1. Introduction

It appears that as long as the wage in the free-market is unrestricted, the economy would experience a resurgence of energy and impetus. There is little doubt regarding the question of whether the positive aspects of the market are exaggerated, or if its negative consequences are overshadowed by its rapid expansion.

This paper acknowledges the market's efficacy in enhancing individual morality in the context of wealth generation, social resource distribution, and free competition. This study aims to examine the adverse repercussions of free market activities, including the threat to competition posed by monopolies, the violation of worker rights in the relentless pursuit of individual profits, and the unequal distribution of wealth. The inherent limitations of the free market prevent it from effectively addressing these flaws. Hence, the objective of this study is to illustrate potential governmental interventions that can address the limitations inherent in the free market system. Within the realm of law and economics, scientists have been advocating for alternative methodologies to address legal, regulatory, and economic matters, diverging from the conventional neoclassical economic framework. Discussions have arisen on the regulations governing competition, legal matters pertaining to labor employment, and the establishment of an efficient yet potentially inequitable working environment, among other topics.

This article is dedicated to examining the imperative nature of government law. Institutional economics has elucidated the significance of institutions in shaping economic behaviors.In this study, we aim to investigate the effects of a specific intervention on the cognitive development This paper argues that it is the responsibility of the government to design and optimize rules and laws that regulate the activities of market participants and ensure the consistent and effective functioning of the free market. One aspect to consider is that it is important for the government to exercise control over market power in order to uphold the principles of free competition. Furthermore, it is imperative for the executive and legislative branches to acknowledge the advocacy for labor rights within cost-saving market operations and the resulting unequal distribution of income, as these factors contribute to societal dissatisfaction and discontent.

The resounding prominence of the free market has overshadowed the pleas and investigations advocating for equitable government action. This study aims to demonstrate the imperative nature of government regulation in the free market and examine potential institutional enhancements.

2. Analysis of the free market

2.1. Merits of free market

From the advent of classical economics by Adam Smith during the 18th century to the prevalence of Neoclassical economics in the latter half of the 20th century, the concept of the free market has consistently garnered acclaim for its beneficial contribution to the efficient allocation of resources and the maximization of production efficiency via the mechanism of perfect competition. Neoclassical economics adheres to the fundamental principle of the rational individual, who is inclined to engage in actions that maximize their self-interest. In theory, those engaged in market activities who are motivated by financial gains would be inclined to minimize resource inefficiency and mitigate economic losses. Hence, market participants actively modify their production levels in response to the interplay between supply and demand in order to attain a state of market equilibrium, when consumption matches production outputs [1].

The free market is characterized by the freedom of enterprises to participate in the market, engage in production of products and services, and determine pricing based on the interplay of supply and demand. The allocation of resources in a free market is efficient as it effectively matches supply with demand. In contrast, administrative instructions tend to be inefficient and slow in adapting to the changing dynamics of the market. One of the fundamental principles underlying the sustainability of a free market system is the existence of "reasonably enforceable private rights" [2]. The free market operates in a state of equilibrium, when the supply of goods and services aligns with consumer demand, since individuals are motivated by their personal interests and the desire for private ownership.

In addition to its flexibility to adapt to changes in supply and demand, the free market is characterized by a high degree of competition, which encourages companies to continuously improve their technology, reduce costs, and enhance price competitiveness. The competitive environment compels corporate enterprises to prioritize the welfare of their customers over their own self-interests. According to scholarly study, perfect competition not only fosters incentives for the adoption of efficient manufacturing procedures, but also promotes the development of superior products and encourages investment in research and development [3]. Adequate free competition confers benefits upon consumers through the provision of improved options, products of superior quality, and pricing that are subject to competition. Organizations are driven by the incentive to maintain customer satisfaction in order to secure client loyalty and continued patronage.

In the context of the free market, heightened rivalry serves as a catalyst for the advancement of economic efficiency through its ability to stimulate consumption, investment, and output. The competitive free market is often regarded as a dynamic and resilient setting that fosters innovation among various stakeholders, enabling them to challenge and transform established and outdated business practices across multiple domains, including marketing strategies, production methods, and product offerings, among others. Throughout history, from the era of the industrial revolution to the advent of the internet, the phenomenon of free competition has served as a driving force behind significant advancements in economic efficiency [4].

