1. Introduction

With the rapid development of global economic integration trends, mergers and acquisitions (M&A) in the healthcare industry have become more frequent, attracting widespread attention. This trend is especially notable in China, where market influence is steadily growing, and state-owned and central enterprises (SOEs and COEs) play a growing role in the integration and restructuring of the healthcare sector. As key economic pillars, SOEs and COEs actively contribute to consolidating and optimizing healthcare resources. These M&A activities not only shape the strategic direction of enterprises but also significantly impact the structure and efficiency of the overall healthcare system.

Although existing research has addressed many aspects of M&A in the healthcare industry, a detailed analysis of the strategies and outcomes of SOEs and COEs in this sector remains limited. Many studies primarily focus on the basic motives, transaction structures, or quantitative outcomes of M&A for individual companies, neglecting the development trajectory of SOEs and COEs in the M&A domain. The driving forces behind this trend are often overlooked. Examining these factors can reveal underlying dynamics and provide suggestions for improvement. More importantly, understanding the motivations and strategies of SOEs and COEs in M&A not only clarifies their role within the healthcare industry but also offers insights into optimizing their practices. While successful M&A activities enhance resource allocation and organizational synergy, failures can result in inefficiencies or unintended consequences. Therefore, it is crucial to identify the factors that enhance M&A effectiveness and those that may hinder it, enabling other enterprises to learn from these cases and improve their future efforts.

This study will examine several M&A activities of SOEs and COEs in the healthcare industry in China. Using data from recent reports and studies, this paper will conduct a systematic analysis of the M&A processes, strategic choices, and implementation outcomes of SOEs and COEs in the healthcare sector. In addition, while analyzing the influence of finance, the paper will specifically focus on the acquisition of Boya Bio-pharmaceuticals by China Resources Pharmaceutical Group, analyzing this case in detail and providing relevant recommendations. Based on the comprehensive and in-depth analysis presented, this study offers a new theoretical framework and perspective for academia on the topic of M&A activities undertaken by SOEs and COEs in the healthcare industry. Furthermore, it provides practical references for decision-making and management in M&A practices, promoting the sustainable and healthy development of SOEs and COEs within the healthcare industry.

The structure of this paper will include case discussions and analysis of key findings. The conclusion will propose specific recommendations and actionable plans.

2. Merger and Acquisition Process

2.1. Overview of M&A Activities in the Healthcare Industry

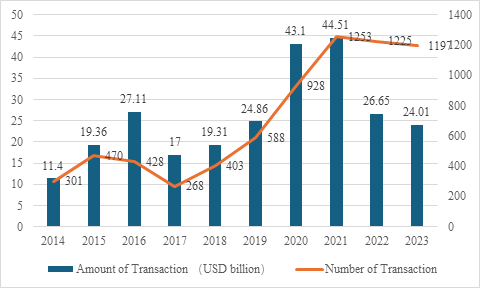

Over the past decade, mergers and acquisitions (M&A) in the healthcare industry have remained highly active. Driven by national economic growth and increasing healthcare demands, the industry has experienced significant consolidation. As illustrated in Figure 1 [1-2], M&A transactions in the healthcare industry exhibited a steady upward trend in both number and value from 2014 to 2022. Specifically, the number of transactions increased nearly fourfold, from 301 deals in 2014 to approximately 1,200 deals by 2023. Correspondingly, transaction values rose from approximately $11.4 billion in 2014 to $24 billion in 2023, with peaks exceeding $40 billion in 2020 and 2021, reflecting rapid growth.

Figure 1. Amount and Number of Healthcare M&A Transactions in China (USD Billion)

A phase-based analysis of the past decade reveals several critical turning points, dividing the period into distinct stages. Initially, the healthcare industry witnessed rapid growth in M&A activity between 2014 and 2016, driven by national policies such as the Healthy China 2030 initiative and a surge in ‘investment enthusiasm.’ During this time, transaction volumes expanded annually as more healthcare-related enterprises leveraged M&A activities to accelerate market expansion and technological innovation. However, in the following two years, both the value and number of transactions saw a noticeable decline. This was due to the industry’s shift in investment direction, tightened regulatory policies, and changes in market conditions, which collectively slowed the momentum in the healthcare M&A sector.

In 2017, the domestic private equity (PE) market experienced a period of significant growth. During this phase, companies increasingly favored independent business operations over pursuing M&A opportunities. According to relevant studies, private equity investment, introduced in China during the 1990s, achieved rapid expansion in asset management scale and investment activities, exhibiting significant diversification trends. PE firms actively invested in listed companies and played a crucial role in corporate governance, providing services that enhanced market capitalization management. As a result, strategic M&A cases became less common during this period [3].

From 2019 to 2020, despite the severe disruptions to the global economy caused by the COVID-19 pandemic, M&A activities in the healthcare industry did not decline significantly. In fact, M&A activities reached a peak in 2021. This can be attributed to the countercyclical growth characteristics of the healthcare industry during the pandemic: heightened demand for drugs and medical devices aimed at preventing and treating COVID-19 infections, coupled with the public’s increased reliance on healthcare services, which allowed the industry to thrive despite economic uncertainties. During this phase, many healthcare enterprises sought to use M&A and restructuring to explore new business growth opportunities and innovative business models, aiming to expand their market share [4].

In the subsequent post-pandemic period, as the effects of the pandemic diminished and macroeconomic conditions and more ‘conservative and rational’ investment philosophies took hold among investors and enterprises, the volume and value of healthcare M&A transactions slightly declined from their pandemic-era highs. Nevertheless, in recent years, the sector has consistently maintained a stable level of activity.

