1. Introduction

The rapid expansion of real estate investment, coupled with saturated consumer demand soaring housing prices, has spurred discussions regarding the effect of real estate on China's economic landscape (Zhang et al., 2016) [12]. The real estate sector plays a pivotal role in driving China's economic growth by generating employment opportunities, fostering the development of ancillary industries, and bolstering consumer spending. Moreover, it serves as a crucial source of funding for local governments, supporting the advancement of public services and infrastructure. Fluctuations in the real estate market often serve as indicators of economic status, the distribution of wealth, and/or customer confidence levels. Although many benefits, the development of Chinese real estate industry also leads to some concerns. Since 2018, the vast majority of Chinese real estate companies have seen their gearing ratios surpass 70%. In the absence of macro-policy regulation, company operations are likely to descend into a negative cycle. Simultaneously, the liberalization of the credit sector has led to enhanced purchasing power for prospective homeowners, a surge in demand for houses, and escalating property prices. Speculators perceived real estate as a type of investment, resulting in a real estate bubble (Jacob & Nair, 2023) [1].

Government and regulatory authorities globally, as well as each country, have instituted macro-prudential policies, such as loan-to-value (LTV) limitations and debt-to-income (DTI) limits, to mitigate excessive borrowing and systemic risk. Due to their aims to ensuring financial stability, which inevitably curb excessive growth in the property market. Thus, these regulations may also affect the real estate market. However, so far, few studies have analyzed the impact of financial policies on the real estate sector.

Prior research has extensively examined real estate investment, consumer demand, and market bubbles to understand the workings of the real estate market. However, there is a lack of in-depth exploration regarding the challenges and strategies of macro policies for highly leveraged enterprises within the framework of the "Three Red Lines" policy. Prior research has extensively examined real estate investment, consumer demand, and market bubbles to understand the workings of the real estate market. Additionally, many studies focus on the effects of financial policies on the entire sector, and a detailed examination based on case studies of the underlying reasons contributing to the success or failure of these policies is still lacking. Specifically, there is a lack of in-depth exploration regarding the challenges and strategies of macro policies for specific enterprises within the framework of the "Three Red Lines" policy.

Since Evergrande was the first real estate enterprise to go bankrupt under the influence of the Three Red Lines policy, we chose it as a study case. We analyzed the impact of the "Three Red Lines" legislation on the real estate market by using behavioral finance theory, with particular attention given to its effects on highly indebted businesses. While the policy aims to reduce excessive risk buildup, our study reveals that it also causes problems for company finance and raises the possibility of corporate bankruptcy. This policy, implemented without considering variations in size, operational structure, and market position of different organizations, has placed in financial strain on certain companies, highlighting the shortcomings of the strategy. This emphasizes the need for evaluating and modifying real estate financing rules to foster the robust growth of the business.

This paper contributes to the existing research from the following aspects. First, this article delves into the case of the initial real estate enterprise that succumbed to bankruptcy as a result of the Three Red Lines policy. As such, it offers a thorough elucidation of the potential ramifications of the policy on other enterprises, thereby providing valuable insights. Also, through the application of behavioral finance principles to the Evergrande case, this study contributes to the practical utilization of behavioral finance within the real estate sector. From a practical standpoint, this study sheds light on the challenges and deficiencies in implementing the "Three Red Lines" policy, offering valuable guidance for future policy formulation and adjustment. Amidst a complex macroeconomic environment, real estate enterprises can glean valuable insights for strategic adaptation and effective risk mitigation. Furthermore, this research underscores the pivotal role of regulatory measures in safeguarding market stability and mitigating financial risks. It also highlights the complexities faced by market regulators in determining policy priorities and actions. For foreign investors, market analysts, and policymakers alike, the Evergrande case offers valuable lessons in risk assessment and crisis management, while also shaping the trajectory and strategic decisions of China's real estate industry.

2. The Evolution of China’s Real Estate Policies

China's real estate sector has undergone multiple policy and regulatory cycles. The first cycle began with the "Four Trillion Plan" in 2008, implemented in response to the global financial crisis and domestic economic downturn. This initiative aimed to boost market vitality via livelihood programs, infrastructure development, and other measures. Following numerous Central Bank interest rate reductions and property policy adjustments, the property market rebounded. In 2010, the Chinese property industry faced regulatory measures involving restrictions on home purchases and loans nationwide. The government introduced the "National Eleven Rules" and other measures for the first time to curb excessive buying and borrowing. Subsequently, in 2011, control measures were further strengthened, including limitations on down payments and lending rates for the acquisition of second homes, along with the initiation of property tax trials in Chongqing and Shanghai. Since 2012, China has begun devising new regulatory policies aimed at stabilizing economic growth. The government relaxed monetary policy through interest rate reductions and adjusted local government real estate policies to stimulate demand. However, as economic growth weakened and real estate inventories remained high in 2013, the government tightened regulations, issuing stricter control policies, such as the "National Five Principles."

The beginning of 2015 witnessed policies aimed at reducing interest rates. This period coincided with a slowdown in the global economy and the onset of a domestic economic downturn, prompting the government to introduce a series of measures to stabilize growth. However, as excessive leverage in the real estate sector became a prominent issue, "deleveraging" emerged as a key objective of supply-side structural reform. In 2016, the concept of "housing without speculation" was introduced, leading to the implementation of stricter property market regulations in many regions. Subsequently, the fifth round of control measures was initiated in 2019, reflecting a new wave of more stringent corrections in the property market. In July, the central government explicitly stated that it would not use the real estate sector as a means to stimulate immediate economic expansion.

