1 Introduction

This paper will attempt to identify how the Chinese banking system has developed over time, looking at how the role of the commercial banks have influenced economic growth. It will additionally attempt to evaluate the advantages and disadvantages of the banking industry to average retail consumer and how this is linked to economic growth by investing access to financial support in their business.

China's economic growth and the modernization of its institutions from purely socialistic in nature to ones with traits of market economies, has been a successful endeavor. The reforms have touched upon all institutions and all forms of life throughout the country. The Chinese banking system is a part of those reforms and is in the midst of a generational program of changes as it transitions to a more open system supportive of China's emergence into global economics after decades of communism and state ownership. The program began in the early 1980s and it continues to the present day [11].

On the development situation of the global banking industry, Economic and Financial Outlook Report 2022 believes that the economies of various countries are heading for recovery, and the profitability is recovering quickly. China's banking sector has become more positive, and its support for the real economy has been strengthened [3]. With the electronation, diversification and globalization of commercial banking business, the traditional market tends to be saturated, the marginal profit of traditional business is declining, and the business competition is becoming increasingly fierce. China's banking industry is facing the challenges of digitalization, cross-border operation, risk management and other new trends. With the promotion of RMB internationalization, the Bank of China is strengthening cooperation with overseas financial institutions. Banks are concurrently broadening the utilization of financial technology, augmenting the examination and exploitation of customer information, and realizing intelligent services. On China's economic and financial situation, the Third Quarter 2023 Economic and Financial Outlook Report believes that China's banking sector has helped play the fundamental role of consumption and the key role of investment, and has raised the level of capital adequacy on the basis of strict risk control. The third quarter of 2023's "Economic and Financial Outlook Report" demonstrates that the banking sector has augmented counter-cyclical backing for the real economy, with the magnitude of assets and liabilities continuing to grow [1].

The banking sector's institution building may be spurred on by China's entrance into the WTO, a question that has been posed. Currently China is one of the most monetised economies in the world. At the end of 1999, the loan to GDP ratio was 114 per cent. However, four large state-owned banks that have combined market shares in loans and deposits of over 70 per cent dominate the banking sector. Furthermore, interest rates are set centrally by the government and banks have little leeway in pricing risk. Although a program is in place to remove the stock of old bad debt from these four banks' balance sheets by transferring it to asset management companies, the likelihood of the state retaining ownership of these banks for the foreseeable future is high.

2 Research Review

2.1 Economic Growth

2.1.1 Overview

Economic growth is an important field of economics research, which involves the economic development and prosperity of countries, regions and societies. The term economic growth typically refers to the increase in the total economic output of a nation or area within a specific timeframe, often quantified by the gross domestic product (GDP) or GDP per person [21]. However, the definition of economic growth is not absolute, and different scholars and policymakers may emphasize different aspects and indicators. The distinction between nominal GDP and real GDP is clear: the former only gauges the actual cost of goods and services, while the latter is based on their monetary worth. The effect of inflation can be estimated through increases in nominal GDP (Amadeo, 2022). Nominal GDP is usually higher than real GDP because inflation is usually positive. One of the most common measures of economic growth GD per capita represents the economic value created by each person on average. So, GDP per capita is commonly used to measure a country's economic growth index along with more traditional GDP indicators. (Fernando, 2023)

The formula of GDP: GDP = consumption + investment + government expenditure + exports - imports [2]

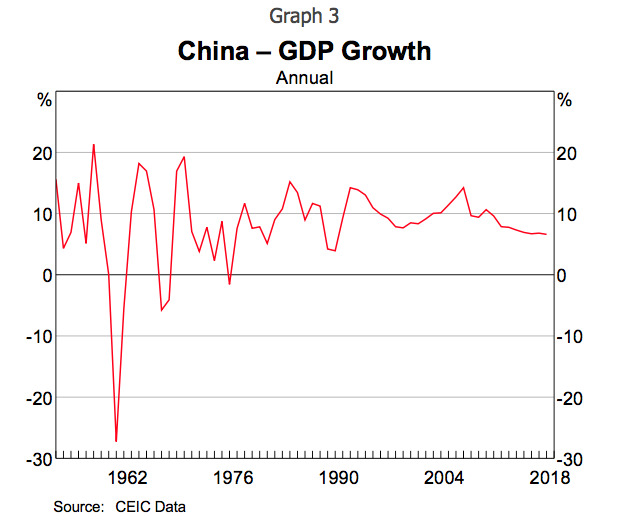

2.1.2 China’s Economic Growth

The speed and scale of China's economic transformation is unparalleled. In 1978, China was one of the poorest countries in the world. Following that, China's per capita GDP has increased by over 8% on average each year. The standard of living for its people has notably progressed, propelling China to its position as the world's second largest economy. While China did experience some economic growth between 1952 and 1978, it was largely driven by government investment and advances in education, while productivity actually regressed due to factors such as famine and the Cultural Revolution.

