1. Introduction

With the progress of society and the development of industry, global warming has become an important environmental issue, and carbon trading is a powerful tool to limit greenhouse gas emissions, and more and more countries are adopting this tool to limit emissions. Many countries have established relatively mature carbon trading strategies, but as carbon trading is still a completely new field, many institutional elements are still imperfect.

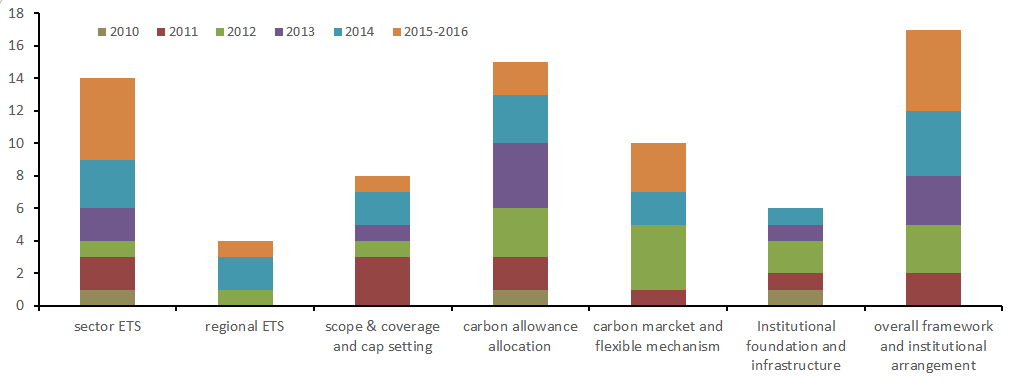

As the largest carbon emitter and the largest developing economy, it is important to establish and operate an emissions trading scheme (ETS) in China. Carbon emissions are about people's survival, development, equality and other factors. Establishing and operating a cap-and-trade ETS in China faces unique political, economic, and institutional issues. China has become the world's most important GHG emitter, accounting for 24.6% of global GHG emissions [1]. To control carbon emissions in a cost-effective manner, China has launched several regional carbon trading pilots and has included the coal power sector in its first carbon trading projects. This is the first time that a cap-and-trade model has been implemented in a developing country, and carbon trading is underway in various sectors of expansion. The first compliance period of China's carbon emission market has been completed in 2022 with good results, but it still lags behind other countries in the world. At present, China’s ETS is still in its infancy, so the process of testing and evaluating it through practice is still ongoing [2]. Figure 1 shows the recent studies on China’s cap-and-trade ETS mechanism design.

Figure 1: Recent studies on China’s cap-and-trade ETS mechanism design.

In recent years, more and more researchers have started to focus on carbon emissions in China and many possibilities are being explored. In this paper, we intend to evaluate and discuss several aspects to provide a simple, clear and systematic perspective on the current research progress. This paper first lists the long-established carbon trading schemes implemented in developed countries and compares them with the current carbon trading in China, pointing out the strengths and weaknesses of China and suggesting suggestions for development and improvement. In order to adjust carbon pricing and accounting methods in a timely manner, balance current developments and address the drawbacks of carbon trading, appropriate directions for adjustment are pointed out, and insights are provided on areas where further research is critically needed in the next few years.

2. Origin and Legal Basis of Carbon Trading

Emission trading Scheme for carbon dioxide (CO2) and other greenhouse gases (GHG) is a form of carbon pricing; also known as cap and trade (CAT) or carbon pricing. It is a way to limit climate change by setting up a market with a finite number of credits for the emission. The Kyoto Protocol establishes provisions for emissions/emissions trading between Parties. Article 6.2 of the Paris Agreement allows Parties to realize their Nationally Determined Contributions (NDCs) in internationally transferable mitigation outcomes (ITMOs), providing the normative basis for such international carbon trading in international law. In addition to this, Article 6.4 of the Paris Agreement provides for a project-based sustainable development mechanism, an international carbon credit trading mechanism undertaken by non-state actors of each Party under the centralized management of the Conference of the Parties (CMA). 2005 saw the establishment of the EU and Norway's respective ETSs, and Japan established a voluntary trading scheme to help it meet its own Kyoto Protocol commitments. Some large companies have also introduced internal carbon pricing schemes. Since the ETS has evolved, with different jurisdictions adopting different designs and approaches. By 2020, a total of 28 countries or territories around the world have implemented or are planning ETS.

