1. Introduction

Silicon Valley Bank is an American financial institution. And this bank institution serves as a financial collaborator within the realm of the innovation economy, boasting a rich history spanning over four decades. The primary focus of SVB corporation is to provide assistance to individuals, as well as innovation or start-up companies, particularly in the technology sector and inventors globally, with the aim of enabling them to attain their business or financial objectives. During this period, SVB has garnered numerous commendations and has a substantial clientele, as well as an extensive network of branches in other countries including China, the United Kingdom, Canada, Germany, India, and other global regions. However, the company, which had experienced significant growth on March 10, 2023, had a sudden collapse within a span of 48 hours after publicly announcing the sale of its assets. This downfall was attributed to the compounding effects of the epidemic and the state of the U.S. economy. The occurrence of this collapse has elicited surprise among numerous individuals and specialists in various industries. One reason for SVB's recent accolades and longstanding reputation is its consistent recognition as one of the top national and regional banks in the United States over a significant period of time. Furthermore, it should be noted that SVB had previously demonstrated a consistent level of performance within the industry. Also, the collapse had a profound influence on technology startups worldwide, resulting in numerous adverse consequences for the United States economy and global financial markets. As an illustration, it can be observed that following the announcement of SVB's collapse, the European Banking Index had a significant decline of 7%, resulting in a market loss of €120 billion [1]. Moreover, a significant number of technology companies exhibited a strong dependence on SVB Bank for their financial needs. The announcement of the bank's collapse resulted in significant adverse impacts on numerous technology companies, leading to their financial distress and subsequent struggles [2]. The following instances of market alterations prompted by the SVB exemplify the extensive influence that the SVB has exerted on the market, leading to a significant escalation in uncertainty within the financial markets. Additionally, the fall of SVB positions it as the second largest bank collapse in the United States, following the demise of the Bank of Washington.

In addition, the collapse had a profound influence on technology startups globally, resulting in a multitude of adverse consequences for the United States economy and global financial markets. Following the declaration of SVB's insolvency, which held the position of the primary financier for technology startups in the United States and maintained numerous business connections, the resultant bankruptcy of SVB instigated significant disruptions within the global financial markets and instilled a sense of apprehension among technology entrepreneurs. The European Banking Index experienced a rapid decline of 7%, resulting in a loss of €120 billion from the market [3]. Furthermore, a significant number of technology firms relied largely on SVB Bank for their financial needs. The announcement of the bank's failure resulted in significant adverse impacts on numerous IT businesses, particularly within the UK region, causing them to face significant challenges and difficulties [4]. The upper instances of market alterations prompted by the SVB exemplify the extensive influence that the SVB has exerted on the market, resulting in a significant escalation of uncertainty within the financial markets. Additionally, the collapse of SVB positions it as the second most substantial bank failure in the United States, following the demise of Washington Bank. The failure of Silicon Valley Bank can be attributed to various factors, including economic instability and recession following the Covid-19 pandemic. Additionally, internal management issues such as inadequate enterprise risk management and a lack of diversity have emerged as significant contributors to SVB's downfall. The many effects can be classified into two categories: external factors and internal reasons. Hence, this essay will primarily centre on these two factors in order to examine the underlying explanations for the lack of success experienced by SVB.

