1 Introduction

In the financial ecosystem of the modern world, global markets are so intricate and entangled that risk management must be highly sophisticated. Old-school risk management models have always been essential components of financial practitioners’ tools, yet often these models are built on a foundation of fixed parameters and data points from the past that may be underrepresentative of changing markets. With the rise of Artificial Intelligence (AI), the model can be further enhanced and can extract massive amounts of information and recognize complex patterns in them that are impossible with traditional techniques. AI tools, notably machine learning and deep learning, enable banks to predict risks far better. AI-based models, for instance, can change dynamically with the market and make it easy for traders to act rapidly on new risks and opportunities. Second, AI enables modelling volatility and stress testing with a more sophisticated perspective on how assets might behave in different environments. Furthermore, the integration of other data sources (for example, social media sentiment and macroeconomic data) in AI models creates a holistic approach to risk-analysis. Yet there are issues associated with the application of AI in finance, namely model parsimony and regulatory compliance [1]. This paper will present the broader application of AI to financial risk management, its strengths, uses, and where it stands for the future of quantitative trading.

2 Advancements in AI Applications for Financial Risk Management

2.1 AI in Volatility Prediction

One task particularly relevant to risk management in quant trading is volatility prediction. Models such as GARCH (generalised autoregressive conditional heteroskedasticity) have been around for years and, wherever market volatility is conducive to such conventional modelling, these approaches have been applied to forecast market volatility. However, in highly volatile, non-linear trading environments, GARCH and other similar statistical approaches can be relatively poor at prediction. AI approaches such as machine-learning models (MLMs) can provide much-improved predictive accuracy, though, as these techniques allow more complex patterns and relations to be captured in the training of the algorithms [2]. For instance, deep learning models, in particular Recurrent Neural Networks (RNNs), have been applied to predict volatility, and these approaches have proven very effective. Among other things, these models can be used to capture time-series dependencies (in contrast with other machine-learning approaches) and are more adept at capturing sentiment and shifts in volatility. AI-based models can enhance prediction accuracy and thus allow traders to react more dynamically to market conditions in real time (thereby minimising exposure to risk).

2.2 AI-Enhanced Portfolio Optimization

Portfolio optimization is another area where Al has made significant strides. Classical approaches like mean-variance optimization rely on the assumption of normally distributed returns and often fail to capture the real-world dynamics of financial markets. Al-based techniques, particularly reinforcement learning, have shown promise in addressing these limitations. The objective function for Al-enhanced portfolio optimization can be expressed as follows:

\( \underset{w}{max}(E[R(w)]-λ\cdot Var(R(w))) \) (1)

where w represents the portfolio weights, \( E[R(w)] \) is the expected return based on market data, and Var \( (R(w)) \) is the variance of the portfolio return. Reinforcement learning algorithms can continuously learn and adapt portfolio weights based on market data, making them highly effective in dynamic environments. Moreover, machine learning techniques such as decision trees and support vector machines (SVMs) are being used to model the risk-return trade-off more accurately, considering non-linear relationships between assets. This leads to more robust portfolios that can adapt to changing market conditions while minimizing risk. Additionally, Al-driven optimization models can incorporate alternative data sources, such as social media sentiment and macroeconomid indicators, to enhance decision-making and improve portfolio resilience against unforeseen market shocks.

2.3 AI in Stress Testing and Scenario Analysis

When it comes to risk management, one of the most important uses of stress testing is to help firms understand how their portfolios might respond during periods of market stress. Typically, firms might use pre-defined stress scenarios (eg, a Black Monday type of market crash) or employ ‘scenario generation’ to create hypothetical but plausible market environments. But while perfectly plausible, such pre-defined scenarios could be limited in their nuance and scope or, alternatively, overly complex. AI-powered stress testing helps to overcome the limitations of these models by enabling dynamic stress scenario construction. AI models can leverage large amounts of structured and unstructured data from historical and real-time market data to construct more credible and nuanced stress scenarios. For example, stress testing models could draw on unsupervised learning methods, such as clustering algorithms that can identify patterns of instability in the market, which can then be used to inform the design of more realistic scenarios [3]. Furthermore, and in contrast to stress testing involving a small set of pre-defined scenarios, an AI model typically constructed after training on a large amount of market data can continue to update and refine stress scenarios in the presence of new data, continuously improving the risk assessment.

