1. Introduction

Quantitative investment in China is still in an imperfect stage of development. It began to emerge since the inception of the first domestic quantitative fund product, Guotai Junan Quantitative Core Fund, in 2004. Quantitative investment, due to its need for processing vast amounts of high-frequency data, high-speed networks, and substantial computing power to support decision-making and trading, has a high barrier to entry. Consequently, its participants are primarily institutional investors with more resources.

However, whether in quantitative investment or the broader financial market, compared to the highly developed capital markets in the United States, quantitative investment and the financial markets in China are still in their infancy. For example, the variety of investment products in the capital markets remains limited, and the trading mechanisms for derivatives are still imperfect. This significantly reduces the hedging capabilities of quantitative investment. Additionally, mainstream quantitative investment strategies have their origins and development in more developed European and American markets. The applicability of these strategy concepts in the distinct Chinese market environment is not guaranteed.

Therefore, as quantitative investment continues to evolve, it is essential to research the quantitative investment industry in the context of the Chinese market environment. This article will investigate the current state of quantitative investment in the Chinese financial market environment, the challenges it faces, and feasible solutions.

2. Current Situation

Quantitative investment in China is still in its early stages of development. It began to sprout since the inception of the first domestic quantitative fund product, Guotai Junan Quantitative Core Fund, in 2004. The high barriers to entry in quantitative investment, which require processing vast amounts of high-frequency data, high-speed networks, and significant computing power to support decision-making and trading, have primarily attracted institutional investors such as public funds, securities firms, and private equity institutions.

The application scope of quantitative investment includes stock investment, financial futures and derivatives investment, as well as commodity futures investment. In recent years, there has been some development in China's capital markets, notably with the introduction of various capital market products such as margin trading and short selling and stock index futures. These developments have provided avenues for investors to use quantitative investment strategies for risk hedging and arbitrage trading.

The return of experienced professionals in quantitative investment, who have gained practical experience abroad, has contributed to the popularization and development of quantitative investment in China.

