1 Introduction

NFT (Non Fungible Token) is a form of digital asset that contains unique financial features. With its unique characteristics of non homogeneity, indivisibility, transparency, and traceability, NFT has brought unprecedented changes to many fields such as art, music, video, game props, and real estate worldwide. It has become an important milestone in the development of blockchain driven cultural digital publishing industry and opened up a new market for blockchain outside the traditional financial field - NFT digital content works trading. Although NFT has attracted widespread attention in the fields of digital content publishing and cultural and creative industries, neither academia nor industry has reached a unified understanding of the definition of NFT. Examined from the physical dimension, NFT is essentially an information entity composed of a piece of code data. Analyzed from the technical dimension, NFT, as an innovative digital credential, has the core function of recording the metadata of a specific digital asset and the historical information of ownership transfer [1]. Turning to the commercial perspective, NFT then becomes a symbolic representation of ownership, carrying an authoritative proof of asset attribution [2]. In the field of digital content publishing, the application of NFT significantly facilitates the interoperability and commercialization process between digital and physical goods [3], which not only greatly improves the efficiency of copyright registration, but also significantly enhances the transparency of the transaction process and the liquidity of assets [4].

Led by the strategy of cultural digitization, digital content and cultural creative industries are soaring on the road of supporting the development of digital economy, and the NFT digital content works trading market has ushered in an unprecedented prosperity. However, with the explosive development of the NFT digital content works trading market, concerns and questions such as speculation, money laundering, and illegal finance have ensued [5]. The reason for this is mainly due to the following problems in grasping the value of NFT: (1) It has the heterogeneous attributes of art consumption and asset investment at the same time, and the balance between the two is difficult to control; (2) It is mostly tied to the commercial power behind it, and the value connotation is complicated; (3) There is a multilevel market, with a long life-cycle and many factors affecting the value; (4) The market is relatively young, and has not yet formed a mature pricing mechanism and value assessment standards.

Different from traditional digital publishing, NFT relies on the programmability of smart contracts and the consensus mechanism of blockchain to give digital content works more value in the following aspects:

From the perspective of digital content, the value of NFT digital content works stems from its rarity, which is specifically reflected in the ability of the NFT technology to prevent the dilution of ownership as data is copied [6]. However, there are also scholars who are skeptical about this, Frye (2021) believes that NFT digital content works have not yet broken free from the shackles of openness and replicability, so the scarcity cannot be discussed [7]. Chohan (2021) pointed out that there are many cases in practice where multiple NFTs are created based on the same asset, and this "artificial scarcity" can only be established in a market where the scarcity of tokens is generally recognized [8]. In the secondary market, the value of NFT digital content works stems from its traceability, which is specifically interpreted as the ability of the creator to sustainably obtain copyright revenue [9]. From the perspective of both consumers and investors, NFTs exhibit a dual appeal. On the one hand, the scarcity of works that grows over time provides consumers with a potential advantage that sell at a higher price in the future for additional gains [10]. On the other hand, NFT is also able to transform the contributions of core fans into real economic value, further motivating their consumption [11]. Finally, the security of the block ecology in which NFTs are located is one of the important factors affecting their value [12]. Cryptocurrencies have spawned the NFT market, and Dowling's (2022) research results indicate that although the effect of volatility transmission between the cryptocurrency market and the NFT market is limited, there is indeed a synergistic movement between the two [13]. In addition, NFT prices are also highly sensitive to macroeconomic conditions, regulatory policies, and public attitudes, and will soar in a low interest rate environment with increased demand for alternative investments [14].

In general, current research on the value of NFTs is mainly limited to a single perspective, and there has not been a comprehensive and in-depth discussion from a systematic perspective. At the same time, these studies have also failed to include the core element of NFT digital content works - property value - as a key consideration factor in the research scope. Therefore, this study takes the value chain theory as the core framework, and innovatively defines the basic concepts and components of the value chain of NFT digital content works. On this basis, we systematically analyzes the multiple factors that affect the value of NFT digital content works, and constructs a preliminary value evaluation index system. Subsequently, we used web crawling technology to obtain NFT digital work trading data from the representative platform OpenSea, and selected typical value evaluation models from the fields of statistics, machine learning, and deep learning for empirical analysis to verify the scientific and effective nature of the indicator system.

