1. Introduction

The fashion business has seen significant transformation in the last two decades due to the emergence and proliferation of fast fashion. Historically, the fashion business adhered to a bi-annual framework, whereby designers would showcase their collections during fashion weeks, and retailers would then make pre-orders many months in advance. The extended timetable significantly delayed the dissemination of the most recent trends to the general consumer population. Nevertheless, the introduction of quick fashion has considerably reduced this timeframe. The term "fast fashion" encompasses rapidly manufacturing and disseminating fresh styles and patterns to meet prevailing trends and satisfy customer preferences. This method has facilitated the democratisation of the fashion industry, increasing the accessibility and affordability of fashionable and attractive clothing to a broader demographic. Zara is widely recognised as a pioneer and highly influential in the fast-fashion sector.

Zara was founded by the Spanish retail magnate and billionaire Amancio Ortega, known for his secrecy. He also has a significant portion of the remaining high-street brands. With record half-year sales and earnings, Inditex today reported a 3% increase in net income to £1.2 billion for the six months that ended on 1 July 2018. Zara's visionary founder, Amancio Ortega, built the company from a little shop in A Coruna to a massive worldwide retail empire with over 7,000 shops.

Ortega opened his first business intending to sell high-end goods at moderate prices. The concept itself was brilliant. To shorten lead times and respond to emerging trends more quickly—what Ortega dubbed "instant fashions"—he altered the design, production, and distribution processes in the 1980s. Without him, the term "fast fashion" would never have been coined, and our purchasing habits would drastically differ [1].

2. Theoretical Basis

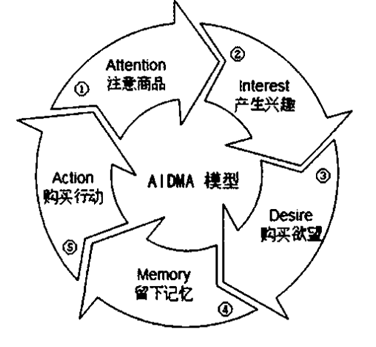

Heinz M. Goldman, a marketing specialist from Europe, proposed the AIDA model that holds that the four phases of consumer behaviour are Attention, Interest, Desire, and Action. In 1898, American advertising expert Louis expanded the AIDA model to include the Memory stage in response to the rise of conventional information sources like newspapers and television. This created the AIDMA consumer behaviour model. It demonstrates the general rule of “cognition-emotion-behavior” in consumer psychology.

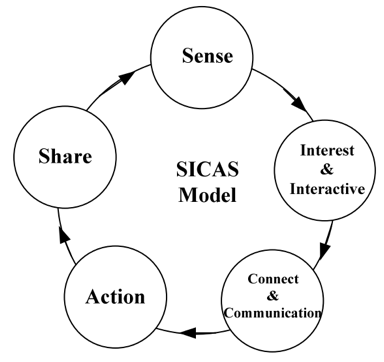

The emergence of the PC-based Internet information medium at the start of the twenty-first century gave customers access to technological help for product sharing and searching. As a result, Japan Dentsu Group first proposed the AISAS (Attention, Interest, Search, Action, Share) model in 2005 and adjusted the last three stages in the AIDMA model to Search, Action, and Share, strengthening the role of search and sharing in the process of consumer behaviour, and realising full coupling with the Internet business environment [2]. Monitoring Research Institute and DCCI (Data Centre of China Internet) released 2.0+ mobile Internet era of all digital consumption trajectory model—SICAS model—in 2011. SICAS experiences these five stages: sense, interest and interaction, connection and communication, action, and sharing [3].

Figure 1: AIDMA Model [4]

Figure 2: AISAS Model [4]

Figure 3: SICAS Model [3]

2.1. Sense

This is the first stage in developing a relationship between the brand and the customer. Brands and users can communicate anytime, anywhere using a variety of contemporary platforms, including social networks, mobile Internet, and LBS location services [3]. Brands and users can also track and analyse user behaviour, feedback, and comments across various platforms using data analytics to comprehend user preferences, needs, and behavioural patterns. Brands must be able to recognise customer requirements and feedback.

