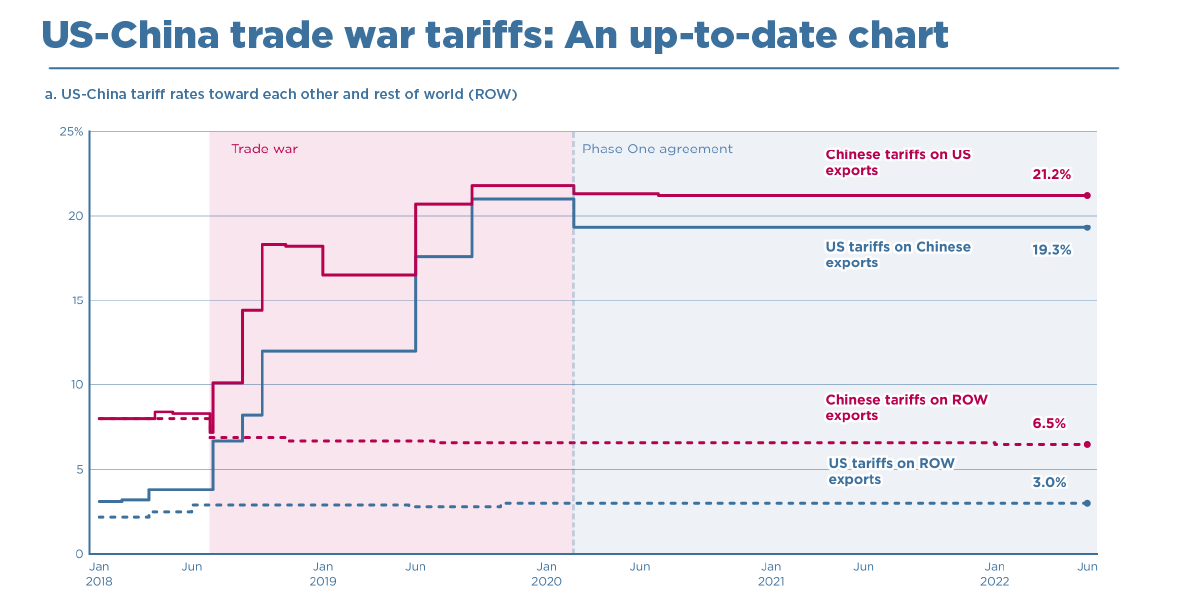

With a 10% increase in tariffs resulting in the US’ value of exports to decline by $32 billion, trade wars are never within a country’s economic interests. However, a lack of mutual trust, exacerbated by political tensions, prevented the countries from turning to legal means and the WTO system to resolve their dispute. This led both the US and China to choose a unilateral approach, with resulted in a Trade War involving ongoing increases in retaliatory tariffs, as shown in Figure 4.

Fig. 4: US-China Trade War Tariffs: An up-to-date chart [44]

5.3 Allegedly Unfair Advantages for Chinese Firms

Leading up to the Trade War, both the United States and China experienced structural changes in their economies. Many of these elements resulted in conflicting objectives and policies.

Low-cost labor, exchange rate controls (with the undervalued Chinese Yuan), and government investments in infrastructure and production capacity have lowered the costs of production in China [45]. Many Chinese exports have also received government subsidies, with a total of over $22.3 billion in 2018 [46]. Additionally, China has a large state-owned banking system, where firms can easily obtain loans. This access to large-scale finance allows Chinese firms to grow more quickly. The largest buyers in China are also typically state-owned firms that favor domestic suppliers over their foreign rivals, creating unbalanced demand for goods. Furthermore, there’s been an increase in domestic investment towards historically import-based industries to strengthen the domestic economy and reduce dependence on foreign technology [47].

These factors combined allow Chinese goods to be sold in international markets, such as the United States’, at prices below the market value, resulting in dumping. This is putting pressure on American producers and creating an unfair competitive edge for the Chinese, as consumers are more likely to purchase the cheaper imports. It is acting as a cause for industry decline and job losses in the United States, particularly in the secondary sector. A total of 3.7 million US jobs lost due to trade relations with China since its WTO entry [48].