2.4 Interpretable AI in Financial Risk Management

One of the major challenges in integrating AI into financial risk management is the interpretability of AI models. While AI techniques like deep learning offer superior predictive performance, they are often criticized for being 'black boxes,' where the decision-making process is not transparent. This lack of interpretability can be problematic in highly regulated industries like finance, where transparency and accountability are critical [4]. To address this issue, researchers are developing interpretable AI models, such as explainable machine learning techniques that provide insights into how specific features contribute to risk predictions. For instance, SHAP (Shapley Additive Explanations) values can be used to interpret the output of complex models, helping traders and risk managers understand the rationale behind AI-driven decisions. By enhancing the interpretability of AI models, firms can build greater trust in AI tools, ensuring that they are used responsibly and in compliance with regulatory standards.

3 AI in Risk-Based Asset Pricing Models

Risk-based asset pricing models, which attempt to show how expected returns are related to risk factors, are another area where AI shines. The widely used Capital Asset Pricing Model (CAPM) and Fama-French multi-factor models can be used to explain the normal relationship between risk, expected return, and complex portfolios. However, these models suffer from the ‘linear factor problem’, which means that they take the relationship between risk and expected return as fixed and fail to account for dynamic market factors in real time. AI-based models, though, can incorporate non-linear interaction among multiple risk factors in a more flexible and efficient manner to generate real-time pricing information. By analysing the causal relationships between risk factors, machine learning algorithms such as neural networks and gradient-boosting trees can detect hidden patterns in financial data and predict asset prices with greater precision than traditional models. AI models can also process alternative data, such as market sentiment and economic indicators, which can better elucidate the factors driving asset prices [5]. This is especially important when sudden events occur in the market, as traditional asset pricing models often struggle to adapt quickly to new information. AI-driven asset pricing models can adjust to changes in market conditions in real time, reducing the risk of mispricing and potentially generating better trading and investment results for traders and investors.

3.1 Incorporating Alternative Data into Asset Pricing

AI and market-moving. Classical asset- and rely on historical price values for explaining the prediction Consequently, models that incorporate complementary data can assessment of what drives asset NLP techniques can offer insights into sentiment from online social media, which could not be captured by a. AI models learn to predict asset prices by mining textual data from social media, financial news feeds and economic reports. a large amount of data in real time and can thus adjust asset prices in a timely manner. trading, AI models can capture how the market sentiment evolves and change their predictions in line with how This can lead to more accurate and timelier asset pricing compared with traditional pricing methods, allowing traders to make informed decisions and reduce the risk of investing in Case study: SHAP values for explaining the prediction of risk for an asset The table shows a caseates that feature’s for the final price of.76, which indicates its role in predicting the risk of the asset. Financial professionals can learn what features contribute to the predictions of risk, improving the transparency of risk models and demonstrating that risk models are based on relevant information. This approach can foster trust between regulators and model-use agencies in the people involved in developing and deploying AI-driven tools [6].

Table 1. Case Study of Interpretable AI in Financial Risk Management Using SHAP Values