2 The Value Chain Model of NFT

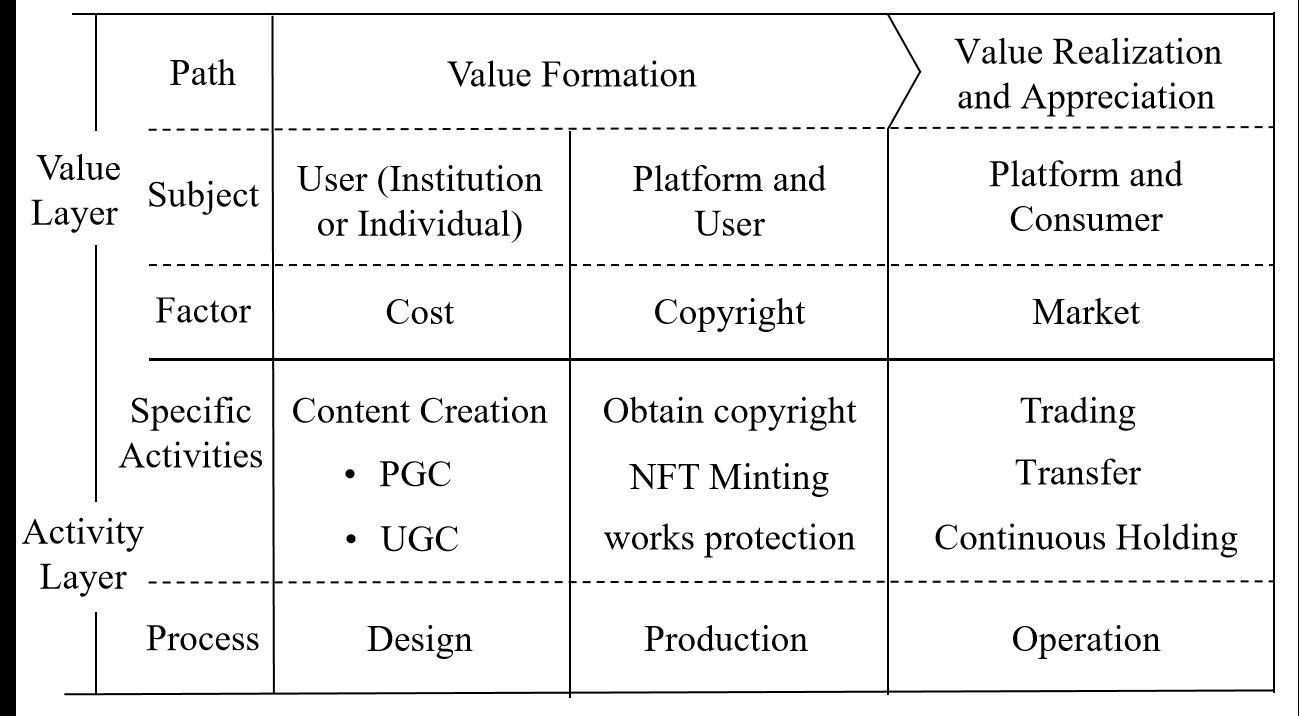

The value chain theory proposed by Michael Porter (1997) reveals two core components of an enterprise's production and operation activities: basic activities and auxiliary activities. Based on this theoretical framework, combined with the minting and circulation process of NFT, this paper constructs the value chain model of NFT digital content works as shown in Figure 1. The model comprehensively analyzes the links and elements of NFT from the two dimensions of value flow and activity composition, providing a powerful analytical tool for in-depth understanding of the operating mechanism of the NFT market.