This strategy, which relies heavily on capital accumulation, is unsustainable and has serious consequences. The attempt to industrialize during the Great Leap Forward (1958-1960) not only did not increase GDP growth rates, but it also had a disastrous impact on agricultural output. When China experienced adverse weather conditions in 1959, a widespread famine occurred. This led to the Great Leap Forward Famine of 1959-1961, which resulted in a significant decrease in the workforce and hindered economic growth. The industrialization policies pursued by the Chinese government between 1952 and 1978 created unfavorable incentives and misallocation of resources, leading to a decline in aggregate productivity, recurrent food crises, and relatively little improvement in living standards [18]. Zhu brings in further detail [18]. While China is going through a Cultural Revolution and economic turmoil [18]. Zhu brings in further detail, claiming that how the Communist Government established the general policy of reform and opening up in 1978. Therefore, from 1978 to 2007, total factor productivity of state-owned and non-state-owned enterprises grew rapidly. The high growth rate of agricultural productivity causes workers to leave agricultural jobs, causing more and more labor to flow to other jobs, resulting in an increase in productivity benefits.

In the past four decades, China's Gross Domestic Product has grown to a staggering 74.35 trillion yuan, averaging 9.6 percent annually and representing an impressive 30-fold increase in total. However, it is worth noting that the growth rate has declined in recent years after accelerating from 1978 to 2007.China's economy has experienced rapid growth since the implementation of reform and opening up policies in recent years. Over the past decade, however, the pace has begun to slow. In 2019, China's per capita income exceeded $10,000. The COVID-19 epidemic has had a devastating effect on China, with economic growth of only 2.2% in 2020 and a mere 8.1% in 2021, due to stringent regulations. However, the faster spreading Omicron virus arrived in China in early 2022. China decided to continue its zero-coronavirus policy, but this resulted in very low GDP growth of just 3% in 2022. Now, China is struggling to reboot its economy, with an official growth target of 5 percent for 2023.

China is expected to face ongoing difficulties in its external environment due to a sharp decrease in global economic growth, the ongoing impact of COVID-19 during an economic decline, challenges within domestic industries, and trade conflicts with nations like the United States. The World Bank predicts a continued decrease in global economic growth to 2.1 percent in 2023, with a slight recovery to 2.4 percent by 2024. In the current grim situation, China faces enormous challenges, but the policies promulgated by the Chinese government are working to restore GDP growth.

Figure 1. Chinese GDP growth in past 50 years

2.1.3 Factors Affect Economic Growth

Many elements, including economy, politics, society, culture and more, shape economic growth. (Economics discussion, 2023)

From the perspective of the international background, real GDP, etc., the impact of these factors on economic growth may be positive or negative [14].

To be specific, first of all, natural resources play a vital role in economic development, such as land, minerals, oil resources, water, forests, climate and so on, relatively speaking, countries with a lot of natural resources enjoy good economic growth. However, the effective use of natural resources depends more on the skills and capabilities of human resources. For example, China has vast natural resources, but its human resources and technology are relatively backward, and its per capita GDP has not reached the level of developed countries.

The second point is human resources, the quality of which depends on education, skills and so on. Labor force has a direct impact on economic growth. Shortage will hinder economic development, while surplus labor force has little significance for economic growth. Instead, it will lead to rising unemployment and social instability. Therefore, a country's human resources should be sufficient in quantity, with skills and abilities to promote economic growth [22].

The third point is capital, capital formation depends on domestic savings, investment and foreign capital inflows. Physical capital is also divided into the first kind of machinery, equipment that helps produce goods. The second category is indirect capital, infrastructure such as electricity, transportation and so on [22]. The third category is called revolving capital, where capital continues to be invested in things like irrigation, fertilizers, etc. Capital accumulation contributes to economic growth by increasing productive capacity and providing more employment opportunities. Therefore, in order to obtain sufficient capital accumulation, the assistance of foreign capital is also needed. For example, China, a developing country, is competing with other developing country to attract foreign investors to increase the output, income and employment of developing countries, so as to improve the level of economic growth.

Fourth, entrepreneurship includes the economic system created by the entire production process and is the main source of economic growth. The catalysts of economic systems and technological advancement are entrepreneurs, as they utilize the three factors explained previously in the production of goods and services [22].

3 Banking Industry

3.1 Overview

Banking is an industry that processes cash, credit, and other financial transactions for individual consumers and businesses. Banking provides households and businesses with the liquidity they need to invest in the future, Banks provide account numbers to customers, so people can store and use their money in banks. Because it provides individuals, families, and organizations with resources to trade and invest, banking is of great value to the economy. One way the banking industry does this is by organizing and issuing loans for applicants, which they can use to buy a property, start a business or finance a college education. (Indeed, 2023)

The operation of banking depends on the holding of financial assets. Typically, banks take deposits from individuals or businesses and promise to withdraw the funds if the depositors want them. Depending on the type of account, banks may also pay interest on depositors' money while attracting more people to put their money in the bank. After accepting deposits, the bank then loans out the money to individuals and businesses, earning interest payments from borrowers in exchange. Banks make money by leveraging the spread between the interest rate paid to depositors and the interest rate charged to borrowers. In addition to loans, banks can invest their own money in other types of assets, such as government securities, to get a certain amount of capital backing and operate profitably [9].

3.2 Features of the Banking Industry

Banking is essential to the modern economy. As a major provider of credit, it provides money for people to buy cars and homes, and for businesses to buy equipment, expand their operations and pay salaries [9]. Banks also provide savers with a safe place to park their money, insure many accounts, and earn some interest on them. Banks provide credit cards, checking accounts, etc. to facilitate daily transactions.

