1. Introduction

At the Fourth Plenary Session of the 19th Central Committee of the Communist Party of China in 2019, the CPC Central Committee and the State Council first proposed the concept of "data factor", designating it as the fifth major factor of production, which subsequently led to the emergence of data assets. In recent years, China's digital economy has flourished, and major enterprises have gained a clearer understanding of data assets. In the "Interim Provisions on Accounting Treatment Related to Enterprise Data Resources" (hereinafter referred to as the "Interim Provisions") issued in August 2023, the Ministry of Finance confirmed the recognition scope and accounting standards related to data assets, providing favorable conditions for the subsequent pilot implementation of incorporating data assets into financial statements. As the financial report data for the first quarter of 2024 are released, the first batch of enterprises that have taken the lead in incorporating data assets into their financial statements in accordance with the "Interim Provisions" have successively emerged on the stage, showcasing their proactive approach to adapting to the new regulatory landscape. Currently, the 18 enterprises that have incorporated data assets into their financial statements have done so under the categories of intangible assets, development expenditures, and inventories. Notably, this count excludes seven enterprises whose listings were subsequently canceled, and thus, they are not included in the scope of this study for consideration.

The inclusion of data assets in financial statements signifies a pivotal shift, marking the transition of data from a mere natural resource to an economic asset whose economic value has been officially recognized. This milestone enables enterprises to explicitly showcase the value of their data assets within their financial reports, providing investors and stakeholders with a more comprehensive view of the company's financial health. By doing so, not only does it facilitate a deeper understanding of the intangible yet vital contributions that data makes to the overall value chain, but it also empowers businesses to evaluate their own worth and potential more precisely. Consequently, this enhanced transparency serves as a robust foundation for critical decision-making processes such as financing, mergers and acquisitions, ultimately guiding the strategic growth and direction of these enterprises.

Regarding the inclusion of data assets in financial statements, how might this event potentially impact and induce fluctuations in the market in the short term? To delve into this question, this paper employs an event study methodology to gauge the response of the Chinese stock market subsequent to the incorporation of data assets into financial reports, with a primary focus on analyzing the changes in return rates among relevant A-share listed companies. Our findings reveal that, in the short run, there was no significant disparity in the volatility of return rates before and after the occurrence of the event. In fact, some companies even experienced a notable decline in their return rates subsequent to the inclusion of data assets.

On one hand, this study examines the implications of the data asset inclusion event on the Chinese stock market, delving into the public's level of awareness surrounding this development and the corresponding changes in corporate performance. It offers valuable insights into how the market perceives and reacts to this new paradigm in financial reporting. On the other hand, by analyzing the observed outcomes, this paper aims to provide recommendations for future endeavors, facilitating the seamless integration of data assets into corporate financial statements and enhancing their overall contribution to corporate performance metrics. Ultimately, our goal is to contribute to the evolution of financial reporting standards, ensuring that data assets, as a vital asset class, are appropriately recognized and valued within the financial ecosystem.

2. Literature Review

The Event Study Method, rooted in Fama's (1970) Efficient Market Hypothesis, is a statistical approach commonly applied in finance to analyze statistically significant market reactions to specific past events. Its practical use dates back to Dolley's (1933) examination of stock splits' value effects [1]. Recent studies in China, including Zhang & Wang (2024) on Yunnan Baiyao's share repurchases, Liu & Wang (2024) on sports policy impacts, Wang & Yang (2024) on ChatGPT's global launch effects on China's fund market, Zhang & Guo (2024) on CATL's capital increase, and Bu (2024) on Mindray Medical's share repurchases, demonstrate the maturing application of this method in various stock market contexts, providing a solid foundation for our exploration of data asset inclusion's impact.

Amidst the booming digital economy, research spans from industrial digitization and digital industrialization to blockchain applications in data assets, innovative funding models, and more (Shi, 2024; Meng, 2024; Huang & Luo, 2024; Liu, 2024; Hua, 2024; Jin, 2024; Feng; Kawther A. Al-Dhlan et al., 2022; Maxat Kassen, 2023; Olivier Desplebin & Gulliver Lux, 2021). Given the limited number of companies involved in the initial data asset inclusion trial, its impact on the stock market remains unclear and warrants further investigation.

3. Study, Analysis, and Model Building

In this era of information explosion and rapid technology change, data has become the core engine to promote social progress and economic development. It is not only the key to gain insight into the world and understand complex phenomena, but also the cornerstone of corporate decision-making, policy making, scientific research and even personal life optimization. In order to make a better hypothesis, this paper conducted an online questionnaire survey before the study, and collected 120 valid questionnaires and distributed them to people around them.