3. Various Carbon Trading Systems in the World

1.1. European Union Emission Trading Scheme (EU ETS)

The first phase, from 2005 to 2007, was an experimental phase with the main objective of learning by doing. The cap on emissions for this phase was set at 6.6 billion tons of CO2, excluding other non-CO2 greenhouse gases. The sectors with emission limits are mainly energy producing and energy intensive, involving five sectors, namely energy supply. The second phase for the first time considers the inclusion of the aviation industry in the emission reduction control system a certain discount rate for each airline to issue free emission allowances, and excess emissions need to be purchased. During this period, penalties for exceeding the emission limits rise and the excess is deducted from the company's emission allowances for the following year. 90% of the allowances are free and 10% are auctioned. Power sector allowances cannot be completely free. The third phase is from 2013 to 2020, with a time span of eight years, and aims to encourage companies to make long-term investments in emissions reduction. The emissions reduction target is an average annual reduction of 17%, from an emissions cap of 2.039 billion tons of CO2 equivalent in 2013, to 1.72 billion tons in 2020. Most of the certificates will be allocated by auction.

1.2. New Zealand Carbon Emissions Trading System

As an Annex I country of the Kyoto Protocol, New Zealand’s committed international emission reduction obligations are to stabilize carbon emissions at 1990 levels in 2010 and to reduce its greenhouse gas emissions by 10-20 on an annual basis in the second commitment period of the Kyoto Protocol In addition, in 2011, New Zealand independently proposed a long-term reduction target of 50% per year.

New Zealand's carbon trading system started in 2008, New Zealand's forest carbon sink is large, in 2009 the forest carbon sink offset about 25% of its total carbon emissions, emission reduction potential, low cost, high comprehensive benefits, is considered the most comparative advantage and competitiveness, is the key area to achieve emission reduction targets, and therefore was the first to be included in the trading system; agriculture and animal husbandry is the pillar industry and greenhouse gas emissions of the large In 2009, emissions accounted for 46.5% of the country, in order to avoid the negative impact of emissions reduction, the last to join the trading system.

The New Zealand's carbon trading system is based on the principle of limited price protection, and the implementation of free allowances. The government calculates quotas through the historical emission laws, and enterprises can cut emissions through their technology, or can buy quotas or carbon sinks, with no cap on forest carbon sinks, and can also buy the emission targets in the international market, but carbon sinks are not allowed to be exported to prevent the loss of state-owned carbon assets. The New Zealand government identified 2008-2012 as a transition period to implement a fixed carbon price to prevent price fluctuations and stabilize the market. They now allocate and auction carbon emission targets. The government has also enforced a secrecy floor price to prevent New Zealand units from being sold at auction at prices significantly lower than secondary market prices. If the auction clearing price is lower than the confidential reserve price, they will not be sold at risk in the auction [7].

1.3. Japan Carbon Emissions Trading System

Japan has established a voluntary carbon trading market, which consists of domestic enterprises joining to voluntarily reduce emissions, and after their emission reduction projects have been approved by the Ministry of the Environment, they can receive subsidies for the corresponding project costs, but if participating enterprises fail to meet their emission reduction targets, all government subsidies will be returned. after 2010 Japan established the Tokyo Cap and Trade Program (TCTP) in Tokyo, which refers to the use of carbon emissions for In the TCTP, there are regular reporting, close monitoring and certification mechanisms to ensure that each member does a good job of reducing emissions, the TCTP has been implemented with significant emission reductions and can achieve an average annual reduction of 20%.

The construction of Japan's carbon trading market reflects a high degree of overall systemic and scientific completeness, which is mainly reflected in four aspects: supporting environment, system construction, institutional setting and expert system. Before the implementation of carbon trading. Japan has done a huge amount of preparatory work at the legislative aspect as well as statistical and technical aspects, while training plenty of professionals to prepare for system building and to be able to move forward relatively smoothly at the time of implementation. Such far-sighted and fundamental input can save a lot of trouble.