2. External Reason

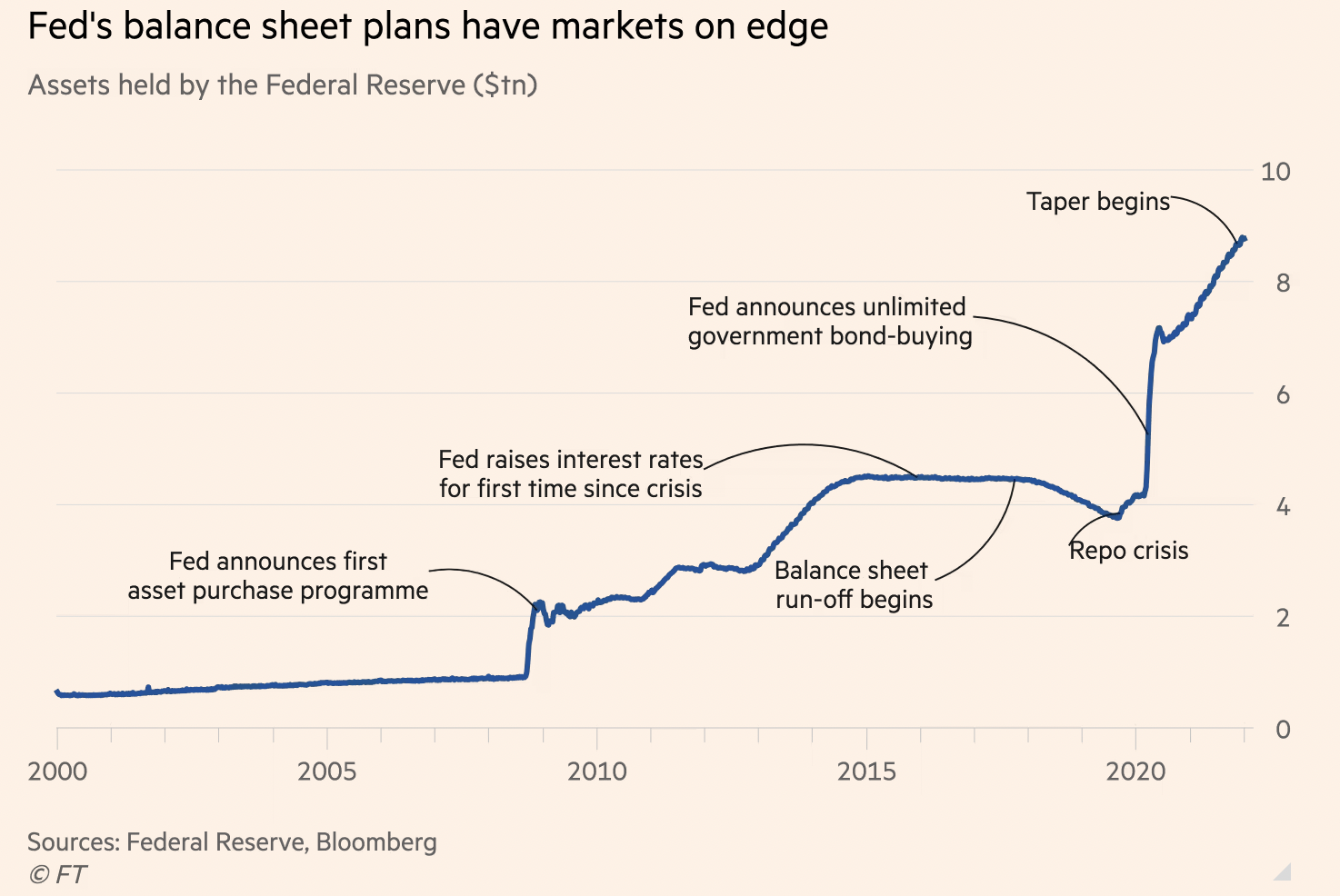

The SVB faces significant challenges due to an unfavorable economic and business environment climate. Commencing in the year 2021, the world economy underwent a period of recession. The global outbreak of the Covid-19 pandemic in 2020 served as the catalyst for these events. In response to the escalating number of infections and fatalities, numerous countries and towns commenced implementing containment measures aimed at mitigating the rapid transmission of the diseases. As a result, the exchange of goods and services between nations or urban centres, as well as the operations and dynamics of businesses and markets, have all experienced significant impacts. Subsequent to the rise in prices, inflation has ensued, accompanied by a global economic downturn. In response to the prevailing unfavourable economic conditions, central banks in several countries have initiated steps. In March 2020, the Federal Reserve implemented an unlimited quantitative easing programme and made a commitment to maintaining near-zero interest rates for a prolonged duration in reaction to the outbreak and recession. This course of action resulted in a substantial increase in liquidity. At the time of the Federal Reserve's rate increase announcement in March 2022, its balance sheet had experienced a cumulative growth of 110%, reaching a maximum value of $9 trillion, as depicted in Figure 1 [2]. During this period, the presence of surplus liquidity led to the increased interest of Silicon Valley banks in acquiring substantial amounts of United States Treasury bonds. In March 2022, the Federal Reserve made an announcement regarding the initiation of interest rate hikes as a measure to manage inflation inside the United States, coinciding with the recuperation of the nation's economy.