In the sixth round of the regulatory cycle, commencing in 2022, the government initiated the deregulation of the real estate sector as a response to the economic downturn. Various policies were introduced to bolster the real estate sector, including measures related to credit, bond, and equity financing. These policies aimed to provide additional financing channels for real estate enterprises, such as the "16 Articles on Finance," the "Three Arrows," and the November 2023 Banking Symposium. Local governments have taken a proactive role in establishing urban real estate financing coordination mechanisms in cities at the prefectural level and above. These mechanisms assess market conditions and industry financing requirements, while addressing challenges and issues in real estate financing. Following principles of fairness and impartiality, efforts are made to integrate real estate project development and construction with the development plans of concerned enterprises. Eligible real estate projects are identified for financing support, and financial institutions are encouraged to provide effective financing assistance.

3. Analysis of the Impact of China's Real Estate Finance Policies from the Perspective of Behavioral Finance: Evergrande Group as A Case Study

3.1. China Evergrande Group's Expansion Strategy and Behavioral Deviations

Evergrande Group, established in Guangzhou in 1996, is a private enterprise boasting trillions in total assets. Since 2004, Evergrande Group has consistently ranked among China’s top ten real estate enterprises, boasting impressive enterprises scale and market share within the industry. However, on January 29, 2024, the High Court of Hong Kong issued a winding-up order against Evergrande Group due to its long-term highly leveraged business model and debt-ridden financial position. This marks the first real estate company to declare bankruptcy since the introduction of the "Three Red Lines" policy.

In its formative years, Evergrande Group adopted a distinctive development strategy centered on large-scale land reserves. While this strategy laid the foundation for future development, it also introduced significant financial risks. Land serves as the fundamental element of real estate development, and ample land reserves signify development potential. Evergrande Group has provided abundant resources for subsequent property development by purchasing a large amount of land. However, land acquisition entails substantial capital investment, posing an initial challenge for Evergrande Group. From a behavioral finance standpoint, Evergrande Group's large-scale land banking strategy may have been motivated by an overconfidence bias, assuming perpetual market demand growth to support their rapid expansion. While this approach may prove effective in bull markets, it puts the business at great risk in bear markets and when regulations tighten. From the standpoint of behavioral finance, Evergrande Group's large-scale land banking approach would have been impacted by an overconfidence bias, which held that market demand would rise and support the company's rapid expansion mode (Costa, 2017) [3]. While this tactic may prove effective in bull markets, businesses that overextend themselves run a greater risk when the economy is unstable and regulations are tightened.

Evergrande Group has utilized a variety of funding avenues, such as corporate bonds, bank loans, and advance receipts, to address the capital issue. These funds provided strong support for Evergrande Group's acquisition of land. However, this also led Evergrande Group to carry a heavy debt burden. In the medium term, Evergrande Group relies on credit to ease the pressure on capital. Evergrande's diversified financing structure reflects its strategy of attempting to diversify risks through multiple financing methods when facing financial risks. However, the prevalence of herd behavior in the financial market means individuals rely excessively on the behavior or opinions of others when making decisions, rather than basing them on their own information or analysis (Banerjee, 1992) [2]. Especially when Evergrande's financial crisis erupted, the public's inclination toward the inefficient behavior of "blindly following the herd" rather than "leveraging their own strengths and weaknesses" may have contributed to a decline in the credit market's overall confidence in the real estate industry. This, in turn, could be heightened the risk that Evergrande and its subsidiaries eroding confidence in the real estate industry. Consequently, such diminished confidence might have led to a broader decline in the credit market’s overall confidence in the real estate industry, potentially making it more challenging for Evergrande and its peers to secure funding (Xia, 2021) [11].

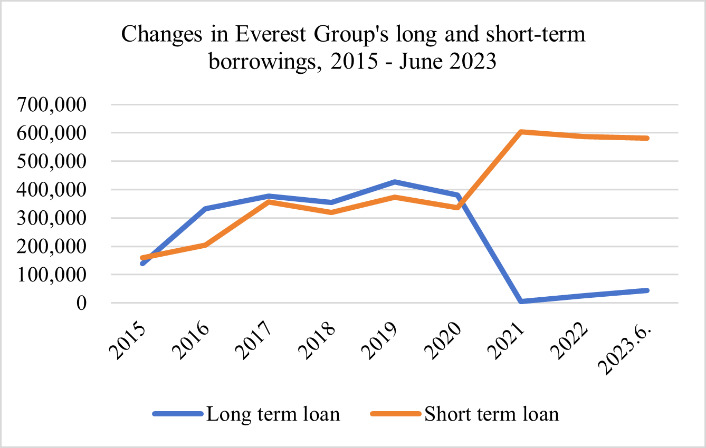

Figure 1. Changes in Evergrande Group's long and short-term borrowings, 2015-June 2023 (Source: Evergrande Group financial statements)

However, relying on credit was merely a temporary solution, and in the later stages, Evergrande Group still had to rely on the sale of commercial properties to recover funds to repay the initial loans. Throughout this process, the risk factor cannot be underestimated. Any issue arising at any stage could rpotentially disrupt the capital chain and deliver a significant blow to the enterprise.