Various categories exist within the banking sector, encompassing retail, commercial, corporate, and investment banks. Large global banks typically operate separate divisions for each category. An institution that furnishes financial services to both individuals and businesses of the public, a commercial or corporate bank is [9]. Commercial banks usually have physical branches and employ ticket makers and advisers who can help customers with deposits or withdrawals, loans, and protection of personal assets. Commercial banks can also help commercial customers obtain commercial loans so that they can use these loans to fund their operations. Retail banks operate similarly to commercial banks by providing financial services to public customers. However, retail banks typically serve individual customers only by helping them with their banking needs, not businesses as customers. Retail banks can help individual customers look after their money, open new checking and savings accounts for customers, facilitate their personal loans, and set up mortgages to help them buy property. Investment banks primarily serve large organizations, companies, and institutions that need investment help. Investment banks can help organize and confirm tasks such as mergers and acquisitions, issuing securities, and helping companies finance projects that require large amounts of capital. (Indeed, 2023) Unlike the banks mentioned above, central banks do not deal directly with the public. The Central bank is an independent body mandated by the government to oversee the country's money supply and monetary policy.

3.3 Chinese banking industry

From the establishment of the People's Republic of China, the banking sector in China has undergone various phases of growth. The initial stage began with the creation of the People's Bank of China in 1949.2018), the People's Bank of China, as the central bank of China, undertook the responsibility of issuing RMB, organizing and regulating currency circulation, and was also a commercial bank engaged in deposit, loan, exchange and foreign exchange business. At that time, Chinese banks had a wide coverage but a small volume of business.

From 1951 to 1979, the Agricultural Bank of China and the China Construction Bank were established successively. Before the reform and opening up, these banks mainly undertook policy tasks. For example, the Agricultural Bank of China mainly provided loans to support agriculture, and the China Construction Bank was mainly responsible for the investment allocation of national infrastructure construction. During this period, these banks were gradually separated from the People's Bank of China and became independent financial institutions.

Between 1979 and 1985, with the advance of reform and opening up, the Agricultural Bank of China and others began to restore their independent legal status, breaking the "grand unification" pattern of the People's Bank of China. This period was the initial stage of China's banking industry, and the business scope of banks gradually expanded.

Since the mid-1980s, China's banking industry has experienced rapid reform and development. Over time, the four leading specialized banks in China, including Industrial and Commercial Bank of China, Bank of China, China Construction Bank, and Agricultural Bank of China, have evolved and now dominate the country's banking sector. These banks gradually transformed from policy banks to commercial banks and began to expand their international business. At the same time, other joint-stock banks and local banks have also been established, further enriching the main composition of China's banking industry.

Following the turn of the century, China's banking sector has experienced substantial transformations in its framework. Many of the big banks are reforming and listing overseas. At the same time, with the opening of the financial market and the promotion of financial innovation, various new financial institutions, such as Internet financial companies and technology financial companies, have begun to rise, which has a profound impact on China's traditional banking business.

In general, China's banking industry has experienced great changes in the past 50 years from scratch, from small to large, from single to multiple. As a result of the reform and opening up policies, the banking sector in China has evolved and improved over time, playing a crucial role in bolstering the country's economic growth.

4 Effect of economic growth in banking industry

Ghossoub mentioned that a large number of macroeconomic studies focus on the role of financial market in economic development, and studies show that an active banking system is conducive to a higher economic growth rate. In addition to the stage of financial development, monetary policy also affects the process of development. The initial research revealed a correlation between inflation and slower economic expansion, yet the 2013 study demonstrated that the effect of monetary policy differs from nation to nation. Ghossoub's research shows that monetary policy can have completely different effects at different stages of financial development. Because policy transmission channels in developing countries are very different from those in developed countries, effective policies in developing countries face major challenges. Shan mentioned that China's financial development and economic development are particularly important, therefore, it is important to establish developed financial institutions, especially central bank independence and interest rate liberalization and sound financial intermediation, all of which are important for the efficient allocation of capital, which in turn helps to establish sustainable economic growth. In China and other countries, the prevalence of strong government control over banks is a common occurrence; however, when this ownership is elevated, financial progress, per capita income, and productivity growth become more sluggish.

Shan shows that China's economy is still a labor-intensive economy, and its main source of growth comes from the extensive use of labor force. Financial development has indeed contributed to China's GDP growth, and rapid changes in China's financial system have brought a large amount of credit into the Chinese economy. The fact that total credit contributes more to China's GDP growth than net investment implies that its main source of growth also comes from the widespread use of credit/resources at the expense of productive net investment. After labor and credit, trade is the second most important component of GDP. The effect of net investment on GDP is small and does not last much longer. China’s economic growth has been significantly impacted by financial development, as evidenced by the total bank credit. This is second only to labor in terms of its influence on economic growth. In view of this, the rapid reform and changes in China's financial system have brought a large amount of credit resources to the economy, thus boosting China's GDP growth. However, we also find that the strong economic growth of the past two decades has had a significant impact on financial development, as it provides a solid credit base (through increases in personal income and income).