2.2. Sub-sectors: M&A Activities in Pharmaceuticals and Medical Devices

2.2.1. Comparison of M&A Directions

In the landscape of mergers and acquisitions (M&A) within the healthcare industry, pharmaceuticals and medical devices represent two of the most pivotal areas. Although both are part of the healthcare industry, they exhibit significant differences in market size, competitive strategies, and M&A activities.

Pharmaceuticals primarily involve the R&D, production, and sales of drugs. In this sub-sector, companies typically pursue M&A to acquire the capabilities necessary for innovative drug development and expand their market share. Types of M&A in the pharmaceutical industry include technology acquisitions focused on patents and R&D capabilities, as well as production line consolidations. In recent years, pharmaceutical companies have shown a preference for acquiring firms whose products feature high technological barriers to R&D, substantial potential, and market scarcity. This strategy helps to enhance their business scope and competitive edge. For example, in 2021, China Resources Pharmaceutical executed a 5-billion-yuan transaction to acquire Boya Bio-pharmaceutical through a combination of ‘equity transfer, voting rights entrustment, and private placement.’ This transaction not only marked China Resources Pharmaceutical’s largest M&A deal in recent years but also encountered challenges due to debt issues within departments in 2020. Nevertheless, considering the scarcity and significant growth potential of the blood products market at the time, along with high entry barriers, limited plasma resources, and the complexity of related technologies regulated by stringent national policies, China Resources Pharmaceutical ultimately decided to invest heavily. This decision led to the acquisition of Boya Bio-pharmaceutical, a leading company in this field [5].

In contrast, the medical device sector places greater emphasis on product innovation and market promotion. Companies in this field achieve product line expansion and technological innovation through multiple M&A activities over time, often focusing on acquiring high-tech medical device companies and integrating technological capabilities and market resources. M&As in the medical device industry often occur amid intensifying market competition, especially with the emergence of new technologies in digitalization, automation, and robotic surgery. The rise of emerging companies has spurred numerous technological collaborations and M&A transactions. A prime example is Mindray Medical, a leading player in the domestic medical device industry. Since embarking on its M&A journey in 2008, Mindray Medical has engaged in over ten acquisition projects, driven by years of independent innovation and integration. It has developed three main business segments—life support, in vitro diagnostics, and medical imaging—covering areas such as high-value consumables and IVD consumables, while also addressing multiple medical disciplines. In recent years, its gross profit margin has consistently exceeded 60%, with a return on equity above 30% for several years [6].

2.2.2. Comparison of the Amount and Number of M&A Transactions

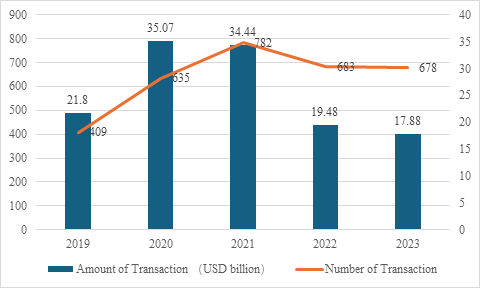

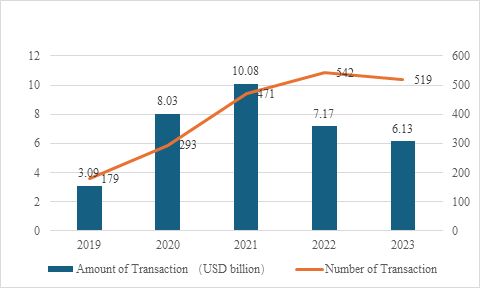

As shown in Figures 2 and 3 [2], M&A activities in the pharmaceutical sector in China have remained relatively stable over the past two years, with the total number of transactions reaching 678, a figure similar to that of 2022. However, transaction volumes have significantly decreased compared to previous years. This trend can be attributed to multiple factors, including the uncertainty of the market environment, changes in relevant policies, and a decline in corporate financing capabilities. Acquirers have become more cautious in selecting transaction targets, opting for M&A activities with lower-risk investments. It is anticipated that there will be a greater future focus on identifying potential small to medium-sized enterprises. In contrast to pharmaceuticals, although the transaction value in the medical devices sector has significantly decreased over the past two years, the number of transactions has seen a modest increase. This suggests that the technological capabilities and innovation potential of small and medium-sized enterprises are increasingly attractive to large companies, resulting in more small-scale transactions.

Figure 2. M&A Transactions in the Pharmaceutical Sector (Billions of USD and Number of Transactions)

Figure 3. M&A Transactions in the Medical Devices Sector (Billions of USD and Number of Transactions)

From a comprehensive analysis of M&A activities in these two sub-sectors, it is clear that, although the overall trend in transactions is similar for both, the pharmaceutical sector still commands a larger market size than the medical devices sector. The significant differences in M&A directions, transaction volumes, and the number of transactions reflect the unique characteristics of each market environment and the diverse strategic choices of the acquiring companies. M&A in the pharmaceutical sector has become more rational and conservative, leaning towards smaller lower-risk transactions. Meanwhile, companies in the medical devices sector continue to actively expand their markets by seeking growth through numerous small-scale transactions, particularly in high-tech areas. These transactions aim to broaden their industry value chains. This suggests that, even amid rising global economic uncertainties, both sub-sectors of the healthcare industry exhibit distinct vitality and M&A characteristics, with transactions increasingly shaped by technological innovation and market orientation.

