1. Introduction

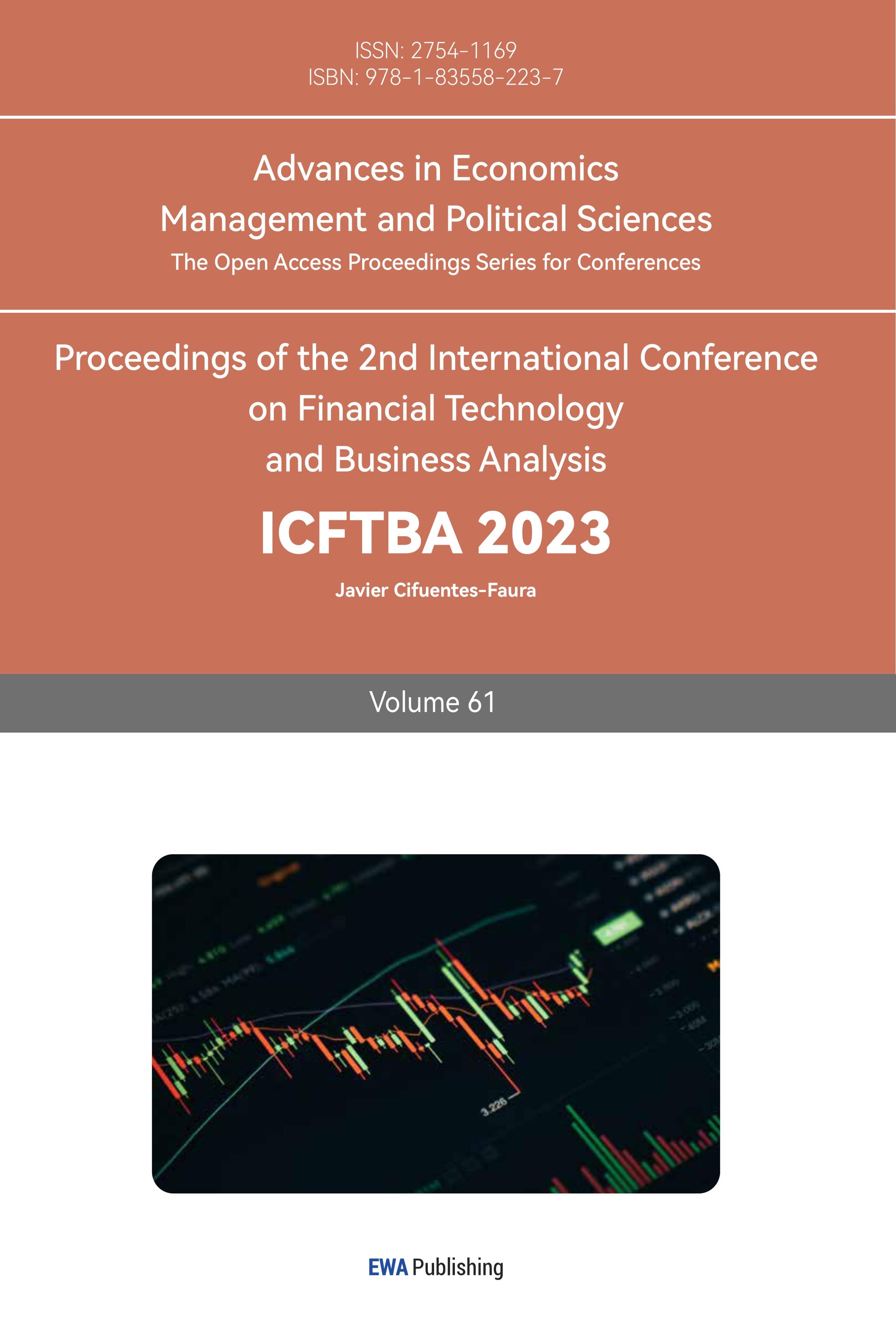

Lehman Brothers Holdings Inc. (Lehman Bro.) was founded in 1850 and used to be one of the top four investment banks in America. In 2007, one year before the subprime lending crisis, it placed 132nd in the Fortune 500, creating $ 4.2 billion in net profit after interest and taxation (PAT) and $70 billion in total assets. It successfully overcame the Great Depression in 1929, had no suitable leader after the founder died in 1973, was acquired by American Express in 1984, and had a capital shortage after separating from American Express in 1994 (Figure 1) [1]. It consistently transferred low-liquid bonds into marketable securities and borrowed short-term debt to cover long-term assets. Its 158 years of development gave it the confidence to handle the financial crisis of 2008. However, this “too big to fall” financial institution ended its enterprise life cycle. It applied for bankruptcy reorganization in 2008 due to its high-risk capital structure, unimplemented bankruptcy proposal, and poor corporate governance.

This study narrates and examines the causes of the 2008 subprime mortgage crisis that began with real estate mortgage contracts through theoretical analysis. Moreover, this research elaborates on the financial derivatives generating process, key participants and series of capital market reactions after the American Federal Reserve's increasing commercial banks' lending interest rates.