2.2. Interest & Interactive

The successful contact between brands and customers may be brought about after selecting the best marketing communication technique and generating a significant interest in consumers. This phase focuses on the quality, not the quantity, of interactions between the brand and its consumers. Brands must comprehend and respond to user interests and requirements.

2.3. Connect & Communication

Brands should consider adopting internet service architectures such as COWMALS (Connect-Open-Web-Mobile-App-Location-Social) to facilitate the integration and sharing of various advertising systems, mobile Internet, and business operations platforms. This approach aims to establish a continuum of connections between brands and users, fostering the establishment and maintenance of user-brand relationships. This extends beyond the inclusion of promotional hyperlinks to the establishment of profound and enduring connections.

2.4. Action

This stage primarily focuses on the consumer's purchasing behaviour. In the contemporary context, transactions may occur across several platforms, including social media platforms such as TikTok, smartphone applications, and conventional online marketplaces such as Taobao and Amazon. These platforms provide a streamlined and user-friendly shopping procedure, use promotional strategies and incentives to encourage purchases, and offer several purchasing channels and alternatives, enhancing sales, optimising conversion rates, and fostering customer loyalty.

2.5. Share

Following a purchase, consumers have the option to express their experiences. In social networking, it is advisable to push users to leave comments and reviews, provide sharing tools and incentives, and diligently monitor and address social media shares. The phenomenon of rapid dissemination and the consequential impact of this kind of sharing may surpass the efficacy of conventional word-of-mouth marketing strategies.

3. ZARA marketing strategy based on the SICAS model

Firstly, based on establishing brand and user perception, the brand's growth and current achievements may be attributed to Zara's unwavering dedication to prioritising the consumer. In 2015, a customer called Miko entered a Zara store in Tokyo and requested a pink scarf, which was unavailable. An almost simultaneous occurrence occurred at Michelle's in Toronto, Elaine's in San Francisco, and Frankfurt. In subsequent days, several Zara enthusiasts saw similar occurrences at various Zara retail establishments throughout the globe. Within seven days, almost 2,000 Zara stores worldwide sold pink scarves. Precisely, a total of 500,000 pink scarves were sent. The product was purchased entirely within three days.

In the phase of Interest and Interactive, in order to improve the quality of interaction between customers and brands, Zara's success is in using radio frequency identification (RFID) technology inside its retail establishments. The firm employs an advanced method to promptly monitor the whereabouts of clothing and expedite the delivery of essential items to clients. It reduces inventory expenses, increases design flexibility, and enables online orders to be fulfilled using goods from the store closest to the delivery location, decreasing shipping costs.

One further factor contributing to Zara's success is the brand's strategic approach of providing comprehensive training and empowerment to its store personnel and managers, enabling them to effectively address and cater to the diverse requirements of its consumer base within the retail environment. Zara salespeople and store managers listen to consumers' remarks, cuts, materials, and collection suggestions and watch for potential new designs. The user's text may be rewritten to be more academic as follows: The text can be seen as an exploration of the translation of several styles into distinct Zara designs. On the contrary, conventional daily sales reports often lack real-time market updates [5].

In the phase of Connect and Communication, Zara has an extraordinary approach to advertising; about 0.3% of Zara's overall sales go on advertising and marketing. Zara prioritises its product selection, store positioning, and price methods more than it does extensive media marketing like TV and billboards. Contrary to many shops, Zara places more of a priority on new product introductions than on in-store discounts or bargains [6]. Zara's marketing and advertising strategy is based on a marketing idea that has been less prominent due to the emergence of new technology and online retail platforms.

One of the most efficacious strategies for acquiring clients involves attracting their attention as they walk by a storefront, attracting them to enter the store, and then facilitating their purchase. Stores in the most significant city locations are the first step.

The windows play a crucial role in the exhibition of the exhibits. Zara focuses on window design in its headquarters in A Coruña, a bunker with multiple windows tested by experts in window dressing and neuromarketing. The final showcase is exported to all stores worldwide.