2.3. Overview of M&A Activities by SOEs and COEs

In recent years, SOEs and COEs have played a dominant role in M&A activities within the healthcare industry, driven by strategic goals aimed at enhancing market competitiveness, expanding business domains, and achieving resource integration. From 2018 to 2024, supported by favorable national policies, increasing financial strength, and robust market demand, SOEs and COEs have maintained their leadership in the scale of M&A transactions within the healthcare industry, actively engaging in M&A activities. These acquisitions not only increase market share but also support revenue growth. As technological advancements and the diversification of market demand continue within the industry, the M&A strategies of SOEs and COEs are expected to evolve in response to the changing market environment and technological requirements. Over the past two years, the number of M&A transactions by Chinese SOEs and COEs in the healthcare industry has increased significantly, with several large-scale deals. Table 1 presents some examples of these [7].

Table 1. Selected M&A Cases of Chinese SOEs in 2023-2024

Announcement Date | Company Name | Specific Event and Amount |

January 2023 | CR Sanjiu | Acquired a 28% stake in Kunming Pharmaceutical Group for CNY 2.902 billion |

May 2023 | CR Pharmaceutical | Increased investment in Hefei Lifeon Pharmaceutical Co., Ltd. by CNY 113 million, resulting in the acquisition of a 51% stake |

June 2023 | SINOPHARM | Acquired Shenzhen Weiguang Biological Products Co., Ltd. to become its controlling shareholder |

September 2023 | CR Double-Crane | Acquired a 89.68% stake in GUIZHOU TIANAN PHARMACEUTICAL SHARES Co., LTD for CNY 260 million |

January 2024 | Mindray Medical | Acquired control of APT Medical Inc for CNY 6.65 billion |

February 2024 | China National Machinery Corporation | Integrated Chongqing Pharmaceutical Group Co., Ltd., with plans to change the controlling shareholder |

February 2024 | SINOPHARM | Proposed the privatization of China National Traditional Chinese Medicine Corporation for HK $15.45 billion |

July 2024 | China General Technology Group | Made a strategic investment in Neusoft Medical, becoming its largest shareholder |

July 2024 | CR Sanjiu | Acquired a 28% stake in TIANJIN TASLY PHARMACEUTICAL CO., LTD for over CNY 6.2 billion |

3. Driving Factor

3.1. Policy Support

Policy support is a crucial driver of M&A activities by Chinese SOEs and COEs in the healthcare industry. This support is evident not only in the increased attention and backing from the state toward the healthcare industry but also in the implementation of specific policy measures by both national and local governments. In recent years, the Chinese government has gradually recognized the importance of the healthcare industry in national economic development, thereby intensifying policy support for this industry. This policy orientation provides significant motivation for M&A activities, as reflected in the following aspects.

First, policy formulation at the national level has set a clear direction for the development of the healthcare industry. For instance, the ‘Healthy China 2030’ Planning Outline, promulgated in 2016, outlines long-term goals for public health and emphasizes the vigorous development of the healthcare industry. Under this policy backdrop, SOEs and COEs, as vital pillars of the national economy, have become key proponents of actively participating in the construction and improvement of healthcare service systems [8]. Secondly, the National Development and Reform Commission and the Ministry of Finance, in their jointly issued ‘Guiding Catalogue of Industrial Structure Adjustment (2024 Edition),’ have indicated that further optimization of industrial structures across sectors will be promoted. This will encompass 24 projects in the pharmaceutical field, aiming to encourage the healthcare industry to seek new breakthroughs in pharmaceutical technology [9]. Lastly, local governments have shown positive support for M&A activities in the healthcare industry. For example, the Beijing Municipal Health Commission’s ‘Implementation Opinions on Promoting the Development of the Health Service Industry,’ released in 2014, called for accelerating the integrated development of health services and related industries. It also called for relaxing market entry regulations, broadening the healthcare service market, and supporting investments and acquisitions by state capital in relevant enterprises [10].

The promotion of national policies provides multifaceted support for SOE and COE M&A in the healthcare industry. It not only eliminates barriers to entry but also opens up more opportunities for acquisitions, thus enabling SOEs and COEs to play a more significant role in the healthcare industry and further advance its progress and development.

3.2. Market Drivers

Market drivers are also significant. As one of the major industrial pillars in China, the revenue size of the healthcare industry has been continuously expanding, maintaining an active M&A landscape in the domestic market. As of now, the number of M&A cases in the healthcare sector in 2024 ranks second in the entire market. An increasing number of companies, particularly SOEs and COEs, are venturing into healthcare M&A, as reflected in their strategic objectives of expanding market share and enhancing competitiveness.

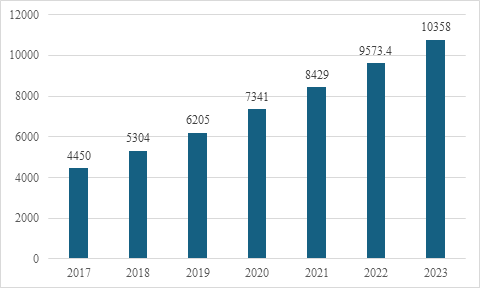

First, expanding market share is a primary motivation for engaging in M&A within the healthcare industry. In recent years, the rapid development of the healthcare industry has made it a focus for investors. According to data from China’s National Medical Products Administration (Figure 4), the performance of the medical device market has been remarkable, with the market size continuously increasing and reaching a new all-time high by surpassing 1 trillion CNY in 2023. This stable growth trend has positioned China as the world’s second-largest medical device market, with projections indicating continued growth in the coming years [4, 11]. In such a vast and promising market, SOEs and COEs can swiftly increase their market share and expand their business operations by acquiring smaller medical enterprises or specialized medical service institutions, thereby capturing larger sales channels and customer bases. Through M&A activities, SOEs and COEs can not only diversify their product lines and service offerings but also enhance brand recognition and market penetration. This strategy equips them with stronger bargaining power against competitors, ultimately improving the overall profitability of the enterprise.

