1. Introduction

As China's investments in Africa continue to increase, coupled with the public's often ingrained perception of Africa as impoverished, there is a growing sentiment within China that views direct investments in Africa as acts of charity, or that China is engaging in altruistic but self-detrimental activities. Besides, there are opinions that claims that China's direct investment in Africa is a form of neocolonialism [1]. Nevertheless, this article does not agree with these viewpoints, which pursue short-term gains while neglecting long-term benefits and the possible win-win scenarios. Instead, the article argues that China's investments in Africa have the following characteristics: They are based on raising the modernization levels of African countries, thereby pursuing long-term returns. Also, China's investments in Africa are led by national initiatives. Besides, these investments also promote economic development within China.

Based on these characteristics, I believe that the reason why Chinese FDI is increasingly strong is that China's direct investment in Africa represents a historical opportunity to develop for both China and Africa.

2. Literature Review

China's type of foreign direct investment capital is distinct from "mobile capital" as it represents a form of "patient capital." This type of capital is willing to accept high-risk investments and is supported by the Chinese government through both explicit and implicit subsidies. Additionally, Chinese "patient capital" also encompasses "long-term" endowments [2].

Considering these characteristics of China's foreign direct investment, rather than seeking short-term gains from its investments in Africa, China prefers to act as a "venture investor." This means focusing on early-stage investment and the development of the industrial base to pursue the possibility of the potential for profits being realized in the future, or in other words, China's patient capital is characterized by investing in "relationships". Investors voluntarily inject funds into recipient countries or partners, prioritizing long-term returns that come as the borrower or investment project grows or expands, over short-term gains.

From another perspective, which this article mainly argues about: as a "new historical opportunity", China's patient capital can be understood as a "new type of rising power." Just like the "One Belt, One Road" initiative, instead of using investments or initiatives as tools or weapons for traditional geopolitical confrontations, China is more inclined to use these methods to complement existing international and regional institutions [3].

In general, compared with Western countries, China places much more emphasis on the profits brought by the development of African countries, rather than viewing them merely as sources of raw materials. So, for China, it will use the “power to withdraw” very carefully, thus enhance the host countries’ capability to draw resources. Then, on the base of these countries’ development, China can gain a lot through these projects with stability. It should be notice that the opinion that claims that China is create a new trap of debt created by western media has misunderstood the Chinese FDI, mainly because that China provides a substantial way for these countries to pay for the investment, China “help” them, instead of “robbing” them. Or in other words, China help African countries to establish the market and benefit by sharing the interest created by the market.

3. The Historical Evolution of China's FDI in Africa

China’s FDI in Africa has been formed for a long time. In my view, the process can be split into two stages, and both has their own characteristics.

3.1. The First Stage

The large-scale China’s FDI in Africa has begun in around 1990s, and almost all the pioneers are state-owned enterprises (SOEs). As the basic power who trying to explore a blue ocean market, the task or the target for them is focused on the resource development and infrastructure building. Large state-owned enterprises such as China National Petroleum Corporation (CNPC) and China State Construction Engineering Corporation (CSCEC) began large-scale investment and construction projects in Africa as early as the early 2000s. In addition, state-owned financial institutions such as the Export-Import Bank of China and the China Development Bank have provided substantial financial support for these investments.

With the strong back up of the Chinese government, the SOEs indeed make differences in African countries. For example, in 1996, when Western oil companies withdrew from Sudan due to the harsh natural environment and war, China National Petroleum Corporation (CNPC) entered Sudan with its own capital and technology, at the invitation of the Sudanese government. In a decade, with the help of China, Sudan established a complete set of oil exploration, drilling, crude oil extraction, processing and petrochemical product production, with advanced technology and matching scale. Driven by the rapid development of the oil industry, Sudan's transportation, manufacturing and construction industries have made great progress. Sudan has grown from a poor country with almost no modern industry to a developing country with rapid industrial development. At present, from the perspective of the oil industry alone, Sudan produces aviation kerosene, gasoline and diesel not only to meet its own needs, but also to export part of it. Driven by the oil industry, Sudan's national economy has developed at an average annual growth rate of 8, 000 in recent years, ranking 1st among the six North African countries [4].