The free market is characterized by two significant advantages, namely the flexibility in resource allocation and the presence of open competition. These factors play a crucial role in expediting the process of wealth generation. The governmental entities that prioritize the enhancement of national wealth and the improvement of public living standards should not underestimate the influence of the market. Market liberalization has emerged as a crucial framework, gaining prominence on both a global and national scale over the latter part of the 20th century. This development is closely linked to the widespread adoption of Neoclassical economics theories.

China serves as a notable example that illustrates how a nation can derive substantial economic gains through the implementation of a free market system, resulting in remarkable accumulation of wealth. China has actively engaged with the global market with the implementation of its policies of openness and reform in the 1970s. The free market's openness not only attracts foreign capital investments, but also fosters domestic innovation and enhances economic vitality. The market facilitates the allocation of resources and promotes free competition, which in turn stimulates economic progress. Chia's membership in the World Trade Organization (WTO) throughout the 2000s has significantly integrated the country into the global economy as a mass producer of low-cost, low-tech commodities for export. The combination of domestic market liberalization and international trade has facilitated China's ability to amass significant wealth, providing a foundation for rapid industrialization and development within a relatively little timeframe.

2.2. Demerits of free market

The efficacy of the free market and free trade within a growing economy has been consistently demonstrated throughout historical records. Nevertheless, the prevalence of market dysfunction is not an uncommon occurrence. The unregulated pursuit of individual financial gains can lead to harmful corporate practices that pose a threat to society. Capital owners in the free market exploit labor providers to an extent that jeopardizes human health and safety, despite the potential for higher returns and reduced costs. This is concerning as advancements in productivity and the economy should ideally lead to improvements in the well-being and protection of individuals. The decline of functional markets not only hinders long-term economic development, but also undermines the significance of economic progress in promoting the well-being of all individuals in society. This section of the article will primarily focus on two prominent market failures and elucidate the imperative and justified role of administrative interventions as a corrective measure for dysfunctional markets.

The existing market regulations are insufficient in maintaining a competitive environment, instead favoring the growth of monopolies, which subsequently diminishes consumer surplus. While the idea of perfect competition highlights the numerous advantages that arise from market rivalry, it is important to acknowledge that this theory relies on certain assumptions that often diverge from the complexities of real-world scenarios. The notion of perfect competition is founded on key principles, including the absence of market entrance and exit obstacles, as well as the availability of complete and accurate information to both consumers and sellers, specifically pertaining to prices [5].

Contrary to popular belief, reality frequently presents a contrasting perspective. The victor of the competition would inherently utilize the excess capital and other prevailing resources to procure or eliminate less competitive participants. The acquisition of additional resources by players and the establishment of capitals can potentially create barriers for new participants. Industries that necessitate substantial initial investments can impede sufficient competition, as new entrants may lack the necessary resources to compete on an equal footing. When market shares become concentrated among the most dominant firms who possess the ability to influence prices without facing significant external challenges, a monopoly emerges and market competition diminishes, resulting in a decline in the benefits often associated with competition [6].

Consumer surplus is a result of effective competition, when suppliers choose the most optimal prices through market competition. Business enterprises participate in price-based rivalry as a means to recruit and keep customers, whereas monopolistic entities hinder the occurrence of such competition. The absence of price competition might result in increased costs for consumers. Hence, the presence of monopolies would result in a decrease in consumer surplus due to the restriction of customer options and the imposition of elevated prices.

