1. Introduction

The Securities and Exchange Commission’s (SEC) rules were altered by the Sarbanes Oxley Act, which was enacted in the US in 2002. In addition, the laws governing accounting standards, auditing firms, and stock markets have all been updated in America. Similarly, European Union Adopted Directive 8 on Securities Disclosure, akin to Sarbanes-Oxley Act.

As for Japan, several changes were implemented between 2001 and 2003, especially in the field of modifying audit laws and regulations, which changed the traditional function of the audit profession into one that is more akin to that of Western nations [1].

In 2002 WorldCom, a telecoms company, was found to have inflated its assets by $11bn. That same year, Tektronix’s chief executive financial officer stole $150 million, financed himself with loans and inflated revenue. In 2009, an Indian corporate of IT services and back-office accounting called Satyam, obtained $1.5 billion in profit illegally [2]. As mentioned above, despite efforts made by governments around the world, there still have been countless accounting fraud scandals like this. Next, the following are some literature reviews related to accounting fraud.

The practice of accounting fraud is still widespread. Through a comparison of the US and Japan, Kizil and Kaşbaşı come to the conclusion that accounting fraud cannot be prevented despite the existence of pertinent rules, regulations, and supervisory institutions and suggest that auditors should receive additional training to help them deal with the current market changes [1].

The implementation of state-level FCA and the change in regulations in 2006 boosted reporting awareness in accounting fraud, however Berger and Lee demonstrate that Dodd-Frank Whistleblower Act’s was unable to prove the deterrent effect of state-level FCA on accounting fraud [3].

The tenure of auditing firms is correlated with accounting fraud. The initial three years of the partnership between auditor and customer are when false financial reporting tends to happen, according to an analysis by Carcello and Nagy of fraudulent and non-fraudulent companies from 1990 to 2001 [4].

Accounting fraud investigations are now more productive because of utilizing big data analysis in the division of auditors’ job. The concept that utilizing large scale data analysis and brainstorming meetings together has increased the effectiveness of audits looking for accounting fraud was examined in an article by Tang and Karim that examined the brainstorming meeting suggested by the SEC [5].

According to a report by Okougbo, Okike and Alao that examined the effects of ethics (EIC) courses on accounting students, those who took ethics intervention courses were able to raise their level of ethical awareness in comparison to those who are access to traditional ethics instruction [6].

The financial ties between businesses allows for the detection of accounting fraud as well. according to the economic relationship between suppliers and customers that Li, Li and Zhang has studied, the discrepancy in growth of a customer’s purchases and a supplier’s sales and excessive purchasing behavior can be used to forecast the revenue fraud of a supplier [7].

According to a study by Mason and Williams, the influence of domestic tax authorities’ oversight on managerial accounting fraud in the US is examined. The study discovers that IRS supervision has a favorable impact on lowering accounting fraud utilizing the IRS audit rate and accounting fraud data released by SEC [8].

Considerations should be given to both public and private law enforcement cases. Donelson, Kartapanis, McInnis and Yust in study points out that, private cases are just as significant to enforcement as national enforcement activities, like SEC cases, which are primarily used to measure accounting fraud [9]. Additionally, the essay proposes that in order to decrease errors and sensibilities, both public and private law enforcement cases should be utilized [9].

Therefore, the author writes this article for the following reason, firstly, this study aids in the prompt detection of typical types of accounting fraud by auditors; secondly, this article serves as a guide for businesses in developing measures to stop employee illegal behavior, and thirdly, the study informs stakeholders, such as investors, who need to know whether their money is flowing securely [10]. Through a study of fraud’s causes, this article will assess and examine the methods used to identify accounting fraud already in use, which also offers recommendations for future approaches to be used to identify accounting fraud.

2. Accounting Fraud

According to Sheikh, accounting fraud refers to a intentional deception of the company’s financial status in the financial reports by understating, omitting, or overstating it [11]. In addition, there are two common forms of accounting fraud, the first is excess of incomes or properties while the second is decline in expenses or debts [12]. According to the United States edition of the 2020 PWC Global Economic Crime and Fraud Survey, 56% of American businesses encountered fraud in the previous 24 months, resulting in losses of $6.2 billion. Accounting fraud was one of the top three categories of fraud recorded, increasing from 21% to 30% [13].