The action taken by the CNPC is representing the Chinese SOEs’ action in Africa: these enterprises firstly trying to help these countries to enhance their own capability to produce, help them to develop economy independence. After that, the interest came to the position.

3.2. The Second Stage

Chinese private companies account for 90% in 2021 of the total number of Chinese companies investing in Africa, and 70% of the value of Chinese FDI, according to the Chinese Ministry of Commerce. By the end of 2010, the number of Chinese companies operated in the continent was 1,955, with more than 100 state-owned actors [5]. So, it’s obvious that after the SOEs’ exploration in the African market, the Chinese private companies see the potential that the Africa has. Instead of saying that the Chinese private companies follow the SOEs because of the direction made by the policy makers, maybe the fact is that they are captivated by Africa’s future, much like Western companies were charmed by China’s 40 years ago.

3.3. The Characteristics of the Chinese FDI in Africa

Totally speaking, based on the two stages ,we can withdraw some characteristics of the Chinese FDI in Africa: Early Dominance by State-Owned Enterprises (SOEs); Strong Government Support in early stage; Emphasis on Enhancing African Countries' Autonomous Production Capacity; Increasing Dominance by Private Enterprises

Based on these characteristics, we can do further analysis in the advantage of Chinese FDI to Africa.

4. The Difference Between Chinese FDI and US FDI

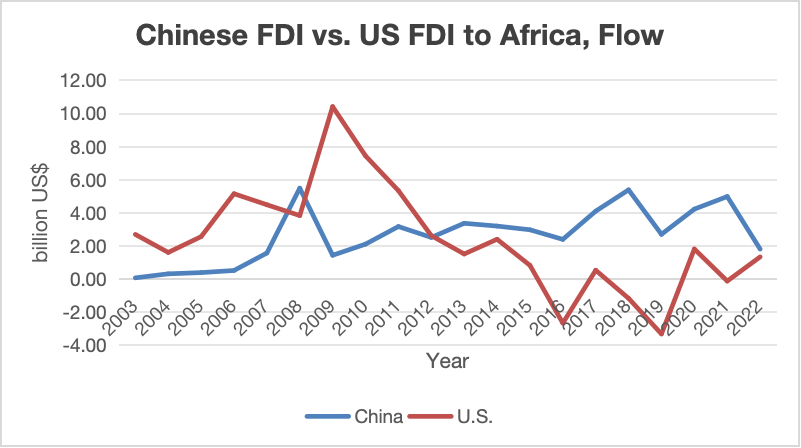

The unique characteristics of Chinese FDI stand in contrast to conventional wisdom, highlighting a long-term focus rather than short-term gains. Notably, Chinese private enterprises dominate investment in Africa, challenging perceptions of risk aversion and profit maximization. Furthermore, a comparison of Chinese and US FDI flows to Africa reveals a marked shift, with China surpassing the US since 2012.

4.1. Chinese FDI: an Exception to the Common Sense

It seems that the Chinese FDI is more like the investment on the long-term interest than the investment for short-term interest. Thus, it’s naturally to think the private companies won’t be willing to invest in the project located in Africa. But the fact is Chinese private companies account for 90% in 2021 of the total number of Chinese companies investing in Africa, and 70% of the value of Chinese FDI just as the last part we mentioned. So, what makes things so different from the common sense?

We intend to believe that private companies always try to optimize their benefits and dislike high risks. It's true, but we should also realize that this common perception assumes that we consider all enterprises to be of the "Western type," I mean, the type that focuses on high value-added production processes.

Thus, the reason why the “common sense” loses its effectiveness to describe the situation that Chinese private companies flooded into Africa becomes clear. It mainly because Chinese private companies originated from the manufacture, which happens to meet the Africa’s needs.