5 Discussion / Development

5.1 The Correlation between the Banking Sector in China and the Nation's Economic Development.

5.1.1 Theory

There are several elements that influence Chinese banking industry, like capital allocation, banking services, risk events, banking structure, inflation and so on. And I will mainly focus on capital allocation and banking services. Because I think capital allocation converting funds a part of banking and being important to growth. Banking structure plays an important part in economic and inflation impacted by the banking sector and through the overall economy links to growth such as GDP, interests’ rates and so on.

5.1.1.1 Capital Allocation

Beck determined that capital allocation is a critical factor in economic expansion. In the course of economic growth, capital allocation is an essential part [25]. By judiciously allocating resources, economic efficiency can be improved and economic growth can be advanced. Specifically, Lin believes that it is important for China, as an emerging economy, to optimize the allocation of resources [17]. Bank loans are one of the main financing channels for enterprises. Optimizing the allocation of bank funds is conducive to providing enterprises with more timely and reasonable financing support and promoting enterprise development and economic growth. In terms of the development of the real economy, China's banking industry has provided important support to the real economy through credit issuance and other means. In addition, Xu also believes that to promote economic development, it is necessary to better deploy resources [28]. China's banking industry actively supports regional economic development by optimizing capital allocation. The bank promotes the coordinated development of regional economies by supporting investment and loans in different regions. At the same time, banks continue to optimize the credit structure, increase support for small and micro enterprises, rural areas and other areas, and promote the development of these areas.

As we all know, the capital allocation of banks is very important for economic development, and efficient industries often need more financial support to obtain more benefits. However, misallocation of capital often leads to great risks. Goel researched that overallocation of capital can lead to economic overheating and asset bubbles, increasing financial risks and economic instability. Moreover, Xu confirmed that China's banking industry has a problem of under-allocation of capital in certain sectors and industries [28]. For example, for emerging industries such as scientific and technological innovation and green energy, banks are often reluctant to invest too much capital because of the greater risk. This has led to the development of these industries being restricted and unable to obtain adequate financial support.

Capital allocation means deciding where a company spends its money in a way that increases efficiency and maximizes benefits. Zhang believes that in the process of economic growth, emerging economies such as China will experience technological bias and structural changes, which will lead to the deviation of resource allocation, especially the serious capital redundancy and resource mismatch in emerging economies, which will hinder the quality of economic growth. Therefore, as an emerging economy, China's social and industrial structure is unstable, and the capital allocation of developed countries is not suitable for China's national conditions, so China still needs to find a capital allocation suitable for its own national conditions. At present, it does not greatly promote economic growth [18].

In my opinion, the efficient allocation of resources by banks can promote economic development. For example, banks can provide credit funds to support and help enterprises develop, and they can also provide capital investment in a certain region to promote regional economic development. Despite its burgeoning economy, China still faces numerous issues, including a lack of proper distribution of capital and resources, as well as redundancy and an absence of resources. China also needs to explore the allocation of capital in order to find the most suitable way to play a catalytic role.

5.1.2 Banking Structure

I think the strength of the banking structure can contribute a lot to economic growth. More than half of the assets in China's banking sector are owned by state-owned banks, so the government has strict controls on lending risk in the banking sector, which facilitates a high degree of transparency in lending, equity offerings and investments. In addition, after China's accession to WTO in 2001, the banking organization was transformed and the amount of foreign investment increased greatly, which also led to the acceleration of domestic economic growth. Therefore, China's banking industry increased its products and services through diversification in the joint venture, which also promoted economic growth. But because the government has too much power, it may lead to official autocracy and undermine the advantages of the banking system. But overall, I think the advantages outweigh the disadvantages at this stage.

The financial sector is essential for promoting a nation's economic advancement, ensuring effective allocation of credit, and supporting the growth of businesses. Wang believes that China's banking industry has a high degree of concentration, and its assets and market shares [26]. The majority of banking services are centralized within the four state-owned commercial banks, which could detrimentally affect the economies of less affluent nations. As China joins the WTO, the growth of its banking sector resulting from the presence of foreign banks may enhance resource allocation efficiency. Additionally, increased competition in the banking industry can help stimulate economic development. growth. Therefore, the study shows that the high concentration of Chinese banks has a negative impact on economic growth, but the impact is not obvious. According to Cui, the structural variables of banking industry are significantly negatively correlated with the amount of economic growth, indicating that the optimization of banking concentration can significantly promote economic growth and exert a more obvious influence on provinces and regions with higher marketization level, thus promoting the development of local economy to a greater extent. In general, Wu demonstrates China's support for the growth of small and medium-sized banks, indicating that the rise in the representation of these banks within the banking system will greatly boost China's overall economic progress [27]. According to Yuan, the financial system in a developing China with a plentiful labor force should consist of small and medium-sized regional banks that offer financial services to small and medium-sized businesses [18]. Yuan emphasizes that the uneven development of the banking market structure is a key factor impacting regional economic growth, leading to the conclusion that optimizing the banking structure can be beneficial for economic growth.