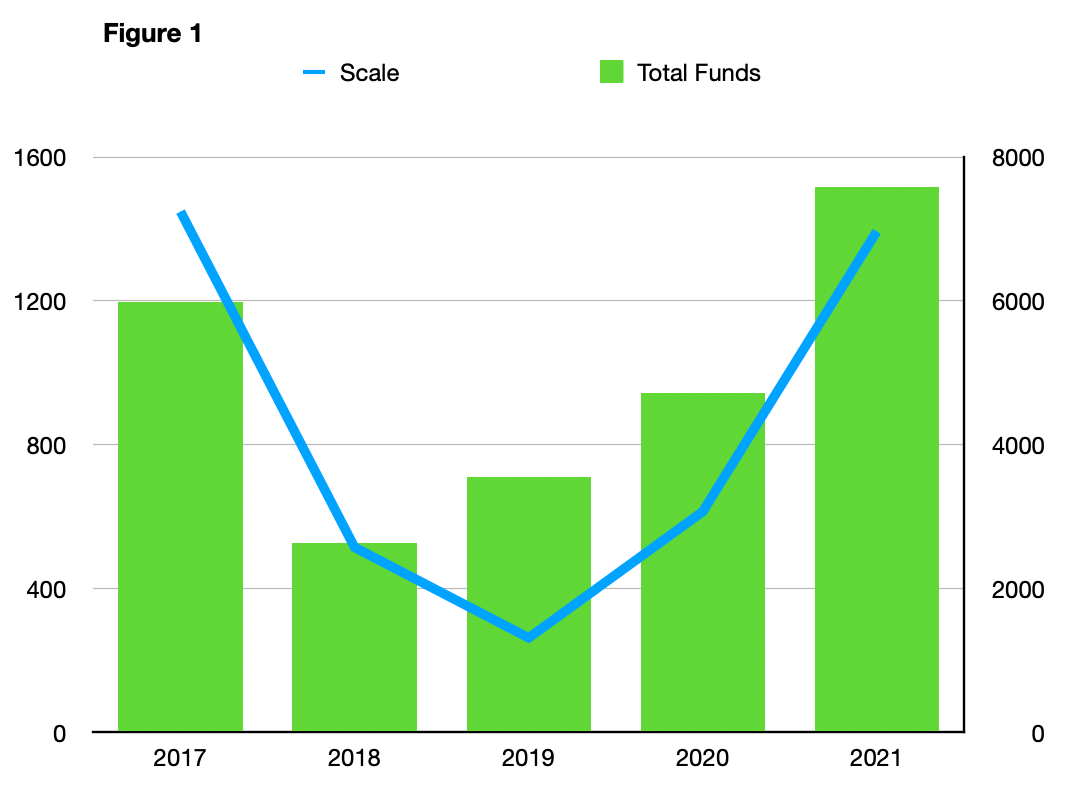

As of the end of 2021, there were 16,850 private equity funds registered with the association and marked as "quantitative," representing a 42.2% increase in quantity compared to the previous year. Their total assets under management reached 1.08 trillion yuan, reflecting a 91.5% increase in scale. In terms of quantity and scale, these funds accounted for 21.9% and 17.1% of the total private equity securities investment funds, respectively (See Table 1 and Figure 1). Additionally, several private equity quantitative fund managers with strong research capabilities have begun to gain prominence, with 28 private equity quantitative fund managers managing assets exceeding one billion yuan, and quantitative private equity funds securing five spots among the top ten private securities investment fund managers [1].

Table 1: New Institutions for Various Strategies from 2018 to 2022

Strategy Classification | 2018 | Annual Addition | 2019 | Annual Addition | 2020 | Annual Addition | 2021 | Annual Addition | 2022 | Annual Addition |

Long Stock | 6733 | 198 | 6843 | 110 | 6957 | 114 | 7251 | 294 | 7372 | 121 |

Stock Market Neutrality | 193 | 11 | 201 | 8 | 208 | 7 | 216 | 8 | 218 | 2 |

Long-Short Equity | 82 | 2 | 85 | 3 | 88 | 3 | 95 | 7 | 95 | 0 |

Bond Fund | 252 | 9 | 257 | 5 | 263 | 6 | 276 | 13 | 281 | 5 |

Managed Futures | 519 | 19 | 526 | 7 | 541 | 15 | 577 | 36 | 584 | 7 |

Arbitrage Strategy | 110 | 0 | 113 | 3 | 113 | 0 | 121 | 8 | 123 | 2 |

Macro Strategy | 126 | 6 | 127 | 1 | 128 | 1 | 137 | 9 | 139 | 2 |

Portfolio Fund | 174 | 5 | 175 | 1 | 181 | 6 | 203 | 22 | 206 | 3 |

Targeted Issuance | 90 | 0 | 91 | 1 | 91 | 0 | 92 | 1 | 92 | 0 |

New Third Board | 32 | 0 | 32 | 0 | 32 | 0 | 32 | 0 | 32 | 0 |

Multi-Strategy | 925 | 24 | 937 | 12 | 951 | 14 | 990 | 39 | 999 | 9 |

Other | 209 | 12 | 221 | 12 | 266 | 45 | 391 | 125 | 395 | 4 |

Total | 9445 | 286 | 9608 | 163 | 9819 | 211 | 10381 | 562 | 10536 | 155 |

Figure 1: Scale and Total Funds

3. Problem

3.1. Limited Hedging Tools

Derivatives play a fundamental role in risk hedging, but China's financial markets lag significantly behind developed countries in terms of the variety, prevalence, and trading systems of derivatives. The derivatives market in China faces challenges such as structural imbalances, limited openness to international markets, incomplete legal and regulatory frameworks, and suboptimal financial infrastructure. It also contends with competition from offshore markets and challenges related to cross-border regulatory cooperation [2]. For instance, in practical investment, prolonged futures contracts trading at a discount can erode returns in the spot market. The liquidity impact of stock index futures often leads to higher transaction costs during actual hedging. For instance, since June 2015, the Hang Seng 300 and CSI 500 futures contracts have spent most of their time in a state of contango, with the far-month contracts experiencing particularly severe contango, at times exceeding 10% [3]. Even if using near-month contracts with a smaller contango, the additional losses due to negative contango can eat away at approximately 1% of returns each month, resulting in an annual loss of approximately 15% of excess returns. This significantly affects the profitability of alpha strategies [4].