Figure 4. Market Size of China’s Medical Device Industry (Billion CNY)

Secondly, enhancing market competitiveness is another core objective for SOEs and COEs undertaking M&A in the healthcare industry. In the current, intensely competitive market environment, participants include numerous private and foreign enterprises, as well as other SOEs and COEs. Against this backdrop, every enterprise needs to augment its market competitiveness to ensure survival and growth. By acquiring technologically advanced and market-established medical companies on a large scale, they can swiftly address their inherent shortcomings. For example, in August 2024, Tasly announced the transfer of its 28% stake to China Resources Sanjiu. As one of the top ten enterprises in terms of market capitalization among listed Chinese medicine companies, Tasly’s acquisition by China Resources Sanjiu further strengthens the position of SOEs in the Chinese medicine field. This not only enhances China Resources Sanjiu’s overall competitiveness in the medical market, reducing internal industry competition, but also enables the rapid introduction and promotion of new products, supporting the pursuit of new strategic objectives. This process presents an opportunity to integrate business operations and strengthen corporate market strategies and innovation capabilities.

The engagement of SOEs and COEs in M&A within the healthcare industry is driven by their desire to expand market share and enhance competitiveness. Amid intensifying competition and a favorable policy environment, SOEs and COEs strive to consolidate resources and diversify operations through mergers and acquisitions, responding to ever-changing market demands and competitive pressures, thereby promoting their long-term, sustainable development.

3.3. Synergy Effects

In the M&A market, synergy effects are regarded as crucial for enhancing enterprise value. When companies engage in M&A for resource integration, synergies help reduce operational costs and improve market competitiveness. In the healthcare industry, synergy effects are particularly evident, generating substantial benefits for both parties through resource sharing, technology integration, and optimization of market channels. These benefits typically include financial and operational synergies. Against the backdrop of increasingly intense market competition in China’s healthcare industry, the success of M&A activities by SOEs and COEs largely depends on their ability to effectively leverage synergy effects. Therefore, synergies are considered one of the key driving forces behind SOEs and COEs’ mergers and acquisitions in the healthcare industry [12-13].

3.3.1. Financial Synergy Effects

Financial synergy refers to the integration of financial resources between two companies after an acquisition, leading to revenue growth, cost reductions, and, ultimately, higher profits. Taking the aforementioned acquisition of Tasly by China Resources Sanjiu as an example, by September 30, 2024, China Resources Sanjiu reported total revenue of 19.74 billion CNY, with a quarter-on-quarter growth of 39.9%, while the acquired Tasly achieved a total revenue of 6.463 billion CNY, reflecting a quarter-on-quarter growth of 47.8%. These figures indicate a significant improvement in the profitability and growth capacity of both companies through the acquisition. This financial integration not only provided China Resources Sanjiu with greater capital and resources for enhanced market competition, laying a foundation for further market expansion, but also helped Tasly address the issue of declining revenue growth in its pharmaceutical segment [14-15].

3.3.2. Operational Synergy Effects

With continuous technological changes and evolving market demands, companies need to possess efficient R&D capabilities to develop new products that meet these needs. For instance, following the acquisition of Tasly, a company primarily focused on traditional Chinese medicine (TCM), China Resources Sanjiu plans to develop the world’s first multi-modal large model, “Digital Intelligent Materia Medica,” which will integrate TCM with clinical practices and high-tech innovations to meet evolving consumer demands and align with current trends. Given the healthcare industry’s inherent challenges, such as high entry barriers, technological hurdles, and substantial investment costs, operational synergies can help companies—particularly SOEs and COEs—expand their market share and extend their industry chains at a lower risk and faster pace [16].

4. Financial Performance: A Case Study of CR Pharmaceutical’s Acquisition of Boya Bio-pharmaceutical

This section analyzes Boya Bio-pharmaceutical’s financial performance from 2020 to 2023, evaluating key aspects such as asset-liability structure, solvency, and profitability following the acquisition.

4.1. Asset-Liability Structure Analysis

Table 2. Detailed Assets and Composition of Boya Bio-pharmaceutical, 2020–2023 (CNY Billion, %) [17]

Item | Dec. 31, 2023 | Dec. 31, 2022 | Dec. 31, 2021 | Dec. 31, 2020 | ||||

Amount | % | Amount | % | Amount | % | Amount | % | |

Total Current Assets | 6.428 | 82.1 | 6.073 | 75.6 | 5.646 | 74.08 | 2.928 | 56.76 |

Total Non-Current Assets | 1.401 | 17.9 | 1.960 | 24.4 | 1.976 | 25.92 | 2.231 | 43.24 |

Total Assets | 7.829 | 100 | 8.033 | 100 | 7.622 | 100 | 5.159 | 100 |

The disclosed financial statements reveal that the total assets of Boya Bio-pharmaceutical increased to RMB 7.622 billion by the end of the first accounting year after the acquisition, representing a year-on-year growth of 47.7%. This growth was primarily driven by a significant increase in current assets, while non-current assets experienced a slight decrease. This shift suggests a strategic adjustment, with reduced long-term investments and a greater emphasis on short-term returns or liquidity.