As of March 2023, the Federal Reserve had implemented a series of interest rate hikes totalling 450 basis points, resulting in a significant increase in U.S. bond yields [5]. The prices of bond assets in the United States, which were previously acquired in significant numbers by banks in Silicon Valley as part of efforts to increase liquidity, experienced a significant decline. Additionally, U.S. Treasuries, classified as available-for-sale assets (AFS), started to exhibit volatility. The increase in interest rates has resulted in a reversal of costs and returns for numerous financial institutions, so exposing various firms, particularly start-ups, who constitute the major clientele of Silicon Valley banks, to significant risks. In the prevailing economic climate, numerous technology start-ups are endeavouring to sustain their operations. Notably, these very start-ups, which had previously entrusted their financial resources to SVB, have been withdrawing their funds from the institution. Nevertheless, the investments made by SVB in bonds, which constituted a significant portion of its prior expenditures, had not yet materialised. Furthermore, the continuous outflow of funds from its clientele resulted in escalating liabilities, interest rates, and liquidity issues. Consequently, SVB was compelled to divest its bond assets at a financial disadvantage in order to fulfil its obligations to its clientele. These external factors made SVB insolvent and eventually led to its bankruptcy.

Figure 1: Fed’s balance sheet plans have markets on edge [4].

3. Internal Reason

3.1. Missmanagement of Assets

In addition to external factors, Silicon Valley Bank encountered a multitude of internal challenges, with the discrepancy between its deposit and loan portfolios emerging as a contributing factor to the enterprise's insolvency. As a result of the prevailing low interest rates during the period of surplus liquidity, SVB made substantial investments in debt instruments. Nevertheless, the firm failed to take into account the potential dangers associated with its decision to spend a substantial amount of resources based on the unique corporate structure of the SVB. This oversight ultimately resulted in the firm's financial collapse. Firstly, it is important to note that SVB distinguishes itself from conventional banks due to its unique business model, which exhibits a high level of concentration, susceptibility to interest rate fluctuations, and a heavy reliance on uninsured deposits. In further elaboration, SVB is an enterprise that offers financial services and lending facilities to emerging businesses. For several decades, the venture's lending operation has incorporated risky debt as a fundamental component. Furthermore, the corporate entity commonly exhibits an imbalanced assortment of obligations, alongside a solitary focus of resources represented by government bonds with extended durations and fixed interest rates. In terms of the liability’s portfolio, it is worth noting that a significant portion of SVB's clientele consists of start-up companies, venture capital firms, and affluent technology entrepreneurs [6]. As a result, SVB has many large existing customer deposits. SVB is more exposed to risk than other banks with more evenly distributed deposits.

Second, it has been observed that in recent years, there has been a notable surge in speculative investments in small technological companies. This surge has resulted in a substantial increase of over 200% in the assets and deposits of the bank, particularly in an environment characterised by low interest rates [7]. Furthermore, to enhance revenue generation within a context of low interest rates, SVB has made substantial investments in U.S. Treasuries [8]. Nevertheless, SVB failed to consider the equilibrium between these two factors, disregarding the potential consequences associated with a significant outflow of deposits. Therefore, SVB is exposed to the potential risk of experiencing significant depletion of its deposits as a result of consumers withdrawing funds following an increase in interest rates by the Federal Reserve. Furthermore, the accumulation of surplus savings is a significant economic phenomenon in contemporary times. Based on Vuillemey's survey conducted in recent decades, there has been a significant increase in the global savings of consumers and corporations [9]. Particularly, enterprises such as Silicon Valley Row, which offer financial assistance in the form of loans and savings to firms. As previously indicated, numerous businesses are currently facing a cost benefit inversion as a result of the increase in borrowing rates. Many technology start-ups are trying to survive and these same startup tech startups that previously deposited money with SVB started to keep withdrawing money from SVB.