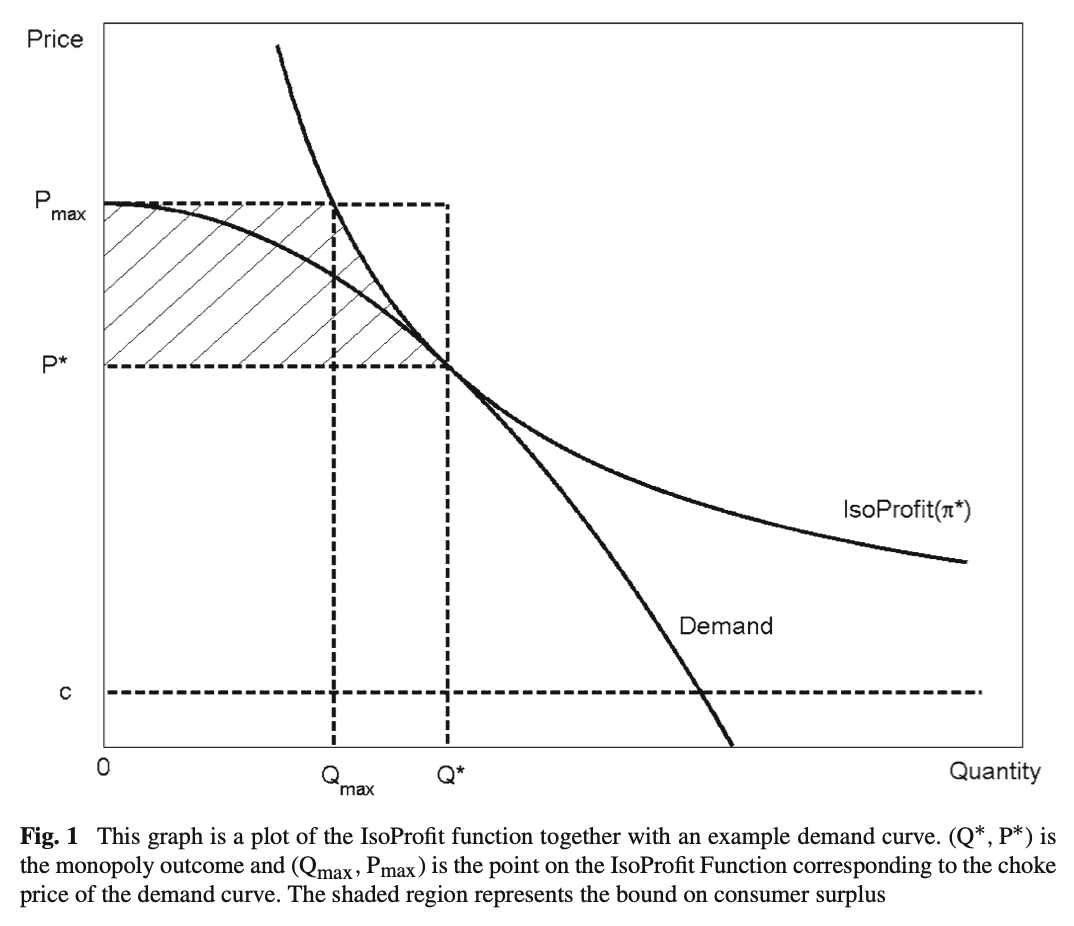

Figure 1: Bounding consumer surplus by monopoly profits

Figure 1 depicts the graphical representation of the IsoProfit function in conjunction with an illustrative demand curve. The outcome (Q*, P*) represents the monopolistic equilibrium, while (Qmax, Pmax) denotes the specific point on the IsoProfit Function that aligns with the choke price of the demand curve. The region that is shaded in the diagram shows the upper limit or constraint on consumer excess [7].

As depicted in Figure 1, the market equilibrium is represented by the intersection point of the Demand curve and the IsoProfit curve, resulting in the optimal price and quantity denoted as P* and Q* respectively. The consumer surplus can be calculated as the difference between the maximum price (P max) and the equilibrium price (P*), multiplied by the equilibrium quantity (Q*), representing the area. Monopolistic entities that hold market dominance tend to set prices beyond the equilibrium price (P*) without facing competitive pressures. Consequently, this practice results in a decrease in consumer surplus, sometimes referred to as deadweight loss. Put simply, if a monopoly has the ability to set higher prices, the difference between the demand curve and the monopoly's output level would be smaller than the output level at the point of P* and Q*.

3. Governmental and Legal Intervention to the Free Market System

The previous section has established the plausible factors that contribute to the existence of a monopoly, such as the undermining of fair competition and the reduction of consumer surplus. The free market, paradoxically, is inadequate in ensuring the preservation of free competition and necessitates government regulation to prevent excessive concentration of market power among private businesses. The government, operating within the framework of the social contract, assumes the responsibility of maintaining social stability and ensuring the provision of public goods. In order to achieve these objectives, it is imperative for the government to enact regulations that effectively curb monopolistic market power. Various governments across the globe have implemented a range of legal measures aimed at addressing the monopolistic behaviors that stifle market competition.