According to Table1 and Figure1, between 2015 and June 2023, the volume of bank loans, corporate bonds, and senior notes issued by Evergrande Group continued to rise, thereby amplifying financial risks. This indicates the accumulation of risks in China's real estate market from a certain perspective. The real estate market is characterized by significant capital requirement, lengthy cycles, and slow returns on capital. Evergrande Real Estate Company finances its own cash, stocks, bank and other borrowings, senior notes, Chinese bonds, perpetual bonds, and convertible bonds. An analyzing Evergrande's primary financing channels reveals a heavy reliance on national policy leniency and the strength of bank lending.

Table 1. Evergrande Group Financing Sources

Vintages |

Bank and other borrowings |

Senior note |

Chinese bonds |

Perpetual bond |

Convertible bond |

|||||

Amount Million |

Real interest rate |

Amount Million |

Real interest rate |

Amount Million |

Real interest rate |

Amount Million |

Real interest rate |

Amount Million |

Real interest rate |

|

2015 |

2357 |

7.98% |

199 |

10.18% |

396 |

7.01% |

757 |

6.72% |

- |

- |

2016 |

4592 |

7.74% |

221 |

9.81% |

538 |

7.04% |

1129 |

9.43% |

- |

- |

2017 |

6211 |

7.62% |

577 |

8.33% |

539 |

7.18% |

- |

- |

- |

- |

2018 |

5369 |

7.99% |

799 |

8.99% |

437 |

7.50% |

- |

- |

127 |

10.71% |

2019 |

6048 |

8.85% |

1366 |

10.06% |

452 |

7.08% |

- |

- |

134 |

10.71% |

2020 |

5056 |

9.52% |

1513 |

10.09% |

450 |

6.83% |

- |

- |

135 |

10.71% |

2021 |

3421 |

- |

1273 |

- |

530 |

- |

- |

- |

66 |

- |

2022 |

3642 |

- |

1396 |

- |

532 |

- |

- |

- |

72 |

- |

2023.6 |

3786 |

- |

1449 |

- |

535 |

- |

- |

- |

75 |

- |

Source: Evergrande Group Annual Report

In 2021, the significant decline in Evergrande Group's long-term borrowing has garnered widespread attentions. To address this phenomenon, this paper will explain it from three key perspectives: Firstly, as of December 31, 2021, Evergrande Group had 602,653 million 1-year borrowings, 4,574 million 1-2-year borrowings, 150 million 2-5-year borrowings, and 0 long-term borrowings. This breakdown of borrowing maturity illustrates that Evergrande Group's borrowing structure is predominantly comprised of short-term borrowings, with a comparatively limited presence of long-term borrowings. Secondly, the implementation of China’s "Three Red Lines" in 2020 placed limitations on the financing options available to real estate companies. The approach may have made it harder for Evergrande Group to get long-term funding, thereby significantly reducing its long-term borrowings. Additionally, concerns about Evergrande Group's financial health within the market have contributed to the decline in its long-term borrowings. Some banks and financial institutions have exhibited caution in lending to Evergrande Group due to its diminishing credit ratings. Consequently, many long-term loans have been reduced or not renewed due to this cautious attitude.

Evergrande Group needed short-term financing to fund long-term investments to meet repayment commitments and build projects. Businesses are more vulnerable to macroeconomic upheavals and market policy changes due to their fragile financial structure, especially during economic downturns. The mismatch between short-term borrowings and long-term investments, the industry slowdown, and tighter credit conditions led Evergrande Group's cash holdings to quickly shrink and create financial risks. Until 2020, Evergrande Group's long-term borrowings exceeded its short-term borrowings and made up a large share of its liabilities. This suggests increased long-term liability pressure on the firm.