China has also been accused of maintaining an artificially low value for its currency, the Chinese Yuan. On September 1st, 2019, the US applied a 10% tariff on an additional $300 billion worth of Chinese imports. In response, China devalued the Chinese Yuan to maintain an illusion of cheap prices when exporting to the US market and ensure that demand for their products stays high. This resulted in the US Treasury adding China to their watchlist of currency manipulating countries, which not only increased economic conflict, but also political tensions.

In an attempt at protectionism, the US continued increasing tariffs on Chinese imports, as shown in Figure 4, and led to the intensification of the Trade War.

5.4 Alleged Disadvantages for Foreign Firms in China

Even in January 2018, prior to the Trade War, China’s tariffs on worldwide exports stood at 8.0% [49], substantially higher than the global average tariff rate of 2.59% in 2017 [50]. China also has a complex distribution and supply chain system, making it difficult for firms to export to the country. To work around this, some firms may choose to set up within China, but this can also come with complications. For a foreign direct investment to occur in China, there must be a joint venture formed with a Chinese national. When setting up in China, there are also technology transfer requirements mandated by the government. This could allow the Chinese government and its supported firms to obtain cutting-edge research and technology, even when they weren’t the ones who developed it. Because domestic competitors receive favoritism such as state-funding and greater knowledge of the local market, it may be more difficult for foreign firms to gain substantial market share within China, especially while maintaining full autonomy. These policies and complications violate the National Treatment Principle of GATT’s Article 3, and result in one-sided, unbalanced trade benefits.

6. Conclusion

In conclusion, both countries had changing economic structures and objectives, with a mutual desire to strengthen domestic industries and protect long-term competitiveness; both countries want their economies to become more resilient to disruptions such as fluctuating trade barriers, supply chain issues, and the pandemic. The conflict of these factors resulted in tariffs rising and the intensification of the Trade War. Moving forward, international institutions such as the WTO should be more stringent when enforcing trade law and taking on a greater role in conflict regulation during the early stages. There should also be greater controls in China’s domestic markets, such as in the monopolization or subsidization of exporting industries.

References

[1]. National Security Strategy of the United States of America [R]. The White House, December, 2017.

[2]. Guy Taylor, Bannon storms Japan, bashes U.S. 'elites' for bungling rise of China[N]. The Washington Times, November 15, 2017.

[3]. Vander, M. E. and Shepherd, B. " Services Trade, Regulation and Regional Integration: Evidence from Sectoral Data." the World d Economy, 2013, 36(11),

[4]. Tian, W. and Yu, M. J. "Processing Trade, Export Intensity, and Input Trade Liberalization: Evidence from Chinese Firms." Journal of Asia⁃Pacific Economy, 2015, 20(3),

[5]. Crozet, M.; Millet, E. and Mirza, D. " The Impact of Domestic Regulations on International Trade in Services: evidence from Firm⁃Level Data ." Journal of Comparative Economics, 2016,

[6]. Francois, J. and Hoekman, B. "Services Trade an d Policy." Journal of Economic Literature, 2010

[7]. Handley, K. " Exporting under Trade Policy Uncertainty: Theory and Evidence." Journal of Economic Literature, 2014

[8]. Juniata, A. " Service Trade Restrictiveness and Internationalisation of Retail Trade" International Economics and Economic Policy, 2019

[9]. Guo M.X., Lu L., Sheng L.G., Yu M. J., 2018, The Day after Tomorrow: Evaluating the Burden of Trumps Trade War [J], Asian Economic Paper 17

[10]. Melitz M.J., Ottaviano,G.I., 2008, Market Size, Trade, and Productivity [J], Review of Economic Studies

[11]. “Journal of International Trade Law and Policy.” Journal of International Trade Law and Policy | Emerald Insight. Accessed July 21, 2022. http://www.emeraldinsight.com/1477-0024.htm.

[12]. “Why Did Trump End the WTO's Appellate Body? Tariffs.” PIIE, March 21, 2022. https://www.piie.com/blogs/trade-and-investment-policy-watch/why-did-trump-end-wtos-appellate-body-tariffs

[13]. “Dispute Settlement - Appellate Body.” WTO. Accessed July 21, 2022. https://www.wto.org/english/tratop_e/dispu_e/appellate_body_e.htm.