4.2. The Current Situation of Chinese FDI and US FDI to Africa

Firstly, here is a line chart (Figure 1) showing the Chinese FDI vs. US FDI to Africa. It’s obvious that after 2012, US FDI to Africa began to fall behind Chinese FDI to Africa, and until 2022, the US has never surmounted China on this value. It seems that America's performance in this area is increasingly weak, while China is increasingly strong. Briefly, we can see a very stable increase when we look to Chinese FDI situation [6].

Figure 1: Chinese FDI vs. US FDI to Africa [7, 8].

4.3. The Reason behind the Phenomenon

This section discusses the contrasting investment strategies of China and the US in Africa, introducing two distinct labels: "Gold Fever" for US FDI focused on short-term, profit-driven investments with high risks, exemplified by Moderna's failed vaccine plant, and "Good Friends" for China's more durable, risk-tolerant FDI aligned with Africa's industrial needs. It explains why China's investment model, based on its manufacturing prowess and suitability to Africa's capacity, has surpassed the US in Africa, creating a win-win situation by enhancing Africa's production capacity and resource absorption while helping China address overcapacity issues.

4.3.1. The Meaning of Gold Fever

The FDI from the US mainly focus on the trade and “humanitarian” affairs. It’s true that it can help the US get a little benefit by exploring new market, but the efficiency is limited, or even worse, suffers from the loss rather than gets the benefit.

Take Moderna's investment plan in Africa for an example. In 2021, Moderna announced a plan to invest $500 million in Africa to build a new mRNA vaccine manufacturing facility in Kenya that will produce 500 million doses per year. The initiative aims to boost the continent's vaccine production capacity to tackle diseases that continue to threaten global health, including the COVID-19 pandemic. However, Moderna's investment plans in Africa have not worked out exactly as expected. Due to market demand, affordability and lack of orders, Moderna decided to stop further development of the African plant and admitted that it suffered more than $1 billion in losses as a result.

Through the case we can see that the US companies cannot bear the high risk. Additionally, without the quick interest, the investment means nothing to them. So, I prefer to call these investment as “Gold Fever”, which is mainly focus on the one-direction benefits.

4.3.2. The Meaning of Good Friends

In contrast, the FDI from China is more durable and more risk tolerant. Before we clarify the issue that why we use the word “suitable”, we should know the needs of the African economy. The fundamental situation of Africa economy is that Africa only has weak capacity to undertake industries, also, it is necessary for Africa to build up basic autonomous production capacity. What’s more, African countries are trying to get rid of the previous race to the bottom.

After knowing that, we looking back to the benefit that Chinese companies can offer to African countries. The most important benefit for African countries is that Chinese companies try to minimize withdrawals. Chinese manufacturing industries is suitable for Africa’s weak capacity to undertake industries.

Both of China and Africa needs each other to handle some crucial issues, none of them can get benefit without each other, and that’s why I call them as “Good Friends”.

4.3.3. Situations

At the beginning of the analysis, we should do some basic classification of the situation. The performance of strong investment is large scale, large scale means large investment intensity, investment intensity can explain two points: First, the project is profitable, this is the base of the investment. Then, the interest agent can fight for it, without that there won’t be any possibility to make interest.

Both China and the United States meet the condition of chasing the profitability, but the prerequisite for pursuing interests can only be met by China, that is, commensurate with Africa's actual industrial undertaking capacity.

The global system of the United States and its capitalist production habits require the United States to put many "broad sense" manufacturing industries in the middle of the industrial chain (including the whole industrial chain of heavy machinery, civil engineering and other industries involved in manufacturing) to other countries to maximize the benefits. China, as a “semi-peripheral nation”, it has undertaken the manufacturing part of the global industrial chain, and through the continuous development of reform and opening, it has become the most complete country in the global manufacturing system [9].

Based on the above basic facts, it is not difficult to find that the problem is that the previous de-manufacturing behavior of the United States led to the deepening of the hollowing out of the American manufacturing industry, resulting in a huge gap between the investment capacity of the United States and the economic foundation of Africa, or in other words, Africa's industrial capacity cannot accept the industrial transfer and investment of the United States. It is precisely because of the existence of this gap that American companies cannot anchor in the blue ocean market in Africa, so they have been away from the blue ocean market in Africa, and focus on education, finance and other industries, also raw materials and energy industries. The basic logic is that America sees Africa more as a source of raw materials than as a potential economy.

