1. Introduction

The rise of cryptocurrency has undoubtedly received global attention in recent years. Throughout this decade, cryptocurrencies have expanded to become a global concern fueled by the lack of regulation, a non-cooperative environment, and existing anonymity [1]. The tightening of U.S. regulatory enforcement has ushered the industry into a cold winter. There have been many papers introducing the definitions, potential risks, crimes and possible regulations of cryptocurrencies in different countries. However, few of them mentioned Hong Kong regulations. This paper would like to focus on the newly implemented “Guidelines for Operators of Virtual Asset Trading Platforms” in Hong Kong, and discuss a distinct regulatory approach from another perspective. Compared to the measures taken by the U.S. in regulating cryptocurrencies and the flaws exposed, Hong Kong’s measures show the lessons learned and its aim to provide a transparent, fair, and safe market environment for cryptocurrency transactions.

This paper first describes the definition and nature of cryptocurrencies, summarizing differences in definitions worldwide. The features of cryptocurrencies may both benefit and harm the economy in different aspects. Then, through case analysis, this paper explains the regulations in the U.S. and the conflicts presented. Regulatory uncertainty and incongruity of agencies have pushed crypto businesses away from the U.S. to the Asian markets. This paper examines the measures taken by the Hong Kong regulatory departments which many investors favour. The potential flaws, such as loosening of investing conditions, over-flexible regulations are also discussed in this paper.

It is clear that cryptocurrencies have been playing a gradually significant role in the global economy. Thus regulatory landscape should gradually take the form of avoiding a “no man’s land”. The analysis of U.S. and Hong Kong regulatory approach may provide a clearer view of future cryptocurrency regulation. Through examining the Hong Kong regulations, this paper discusses future room for improvement in protecting investors’ assets and data.

2. Definition and Nature of Cryptocurrencies

The definition of cryptocurrencies has been long debated. Although the Securities and Exchange Commission (SEC) considers cryptocurrency as a security, its legal status is still controversial. From a policy perspective, according to the ‘Executive Order on Ensuring Responsible Development of Digital Assets’ released by the U.S. government in March 2022, cryptocurrencies are defined as digital assets [2], which may be a medium of exchange, for which generation or ownership records are supported through a distributed ledger that relies on cryptography. In some circumstances, the Europe Central Bank similarly contends cryptocurrencies as an alternative to currency [3].

While it is common ground that cryptocurrency is a form of payment as currency, the exact attitudes of national laws of major jurisdictions are practically different. The 2016 amendment to the Payment Services Act of Japan states that virtual currencies are proprietary values that may be used to pay an unspecified person consideration for the purchase or leasing of goods or the receipt of the provision of services [4]. The Indonesian legal system qualifies cryptocurrencies as endless non-material commodities that can be used economically and have a fixed value [5]. From an institutional perspective, only the U.S. and Japan recognize cryptocurrencies as a means of payment, most countries consider it a digital commodity. The differences between securities and commodities include institutional protection, capital requirement, investment cycle, and other mechanisms, which are mandatory considering factors for customers.

Speaking of the nature of cryptocurrencies, we start from its most salient idiosyncrasy: decentralization. The main innovation of cryptocurrencies is the use of blockchain, a ledger containing all transactions for every single unit of currency, which employs verification based on cryptographic proof, where various network members verify ‘blocks’ of transactions app every 10 minutes [6]. This ensures a decentralized transaction process and functions all-time globally. In terms of anonymity, there is no physical presence of transactions as it bypasses financial institutions, thus, user identities are encrypted. Cryptocurrency transactions are irreversible as they store and flow through a peer-to-peer computer network without a single user controlling the network. The distinct nature of cryptocurrencies boosts growth in various industries while revealing potential risks when they fall into the wrong hands, such as money laundering and fraudulence.

3. Regulation Approach of the U.S. to Cryptocurrencies

Not only are muddled definitions of cryptocurrencies between boundaries globally, but regulations within a country may also be multifaceted yet confusing. There is no direct Federal regulation of cryptocurrencies under U.S. Law, and the regulation evolved into two levels of approach.

