1. Introduction

1.1. Research Background

In the era of rapid economic development, environmental issues are often ignored, and people often want to obtain future benefits in a low-cost and high-yield way to achieve rapid economic growth. However, with the slowdown of economic growth, environmental problems that were ignored in the past have been amplified, and environmental pollution problems are gradually affecting People's Daily life. Therefore, governments and the public pay more and more attention to environmental problems. Therefore, in 2006, the United Nations Environment Program proposed the concept of responsible investment, hoping that investors can take ESG information (environmental, social, corporate governance) as an important consideration in investment decisions, in which environmental factors are in the first place.

Based on the above background, some enterprises begin to carry out greenwashing in order to cater to the market's pursuit of green environmental protection concepts and reduce the environmental risks they may face. While establishing a green image of enterprises, they exaggerate or fabricate their own contributions to environmental protection and cover up the environmental pollution problems caused by their production and operation. This behavior not only harms the interests of investors, but also hinders the healthy development of the industry. The existing literature is still in the initial stage of exploring this issue, and there is few research on the economic benefits generated by enterprise greenwashing and the motivation behind it.

Therefore, this paper takes the "Diesel Scandal" greenwashing incident of Volkswagen Group as the research object. First, this paper introduces the basic situation of the case company, and reviews its greenwashing incident from the timeline. Secondly, this paper analyzes the short-term market performance and explores the impact of the case company after the exposure of the greenwashing incident. Finally, this paper analyzes the motivation of the case enterprise greenwashing and puts forward targeted management suggestions based on the motivation.

1.2. Research Significance

In terms of theoretical significance, this paper enriches the existing literature, takes Volkswagen Group as the research object, and analyzes the impact of greenwashing on corporate earnings combined with market reaction. At present, most scholars focus on the economic consequences caused by greenwashing behavior, but the study of the motivation of greenwashing behavior is limited. This paper measures the relationship between the motivation and enterprise greenwashing and analyzes the specific problems.

In terms of practical significance, this paper explores the impact of Volkswagen's greenwashing behavior on the market, and analyzes the internal factors, so as to find countermeasures to control ESG's "greenwashing", which has important practical significance for protecting the interests of investors from the harm of greenwashing enterprises and helps investors to identify the "greenwashing" behavior of enterprises. To protect the interests of investors from infringement. In addition, it can make enterprises realize the serious consequences brought by greenwashing. By studying the impact on stock price after the exposure of enterprise greenwashing behavior, enterprises in the market can realize the potential harm of greenwashing behavior, so as to reduce greenwashing behavior.

2. Theoretical Foundation and Literature Review

2.1. Greenwashing Definition

First described by Jay Wester veld in 1986, Greenwash refers to a business that claims to protect the environment but actually does the opposite, essentially a form of false environmental propaganda. In the following years, researches on greenwashing were carried out at home and abroad, and different opinions on its definition were put forward. Scot Case mentioned in The Six Sins of Greenwashing that the six SINS of greenwashing were concluded through investigation and analysis of consumers and related products [1]. In the same year, according to the specific behavior of the enterprise green bleaching, the United States environmental protection marketing organization further proposed the crime of bias, the crime of insufficient evidence, the crime of ambiguity, the crime of irrelevance, the misdemeanor of two evils, the crime of telling a little lie, and the crime of worshipping false signs, which have become the main basis for foreign judgments about whether enterprises exist green bleaching behavior.

2.2. Greenwashing Incentives

In order to study the real motivation of enterprise greenwashing, scholars analyzed the internal and external factors of this phenomenon and drew a conclusion. From the external perspective of enterprises, the regulatory environment and governance system, stakeholders, information asymmetry and other factors have brought about the occurrence of greenwashing phenomenon. Tirole believes that imperfect supervision mechanism is an important incentive for enterprises' greenwashing behavior [2]. Bi Siyong believed that the imperfect environmental standards and asymmetric information resulted in enterprise greenwashing [3]. Pargurl proposed that consumers' ability to identify the authenticity of CSR reports is negatively affected by information asymmetry [4]. Wu Y Consumers will be more likely to be attracted by companies with green and low-carbon images and gain excess returns [5]. Internally, enterprise management level and cost are the reasons for greenwashing behavior. Yang Bo pointed out that greenwashing behavior is easy to occur when enterprises have poor management and execution ability [6]. Sun Jianqiang and Wu Xiaomeng conducted an empirical study and found that in the early stage of greenwashing, enterprises will reduce costs and thus have a positive impact on financial performance in the short term, bringing excess profits to enterprises and establishing a green image [7]. Li Haoyu found that because the greenwashing governance policy has not yet been perfected, some enterprises choose to take risks[8]