However, the bonds that SVB had invested in at a previous cost of much money had not yet materialized, and with the increasing withdrawals from customers, the liabilities, interest rates, and liquidity risks were rising. Consequently, SVB was compelled to divest its bond assets at a financial disadvantage in order to fulfil its obligations to its clientele. Consequently, this kind of action engendered a pervasive sense of distrust among customers towards SVB, culminating in a notable instance wherein investors and depositors sought to withdraw a substantial sum of $42 billion from Silicon Valley Bank on Thursday. This event marked one of the most significant bank runs witnessed in the United States in over ten years [10]. This further intensified the bank's downfall.

Thus, inadequate internal risk management practises render SVB highly responsive and inclined to assume greater risks in the case of occurrences such as an epidemic or an increase in interest rates. When the impact of these risks exceeds the bank's capacity to manage, it gives rise to the possibility of SVB's insolvency.

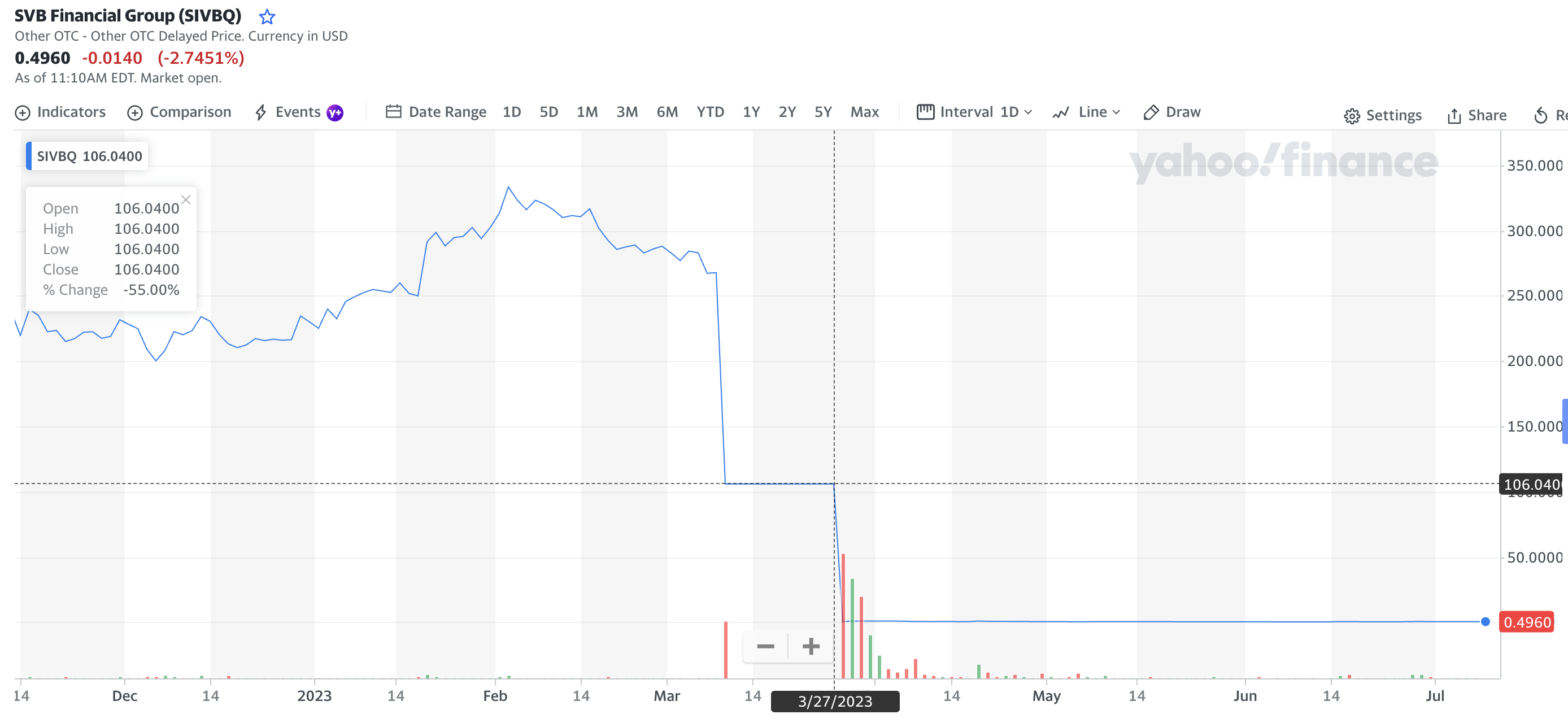

3.2. Lack of Diversification

Meanwhile, the failure of Silicon Valley Bank can be attributed to its too homogeneous customer base. The customer base of Silicon Valley Bank predominantly consisted of technological companies, specifically a limited cohort of venture capitalists. The clustering of depositors poses a notable vulnerability in the form of a bank run, particularly in the event of the bank's deteriorating performance, given the interrelated nature of these depositors. In the scenario where there is just one customer, the firm gets reliant on this particular customer base. Consequently, if any issues arise within this segment of customers, the firm will have adverse consequences for the initial time. The presence of a solitary consumer introduces a level of uncertainty to the business, so impacting its long-term profitability and generating substantial ambiguity. In these two years due to the outbreak of Covid-19, many tech companies sprouted and SVB also funded the growth of these tech companies. The again with the change in policy and economic environment as mentioned in 3.1, this has hit these startups very hard and this has made these firms need more of themselves to sustain the business. The negative economic environment during the outbreak of Covid-19 therefore came as a great shock to SVB's major clients. The costs required by start-ups were high and inefficient compared to large, well-established firms. Especially during the outbreak, the costs