Figure 1. Value Chain Model of NFT Digital Content Works

In terms of value layer, the NFT digital art value chain model covers multiple value contributing entities and their interactive processes. Specifically, organizations or individual creators achieve initial value creation through digital content design and minting. As an intermediary, the trading platform achieves value appreciation by providing a series of supporting services and sustainable business strategies. The value contributors represented by consumers and platforms not only achieve instant transfer of work value through various means such as transactions and gifts, but also form a dynamic value realization and appreciation cycle in the secondary market.

In terms of the activity layer, the production and operation activities of NFT digital content works are divided into three stages, each of which carries different core value influencing factors. The first stage is content design, which focuses on the creation and generation of digital works, and with cost being a key factor affecting value. The next stage is the acquisition of works. The goal of this stage is to ensure the legality and uniqueness, mainly including copyright acquisition and minting on blockchain, with copyright content becoming a key factor affecting value. The final stage is the operation phase of the work, which involves market activities such as trading, gifting, and continuous holding of the work. At this stage, market factors are the main factors that dominate the value of works, reflecting market dynamics such as market demand, price fluctuations, and trading activity.

3 Factors Influencing the Value of NFT

Based on the NFT digital content value chain model, we further analyze the influencing factors from three aspects: cost composition, copyright content and market demand.

3.1 Cost Composition

NFT digital content works are a kind of intangible assets. It can be seen from the classic evaluation method of traditional intangible assets "Cost Method" that cost factors cannot be ignored in evaluating their value. The study categorizes the cost of NFT digital content works into direct cost and indirect cost. The direct cost refers to the necessary cost of the work from the creative conception to the final product, including production costs and technical implementation costs. Indirect costs refer to unnecessary expenses that are available for selection after a work enters the market, including marketing costs and transaction costs.

As an intelligence intensive product, NFT's creative process heavily relies on non-material elements such as creativity, culture, and knowledge. At the same time, this process also involves the acquisition and procurement of material materials such as images, music, animations, and intellectual property (IP). Taking NFT trading platform Nifty Gateway as an example, its artist team or platform often purchases IP for development at a fixed price, or pays a certain proportion of investment costs to cooperate with IP holders for development. The cost of technology implementation is the necessary expenditure for converting creative content into NFT, such as transaction fees for blockchain platforms, writing and deployment fees for smart contracts, and digitization and storage costs for works.

Indirect costs focus on the expenses incurred in promoting and selling NFT works in the market, specifically divided into marketing expenses and transaction expenses. Marketing costs include all expenses used to raise awareness of NFT works and attract potential buyers, such as advertising costs, community building and maintenance costs. transaction expenses are the service fees that the NFT Transaction Services platform extracts from each transaction. For example, the OpenSea and Rarible platforms charge 2.5% per transaction, while the SuperRare platform charges 3% per transaction.

3.2 Copyright Content

As a new type of digital publication, copyright is one of the intrinsic properties of NFTs. Once digital content is minted as NFTs on the blockchain, its copyright will be immediately confirmed [15]. By reviewing relevant literature on factors affecting copyright value, this study categorizes the factors influencing NFT copyright value into four aspects: originality, timeliness, authority, and richness.

Originality refers to the degree of innovation of the creative content of the work. The “community self-governance system” constructed by NFT is opening the era of originality in contemporary art [16]. The originality of NFT digital content works is the prerequisite for copyright protection. From the first case of domestic NFT infringement “Fat Tiger Vaccine”, how to prevent users from copying, plagiarizing, and tampering with other people's works to mint NFTs is a major problem in realizing the value of NFT digital content works.

Timeliness emphasizes the minting time and release speed of NFT digital content works. In the current era of rapid development of information technology, mastering the timeliness of technology and creativity has become the key to gaining the initiative. In this cultural transformation, early minted NFTs tend to be more valuable, such as the CryptoPunks project, whose transaction price for a single work had reached 11.8 million dollars. At the same time, the speed of release of NFT digital works also has an impact on their value, with too rapid a release rate leading to dilution of the value of the work. In addition, too rapid a release rate can lead to dilution of the value of NFT digital content works.