The marketing and advertising approach used by Zara does not include the utilisation of renowned individuals, such as models, actresses, or singers, in contrast to other firms. Zara utilises nameless models to market its clothing and depends on young, unknown designers (mainly women) [7].

It is interesting to note that Zara seldom uses their emblem on merchandise. Zara's personnel does not depend on one-on-one sales presentations, unlike neighbouring retailers, e.g. J2 Clothing. Customers return to Zara because of its creative items and affordable pricing, although its in-store customer service may not be of the highest calibre. In essence, Zara's products self-promote [6].

Subsequently, in the Action phase, Zara has transitioned towards adopting the contemporary 4Es marketing strategy, whereby Experience substitutes Product, Exchange replaces Price, Evangelism takes the place of Promotion, and Every Place serves as the new Place. This strategic shift emphasises the consumer as the focal point around which the business and brand revolve. Zara strongly emphasises prioritising the client in all aspects of their business, including customer experiences, customer exchange, customer evangelism, and customer accessibility. For instance, Zara has a substantial social media following, with over 25 million Facebook followers, 16 million Instagram followers, and over one million Twitter followers [8]. When consumers are exposed to the latest Zara apparel offerings via social media platforms, they can conveniently make online purchases or visit physical retail stores to get the desired items promptly. The consistent influx of buyers may be attributed to Zara's rapid introduction of new merchandise and regular updates on various social media platforms.

Last but not least, in the Share step, Zara effectively manages user experience and consumer feedback. More than 17 million customer enquiries were answered by service representatives in 2016. As its most important brand asset, Zara genuinely listens to client feedback to enhance its goods and services [8]. The success of Zara is based on its data-driven decision-making process. Zara can make strategic decisions following what the market demands by carefully examining client data and trends. Zara often conducts online and mobile app polls of its clients while closely monitoring social media, runway events, and customer feedback. Questions ask about brand satisfaction, purchasing habits, and product interest. This information helps decide which items to create and how to improve the online user experience. In order to understand consumers' opinions on current fashion trends, brand perceptions, and room for development, Zara employees routinely engage with customers. Employees take notes during these discussions and provide the market research team with essential information. Zara carefully monitors several social media sites to see what users say about the company and its goods. Social media mentions of Zara provide information about consumer mood that may affect tactical choices [9].

4. Improvement

The potential for the brand to broaden its client base and stimulate more purchasing activity might be enhanced by strategically allocating resources towards digital platform marketing and enhancing its e-commerce sector's functioning [10]. Investment in Zara's e-commerce platform and mobile app may be increased substantially to better serve clients and inspire more devotion to the brand. Specifically, Zara may expand its funding for virtual reality hardware and software. By recreating the image in their minds when they put on the garments, customers are less likely to be disappointed by items that look nothing like the photos online. If virtual reality technology could be perfected, the profits would be lower. Furthermore, this technology has the potential to enhance Zara's competitiveness relative to its rivals significantly.

With the help of Taobao and JD.com, two of China's largest e-commerce platforms, Zara can deepen its partnership with the country. During high-traffic times like New Year's, Spring Festival, Double Eleven, etc., brands may offer deeper discounts akin to the Western "Black Friday". It helps market the product and drive more sales. Zara should slow the growth of its brick-and-mortar locations to improve liquidity and enable the company to better weather crises like the current coronavirus outbreak [11].

As environmental concerns grow, brands are pressured to be transparent about their sustainability efforts. Zara could further market its sustainable lines and initiatives while investigating areas to improve sustainability in its production and supply chain processes. For example, Zara pledged to run their business entirely on renewable energy by 2022. They pledge to stop selling single-use plastics to consumers by 2023. They want to roll out more recycled or sustainable polyester and sustainable 100% linen by 2025 [12].