and capital required to run the company increased in order to keep it afloat. The potential for higher risk is associated with a bank that relies on a solitary customer compared to a bank that possesses a diversified customer portfolio when confronted with challenges. The aggregate demand for money has the potential to substantially diminish the deposits of these clientele within the financial institution, so exposing the bank to the peril of reimbursing a substantial sum of funds. Consequently, the prevailing economic recession and the devaluation of invested treasury bonds have prompted several clients to initiate the process of withdrawing monies from their accounts. This reveals the bank's potential losses that have not yet been realised, which are influenced by factors such as interest rates, the pace of GDP growth, the level of insured deposits, and the withdrawal of centralised deposits. In contrast to the impact of GDP growth rate or insured deposits on banks' unrealized losses, there exists a negative correlation between interest rates and withdrawal of centralised deposits with these losses. The findings of this study indicate that banks are exposed to considerable financial losses in the event of interest rate hikes and the withdrawal of funds by centralised depositors. Ultimately, SVB experienced insolvency, leading to a significant decrease in the company's stock value in March, as depicted in Figure 2, ultimately resulting in the declaration of bankruptcy [11].

Figure 2: SVB Financial Group [11].

4. Suggestion

The bankruptcy of Silicon Valley Bank has brought to light the potential for the bank to have averted this situation through the enhancement of its management practises in three key domains: boosting corporate stability, strengthening liquidity management, and mitigating the substantial allocations on the asset side.

Firstly, commercial banks need to balance the risks associated with business focus when developing their own differentiated competitive advantages [12]. Silicon Valley Bank has amassed a substantial quantity of valuable customer resources and liability base as a result of its enduring commitment to the realm of science and technology venture capital. However, this also results in a customer base that is overly concentrated, which poses a challenge to the Silicon Valley Bank's ability to effectively manage risk. This weakness makes the bank more susceptible to experiencing large-scale runs. Hence, it is advisable for banks to expand their operations into other business sectors and mitigate risks by cultivating distinctive competitive advantages.