In addition, this study provides a complete chronology of Lehman Brothers' bankruptcy with detailed descriptions and proposed solutions, thus filling the gaps in scholarly accounts of the characterization of events such as Lehman Brothers' last chairman, the termination of employees, and the negotiations at the dinner party on September 12th, 2008, as well as proposals for updating the stock option plan to mitigate the agency problem.

Figure 1: Lehman Bro. Critical events timeline and plunging stock price in 2008 [1]

2. Factors leading to Lehman Bro. Bankruptcy-Capital Structure

2.1. Subprime Lending Crisis

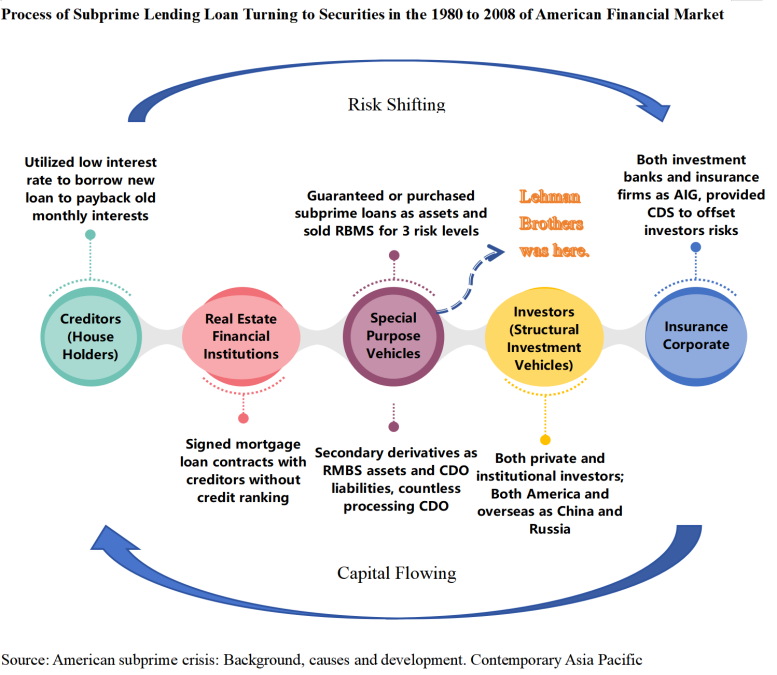

In the 1990s, the American capital market entered a liberalization and securitization era [2]. Financial institutions such as Lehman Bro. Transferred mortgage lending loans into residual mortgage-based security (RMBS) and collateral debt obligation (CDS) and sold them to local and international end investors. Besides, insurance corporations such as AIG issued premium insurance to offset subprime lending bond risks. The process is shown in Figure 2.