3.1. State Level

The legal approach at state level is not consistent. There are mainly two attitudes towards cryptocurrencies. Some state governments, for example, Wyoming, passed favorable regulations for the innovation and dissemination of cryptocurrencies, exempting them from state securities laws and money transmission laws. Special purpose depository institution are created to offer virtual currency custody services, which increases the liquidity of cryptocurrencies in these states. On the other hand, some state governments prohibit the state and political subdivisions from accepting payment in the form of cryptocurrencies and issued warnings about investing in cryptocurrencies. The New York’s Attorney General proposed a Crypto Regulation, Protection, Transparency and Oversight Act, requiring companies to increase transparency and undergo mandatory measures to restrict the crypto industry further [7].

3.2. Federal Level

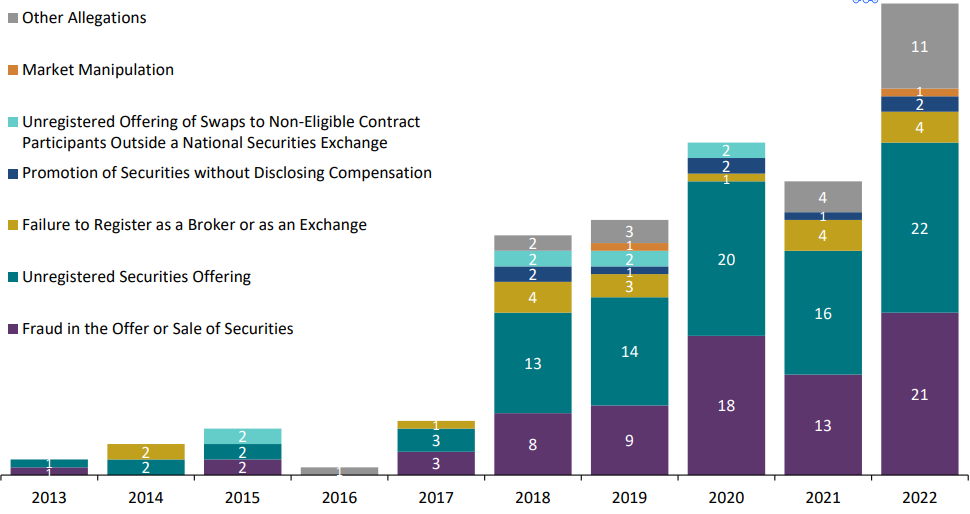

The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are the two main agencies regulating cryptocurrencies in the U.S. In the recent decade, the SEC has significantly tightened its enforcement, increasing scrutiny and aggressively enforcing U.S. securities laws in cases involving digital assets, as shown in Figure 1.

Figure 1: Allegations in SEC Cryptocurrency Enforcement Actions 2013-2022 [8].

The SEC views cryptocurrencies as a security like any other stocks or Exchange Traded Fund (ETF) on a stock exchange. “Security’ includes “an investment contract”, which is an investment of money in a common enterprise with a reasonable expectation of profits deriving from the entrepreneurial or managerial efforts of others. The SEC strongly emphasized the substance of the transaction instead of its form. The Howey Test determines that an offering is an investment contract if there is (i) an investment of money, (ii) in a common enterprise, (iii) with an expectation of profits, (iv) solely from the efforts of others [9]. Initial Coin Offerings (ICOs) that meet the Howey Test are deemed securities, thus obliged to the SEC and subject to regulation. The CFTC takes a more consumer-friendly approach towards cryptocurrencies. The CFTC declares virtual currencies to be a ‘commodity’ subject to oversight under its authority under the Commodity Exchange Act (CEA) and allows cryptocurrency derivatives to be traded publicly. The CFTC believes that the responsible regulatory response to virtual currencies also involves consumer education, asserting legal authority, market intelligence, robust enforcement, and government-wide coordination [10].

4. Flaws of the U.S. Cryptocurrency Regulations

The two mentioned approaches in the U.S. have developed into regulatory uncertainty and lack of transparency, resulting in vulnerable consumer protection. Ambiguous regulations have become a major impediment to the innovation of the industry.