3.2. Market Liquidity Impact

High-frequency trading (HFT) is a specialized form of algorithmic trading. HFT firms, as liquidity providers in the market, play a fundamental role in market formation and trade execution. However, when HFT development becomes excessive, the liquidity they provide can become unstable, exacerbating market liquidity volatility risks. Take the CTA strategy as an example; although there may be some differences in implementation, most are based on trend-following principles. Moreover, most quantitative CTA strategies use automated order placement with extremely high trading speeds and large volumes. Consequently, as the market enters a downtrend, quantitative CTA strategies may further amplify the bearish sentiment through stock index futures. Despite the relatively small scale of quantitative CTA strategies in the market, the dominant investor structure in China's stock market consists of retail investors, making the market highly susceptible to herd behavior. This, coupled with the market's substantial inertia, makes it easy for such strategies to have a significant impact on the market, thereby contributing to extreme market movements [5].

3.3. Financial Market Deficiencies

Compared to developed countries' financial markets, China's financial market infrastructure still requires improvement. From the perspective of investment instruments, the variety of investable products in the capital market remains limited. Currently, investable products are primarily limited to stocks, Shanghai and Shenzhen 300 index futures, and bonds. This limitation significantly hampers the development of quantitative investment, which relies on a diverse range of investment tools for hedging and arbitrage. In terms of industry regulations, the "People's Republic of China Fund Law" mandates that equity funds must allocate no less than 60% of their fund assets to equity assets. This, to some extent, restricts funds from reducing their holdings significantly. Additionally, it may create a signaling effect where policies do not support funds making substantial reductions during bear markets, inhibiting the freedom of funds to reduce their exposure. This limitation reduces the ability to mitigate systemic risks and hinders the market's pricing efficiency [6].

4. Solution

4.1. Limited Hedging Tools

Enhance the infrastructure development of the derivatives market, increase the variety of derivative products, refine relevant laws and regulations, and strengthen regulatory oversight.

Expand and improve the range of investable derivatives in the financial market, such as various index and single-stock options. Enhance the trading infrastructure and ensure that all exchanges have robust trading platforms and interfaces. In terms of regulatory design, ensure that the trading systems for various derivatives meet the market demands of derivative trading. Simultaneously, bolster the supervision of derivative product design and trading, establish risk management and compliance regulations, and maintain market fairness.

Elevate the competence of financial industry professionals, promote the use of hedging tools, and enhance risk management awareness. The financial sector's understanding and adoption of derivatives in China still lag behind that of more developed financial markets, necessitating comprehensive training on derivative hedging for relevant professionals. The refinement of trading infrastructure and adherence to industry regulations can reduce the cost of market participants. The departments responsible for derivative product design and trading should also heighten their risk management awareness to prevent systemic risks [7].

4.2. Impact on Market Liquidity

Strengthen market supervision and refine trading systems. Implement stringent criteria for identifying abnormal trading behavior and increase the costs associated with such behavior.

Establish a comprehensive trading evaluation mechanism capable of relatively precise identification of abnormal trading behavior. Provide alerts and enforce measures that raise the costs for those engaging in abnormal trading activities.

For high-frequency traders who impact market stability and fairness, consider implementing restrictive measures such as higher transaction fees or limitations on trading frequency within a specified time frame. Additionally, conduct reviews and verifications of trader profiles [8].

4.3. Financial Market Deficiencies

Further refine the market long-short mechanism to prevent concentrated risk release that can lead to systemic risks.

Enhance the trading systems for short selling and hedging, ensuring that the market's pricing function is fully realized. This allows the market to effectively manage and release risk, preventing excessive market impact resulting from concentrated position unwinding [9].

Consider refining existing regulations for mutual funds. For instance, amend regulations specifying that at least 60% of fund assets must be allocated to stocks to instead require that at least 60% of fund assets be invested in equities or other eligible securities, with a minimum of 40% of fund assets held in securities assets. Additionally, strengthen measures against insider trading and enforce regulations that mandate legal and compliant information disclosures by corporations, aiming to eliminate the use of non-public information for trading purposes [10].

5. Conclusion

The challenges faced by the quantitative investment industry in China are primarily manifested in several aspects when compared to developed countries. Firstly, China's financial markets lack diversity in trading instruments, have relatively limited hedging tools, and feature somewhat outdated trading platforms. Secondly, the unique environment of China's financial markets can amplify market volatility in the short term, potentially causing disruptions and hindering the maintenance of a stable market ecosystem. Lastly, China's financial market regulations and rules are in need of further refinement, including addressing unreasonable restrictions on market participants and improving risk management mechanisms, particularly within the context of short selling. Finally, this paper put forward several suggestions to benefit the Chinese capital market.