Figure 2: Detailed process of mortgage loans into security [3]

Following the Dot-com bubble breaking in 2001, the Federal Reserve Board increased interest rates, increasing aggregated real estate demand and market prices. Therefore, creditors could not rely on houses to borrow new loans to pay off old ones’ interest. As RMBS and CDO risks and costs increased, their key holders, the Structural Investment Vehicle (SIV), sought financial assistance from their parent groups, usually top-tier investment banks, to overcome cash flow shortages. Those banks chose to reduce debt or equity ratio when facing higher market risks and uncertain foreshadowing and subjectively rejected further new loans to real economy entities.

As a result, credit contraction caused actual economic downsizing. American citizens owned fewer job opportunities and less disposable income for house purchases and debt repayment, so the market price of real estate assets continued plunging. Many American mortgage loan providers, such as Freddie Mac and Fannie Mae, applied for bankruptcy at that time. The American Federal Reserve Board was authorized to give special aid to these two companies for "Discount" and issue a new risk-free treasury to infuse them with new capital. Therefore, the American authority was reluctant to issue large amounts of new treasury bonds for non-state-owned financial institutions on Wall Street because of their liquidity and insolvency problems. Issuing new bonds would increase the treasury-required return cost and depreciate existing holders’ treasury assets due to non-payback risk but also let taxpayers blame the American government for misappropriating revenue to disturb the so-called free capital market [3]. As a result, Lehman Bro. Could not gain an extra capital injection through the American Federal Reserve. At the same time, its high leverage and lack of liquidity could only be settled through the capital structure correction method.