5.1.3 Inflation

Inflation also appears to be a complicating factor for economic growth. According to Christopher, after 15 years of economic reform, the most significant feature of China's economy today is high economic growth and inflation. The following aspects mainly demonstrate the beneficial effect of inflation on economic expansion. First, moderate inflation can boost consumption and investment. Inflationary conditions lead to a decrease in the real purchasing power of money, causing people to be more likely to invest and consume ahead of time, thus stimulating market demand and economic growth. Second, inflation reduces the burden of debt. For debtors, rising prices due to inflation mean a reduction in the real debt burden, which helps to reduce debt pressure and stimulate economic growth [3].

However, inflation can also have a negative impact on economic growth. Inflation will lead to a decline in the efficiency of resource allocation. Due to rising prices, producers are more inclined to produce high-priced goods, while consumers are more inclined to buy low-priced goods, resulting in lower resource allocation efficiency. China's inflation is mainly generated by over-investment and unproductive development in the eastern region, which is financed by excessive money printing and central budget deficits, but the adverse effects of inflation are mainly borne by poor areas.

5.2 Positive/negative impacts and elements of the banking industry

I think the development of banking and economic growth go hand in hand. China is a developing country, and the credit services provided by banks can, to a large extent, provide capital flow for China to support the development of enterprises, thus promoting economic development. But bank financing above optimal levels is bad for growth.

Tongurai argues that international capital flows have a direct impact on economic growth and an indirect impact on the banking sector and overall financial development, and that foreign capital inflows increase financial resources in the domestic economy, reduce financial restrictions on companies, promote domestic investment, and subsequently promote economic growth [23]. As the banking system expanded and became more sophisticated, it may have transformed into a more information-driven economy. Toguri noted that most academics think the bond between financial growth and economic expansion is twofold, with economic growth being beneficial for the advancement of the banking sector. Nonetheless, the research indicates that the influence of financial advancement on economic expansion differs across sectors, dissecting economic growth into sector-specific increments and highlighting the significant role played by both agricultural and industrial sector growth in fostering the advancement of the banking sector. In other words, economic growth can be a one-way street in promoting the development of banking. Fufa contends that the influence of financial intermediaries and markets on expansion may differ depending on a nation's economic development stage, thus demonstrating that the connection between financial advancement and economic growth is contingent upon the country's economic growth level being examined. The research reveals that bank credit is an influential element in economic growth; however, the correlation between economic growth and bank development is not necessarily advantageous. Law found that the level of financial development can only increase to a certain threshold. Beyond the threshold level, further financial development tends to have an adverse impact on growth [15]. And more bank financing is not necessarily conducive to economic growth, the "optimal" level of financial development is more critical to promote growth.

5.3 Future Development of the Banking Industry

My belief is that the banking sector in China has a powerful correlation to economic expansion. Banks are responsible for providing credit, which can lead to more loans and capital flow, thus allowing consumers and businesses to access additional funds. Additionally, companies' increased expenditure can also boost GDP and economic growth. Banks can also provide interest to customers to deposit money, which can boost the savings rate of customers. The higher the interest rate, the more principal the bank can earn, and the more money it can lend to businesses, regions, or governments, the better to facilitate the circulation of money. On the other hand, if the interest rate is lower, there will be fewer customers to save money, consumption will be stimulated, and money will be able to circulate in the market to boost GDP. In the 1970s, people usually paid in cash in their daily life, but since the establishment of the Bank of China, people have gradually realized the advantages of bank accounts and credit, which can make money make money. It also contributes a lot to economic growth, so banking is inseparable from economic growth. However, there are other aspects of promoting economic growth that have nothing to do with banks, such as government policies, such as China's accession to the WTO in 2001, foreign capital has been invested in a large part to promote economic development, and Sino-foreign joint ventures have enabled Chinese enterprises to continue to develop. Since the implementation of the two-child policy, China's population has also increased rapidly, which has undoubtedly brought a large number of labor force and GDP growth to China.

Chen's report points to more prominent structural problems and divergence in the global economy in the areas of consumption, employment and inflation, which is expected to further drag on global economic growth [18]. For China's economy, as the impact of the novel coronavirus epidemic has subsided significantly and policies to stabilize the economy have been given top priority, China's economy is recovering and maintaining a good economic momentum.

On the development of the global banking sector, Wang report concluded that the world economy has been facing growth challenges in 2023, and continued sharp interest rate hikes in major economies have triggered financial turbulence [16]. Global bank assets are contracting while banking businesses are under increasing pressure, which is undermining earnings growth and capital replenishment. In contrast, China's banking environment is improving across the board as the domestic economic recovery gathers momentum. Fiscal and monetary policies are working effectively. Financial regulators need to focus on advancing reforms, strengthening weaknesses, promoting development, improving living standards and preventing risks, and guiding the sound growth of the financial sector in a sound ecosystem of competition and cooperation. Against this backdrop, China's banking sector has maintained rapid expansion in an improving environment, demonstrating a steady recovery in profitability, sound asset quality and capital adequacy. Overall, in the post-pandemic era, the global and Chinese banking environment has undergone profound changes, and new developments are needed.