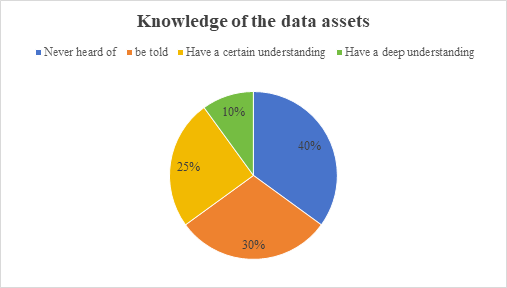

Figure 1. Pie chart of the understanding of the data assets

Through the questionnaire survey, this paper finds that on the whole, the public has a relatively shallow understanding of data assets, mostly staying in the "listening and speaking" stage. But given the keen insight of the capital markets, they can quickly detect assets with investment value. As an emerging factor of production, the potential investment value of data assets is valued by the capital market. Through mergers and acquisitions of enterprises with high-quality data resources, listed companies can quickly make up for their own data shortcomings and improve their market competitiveness, so as to obtain better valuation and financing conditions. Therefore, this paper puts forward the assumption based on rigor: in the short term, the market effect of data assets in the table event is positive, that is, the return rate of each company will rise to varying degrees.

In view of the significant volatility characteristics of Chinas stock market, this paper adopts the market simulation estimation method to accurately measure the abnormal return (AR) of individual stocks. In this process, we assume that asset returns are statistically independent of each other and follow the law of normal distribution, which is a common and robust assumption to predict the normal returns of stocks based on market models. Through this method, we can more accurately capture the impact of market fluctuations on the performance of individual stocks, so as to calculate the abnormal return part after excluding market factors.

This paper begins to calculate the yield index of individual stock and market level. Specifically, the actual return rate (Rit) of individual stocks of each company is calculated by the formula (Pt - Pt-1) / Pt-1, where Pt and Pt-1 represent the closing price of each company’s shares on day t and t-1, respectively. Due to the fact that 9 of the 18 listed companies, such as Zhuochuang Zixun and Zhongyuan Haike, are listed on the A-share market of the Shenzhen Stock Exchange, and the other nine are for the Shanghai A shares, the market yield (Rmt) is based on the Shenzhen component index and the Shanghai A share index the two-market index respectively. The formula is (Mt - Mt-1) / Mt-1, including Mt and Mt-1 respectively represent two in the t day and t-1 day closing index.

Next, to establish the correlation between the individual stock yield and the market yield, we constructed the market model Rit = α + β Rmt. This model aims to estimate the values of the parameters α and β through the sample data of the event estimation period, which reflect the sensitivity and intercept terms of the stock returns to the overall performance of the market. Using Stata statistical software, this paper substitutes the individual stock and market yield data collected during the event estimation period into the market model, and the α and β parameter values corresponding to the data assets of each company are obtained through regression analysis.

Finally, in order to evaluate the potential impact of data assets entry events on the stock returns of each company, this paper substitutes the index closing index in the event window into the constructed market model Rit = α + β Rmt, so as to calculate the expected return rate R it of each company in the event window. Subsequently, this paper further calculates the excess yield (ARit) and cumulative excess yield (CARit), where ARit = Rit - Rit represents the difference between the actual yield and the expected yield; CARit is the cumulative value of all trading days during the event window to measure the total excess return during the whole event period. Such an analytical framework not only helps us to understand the impact of the specific share data asset entry events on the stock returns of different listed companies, but also provides tools to quantify these impacts.

4. Design Elaboration

In exploring the market effects of data assets in the table, this paper identifies key time frames to accurately capture the potential impact of the event on the stock price. The event window period refers to the time frame during which a specific event exerts an influence on stock prices. If the event window period is too long, it may lead to interference from other factors, whereas if it is too short, the results may be inaccurate due to an insufficient sample size [2]. In order to avoid the confusion of the analysis results by unnecessary factors, this paper carefully designed an event window period, that is, around the ten trading days before and after the release of the quarterly report of each company, a total of 21 trading days, marked as (-10, + 10) period. This choice aims to balance the sensitivity of the analysis with the adequacy of the data, neither excessively extending to incorporate irrelevant factors nor limiting to lose the depth of information. It should be noted here that, due to the limited sample of companies disclosing data assets in the first quarter, and the suspension of trading in the event window period, and the lack of other reference companies, the 21 trading days are the result of excluding the suspension date.