[14]. “The World Trade Organization: The Appellate Body Crisis.” The World Trade Organization: The Appellate Body Crisis | Center for Strategic and International Studies, September 18, 2019.

[15]. Bloomberg.com. Bloomberg. Accessed July 22, 2022. https://www.bloomberg.com/news/articles/2020-09-24/why-the-wto-is-caught-in-trump-s-trade-war-crossfire-quicktake.

[16]. Bloomberg.com. Bloomberg. Accessed July 22, 2022. https://www.bloomberg.com/news/articles/2020-09-24/why-the-wto-is-caught-in-trump-s-trade-war-crossfire-quicktake.

[17]. “Tariff Measures on Certain Goods from China.” United States Trade Representative. Accessed July 22, 2022. https://ustr.gov/issue-areas/enforcement/dispute-settlement-proceedings/wto-dispute-settlement/pending-wto-disputes/tariff-measures-certain-goods-china

[18]. Simon LesteronMarch, and Simon Lester. “Ending the WTO Dispute Settlement Crisis: Where to from Here?” International Institute for Sustainable Development. Accessed July 22, 2022. https://www.iisd.org/articles/united-states-must-propose-solutions-end-wto-dispute-settlement-crisis

[19]. “Why Did Trump End the WTO's Appellate Body? Tariffs.” PIIE, March 21, 2022. https://www.piie.com/blogs/trade-and-investment-policy-watch/why-did-trump-end-wtos-appellate-body-tariffs.

[20]. “Why Did Trump End the WTO's Appellate Body? Tariffs.” PIIE, March 21, 2022. https://www.piie.com/blogs/trade-and-investment-policy-watch/why-did-trump-end-wtos-appellate-body-tariffs.

[21]. “WTO Reform: The Beginning of the End or the End of the Beginning?” WTO Reform: The Beginning of the End or the End of the Beginning? | Center for Strategic and International Studies. Accessed July 21, 2022. https://www.csis.org/analysis/wto-reform-beginning-end-or-end-beginning.

[22]. Bajpai, Aditya Rathore and Ashutosh. “The WTO Appellate Body Crisis: How We Got Here and What Lies Ahead?” Jurist, April 14, 2020. https://www.jurist.org/commentary/2020/04/rathore-bajpai-wto-appellate-body-crisis/.

[23]. Bajpai, Aditya Rathore and Ashutosh. “The WTO Appellate Body Crisis: How We Got Here and What Lies Ahead?” Jurist, April 14, 2020. https://www.jurist.org/commentary/2020/04/rathore-bajpai-wto-appellate-body-crisis/.

[24]. Bajpai, Aditya Rathore and Ashutosh. “The WTO Appellate Body Crisis: How We Got Here and What Lies Ahead?” Jurist, April 14, 2020. https://www.jurist.org/commentary/2020/04/rathore-bajpai-wto-appellate-body-crisis/.

[25]. “WTO Appellate Review: Reform Proposals and Alternatives.” World Trade Institute, August 6, 2019. https://www.wti.org/research/publications/1228/wto-appellate-review-reform-proposals/.

[26]. Simon LesteronMarch, and Simon Lester. “Ending the WTO Dispute Settlement Crisis: Where to from Here?” International Institute for Sustainable Development. Accessed July 22, 2022. https://www.iisd.org/articles/united-states-must-propose-solutions-end-wto-dispute-settlement-crisis.

[27]. Iloani, Francis Arinze. “Explainer: How Veto Power Works in WTO Decision Making.” Dubawa, November 4, 2020. https://dubawa.org/explainer-how-veto-power-works-in-wto-decision-making/.

[28]. Aarup, Sarah Anne. “'All Talk and No Walk': America Ain't Back at the WTO.” POLITICO. POLITICO, November 24, 2021. https://www.politico.eu/article/united-states-world-trade-organization-joe-biden/.

[29]. “WTO Reform: The Beginning of the End or the End of the Beginning?” WTO Reform: The Beginning of the End or the End of the Beginning? | Center for Strategic and International Studies. Accessed July 21, 2022. https://www.csis.org/analysis/wto-reform-beginning-end-or-end-beginning.