3.2 Gearing and Market Reaction

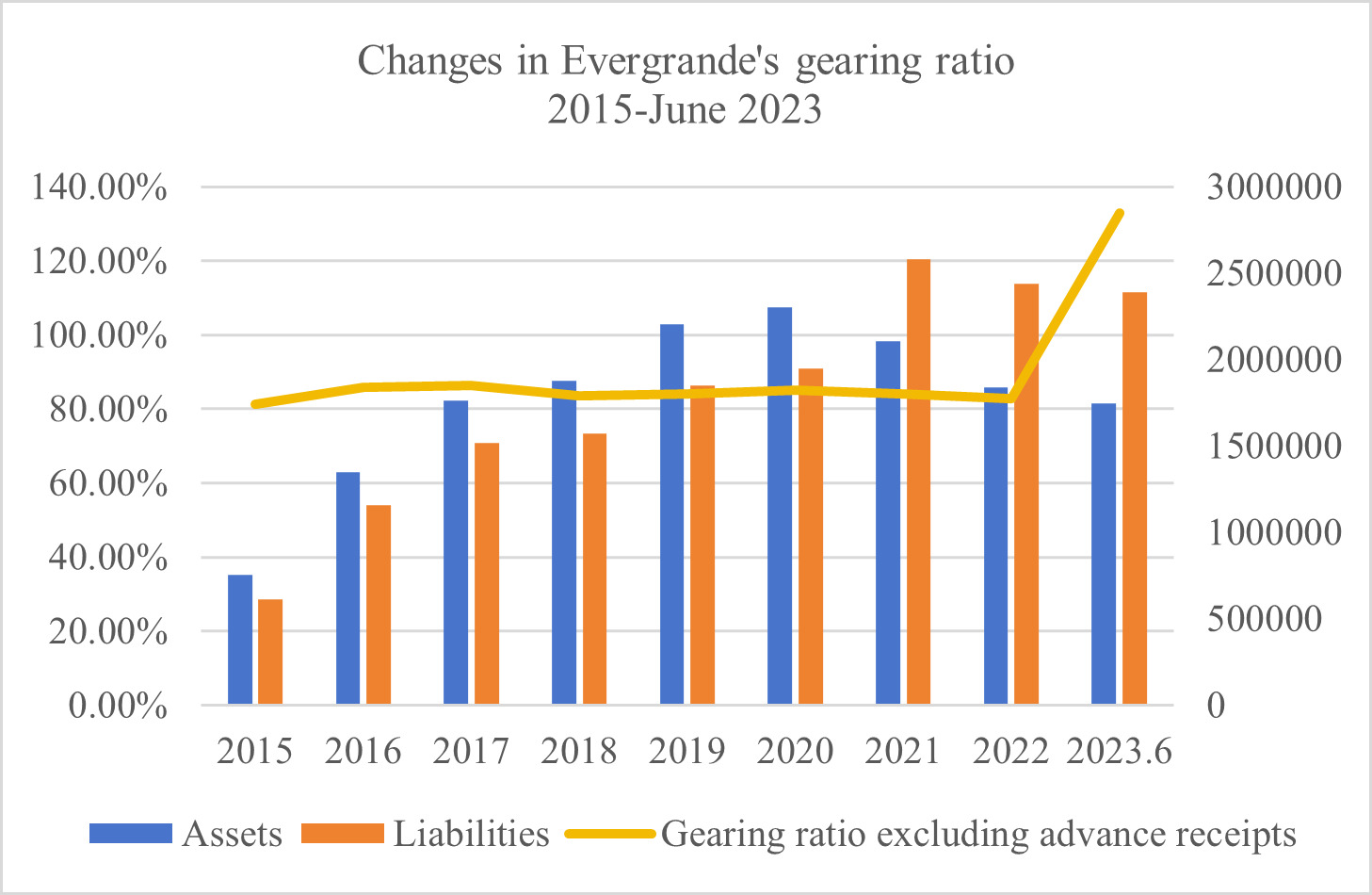

The gearing ratio, a crucial financial indicator, delineates the proportion of a firm's assets financed through debt. Figure 2 illustrates Evergrande Group's leverage ratio trajectory from 2015 to June 2023, shedding light on the substantial risks associated its rapid expansion. Evergrande Group's excessively high gearing ratio could precipitate liquidity issues and diminish solvency, highlighting the critical need for balanced financial management to mitigate such risks (Sun & Cao, 2021) [8].

According to the table, Evergrande Group's gearing ratio oscillated between 81.34% and 86.31% from 2015 to 2017, evidencing a marginal increase. Subsequent to the strategic shift towards a "three highs and one low" model post-2017, the ratio witnessed a decrease. However, by 2020, the gearing ratio surged back to 85.04%, surpassing the “first red line” set by the regulatory policy. This exceedance signifies escalating enterprise risk as it implies an increased obligation for Evergrande to service debt through interest and principal payments. The firm is under significant financial strain and increased risk due to the recurrence of a high gearing ratio of 85.04%. As a result, strict financial management is required to minimize potential liquidity concerns and solvency issues.

Figure 2. Changes in Evergrande Group's Gearing Ratio Excluding Advance Receipts 2015-June 2023 (Data source: Evergrande Group financial statements)

By 2021, the magnitude of the company's liabilities had exceeded its assets, creating formidable barriers to growth. Excessive debt limits a company's ability to grow and develop (Zhang et al., 2015) [13]. Moreover, the market trust of Evergrande Group is undermined by this financial approach. Growing debt levels might make investors less optimistic about the company's prospects going forward, which would be bad for the market capitalization and share price. Market confidence may be negatively impacted by high company debt (Molnár & Lu, 2019) [4].

From a behavioral finance perspective, Evergrande Group's elevated gearing ratio mirrors market optimism regarding leverage. During periods of real estate market expansion and economic prosperity, heavy leverage is sometimes seen as a good way to expand capital. However, changes in market attitude and policy-related uncertainty, such as the adoption of the "Three Red Lines" regulation, might quickly turn into negative opinions about highly indebted companies, increasing Evergrande's financial strain. Market participants' propensity to overreact to new information further fuels price volatility (Shiller, 2016) [7].