1.4. Status of China's carbon market

China approved seven provinces and cities, Beijing, Tianjin, Shanghai, Chongqing, Hubei, Guangdong, and Shenzhen, to carry out carbon trading pilot work and promote the construction of a regional carbon trading system. These carbon trading markets have made different attempts. The National Development and Reform Commission issued the Interim Measures for the Management of Voluntary Greenhouse Gas Emission Reduction Trading, which set out the rules for the management of China's certified voluntary emission reductions [3]. China's carbon trading mechanism relies heavily on CDM, with major projects in the energy bracket, relatively narrow coverage and a confusing market [4]. On July 16, 2021, the national carbon emission trading market was launched online for trading. The power generation industry became the first industry to be included in the national carbon market, and the first batch of the national carbon market included 2,162 key emission units in the power industry, covering emissions of more than 4 billion tons. China's carbon market will become the world's largest market covering greenhouse gas emissions [5].

1.5. Evaluation

The EU ETS system started early and has accumulated more experience in the early years. The European Commission attaches importance to the carbon trading system, on top of which it has continuously improved the system and established a strict approval system and enterprise survey. Unfortunately, stage 3 has been too high to give allowances, and the carbon price has been maintained at a low level, making it difficult to form an effective carbon emission target.

New Zealand has a large number of forests and a good economic foundation, and it is very worthwhile for various countries to learn from the implementation of carbon trading systems in the industry from easy to difficult step by step.Japan has made preparations in a number of areas in advance, paving the way in advance in various, forward-looking government functions to provide assistance to carbon trading in order to facilitate subsequent work to advance. Progress has been made in various pilot projects, which has promoted the enthusiasm of enterprises to participate.

4. Gap between China and the World Carbon Trade

1.6. The Stage of Economic Development is Different

First, the phase of economic progress and historical emission responsibilities are different. Most developed countries have completed industrialization and urbanization, have crossed the peak per capita carbon dioxide emissions region, the total emissions growth is slower or even has entered the negative growth phase; while China is still in a critical period of industrialization and new urbanization process, the stage of economic development of high energy dependence determines the high growth of emissions, although barely completed the peak of emissions intensity across, but the intensity decline is not balanced, still does not have . Although the peak of emission intensity has barely been crossed, the decrease in intensity is uneven and still does not have global characteristics, and it is still difficult to cross the peak of per capita emission and total emission in the short term [6]. The target setting and route arrangement of low-carbon emission reduction cannot be detached from the development reality, and must be gradual and progressive. China is actively developing a domestic carbon trading market under the framework agreement of the international greenhouse gas emission reduction negotiations, not only to fulfil its “common but differentiated responsibilities and respective responsibilities”, but also to accelerate the transformation of its economic development and the upgrading and adjustment of its industrial structure as well as the optimisation of its energy structure through such environmental and economic means, thereby mitigating the impact of the ecological environment on its economic and social development. The main purpose is to accelerate the transformation of the economic development mode and the upgrading and adjustment of the industrial structure as well as the optimization of the energy structure through this environmental economic instrument, so as to alleviate the bottleneck constraint of the ecological environment on the economic and social development.

1.7. The Industrial Structure and Energy Dependence are Different

China's labour-intensive and energy-intensive industries contribute significantly to economic development, energy efficiency still varies greatly by industry and region, and energy sources that rely primarily on coal lead to high emissions, suggesting that there is difficulty in reducing emissions in China, but huge scope for doing so [9]. At the same time, China's secondary industry accounts for a relatively large share, and the secondary industry covers mainly heavy chemical industries and "high energy consumption, high pollution and high emission" industries, and this industrial structure also determines the large amount of carbon emissions characteristic of economic development.

Third, the gap between financial market instruments. Healthy development of carbon trading market requires highly developed technical level and institutional system under the mature market economy system [10]. The former includes low carbon emission reduction technology, monitoring and statistical technology, market platform technology, etc. The latter includes environmental economic policy system, low carbon and green standard system, energy efficiency policy system, carbon financial system (carbon fund, credit, securities), etc. Carbon trading market, as a branch of the financial market, needs a developed market economy system to support it, while the monetary market and capital market in China still need to be developed, and a comprehensive and in-depth institutional reform is needed according to specific national conditions and needs.