2.3. Greenwash Exposure Effect

At the same time, the exposure of greenwashing will cause a series of adverse effects. Akturan proposed that exposure of greenwashing behavior would not only reduce brand reputation but even reduce consumers' purchase intention [9]. Sun Jianqiang conducted an empirical study and found that the exposure of greenwashing behavior would affect the financial performance of enterprises [7]. Ye Jianmu et al. studied the environmental violations of petrochina and found that the degree of greenwashing of enterprises and media attention were positively correlated with negative market reactions [10]. Xiao Hongjun et al. found that green bleaching would reduce the sustainable development ability of enterprises, lead to adverse selection in the market, and have a negative impact on social development [11].

2.4. Comment

This paper starts with the relevant research of scholars in different countries on the definition of greenwashing, and then elaborates on the causes of greenwashing and its impact on exposure. For the definition of greenwashing, through continuous research at home and abroad have a clear definition of standards. When it comes to the causes of greenwashing, we take enterprises as the main body and analyze their internal and external environment. External factors such as regulatory environment and governance standards, stakeholders, and information asymmetry all contribute to the occurrence of greenwashing, and enterprise management level and cost are internal factors affecting the occurrence of greenwashing. Finally, this paper studies a series of adverse effects after the exposure of greenwashing and concludes that the disclosure of greenwashing information will affect the performance and image of enterprises, reduce the willingness of consumers to buy, and bring serious harm to the internal order of the market and social development.

3. A Review of Volkswagen Group Greenwashing

3.1. General Situation of Volkswagen

Founded in 1937, Volkswagen is headquartered in Germany and has grown into an international company with the following car brands: Volkswagen, Audi, Lamborghini, Porsche and so on. Volkswagen is a company specializing in the production and sale of traditional vehicles and new energy vehicles. Volkswagen ranked 7th on the Asset Global 500 list in 2022. The Volkswagen Group has set itself the long-term goal of becoming net carbon neutral by 2050, which includes supplying its chain stores, factories and business units, as well as vehicles used by customers. By 2030, the Volkswagen Group has also set itself a target of reducing CO2 emissions from passenger cars and light commercial vehicles by 30% compared to 2018. The environmental compatibility of the Volkswagen Group's products, services and processes is one of its fundamental elements. Make cars cleaner, smarter, quieter and safer through electronic drives, digital connectivity and autonomous driving. Use the power of innovation to reduce the entire product and mobility solution lifecycle. Product innovation also aims to help customers become more environmentally friendly. Its vision is to become the world's leading provider of sustainable mobility and a role model for environmental protection.

3.2. The Process of the "Diesel Scandal" Incident of Volkswagen

In 2008, Volkswagen CEO Martin Winterkorn announced the company's strategic plan for the United States, calling for 2018 Previously, the company surpassed General Motors and Toyota in U.S. sales to become the world's No. 1 automaker. The key to achieving this strategic goal is the promotion of clean diesel vehicles. After years of constant pressure from group executives, engineers adopted the installation of cheating devices as a solution. In September 2015, the Environmental Protection Agency (EPA) discovered that Volkswagen's greenwashing practices in the United States sold vehicles with special software embedded in the engine controllers to circumvent official inspections. The EPA alleges that the Volkswagen Group, the Audi A3, Volkswagen Golf, Volkswagen New Beetle, Volkswagen Jetta, Volkswagen Passat and other vehicles in the United States with EA 189 diesel engines, installed software in the engine controller that can circumvent official tests. The software operates in two modes: The software, which is specifically designed for emissions testing, can identify if a car is in a detected state and then quietly initiate a test mode in which the car fully complies with all federal emissions standards. However, when the car is normally driving, the computer switches to a separate mode, emitting air pollutants (nitrogen oxides) that are 10 to 40 times higher than the federal limit. In the model years from 2009 to 2015, Volkswagen deployed the software in about 11 million vehicles worldwide, including 500,000 in the United States. On September 20 of that year, Volkswagen Group admitted to fraud and made a public apology, and its share price fluctuated sharply after the incident.