6 Conclusion

The 2008 financial crisis not only made people cognizant of the perils of financial derivatives, but also unmistakably illustrated the close bond between finance and the economy. Finance, as a driving force for economic development, gathers social funds and allocates idle funds in a reasonable manner to further improve the efficiency of fund utilization and achieve rapid economic development. A sound financial market mechanism and efficient operating model can provide an appropriate and relaxed development environment for the economy, achieving rapid economic development. The financial industry is currently composed of banks, insurance, securities, trusts, and leasing, but in China's special economic development model, the development of the banking industry is highly valued. Researchers in China have examined the influence of the banking sector on the country's economic development. Huang Chao focused primarily on how the structure of the banking industry affects economic growth [5]. After analyzing the market structure of China's banking industry and investigating its impact on economic development, it was concluded that a notable correlation exists between the industry structure and economic growth. Nonetheless, reforming the banking structure is a challenging and time-consuming endeavor, making it less practical. Xu Yanjie selected two sets of data: data related to the development of the banking industry and data related to economic development [28]. Through correlation analysis, the impact of banking development on economic development was ultimately obtained. However, in terms of selecting economic indicators, the selected indicators are too single, and their reliability and representativeness are poor. This article mainly analyzes the positive and negative impacts of the banking industry on economic growth. The study's primary findings are that, in the course of economic growth, financial development and economic expansion remain closely intertwined; however, it is hard to determine the cause-and-effect relationship between them. The question of whether financial development drives economic growth or vice versa has sparked debate among academics. According to the viewpoint of economic progress, a robust financial system is essential during the economic growth phase to facilitate effective and swift expansion. The financial system, with its efficient operation, can detect industries that have the potential for growth during economic development and make full use of its fund allocation capacity to allocate idle social funds to those industries that are beginning to thrive, thus leading to swift economic expansion. The development of finance is undeniably bolstered by economic expansion, which will inevitably result in an augmented stock of social capital and a greater liquidity of funds. Traditional credit is difficult to meet people's needs for investment and wealth management. Therefore, under the stimulation of economic growth, the financial industry will inevitably accelerate financial innovation and meet people's needs for financial development.

References

[1]. Bank of China. (2023, June 17). Economic and Financial Outlook Report 2022. Available at: https://www.boc.cn/aboutboc/bi1/202111/t20211130_20368939.html

[2]. Bank of China. (2023, July). Economic and Financial Outlook for the third quarter of 2023. Available at: https://www.boc.cn/aboutboc/bi1/202307/t20230703_23314068.html

[3]. Bank of China. (2021). The Bank of China Research Institute released the "2022 Economic and Financial Outlook Report.". Available at: https://www.boc.cn/aboutboc/bi1/202111/t20211130_20368939.html [Accessed March 8, 2024].

[4]. Banton, C. (2019). Introduction to the Chinese Banking System. Investopedia. Available at: https://www.investopedia.com/articles/economics/11/chinese-banking-system.asp.

[5]. Bonin, J. P., & Huang, Y. (2012). China’s opening up of the banking system: Implications for domestic banks. JSTOR. Available at: https://www.jstor.org/stable/j.ctt24hcck.10.

[6]. Bruegel. (2023). Can Chinese growth defy gravity? Bruegel | The Brussels-based economic think tank. Available at: https://www.bruegel.org/policy-brief/can-chinese-growth-defy-gravity.

[7]. Chinafund. (n.d.). China’s Banking System: Past, Present and Future – Welcome to ChinaFund.com. Available at: https://chinafund.com/china-banking-system/ [Accessed March 8, 2024].

[8]. Du, Y., Li, Y., Li, Y., Ma, Y., He, T., Kong, H., Li, Y., Lei, S., Zhe, W., Xin, H., Bo, Y., Lei, J., York, N., Huang, Y., & Brazil. (2023). BOC Research Institute Global Banking Sector Outlook Highlights 2023Q2 (Issue 54). Available at: https://pic.bankofchina.com/bocappd/rareport/202304/P020230427552203361737.pdf [Accessed March 8, 2024].

[9]. Hall, M. (2021). What is the banking sector? Investopedia. Available at: https://www.investopedia.com/ask/answers/032315/what-banking-sector.asp.

[10]. Indeed Editorial Team. (2021). The Banking Industry: Definition, Trends and Key Terms. Indeed Career Guide. Available at: https://www.indeed.com/career-advice/career-development/banking-industry.

[11]. Investopedia. (2022.). What Is Economic Growth and How Is It Measured? Available at: https://www.investopedia.com/terms/e/economicgrowth.asp#Understanding%20Economic%20Growth [Accessed March 8, 2024].

[12]. Investopedia. (2023). How Banking Works, Types of Banks, and How To Choose the Best Bank for You. Available at: https://www.investopedia.com/terms/b/bank.asp#How%20Are%20Banks%20Regulated [Accessed March 8, 2024].

[13]. Koivu, T. (2002). Do efficient banking sectors accelerate economic growth in transition countries? BOFIT Discussion Papers. Available at: https://ideas.repec.org/p/zbw/bofitp/bdp2002_014.html [Accessed March 8, 2024].

[14]. Kumar, S. (2024). Factors Affecting Economic Growth – Indian Economy Notes. Prepp. Available at: https://prepp.in/news/e-492-factors-affecting-economic-growth-indian-economy-notes#Factors.

[15]. Law, S. H., & Singh, N. (2014). Does too much finance harm economic growth? Journal of Banking & Finance, 41, 36–44. doi: https://doi.org/10.1016/j.jbankfin.2013.12.020.