5. Talking about the Idea of Pricing Mechanism

Carbon pricing policies are set by governments and put a price on carbon emissions based on carbon content. Such policies provide flexibility in how and when emissions reductions are made.

As such they are implemented primarily to encourage cost-effective emission reduction activities. Depending on their design, such policies can also be implemented by increasing public investment revenues, creating new industries and jobs, and reducing emissions. Depending on their design, such policies can also generate development benefits by increasing public investment revenues, creating new industries and jobs, promoting low-carbon investments, improving air quality, and enhancing energy security.

In general, there are two specific methods of allocating quotas for a fee: fixed price sales and auctions.

The fixed-price sales method generally involves dividing the pre-sold quotas into a number of equal parts, with prices set at different levels, and the management selling the quotas in order of price from lowest to highest. If there are more bids than quota pre-sales at a given price level, the allocation is made in proportion to the total number of individual bids; if there are fewer bids than quota pre-sales at a given price level, the bids are met first and the remaining quota is allocated to the highest bidders in random order.

Carbon quota auctions are homogeneous auctions where bidders offer to buy allowances at different price tiers and the final transaction price is determined through some mechanism. International carbon market allowance auctions are primarily sourced from sources other than free allowances and are typically used to regulate market prices. Auction mechanisms are designed to maximise efficiency and revenue.

EUETS has tried to put 50% of its allowances up for auction to ensure better carbon pricing, and South Korea has tried auctioning carbon allowances [8].

Most of China's allowances come from the market and trading, with Shenzhen piloting the first attempts at auctions, but there are few such models nationwide. As a developing country, China is still industrialising, urbanising and modernising and therefore, unlike developed countries, still has some way to go before it reaches peak carbon. In 2008, the share of coal and oil in China's primary energy consumption structure was as high as 87.4%, while the average share in the world energy consumption structure was only 64%. This economy, which relies heavily on carbon-based energy sources for its rapid development, has resulted in serious environmental pollution and large amounts of greenhouse gas emissions. At present, China has become the second largest emitter of greenhouse gases in the world. In the context of the global low-carbon revolution, developing countries are not included in the Kyoto Protocol's mandatory emission reduction plan for the time being. After that there may be a change in the international carbon emission reduction system. 25 November 2009 decided to reduce the carbon emission intensity per unit of GDP by 40%~45% in 2020 based on 2005, and include it as a binding indicator in the medium and long-term national economic and social development plan, while establishing a unified statistical, monitoring and assessment system. Many industries in China, such as coal, steel, metals and renewable energy, have great potential to undertake CDM projects. The certified emission reductions generated by CDM projects in China in 2008 alone accounted for 84% of the world's total turnover. Although China's real economy enterprises have created a large amount of emission reductions for the international carbon trading market, they themselves are still at the bottom of the entire carbon trading industry chain. Under the current CDM mechanism, the main certification bodies are from Europe, while domestic financial institutions know little about carbon trading. Since there is no corresponding carbon trading market rules and system, they cannot establish their own financial products and derivative products. In the long run, the issue of carbon emission reduction is a strategic issue to compete for the discourse of the future emerging carbon finance market. We hope that China can improve the system construction and establish a connection with the carbon trading system of EU and Japan to jointly reduce emissions and control global temperature in advance.

6. Conclusion

As carbon trading advances step by step, more issues will emerge, while various mechanisms will continue to improve. In summary, these factors have a great role to play in the rapid formation by China of a well-established carbon trading market. This will also help the development of other carbon trading markets, and the expansion of the range of carbon trading mechanisms applied in China will further rein in carbon emissions. There is a need for a multi-tiered emissions trading system, using a variety of market-based instruments, from central to local levels, and using more flexible carbon pricing to sustain the carbon market. In the future, it will be valuable to study and analyse the role of carbon trading in the process of achieving multi-policy synergy for carbon capping and carbon neutrality, to explore the impact of carbon trading on enterprises' production and operation activities from a micro perspective, and to study the practical development issues such as policy synergy, green paradox, and carbon leakage based on carbon trading policies.