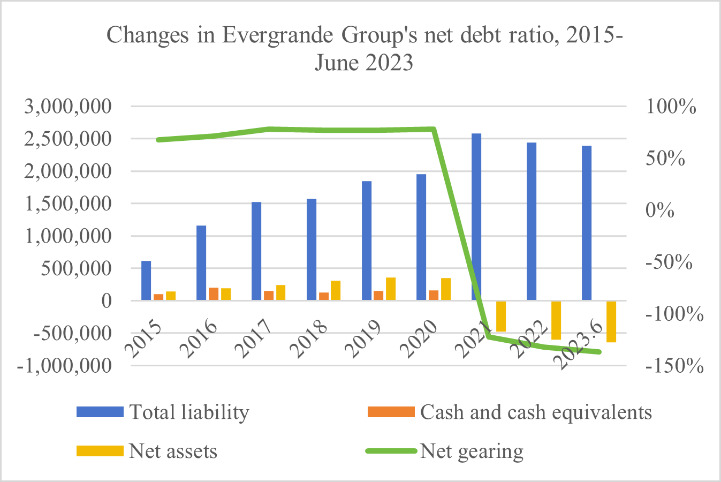

3.3 Analysis of Behavioral Financial Bias Under Changes in Net Debt Ratio

A more in-depth examination of an organization's financial status is facilitated by the net debt ratio, a crucial measure of financial leverage and solvency. To provide a more accurate depiction of their financial position, businesses must highlight the role that cash and cash equivalents play in repaying external debt in order to use this indicator The concept of framing effects delves into how individuals' decision-making processes are influenced by the context in which options are presented. It furnishes a theoretical framework to understand why decision-makers at Evergrande Group might ignore financial risks if they have an optimistic outlook (Kahneman & Tversky, 1981) [9]. The decision-makers at Evergrande may have justified the company's high-risk expansion and excessive debt as a means of "pursuing growth" when assessing its financing and investment choices. This positive framing leads decision-makers to overlook the potential financial risks that come with it. As shown in Figure 3, the changes in Evergrande Group's net debt ratio from 2015 to June 2023 are presented. Since 2016, Evergrande Group's total liabilities have significantly surged, with the net gearing ratio reaching as high as 78% by 2020. This figure indicates that China Evergrande exceeded the second "red line" stipulated by the policy in 2020. Evergrande's decision-makers may have overlooked the warning signs of heightened external debt risk owing to confirmation bias. This cognitive bias renders decision-makers more inclined to accept and seek information that supported their continued expansion strategy while ignoring or underestimating the risks associated with high debt, reflecting a clear blind spot in the company's assessment of and response to financial risk (Nickerson, 1998) [6].

Taking Evergrande Group as a case study to analyze its external debt, excessive optimism has led Evergrande Group to overestimate its ability to cope with risks and its expectation of future returns. This overoptimism is reflected in its continuous asset expansion and large amount of external debt financing. As of now, Evergrande still has US$20 billion in external debt to be repaid, which exposes the risk perception of an over-optimistic estimation of market fluctuations and policy changes (Weinstein, 1980) [10]. In the project development process, Evergrande Group contributes only a small proportion of the funds, with the bulk being fronted by the construction side. While this model was previously effective, as the construction side would advance the majority of the funds while Evergrande Group contributed only a minor proportion to the project development, the frequent utilization of this approach in business and asset expansion has unveiled Evergranda Group's highly leveraged and indebted business model. The mounting liabilities of Evergrande Group primarily stem from its aggressive land purchasing behavior. Since its listing, Evergrande has resorted to raising debt to purchase a large amount of land. Especially in 2017, despite the policy emphasis on "housing without speculation," Evergrande Group continued to purchase large amounts of land, contrary to industry policy. To support this counter-market expansion, incurring debt became a crucial financing method. In the first half of 2019, Evergrande's interest-bearing debt reached a historical pinnacle. Despite the “Three Red Lines” policy implemented by the government between 2016 and 2019, Evergrande Group struggled to curtail its interest-bearing debt. Table 2 shows Evergrande Group's international bonds. It is evident that Evergrande Group has a significant funding gap, indicating that the debt risk is in an unsatisfactory state.

Figure 3. Changes in Evergrande Group's Net Debt Ratio, 2015-2021 (Source: Evergrande Group Annual Report)