3.3. Analysis on the Motivation of Greenwashing Behavior of Volkswagen

Profitability is an important criterion to measure the management level and economic strength of enterprises. Research shows that corporate financial performance has a positive impact on environmental performance. Due to the long cycle and high risk of environmental governance, enterprises need to pay high financial costs when they assume environmental responsibility, which leads them into a "dilemma" of legitimacy risk and shortage of funds, so green bleaching becomes an attractive option. With the enactment of the new environmental law in the United States, the United States has more stringent requirements for nitrogen oxide emission standards than the European emission standards. So to convert the original European standard exhaust emissions device to the American standard, it needs to increase a large investment, here to compress the emissions 10-40 times. In order to meet the strict environmental standards in the United States, Volkswagen Group needs to invest a lot of costs to meet its defined standards. The Volkswagen automobile industry is a global industry, producing millions of cars every year, and there are factories and dealers all over the world, and the entire exhaust gas treatment device on millions of cars will be faked, which will bring unlimited profits to the Volkswagen Group.

4. Analysis of The Impact of Greenwashing on Volkswagen Group: Analysis of Short-term Market Effect

Event Study was pioneered by Ball& Brown (1968) and Fama et al. (1969). Its principle is to select a specific event according to the research purpose, study the change of the sample stock return rate before and after the event, and then explain the impact of the specific event on the sample stock price change and return rate, mainly used to test the price change before and after the event or the reaction degree of the price to the disclosed information. This paper uses the market model to establish the market model equation for the index return (

for the index return ( ) of Volkswagen Group stock price and the daily return (

) of Volkswagen Group stock price and the daily return ( ) of Standard & Poor's 500 index (SP500). In the extracted data, the actual rate of return and market rate of return data selected in this paper are from www.investing.com

) of Standard & Poor's 500 index (SP500). In the extracted data, the actual rate of return and market rate of return data selected in this paper are from www.investing.com

We set Event I as: On September 20, 2015, Volkswagen Group admitted to installing cheat devices to commit fraud. With the help of the event study method, this paper studies the stock price fluctuation and market return caused by the greenwashing behavior of Volkswagen Group in a certain period of time, and analyzes its market effect. The event window period and estimate window are set as follows:

Table 1: The event window period and estimation window.

Events | Working day | Event window | Estimation window |

Event I Volkswagen Group admitted to greenwashing | 2015-09-21 | 2015-09-15 to 2015-09-25 | 2015-03-02 to 2015-08-24 |

Excel is used to generate a scatter chart, and the values of parameters α and β are obtained. The scatter chart is shown in Figure 1:

Figure 1: Equation of event Ⅰ estimation window.

Table 2: Final parametric equation.

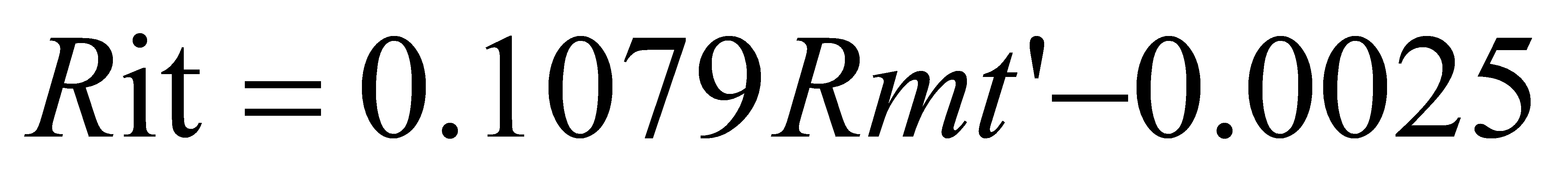

From the perspective of β value, there is a positive correlation between VW group's return rate ( ) and market return rate (

) and market return rate ( ). By bringing the daily market return rate (

). By bringing the daily market return rate ( ) of the event period into the regression equation

) of the event period into the regression equation , the expected daily return rate of Volkswagen Group can be obtained. The expected return rate

, the expected daily return rate of Volkswagen Group can be obtained. The expected return rate of Event I is shown in Table 3:

of Event I is shown in Table 3:

Events | Estimation window | Parameter equation | α | β |

Event I Volkswagen Group admitted to greenwashing | 2015-03-02 to 2015-08-24 | y = 0.1079x - 0.0025 | -0.0025 | 0.1079 |

Table 3: Correlated returns of event I.