[30]. Haotian Ding, et al."Discussion on Feasible Strategies of China's Trade War between China and the United States".Proceedings of 2019 International Conference on Global Economy and Business Management(GEBM 2019).Ed.. Clausius Scientific Press,Canada, 2019, 184-187.

[31]. Joshi Ashish B.,and Perin Marina."United States – China trade War and its effects on Global Economy." International Journal of Management Studies VI.1(4)(2019). doi:10.18843/ijms/v6i1(4)/08.

[32]. Kalsie Anjala,and Arora Ashima."US–China Trade War: The Tale of Clash Between Biggest Developed and Developing Economies of the World." Management and Economics Research Journal 5.(2019). doi:10.18639/merj.2019.956433.

[33]. Liu Kerry."China’s Policy Response to the Sino US Trade War: An Initial Assessment."The Chinese Economy 53.2(2020). doi:10.1080/10971475.2019.1688003.

[34]. Weihuan Zhou,and Henry Gao."US–China Trade War: A Way Out?." World Trade Review.(2020). doi:10.1017/s1474745620000348.

[35]. Law.duke.edu. 2022. GATT/WTO. [online] Available at: <https://law.duke.edu/lib/research-guides/gatt/> [Accessed 22 July 2022].

[36]. Wto.org. 2022. WTO | Disputes - Dispute Settlement CBT - The process - Stages in a typical WTO dispute settlement case - Flow chart of the Dispute Settlement Process - Page 1. [online] Available at: <https://www.wto.org/english/tratop_e/dispu_e/disp_settlement_cbt_e/c6s1p1_e.htm#:~:text=There%20are%20three%20main%20stages,by%20the%20losing%20party%20to> [Accessed 22 July 2022].

[37]. The People's Republic of China (no date) United States Trade Representative. Available at: https://ustr.gov/countries-regions/china-mongolia-taiwan/peoples-republic-china (Accessed: November 28, 2022).

[38]. Data.worldbank.org. 2022. GDP (current US$) - China | Data. [online] Available at: <https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=CN> [Accessed 22 July 2022].

[39]. BBC News. 2022. Has China lifted 100 million people out of poverty?. [online] Available at: <https://www.bbc.com/news/56213271> [Accessed 22 July 2022].

[40]. BBC News. 2022. Charting the US-China trade battle. [online] Available at: <https://www.bbc.com/news/business-44728166> [Accessed 22 July 2022].

[41]. Time. 2022. Read Donald Trump's Speech on Trade. [online] Available at: <https://time.com/4386335/donald-trump-trade-speech-transcript/> [Accessed 22 July 2022].

[42]. Reinbold, B. and Wen, Y. (2021) Understanding the roots of the U.S. trade deficit: St. Louis Fed, Saint Louis Fed Eagle. Federal Reserve Bank of St. Louis. Available at: https://www.stlouisfed.org/publications/regional-economist/third-quarter-2018/understanding-roots-trade-deficit (Accessed: November 28, 2022).

[43]. PIIE. 2022. US-China Trade War Tariffs: An Up-to-Date Chart. [online] Available at: <https://www.piie.com/research/piie-charts/us-china-trade-war-tariffs-date-chart> [Accessed 22 July 2022].

[44]. PIIE. 2022. US-China Trade War Tariffs: An Up-to-Date Chart. [online] Available at: <https://www.piie.com/research/piie-charts/us-china-trade-war-tariffs-date-chart> [Accessed 22 July 2022].

[45]. Harvard Business Review. 2022. A New Approach to Rebalancing the U.S-China Trade Deficit. [online] Available at: <https://hbr.org/2021/12/a-new-approach-to-rebalancing-the-u-s-china-trade-deficit> [Accessed 22 July 2022].

[46]. Ft.com. 2022. China paid record $22bn in corporate subsidies in 2018. [online] Available at: <https://www.ft.com/content/e2916586-8048-11e9-b592-5fe435b57a3b> [Accessed 22 July 2022].

[47]. Council on Foreign Relations. 2022. U.S.-China Trade War: How We Got Here. [online] Available at: <https://www.cfr.org/blog/us-china-trade-war-how-we-got-here> [Accessed 22 July 2022].