4.1. Unclear Classification Between Securities and Commodities - Ripple Case

In December 2020, the SEC announced that it filed an action in the Southern District Court of New York (SDNY) against Ripple Labs, Inc., alleging that Ripple raised over $1.3 billion by offering the sales of Ripple Credits (XRP) to U.S. investors for capital raising. Ripple is alleged of issuing unregistered securities. However, Ripple asserted that XRP is a cryptocurrency that does not need to be registered as an investment contract. Ripple claimed that it had settled with the U.S. Department of Justice (DOJ) and the U.S. Department of the Treasury, which described XRP as a “convertible virtual currency”, permitting future sales of XRP subject to laws and regulations applicable to Mortgage Backed Securities (MSBs). Though this case is pending, the indeterminacy between securities and commodities in both judicial and business practices is readily seen. Moreover, in a nuanced speech delivered in June 2018, William Hinman, the former SEC Director of Corporate Finance, stated that “a digital token that might initially be sold in a transaction, constituting the sale of a security, might thereafter be sold as a non-security where the facts and circumstances have changed over time, such that the Howey test is no longer met” [11]. This further reflects that securities and commodities may be interchangeable under some circumstances. Whether a virtual currency is a security is still not clearly classified under SEC’s enforcement.

4.2. Overlapping Regulatory Agencies - Coinbase Case

In July 2022, the SEC brought an insider trading charge against a former Coinbase product manager for recklessly delivering false, misleading, and inaccurate reports concerning transactions in 25 digital assets before Coinbase's announcement that they would be listed on the company’s platform. The SEC alleged Coinbase of violating Section 10(b) and Rule 10(b)-5 of the Exchange Act, which indicates that the tokens traded were regarded as securities. However, Coinbase defended that only nine of the assets were securities, while others were not even identified. Chair Gensler even publicly testified to Congress on May 6, 2021 that the SEC does not have authority to regulate crypto exchanges at all [12]. Shortly after SEC’s charge, CFTC Commissioner Caroline Pham publicly criticized that “the SEC complaint alleges that dozens of digital assets, including those that could be described as utility tokens and/or certain tokens relating to decentralized autonomous organizations (DAOs), are securities” [13], and urged the CFTC to take a more proactive role in regulating cryptocurrencies. To the CFTC, if the SEC hadn't stepped in, regulation of the Coinbase case likely would have fallen under the CFTC’s purview [14]. This highlights the tension between the SEC and CFTC regarding who should regulate digital assets and the underlying problems of duplicated regulation.

5. Hong Kong Regulations Towards Cryptocurrencies

Similar to the regulatory logic of the International Organization of Securities Commissions (IOSCO) and the SEC [15], the Hong Kong Securities and Futures Commission (SFC) modifies traditional securities laws to apply on cryptocurrencies. A compulsory licensing system (Virtual Asset Service Provider license) is applied based on “same business, same risks, same rules” principle. The “Guidelines for Operators of Virtual Asset Trading Platforms” was launched on May 23, 2023, regulating securities and non-securities token transactions on crypto asset trading platforms.

5.1. Rigorous Threshold for Obtaining a License

The SFC sets harsh and comprehensive filtering criteria for crypto service providers. Factors such as financial status, solvency, education level, reputation, and financial stability are screened for individuals. Individuals must attend 5 hours of annual mandatory training courses to maintain and enhance personal technical knowledge and professional awareness. Business operations, internal monitoring measures, operational reviews, and other factors are examined for corporations. Under U.S. regulations, only accredited investors may buy “less regulated securities” determined by their company position and total assets. It requires the investors’ risk identification and bearing capacity while the SFC places more restrictions on the service provider. As a result, service providers in Hong Kong are assured to be professionals, and consumers’ rights are well-protected throughout the transaction process.