As China's industrial transfer and investment are commensurate with Africa's industrial undertaking capacity, the African blue Ocean market that is in line with China's investment capacity is being explored [10]. The saturation of the US market in Africa contrasts with the continuous development of the Chinese market in Africa, so the "Gold Rush" investment model is gradually declining to the "Good Friends" investment model.

4.3.4. Win-win Situation

Let's start our analysis from an African perspective. Africa's economic situation is very similar to that of China in the early days of reform and opening, with a large number of cheap labors, a low level of industrialization, and poor infrastructure. Therefore, Africa's historical development dilemma has never been the traditional "resource curse” but is more likely to be based on its colonial history, which limited its ability to produce on its own and forced it to export raw materials and energy [11]. It is precisely because of the congenital defect of being unable to produce independently caused by the colonial history that African countries choose to race to bottom to attract foreign investment when pursuing their own development, which further limits Africa's economic autonomy. China's long-term oriented "patient capital", based on the characteristics of its capital type, will minimize the possibility of using its withdrawal right. On top of that, the absence of policy conditionality has eased the race to bottom. In addition, based on the similarity of economic development between China and Africa, China's manufacturing industry and private enterprises meet the access conditions of Africa's blue ocean market to a large extent, thus helping African countries optimize their production level and resource absorption capacity.

Maybe we can use some cases to prove the effectiveness of the Chinese Disaccording to the IMF database, from 1991 to 2004, the proportion of income tax, profit tax and capital gains tax in Ethiopia's total tax revenue showed a significant downward trend. But after a large influx of Chinese capital into Ethiopia in 2004, the index rose overall. As a direct tax representative, income tax and profit tax are very important for a country to optimize its tax structure. The optimization of tax structure itself also indicates the improvement of national resource absorption capacity. Besides, we can also see a sharp increase in Ethiopia’s volume of exports of goods and services after 2004, and keep the growth percentage above 0%, except for 2008’s global financial crisis & 2020’s COVID-19, which also shows that with the influx of Chinese FDI, Ethiopia improves its capability to produce and keep the growth stably [12].

Then, the Chinese perspective. As mentioned above, the economic situation in Africa is very similar to the situation in the early days of China's reform and opening, which also means some problems of today’s Chinese enterprises from another perspective: the domestic market is close to saturation, resulting in excess capacity, which makes some companies must explore overseas markets [13]. In fact, this is also the same as China's previous industrial transfer to developed countries, that is, China and Africa are undertaking marginal technology, which is mainly limited by their own industrial capacity [14].