However, accounting fraud’s negative impacts extend beyond monetary losses. With regard to companies, the occurrence of accounting fraud causes damage to a company’s reputation globally. However, if seriously, heavy debt or violate stock might lead to the bankruptcy of companies, such as Enron and Leman Brothers. Moreover, employees will probably be fired in that corporate tends to downsize and dismisses workers when the firm fail to pay salary for employees. Taking WorldCom as an example, in June 2002, about 17,000 workers get job lost in WorldCom due to the accounting fraud [11]. In addition, the emergence of onerous market institutions like a variety of ineffectual regulations are created and enforced by the PCAOB, which has unrestricted authority, interfering with accountants’ daily tasks [14]. Why does the fraud rate not go down despite the serious consequences of accounting fraud? The subsequent authors analyze three typical reasons.

The first reason is the supervision of auditors, who play an important role in identifying accounting fraud. However, accounting fraud often occurs due to the different tenure and professional knowledge of auditors [4].

Secondly, one of the reasons for preventing fraud in financial reporting has been highlighted in many organizations with accounting fraud: corporate governance structures are ineffective as a tool for effective oversight. There are issues with management structures when one person holds two or more positions, as in the case of the corporation indicated in paragraph written by Carcello and Nagy, when one individual serves as both CEO and chair of the border, the likelihood of data manipulation by accountants is considerably raised [4].

In addition to the two reasons mentioned above, the low business ethics of accounting belongs to internal reasons. According to a survey of 1200 accounting teachers from all American universities shows that the coverage rate of professional ethics courses in accounting schools is low compared with other courses, which also means that teachers attach less importance to ethics [15]. Furthermore, the company’s moral culture also serves as a guide to influence the accounting business ethics. For instance, if a company’s goal is merely to maximize the profit, then the company will take various means to make profit, no matter it is legal or illegal. Therefore, when forced by various external pressures, for accountants, keeping the bottom line of business ethics is likely to prevent accounting fraud more effectively.

On the basis of three prevalent causes mentioned in the article, the author will then assess the effectiveness of some strategies for combating accounting fraud.

3. BDA Applied to Brainstorming Session

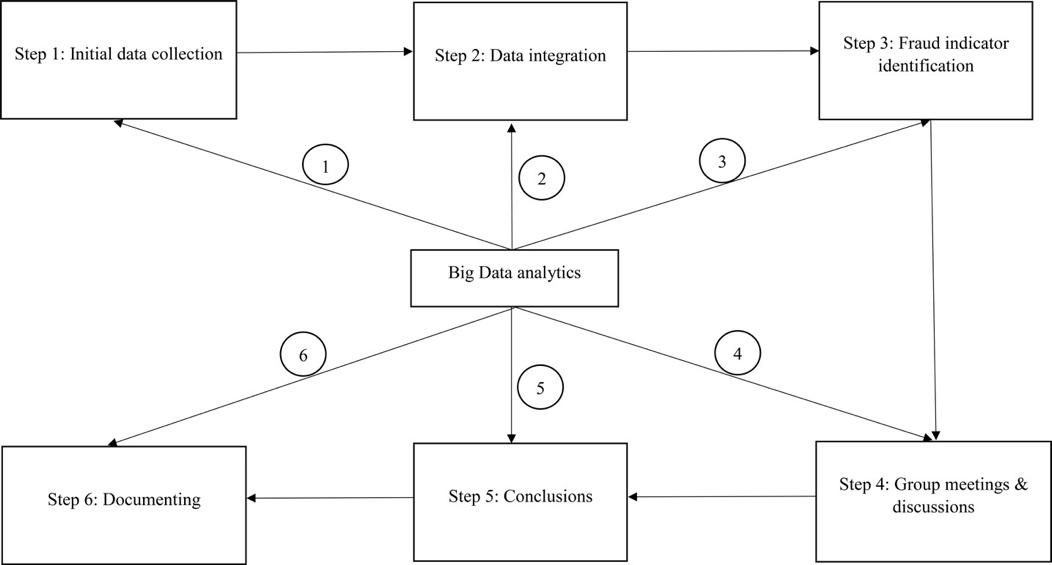

According to Tang and Karim, Brainstorm session was required by SAS. No. 99 as part of audits’ work [5]. The following is a model of how big data can be applied to the regular meeting of audits.