Secondly, liquidity management of commercial banks is very important [13]. Silicon Valley banks have been overdoing asset maturity mismatch of long-term securities investment and insufficient retention of cash-based assets due to ignoring the extreme capital utilization needs of science and technology enterprises under the interest rate hike cycle, thus triggering liquidity risk. Therefore, it is imperative for Silicon Valley Bank to prioritise the strategic management of its assets and liabilities over the long term, aligning its asset management practises with its unique business characteristics. Additionally, the bank must ensure the maintenance of a sufficient level of liquidity stability, even in the face of adverse circumstances resulting from unforeseen events. Silicon Valley Bank has the potential to mitigate corporate losses in unfavourable environments and substantially decrease the likelihood of bankruptcy.

Finally, Silicon Valley Bank could reduce its large asset allocation to long-term Treasuries and mortgage-backed securities. Silicon Valley banks have experienced a rise in demand deposits, leading to significant investments in long-term Treasury bonds and mortgage securities on their asset side. However, this technique also gives rise to numerous hazards for the business. For instance, in the event of fluctuations in interest rates, the firm may encounter challenges in promptly adapting to the changes, hence potentially leading to adverse consequences for the business in the near term. Hence, in the case of banks with commendable liabilities, enhancing their resilience to unforeseen circumstances can be achieved by diminishing dependence on asset-side arbitrage techniques and adopting more cautious and prudent measures. This can ultimately enhance the adaptability of the institution.

5. Conclusion

In conclusion, there are multiple factors that contributed to the closure of SVB. The growth and profitability of a firm can be affected by several internal and external factors. An illustration of this phenomenon may be observed in the cascading effects of the Covid-19 pandemic, which have resulted in a detrimental trajectory for the economy. Similarly, the lack of foresight in corporate operations, both in terms of bank development and internal planning, has contributed to their collapse. Various variables can contribute to the heightened level of uncertainty experienced by businesses as they meet changes in developmental aspects. Particularly in the realm of internal firm management. In summary, through an examination of the factors contributing to the insolvency of SVB, it is recommended that banks enhance their asset and liquidity management practises to mitigate the adverse effects of external fluctuations on the organisation, thereby averting comparable instances of bankruptcy.

References

[1]. Aharon, D., Ali, S., Navid, M. (2023). Too Big to Fail: The Aftermath of Silicon Valley Bank (SVB) Collapse and Its Impact on Financial Markets, Research in International Business and Finance, 66, 102036.

[2]. Bradshaw, T., Noonan, L., Raval, A., Parker, G. (2023). “Hunt Scrambles to Protect UK Tech from Silicon Valley Bank Collapse, Financial Times, Retrieved from: https://www.ft.com/content/258d0732-d37b-49d6-8de8-b230a6568965

[3]. Liesman, S. (2020). Federal Reserve Cuts Rate to Zero and Launches Massive $700 Billion Quantitative Easing Program, Retrieved from: https://www.cnbc.com/2020/03/15/federal-reserve-cuts-rates-to-zero-and-launches-massive-700-billion-quantitative-easing-program.html

[4]. Smith, C., Platt, E. (2022). Federal Reserve Prepare to Shrink $9tn Balance Sheet After Pandemic Largesse, Retrieved from: https://www.ft.com/content/9af75cb4-9743-41af-896f-f25d7588d323

[5]. Saphir, A., Dunsmuir, L. (2023). Fed Seen Delivering Quarter-point Rate Hike Next Week, Retrieved from: https://www.reuters.com/markets/rates-bonds/fed-seen-delivering-quarter-point-rate-hike-next-week-2023-03-16/

[6]. Federal Reserve. (2023). Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank, Retrieved from: https://www.federalreserve.gov/publications/files/svb-review-20230428.pdf

[7]. Khoo, S. (2023). Commentary: Lesson from SVB’s collapse on sustainability and sustainable finance: ensuring resilience from “unsustanability”, Journal of Risk Finance, 24,386-389.3

[8]. Vo, L., Le, H. (2023). From Hero to Zero – The Case of Silicon Valley Bank, SSRN, 4394553.