The excess rate of return AR is directly formed by the behavior of information disclosure. It is the rate of return beyond the normal market return. The excess rate of return is the actual rate of return of JIU 'an Medical in the event period minus the expected rate of return under the market model :

Date | Event period | Effective rate of return | Market return | expected return |

2015/9/15 | -4 | 0.82% | -7.99% | -1.112% |

2015/9/16 | -3 | 0.39% | -6.38% | -0.938% |

2015/9/17 | -2 | -0.06% | 3.31% | 0.107% |

2015/9/18 | -1 | -3.61% | 4.03% | 0.185% |

2015/9/21 | 0 | -17.14% | -4.19% | -0.702% |

2015/9/22 | 1 | -16.83% | 4.67% | 0.254% |

2015/9/23 | 2 | 6.92% | -1.68% | -0.431% |

2015/9/24 | 3 | 0.00% | 2.35% | 0.004% |

2015/9/25 | 4 | -2.82% | 1.67% | -0.070% |

(1)

(1)

The cumulative abnormal return rate is the sum of the ultra long daily return rate of ANDON HEALTH stock in the event period. Compared with the excess rate of return, the cumulative abnormal rate of return can better reflect the influence of information disclosure behavior and regulatory inquiries on ANDON HEALTH :

(2)

(2)

is the calculation interval of cumulative excess return, this paper selects event Ⅰ

is the calculation interval of cumulative excess return, this paper selects event Ⅰ

The income rate of event Ⅰ during the event window is shown in Table 4 and Figure 2:

Table 4: The income rate of event Ⅰ.

Date | Event period | Effective rate of return | Expected return | Yield advantage |

2015/9/15 | -4 | 0.82% | -1.112% | 1.932% |

2015/9/16 | -3 | 0.39% | -0.938% | 1.328% |

2015/9/17 | -2 | -0.06% | 0.107% | -0.167% |

2015/9/18 | -1 | -3.61% | 0.185% | -3.795% |

2015/9/21 | 0 | -17.14% | -0.702% | -16.438% |

2015/9/22 | 1 | -16.83% | 0.254% | -17.084% |

2015/9/23 | 2 | 6.92% | -0.431% | 7.351% |

2015/9/24 | 3 | 0.00% | 0.004% | -0.004% |

2015/9/25 | 4 | -2.82% | -0.070% | -2.750% |

Figure2: Abnormal return and cumulative abnormal return of Event Ⅰ.

As figure2 shown, through comprehensive analysis of the abnormal rate of return and cumulative abnormal rate of return of event I,  on the event day decreased significantly compared with the previous days, and on September 22, that is, the second day of the event day,

on the event day decreased significantly compared with the previous days, and on September 22, that is, the second day of the event day, was as low as -34.223%. It can be seen that in the first two working days after the green bleaching incident in which Volkswagen Group admitted to installing cheating software on cars, it had a strong negative impact on the market and lost confidence in Volkswagen Group. In the following days, negative excess benefits continued to occur, and

was as low as -34.223%. It can be seen that in the first two working days after the green bleaching incident in which Volkswagen Group admitted to installing cheating software on cars, it had a strong negative impact on the market and lost confidence in Volkswagen Group. In the following days, negative excess benefits continued to occur, and  was about 26%, but there was no significant rebound, and the market reaction was overwhelmingly negative. To sum up, in the short term, the exposure and implementation of the greenwashing scandal has a significant negative impact on Volkswagen Group.

was about 26%, but there was no significant rebound, and the market reaction was overwhelmingly negative. To sum up, in the short term, the exposure and implementation of the greenwashing scandal has a significant negative impact on Volkswagen Group.

5. Conclusion

This paper uses the event study method to explore the market reaction of Volkswagen Group's admission of greenwashing and finds that the capital market has made a punitive response to this greenwashing incident, showing a significant market reaction in a short period of time, and the green image of Volkswagen Group has been seriously damaged. Before the day of the incident, the Volkswagen Group's greenwashing incident was still exposed by major media, but it did not have such a strong impact on the market as the Volkswagen Group personally admitted, which reflects that the green image established by the Volkswagen Group before 2015 has long been deeply rooted in the people's heart and has gained high trust in the market. However, it is worth noting that Volkswagen Group carried out a share buyback in 2017 and extended the warranty period of a series of cars in 2018, and the implementation of the above actions for the benefit of consumers has regained the reputation and consumer trust of Volkswagen Group.

Therefore, in order to avoid the greenwashing behavior of enterprises, the public and the media need to actively play a supervisory role, timely discover the clues of enterprise greenwashing, government departments should increase daily supervision and management, improve the corresponding laws and regulations to increase the illegal cost of enterprises and timely deal with the illegal matters of relevant enterprises, widely listen to the public report and check and handle in time. Secondly, enterprises also need to improve the level of internal management, improve the supervision system, and understand that only honest control of environmental costs can bring long-term benefits to enterprises.

References

[1]. Case S, Zhang Lingning. (2010) Six Crimes of "greenwashing" environmental protection [J].WTO Economic Guide,02:66-67.