The Sherman Act, which may be traced back to 1890, was enacted by the United States Congress as the initial antitrust statute. Following the events of 1914, the Federal Trade Commission (FTC) was established as a result of the enactment of the Federal Trade Commission Act, which introduced supplementary antitrust legislation [8]. The regulatory authority responsible for enforcing rules pertaining to unfair mergers and acquisitions, which have the potential to excessively expand a company's market position, is the Federal Trade Commission [9]. The application of the Sherman Act in the United States v. Standard Oil case exemplifies the utilization of trademark regulations by the Supreme Court to restrict the dominant oil corporation of that era. The Standard Oil Company, established in 1870, had achieved a dominant position in the production, transportation, refining, and distribution of petroleum inside the United States by 1882, controlling approximately ninety percent of the market [9]. According to the court's ruling, the corporation was held accountable for engaging in anti-competitive practices through its ongoing acquisition of efficient resources, its ownership of national transportation infrastructure, and its strategic division of the country into distinct regions, which were then brought under its control through subsidiary companies [10]. Despite the passage of centuries, history exhibits a tendency to repeat itself. In the present day, the Federal Trade Commission (FTC), in conjunction with the Department of Justice, is fervently dedicated to addressing the collaborations among major technology companies that impede market competition [10]. The recently formulated merger standards pertaining to mergers and acquisitions have been drafted.

The free market fosters economic development by incentivizing private profits, which serve as the primary catalyst for efficiency improvements, inventions, and other related outcomes. Nevertheless, the endeavor to maximize individual financial gains can have both positive and negative consequences, potentially leading to unethical and illicit economic practices that violate the rights of workers.

There are two primary strategies for maximizing personal profits: enhancing pricing strategies and managing costs effectively. The management of costs, often known as cost control, involves the regulation of input prices and the enhancement of input utility. One input that distinguishes itself from other raw material inputs is labor. The achievement of cost control optimization may result in the private owner's success at the detriment of workforce exploitation.

Taking the global Internet economy as an illustrative case, Uber, Didi, and Meituan are prominent entities within the Internet economy, operating as significant participants in the commerce and service sectors. These companies function as Internet platforms designed to streamline transactions [11]. Food delivery riders and taxi drivers register for a working account on virtual platforms in order to be allocated with orders. The Internet Economy has been recognized as a substantial contributor to economic growth, as it has effectively utilized data-driven algorithms to absorb a considerable portion of the labor force [12]. Nevertheless, beneath the facade of the prosperous internet industry lies the arduous endeavor of platform operations. The livelihoods, wellbeing, and reproduction of platform workers are intricately linked to the collection and manipulation of data, which serves the purpose of facilitating the expansion of digital platforms. This parallel may be drawn to the situation of factory workers who find themselves enmeshed in the processes of industrialization [13]. Shareholders often seek the use of optimal algorithms in order to get a highly desirable growth rate, hence attracting increased investments from zealous stakeholders and enhancing market value assessments. Following multiple rounds of fundraising, organizations have the opportunity to undergo an initial public offering (IPO), enabling capital investors to obtain favorable returns on their investments. The aforementioned argument follows a coherent logical sequence, wherein the wellbeing of the working community, which serves as a fundamental pillar of contemporary society, is disregarded.

The malfunction in wealth distribution within the free market serves as an additional rationale for government intervention in order to regulate market activities. The free market operates under the premise of a rational individual who seeks to maximize profits. The pursuit of personal prosperity, as well as other forms of entertainment and the validation of one's ego, have historically served as catalysts for societal advancement. Motivated by the pursuit of financial gain, individuals engage in the endeavor of seeking innovations that enhance production efficiency, driven by the belief that their diligent efforts would yield future benefits. Technological developments have played a pivotal role in shaping our contemporary society, facilitating significant improvements in productivity across several domains. This transformative process can be traced back to historical milestones such as the transition from manual weaving to the utilization of steam engines, the adoption of oil energy applications, the advent of electric power, the rise of mass manufacturing, and the subsequent digital and Internet revolution. These advancements have collectively contributed to the creation of the society in which we currently reside.