Feature |

Value |

SHAP Value |

Contribution to Risk Prediction |

Interpretation |

Historical Volatility |

15% |

0.25 |

Positive |

Higher historical volatility increases the perceived risk of the asset. |

Market Sentiment |

-0.1 |

-0.15 |

Negative |

Negative market sentiment decreases risk, suggesting cautious trading. |

Economic Indicator |

2.5 |

0.20 |

Positive |

Strong economic indicators positively impact the asset's stability. |

Asset Liquidity |

$1M |

0.10 |

Positive |

Higher liquidity reduces trading risk, making the asset more attractive. |

News Impact |

-1 |

-0.30 |

Negative |

Adverse news events significantly increase perceived risk. |

Regulatory Compliance |

100% |

0.05 |

Positive |

Full compliance with regulations reduces risk perception. |

3.2 Non-Linear Modeling of Risk Factors

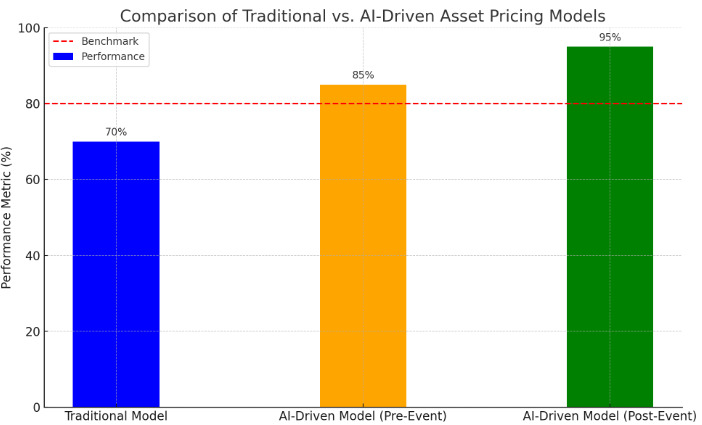

Figure 1. Comparison of Traditional vs. AI-Driven Asset Pricing Models

The traditional asset pricing models assume linear relationships between different risk factors and asset returns, an oversimplification of the complex realities of market behaviour. Deep learning techniques are particularly well-suited to modelling multiple, complex, non-linear relationships between risk factors, and thus may better estimate complex underlying returns dynamics in the real world. These models can derive additional information from large datasets, and be better at detecting complex non-linear patterns that other methods might miss. AI models can, for example, capture the non-linear effects of factors such as liquidity, market volatility and investor sentiment on asset prices, providing a much closer fit to how the market works. This is especially useful during periods of market turbulence, when there is greater uncertainty around the relationship between risk factors and asset returns [7]. Able to better distinguish between types of market volatility, AI/ML models can produce richer information for making risk assessments, and aid in better risk-adjusted asset allocation decisions.

3.3 Dynamic Adaptation to Market Changes

Another important benefit of AI-based asset pricing is that the parameters of the models are not static but dynamically change depending on market conditions. In contrast to AI, most traditional models of asset pricing are static. As a result, these models rely heavily on historical data. However, this information determines only very general properties of a specific model. Thus, when a market regime changes, the simplified models typically fail to represent the data accurately. For example, in periods of turbulent markets with largeitional mean of asset returns proxy for the return distribution, since the market regime changes constantly. Fortunately, AI models can continuously adapt to changing market conditions by learning new data. [8] This dynamic self-adaptation based on real-time prices is a clear advantage of AI-driven models, making them more attractive and useful for complex markets that can shift rapidly in response to unexpected events. For instance, reinforce to adapt a pricing model continuously to new market data.

4 AI-Powered Sentiment Analysis in Risk Assessment

Sentiment analysis is a staple of modern financial risk assessment, and especially of financial risk assessment in an era of social media and 24-hour news cycles. The real-time understanding of market sentiment, via large volumes of text data, whether from news articles, financial disclosures or social media platforms, enables traders and risk managers to gain insights about market behaviours and anticipate potential shifts and reactions by market participants.

4.1 Natural Language Processing in Sentiment Analysis

Natural Language Processing (NLP) is the discipline of AI that supports machines to process human language. In the context of risk analysis in the financial sector, NLP trained to extract information about Feeding thousands of newspapers or tweets on an sentiment scores will reveal market participants’ mood in real time, thereby providing risk ability to dynamically change instance, news headlines convey a substantial amount of information about an activity or about an event. Large is one of the ways that NLP is applied [9]. Sentiment analysis refers to the process of determining the emotions or attitudes contained in a piece of text, whether it’s an article, news or a tweet. With the help of NLP, it is possible to go beyond the traditional risk modelling and incorporate how market participants or investors feel about certain stocks and about market conditions in real time.

4.2 Sentiment as a Leading Indicator of Market Risk

Perhaps the most promising use for sentiment analysis is as a leading indicator of market risk. Typically risk models have relied on historic price data and market volatility measures, both of which can be lagging indicators. Sentiment analysis could provide early warning signals by picking up shifts in investor sentiment before they show up in price data. For example, a sudden surge of negative sentiment on a particular stock might indicate that market participants are anticipating some bad news, such as disappointing earnings or even a broader market downturn. With sentiment data in hand, traders could shift portfolios to minimise risk if they expected a market event to change prices. This would provide a more proactive approach to risk management, reducing the magnitude of losses in periods of volatility.

4.3 AI-Based Tools for Real-Time Sentiment Monitoring

Automated sentiment analysis tools also allow for real-time monitoring of market sentiment. These tools use machine learning and natural language processing to continuously monitor text data from multiple sources, providing traders with up-to-the-minute assessments of market sentiment. Real-time monitoring enables traders to quickly react to changing investor sentiment and thereby to better manage risk in volatile markets. For instance, if sentiment analysis tools detect that social media sentiment in a stock is shifting very suddenly, traders may be able to react by adjusting their portfolio to reduce exposure or seek out new arbitrage opportunities [10]. By incorporating real-time sentiment analysis into its risk management strategies, a trader can gain a potentially important competitive advantage and lower its overall risk exposure.