[2]. Tirole J. (1998) The Theory of Industrial Organization. Economica 56,226-227.

[3]. Bi S Y, Zhang L J. (2010) Analysis of enterprise greenwashing behavior. Research on Financial and Economic Issues. 10:97-100.

[4]. Parguel B., Benoit-Moreau F., Larceneux F. (2011) How sustainability ratings might deter'greenwashing': A closer look at ethical corporate communication. Journal of business ethics 102,15-28.

[5]. WuY , Zhang K , Xie J .(2020) Bad Greenwashing, Good Greenwashing: Corporate Social Responsibility and Information Transparency[J]. Management Science, 66.

[6]. Yang Bo. (2010) Harm, causes and management of greenwashing behavior of large retailers. Journal of Guangdong College of Commerce. Phase 2:12-16.

[7]. Sun Jianqiang, Wu Xiaomeng. (2019) Study on the impact of Corporate Social Responsibility "greenwashing" on financial performance: A case study of petrochina [J]. Journal of Finance and Accounting,22,7-13.

[8]. Li Haoyu. (2023)Corporate ESG drift green behavior recognition and motivation and economic consequences [D]. Anhui finance and economics, https://kns.cnki.net/kcms2/article/abstract?v=lDUDaiPi9qccC5GE2dy_NHYMyIdfPxJ6imvlc3_RSG0Eq3yOeh7QcPqWrRbsZZqQHpRpZB72UJHTL5K5rviI34lPMJSBE3mIU2UpA9X3bicPf0R0xBP35orQbBSBOqwk&uniplatform=NZKPT&language=CHS

[9]. Akturan U. (2018) How does greenwashing affect green branding equity and purchase intention? An empirical research. Marketing Intelligence & Planning 36,809-824.

[10]. Ye Jianmu, Pan Yuan. (2017) Analysis of China National Petroleum greenwashing event and its market reaction: Based on event study method [J]. Finance and Accounting Monthly 7,100-104.

[11]. Li Weiyang, Xiao Hongjun. (2011) The logic of Corporate Social Responsibility. Industrial Economy of China. Issue 10:87-97.

Cite this article

Ma,M. (2024). A Study on the Impact of ESG Greenwashing on Listed Companies -- A Case Study of Volkswagen Group. Advances in Economics, Management and Political Sciences,59,315-322.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Case S, Zhang Lingning. (2010) Six Crimes of "greenwashing" environmental protection [J].WTO Economic Guide,02:66-67.

[2]. Tirole J. (1998) The Theory of Industrial Organization. Economica 56,226-227.

[3]. Bi S Y, Zhang L J. (2010) Analysis of enterprise greenwashing behavior. Research on Financial and Economic Issues. 10:97-100.

[4]. Parguel B., Benoit-Moreau F., Larceneux F. (2011) How sustainability ratings might deter'greenwashing': A closer look at ethical corporate communication. Journal of business ethics 102,15-28.

[5]. WuY , Zhang K , Xie J .(2020) Bad Greenwashing, Good Greenwashing: Corporate Social Responsibility and Information Transparency[J]. Management Science, 66.

[6]. Yang Bo. (2010) Harm, causes and management of greenwashing behavior of large retailers. Journal of Guangdong College of Commerce. Phase 2:12-16.

[7]. Sun Jianqiang, Wu Xiaomeng. (2019) Study on the impact of Corporate Social Responsibility "greenwashing" on financial performance: A case study of petrochina [J]. Journal of Finance and Accounting,22,7-13.

[8]. Li Haoyu. (2023)Corporate ESG drift green behavior recognition and motivation and economic consequences [D]. Anhui finance and economics, https://kns.cnki.net/kcms2/article/abstract?v=lDUDaiPi9qccC5GE2dy_NHYMyIdfPxJ6imvlc3_RSG0Eq3yOeh7QcPqWrRbsZZqQHpRpZB72UJHTL5K5rviI34lPMJSBE3mIU2UpA9X3bicPf0R0xBP35orQbBSBOqwk&uniplatform=NZKPT&language=CHS

[9]. Akturan U. (2018) How does greenwashing affect green branding equity and purchase intention? An empirical research. Marketing Intelligence & Planning 36,809-824.

[10]. Ye Jianmu, Pan Yuan. (2017) Analysis of China National Petroleum greenwashing event and its market reaction: Based on event study method [J]. Finance and Accounting Monthly 7,100-104.

[11]. Li Weiyang, Xiao Hongjun. (2011) The logic of Corporate Social Responsibility. Industrial Economy of China. Issue 10:87-97.