Authors Contribution

All the authors contributed equally and their names were listed in alphabetical order.

References

[1]. Editorial Committee of the 2022 China Quantitative Investment White Paper (2023). 2022 China Quantitative Investment White Paper, 4, 7

[2]. Liu, C. Y. (2019). Research on the Interactive Relationship between Financial Derivatives Market Regulation and Development. Unpublished doctorial dissertation, East China Normal University, Shanghai.

[3]. Li, X. D. (2019). A Study on the Relationship between Investor Sentiment and Shanghai-Shenzhen 300 Stock Index Futures under Short Selling Restrictions. Unpublished master's dissertation, Jilin University, Jilin

[4]. Zhan, F. (2017). Application and Practice of Quantitative Investment in the Domestic Investment Industry. Science & Technology Ecnony Market, 105-106.

[5]. Tsinghua University PBC School of Finance. (2016). The Impact of High-Frequency Trading on the Market. Tsinghua financial review.

[6]. Lu, L. Z. (2012). A Study on the Application Effectiveness of Quantitative Investment Strategies. Unpublished master's dissertation, Jinan University, Guangdong

[7]. Li, Z. H., Li, X. Y., and Du, Y. (2021). Can Professional Institutional Investors Suppress Market Manipulation?—Anomaly Trading Identification Model Based on High-Frequency Trading Data. Modern Finance And Economics-Fournal of Tianjin Universitj of Finance And Economics, 3-5, 16.

[8]. Liu, P. P. (2021). Research on Regulatory Issues of Abnormal Securities Trading Behavior. Financial Development Research. Journal of Financial Development Research, 84-87.

[9]. Li, C., He, X. H., Li, Z. S., & Xu, S. F. (2017) Short Selling Mechanism as a Risk Release Tool—A Study on Short Selling Effects under Different Market Conditions. Financial Markets. Studies of International Finance, 67, 73.

[10]. Gao, L., & Lu, X. (2021) Research on Relaxing Short Selling Restrictions and Corporate Innovation Incentives. Financial Regulation Research. Financial Regulation Research, 101-103, 113.

Cite this article

He,C.;Wang,Y. (2024). Research on the Current Situation of Quantitative Investment in China. Advances in Economics, Management and Political Sciences,59,6-11.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Editorial Committee of the 2022 China Quantitative Investment White Paper (2023). 2022 China Quantitative Investment White Paper, 4, 7

[2]. Liu, C. Y. (2019). Research on the Interactive Relationship between Financial Derivatives Market Regulation and Development. Unpublished doctorial dissertation, East China Normal University, Shanghai.

[3]. Li, X. D. (2019). A Study on the Relationship between Investor Sentiment and Shanghai-Shenzhen 300 Stock Index Futures under Short Selling Restrictions. Unpublished master's dissertation, Jilin University, Jilin

[4]. Zhan, F. (2017). Application and Practice of Quantitative Investment in the Domestic Investment Industry. Science & Technology Ecnony Market, 105-106.

[5]. Tsinghua University PBC School of Finance. (2016). The Impact of High-Frequency Trading on the Market. Tsinghua financial review.

[6]. Lu, L. Z. (2012). A Study on the Application Effectiveness of Quantitative Investment Strategies. Unpublished master's dissertation, Jinan University, Guangdong

[7]. Li, Z. H., Li, X. Y., and Du, Y. (2021). Can Professional Institutional Investors Suppress Market Manipulation?—Anomaly Trading Identification Model Based on High-Frequency Trading Data. Modern Finance And Economics-Fournal of Tianjin Universitj of Finance And Economics, 3-5, 16.

[8]. Liu, P. P. (2021). Research on Regulatory Issues of Abnormal Securities Trading Behavior. Financial Development Research. Journal of Financial Development Research, 84-87.

[9]. Li, C., He, X. H., Li, Z. S., & Xu, S. F. (2017) Short Selling Mechanism as a Risk Release Tool—A Study on Short Selling Effects under Different Market Conditions. Financial Markets. Studies of International Finance, 67, 73.

[10]. Gao, L., & Lu, X. (2021) Research on Relaxing Short Selling Restrictions and Corporate Innovation Incentives. Financial Regulation Research. Financial Regulation Research, 101-103, 113.