Table 3. Detailed Liabilities and Composition of Boya Bio-pharmaceutical, 2020–2023 (CNY Million, %) [17]

Item | Dec. 31, 2023 | Dec. 31, 2022 | Dec. 31, 2021 | Dec. 31, 2020 | ||||

Amount | % | Amount | % | Amount | % | Amount | % | |

Total Current Liabilities | 456.4 | 89.84 | 705.3 | 94.25 | 630.9 | 89.96 | 871.9 | 90.25 |

Total Non-Current Liabilities | 51.63 | 10.16 | 43.01 | 5.75 | 70.36 | 10.04 | 94.15 | 9.75 |

Total Liabilities | 508 | 100 | 748.3 | 100 | 701.3 | 100 | 966.1 | 100 |

The liability data show that Boya Bio-pharmaceutical’s total liabilities decreased to RMB 701.3 million in the first accounting year after the acquisition, representing a year-on-year decrease of 27.4%. This indicates that the company’s financial pressure eased and reflects improved financial health after the acquisition. The proportion of current liabilities slightly decreased (from 90.25% to 89.96%), and the reduction in overall current liabilities signifies enhanced short-term solvency and lower liquidity risks. Additionally, the improvement in the liability structure (a slight decrease in current liabilities and an increase in non-current liabilities) suggests a more stable financing strategy post-acquisition, reducing short-term debt reliance and enhancing long-term stability and operational flexibility.

Further analysis reveals that Boya Bio’s total assets decreased rather than increased between 2022 and 2023. This decline is attributed to the underperformance of non-core subsidiaries previously acquired by Boya Bio, including Nanjing Xinbai Pharmaceutical in the biochemical field and Guizhou Tian’an Pharmaceutical in the diabetes field. Both subsidiaries experienced a downward trend in revenue in recent years, with goodwill impairment significantly reducing the book value of the company’s non-current assets, leading to a decrease in total asset value in 2023. Following the acquisition of Boya Bio, China Resources Pharmaceutical initiated a plan to help the company divest some of its previously acquired subsidiary businesses. In 2023, with the assistance of China Resources Pharmaceutical, Boya Bio successfully divested Guangdong Fuda Pharmaceutical and Guizhou Tian’an Pharmaceutical, resulting in noticeable financial improvements. According to data disclosed by Boya Bio, as of September 30, 2024, the company’s total assets had reached RMB 8.158 billion, indicating a growth trend compared to the end of 2022.

Simultaneously, Boya Bio’s total liabilities increased from 2021 to 2022 but showed a significant decline in 2023. This trend is also related to the divestment of non-core businesses. During the 2021–2022 period, Boya Bio was in a post-acquisition resource integration phase. Subsequently, China Resources Pharmaceutical implemented the divestment plan for non-core businesses. As Boya Bio gradually exited operations unrelated to its core blood products business, the associated liabilities were either transferred or settled, reducing its financial burden. Additionally, the overall scale of operations contracted, lowering the company’s reliance on external financing and preventing further increases in liabilities after the acquisition [18].

4.2. Solvency Analysis

This analysis evaluates both short-term and long-term solvency using the current and quick ratios for short-term solvency and the debt-to-asset and gearing ratios for long-term solvency.

Table 4. Solvency Indicators for Boya Bio-pharmaceutical, 2020–2023 [17]

indicator | Dec. 31, 2023 | Dec. 31, 2022 | Dec. 31, 2021 | Dec. 31, 2020 |

Debt-to-Asset Ratio (%) | 6.49 | 9.32 | 9.20 | 18.73 |

Current Ratio (times) | 14.08 | 8.611 | 8.948 | 3.358 |

Quick Ratio (times) | 12.86 | 7.665 | 7.876 | 2.567 |

Gearing Ratio (%) | 0.7 | 0.59 | 1.01 | 2.20 |

Short-Term Solvency: Based on the composition of the debt, the company’s current ratio (e.g., 8.948 times in 2021 and 3.358 times in 2020) and quick ratio (e.g., 7.876 times in 2021 and 2.567 times in 2020) indicate a stronger ability to cover current liabilities with current assets after the acquisition, highlighting the enterprise’s adequate capital and strong short-term solvency.

Long-Term Solvency: From 2020 to 2023, the debt-to-asset ratio dropped significantly, from 18.73% to 6.49%, demonstrating better debt management. The gearing ratio declined from 2.20% to 0.7%, reflecting reduced dependence on external debt. These improvements can be attributed to the divestiture of underperforming subsidiaries, which enabled Boya Bio-pharmaceutical to optimize its asset structure, alleviate financial pressure, and improve asset management.

4.3. Profitability Analysis

Profitability is assessed using six indicators: return on equity (ROE), return on assets (ROA), total revenue, gross profit, gross profit margin, and net profit margin.

Table 5. Profitability Indicators for Boya Bio-pharmaceutical, 2020–2023 [17]

indicators | Dec. 31, 2023 | Dec. 31, 2022 | Dec. 31, 2021 | Dec. 31, 2020 |

ROE (%) | 3.28 | 6.18 | 7.83 | 6.49 |

ROA (%) | 3.13 | 5.69 | 5.61 | 5.29 |

Total Revenue | 2.652 billion | 2.759 billion | 2.651 billion | 2.513 billion |

Gross Profit | 1.399 billion | 1.508 billion | 1.510 billion | 1.459 billion |

Gross Profit Margin (%) | 52.76 | 54.66 | 56.98 | 58.07 |

Net Profit Margin (%) | 9.36 | 16.15 | 13.52 | 10.95 |

The data from 2020 to 2023 reveals notable trends in profitability. While certain indicators, such as ROE and ROA, declined in 2023 (to 3.28% and 3.13%, respectively), total revenue and gross profit showed an overall upward trajectory. For instance, total revenue increased from RMB 2.513 billion in 2020 to RMB 2.652 billion in 2023, and gross profit reached RMB 1.399 billion.