[16]. Liang, J., Zhao, T., Fan, R., Liang, S., Ye, Y., Liu, C., Wu, D., Qiu, Y., Liu, P., Wang, J., Zhang, W., & Kong, H. (2023). Sources: BOC Research %. Available at: https://pic.bankofchina.com/bocappd/rareport/202304/P020230427551723989307.pdf [Accessed March 8, 2024].

[17]. Lin, J. Y., Sun, X., & Wu, H. X. (2015). Banking structure and industrial growth: Evidence from China. Journal of Banking & Finance, 58, 131–143. doi: https://doi.org/10.1016/j.jbankfin.2015.02.012.

[18]. Lu, Y., Zhang, Y., Cao, X., Wang, C., Wang, Y., Zhang, M., Ferrier, R. C., Jenkins, A., Yuan, J., Bailey, M. J., Chen, D., Tian, H., Li, H., von Weizsäcker, E. U., & Zhang, Z. (2019). Forty years of reform and opening up: China’s progress toward a sustainable path. Science Advances, 5(8), eaau9413. doi: https://doi.org/10.1126/sciadv.aau9413.

[19]. Nordqvist, C. (2019). How Does Banking Affect the Economy? Market Business News. Available at: https://marketbusinessnews.com/how-does-banking-affect-the-economy/198432/.

[20]. Roberts, I., & Russell, B. (2019). Long-term growth in China | Bulletin – December 2019. Available at: https://www.rba.gov.au/publications/bulletin/2019/dec/long-term-growth-in-china.html#fn0.

[21]. Roser, M. (2013). Economic Growth. Our World in Data. Available at: https://ourworldindata.org/economic-growth.

[22]. Ross, S. (2019). Why are the factors of production important to economic growth? Investopedia. Available at: https://www.investopedia.com/ask/answers/040715/why-are-factors-production-important-economic-growth.asp.

[23]. Tongurai, J., & Vithessonthi, C. (2018). The impact of the banking sector on economic structure and growth. International Review of Financial Analysis, 56, 193–207. doi: https://doi.org/10.1016/j.irfa.2018.01.002.

[24]. U.S. Bank. (2023). Analysis: China’s Economy and Its Influence on Global Markets. Available at: https://www.usbank.com/investing/financial-perspectives/market-news/chinas-economic-influence.html.

[25]. Van, M., Lambert, T., & Beck, T. (2022). How banks affect investment and growth: New evidence. Available at: https://cepr.org/voxeu/columns/how-banks-affect-investment-and-growth-new-evidence.

[26]. Wang, H. (2002). Banking Structure and Economic Development: Empirical analysis of Chinese banking industry. Available at: https://jjxj.swufe.edu.cn/CN/article/downloadArticleFile.do?attachType=PDF&id=1362.

[27]. Wu, J., & Kang, J. (2021). The influence of banking structure on regional economic development: Theoretical and empirical tests based on new structural finance. Journal of Lanzhou University (Social Sciences), 49(1). doi: https://doi.org/10.13885/j.issn.1000-2804.2021.01.001.

[28]. Zhou, M., Li, Y.-J., Tang, Y.-C., Hao, X.-Y., Xu, W.-J., Xiang, D.-X., & Wu, J.-Y. (2022). Apoptotic bodies for advanced drug delivery and therapy. Journal of Controlled Release, 351, 394–406. doi: https://doi.org/10.1016/j.jconrel.2022.09.045.

Cite this article

Su,Y. (2024). To What Extent Did the Chinese Banking Industry Affect China’s Economic Growth in Past 50 Years?. Journal of Applied Economics and Policy Studies,10,6-14.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Bank of China. (2023, June 17). Economic and Financial Outlook Report 2022. Available at: https://www.boc.cn/aboutboc/bi1/202111/t20211130_20368939.html

[2]. Bank of China. (2023, July). Economic and Financial Outlook for the third quarter of 2023. Available at: https://www.boc.cn/aboutboc/bi1/202307/t20230703_23314068.html

[3]. Bank of China. (2021). The Bank of China Research Institute released the "2022 Economic and Financial Outlook Report.". Available at: https://www.boc.cn/aboutboc/bi1/202111/t20211130_20368939.html [Accessed March 8, 2024].

[4]. Banton, C. (2019). Introduction to the Chinese Banking System. Investopedia. Available at: https://www.investopedia.com/articles/economics/11/chinese-banking-system.asp.

[5]. Bonin, J. P., & Huang, Y. (2012). China’s opening up of the banking system: Implications for domestic banks. JSTOR. Available at: https://www.jstor.org/stable/j.ctt24hcck.10.

[6]. Bruegel. (2023). Can Chinese growth defy gravity? Bruegel | The Brussels-based economic think tank. Available at: https://www.bruegel.org/policy-brief/can-chinese-growth-defy-gravity.

[7]. Chinafund. (n.d.). China’s Banking System: Past, Present and Future – Welcome to ChinaFund.com. Available at: https://chinafund.com/china-banking-system/ [Accessed March 8, 2024].