Authority refers to the popularity, specialization, and influence of NFT digital content creators or communities. The effects of "traffic is king" and "fan economy" are almost applicable to all markets, especially in the "creator economy" field empowered by NFTs. The more followers a creator has, the larger the consumer market and more avenues for value realization for the NFTs they create.

Richness emphasizes the storytelling of the creative background and the knowledge retention of the content of the work. Previous studies have confirmed that richness can enhance the expressiveness of knowledge content, and information content is an important indicator for measuring richness [17]. The richness of NFT digital content works can be reflected in storylines, logical organization, color harmony, element coordination, and other aspects.

3.3 Market Demand

The value of any product put on the market is affected by market factors such as competition, supply and demand, and the economy. Especially in the NFT market, where speculative tendencies are significant, value is more sensitive to changes in environmental factors such as regulatory policy and financial volatility. The study analyzes the market factors that affect NFTs from five aspects: rarity, sociality, liquidity, power scope, and market externalities.

Rarity refers to the degree to which a product is difficult to obtain due to limited resources or insufficient supply. The rarity of NFT digital content works includes two concepts: feature rarity and asset rarity. The feature rarity measures the frequency of each feature's appearance; The asset rarity represents its overall rarity score. In practical applications, many NFT trading platforms have developed their own rarity scoring systems. For example, “Rarity.Tools” uses a scoring criterion that accumulates the inverse of the percentage of the frequency of occurrence of each feature, while NFTGO quantifies the differences between the assessed objects based on the Jaccard distance assignment mechanism.

Sociality involves the recognition that NFT digital content works gain in terms of social class, identity, and spirit. In the current era, where consumption is driven by motives of "socializing, self-branding, and self-gratification," NFTs have become a "symbolic tool" to enhance individual interpersonal interactions, group identity, and a shared sense of consciousness within the group. Different NFT works reflect certain social groups, social phenomena and cultural characteristics, representing the aesthetic and emotional resonance of the group. For example, Cryptopunk represents the fundamentalism and punk spirit of the cryptosphere; Bored Ape maps the nihilistic and uninhibited attitude of existentialism; and Azuki contains elements of Japanese anime culture.

Liquidity refers to the ability of NFTs to quickly meet the capital flow needs of their holders. Similar to non-homogeneous assets in the physical world, such as real estate, NFTs tend to increase their value by reducing the risk of holding the work. Collectible NFTs such as avatars and artworks are typically exhibit lower liquidity, and can only be traded at a fair value when they encounter suitable buyers. Otherwise, the seller may need to adopt asset value loss strategies such as price reductions to achieve liquidity.

The scope of power refers to the asset rights obtained after purchasing NFT digital content works, including full commercial rights, limited commercial rights, and additional rights granted by the creator. Typically, the purchaser acquires only ownership of NFTs. However, in order to satisfy the commercial use of digital works, the market often requires certain copyright licenses in addition to “ownership”. For example, Azuki grants the purchaser full commercial rights, with no restrictions on the form or duration of revenue, while Doodles grants the purchaser limited commercial rights, with a cap on revenue and prohibition on modifying the content of the work.

Market externalities mean that the value of NFTs is affected by external factors such as cryptocurrency indices, culture, and policy, in addition to the digital work itself and factors internal to the market. Typically, larger markets tend to diffuse into smaller associated markets. At this point, the cryptocurrency market, as a larger market associated with the NFT market, has been empirically studied to indicate significant synergies between the two.

4 Empirical Analysis

4.1 Indicators and Data Description

Nadini's (2021) study showed that NFT's historical transaction data demonstrated good performance in its price prediction process [18]. Therefore, in order to verify the validity of the above value-influencing factors, this study collected 1,005 samples from the NFT historical transaction tracking website (https://www.cryptoslam.io) for exploratory empirical analysis. Through expert consultation and in-depth research on the meanings of the fields shown on the website, combined with the analysis in the previous section, the quantitative entries of the indicators as shown in Table 1 are finally formed.