The issue at hand pertains to the unequal distribution of the final outcome between capital holders and labor providers, despite the fact that production necessitates the simultaneous utilization of both capital and labor as essential components. There is a consensus among scholars that the free-market system does not ensure an equitable distribution of the benefits derived by collective endeavors [14]. The advent of technology advancements, particularly the digital revolution, has predominantly favored capital owners and highly educated individuals in positions of authority. Innovations have the potential to impact the labor requirements for employees with lower skill levels, resulting in increased unemployment rates and exacerbating income inequality [15]. In the context of technical advancements, the emergence of private entrepreneurs has provided an opportunity for business owners to amass greater financial gains [16]. Technological advancements have posed a threat to employment opportunities at lower hierarchical levels, hence potentially undermining the economic stability of numerous families. The erosion of a significant number of employment prospects elicits frustration among a considerable portion of the populace and weakens the stability of the social fabric.

The rationale behind government regulation in the context of the free market pertains to addressing issues such as unemployment and the expanding wealth gap. These phenomena serve as disruptive indicators that can potentially disrupt the business cycle over an extended period of time. The most commonly employed measures for achieving income redistribution include progressive taxes on income, wealth, and inheritance, as well as the implementation of social security programs and the provision of public services such as healthcare, education, and potentially affordable housing [17]. Through the implementation of legislation and the enforcement of effective rules, it is imperative for the government to take measures to prevent the profit-driven mindset inherent in the free market system from undermining fundamental labor rights and human morals. Moreover, it is imperative that there exists a legal authority to facilitate the equitable redistribution of wealth, so guaranteeing that the economic benefits derived from the unrestricted market are accessible to all citizens, irrespective of their social class, ethnic background, or degree of education.

4. Conclusion

The neoclassical economic theory espouses the principles of free trade and free markets, asserting that these mechanisms can significantly enhance economic growth for nations by promoting economic innovations and efficiency. The previous century seen the implementation of neoclassical economic ideas and the subsequent liberalization of markets. This included the improvement of market freedom at the national level and the establishment of a globalized market with decreased tariffs, facilitating the flow of commodities. Market freedom has a crucial role in driving the growth of rising economies such as China, since it significantly enhances the efficient utilization of resources and fosters a vibrant corporate environment.

It is subjective to say that the free market supports economic progress and allows people to benefit from economics. Instead, the free-market system may be stagnant and need major revisions. Neoclassical economic theory ignores free market limits. Significant loopholes in the free market promote industry concentration and distributive fairness. The New Institutional Economics theory emphasizes institutions' influence on market participation and economic success. The legal system's impact on economic agents and macro business transaction dynamics is fundamental to modern institutional economics. The government should use its administrative and legislative power to build institutions to maintain market stability and maximize national development. The government should comprehensively address the monopolistic market structure that hinders competition. Another view is that the government must intervene in market participants' predisposition to favor personal gains, which may violate workers' rights. Anti-trust laws should limit market monopolies to protect consumers and economic efficiency. Government labor welfare measures like minimum pay guarantees can boost productivity and technology. In contrast, the traditional approach claims labor welfare binds businesses.

References

[1]. Douglass C. North. Institutions, Institutional Change And Economic Performance, Cambridge University Press, 1990: 3-5.

[2]. ten Kate, A., Sr., On Free Markets, Their Benefits and Shortcomings, and How Competition Policy Operates in Such Markets. Criterion Journal on Innovation, 2016: 381-383.

[3]. John N. Drobak. Rethinking Market Regulation., Oxford University Press, 2021:15, 16-17

[4]. Beard, T., & Stern, M. Bounding consumer surplus by monopoly profits. Journal of Regulatory Economics, 2008: 86–94.

[5]. Raymond, R. L. Standard oil and tobacco cases. Harvard Law Review, 2020, 1911-1912:33.

[6]. The Antitrust Laws, 2023. https://www.ftc.gov/advice-guidance/competition-guidance/guide-antitrust-laws/antitrust-laws

[7]. FTC and DOJ Seek Comment on Draft Merger Guidelines, 2023. https://www.ftc.gov/news-events/news/press-releases/2023/07/ftc-doj-seek-comment-draft-merger-guidelines

[8]. Julie Yujie Chen, Platform Economies: The Boss’s Old and New Clothes, Australian National University Press, 201: 122-123.

[9]. ten Kate, A., Sr. On Free Markets, Their Benefits and Shortcomings, and How Competition Policy Operates in Such Markets. Criterion Journal on Innovation, 2016: 390.

[10]. Sun, Yichen. "The Effect of Changes in Labor Demand and Entrepreneurship on Income Inequality through Innovation." The Journal of Applied Business and Economics, 2022: 97-103.