2.2. High Leverage and Inadequate Liquidity

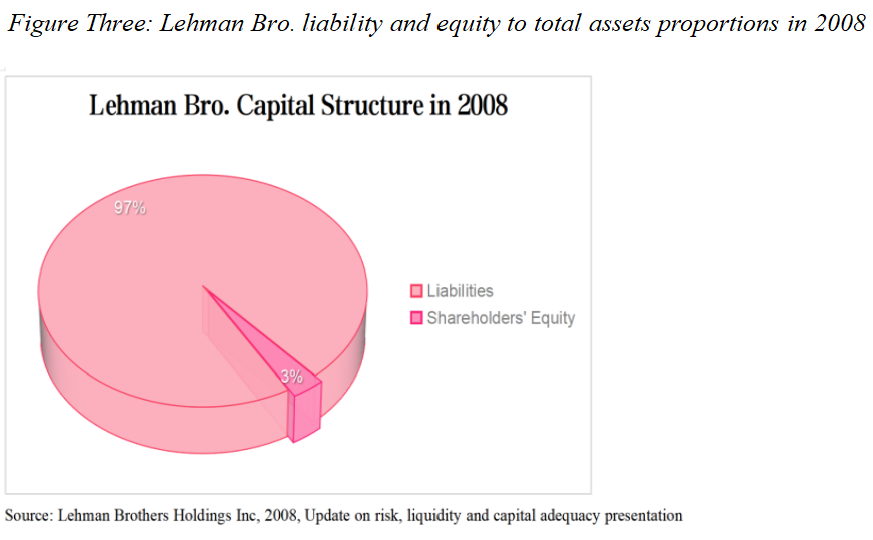

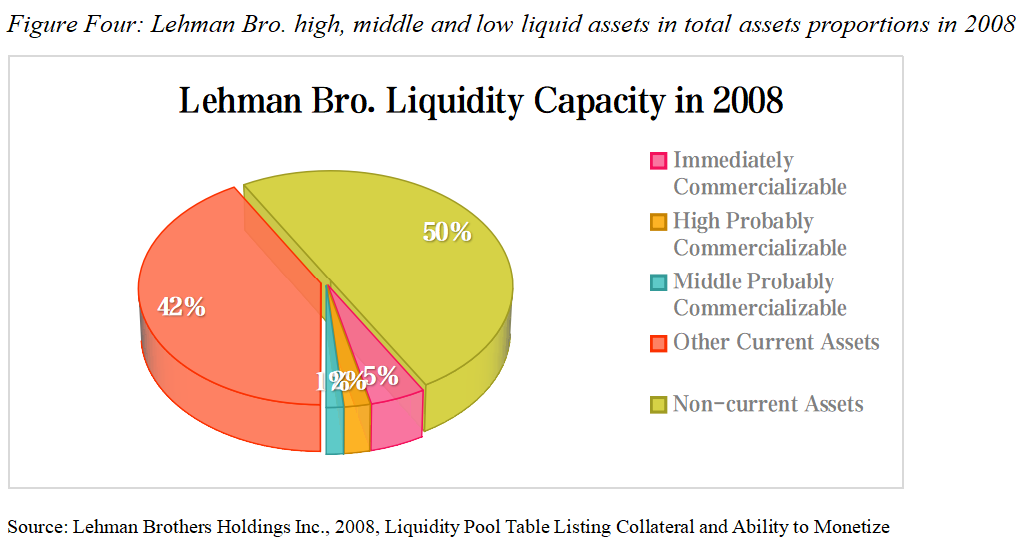

Entering the 20th century, Lehman Bro. Dismissed managers of fixed income and risk control, expanded corporate investments without regard to potential risks and purchased large amounts of value-destroyed CDO and real estate assets after the federal government increased the borrowing rate. According to its financial statement in 2008, Lehman Bro. Owned $ 63.9 billion in assets and $61.9 billion in liabilities, leaving merely $2 billion in shareholders’ equity while there was a fake higher valuation of intangible assets and lower marketable capacity (Figure 3(a)). At the point of bankruptcy, its current assets pool was worth $32 billion, of which only $ 3 billion and $ 2.334 billion, respectively, were immediate and above middle commercial capacities (Figure 3(b)).

(a) |

(b) |

Figure 3: Ratio of Lehman Brothers' total assets in 2008 [1]: (a)Lehman Bro. Liability and Equity to Total Assets Proportions in 2008; (b)Lehman Bro. High, Middle and Low Liquid Assets in Total Assets Proportions in 2008;

However, the American government decided not to salvage Lehman Bro. Anymore, and hoped it could turn to Wall Street partners for help instead of expecting to utilize taxpayer capital to correct minority managers’ mistakes. Therefore, Lehman Bro. Applied for bankruptcy reorganization on September 15th, 2008, for mismatched equity and liabilities and liquidity shortage.

3. Factors leading to Lehman Bro. Bankruptcy-Bankruptcy

3.1. Lehman Bro. Original agreement and being breached

On September 12th, 2008, Lehman Bro. Held a dinner party anticipating a capital injection from its Wall Street partners to fill its more than $610 billion financial hole. That night, Barclays Bank, the largest bank in the United Kingdom, agreed to acquire qualified parts of Lehman Bro. and other private equity, such as Goldman Sachs and JP Morgan Chase, for purchasing inferior assets at a much lower price than the market price. However, on the next date, all participants rejected this proposal for not measuring risks. Furthermore, the U.S.A. authority decided to make Lehman Bro. The first insolvent corporation in this subprime lending crisis for two reasons. One is that the government has already issued more than $180 billion in the treasury to assist Freddie Mac and Fannie Mae. It would be identified as a free market conversion if it continually does so with taxpayer revenue. Second, the capital injection from the government required that targeted corporate total assets not be less than the total debt. Otherwise, this assistance would be absorbed by secured creditors first instead of existing or future shareholders (investors). Lehman Bro. Did not satisfy that requirement if apply for bankruptcy.

Due to the relatively high leverage of Lehman Bro., no counter-party intended to acquire it. It applied for Chapter 11 in a New York, America district court on September 15th, 2008. After that, American and global stock markets came into “Black Monday”.