Table 1. Quantification of indicators

Primary Indicator |

Secondary Indicator |

Quantification |

Cost |

Direct Cost Indirect Cost |

Mint fees Transaction fees |

Copyright |

Originality Timeliness Authority Richness |

Category of digital content Minting date Wash sales Word count of description |

Market |

Rarity Sociality Liquidity Power Scope Externalities |

Supply volume Whether to establish the community Average holding time Whether to grant commercial use Categories of blockchain |

Value |

Sales |

Historical cumulative transaction sales |

The study uses the minting and transaction fees of NFTs to represent direct and indirect costs, respectively. Represent originality by the industry category of NFT. Through expert consultation, it was concluded that the art industry has the highest originality, followed by collectible, Game, metaverse, and finally utility. The timeliness is characterized by the time from minting date to present. Characterization of authority in terms of washing sales. Wash transaction refers to the market manipulation behavior in which investors sell the same NFT in a short period of time and then buy it again. The authority of NFTs decreases as the volume of clean transactions increases. Characterize richness in terms of statistical word counts of descriptions. Characterize rarity with supply volume. Characterize sociality by whether to establish the community. Characterize liquidity in terms of average holding time. Characterize the power scope in terms of whether to grant commercial use. Characterize externalities in terms of the class of blockchain to which the NFT belongs. Characterize market externalities in terms of the class of blockchain to which the NFT belongs. Characterize the value of NFT in terms of historical cumulative transaction sales and volume.

The externalities is a categorical variable and it is not possible to accurately generalize the kinds of categories it covers before data collection is complete. Therefore, for this large-scale categorical feature, the study refers to research of Nazyrova (2022) and uses Target-Encoding for processing [19]. For the feature of Originality, which has a hierarchical relationship, the study adopts Ordinal Encoding for processing. For Social and Power Scope features that do not have a hierarchical relationship, the study adopts One-Hot Encoding to ensure that the different categories were on equal footing. For the remaining numerical variables, the study uses normalization methods to map the values to the range of 0 to 1.

We have reviewed the research on the topic of “data/digital+assets/resources” in recent years, and found that the related value assessment models can be broadly categorized into three types: statistical methods, machine learning methods, and deep learning methods. The study selected multiple linear regression (MLR) in the field of statistics, K-Nearest Neighbor (KNN) algorithm in the field of machine learning, and BP (Back Propagation) neural network in the field of deep learning as validation models, and selected the coefficient of determination (R2), root mean square error (RMSE), and mean absolute error (MAE) to evaluate the performance of them. For model construction, we used the first 705 samples for training and the last 300 for testing.

4.2 Empirical Analysis Based on Multiple Methods

Multiple regression (MLR) is the most widely used evaluation method in the field of statistics to reflect the correlation between multiple variables. This study used SPSS 25.0 software and stepwise regression to establish the optimal regression equation. The final expression of the optimal model is shown in equation (1), and the correlation coefficients between variables and model tests are shown in Table 2. According to the experimental results, the indicators Richness and Externalities were excluded from the optimal model, indicating that their linear predictive ability for value is not significant. The model's coefficient of determination R2=0.664 indicates that the model's fitting effect is basically qualified. The Durbin Watson test value is 1.841, which basically passes the test, indicating strong independence of the sample values. At a significance level of 0.05, all variables passed the t-test, indicating that the selection of variables was effective.

\( Y=38.317X_{1}-43.323X_{2}+66.65X_{3}-188.296X_{4}-145.806X_{5}+99.71X_{6}+14.803X_{7}-46.901X_{8}+401.754X_{9}-7.016 \) (1)