Figure 1: Model for applying big data analytics to the brainstorming session (Picture credit: Tang and Karim, 2019).

As shown in Figure 1, the model is divided into six steps, each of which can be leveraged to increase brainstorming session effectiveness using big data techniques [5]. As an illustration, the first phase in the process is data collection, and big data can gather significant quantities of both organized and unstructured data [5]. In the fourth step, big data techniques may capture everyone’s ideas and suggestions during group discussions. Group meetings are significantly more productive when they are displayed on the same large screen for shared sharing [5].

To evaluate whether BDA combined with big data analytics is effective. Using Canadian qualitative research methods, a study was conducted in Canada with 22 external auditors, 12 from the Big Four accounting firms, while 10 from mid-sized audit firms to examine the application of big data in idea-generating sessions at Canadian audit companies and whether it helps with risk assessment and fraud detection [16]. Face-to-face office interviews that are semi-structured are conducted in four significant Canadian cities. Most participants in the study agreed, according to the study’s findings, that adding BDA to brainstorming sessions enhanced auditor performance and productivity [16].

In terms of advantages, auditors can produce fresh, high-quality ideas during brainstorming session, moreover,computers can make comparison of different data over time and industry effectively to quickly, spotting anomalies and producing trustworthy results, additionally, big data can streamline communication between participating team members, for example, even between former and successor auditors to improve the effectiveness of fraud detection [5]. However, the cost of the combination is relatively high, due to the requirement to regularly update the system and gather various sorts of data [5]. Therefore, it is not difficult to imagine that large audit departments with greater revenue performance may be better suited to use this approach. In addition, the author holds a belief that the security of big data cannot be guaranteed either.

4. Benford’s Law

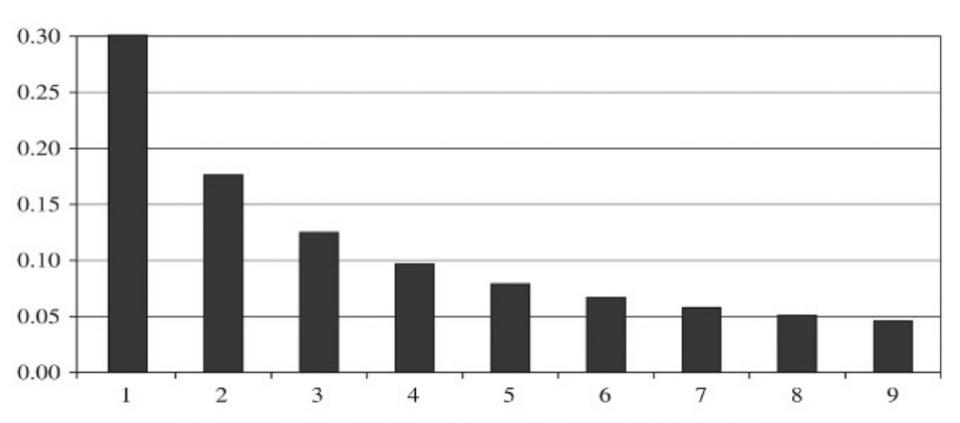

One famous math weapon to detect accounting fraud is Benford’s Law, which is a formula that decides expected frequency distribution of large numbers in a data set by using the integral method illustrated by Bourke and Van Penursem [17]. The content of the law can be shown in Figure 2 [18]. It can be easily observed that on average, approximately 30% percent of large numbers begin with first digit 1 while less than five percent of large numbers begin with first digit 9 [17]. The application of the law is that if any data in financial reports is deviated from the established expected frequency, accounting fraud is likely to happen [17].

Figure 2: Benford distribution of first digits (picture credit: Todter, 2009).