5. Conclusions

Based on the 5 factors of the SICAS model, Zara demonstrates remarkable agility in responding to consumer demands, as evidenced by the rapid production and sale of pink scarves following global customer feedback. This incident underscores Zara's commitment to prioritising the customer and its operational proficiency in rapidly scaling product offerings. In addition, incorporating RFID technology in Zara's operational processes highlights the brand's innovative approach. It aids in efficient inventory management and ensures prompt delivery of products, thus enhancing customer experience. Meanwhile, Zara adopts an unconventional marketing strategy by investing minimally in traditional advertising, relying instead on product quality, store positioning, and strategic pricing. Their emphasis on store location, window design, and the non-use of celebrity endorsements uniquely differentiates their marketing approach. More importantly, Zara's shift to the 4Es marketing strategy emphasises the importance of the consumer. The brand's substantial social media presence ensures that customers are consistently engaged and informed about the latest product offerings. Also, Zara significantly emphasises monitoring user feedback to inform their decision-making processes. The brand effectively manages customer inquiries and considers the data derived from various channels, including social media and direct customer interactions. Furthermore, it is advisable for firms to carefully allocate resources towards digital platform marketing, bolster their e-commerce capabilities, and uphold sustainable initiatives.

In a nutshell, Zara's success can largely be attributed to its customer-centric approach, operational agility, and innovative marketing strategies. The brand's ability to quickly respond to market demands and trends sets it apart in the competitive fashion industry. Zara's robust feedback mechanism and its use of technology ensure it remains in sync with customer preferences. Zara maintains a strong market presence and loyal customer base by consistently prioritising the customer and leveraging data-driven decision-making processes. The unique marketing approach, which emphasises product quality and strategic store positioning over traditional advertising mediums, is a testament to the evolving nature of retail marketing in the age of technology and digital platforms.

References

[1]. Kala, K. (2018) Fashion history- Zara, Medium. Available at: https://medium.com/@kalyanii8927/fashion-history-zara-19ac531d9ab1 (Accessed: 04 September 2023).

[2]. Pan, J., Wang, B. and Dong, X. (2020) ‘Enterprise Strategy’, Based on SICAS consumer behavior model Social e-commerce models and comparative research, 10(39), pp. 37–43. doi:10.13529/j.cnki.enterprise.economy.2020.10.005.

[3]. Yan, X. et al. (2017) ‘Research on the social e-commerce marketing model based on SICAS model in China’, International Journal of Marketing Studies, 9(3). doi:10.5539/ijms.v9n3p113.

[4]. Yang, Y. (2011) ‘Exploration of enterprise social marketing model based on SICAS model’, New Marketing, pp. 16–17. doi:10.14011/j.cnki.dzsw.2011.12.019.

[5]. Roll, M. (2021). The Secret of Zara’s Success: A Culture of Customer Co-creation, Business & Brand leadership. Available at: https://martinroll.com/resources/articles/strategy/the-secret-of-zaras-success-a-culture-of-customer-co-creation/

[6]. Thomas, S. (2023) The Zara’s 0$ advertising strategy and why it succeeds, Avada. Available at: https://avada.io/resources/zara-advertising.html (Accessed: 07 September 2023).

[7]. The marketing and advertising strategy of Zara | Telling Advertising (2017) Eslogan Magazine | Noticias de Marketing y Publicidad, Branding y Social Media. Available at: https://en.esloganmagazine.com/marketing-and-advertising-strategy-of-zara/.

[8]. Danziger, P.N. (2022) ‘Why Zara Succeeds: It Focuses On Pulling People In, Not Pushing Product Out’, Forbes, 12 October. Available at: https://www.forbes.com/sites/pamdanziger/2018/04/23/zaras-difference-pull-people-in-not-push-product-out/?sh=13fbc43423cb (Accessed: 7 September 2023).

[9]. The Secret of ZARA’S Success: Data-Driven Decisions (2023) Linkedin.com. Available at: https://www.linkedin.com/pulse/secret-zaras-success-data-driven-decisions-steadypace-sa (Accessed: 7 September 2023).