In order to accurately estimate the normal return rate under the influence of no data assets in the table, we further set an event estimation period, which selects 100 trading days before the financial release of the listed companies in the first quarter of 2024, specifically (-110, -11). This setting aims to build a benchmark yield model without event interference by using sufficient historical data, so as to more accurately measure the specific impact of data assets in the table on the rate of return. With this approach, we ensured the rigor of the analysis and the reliability of the conclusions. However, it is worth noting that because the historical data of Ping’an Diangong is only one month’s data before the release of the first quarter of 2024, and there are still many suspension days, so it is impossible to build a more accurate yield model. Therefore, we do not consider Ping’an Diangong, but study the other 17 A-share listed companies.

5. Findings

After a regression, Under the Shenzhen component Index, The Hengxin Dongfang model is: Rit = -0.0032 + 1.8402 Rmt; The Meiri Hudong model is: Rit = -0.0008 + 1.7430 Rmt; The Meinian Jiankang model is: Rit = -0.0018 + 1.0185 Rmt; The Tuo’ersi model is: Rit = -0.0002 + 2.0473 Rmt; The Zhejiang Jiaoke model is: Rit = 0.0007 + 0.9471 Rmt; The Zhongwen Zaixian model is: Rit = 0.0019 + 1.4488 Rmt; The Zhongyuan Haike model is: Rit = -0.0007 + 1.1205 Rmt; The Zhuochuang Zixun model is: Rit = -0.0023 + 1.5492 Rmt.

Table 1. Excess return AR and cumulative excess return CAR of eight Shenzhen A-share listed companies

Hengxin Dongfang 300081 | Meiri Hudong 300766 | Meinian Jiankang 002044 | Tuo’ersi 300229 | Zhejiang Jiaoke 002061 | Zhongwen Zaixian 300364 | Zhongyuan Haike 002401 | Zhuochuang Zixun 301299 | |||||||||

AR | CR | AR | CR | AR | CR | AR | CR | AR | CR | AR | CR | AR | CR | AR | CR | |

-10 | -0.79% | -0.79% | 5.84% | 5.84% | 3.66% | 3.66% | 3.08% | 3.08% | 2.63% | 2.63% | -9.42% | -9.42% | 1.73% | 1.73% | 0.11% | 0.11% |

-9 | -5.11% | -5.90% | 0.67% | 6.51% | -3.65% | 0.02% | -5.50% | -2.42% | -2.68% | -0.05% | 10.00% | 0.58% | -2.06% | -0.33% | 6.13% | 6.24% |

-8 | -1.06% | -6.96% | 2.23% | 8.74% | 1.87% | 1.89% | 1.68% | -0.74% | -0.28% | -0.33% | 6.98% | 7.56% | 2.53% | 2.20% | -3.44% | 2.80% |

-7 | 2.53% | -4.42% | -4.42% | 4.32% | 0.92% | 2.81% | 2.53% | 1.79% | 1.17% | 0.84% | -7.10% | 0.46% | -3.29% | -1.09% | -0.85% | 1.94% |

-6 | -0.67% | -5.09% | 0.64% | 4.96% | 1.92% | 4.72% | -0.63% | 1.16% | 0.87% | 1.71% | -2.49% | -2.04% | 3.05% | 1.95% | 4.30% | 6.24% |

-5 | 0.53% | -4.56% | 3.29% | 8.25% | -0.32% | 4.41% | 1.93% | 3.09% | -0.80% | 0.91% | 2.42% | 0.39% | 0.26% | 2.21% | 1.97% | 8.21% |

-4 | -0.02% | -4.58% | -0.44% | 7.81% | 0.24% | 4.64% | -2.77% | 0.33% | 0.56% | 1.47% | 5.39% | 5.77% | 0.50% | 2.71% | 5.69% | 13.90% |

-3 | -1.35% | -5.93% | 0.09% | 7.90% | 0.04% | 4.68% | -4.73% | -4.40% | -1.25% | 0.21% | 2.81% | 8.59% | 0.02% | 2.73% | -4.46% | 9.44% |

-2 | -5.27% | -11.20% | 0.79% | 8.69% | -1.53% | 3.15% | -4.03% | -8.43% | -2.90% | -2.68% | 13.51% | 22.10% | -4.49% | -1.76% | -1.89% | 7.55% |