Table 2. Experimental results of MLR model

Variable |

Secondary Indicator |

Coefficient |

T-test |

Significance |

R2 |

D-W |

X1 |

Direct Cost |

38.317 |

4.367 |

0.00 |

0.664 |

1.841 |

X2 |

Indirect Cost |

-43.323 |

-3.457 |

0.001 |

||

X3 |

Originality |

66.65 |

7.074 |

0.00 |

||

X4 |

Timeliness |

-188.296 |

-3.319 |

0.001 |

||

X5 |

Authority |

-145.806 |

-3.482 |

0.001 |

||

X6 |

Rarity |

99.71 |

2.592 |

0.01 |

||

X7 |

Sociality |

14.803 |

2.472 |

0.014 |

||

X8 |

Liquidity |

-46.901 |

-3.465 |

0.001 |

||

X9 |

Power Scope |

401.754 |

24.979 |

0.00 |

||

C |

-- |

-7.016 |

-1.936 |

0.053 |

||

Y |

Sales |

-- |

-- |

-- |

KNN is one of the most fundamental algorithms in the fields of machine learning and data mining. The core idea of the KNN algorithm is 'birds of a feather flock together'. Specifically, the predicted value of a new instance can be estimated by examining the dependent variable values of its nearest K training instances (neighbors). The model sets the initial K value to 2, with a loop step size of 1, matches adjacent samples based on Euclidean distance, and calculates the error using inverse distance weighting. Finally, the K value that results in the smallest error is found to be 10.

The core of BP neural network is error back-propagation, which has strong nonlinear adaptability and learning ability, and is one of the most widely used models in the field of deep learning. The network structure generally consists of an input layer, a hidden layer, and an output layer, and information is transmitted and processed between each layer through connection functions, weights, and thresholds. The final BP neural network structure constructed in this study consists of 16 input layer nodes; One output layer node; There are 2 hidden layers, each containing 15 nodes; The activation function is the REUL function; The maximum number of iterations is 2000.

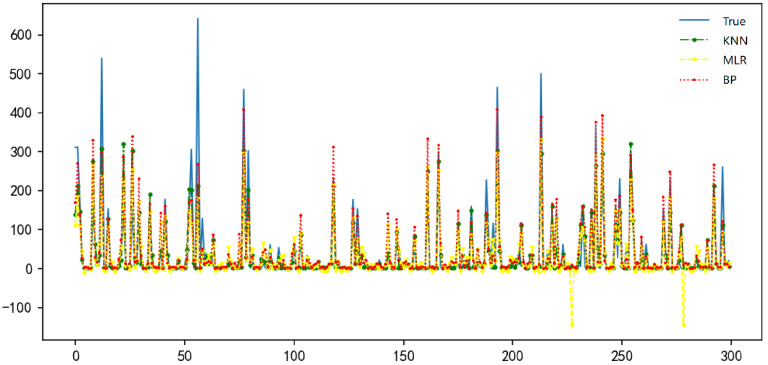

The study used Python language to compare the predictive performance of the above models, which is shown in Figure 2, and the performance comparison is summarized in Table 3. Observing Figure 2, it can be observed that representative evaluation methods in the fields of statistics, machine learning, and deep learning can all predict the value of works well, indicating that the value influencing factors proposed in this paper are reasonable and effective. From the perspective of model performance, the prediction results of linear regression models are relatively rough, even showing negative values; Meanwhile, the nonlinear models KNN and BP perform better than linear regression in terms of goodness of fit R2, root mean square error RMSE, and mean absolute error MAE. Nonlinear models have higher applicability than linear models in evaluating the value of NFT digital content works. From the perspective of model interpretability, the coefficient of determination increases as the interpretability of the model decreases, confirming the contradiction between model accuracy and interpretability. The above analysis provides ideas and directions for exploring refined evaluation models and methods in the future, indicating that non-linear models that balance accuracy and interpretability may become one of the research directions for evaluating the value of NFT digital content works.

Figure 2. Comparative analysis of model prediction performance

Table 3. Comparison of Model Performance

Performance |

MLR |

KNN |

BP |

R2 |

0.66 |

0.74 |

0.77 |

RMSE |

51.59 |

47.33 |

44.89 |

MAE |

23.70 |

19.02 |

20.44 |

Interpretability |

Strong |

Medium |

Weak |

5 Conclusion

Based on the value chain theory, the study proposes the influencing factors of the value of NFT digital content works, constructs the value assessment index system from three dimensions of cost, copyright and market, and further empirically analyzes based on the historical transaction data by using multivariate linear regression, K-neighborhood algorithm and BP neural network. The research results indicate that, firstly, the NFT digital content work value evaluation index system constructed in this article has certain effectiveness. Secondly, compared to linear models, nonlinear evaluation models are more suitable for the value assessment of NFT digital content works. Finally, exploring an evaluation model that balances accuracy and interpretability is one of the challenges in the research of NFT digital content valuation.