How effective the Benford’s Law would be? It applies to a wide range of data sets, especially for financial data sets [17]. Furthermore, the author thinks the law serves as a necessary predictor for audits to identify potential fraud. For example, it is claimed by McGnity that the KPMG company detected over $10,000 fraudulent funds issued by each operator successfully by using the law [19]. Nevertheless, Benford’s Law is not perfect. The shortcoming is that the law is not applicable in specific figures, which probably be influenced by the default mindset of people, for instance, the price of supermarket items is basically fixed in a few numbers [17]. Thus, the existence of accounting fraud cannot be proven simply by a divergence from Benford’s Law.

5. Manage the Corporate Governance Structure

Not only the audit department bears certain responsibility for accounting fraud, but also the management structure of companies such as the board of directors will affect the possibility of accounting fraud. Two models for predicting bankruptcy using Z-score and Beneish M scores were utilized to identify accounting fraud based on Razali and Arshad collected annual reports of 227 superior enterprises in Malaysia from 2010 to 2017 [20]. The results show that while the scale of the board of directors and board experience are not significant predictors of financial report fraud, independent non-executive directors are adversely connected with financial report fraud [20]. Therefore, the company should move quickly to improve the performance of the board of directors.

This study proposes new standards for the corporate management structure, particularly the board of directors, however some shortcomings still exist. In this study, merely two fraud models are used, and other indication models are not taken into consideration [20]. In addition, the author contends that not all businesses should use this study, and that larger businesses benefit more from the continued development of the board of directors than do smaller businesses.

6. Ethical Intervention Course (EIC)

To solve accounting fraud, strengthening external supervision and adjust the management structure of the company is far from adequate, it is important to cultivate accounting business ethics as well, which also puts forward higher requirements for higher education in accounting ethics [6]. A pre-test and subsequent non-equivalent control group design was employed in an experiment in Nigeria, where the experimental group used the new ethical intervention course (EIC) whereas the control group did not [6]. The trial went through two phases in 2016 and 2017, respectively [6]. While the control group was instructed using conventional techniques, students in the two-stage treatment group took a six-week ethical intervention course that included active learning strategies like digital films, group learning, and case studies [6]. The study found that, compared with the control group, ethics courses can improve the ethical consciousness of students in the experimental group [6]. As a result, it can be said that moral intervention courses help undergraduates in accounting become more morally aware.

The addition of ethics courses aids in the promotion of the accounting ethics system being incorporated into the teaching process as opposed to being dispersed among various courses [6]. In addition, the Nigerian Accounting Association (NAA) will hold symposiums, seminars, exchanges, and training on how to teach accounting ethics in academia and promote accounting ethics training throughout the nation [6]. Even Nevertheless, there are several drawbacks to the ethics course that prevent it from fully enhancing the corporate ethics of accounting students. Professional accounting ethics education is insufficient while the professor’s delivery of the material is more crucial [6]. Furthermore, it’s crucial to know how to make a decision in accordance with business ethics when confronted with a choice, which is greatly influenced by students’ comprehension of ethics classes [6].

7. Conclusion

In this essay, the causes and solutions to accounting fraud are examined. The findings of the study indicate that lack moral awareness among accountants, insufficient audit department oversight, and inappropriate corporate management structures are the key contributors to accounting fraud. According to the first strategy that has mentioned, inadequate oversight of audit departments can be improved through utilizing big data tools, and big data analysis can collect various types of data and increase the effectiveness of audit departments while examining financial reports. Applying Benford’s Law is beneficial to auditors, as demonstrated above, there is a high likelihood that accounting fraud occur when data seriously violate Benford’s Law. The annual reports of 207 Malaysian firms were examined and it was shown that while board size and members’ experience with the board have minimal impact, independent non-executive directors are inversely connected with financial fraud reporting. The final experimental research related to accounting business ethics concluded that taking ethical intervention classes helps accounting students develop their business ethics, hence satisfying the need for the financial statements’ credibility. Eventually, the result reached in this work is based on the evaluation and analysis of existing accounting fraud methods. The author perceives future research should also examine accounting fraud’s historical context, and novel fraud techniques and fraud psychology also require in-depth study.