-1 | -0.66% | -11.85% | -4.32% | 4.37% | -2.40% | 0.75% | -5.00% | -13.43% | -1.90% | -4.58% | -7.68% | 14.42% | 9.89% | 8.14% | -8.80% | -1.25% |

0 | -3.35% | -15.20% | -2.65% | 1.72% | -0.02% | 0.73% | 0.17% | -13.25% | -0.82% | -5.40% | 5.81% | 20.23% | -2.49% | 5.65% | -0.26% | -1.51% |

1 | -4.32% | -19.53% | -3.67% | -1.95% | -1.54% | -0.81% | -5.85% | -19.11% | -1.69% | -7.10% | -23.27% | -3.05% | -2.82% | 2.83% | 1.68% | 0.18% |

2 | 6.26% | -13.27% | 0.40% | -1.55% | 0.10% | -0.71% | 9.68% | -9.42% | 1.09% | -6.01% | -2.37% | -5.42% | -0.22% | 2.61% | -3.19% | -3.01% |

3 | 4.02% | -9.24% | -6.73% | -8.27% | -0.07% | -0.78% | 1.51% | -7.91% | 1.74% | -4.27% | 3.64% | -1.77% | 2.02% | 4.63% | -1.99% | -5.00% |

4 | -6.14% | -15.39% | 7.27% | -1.00% | -3.21% | -3.98% | -8.52% | -16.43% | -3.40% | -7.67% | 2.31% | 0.54% | 1.76% | 6.39% | 6.32% | 1.32% |

5 | 7.63% | -7.76% | 4.47% | 3.47% | 1.44% | -2.54% | 1.98% | -14.46% | 1.29% | -6.38% | 1.32% | 1.86% | -2.43% | 3.96% | -0.35% | 0.97% |

6 | 10.13% | 2.38% | -7.19% | -3.72% | 7.28% | 4.74% | 11.99% | -2.47% | -0.30% | -6.68% | 0.06% | 1.91% | -0.97% | 2.99% | -3.05% | -2.08% |

7 | -2.29% | 0.09% | 2.41% | -1.31% | -1.33% | 3.41% | 2.29% | -0.18% | -1.91% | -8.60% | 2.49% | 4.41% | 1.71% | 4.70% | 0.74% | -1.34% |

8 | 4.99% | 5.08% | 4.56% | 3.24% | -1.94% | 1.47% | 3.06% | 2.89% | 1.86% | -6.73% | 0.75% | 5.16% | -0.82% | 3.89% | 5.45% | 4.11% |

9 | -0.79% | 4.29% | -1.20% | 2.04% | -0.19% | 1.27% | 1.90% | 4.79% | 1.09% | -5.64% | -0.84% | 4.32% | -0.76% | 3.12% | 2.98% | 7.09% |

10 | -5.05% | -0.76% | 2.77% | 4.81% | -1.60% | -0.33% | -3.53% | 1.25% | -1.65% | -7.29% | -1.50% | 2.82% | 2.81% | 5.93% | 4.44% | 11.54% |

Under the Shanghai A-share Index, The Bomin Dianzi model is: Rit = -0.0029 + 2.2963 Rmt; The Haitian Ruisheng model is: Rit = 0.0008 + 2.8010 Rmt; The Hangtian Hongtu model is: Rit = -0.0065 + 2.7116 Rmt; The Jiahua Keji model is: Rit = -0.0044 + 2.4489 Rmt; The Kaipuyun model is: Rit = 0.0033 + 3.0671 Rmt; The Nangang Gufen model is: Rit = 0.0027 + 0.4302 Rmt; The Qingdao Gang model is: Rit = 0.0029 + 0.4551 Rmt; The Shandong Gaosu model is: Rit = 0.0033 + 0.3342 Rmt; The Zhongjiao Sheji model is: Rit = -0.0003 + 1.5846 Rmt.

Table 2. Excess return AR and cumulative excess return CAR of the nine Shanghai A-share listed companies

Bomin Dianzi 603936 | Haitian Ruisheng 688787 | Hangtian Hongtu 688066 | Jiahua Keji 688051 | Kaipuyun 688228 | Nangang Gufen 600282 | Qingdao Gang 601298 | Shandong Gaosu 600350 | Zhongjiao Sheji 600720 | ||||||||||

AR | CR | AR | CR | AR | CR | AR | CR | AR | CR | AR | CR | AR | CR | AR | CR | AR | CR | |

-10 | 3.16% | 3.16% | 6.20% | 6.20% | 5.72% | 5.72% | 5.13% | 5.13% | 3.73% | 3.73% | -0.02% | -0.02% | -0.24% | -0.24% | 0.37% | 0.37% | 3.30% | 3.30% |