[9]. Vuillemey, G. (2023). From Saving Glut to Financial Instability: Evidence From Silicon Valley Bank Failure. SSRN 4413287.

[10]. Weinstein, A., Bloomberg. (2023). $42 Billion In One Day: SVB Bank Run Biggest In More Than a Decade, Fortune, Retrieved from: https://fortune.com/2023/03/11/silicon-valley-bank-run-42-billion-attempted-withdrawals-in-one-day/

[11]. Yahoo Finance (2023). ‘SVB Financial Group’, Yahoo Finance, Retrieved from: https://finance.yahoo.com/quote/SIVBQ/

[12]. Nguyen, K. (2019). Revenue Diversification, Risk and Bank Performance of Vietnamese Commercial Banks. Journal Risk of Financial Management, 12, 138.

[13]. Adebayo, O., David, A., Samuel, O. (2011). Liquidity Management and Commercial Banks’ Profitability in Nigeria. Research Journal of Financial and Accounting, 2, 7-8.

Cite this article

Wang,H. (2024). The Reason for Silicon Valley Bank Collapse and Relevant Suggestion. Advances in Economics, Management and Political Sciences,57,85-91.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Aharon, D., Ali, S., Navid, M. (2023). Too Big to Fail: The Aftermath of Silicon Valley Bank (SVB) Collapse and Its Impact on Financial Markets, Research in International Business and Finance, 66, 102036.

[2]. Bradshaw, T., Noonan, L., Raval, A., Parker, G. (2023). “Hunt Scrambles to Protect UK Tech from Silicon Valley Bank Collapse, Financial Times, Retrieved from: https://www.ft.com/content/258d0732-d37b-49d6-8de8-b230a6568965

[3]. Liesman, S. (2020). Federal Reserve Cuts Rate to Zero and Launches Massive $700 Billion Quantitative Easing Program, Retrieved from: https://www.cnbc.com/2020/03/15/federal-reserve-cuts-rates-to-zero-and-launches-massive-700-billion-quantitative-easing-program.html

[4]. Smith, C., Platt, E. (2022). Federal Reserve Prepare to Shrink $9tn Balance Sheet After Pandemic Largesse, Retrieved from: https://www.ft.com/content/9af75cb4-9743-41af-896f-f25d7588d323

[5]. Saphir, A., Dunsmuir, L. (2023). Fed Seen Delivering Quarter-point Rate Hike Next Week, Retrieved from: https://www.reuters.com/markets/rates-bonds/fed-seen-delivering-quarter-point-rate-hike-next-week-2023-03-16/

[6]. Federal Reserve. (2023). Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank, Retrieved from: https://www.federalreserve.gov/publications/files/svb-review-20230428.pdf

[7]. Khoo, S. (2023). Commentary: Lesson from SVB’s collapse on sustainability and sustainable finance: ensuring resilience from “unsustanability”, Journal of Risk Finance, 24,386-389.3

[8]. Vo, L., Le, H. (2023). From Hero to Zero – The Case of Silicon Valley Bank, SSRN, 4394553.

[9]. Vuillemey, G. (2023). From Saving Glut to Financial Instability: Evidence From Silicon Valley Bank Failure. SSRN 4413287.

[10]. Weinstein, A., Bloomberg. (2023). $42 Billion In One Day: SVB Bank Run Biggest In More Than a Decade, Fortune, Retrieved from: https://fortune.com/2023/03/11/silicon-valley-bank-run-42-billion-attempted-withdrawals-in-one-day/

[11]. Yahoo Finance (2023). ‘SVB Financial Group’, Yahoo Finance, Retrieved from: https://finance.yahoo.com/quote/SIVBQ/

[12]. Nguyen, K. (2019). Revenue Diversification, Risk and Bank Performance of Vietnamese Commercial Banks. Journal Risk of Financial Management, 12, 138.

[13]. Adebayo, O., David, A., Samuel, O. (2011). Liquidity Management and Commercial Banks’ Profitability in Nigeria. Research Journal of Financial and Accounting, 2, 7-8.