With the deep integration of blockchain technology and cultural digital publishing industry, the connotation and extension of NFT digital content works will continue to enrich. The next step of the research will be to further improve the above-mentioned indicator models, develop a value evaluation method for NFT digital content works that balances accuracy and interpretability, and conduct empirical research on NFT digital content works of different platforms and categories, providing countermeasures and suggestions for the development of NFT digital publishing industry and the transformation and upgrading from traditional digital publishing to NFT digital publishing.

References

[1]. Wang, Q., Li, R., Wang, Q., et al. (2021). Non-fungible token (NFT): Overview, evaluation, opportunities, and challenges. arXiv preprint arXiv:2105.07447.

[2]. Kastrenakes, J. (2021, March 25). Your million-dollar NFT can break tomorrow if you're not careful. The Verge. Retrieved April 9, 2021, from https://www.theverge.com/2021/3/25/22349242/nft-metadata-explained-art-crypto-urls-links-ipfs

[3]. Idelberger, F., & Mezei, P. (2022). Non-fungible tokens. Internet Policy Review, 11(2).

[4]. Bamakan, S. M. H., Nezhadsistani, N., Bodaghi, O., et al. (2022). Patents and intellectual property assets as non-fungible tokens: Key technologies and challenges. Scientific Reports, 12(1), 2178.

[5]. Wang, Q., Li, R., Wang, Q., et al. (2021). Non-fungible token (NFT): Overview, evaluation, opportunities, and challenges. arXiv preprint arXiv:2105.07447.

[6]. Guadamuz, A. (2021). The treachery of images: Non-fungible tokens and copyright. Journal of Intellectual Property Law and Practice, 16(12), 1367–1385.

[7]. Frye, B. L. (2021). After copyright: Pwning NFTs in a clout economy. Columbia Journal of Law & the Arts, 45, 341.

[8]. Chohan, U. W. (2021). Non-fungible tokens: Blockchains, scarcity, and value. Critical Blockchain Research Initiative (CBRI) Working Papers.

[9]. Chevet, S. (2018). Blockchain technology and non-fungible tokens: Reshaping value chains in creative industries. Available at SSRN 3212662.

[10]. Piyadigama, D., & Poravi, G. (2022). An analysis of the features considerable for NFT recommendations. In 2022 15th International Conference on Human System Interaction (HSI) (pp. 1–7). IEEE.

[11]. Raizberg, E. (2023). Non-fungible tokens: A bubble or the end of an era of intellectual property rights. Financial Innovation, 9(1), 1–20.

[12]. Taherdoost, H. (2022). Non-fungible tokens (NFT): A systematic review. Information, 14(1), 26.

[13]. Dowling, M. (2022). Is non-fungible token pricing driven by cryptocurrencies? Finance Research Letters, 44, 102097.

[14]. Kong, D. R., & Lin, T. C. (2021). Alternative investments in the Fintech era: The risk and return of Non-Fungible Token (NFT). Available at SSRN 3914085.

[15]. Lynn, M. (1991). Scarcity effects on value: A quantitative review of the commodity theory literature. Psychology & Marketing, 8(1), 43–57.

[16]. Kushwaha, S. S., Joshi, S., Singh, D., et al. (2022). Ethereum smart contract analysis tools: A systematic review. IEEE Access, 10, 57037–57062.

[17]. Daft, R. L. (1984). Information richness: A new approach to managerial behavior and organization design. Research in Organizational Behavior, 6, 191–233.