5.2. Obligations of Platform Operators

The licensed office shall submit a detailed financial declaration form to the SFC within three weeks after the end of each month. Each platform operator must establish a token inclusion and review committee. The committee is responsible for formulating and implementing guidelines and applications for incorporating virtual assets for sale, and ensuring that the decision-making process for including or removing virtual assets is transparent, fair, and well-documented. To assess the suitability of virtual assets for consumers, platform operators are to build appropriate mechanisms that provide reasonable and appropriate advice to consumers. Such a mechanism assures that transaction platforms operate under a sound capital structure. As a result, consumers will be fully informed of the platforms’ status through this transparent framework. To prevent following the tracks of an overturned cart of the Signature Bank case [16], the SFC requires platform operators to fully disclose the nature and potential risks that consumers may bear in buying and selling virtual assets and using their virtual asset trading services. Compensation arrangements, including third-party insurance and trusts, have to be approved by the SFC in advance to address the risks associated with the safekeeping of virtual assets by the consumers’ affiliated entities, such as situations of platform hacking or default by platform operators or their affiliated entities.

5.3. Consumer Protection

As virtual asset trading platforms are allowed to provide services to retail investors, the SFC strongly emphasizes protecting consumers’ privacy and property. The virtual assets and funds of consumers are held on trust by affiliated entities, and they are not allowed to engage in any business involving cryptocurrencies. Double authentication is implemented for consumer account login, and the login password is randomly generated by the system and sent to consumers through communication channels where there is no way for the platform operator to intercept or tamper. This mechanism thoroughly eradicated any possibility that platform operators may manipulate or peculate consumers’ assets. Most of the transfers of cryptocurrencies are irrevocable. Therefore, private key information and the physical key have to be kept in a secure manner. Seeds and private keys must be stored in Hong Kong. Any trading systems used by consumers must be tested and regularly inspected to ensure reliability. Holistic protection is provided to consumers and the assets can be relieved timely.

6. Potential Flaws of Hong Kong’s Regulation

In contrast to the SEC’s tightening execution potency, the attitude of SFC towards cryptocurrencies is apparently milder and more welcoming. The SFC has been taking a gradual and cautious approach towards cryptocurrencies. In view of the Coinbase case and Ripple cases, the SFC adjusts its regulation approach and combines the regulation of securities and non-securities in just one department. However, there are still may be potential flaws.

6.1. Risks of Financial Inclusion Principle

Based on the “financial inclusion” principle and suggestions received from multiple public consultations [17], the SFC has decided to allow retail investors to participate in the trading of cryptocurrencies and no longer restrict to “professional investors”. Before setting up an account for a consumer, the service provider has to evaluate the consumer’s knowledge of the virtual asset. If one has no relevant knowledge, only when the service provider has provided sufficient training an account may be opened for the consumer. Inexplicably, the definition of relevant knowledge is only limited to current or previous working experience or trading experience in relevant virtual asset aspects. Some consumers may have only meager knowledge and few trading experiences, but they meet the requirements of the SFC. Thus, they are exposed to much greater risk to be misguided, manipulated, fraudulent, and other illegal activities while undergoing transactions [18]. Although loosening consumer restrictions may enable more market participants, it is adverse to protecting consumers’ property.

6.2. Operating Rules Are Self-determined

The “Guidelines for Operators of Virtual Asset Trading Platforms” require service providers to have comprehensive trading and operational rules to regulate the operation of their platform for both on and off platform transactions. The platform determines the minimum and maximum quantity limits and transaction verification procedures for each relevant currency or virtual asset transaction instruction. Only a few compulsory requirements must be approved by the SFC. As investors are eased to individual investors, even when the risks of transactions are fully disclosed, the underlying risks and losses of the transaction may not be visible and controllable by the trading platform and investors. Too much flexibility is given to service providers, which may result in a chaotic market order and detrimental loss in cryptocurrency transactions of investors.