3.2. Further Impacts on Investors, Credit and Real Economy

American and global share investors are extremely passive about future stock market prices, leading to significant shares prices on the New York Stock Exchange plunging. More creditors needed extra capital to repay old and new loan principles and interests. Financial institutions’ lousy debt (irrecoverable trade receivable) increased dramatically. It held a more vigilant view of new loans and reports from independent and professional” credit ranking and auditing firms. Credit contraction directly led to actual economy finance costs surging [3]. A Large quantity of labour force lost jobs. China and Russia suffered the most severely due to holding billions of U.S.A. dollars in foreign exchange reserves. After that, global capital markets restricted monitoring of the banking industry and financial derivatives.

4. Factors leading to Lehman Bro. Bankruptcy-Corporate Governance

4.1. Agency Problem Between Manager and Shareholders

Richard S. Fuld serves as both chair and chief executive officer (CEO) of Lehman Bro, without separation of ownership or control. Fuld focused on building up their investment empire kingdom but ignored the risk behind it while adopting expansion and reversal policies. He rejected disposing of partial or whole corporations when CDO and real estate assets decreased in value and blamed the White House for doing nothing.

Li pointed out that share options are more suitable for high-tech corporations as Microsoft sets up periods with a higher growth rate to purchase future employment shares much lower than market prices to earn capital gains. In comparison, RSU requires employees to continue working for the same employment for a specific period to monetize with free-for-charge shares and are more suited to enterprises already large in size and growing at a moderate rate [4]. Compared to directly allotting shares to shareholders and employees for no charge, share options show less impact on share intrinsic and market values while connecting managers' and shareholders’ value maximization (present value of future net cash flow) from long-term corporate operational and financial performances.

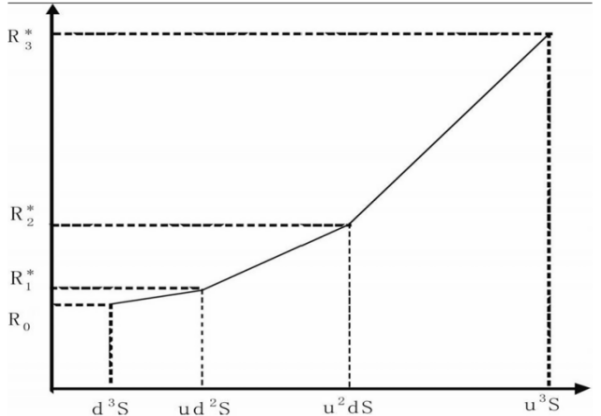

Wang argued that share options allow CEO return not to linear correlate with the corporate current market value (share price*share number) (Figure 4) [5]. Nevertheless, when corporations are giant enough within range (u^2dS to u^3S), option return shows a significantly similar increase with corporate market value, leading to managers pursuing their short-term private interests instead of owners’ long-term benefits by exercising options immediately. Therefore, more than convex incentives are needed for large companies when combining managers' and shareholders’ long-term benefits.

Figure 4: Optimal Incentive Contract in Two Periods of Moral Hazard [5]

Lehman Bro. Top executives held approximately 61% share options in 2003 [6]. This top investment bank continued to adopt share options in compensation packages. This explains why Lehman Bro. The last CEO and chairman, who received 466 million dollars, with 78% coming from share option exercise during his 15-year tenure [7], invested large quantities of CDO despite depreciating dramatically. This is managers and shareholders’ conflicts of interest, where the CEO seeks to maximize personal interest while neglecting owners’ long-term benefits.

4.2. Insider Information Leakage

JPMorgan Chase & Co as the liquidator of Lehman Bro. got access to Lehman Bro—liquidity shortage and desiring to gain short-term debt through inside information. JPMorgan required Lehman Bro. to secure more assets, such as 8.6 billion dollars for the same mortgage loan amount. This action made Lehman Bro. Liquidity capacity is much weaker [8].