Table 2. Evergrande Group's Overseas Bonds

Stock code |

Issue date |

Expiry date |

Current balance ($ billion) |

Interest rate |

Type of securities |

ZAQB.SG |

2020-01-20 |

2023-01-20 |

10.0 |

10.0 |

Overseas debt |

Y7XB.SG |

2020-03-15 |

2024-03-15 |

11.0 |

11.0 |

Overseas debt |

IGMB.SG |

2019-03-13 |

2024-03-13 |

6.0 |

10.0 |

Overseas debt |

W8LB.SG |

2019-03-20 |

2023-03-20 |

8.0 |

9.8 |

Overseas debt |

NWUB.SG |

2019-05-09 |

2022-05-09 |

13.0 |

9.0 |

Overseas debt |

75VB.SG |

2017-05-27 |

2023-05-27 |

11.5 |

7.0 |

Overseas debt |

75WB.SG |

2017-04-25 |

2025-04-25 |

45.5 |

8.0 |

Overseas debt |

6K7B.SG |

2017-03-26 |

2024-03-26 |

10.0 |

8.5 |

Overseas debt |

617B.SG |

2017-03-15 |

2022-03-15 |

20.5 |

8.5 |

Overseas debt |

Source: Wind

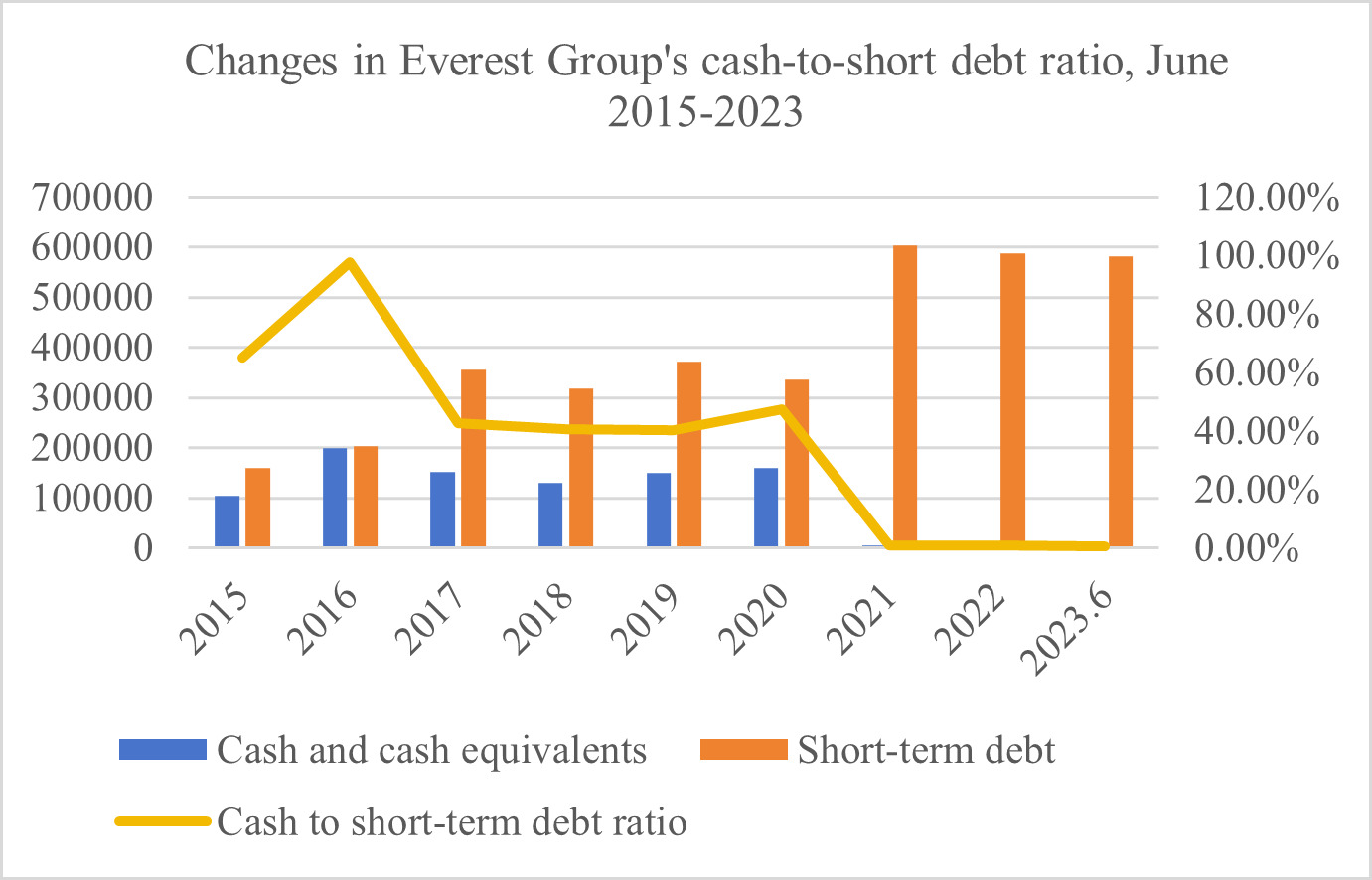

Figure 4. Change in cash short debt ratio, 2015 - June 2023 (Source: Evergrande Group financial statements)

3.4 Cash to Short-term Debt Ratio and Liquidity Risk

The cash-short debt ratio analysis assesses a company's liquidity and solvency by comparing cash and cash equivalents to short-term debt. Evergrande Group's cash-to-short-term debt ratio from 2015 to June 2023 is shown in Figure 4. Evergrande Group has struggled to adhere to the government's "Three Red Lines" regulation for real estate companies, leading to an uptick in its short-term borrowings. Especially in 2017, Evergrande issued a large number of senior notes to repay old debts, while a substantial portion of borrowings were classified as debt, leading to a rapid decline in the cash-short debt ratio. Loss avoidance preferences in behavioral finance may have prompted firms to take short-term measures to maintain liquidity in the face of financial stress, which has led to a more intuitive rather than analytical investment decision-making process, such as the issuance of short-term debt, at the expense of long-term financial stability. Such short-term behavior may exacerbate firms' financial distress when policies become more stringent (Virigineni & Rao, 2017) [5].

Against this backdrop, finance assumes a pivotal role as a critical component of exogenous funding. Exogenous financing—borrowing and other methods—usually involves higher interest charges. Evergrande's net profit is hampered by rising finance expenses due to its high dependence on external capital. Evergrande Group's net profit is compressed owing to high financing costs, reducing endogenous financing, or operating revenue. Evergrande Group's cash flow suffers from this combination.