References

[1]. Kizil, C. and Kaba, B. (2018) Accounting Scandals and Eye-catching Frauds: USA-Japan Comparison by Considering the Role of Auditing. Journal of Asian Research, 2.

[2]. Tutino, M. and Merlo, M. (2019) Accounting Fraud: a Literature Review. Risk Governance & Control: Financial Markets & Institutions, 9.

[3]. Berger, P.G. and Lee, H. (2022) Did the Dodd-Frank Whistleblower Provision Deter Accounting Fraud? Journal of Accounting Research, 60, 1337-1378.

[4]. Carcello, J.V. and Nagy, A.L. (2004) Audit Firm Tenure and Fraudulent Financial Reporting. Auditing: a Journal of Practice and Theory, 23, 55-69.

[5]. Tang, J. and Karim, K.E. (2019) Financial Fraud Detection and Big Data Analytics - Implications on Auditors’ Use of Fraud Brainstorming Session. Managerial Auditing Journal, 34, 324-337.

[6]. Okougbo, P.O., Okike, E.N. and Alao, A. (2021) Accounting Ethics Education and the Ethical Awareness of Undergraduates: an Experimental Study. Accounting education (London, England), 30, 258-276.

[7]. Li, C., Li, N. and Zhang, F. (2023) Using Economic Links Between Firms to Detect Accounting Fraud. The Accounting Review, 98, 399-421.

[8]. Mason, P. and Williams, B. (2022) Does IRS Monitoring Deter Managers from Committing Accounting Fraud? Journal of Accounting, Auditing & Finance, 37, 700-722.

[9]. Donelson, D.C., Kartapanis, A., McInnis, J. and Yust, C.G. (2021). Measuring Accounting Fraud and Irregularities Using Public and Private Enforcement. The Accounting Review, 96, 183-213.

[10]. Ikbal, M., Irwansyah, I., Paminto, A., Ulfah, Y. and Darma, D.C. (2020) Explores the Specific Context of Financial Statement Fraud Based on Empirical from Indonesia. Universal Journal of Accounting and Finance, 8, 29-40.

[11]. Sheikh, F. (2021) When Numbers don’t Add Up: Accounting Fraud and Financial Technology. New York: Business Expert Press.

[12]. Shakouri, M.M., Taherabadi, A., Ghanbari, M. and Jamshidinavid, B. (2021) Explaining the Beneish Model and Providing a Comprehensive Model of Fraudulent Financial Reporting (FFR). International Journal of Nonlinear Analysis and Applications, 12, 39-48.

[13]. Kaminski, K.A. and Hogan, E.A. (2023) An Examination of Non-Linearity in Financial Statement Data Using Topological Tests. Journal of Forensic and Investigative Accounting , 15.

[14]. Ball, R. (2009) Market and Political/Regulatory Perspectives on the Recent Accounting Scandals. Journal of accounting research 47: 277-323.

[15]. Miller, W.F. and Becker, D.A.A. (2011) Ethics In The Accounting Curriculum: What Is Really Being Covered?. American Journal of Business Education, 4, 1-10.

[16]. Yaseen, S.G. (Ed.) (2022) Digital Economy, Business Analytics, and Big Data Analytics Applications. Retrieved from Switzerland: Springer Nature.

[17]. Bourke, N.M. and Van Peursem, K.A. (2004) Detecting Fraudulent Financial Reporting: Teaching the’Watchdog’ New Tricks. Hamilton, New Zealand: University of Waikato.

[18]. Tödter, K.H. (2009) Benford’s Law as an Indicator of Fraud in Economics. German Economic Review 10: 339-351.

[19]. McGinty, J.C. (2014) Accountants Increasingly Use Data Analysis to Catch Fraud; Auditors Wield Mathematical Weapons to Detect Cheating. The Wall Street Journal. (Eastern edition) 5 December.

[20]. Razali, W.A.A.W.M. and Arshad, R. (2014) Disclosure of Corporate Governance Structure and the Likelihood of Fraudulent Financial Reporting. Procedia, Social and Behavioral Sciences, 145, 243-253.