-9 | -1.52% | 1.63% | 4.10% | 10.30% | 2.03% | 7.75% | 1.25% | 6.38% | 3.15% | 6.88% | -0.24% | -0.26% | -0.86% | -1.10% | 0.18% | 0.56% | -3.83% | -0.53% |

-8 | 4.44% | 6.07% | 0.34% | 10.64% | 2.53% | 10.29% | 5.49% | 11.88% | 0.73% | 7.61% | -0.64% | -0.90% | 0.80% | -0.30% | -1.12% | -0.56% | -0.02% | -0.55% |

-7 | -5.24% | 0.83% | -8.27% | 2.37% | -7.53% | 2.75% | -4.11% | 7.76% | 1.97% | 9.57% | 0.21% | -0.69% | -1.26% | -1.56% | -0.08% | -0.65% | 0.49% | -0.06% |

-6 | 1.15% | 1.98% | -0.20% | 2.17% | 1.00% | 3.75% | -0.39% | 7.37% | -3.23% | 6.35% | 0.00% | -0.69% | 0.01% | -1.55% | 0.81% | 0.17% | 1.56% | 1.50% |

-5 | 2.46% | 4.44% | 1.50% | 3.67% | 9.36% | 13.11% | 1.37% | 8.74% | 3.98% | 10.33% | 0.98% | 0.29% | -0.33% | -1.88% | 0.07% | 0.23% | -0.03% | 1.47% |

-4 | -0.96% | 3.47% | 0.54% | 4.21% | -0.64% | 12.46% | 0.01% | 8.75% | -1.41% | 8.92% | -0.92% | -0.63% | 0.35% | -1.53% | 0.78% | 1.01% | -0.11% | 1.37% |

-3 | 0.56% | 4.03% | 4.18% | 8.39% | 3.76% | 16.22% | 2.11% | 10.87% | 12.60% | 21.52% | -0.58% | -1.21% | 0.22% | -1.31% | -1.17% | -0.15% | -1.14% | 0.22% |

-2 | 0.02% | 4.05% | -2.95% | 5.44% | -0.79% | 15.43% | -1.09% | 9.78% | 8.36% | 29.87% | -1.22% | -2.43% | 0.04% | -1.27% | -0.42% | -0.57% | -1.92% | -1.70% |

-1 | -2.10% | 1.95% | -5.82% | -0.38% | -4.87% | 10.56% | -2.71% | 7.07% | 3.34% | 33.22% | 0.56% | -1.87% | 0.25% | -1.02% | -0.14% | -0.72% | -0.55% | -2.25% |

0 | -1.21% | 0.75% | -2.53% | -2.91% | -2.18% | 8.38% | -3.50% | 3.58% | -1.17% | 32.05% | 0.05% | -1.82% | -1.48% | -2.50% | -0.69% | -1.41% | -0.98% | -3.23% |

1 | -1.07% | -0.33% | -1.84% | -4.75% | -1.25% | 7.13% | -0.67% | 2.90% | -3.33% | 28.72% | -1.13% | -2.95% | 0.18% | -2.32% | 0.63% | -0.78% | -2.67% | -5.90% |

2 | 2.86% | 2.53% | -1.97% | -6.72% | -0.72% | 6.40% | -0.57% | 2.33% | 11.70% | 40.42% | 0.16% | -2.79% | -0.01% | -2.33% | -0.55% | -1.33% | 1.23% | -4.67% |

3 | -4.66% | -2.13% | -5.40% | -12.12% | -5.28% | 1.13% | -3.20% | -0.87% | -10.83% | 29.59% | 0.03% | -2.77% | 0.16% | -2.17% | 0.76% | -0.57% | 1.48% | -3.19% |

4 | 0.50% | -1.63% | 8.74% | -3.38% | 1.07% | 2.20% | 3.52% | 2.65% | -2.39% | 27.20% | -1.14% | -3.91% | 0.10% | -2.07% | -0.01% | -0.58% | -2.98% | -6.17% |

5 | 0.62% | -1.01% | 1.66% | -1.72% | 5.11% | 7.31% | 3.08% | 5.73% | -6.37% | 20.84% | 0.11% | -3.79% | 1.44% | -0.63% | -0.62% | -1.21% | -0.38% | -6.54% |