[48]. Harvard Business Review. 2022. A New Approach to Rebalancing the U.S-China Trade Deficit. [online] Available at: <https://hbr.org/2021/12/a-new-approach-to-rebalancing-the-u-s-china-trade-deficit> [Accessed 22 July 2022].

[49]. PIIE. 2022. US-China Trade War Tariffs: An Up-to-Date Chart. [online] Available at: <https://www.piie.com/research/piie-charts/us-china-trade-war-tariffs-date-chart> [Accessed 22 July 2022].

[50]. Data.worldbank.org. 2022. Tariff rate, applied, weighted mean, all products (%) | Data. [online] Available at: <https://data.worldbank.org/indicator/TM.TAX.MRCH.WM.AR.ZS> [Accessed 22 July 2022].2

Cite this article

Wang,H.;Li,T.;Cai,X. (2023). Sino U.S. Trade War: Settling the US-China Trade War from the Perspective of International Organization and Regulation. Advances in Economics, Management and Political Sciences,6,403-419.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2022 International Conference on Financial Technology and Business Analysis (ICFTBA 2022), Part 2

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. National Security Strategy of the United States of America [R]. The White House, December, 2017.

[2]. Guy Taylor, Bannon storms Japan, bashes U.S. 'elites' for bungling rise of China[N]. The Washington Times, November 15, 2017.

[3]. Vander, M. E. and Shepherd, B. " Services Trade, Regulation and Regional Integration: Evidence from Sectoral Data." the World d Economy, 2013, 36(11),

[4]. Tian, W. and Yu, M. J. "Processing Trade, Export Intensity, and Input Trade Liberalization: Evidence from Chinese Firms." Journal of Asia⁃Pacific Economy, 2015, 20(3),

[5]. Crozet, M.; Millet, E. and Mirza, D. " The Impact of Domestic Regulations on International Trade in Services: evidence from Firm⁃Level Data ." Journal of Comparative Economics, 2016,

[6]. Francois, J. and Hoekman, B. "Services Trade an d Policy." Journal of Economic Literature, 2010

[7]. Handley, K. " Exporting under Trade Policy Uncertainty: Theory and Evidence." Journal of Economic Literature, 2014

[8]. Juniata, A. " Service Trade Restrictiveness and Internationalisation of Retail Trade" International Economics and Economic Policy, 2019

[9]. Guo M.X., Lu L., Sheng L.G., Yu M. J., 2018, The Day after Tomorrow: Evaluating the Burden of Trumps Trade War [J], Asian Economic Paper 17

[10]. Melitz M.J., Ottaviano,G.I., 2008, Market Size, Trade, and Productivity [J], Review of Economic Studies

[11]. “Journal of International Trade Law and Policy.” Journal of International Trade Law and Policy | Emerald Insight. Accessed July 21, 2022. http://www.emeraldinsight.com/1477-0024.htm.

[12]. “Why Did Trump End the WTO's Appellate Body? Tariffs.” PIIE, March 21, 2022. https://www.piie.com/blogs/trade-and-investment-policy-watch/why-did-trump-end-wtos-appellate-body-tariffs

[13]. “Dispute Settlement - Appellate Body.” WTO. Accessed July 21, 2022. https://www.wto.org/english/tratop_e/dispu_e/appellate_body_e.htm.

[14]. “The World Trade Organization: The Appellate Body Crisis.” The World Trade Organization: The Appellate Body Crisis | Center for Strategic and International Studies, September 18, 2019.

[15]. Bloomberg.com. Bloomberg. Accessed July 22, 2022. https://www.bloomberg.com/news/articles/2020-09-24/why-the-wto-is-caught-in-trump-s-trade-war-crossfire-quicktake.

[16]. Bloomberg.com. Bloomberg. Accessed July 22, 2022. https://www.bloomberg.com/news/articles/2020-09-24/why-the-wto-is-caught-in-trump-s-trade-war-crossfire-quicktake.