[10]. Ha, J. (2021) Zara Strategic Analysis, DigitalCommons@University of Nebraska - Lincoln. Available at: https://digitalcommons.unl.edu/cgi/viewcontent.cgi?article=1368&context=honorstheses (Accessed: 09 September 2023).

[11]. Li, Y. (2021) 'How should Zara optimise its marketing strategies to cater to the needs of new generations – gen Z and millennials', Proceedings of the 2021 International Conference on Financial Management and Economic Transition (FMET 2021), 190. doi:10.2991/aebmr.k.210917.048.

[12]. Live Frankly Team (2023) How sustainable is Zara?: Sustainable fashion, Live Frankly. Available at: https://livefrankly.co.uk/sustainable-fashion/how-sustainable-is-zara-and-can-i-shop-there-with-a-clean-conscience/ (Accessed: 09 September 2023).

Cite this article

Yu,W. (2023). Research on Using the SICAS Model to Analyse the Zara Marketing Strategy. Advances in Economics, Management and Political Sciences,64,127-133.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Kala, K. (2018) Fashion history- Zara, Medium. Available at: https://medium.com/@kalyanii8927/fashion-history-zara-19ac531d9ab1 (Accessed: 04 September 2023).

[2]. Pan, J., Wang, B. and Dong, X. (2020) ‘Enterprise Strategy’, Based on SICAS consumer behavior model Social e-commerce models and comparative research, 10(39), pp. 37–43. doi:10.13529/j.cnki.enterprise.economy.2020.10.005.

[3]. Yan, X. et al. (2017) ‘Research on the social e-commerce marketing model based on SICAS model in China’, International Journal of Marketing Studies, 9(3). doi:10.5539/ijms.v9n3p113.

[4]. Yang, Y. (2011) ‘Exploration of enterprise social marketing model based on SICAS model’, New Marketing, pp. 16–17. doi:10.14011/j.cnki.dzsw.2011.12.019.

[5]. Roll, M. (2021). The Secret of Zara’s Success: A Culture of Customer Co-creation, Business & Brand leadership. Available at: https://martinroll.com/resources/articles/strategy/the-secret-of-zaras-success-a-culture-of-customer-co-creation/

[6]. Thomas, S. (2023) The Zara’s 0$ advertising strategy and why it succeeds, Avada. Available at: https://avada.io/resources/zara-advertising.html (Accessed: 07 September 2023).

[7]. The marketing and advertising strategy of Zara | Telling Advertising (2017) Eslogan Magazine | Noticias de Marketing y Publicidad, Branding y Social Media. Available at: https://en.esloganmagazine.com/marketing-and-advertising-strategy-of-zara/.

[8]. Danziger, P.N. (2022) ‘Why Zara Succeeds: It Focuses On Pulling People In, Not Pushing Product Out’, Forbes, 12 October. Available at: https://www.forbes.com/sites/pamdanziger/2018/04/23/zaras-difference-pull-people-in-not-push-product-out/?sh=13fbc43423cb (Accessed: 7 September 2023).

[9]. The Secret of ZARA’S Success: Data-Driven Decisions (2023) Linkedin.com. Available at: https://www.linkedin.com/pulse/secret-zaras-success-data-driven-decisions-steadypace-sa (Accessed: 7 September 2023).

[10]. Ha, J. (2021) Zara Strategic Analysis, DigitalCommons@University of Nebraska - Lincoln. Available at: https://digitalcommons.unl.edu/cgi/viewcontent.cgi?article=1368&context=honorstheses (Accessed: 09 September 2023).

[11]. Li, Y. (2021) 'How should Zara optimise its marketing strategies to cater to the needs of new generations – gen Z and millennials', Proceedings of the 2021 International Conference on Financial Management and Economic Transition (FMET 2021), 190. doi:10.2991/aebmr.k.210917.048.

[12]. Live Frankly Team (2023) How sustainable is Zara?: Sustainable fashion, Live Frankly. Available at: https://livefrankly.co.uk/sustainable-fashion/how-sustainable-is-zara-and-can-i-shop-there-with-a-clean-conscience/ (Accessed: 09 September 2023).