The profitability indicators have experienced varying degrees of decline, which can be attributed to two primary reasons. First, the decline is closely related to Boya Bio’s core business—blood products. As a high-barrier industry with stringent government controls and significant technological challenges, the domestic market for blood products has long been characterized by supply shortages. With substantial market demand and growth potential, Boya Bio has focused on integrating resources related to blood products following its acquisition by China Resources Pharmaceutical. This includes increasing the number of blood plasma collection stations and establishing new blood product manufacturing facilities, with a total project investment of RMB 2.185 billion. However, substantial cash outflows for these investments in 2023 hindered the company’s ability to offset high investment costs with revenue [19].

Second, in 2023, Boya Bio officially transferred its equity in Guangdong Fuda Pharmaceutical and Guizhou Tian’an Pharmaceutical, resulting in the financial performance of these companies no longer being consolidated into the group’s financial statements, which led to a sharp decline in certain indicators. Lastly, the company accrued RMB 330 million in asset impairment provisions in 2023, leading to a significant decrease in net profit [18]. These major events collectively contributed to the decline in various profitability indicators.

However, this downward trend is unlikely to persist. In April 2023, Boya Bio signed a “Strategic Cooperation Framework Agreement” with Gaotejia Investment Group and Guangdong DANXIA BIO Pharmaceutical, signaling a potential breakthrough in profitability for its blood product business. This development is expected to restore the company’s profitability indicators to their previous growth trajectory. The steady growth of the blood product industry and Boya Bio’s continued investment in technological innovation will provide momentum for the recovery of its long-term profitability [19]. Therefore, despite short-term fluctuations and pressures, Boya Bio remains well-positioned to achieve positive profit growth in the future.

5. Future Outlook

In the future, M&A activities by SOEs and COEs in the healthcare industry are expected to become more concentrated and strategically oriented. When selecting acquisition targets, these enterprises will focus more on strategic alignment, emphasizing the value of the acquired companies in terms of technological innovation and market prospects, rather than solely considering market share and the expansion of their industrial chains. Government policy support and diversified market demands are among the driving forces behind the active engagement of Chinese SOEs and COEs in healthcare M&A. From 2018 to 2024, they will have dominated M&A transactions in the healthcare industry, demonstrating their strong capabilities in market operations and capital deployment. Looking ahead, these enterprises are expected to prioritize resource integration and technological innovation in their M&A strategies to adapt to the evolving market environment and technological needs. In particular, the growing emphasis by the government on innovative and high-tech healthcare products, combined with the trend of many enterprises in the healthcare industry transitioning toward becoming technology-driven, has created a dual impetus. Small and medium-sized high-tech enterprises are poised to generate greater market value and improve their industrial chains, making them increasingly attractive to SOEs and COEs. As a result, SOEs and COEs are likely to intensify acquisitions of such companies to enhance market share and industry competitiveness in the future.

Amid changes in the economic environment and policy liberalization, the domestic market is approaching saturation. Consequently, SOEs and COEs are expected to look beyond domestic opportunities, actively pursuing cross-border M&A to expand into international markets, explore new opportunities, and increase their global influence. This strategic move aims to foster the globalization of healthcare-related businesses and secure a competitive edge in the international healthcare market.

M&A activities by SOEs and COEs provide considerable benefits to the acquired companies. With their robust financial resources, SOEs and COEs can provide ample funding to accelerate the research and development (R&D) and market entry processes of the acquired entities. Additionally, through post-acquisition integration, they can utilize their extensive management experience and scientific management philosophies to optimize the internal operations of the acquired companies, thereby reducing unnecessary costs and investments. They can also help the acquired companies establish a favorable market image and promote market expansion. However, it is important to note that, as observed from Figure 2-1 and previous analyses, while the outlook for M&A by SOEs and COEs remains optimistic, future M&A activities will likely shift toward a more rational approach. This shift in strategy will involve a greater emphasis on practical strategic synergies and value enhancement, driving the Chinese healthcare industry toward higher-quality development.

6. Conclusion

6.1. Research Overview

This paper investigates the trends and driving forces behind mergers and acquisitions (M&As) in China’s healthcare industry, focusing on the strategic advantages leveraged by state-owned enterprises (SOEs) and central enterprises (COEs). The study uncovers the overarching patterns in recent M&A activities in China, including variations in transaction volume and value, as well as dynamics within different sub-sectors of the healthcare market. Emphasis is placed on the dominant role and influence of SOEs and COEs in this context. By analyzing factors such as policy support, market drivers, and synergy effects, the paper explores the strategies and success factors of these enterprises in healthcare M&As. Using the acquisition of Boya Bio-pharmaceutical by China Resources Pharmaceutical as a case study, the analysis examines the financial structure, solvency, and profitability of Boya Bio-pharmaceutical before and after the acquisition. The study concludes with insights into future M&A trends and market dynamics for SOEs and COEs in China’s healthcare industry.

6.2. Main Findings

Recent years have witnessed a stable yet upward trend in M&A activities within China’s healthcare industry, a trend that has become increasingly apparent in the post-pandemic period. By 2023, the industry recorded nearly 1,200 M&A transactions, amounting to $24 billion in value. These figures reflect a rational yet promising investment outlook for the healthcare sector. The global surge in demand for medical services and products during the pandemic stimulated growth that countered economic downturns, particularly in the pharmaceutical and medical device sub-sectors. Despite market turbulence, M&A activities accelerated, demonstrating resilience and growth potential.

SOEs and COEs have played a pivotal role in this wave of M&As, owing to their inherent advantages and leadership capabilities. These enterprises have benefited from policy support, abundant funding, and market demand. Policy incentives have provided them with greater certainty and security, enabling them to navigate complex market environments and implement strategic layouts with confidence. Market-driven dynamics have guided their M&A plans and strategies.