6.3. Decentralized Trading Platforms are Not Regulated

The “Guidelines for Operators of Virtual Asset Trading Platforms” require all Hong Kong licensed trading platforms to be centralized finance (CEX), whose asset storage and trading operations are entirely based on the establishment of centralized institutions for exchanges. Any decentralized finance (DEX) has to end their business within a limited period. However, most virtual asset trading platforms accessible to the public currently are not under the SFC’s regulation [18]. This new regulation may push decentralized trading platforms to transfer their business to other more loosely regulated markets and result in difficulties in relieving and supervising existing virtual assets. To address the above problems, the SFC should promulgate more specific guidelines on transaction procedures to provide more safeguards to consumers. While banning DEX from operating in Hong Kong, the SFC has to consider the transition period and ensure the current consumers’ assets are still under the SFC’s monitor.

7. Conclusion

This paper highlights different definitions of cryptocurrencies from different perspectives by different organizations worldwide. The nature of cryptocurrencies and the difference in regulatory approach of each country inevitably lead to the regulatory debate and potential crimes. The regulatory approach of the U.S. and existing problems demonstrate that even in one sovereignty, there are inconsistencies and overlaps of regulatory authorities. Heeding the U.S. example, the SFC of Hong Kong has been taking a new approach towards the regulation of cryptocurrencies. Potential problems are summarized, and further discussions can be continued on the topics mentioned.

References

[1]. De-Yolande, M.H Virtual Currency Societal Impact Today: Mitigate the Risks through Regulatory Framework [J]. Beijing Law Review, 2022: 771-784.

[2]. Executive Order on Ensuring Responsible Development of Digital Assets, 2022. https://www.whitehouse.gov/briefing-room/presidential-actions/2022/03/09/executive-order-on-ensuring-responsible-development-of-digital-assets/

[3]. European Central Bank. Virtual currency schemes - a further analysis [M]. European Central Bank, 2015, 6-8.

[4]. Ishikawa,Mai.Designing Virtual Currency Regulation in Japan: Lessons from the Mt Gox Case[J]. Journal of Financial Regulation,2017:125-131.

[5]. Sholihah R P , Afriansyah A .Regulation of Crypto Currency in World Trade Organization[C]. International Conference on Law and Governance, 2020:39-43.

[6]. Peters, Gareth , E. Panayi , and A. Chapelle. "Trends in Crypto-Currencies and Blockchain Technologies: A Monetary Theory and Regulation Perspective” [J]. Social Science Electronic Publishing, vol.3, 2015:92-113.

[7]. New cryptocurrency bill targets crypto crime and ‘rampant fraud’ across U.S., 2023. https://www.reuters.com/technology/us-congressional-committee-set-weigh-crypto-bills-2023-07-26/

[8]. SEC Cryptocurrency Enforcement, 2022. https://seclaw.com/sec-tightens-cryptocurrency-enforcement

[9]. Laura Gritz, Teaching a New Dog Old Tricks: Why the Howey Test is Still the SEC’s Best Friend When Examining Initial Coin Offerings, 2018, 194-219.

[10]. How are Cryptocurrencies regulated in the U.S. and the EU? 2023. https://www.dowjones.com/professional/risk/glossary/cryptocurrency/us-eu-regulation/

[11]. Jeff John Robert, Jeff Benson. Ripple Can Depose SEC Official Who Ruled Ethereum Isn’t a Security: Judge [N]. DECRYPT, 2021.

[12]. Andrew M. Hinkes , Clifford C. Histed , Judith E. Rinearson , Eden L. Rohrer , Maxwell J. Black of K&L Gates. Crypto experts react to SEC Coinbase, Binance Enforcement Actions [C]. The National Law Review, 2023.

[13]. Statement of Commissioner Caroline D. Pham on SEC v. Wahi, 2022. https://www.cftc.gov/PressRoom/SpeechesTestimony/phamstatement072122

[14]. Aislinn Keely. CFTC commissioners speak up after SEC files crypto insider trading case [N]. The Block, 2022,

[15]. Chen Gengzhao. Research on the Regulatory Policy of Hong Kong Virtual Asset Trading Platform [J]. Economic and Trade Law Review,2020(06):110-128

[16]. Wang Fangran. Signature Bank Flash Crash: It's All About Cryptocurrencies [C]. China Business News, 2023, A03, 2-4.