Wen pointed out that JPMorgan rejected Lehman Bro. Request to withdraw approximately 17 billion dollars cash and bonds and regarded those assets as securities for 23 million dollars money lending to Lehman Bro. on September 12th, 2008. In the New York Court on October 6th, 2023, those principal debtors of Lehman Bro. Consistently required JPMorgan to present the bank transaction record of Lehman Bro. on September 12th, 2008, to prove it not to occupy mortgage assets to reduce Lehman Bro privately. Liquidity and cash flow capacity while leading to final bankruptcy restructure application [9].

4.3. Incorrect Audit Report and Credit Ranking

Chen Chen pointed out that Ernst & Young Accounting Firm (EY) neglected Lehman Bro. Internal accounting policy by adopting REPO105 to transfer normal repurchases into debt selling to reduce low-liquid Commercial Real Estate (CRE) assets and security liability [10]. Lehman Bro. also took advantage of regional legislation differences to gain a non-objection allowance on those non-substantial transactions from European law firms. REPO105 dealing was not fully disclosed and delivered a fake lower leverage ratio to Lehman Bro: shareholders and external investors. EY did not take responsibility for Lehman Bro. Shareholders with professional suspects and increasing material level on fundamental financial valuation model, also pressing more on economic substance than legal form.

5. Suggestions

The Anglo-Saxon Economic System advocates less financial aid. It monitors from an authority, whether financial or monetary while regarding the capital market as the purest and most perfect market mechanism. Market fundamentalism neglects government monitoring positive impacts on market failure, information asymmetry, and zero-sum game probability that freely entities competitions cannot create more value for the whole society [2]. Therefore, there are seven practical solutions for the government, financial institutions and employees to learn from Lehman Bro bankruptcy in 2008. The first three solutions are for international organizations such as the International Monetary Fund, the World Trade Organization and local authorities from a macro perspective. From a micro perspective, the remaining four solutions are for specific financial institutions and their staff.

5.1. Macro

Firstly, the government utilizes monetary policy to upward or downward interest rates, while financial policy focuses on tax revenue and expenditure. The Anglo-Saxon economic system is different from a superior system that can be generalized. The authority adopts cost-benefit analysis to assist corporations in a timely. Secondly, the government focuses more on corporate financial statements and uses forward expenditures to fulfil the current firm's losses. When forward revenue is achieved, the authority records accounting differences in the forward balance sheet and income statement. Finally, the government should strike a rational balance between financial innovation and restrictions to ensure the capital market’s relatively free competition rather than systematic information profit reduction.

5.2. Micro

Corporations should update competitive behaviour, such as selling CDOs with impaired values while using frequently audited financial plans to anticipate the risk of adopting reversal policies. In addition, companies should separate ownership and control and prohibit the same person from holding the positions of CEO and presiding officer. Furthermore, establish an independent board of directors and audit committee to review internal controls and risk management monthly or quarterly. The company's shareholders could directly hire an external audit team to improve auditor independence and professionalism and avoid window-dressing of annual reports. Credit rating agencies must take responsibility for reflecting the accurate level of risk. Employees must continuously gather the latest information and improve their professional skills. They had better report any risks to their supervisors and be prepared for the collapse of any regarded “too big to fall” enterprises.

6. Conclusion

This research points out the economic background of Lehman Bro. Bankruptcy and three main factors leading to this result: mismatching capital structure, not gaining timely capital injection from the American government, and disobeying original disposal agreement from Wall Street partners to bankruptcy reorganization or liquidation. Finally, it provides suggestions for future financial innovations and monitors from Macro and Micro aspects.

This research analyzes Lehman Bro. Bankruptcy comprehensively, yet there are still several shortfalls. Firstly, it shows little connection with the last new-jacking events, such as the Credit Suisse Securities stock short sale in 2022 and the Google Bank Collapse in 2023. Secondly, further scholars had better build up mathematical models to calculate generalized formulas for dynamic balance between financial innovations and government monitoring if banks carry out securities business, and also optimal compensation package (containing basic salary, restricted stock unit and share options) for professional managers in various market sizes and industry categories.