Through M&As, SOEs and COEs have not only enhanced their market share and competitiveness but also injected new momentum into the healthcare industry’s development. The government’s emphasis on the healthcare sector has created a favorable environment for the growth of these enterprises. During major public health events, technological innovations, and market challenges, SOEs and COEs have exhibited strong adaptability and flexibility, achieving profit growth across various healthcare-related business lines.

By analyzing the synergistic effects and conducting a financial analysis of the acquisition of Boya Bio-pharmaceutical by China Resources Pharmaceutical, this paper reveals the close relationship between improved financial performance and synergy. Through restructuring and optimizing Boya Bio-pharmaceutical’s internal operations—such as divesting underperforming and non-core businesses—China Resources reduced financial burdens and concentrated resources on its core blood product business. Subsequent collaborations with other enterprises further accelerated the integration of technological and market resources, enhancing the company’s profitability. These improvements are closely linked to the synergy achieved through resource integration, technology sharing, and channel optimization. As a result, Boya Bio-pharmaceutical’s operational efficiency and market competitiveness were significantly boosted, enabling it to seize market opportunities and achieve sustainable development. The case of China Resources’ acquisition demonstrates that successful M&A activities can improve financial and operational performance by leveraging synergy effects. Synergy plays a key role in the success of M&A activities.

6.3. Implications and Significance

This study provides valuable insights into the strategic significance of SOEs and COEs in healthcare M&As. First, the combination of policy support and market dynamics serves as a dual engine driving corporate M&A activities. In the context of rapid market changes and technological advancements, the alignment of proactive government policies with corporate strategic demands can maximize market vitality and foster sustainable industry development. SOEs and COEs should continue to analyze market trends to adapt to evolving policy environments and market demands. Second, achieving synergy is not only a hallmark of successful M&A activities for SOEs and COEs but also a critical step toward enhancing overall competitiveness. From financial and operational perspectives, synergy enables enterprises to achieve significant returns in resource integration, technological expansion, and market channel development, thereby supporting stable growth in the domestic market.

Looking ahead, the M&A activities of SOEs and COEs in the healthcare industry are expected to evolve toward greater strategic concentration and the integration of innovative technologies. More rational and highly integrated M&A strategies will further bolster the competitiveness of China’s healthcare industry. As global healthcare technologies advance and demand fluctuates, M&A activities in China’s healthcare industry are anticipated to grow steadily. Continued policy support and increasing market demand will provide SOEs and COEs with numerous development opportunities. In a globalized context, cross-border M&As are likely to become another key avenue for SOEs and COEs to expand markets and acquire cutting-edge technologies. However, the study is limited by the lack of analysis on global M&A trends and transaction dynamics, as well as the incorporation of recent cases of cross-border M&As as cited examples. Consequently, determining how Chinese enterprises can effectively compete in international markets and optimize resource allocation will be a critical strategic focus for SOEs and COEs in the future. Achieving this goal will require substantial efforts and continuous work and research in the years to come. Through continuous exploration and practice, the sustainable growth of the healthcare industry will drive national economic development and enhance global competitiveness. Future M&A activities will transcend mere market and capital operations, focusing on technological innovation and strategic collaboration to explore new paths for sustainable development.

References

[1]. Fang, Z., Wang, C., Shen, C., et al. (2023). Analysis of the mergers and acquisitions in the Chinese pharmaceutical industry in the past decade. China New Drugs Journal, 32(15), 1503–1506.

[2]. PwC. (2024, February 23). PwC 2023 M&A market review - Chinese pharmaceutical and life sciences sector [Report]. Retrieved October 10, 2024, from https://www.pwccn.com/zh/pharmaceuticals/publications/ma-2023-review-and-outlook-pharmacy.pdf

[3]. Zhao, Z. (2016). A case study on the impact of PE investment on the performance of listed companies: A case of HB Company (Doctoral dissertation, East China University of Science and Technology).

[4]. Yang, Y. (2020). The global impact of the COVID-19 pandemic on the economy and its effect on the healthcare industry. China Finance, 20, 2.

[5]. CPA. (2024). Mergers and acquisitions motivations and performance analysis in pharmaceutical companies: A case study of China Resources Pharmaceutical’s acquisition of Boya Biotech (Doctoral dissertation, Hebei University of Geosciences).

[6]. China Listed Companies Association. (2024, September 25). M&A restructuring activates capital markets: “A-control A” enters new track; Mindray Medical sets an example for industry integration. China Listed Companies Association [EB/OL]. Retrieved November 22, 2024, from https://www.capco.org.cn/hyzl/zthd/bgcz/202409/20240925/j_2024092515481900017272506197481042.html

[7]. Pharmaceutical Economic News. (2024, February 28). The big integration of state-owned capital worth billions! China Resources Pharmaceutical, Sinopharm Group, and China General initiate a wave of M&As. Pharmaceutical Economic News [EB/OL]. Retrieved November 22, 2024, from https://www.yyjjb.com.cn/03/05/202403051422152215_20869.shtml

[8]. Communist Party of China Central Committee & State Council of the People’s Republic of China. (2017). Healthy China 2030 plan outline. Chinese Practical Rural Doctor Journal, 024(007), 1–12.

[9]. National Development and Reform Commission. (2024). National Development and Reform Commission release: “Guiding Catalogue for Industrial Structure Adjustment (2024 Edition)” to be implemented from February 1. China Paper Industry, 45(1), 1–1.