6 | -5.66% | -6.67% | -8.49% | -10.20% | -5.22% | 2.09% | -6.24% | -0.50% | -3.45% | 17.38% | -1.57% | -5.36% | -1.46% | -2.10% | 0.32% | -0.89% | 0.84% | -5.70% |

7 | 0.08% | -6.59% | 0.81% | -9.39% | 2.10% | 4.19% | 1.73% | 1.22% | 0.51% | 17.89% | -0.63% | -6.00% | -0.13% | -2.23% | 1.14% | 0.26% | -1.69% | -7.39% |

8 | 0.11% | -6.48% | 6.93% | -2.46% | 3.01% | 7.20% | 5.88% | 7.11% | 3.04% | 20.93% | 1.07% | -4.93% | -0.03% | -2.27% | -0.06% | 0.20% | 1.43% | -5.96% |

9 | 1.49% | -4.99% | 1.93% | -0.54% | 5.22% | 12.42% | 2.12% | 9.23% | 12.25% | 33.18% | -0.89% | -5.82% | 1.02% | -1.24% | 0.21% | 0.41% | 0.10% | -5.86% |

10 | 3.96% | -1.03% | 5.15% | 4.61% | 3.04% | 15.46% | 4.27% | 13.50% | 3.09% | 36.27% | -1.07% | -6.89% | 0.55% | -0.69% | 0.61% | 1.03% | -3.14% | -9.00% |

The R²in the above models is basically all around 0.1-0.4. For example, the R² of the Bomin Dianzi model is 0.3894 and the Haitian Ruisheng is 0.2222. In view of the previous analysis, this paper confirms that the above 17 models can fit them well, and that their regression equation is important in explaining the relationship of variables.

From the perspective of AR, except for the three listed companies of Qingdao Gang, Shandong Gaosu and Zhuochuang Zixun, where the yield was positive in the first trading day after the event (the maximum value is Zhuochuang Zixun, 1.68%), the AR of all the other companies was negative. During the (0,10) period, the AR of each company fluctuated around 0, and the change range was large. It can be seen that the data assets in the table have not achieve the following six reasons:

• Significant Initial Investment Costs:In the process of incorporating data assets into the balance sheet, enterprises may need to undertake substantial upfront investments. These encompass data cleansing, organization, classification, storage, as well as associated technology upgrades and personnel training. Furthermore, classifying data assets into intangible assets or inventories necessitates amortization and impairment, which subsequently elevates corporate costs and diminishes profitability.

• Challenges in Data Asset Ownership Verification:Currently, companies face obstacles in establishing clear ownership and usage rights of data assets. The absence of definitive boundaries for these rights hinders the smooth inclusion of data assets into financial statements or exposes enterprises to legal risks. This undermines investor confidence, potentially impacting market valuation and profitability.

• Prominent Data Security Concerns:Once data assets are incorporated into the balance sheet, enterprises must intensify their protection and management of data resources to prevent breaches, tampering, and other security risks. Gaps or inadequacies in data security management can lead to security incidents, damaging corporate reputation, severing partnerships, and ultimately reducing profitability.

• Complexity in Accounting Treatment:As a novel asset class, data assets present complexities and uncertainties in accounting treatment. Inaccuracies or irregularities in accounting practices may result in distorted financial statements or mislead investors, thereby affecting market valuation and profitability.

• Intense Market Competition:As more enterprises prioritize the management and utilization of data assets, market competition intensifies. If companies fail to effectively enhance their competitiveness and profitability post-incorporation, they may experience market share erosion, slower revenue growth, and ultimately, decreased profitability.

• Limited Public Understanding:As depicted in Figure 1, the majority of the public's knowledge about data assets remains at the "heard of" level. Given that the incorporation of data assets into balance sheets is still in a pilot and immature stage, the fluctuations associated with this event can be seen as a manifestation of public apprehension and mixed sentiments towards the development. This limited understanding contributes to a cautious outlook towards the event's potential outcomes.

Eighteen listed companies have disclosed a total of 103 million yuan in data resources being recognized on their balance sheets, with 79 million yuan under intangible assets, 18 million yuan under development expenditures, and the rest under inventories. Li Feng, Vice Dean and Accounting Chair Professor at the Shanghai Advanced Institute of Finance, believes that the number and amount of such recognition reflect the cautious attitude of listed companies towards the "inclusion" of data resources on their balance sheets [3]. Clearly, there are still numerous considerations and concerns for enterprises when it comes to the recognition of data assets. On the one hand, they aspire to unlock the value of data assets and enhance their market competitiveness. On the other hand, they fear being trapped in difficulties due to unclear standards, immature technologies, or uncontrollable risks. This contradictory mindset leads enterprises to proceed cautiously on the path of recognizing data assets, constantly observing and testing, in the hope of safeguarding their own interests while also keeping up with the trend of the times, seizing the new opportunities brought about by data. Actively participating in international cooperation and introducing advanced external technologies and management experiences, through such strategic layouts, we can jointly lay a solid digital foundation for the future development of Chinese enterprises and ensure their continued dominance in future industrial development [4].