5 Conclusion

Adopting AI in FR signals the natural evolution of traditional methods in finance, embedding advanced predictive capabilities and adaptability into risk management paradigms. In this paper, we have reviewed applicationsatility prediction, portfolio optimisation, stress testing have shown that they can play an important role in strengthening the decision-making process in turbulent markets, as financial traders and risk managers are able to predict potential deviations from the mean and or mitigating lossesmade AI models such a language processing and others are changing the recommendations and rulesable development of AI toolsable models are developed, thus responding to the recommendations that come from the financialapting non-traditional machine-learning methodologies to financial applications for which transparency and management requires a deeper understanding concerns with overfitting new automated trading technologies, will remain a competitive advantage to transform the management of risks in an ever-changing environment that seems to become less and less predictable. Going forward, future research endeavours should aim at developing new methodologies to make AI models more interpretable and provide further insight into knowing which type of AI methodologies can be integrated in the existing ecosystem of risk management in an agile manner.

References

[1]. El Hajj, M., & Hammoud, J. (2023). Unveiling the influence of artificial intelligence and machine learning on financial markets: A comprehensive analysis of AI applications in trading, risk management, and financial operations. Journal of Risk and Financial Management, 16(10), 434.

[2]. Giudici, P., Centurelli, M., & Turchetta, S. (2024). Artificial Intelligence risk measurement. Expert Systems with Applications, 235, 121220.

[3]. Vaswani, A., Shazeer, N., Parmar, N., Uszkoreit, J., Jones, L., Gomez, A. N., ... & Polosukhin, I. (2017). Attention is all you need. NIPS. arXiv preprint arXiv:1706.03762.

[4]. Schuett, J. (2023). Risk management in the artificial intelligence act. European Journal of Risk Regulation, 1–19.

[5]. Wong, L.-W., et al. (2024). Artificial intelligence-driven risk management for enhancing supply chain agility: A deep-learning-based dual-stage PLS-SEM-ANN analysis. International Journal of Production Research, 62(15), 5535–5555.

[6]. Doumpos, M., et al. (2023). Operational research and artificial intelligence methods in banking. European Journal of Operational Research, 306(1), 1–16.

[7]. Saffari, G. (2024). Ranking of business risks by artificial intelligence and multi-criteria decision making. International Journal of Industrial Engineering and Operational Research, 6(2), 1–16.

[8]. Javaid, H. A. (2024). AI-driven predictive analytics in finance: Transforming risk assessment and decision-making. Advances in Computer Sciences, 7(1).

[9]. Giudici, P., & Raffinetti, E. (2023). SAFE artificial intelligence in finance. Finance Research Letters, 56, 104088.

[10]. Hong, H. (2024). Construction and application of financial risk early warning model based on machine learning. Journal of Electrical Systems, 20(7s), 3016–3030.

Cite this article

Leng,R. (2024). Exploring AI's Role in Enhancing Risk Assessment Models in Financial Quantitative Trading. Journal of Applied Economics and Policy Studies,12,1-5.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. El Hajj, M., & Hammoud, J. (2023). Unveiling the influence of artificial intelligence and machine learning on financial markets: A comprehensive analysis of AI applications in trading, risk management, and financial operations. Journal of Risk and Financial Management, 16(10), 434.

[2]. Giudici, P., Centurelli, M., & Turchetta, S. (2024). Artificial Intelligence risk measurement. Expert Systems with Applications, 235, 121220.

[3]. Vaswani, A., Shazeer, N., Parmar, N., Uszkoreit, J., Jones, L., Gomez, A. N., ... & Polosukhin, I. (2017). Attention is all you need. NIPS. arXiv preprint arXiv:1706.03762.

[4]. Schuett, J. (2023). Risk management in the artificial intelligence act. European Journal of Risk Regulation, 1–19.

[5]. Wong, L.-W., et al. (2024). Artificial intelligence-driven risk management for enhancing supply chain agility: A deep-learning-based dual-stage PLS-SEM-ANN analysis. International Journal of Production Research, 62(15), 5535–5555.

[6]. Doumpos, M., et al. (2023). Operational research and artificial intelligence methods in banking. European Journal of Operational Research, 306(1), 1–16.

[7]. Saffari, G. (2024). Ranking of business risks by artificial intelligence and multi-criteria decision making. International Journal of Industrial Engineering and Operational Research, 6(2), 1–16.

[8]. Javaid, H. A. (2024). AI-driven predictive analytics in finance: Transforming risk assessment and decision-making. Advances in Computer Sciences, 7(1).

[9]. Giudici, P., & Raffinetti, E. (2023). SAFE artificial intelligence in finance. Finance Research Letters, 56, 104088.

[10]. Hong, H. (2024). Construction and application of financial risk early warning model based on machine learning. Journal of Electrical Systems, 20(7s), 3016–3030.