[17]. “Tariff Measures on Certain Goods from China.” United States Trade Representative. Accessed July 22, 2022. https://ustr.gov/issue-areas/enforcement/dispute-settlement-proceedings/wto-dispute-settlement/pending-wto-disputes/tariff-measures-certain-goods-china

[18]. Simon LesteronMarch, and Simon Lester. “Ending the WTO Dispute Settlement Crisis: Where to from Here?” International Institute for Sustainable Development. Accessed July 22, 2022. https://www.iisd.org/articles/united-states-must-propose-solutions-end-wto-dispute-settlement-crisis

[19]. “Why Did Trump End the WTO's Appellate Body? Tariffs.” PIIE, March 21, 2022. https://www.piie.com/blogs/trade-and-investment-policy-watch/why-did-trump-end-wtos-appellate-body-tariffs.

[20]. “Why Did Trump End the WTO's Appellate Body? Tariffs.” PIIE, March 21, 2022. https://www.piie.com/blogs/trade-and-investment-policy-watch/why-did-trump-end-wtos-appellate-body-tariffs.

[21]. “WTO Reform: The Beginning of the End or the End of the Beginning?” WTO Reform: The Beginning of the End or the End of the Beginning? | Center for Strategic and International Studies. Accessed July 21, 2022. https://www.csis.org/analysis/wto-reform-beginning-end-or-end-beginning.

[22]. Bajpai, Aditya Rathore and Ashutosh. “The WTO Appellate Body Crisis: How We Got Here and What Lies Ahead?” Jurist, April 14, 2020. https://www.jurist.org/commentary/2020/04/rathore-bajpai-wto-appellate-body-crisis/.

[23]. Bajpai, Aditya Rathore and Ashutosh. “The WTO Appellate Body Crisis: How We Got Here and What Lies Ahead?” Jurist, April 14, 2020. https://www.jurist.org/commentary/2020/04/rathore-bajpai-wto-appellate-body-crisis/.

[24]. Bajpai, Aditya Rathore and Ashutosh. “The WTO Appellate Body Crisis: How We Got Here and What Lies Ahead?” Jurist, April 14, 2020. https://www.jurist.org/commentary/2020/04/rathore-bajpai-wto-appellate-body-crisis/.

[25]. “WTO Appellate Review: Reform Proposals and Alternatives.” World Trade Institute, August 6, 2019. https://www.wti.org/research/publications/1228/wto-appellate-review-reform-proposals/.

[26]. Simon LesteronMarch, and Simon Lester. “Ending the WTO Dispute Settlement Crisis: Where to from Here?” International Institute for Sustainable Development. Accessed July 22, 2022. https://www.iisd.org/articles/united-states-must-propose-solutions-end-wto-dispute-settlement-crisis.

[27]. Iloani, Francis Arinze. “Explainer: How Veto Power Works in WTO Decision Making.” Dubawa, November 4, 2020. https://dubawa.org/explainer-how-veto-power-works-in-wto-decision-making/.

[28]. Aarup, Sarah Anne. “'All Talk and No Walk': America Ain't Back at the WTO.” POLITICO. POLITICO, November 24, 2021. https://www.politico.eu/article/united-states-world-trade-organization-joe-biden/.

[29]. “WTO Reform: The Beginning of the End or the End of the Beginning?” WTO Reform: The Beginning of the End or the End of the Beginning? | Center for Strategic and International Studies. Accessed July 21, 2022. https://www.csis.org/analysis/wto-reform-beginning-end-or-end-beginning.

[30]. Haotian Ding, et al."Discussion on Feasible Strategies of China's Trade War between China and the United States".Proceedings of 2019 International Conference on Global Economy and Business Management(GEBM 2019).Ed.. Clausius Scientific Press,Canada, 2019, 184-187.

[31]. Joshi Ashish B.,and Perin Marina."United States – China trade War and its effects on Global Economy." International Journal of Management Studies VI.1(4)(2019). doi:10.18843/ijms/v6i1(4)/08.

[32]. Kalsie Anjala,and Arora Ashima."US–China Trade War: The Tale of Clash Between Biggest Developed and Developing Economies of the World." Management and Economics Research Journal 5.(2019). doi:10.18639/merj.2019.956433.