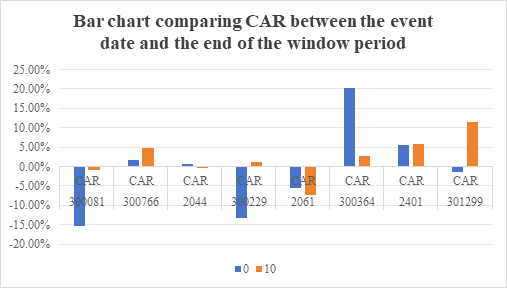

Figure 2. Bar chart of CAR between the date of event and the end of window period (Shenzhen)

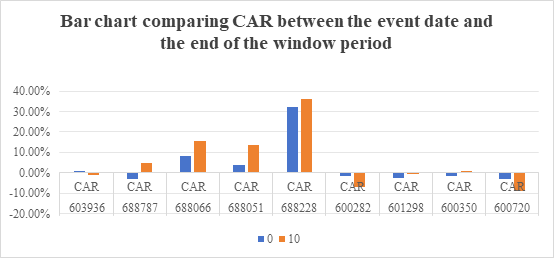

Figure 3. Bar chart of CAR between the date of event and the end of the window period (Shanghai)

From the perspective of Cumulative Abnormal Return (CAR), the cumulative returns of the eleven companies - Hengxin Dongfang, Meiri Hudong, Tuo’ersi, Zhongyuan Haike, Zhuochuang Zixun, Haitian Ruisheng, Hangtian Hongtu, Jiahua Keji, Kaipuyun, Qingdao Gang, and Shandong Gaosu - at the end of the event window show almost all experienced growth or stabilization compared to the event occurrence day. This suggests that the incorporation of data assets into balance sheets can bring about some positive impacts. Notably, Hengxin Dongfang and Zhuochuang Zixun exhibited the most significant changes. At the start of the event window (time 0), their CARs were -15.20% and -1.51% respectively, which soared to -1.03% and 11.54% by the end of the window, representing remarkable increases of 14.17% and 13.05%. Conversely, the remaining six listed companies saw varying degrees of decline, with Zhongwen Zaixian fall reaching 17.41%.

This study reveals that among the 17 enterprises analyzed, only Zhuochuang Zixun provided relatively detailed disclosures regarding data assets. Zhuochuang Zixun's rationale for accounting for data assets as intangible assets stems from the fact that the company's primary objective in holding these assets is not for direct sale but rather as underlying data supporting its information services and digital intelligence services-related products. When combined with Zhuochuang Zixun's high CAR growth, this study posits that the company's effective disclosure of data assets has bolstered public confidence, significantly driving up its cumulative returns.

In conclusion, the short-term market effects of incorporating data assets into balance sheets are not pronounced, indicating that this pilot program may pose more challenges than benefits for listed companies.

6. Epilogue

Taking 17 listed companies in the table as an example, this paper studies the short-term market effect of the data assets in the table by using the event research method. The analysis shows that the occurrence of this event does not bring significant positive effect, but the effective disclosure of data assets can bring the growth of positive return and cumulative return.

In theory, data assets are undoubtedly one of the core competencies of modern enterprises and organizations. Like oil in the digital era, they are the key drivers of business growth, optimal decision making, operational efficiency, and personalized services and innovation.

But, how to promote the development of data assets in the current situation?

First, implement strategies to safeguard digital assets policy support. Although digital assets do not have a physical form, this does not hinder the implementation of digital strategies and the enhancement of asset value. Enterprises can increase asset value by purchasing digital assets, take effective measures to protect digital assets, implement rights protection strategies, utilize access control, password management, and other methods, and choose reputable trading platforms to safeguard asset security [5].

Second, raise public awareness and convey the importance of the data. Keep the public informed about the latest developments in data protection laws, regulations, and best practices. Issue regular updates, alerts, and advisories to help people stay on top of the evolving landscape. Provide clear and concise definitions of what data assets are, their significance in today's digital economy, and how they contribute to individual and societal well-being. Use simple language and real-world examples to illustrate the concept.