[17]. Fintech Association of Hong Kong. Response to the Public Consultation on Legislative Proposals to Enhance Anti-money Laudering and Counter-Terrorist Financing Regulation in Hong Kong [M]. Fintech Association of Hong Kong 2021,

[18]. Hou Jiening, Mao Yirong. The Hong Kong Securities and Futures Commission: The new regulations on the regulation of virtual asset trading platforms will take effect from June 1st [N]. Securities Daily, 2023

Cite this article

Dong,H. (2024). Analysis of U.S. and Hong Kong Cryptocurrency Regulation Approach. Advances in Economics, Management and Political Sciences,67,37-43.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. De-Yolande, M.H Virtual Currency Societal Impact Today: Mitigate the Risks through Regulatory Framework [J]. Beijing Law Review, 2022: 771-784.

[2]. Executive Order on Ensuring Responsible Development of Digital Assets, 2022. https://www.whitehouse.gov/briefing-room/presidential-actions/2022/03/09/executive-order-on-ensuring-responsible-development-of-digital-assets/

[3]. European Central Bank. Virtual currency schemes - a further analysis [M]. European Central Bank, 2015, 6-8.

[4]. Ishikawa,Mai.Designing Virtual Currency Regulation in Japan: Lessons from the Mt Gox Case[J]. Journal of Financial Regulation,2017:125-131.

[5]. Sholihah R P , Afriansyah A .Regulation of Crypto Currency in World Trade Organization[C]. International Conference on Law and Governance, 2020:39-43.

[6]. Peters, Gareth , E. Panayi , and A. Chapelle. "Trends in Crypto-Currencies and Blockchain Technologies: A Monetary Theory and Regulation Perspective” [J]. Social Science Electronic Publishing, vol.3, 2015:92-113.

[7]. New cryptocurrency bill targets crypto crime and ‘rampant fraud’ across U.S., 2023. https://www.reuters.com/technology/us-congressional-committee-set-weigh-crypto-bills-2023-07-26/

[8]. SEC Cryptocurrency Enforcement, 2022. https://seclaw.com/sec-tightens-cryptocurrency-enforcement

[9]. Laura Gritz, Teaching a New Dog Old Tricks: Why the Howey Test is Still the SEC’s Best Friend When Examining Initial Coin Offerings, 2018, 194-219.

[10]. How are Cryptocurrencies regulated in the U.S. and the EU? 2023. https://www.dowjones.com/professional/risk/glossary/cryptocurrency/us-eu-regulation/

[11]. Jeff John Robert, Jeff Benson. Ripple Can Depose SEC Official Who Ruled Ethereum Isn’t a Security: Judge [N]. DECRYPT, 2021.

[12]. Andrew M. Hinkes , Clifford C. Histed , Judith E. Rinearson , Eden L. Rohrer , Maxwell J. Black of K&L Gates. Crypto experts react to SEC Coinbase, Binance Enforcement Actions [C]. The National Law Review, 2023.

[13]. Statement of Commissioner Caroline D. Pham on SEC v. Wahi, 2022. https://www.cftc.gov/PressRoom/SpeechesTestimony/phamstatement072122

[14]. Aislinn Keely. CFTC commissioners speak up after SEC files crypto insider trading case [N]. The Block, 2022,

[15]. Chen Gengzhao. Research on the Regulatory Policy of Hong Kong Virtual Asset Trading Platform [J]. Economic and Trade Law Review,2020(06):110-128

[16]. Wang Fangran. Signature Bank Flash Crash: It's All About Cryptocurrencies [C]. China Business News, 2023, A03, 2-4.

[17]. Fintech Association of Hong Kong. Response to the Public Consultation on Legislative Proposals to Enhance Anti-money Laudering and Counter-Terrorist Financing Regulation in Hong Kong [M]. Fintech Association of Hong Kong 2021,

[18]. Hou Jiening, Mao Yirong. The Hong Kong Securities and Futures Commission: The new regulations on the regulation of virtual asset trading platforms will take effect from June 1st [N]. Securities Daily, 2023