[18]. Nadini, M., Alessandretti, L., Di Giacinto, F., et al. (2021). Mapping the NFT revolution: Market trends, trade networks, and visual features. Scientific Reports, 11(1), 20902.

[19]. Nazyrova, N., Chaussalet, T. J., & Chahed, S. (2022). Machine learning models for predicting 30-day readmission of elderly patients using custom target encoding approach. In International Conference on Computational Science (pp. 122–136). Springer International Publishing.

Cite this article

Gao,Y.;Xie,X. (2024). Research on the Factors Influencing the Value of NFT Digital Content Works. Journal of Applied Economics and Policy Studies,14,52-58.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wang, Q., Li, R., Wang, Q., et al. (2021). Non-fungible token (NFT): Overview, evaluation, opportunities, and challenges. arXiv preprint arXiv:2105.07447.

[2]. Kastrenakes, J. (2021, March 25). Your million-dollar NFT can break tomorrow if you're not careful. The Verge. Retrieved April 9, 2021, from https://www.theverge.com/2021/3/25/22349242/nft-metadata-explained-art-crypto-urls-links-ipfs

[3]. Idelberger, F., & Mezei, P. (2022). Non-fungible tokens. Internet Policy Review, 11(2).

[4]. Bamakan, S. M. H., Nezhadsistani, N., Bodaghi, O., et al. (2022). Patents and intellectual property assets as non-fungible tokens: Key technologies and challenges. Scientific Reports, 12(1), 2178.

[5]. Wang, Q., Li, R., Wang, Q., et al. (2021). Non-fungible token (NFT): Overview, evaluation, opportunities, and challenges. arXiv preprint arXiv:2105.07447.

[6]. Guadamuz, A. (2021). The treachery of images: Non-fungible tokens and copyright. Journal of Intellectual Property Law and Practice, 16(12), 1367–1385.

[7]. Frye, B. L. (2021). After copyright: Pwning NFTs in a clout economy. Columbia Journal of Law & the Arts, 45, 341.

[8]. Chohan, U. W. (2021). Non-fungible tokens: Blockchains, scarcity, and value. Critical Blockchain Research Initiative (CBRI) Working Papers.

[9]. Chevet, S. (2018). Blockchain technology and non-fungible tokens: Reshaping value chains in creative industries. Available at SSRN 3212662.

[10]. Piyadigama, D., & Poravi, G. (2022). An analysis of the features considerable for NFT recommendations. In 2022 15th International Conference on Human System Interaction (HSI) (pp. 1–7). IEEE.

[11]. Raizberg, E. (2023). Non-fungible tokens: A bubble or the end of an era of intellectual property rights. Financial Innovation, 9(1), 1–20.

[12]. Taherdoost, H. (2022). Non-fungible tokens (NFT): A systematic review. Information, 14(1), 26.

[13]. Dowling, M. (2022). Is non-fungible token pricing driven by cryptocurrencies? Finance Research Letters, 44, 102097.

[14]. Kong, D. R., & Lin, T. C. (2021). Alternative investments in the Fintech era: The risk and return of Non-Fungible Token (NFT). Available at SSRN 3914085.

[15]. Lynn, M. (1991). Scarcity effects on value: A quantitative review of the commodity theory literature. Psychology & Marketing, 8(1), 43–57.

[16]. Kushwaha, S. S., Joshi, S., Singh, D., et al. (2022). Ethereum smart contract analysis tools: A systematic review. IEEE Access, 10, 57037–57062.

[17]. Daft, R. L. (1984). Information richness: A new approach to managerial behavior and organization design. Research in Organizational Behavior, 6, 191–233.

[18]. Nadini, M., Alessandretti, L., Di Giacinto, F., et al. (2021). Mapping the NFT revolution: Market trends, trade networks, and visual features. Scientific Reports, 11(1), 20902.

[19]. Nazyrova, N., Chaussalet, T. J., & Chahed, S. (2022). Machine learning models for predicting 30-day readmission of elderly patients using custom target encoding approach. In International Conference on Computational Science (pp. 122–136). Springer International Publishing.