Third, transform the data assets into digital assets, and use blockchain technology to ensure the unique data source, traceability, tamper proof and improve security. Blockchain technology makes it possible to create and use a public register of transactions and organize the transactions in chronological order [6]. Traditional accounting voucher management relies on paper or electronic documents, involving cumbersome review and verification processes, plagued by information asymmetry and complexity, reducing efficiency and vulnerability to errors and fraud. Blockchain technology transforms accounting vouchers into digital assets, enabling smart contract-based management and verification. Digital assets, data-generated on blockchain, are exchangeable, transferable, storable, and utilizable. This conversion ensures blockchain-recorded vouchers' immutability and traceability, boosting efficiency, transparency, and mitigating human errors and fraud risks [7]. It is necessary to realize that the assets do not create actual revenue and profit after entering the table, so the data assets must go to the top and become digital assets, so as to promote the full circulation of data. Additionally, enterprises should be encouraged to adopt advanced data governance technologies, data analytics technologies, and artificial intelligence technologies to enhance the efficiency of data asset management and the ability to mine value from them. Furthermore, exploring the application scenarios of data assets in areas such as business decision-making, product innovation, and market expansion can fully leverage the commercial value of data assets.

It is believed that digital assets will undoubtedly shine brightly in the global business landscape in the future. As technology continues to evolve and digitization becomes increasingly pervasive, digital assets will play a pivotal role in transforming business operations, enhancing competitiveness, and driving growth.

References

[1]. Wang, L., & Yang, Q. (2024). A study on the performance of China's fund market in response to the global launch of ChatGPT - Based on the event study method. Enterprise Economy, 43(07), 151-160. https://doi.org/10.13529/j.cnki.enterprise.economy.2024.07.015

[2]. Zhang, X., & Wang, J. (2024). Research on the short-term market effect of Yunnan Baiyao's share repurchase. Market Modernization, (15), 177-179. https://doi.org/10.14013/j.cnki.scxdh.2024.15.006

[3]. Feng, X., & Wen, T. (2024, July 26). Eighteen listed companies "take a bite" of including data assets in financial statements. Shanghai Securities News, 005. https://doi.org/10.28719/n.cnki.nshzj.2024.003489

[4]. Shi, J. (2024). The development of digital asset value is key to future industrial development. Economy, (06), 28-31.

[5]. Meng, H. (2024). The impact of digital assets on corporate operations in the context of the digital economy. International Business Accounting, (13), 34-37.

[6]. Alarcon, J. L., & Ng, C. (2018). Blockchain and the future of accounting. Pennsylvania CPA Journal, 90(1), 3-7.

[7]. Hua, C. (2024). Application of blockchain technology in the field of accounting. Finance and Economics, (18), 120-122. https://doi.org/10.19887/j.cnki.cn11-4098/f.2024.18.033

Cite this article

Jin,M. (2024). Research on the Short-Term Market Effect of Data Assets in Financial Statement—Take the 18 Listed Companies as Examples. Journal of Applied Economics and Policy Studies,12,69-76.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wang, L., & Yang, Q. (2024). A study on the performance of China's fund market in response to the global launch of ChatGPT - Based on the event study method. Enterprise Economy, 43(07), 151-160. https://doi.org/10.13529/j.cnki.enterprise.economy.2024.07.015

[2]. Zhang, X., & Wang, J. (2024). Research on the short-term market effect of Yunnan Baiyao's share repurchase. Market Modernization, (15), 177-179. https://doi.org/10.14013/j.cnki.scxdh.2024.15.006

[3]. Feng, X., & Wen, T. (2024, July 26). Eighteen listed companies "take a bite" of including data assets in financial statements. Shanghai Securities News, 005. https://doi.org/10.28719/n.cnki.nshzj.2024.003489

[4]. Shi, J. (2024). The development of digital asset value is key to future industrial development. Economy, (06), 28-31.

[5]. Meng, H. (2024). The impact of digital assets on corporate operations in the context of the digital economy. International Business Accounting, (13), 34-37.

[6]. Alarcon, J. L., & Ng, C. (2018). Blockchain and the future of accounting. Pennsylvania CPA Journal, 90(1), 3-7.

[7]. Hua, C. (2024). Application of blockchain technology in the field of accounting. Finance and Economics, (18), 120-122. https://doi.org/10.19887/j.cnki.cn11-4098/f.2024.18.033