[8]. Du, Y., Li, Y., Li, Y., Ma, Y., He, T., Kong, H., Li, Y., Lei, S., Zhe, W., Xin, H., Bo, Y., Lei, J., York, N., Huang, Y., & Brazil. (2023). BOC Research Institute Global Banking Sector Outlook Highlights 2023Q2 (Issue 54). Available at: https://pic.bankofchina.com/bocappd/rareport/202304/P020230427552203361737.pdf [Accessed March 8, 2024].

[9]. Hall, M. (2021). What is the banking sector? Investopedia. Available at: https://www.investopedia.com/ask/answers/032315/what-banking-sector.asp.

[10]. Indeed Editorial Team. (2021). The Banking Industry: Definition, Trends and Key Terms. Indeed Career Guide. Available at: https://www.indeed.com/career-advice/career-development/banking-industry.

[11]. Investopedia. (2022.). What Is Economic Growth and How Is It Measured? Available at: https://www.investopedia.com/terms/e/economicgrowth.asp#Understanding%20Economic%20Growth [Accessed March 8, 2024].

[12]. Investopedia. (2023). How Banking Works, Types of Banks, and How To Choose the Best Bank for You. Available at: https://www.investopedia.com/terms/b/bank.asp#How%20Are%20Banks%20Regulated [Accessed March 8, 2024].

[13]. Koivu, T. (2002). Do efficient banking sectors accelerate economic growth in transition countries? BOFIT Discussion Papers. Available at: https://ideas.repec.org/p/zbw/bofitp/bdp2002_014.html [Accessed March 8, 2024].

[14]. Kumar, S. (2024). Factors Affecting Economic Growth – Indian Economy Notes. Prepp. Available at: https://prepp.in/news/e-492-factors-affecting-economic-growth-indian-economy-notes#Factors.

[15]. Law, S. H., & Singh, N. (2014). Does too much finance harm economic growth? Journal of Banking & Finance, 41, 36–44. doi: https://doi.org/10.1016/j.jbankfin.2013.12.020.

[16]. Liang, J., Zhao, T., Fan, R., Liang, S., Ye, Y., Liu, C., Wu, D., Qiu, Y., Liu, P., Wang, J., Zhang, W., & Kong, H. (2023). Sources: BOC Research %. Available at: https://pic.bankofchina.com/bocappd/rareport/202304/P020230427551723989307.pdf [Accessed March 8, 2024].

[17]. Lin, J. Y., Sun, X., & Wu, H. X. (2015). Banking structure and industrial growth: Evidence from China. Journal of Banking & Finance, 58, 131–143. doi: https://doi.org/10.1016/j.jbankfin.2015.02.012.

[18]. Lu, Y., Zhang, Y., Cao, X., Wang, C., Wang, Y., Zhang, M., Ferrier, R. C., Jenkins, A., Yuan, J., Bailey, M. J., Chen, D., Tian, H., Li, H., von Weizsäcker, E. U., & Zhang, Z. (2019). Forty years of reform and opening up: China’s progress toward a sustainable path. Science Advances, 5(8), eaau9413. doi: https://doi.org/10.1126/sciadv.aau9413.

[19]. Nordqvist, C. (2019). How Does Banking Affect the Economy? Market Business News. Available at: https://marketbusinessnews.com/how-does-banking-affect-the-economy/198432/.

[20]. Roberts, I., & Russell, B. (2019). Long-term growth in China | Bulletin – December 2019. Available at: https://www.rba.gov.au/publications/bulletin/2019/dec/long-term-growth-in-china.html#fn0.

[21]. Roser, M. (2013). Economic Growth. Our World in Data. Available at: https://ourworldindata.org/economic-growth.

[22]. Ross, S. (2019). Why are the factors of production important to economic growth? Investopedia. Available at: https://www.investopedia.com/ask/answers/040715/why-are-factors-production-important-economic-growth.asp.

[23]. Tongurai, J., & Vithessonthi, C. (2018). The impact of the banking sector on economic structure and growth. International Review of Financial Analysis, 56, 193–207. doi: https://doi.org/10.1016/j.irfa.2018.01.002.

[24]. U.S. Bank. (2023). Analysis: China’s Economy and Its Influence on Global Markets. Available at: https://www.usbank.com/investing/financial-perspectives/market-news/chinas-economic-influence.html.

[25]. Van, M., Lambert, T., & Beck, T. (2022). How banks affect investment and growth: New evidence. Available at: https://cepr.org/voxeu/columns/how-banks-affect-investment-and-growth-new-evidence.

[26]. Wang, H. (2002). Banking Structure and Economic Development: Empirical analysis of Chinese banking industry. Available at: https://jjxj.swufe.edu.cn/CN/article/downloadArticleFile.do?attachType=PDF&id=1362.

[27]. Wu, J., & Kang, J. (2021). The influence of banking structure on regional economic development: Theoretical and empirical tests based on new structural finance. Journal of Lanzhou University (Social Sciences), 49(1). doi: https://doi.org/10.13885/j.issn.1000-2804.2021.01.001.

[28]. Zhou, M., Li, Y.-J., Tang, Y.-C., Hao, X.-Y., Xu, W.-J., Xiang, D.-X., & Wu, J.-Y. (2022). Apoptotic bodies for advanced drug delivery and therapy. Journal of Controlled Release, 351, 394–406. doi: https://doi.org/10.1016/j.jconrel.2022.09.045.