[11]. Sun, Yichen. "The Effect of Changes in Labor Demand and Entrepreneurship on Income Inequality through Innovation." The Journal of Applied Business and Economics, 2022: 97-103.

[12]. ten Kate, A., Sr. On Free Markets, Their Benefits and Shortcomings, and How Competition Policy Operates in Such Markets. Criterion Journal on Innovation, 2016: 399.

[13]. ten Kate, A., Sr. On Free Markets, Their Benefits and Shortcomings, and How Competition Policy Operates in Such Markets. Criterion Journal on Innovation, 2016: 390-393.

[14]. Margaret Oppenheimer and Nicholas Mercuro. Law and Economics: Alternative Economic Approaches to Legal and Regulatory Issues. M.E.Sharpe, 2005: 3-4.

[15]. Claude Menard. Law and Economics: Alternative Economic Approaches to Legal and Regulatory Issues. M.E.Sharpe, 2005: 27.

[16]. Kenneth G. Dau-Schmidt. Law and Economics: Alternative Economic Approaches to Legal and Regulatory Issues. M.E.Sharpe, 2005: 83-85.

[17]. Morris Altman. Law and Economics: Alternative Economic Approaches to Legal and Regulatory Issues. M.E.Sharpe, 2005: 280.

Cite this article

Mao,J. (2024). The Plausibility Check of Governmental and Legal Intervention to the Free Market System. Advances in Economics, Management and Political Sciences,69,213-219.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Douglass C. North. Institutions, Institutional Change And Economic Performance, Cambridge University Press, 1990: 3-5.

[2]. ten Kate, A., Sr., On Free Markets, Their Benefits and Shortcomings, and How Competition Policy Operates in Such Markets. Criterion Journal on Innovation, 2016: 381-383.

[3]. John N. Drobak. Rethinking Market Regulation., Oxford University Press, 2021:15, 16-17

[4]. Beard, T., & Stern, M. Bounding consumer surplus by monopoly profits. Journal of Regulatory Economics, 2008: 86–94.

[5]. Raymond, R. L. Standard oil and tobacco cases. Harvard Law Review, 2020, 1911-1912:33.

[6]. The Antitrust Laws, 2023. https://www.ftc.gov/advice-guidance/competition-guidance/guide-antitrust-laws/antitrust-laws

[7]. FTC and DOJ Seek Comment on Draft Merger Guidelines, 2023. https://www.ftc.gov/news-events/news/press-releases/2023/07/ftc-doj-seek-comment-draft-merger-guidelines

[8]. Julie Yujie Chen, Platform Economies: The Boss’s Old and New Clothes, Australian National University Press, 201: 122-123.

[9]. ten Kate, A., Sr. On Free Markets, Their Benefits and Shortcomings, and How Competition Policy Operates in Such Markets. Criterion Journal on Innovation, 2016: 390.

[10]. Sun, Yichen. "The Effect of Changes in Labor Demand and Entrepreneurship on Income Inequality through Innovation." The Journal of Applied Business and Economics, 2022: 97-103.

[11]. Sun, Yichen. "The Effect of Changes in Labor Demand and Entrepreneurship on Income Inequality through Innovation." The Journal of Applied Business and Economics, 2022: 97-103.

[12]. ten Kate, A., Sr. On Free Markets, Their Benefits and Shortcomings, and How Competition Policy Operates in Such Markets. Criterion Journal on Innovation, 2016: 399.

[13]. ten Kate, A., Sr. On Free Markets, Their Benefits and Shortcomings, and How Competition Policy Operates in Such Markets. Criterion Journal on Innovation, 2016: 390-393.

[14]. Margaret Oppenheimer and Nicholas Mercuro. Law and Economics: Alternative Economic Approaches to Legal and Regulatory Issues. M.E.Sharpe, 2005: 3-4.

[15]. Claude Menard. Law and Economics: Alternative Economic Approaches to Legal and Regulatory Issues. M.E.Sharpe, 2005: 27.

[16]. Kenneth G. Dau-Schmidt. Law and Economics: Alternative Economic Approaches to Legal and Regulatory Issues. M.E.Sharpe, 2005: 83-85.

[17]. Morris Altman. Law and Economics: Alternative Economic Approaches to Legal and Regulatory Issues. M.E.Sharpe, 2005: 280.