References

[1]. Qi Jue. (2023, January 24th). Too Big to Fail: The Fall of Lehman Brothers. Zhihu. https://zhuanlan.zhihu.com/p/600805216.

[2]. Cao Y. (2009). Financial Bailouts and Market Fundamentalism. Chinese Financier (07),131-133. doi:10.19294/j.cnki.cn11-4799/f.2009.07.040.

[3]. Yu Yongding. (2008). American subprime crisis: Background, causes and development. Contemporary Asia Pacific, pp. 5, 14–32.

[4]. Li Q. (2009). Another Perspective for Understanding Corporate Failure and Economic Crisis: A Review of Hu Jingsheng's Convex Incentives: Research on Stock Options-Related Issues. Dong yue lun cong, 7, 7. 191-191.

[5]. Wang Y. (2009). Optimal allocation of managers' stock options. Zhejiang social sciences (12), 17+10-125 doi: 10.14167 / j.z JSS. 2009.12.019.

[6]. Ren Chuanpu. (2012). Equity incentive system from the bankruptcy of Lehman Brothers. China Economic and Trade Herald, pp. 20, 48–49.

[7]. Xiong Y. &Hao J. (2008, October 18th). Here is how Lehman Brothers got their high salaries. Chinesetimes.net.cn. https://www.chinatimes.net.cn/article/699.html.

[8]. Demos, T., & Braithwaite, T. (2012). Mixed ruling in Lehman-JPMorgan dispute. FT.com.

[9]. Wang Y. (2009). Optimal allocation of managers' stock options. Zhejiang social sciences (12), 17+10-125 doi: 10.14167 / j.z JSS. 2009.12.019.

[10]. Chen S. &Chen Y. (2012). Analysis of the audit of Lehman Brothers Bankruptcy. Commercial Research, 8, 1-7. https://doi.org/10.3969/j.issn.1001-148X.2012.08.001

Cite this article

Yang,S. (2023). Too Big To Fall: Bankruptcy of Lehman Brothers Holdings Inc. in 2008. Advances in Economics, Management and Political Sciences,61,64-70.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Qi Jue. (2023, January 24th). Too Big to Fail: The Fall of Lehman Brothers. Zhihu. https://zhuanlan.zhihu.com/p/600805216.

[2]. Cao Y. (2009). Financial Bailouts and Market Fundamentalism. Chinese Financier (07),131-133. doi:10.19294/j.cnki.cn11-4799/f.2009.07.040.

[3]. Yu Yongding. (2008). American subprime crisis: Background, causes and development. Contemporary Asia Pacific, pp. 5, 14–32.

[4]. Li Q. (2009). Another Perspective for Understanding Corporate Failure and Economic Crisis: A Review of Hu Jingsheng's Convex Incentives: Research on Stock Options-Related Issues. Dong yue lun cong, 7, 7. 191-191.

[5]. Wang Y. (2009). Optimal allocation of managers' stock options. Zhejiang social sciences (12), 17+10-125 doi: 10.14167 / j.z JSS. 2009.12.019.

[6]. Ren Chuanpu. (2012). Equity incentive system from the bankruptcy of Lehman Brothers. China Economic and Trade Herald, pp. 20, 48–49.

[7]. Xiong Y. &Hao J. (2008, October 18th). Here is how Lehman Brothers got their high salaries. Chinesetimes.net.cn. https://www.chinatimes.net.cn/article/699.html.

[8]. Demos, T., & Braithwaite, T. (2012). Mixed ruling in Lehman-JPMorgan dispute. FT.com.

[9]. Wang Y. (2009). Optimal allocation of managers' stock options. Zhejiang social sciences (12), 17+10-125 doi: 10.14167 / j.z JSS. 2009.12.019.

[10]. Chen S. &Chen Y. (2012). Analysis of the audit of Lehman Brothers Bankruptcy. Commercial Research, 8, 1-7. https://doi.org/10.3969/j.issn.1001-148X.2012.08.001