[33]. Liu Kerry."China’s Policy Response to the Sino US Trade War: An Initial Assessment."The Chinese Economy 53.2(2020). doi:10.1080/10971475.2019.1688003.

[34]. Weihuan Zhou,and Henry Gao."US–China Trade War: A Way Out?." World Trade Review.(2020). doi:10.1017/s1474745620000348.

[35]. Law.duke.edu. 2022. GATT/WTO. [online] Available at: <https://law.duke.edu/lib/research-guides/gatt/> [Accessed 22 July 2022].

[36]. Wto.org. 2022. WTO | Disputes - Dispute Settlement CBT - The process - Stages in a typical WTO dispute settlement case - Flow chart of the Dispute Settlement Process - Page 1. [online] Available at: <https://www.wto.org/english/tratop_e/dispu_e/disp_settlement_cbt_e/c6s1p1_e.htm#:~:text=There%20are%20three%20main%20stages,by%20the%20losing%20party%20to> [Accessed 22 July 2022].

[37]. The People's Republic of China (no date) United States Trade Representative. Available at: https://ustr.gov/countries-regions/china-mongolia-taiwan/peoples-republic-china (Accessed: November 28, 2022).

[38]. Data.worldbank.org. 2022. GDP (current US$) - China | Data. [online] Available at: <https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=CN> [Accessed 22 July 2022].

[39]. BBC News. 2022. Has China lifted 100 million people out of poverty?. [online] Available at: <https://www.bbc.com/news/56213271> [Accessed 22 July 2022].

[40]. BBC News. 2022. Charting the US-China trade battle. [online] Available at: <https://www.bbc.com/news/business-44728166> [Accessed 22 July 2022].

[41]. Time. 2022. Read Donald Trump's Speech on Trade. [online] Available at: <https://time.com/4386335/donald-trump-trade-speech-transcript/> [Accessed 22 July 2022].

[42]. Reinbold, B. and Wen, Y. (2021) Understanding the roots of the U.S. trade deficit: St. Louis Fed, Saint Louis Fed Eagle. Federal Reserve Bank of St. Louis. Available at: https://www.stlouisfed.org/publications/regional-economist/third-quarter-2018/understanding-roots-trade-deficit (Accessed: November 28, 2022).

[43]. PIIE. 2022. US-China Trade War Tariffs: An Up-to-Date Chart. [online] Available at: <https://www.piie.com/research/piie-charts/us-china-trade-war-tariffs-date-chart> [Accessed 22 July 2022].

[44]. PIIE. 2022. US-China Trade War Tariffs: An Up-to-Date Chart. [online] Available at: <https://www.piie.com/research/piie-charts/us-china-trade-war-tariffs-date-chart> [Accessed 22 July 2022].

[45]. Harvard Business Review. 2022. A New Approach to Rebalancing the U.S-China Trade Deficit. [online] Available at: <https://hbr.org/2021/12/a-new-approach-to-rebalancing-the-u-s-china-trade-deficit> [Accessed 22 July 2022].

[46]. Ft.com. 2022. China paid record $22bn in corporate subsidies in 2018. [online] Available at: <https://www.ft.com/content/e2916586-8048-11e9-b592-5fe435b57a3b> [Accessed 22 July 2022].

[47]. Council on Foreign Relations. 2022. U.S.-China Trade War: How We Got Here. [online] Available at: <https://www.cfr.org/blog/us-china-trade-war-how-we-got-here> [Accessed 22 July 2022].

[48]. Harvard Business Review. 2022. A New Approach to Rebalancing the U.S-China Trade Deficit. [online] Available at: <https://hbr.org/2021/12/a-new-approach-to-rebalancing-the-u-s-china-trade-deficit> [Accessed 22 July 2022].

[49]. PIIE. 2022. US-China Trade War Tariffs: An Up-to-Date Chart. [online] Available at: <https://www.piie.com/research/piie-charts/us-china-trade-war-tariffs-date-chart> [Accessed 22 July 2022].

[50]. Data.worldbank.org. 2022. Tariff rate, applied, weighted mean, all products (%) | Data. [online] Available at: <https://data.worldbank.org/indicator/TM.TAX.MRCH.WM.AR.ZS> [Accessed 22 July 2022].2