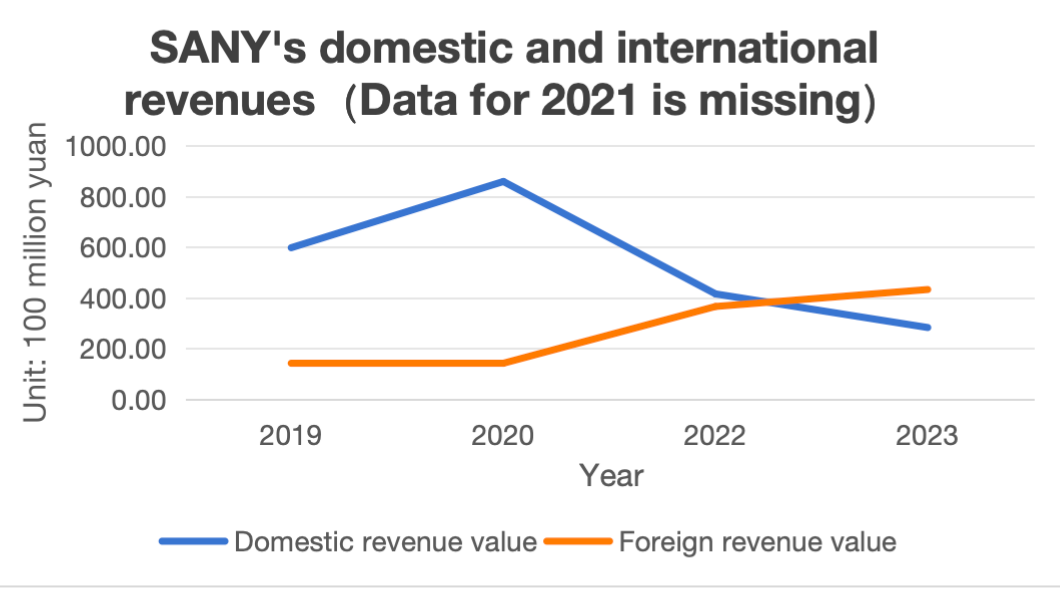

Take SANY as an example. As a heavy machinery manufacturer, SANY's products have gradually grown in the process of China's domestic infrastructure construction. However, according to Figure 2, with the gradual saturation of China's domestic real estate industry and infrastructure in recent years, the domestic demand for heavy machinery is also gradually decreasing. Meanwhile, we can see a gradual increase in the foreign revenue value, in which Africa market share is very significant. In other words, China also needs Africa countries to deal with the problem of overcapacity.

Figure 2: SANY's domestic and international revenues [15].

5. Conclusion

China's FDI in Africa represents a new historical opportunity for win-win cooperation between the two continents. By leveraging its unique advantages in manufacturing, technology, and capital, China is helping African nations to achieve sustainable economic growth and industrialization. At the same time, China's investments in Africa are also contributing to the country's own economic development by opening new markets and sources of revenue. This mutually beneficial relationship is set to continue and deepen in the years to come, as both China and Africa strive to build a shared future of prosperity and development.

References

[1]. Xie, Q., Tian, F., & Huang, M. B. (2012). Clarifying several misunderstandings about China's foreign aid. International Economic Review, (4), 147-157.

[2]. Kaplan, S. B. (2021). Globalizing patient capital: The political economy of Chinese finance in the Americas. [E-book]. Cambridge University Press. Retrieved from<https://lccn.loc.gov/2020058125.>

[3]. Bondaz, A. (2015). "One belt, one road": China’s great leap outward. China Analysis, European Council on Foreign Relations, p. 6 Retrieved from<https://ecfr.eu/publication/one_belt_one_road_chinas_great_leap_outward3055/>

[4]. Embassy of the People's Republic of China in Sudan. (2019). The economic cooperation between China and Sudan promotes the common development of the two countries. [Online]. Retrieved from< http://sd.china-embassy.gov.cn/chn/nwksd/201912/t20191202_6756435.htm>

[5]. Ze Yu, S. (2021, April 2). Why substantial Chinese FDI is flowing into Africa [Blog post]. Retrieved from: <https://blogs.lse.ac.uk/africaatlse/2021/04/02/why-substantial-chinese-fdi-is-flowing-into-africa-foreign-direct-investment/>

[6]. Zhu, W., Xu, K., & Wang, M. (2018). Does China's aid promote economic growth in Africa? International Trade Issues, 7

[7]. Statistical Bulletin of China's Outward Foreign Direct Investment. Retrieved from <https://www.sais-cari.org/chinese-investment-in-africa>

[8]. China Africa Research Initiative. (Year retrieved). Chinese FDI in Africa data overview. [Online]. Available at: https://www.sais-cari.org/chinese-investment-in-africa

[9]. Wallerstein, I. (1974). The rise and future demise of the world capitalist system: Concepts for comparative purposes analysis. Comparative Studies in Society and History, 16(4), 402-402.

[10]. Xu, L., Wu, W., & Sun, C. (2020). Whose Aid will Promote the Industrial Development of Africa: China or the US? The Journal of World Economy, 43(11), 3-27.