Cite this article

Li,J. (2023). The Evaluation of Strategies Based on the Analysis of Three Causes of Accounting Frauds. Advances in Economics, Management and Political Sciences,62,159-165.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Kizil, C. and Kaba, B. (2018) Accounting Scandals and Eye-catching Frauds: USA-Japan Comparison by Considering the Role of Auditing. Journal of Asian Research, 2.

[2]. Tutino, M. and Merlo, M. (2019) Accounting Fraud: a Literature Review. Risk Governance & Control: Financial Markets & Institutions, 9.

[3]. Berger, P.G. and Lee, H. (2022) Did the Dodd-Frank Whistleblower Provision Deter Accounting Fraud? Journal of Accounting Research, 60, 1337-1378.

[4]. Carcello, J.V. and Nagy, A.L. (2004) Audit Firm Tenure and Fraudulent Financial Reporting. Auditing: a Journal of Practice and Theory, 23, 55-69.

[5]. Tang, J. and Karim, K.E. (2019) Financial Fraud Detection and Big Data Analytics - Implications on Auditors’ Use of Fraud Brainstorming Session. Managerial Auditing Journal, 34, 324-337.

[6]. Okougbo, P.O., Okike, E.N. and Alao, A. (2021) Accounting Ethics Education and the Ethical Awareness of Undergraduates: an Experimental Study. Accounting education (London, England), 30, 258-276.

[7]. Li, C., Li, N. and Zhang, F. (2023) Using Economic Links Between Firms to Detect Accounting Fraud. The Accounting Review, 98, 399-421.

[8]. Mason, P. and Williams, B. (2022) Does IRS Monitoring Deter Managers from Committing Accounting Fraud? Journal of Accounting, Auditing & Finance, 37, 700-722.

[9]. Donelson, D.C., Kartapanis, A., McInnis, J. and Yust, C.G. (2021). Measuring Accounting Fraud and Irregularities Using Public and Private Enforcement. The Accounting Review, 96, 183-213.

[10]. Ikbal, M., Irwansyah, I., Paminto, A., Ulfah, Y. and Darma, D.C. (2020) Explores the Specific Context of Financial Statement Fraud Based on Empirical from Indonesia. Universal Journal of Accounting and Finance, 8, 29-40.

[11]. Sheikh, F. (2021) When Numbers don’t Add Up: Accounting Fraud and Financial Technology. New York: Business Expert Press.

[12]. Shakouri, M.M., Taherabadi, A., Ghanbari, M. and Jamshidinavid, B. (2021) Explaining the Beneish Model and Providing a Comprehensive Model of Fraudulent Financial Reporting (FFR). International Journal of Nonlinear Analysis and Applications, 12, 39-48.

[13]. Kaminski, K.A. and Hogan, E.A. (2023) An Examination of Non-Linearity in Financial Statement Data Using Topological Tests. Journal of Forensic and Investigative Accounting , 15.

[14]. Ball, R. (2009) Market and Political/Regulatory Perspectives on the Recent Accounting Scandals. Journal of accounting research 47: 277-323.

[15]. Miller, W.F. and Becker, D.A.A. (2011) Ethics In The Accounting Curriculum: What Is Really Being Covered?. American Journal of Business Education, 4, 1-10.

[16]. Yaseen, S.G. (Ed.) (2022) Digital Economy, Business Analytics, and Big Data Analytics Applications. Retrieved from Switzerland: Springer Nature.

[17]. Bourke, N.M. and Van Peursem, K.A. (2004) Detecting Fraudulent Financial Reporting: Teaching the’Watchdog’ New Tricks. Hamilton, New Zealand: University of Waikato.

[18]. Tödter, K.H. (2009) Benford’s Law as an Indicator of Fraud in Economics. German Economic Review 10: 339-351.

[19]. McGinty, J.C. (2014) Accountants Increasingly Use Data Analysis to Catch Fraud; Auditors Wield Mathematical Weapons to Detect Cheating. The Wall Street Journal. (Eastern edition) 5 December.

[20]. Razali, W.A.A.W.M. and Arshad, R. (2014) Disclosure of Corporate Governance Structure and the Likelihood of Fraudulent Financial Reporting. Procedia, Social and Behavioral Sciences, 145, 243-253.