References

[1]. Jiang J. J., Ye B., Ma X. M., (2014) The construction of Shenzhen׳ s carbon emission trading scheme. Energy Policy, 75, 17-21.

[2]. Jiang J., Xie D., Ye B., Shen B., Chen Z., (2016). Research on China’s cap-and-trade carbon emission trading scheme: Overview and outlook. Applied Energy, 178, 902-917.

[3]. Han G., Olsson M., Hallding K., Lunsford D., (2012) China’s carbon emission trading: an overview of current development.

[4]. Guo H., Liu M., Yang M., Zhang S., Zhao X. (2019, August). Investigation and Survey on the Standardization of China’s carbon emission trading market Based on the Government Demand Analysis. In IOP Conference Series: Earth and Environmental Science (Vol. 310, No. 5, p. 052022). IOP Publishing.

[5]. Ren H. X., (2020) A comparative study of domestic and international carbon trading markets. Energy Saving Technology.

[6]. Zhang J. H., Zhi R. P., Qi S. Z. (2019). Coverage and industry selection of China's carbon emissions trading market - A multi-objective optimization-based approach. Journal of China

[7]. New Zealand Emissions Trading Scheme University of Geosciences: Social Science Edition, 19(1), 12. https://environment.govt.nz/what-government-is-doing/areas-of-work/climate-change/ets/

[8]. Santikarn M., Eden A., Li L., Ackva J., Haug C., (2017) Emissions Trading Worldwide: Status Report 2017, ICAP, 8-22.

[9]. Wang P., Dai H. C., Ren S. Y., Zhao D. Q., Masui T., (2015) Achieving Copenhagen target through carbon emission trading: Economic impacts assessment in Guangdong Province of China. Energy, 79, 212-227.

[10]. Hu Y., Ren S., Wang Y., Chen X., (2020) Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Economics, 85, 104590.

Cite this article

Meng,R. (2023). A Comparative Study of Carbon Trading in China and Internationally. Advances in Economics, Management and Political Sciences,5,6-12.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2022 International Conference on Financial Technology and Business Analysis (ICFTBA 2022), Part 1

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Jiang J. J., Ye B., Ma X. M., (2014) The construction of Shenzhen׳ s carbon emission trading scheme. Energy Policy, 75, 17-21.

[2]. Jiang J., Xie D., Ye B., Shen B., Chen Z., (2016). Research on China’s cap-and-trade carbon emission trading scheme: Overview and outlook. Applied Energy, 178, 902-917.

[3]. Han G., Olsson M., Hallding K., Lunsford D., (2012) China’s carbon emission trading: an overview of current development.

[4]. Guo H., Liu M., Yang M., Zhang S., Zhao X. (2019, August). Investigation and Survey on the Standardization of China’s carbon emission trading market Based on the Government Demand Analysis. In IOP Conference Series: Earth and Environmental Science (Vol. 310, No. 5, p. 052022). IOP Publishing.

[5]. Ren H. X., (2020) A comparative study of domestic and international carbon trading markets. Energy Saving Technology.

[6]. Zhang J. H., Zhi R. P., Qi S. Z. (2019). Coverage and industry selection of China's carbon emissions trading market - A multi-objective optimization-based approach. Journal of China

[7]. New Zealand Emissions Trading Scheme University of Geosciences: Social Science Edition, 19(1), 12. https://environment.govt.nz/what-government-is-doing/areas-of-work/climate-change/ets/

[8]. Santikarn M., Eden A., Li L., Ackva J., Haug C., (2017) Emissions Trading Worldwide: Status Report 2017, ICAP, 8-22.

[9]. Wang P., Dai H. C., Ren S. Y., Zhao D. Q., Masui T., (2015) Achieving Copenhagen target through carbon emission trading: Economic impacts assessment in Guangdong Province of China. Energy, 79, 212-227.

[10]. Hu Y., Ren S., Wang Y., Chen X., (2020) Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Economics, 85, 104590.