[11]. Auty, R. M. (1993). Sustaining development in mineral economies: The resource curse. Routledge.

[12]. IMF WEO database. International Monetary Fund. https://www.imf.org/en/Publications/WEO/weo-database

[13]. Yang, G., Li, X. F., Chen, M., Tong, F., Liu, D., & Fan, S. H. (2015). The current status and future prospects of technology transfer from Chinese enterprises to Africa. West Asia and Africa.

[14]. Wang, Q. Y. (2004). An empirical analysis of "exchanging markets for technology." Journal of Guangdong University of Finance and Economics, 19(5), 67-71.

[15]. SANY Heavy Industry Reports Earnings: Overseas Revenue Soars to 60% of Core Business Amid Market Pressures, Signaling Strong Global Expansion,[Online]available at:https://www.sanyglobal.com/press_releases/

Cite this article

Zheng,Z. (2024). China's Patient Capital in Africa: Navigating Long-term Investments and Economic Cooperation. Lecture Notes in Education Psychology and Public Media,71,8-15.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICGPSH 2024 Workshop: Industry 5 and Society 5 – A Study from The Global Politics and Socio-Humanity Perspective

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Xie, Q., Tian, F., & Huang, M. B. (2012). Clarifying several misunderstandings about China's foreign aid. International Economic Review, (4), 147-157.

[2]. Kaplan, S. B. (2021). Globalizing patient capital: The political economy of Chinese finance in the Americas. [E-book]. Cambridge University Press. Retrieved from<https://lccn.loc.gov/2020058125.>

[3]. Bondaz, A. (2015). "One belt, one road": China’s great leap outward. China Analysis, European Council on Foreign Relations, p. 6 Retrieved from<https://ecfr.eu/publication/one_belt_one_road_chinas_great_leap_outward3055/>

[4]. Embassy of the People's Republic of China in Sudan. (2019). The economic cooperation between China and Sudan promotes the common development of the two countries. [Online]. Retrieved from< http://sd.china-embassy.gov.cn/chn/nwksd/201912/t20191202_6756435.htm>

[5]. Ze Yu, S. (2021, April 2). Why substantial Chinese FDI is flowing into Africa [Blog post]. Retrieved from: <https://blogs.lse.ac.uk/africaatlse/2021/04/02/why-substantial-chinese-fdi-is-flowing-into-africa-foreign-direct-investment/>

[6]. Zhu, W., Xu, K., & Wang, M. (2018). Does China's aid promote economic growth in Africa? International Trade Issues, 7

[7]. Statistical Bulletin of China's Outward Foreign Direct Investment. Retrieved from <https://www.sais-cari.org/chinese-investment-in-africa>

[8]. China Africa Research Initiative. (Year retrieved). Chinese FDI in Africa data overview. [Online]. Available at: https://www.sais-cari.org/chinese-investment-in-africa

[9]. Wallerstein, I. (1974). The rise and future demise of the world capitalist system: Concepts for comparative purposes analysis. Comparative Studies in Society and History, 16(4), 402-402.

[10]. Xu, L., Wu, W., & Sun, C. (2020). Whose Aid will Promote the Industrial Development of Africa: China or the US? The Journal of World Economy, 43(11), 3-27.

[11]. Auty, R. M. (1993). Sustaining development in mineral economies: The resource curse. Routledge.

[12]. IMF WEO database. International Monetary Fund. https://www.imf.org/en/Publications/WEO/weo-database

[13]. Yang, G., Li, X. F., Chen, M., Tong, F., Liu, D., & Fan, S. H. (2015). The current status and future prospects of technology transfer from Chinese enterprises to Africa. West Asia and Africa.

[14]. Wang, Q. Y. (2004). An empirical analysis of "exchanging markets for technology." Journal of Guangdong University of Finance and Economics, 19(5), 67-71.

[15]. SANY Heavy Industry Reports Earnings: Overseas Revenue Soars to 60% of Core Business Amid Market Pressures, Signaling Strong Global Expansion,[Online]available at:https://www.sanyglobal.com/press_releases/