4. Conclusions and Recommendations

4.1. Conclusions

Real estate is of great significance to China. While improving people's well-being, real estate is also important for promoting economic growth and maintaining social stability. But the rapid development of the real estate industry, coupled with the wake of government intervention, has exposed the industry to serious financial risks, such as excessive leverage. By taking Evergrande Group as a specific case, we analyze the main reasons for Evergrande Group's bankruptcy. The authors found that in the primary stage of the development of the enterprise, due to the enterprise failed to manage the risk well, and the management in the decision-making there are certain mistakes, which directly led to the later Evergrande Group's bankruptcy. At the same time, the enterprise's lack of seriousness about its own situation, leading to excessive optimism, is also an important reason. In addition to its own impact, the bankruptcy of Evergrande Group has also generated a certain threat to the entire financial market.

Macro-control is very important for the development of real estate enterprises. As an industry sensitive to government intervention, the development of the real estate industry has always attracted much attention. Analyzing and judging the impact of national financial policies on real estate enterprises is conducive to helping enterprises accurately position themselves and adjust their business strategies in a timely manner. Although the initial intention of the " Three Red Lines" policy is to help enterprises avoid risks in their operations, its implementation process as well as its effects remain to be evaluated. Moreover, as enterprises are more heterogeneous in terms of scale needs, it is necessary to provide them with personalized credit program options based on their actual situation.

4.2. Suggestion

Different from other industries, real estate industry is an industry affected by government laws and regulations. A timely understanding of the impact of real estate business policies on enterprises is important for enterprises to accurately identify their own situation and actually adjust their business decision-making strategies. Although the "Three Red Lines" policy was originally intended to help the industry reduce the risks it faces in its business decision-making process, its implementation is still uncertain due to the lack of flexibility in the policy itself. It is therefore necessary to evaluate the effectiveness of the policy's implementation so as to ensure the orderly operation of the real estate market. In addition, given the significant differences in size, needs and development strategies of enterprises, it is necessary to develop individualized credit programs based on the actual situation of enterprises.

The biggest drawback of the "Three Red Lines" policy is that there are uniform financial criteria for all real estate companies, which lack consideration of the specific characteristics of real estate companies. Under such a rigid rule, companies with good financial standing are likely to be better off, while companies with poor financial standing are likely to be hit by bankruptcy and other shocks. It's advisable to categorize businesses based on more appropriate financial criteria aligned with their characteristics and development stages. Reinforcing budgetary control, especially for companies with high obligation proportions, by actualizing stricter obligation administration rules, upgrading money-related straightforwardness, and forcing review oversight seems to decrease the hazard of over-the-top borrowing and avoid the breakdown of capital chains.

The policy's short-term focus overlooks the potential for long-term development and the positive showcase commitments of companies. This short-sightedness might constrain businesses to compromise on long-term planning and innovation to meet arrangement prerequisites. The government ought to encourage companies to prioritize long-term key arranging and maintainable speculation, progress the straightforwardness of policy-making, and guarantee all partners completely get the eagerness and necessities of the approach. Normal intuition with industry agents and input collection can lead to convenient alterations and enhancements in approaches, guaranteeing they reflect showcase needs and contribute to the vigorous improvement of the division.

In addition, it is crucial to provide enterprises in a highly leveraged position with reasonable transition periods and risk mitigation measures. Temporary financial relief, loan extensions, or restructuring support could help these enterprises navigate policy adjustments smoothly and alleviate sudden financial pressure and liquidity crises.

Real domain endeavors ought to closely screen the government's macro-control arrangements, counting counter-cyclical and cross-cyclical measures like unused loaning laws and outside obligation recovery. To dodge capital chain disturbances as these rules, fix, endeavors must alter their financing technique and monetary arrangements. Given the limitations and risks associated with external credit financing, real estate companies should strengthen their internal finances by increasing internal savings reserves and reducing external funds. Cost control, operational effectiveness, and cash flow administration are critical to an enterprise's self-financing and budgetary stability. To optimize project management and market analysis, real estate companies should leverage information technology and big data analytics to enhance operational efficiency and decision-making quality. This includs optimizing cash flow management, strengthening cost control, and improving operational efficiency to enhance the self-financing capability and financial stability of the business.

Within the setting of constrained supply, solid demand, and cruel showcase competition, companies ought to avoid aggressive cost wars and aimless development activities, which might begin a negative industry cycle. In step, firms may separate themselves and grow reasonably by actualizing competitive estimating strategies, making strides in item quality, and raising benefit guidelines. Companies need to focus on item development and particular competitive techniques due to changing client inclinations and advertising divisions. This methodology meets the market's expanded requests and plans the company for long-term victory in a changing business climate. The creation of retirement homes and rental lodging for certain populations may open unused markets and boost competitiveness. Risks must be mitigated through prudence, collaboration, and diversification. Investors, financial institutions, and other stakeholders must collaborate over the long term to manage market volatility effectively.

Authors Contributions

According to the specific works, Siya Wang and Fazheng Wang have the equal contributions.

References

[1]. Adit Jacob & Suraj Nair. (2023). The historical political economy of Chinese housing regulation and price speculation. Journal of student-scientists' research.

[2]. Banerjee, A. V. (1992). A Simple Model of Herd Behavior. The Quarterly Journal of Economics, 107(3), 797–817. https://doi.org/10.2307/2118364

[3]. Costa, D. F., de Melo Carvalho, F., de Melo Moreira, B. C., & do Prado, J. W. (2017). Bibliometric analysis on the association between behavioral finance and decision making with cognitive biases such as overconfidence, anchoring effect and confirmation bias. Scientometrics, 111(3), 1775–1799. https://doi.org/10.1007/s11192-017-2371-5

[4]. Molnar, M., & Lu, J. (2019). State-owned firms behind China’s corporate debt. Www.oecd-Ilibrary.org. https://doi.org/10.1787/7c66570e-en

[5]. Mydhili Virigineni, & Madasu Bhaskara Rao. (2017). Contemporary Developments in Behavioural Finance. DergiPark (Istanbul University).

[6]. Nickerson, R. S. (1998). Confirmation bias: A ubiquitous phenomenon in many guises. Review of General Psychology, 2(2), 175–220. https://journals.sagepub.com/doi/10.1037/1089-2680.2.2.175

[7]. Shiller, R. J. (2016). Irrational Exuberance. Irrational Exuberance. https://doi.org/10.1515/9781400865536

[8]. Sun, Y., & Cao, Z. (2021). Financing Mode Analysis of Chinese Real Estate Enterprises – A Case Study of Evergrande Group. 2021 2nd Asia-Pacific Conference on Image Processing, Electronics and Computers. https://doi.org/10.1145/3452446.3452575

[9]. Tversky, A., & Kahneman, D. (1981). The Framing of Decisions and the Psychology of Choice. Science, 211(4481), 453–458. https://doi.org/10.1126/science.7455683

[10]. Weinstein, N. D. (1980). Unrealistic optimism about future life events. Journal of Personality and Social Psychology, 39(5), 806–820. https://doi.org/10.1037/0022-3514.39.5.806

[11]. Xia Zihang. (2021, Aprial). The Corporate Financialisation Cohort Effect: "Complementing Strengths" or "Blindly Following the Wind"? https://xuebao.zuel.edu.cn/2021/0722/c4066a275919/page.htm

[12]. Zhang, H., Li, L., Chen, T., & Li, V. (2016). Where will China’s real estate market go under the economy’s new normal? Cities, 55, 42–48. https://doi.org/10.1016/j.cities.2016.03.014

[13]. Zhang, W., Han, G., Ng, B., & Chan, S. W.-W. (2015). Corporate Leverage in China: Why Has It Increased Fast in Recent Years and Where Do the Risks Lie? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2597451

Cite this article

Wang,S.;Wang,F.;Wang,Q. (2024). The Impact of China's Financial Policies on the Real Estate Industry and Suggestions - A Case Study of Evergrande Group. Journal of Applied Economics and Policy Studies,4,50-57.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Adit Jacob & Suraj Nair. (2023). The historical political economy of Chinese housing regulation and price speculation. Journal of student-scientists' research.

[2]. Banerjee, A. V. (1992). A Simple Model of Herd Behavior. The Quarterly Journal of Economics, 107(3), 797–817. https://doi.org/10.2307/2118364

[3]. Costa, D. F., de Melo Carvalho, F., de Melo Moreira, B. C., & do Prado, J. W. (2017). Bibliometric analysis on the association between behavioral finance and decision making with cognitive biases such as overconfidence, anchoring effect and confirmation bias. Scientometrics, 111(3), 1775–1799. https://doi.org/10.1007/s11192-017-2371-5

[4]. Molnar, M., & Lu, J. (2019). State-owned firms behind China’s corporate debt. Www.oecd-Ilibrary.org. https://doi.org/10.1787/7c66570e-en

[5]. Mydhili Virigineni, & Madasu Bhaskara Rao. (2017). Contemporary Developments in Behavioural Finance. DergiPark (Istanbul University).

[6]. Nickerson, R. S. (1998). Confirmation bias: A ubiquitous phenomenon in many guises. Review of General Psychology, 2(2), 175–220. https://journals.sagepub.com/doi/10.1037/1089-2680.2.2.175

[7]. Shiller, R. J. (2016). Irrational Exuberance. Irrational Exuberance. https://doi.org/10.1515/9781400865536

[8]. Sun, Y., & Cao, Z. (2021). Financing Mode Analysis of Chinese Real Estate Enterprises – A Case Study of Evergrande Group. 2021 2nd Asia-Pacific Conference on Image Processing, Electronics and Computers. https://doi.org/10.1145/3452446.3452575

[9]. Tversky, A., & Kahneman, D. (1981). The Framing of Decisions and the Psychology of Choice. Science, 211(4481), 453–458. https://doi.org/10.1126/science.7455683

[10]. Weinstein, N. D. (1980). Unrealistic optimism about future life events. Journal of Personality and Social Psychology, 39(5), 806–820. https://doi.org/10.1037/0022-3514.39.5.806

[11]. Xia Zihang. (2021, Aprial). The Corporate Financialisation Cohort Effect: "Complementing Strengths" or "Blindly Following the Wind"? https://xuebao.zuel.edu.cn/2021/0722/c4066a275919/page.htm

[12]. Zhang, H., Li, L., Chen, T., & Li, V. (2016). Where will China’s real estate market go under the economy’s new normal? Cities, 55, 42–48. https://doi.org/10.1016/j.cities.2016.03.014

[13]. Zhang, W., Han, G., Ng, B., & Chan, S. W.-W. (2015). Corporate Leverage in China: Why Has It Increased Fast in Recent Years and Where Do the Risks Lie? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2597451