[10]. Beijing Municipal Health Commission. (2014, October 13). Implementation opinions on promoting the development of the health services industry in Beijing. Beijing Municipal Health Commission [EB/OL]. Retrieved November 23, 2024, from https://wjw.beijing.gov.cn/xwzx_20031/wnxw/201912/t20191214_1172332.html

[11]. Wang, B., & Geng, H. (2023). China medical device industry development report (2023). Beijing: Social Sciences Academic Press.

[12]. Rousseau, L. (2024). Research on the valuation of mergers and acquisitions in the pharmaceutical industry: A case study of China Resources Sanjiu’s acquisition of Aonuo Pharmaceutical. China Township Enterprise Accounting, (05), 6–8.

[13]. Xie, W. (2024). A study on value creation in consecutive M&A behavior of enterprises from the perspective of resource arrangement (Doctoral dissertation, Jimei University). https://doi.org/10.27720/d.cnki.gjmdx.2024.000300

[14]. Dongfang Caifu Net. (2024, October 26). China Resources Sanjiu - Financial Analysis. Dongfang Caifu Net [EB/OL]. Retrieved November 23, 2024, from https://emweb.securities.eastmoney.com/pc_hsf10/pages/index.html?type=web&code=SZ000999&color=b#/cwfx

[15]. Dongfang Caifu Net. (2024, October 26). Tianshili - Financial Analysis. Dongfang Caifu Net [EB/OL]. Retrieved November 23, 2024, from https://emweb.securities.eastmoney.com/pc_hsf10/pages/index.html?type=web&code=SH600535&color=b#/cwfx

[16]. Dongfang Caifu Net. (2024, August 7) China Resources Sanjiu analysis report: Plans to acquire 28% of Tianshili’s shares, expected to strengthen capabilities in traditional Chinese medicine innovation [EB/OL]. Retrieved November 24, 2024, from http://www.eastmoney.com

[17]. Dongfang Caifu Net. (2024, October 25). Boya Biotech - Financial Analysis. Dongfang Caifu Net [EB/OL]. Retrieved November 24, 2024, from https://emweb.securities.eastmoney.com/pc_hsf10/pages/index.html?type=web&code=SZ300294&color=b#/cwfx

[18]. Dongfang Caifu Net. (2024, June 25). Boya Biotech - Review Report: 2024 Q1: Divesting non-blood products business, significant profit increase. Dongfang Caifu Net [EB/OL]. Retrieved November 24, 2024, from https://data.eastmoney.com/report/info/AP202406251636856554.html

[19]. Dongfang Caifu Net. (2024, June 25). Boya Biotech - Initial Coverage Report: China Resources continues to empower, promising future for blood product business. Dongfang Caifu Net [EB/OL]. Retrieved November 24, 2024, from https://data.eastmoney.com/report/zw_stock.jshtml?encodeUrl=CJDlMxeHVFlgnlk1Svze2UX7dZ8V3uqV0dN4AQLhaM8=

Cite this article

Cheng,Y. (2024). An Empirical Study of Mergers and Acquisitions in China’s Healthcare Industry: Strategies of State-Owned and Central Enterprises. Journal of Applied Economics and Policy Studies,15,61-71.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fang, Z., Wang, C., Shen, C., et al. (2023). Analysis of the mergers and acquisitions in the Chinese pharmaceutical industry in the past decade. China New Drugs Journal, 32(15), 1503–1506.

[2]. PwC. (2024, February 23). PwC 2023 M&A market review - Chinese pharmaceutical and life sciences sector [Report]. Retrieved October 10, 2024, from https://www.pwccn.com/zh/pharmaceuticals/publications/ma-2023-review-and-outlook-pharmacy.pdf

[3]. Zhao, Z. (2016). A case study on the impact of PE investment on the performance of listed companies: A case of HB Company (Doctoral dissertation, East China University of Science and Technology).

[4]. Yang, Y. (2020). The global impact of the COVID-19 pandemic on the economy and its effect on the healthcare industry. China Finance, 20, 2.

[5]. CPA. (2024). Mergers and acquisitions motivations and performance analysis in pharmaceutical companies: A case study of China Resources Pharmaceutical’s acquisition of Boya Biotech (Doctoral dissertation, Hebei University of Geosciences).

[6]. China Listed Companies Association. (2024, September 25). M&A restructuring activates capital markets: “A-control A” enters new track; Mindray Medical sets an example for industry integration. China Listed Companies Association [EB/OL]. Retrieved November 22, 2024, from https://www.capco.org.cn/hyzl/zthd/bgcz/202409/20240925/j_2024092515481900017272506197481042.html

[7]. Pharmaceutical Economic News. (2024, February 28). The big integration of state-owned capital worth billions! China Resources Pharmaceutical, Sinopharm Group, and China General initiate a wave of M&As. Pharmaceutical Economic News [EB/OL]. Retrieved November 22, 2024, from https://www.yyjjb.com.cn/03/05/202403051422152215_20869.shtml

[8]. Communist Party of China Central Committee & State Council of the People’s Republic of China. (2017). Healthy China 2030 plan outline. Chinese Practical Rural Doctor Journal, 024(007), 1–12.

[9]. National Development and Reform Commission. (2024). National Development and Reform Commission release: “Guiding Catalogue for Industrial Structure Adjustment (2024 Edition)” to be implemented from February 1. China Paper Industry, 45(1), 1–1.

[10]. Beijing Municipal Health Commission. (2014, October 13). Implementation opinions on promoting the development of the health services industry in Beijing. Beijing Municipal Health Commission [EB/OL]. Retrieved November 23, 2024, from https://wjw.beijing.gov.cn/xwzx_20031/wnxw/201912/t20191214_1172332.html

[11]. Wang, B., & Geng, H. (2023). China medical device industry development report (2023). Beijing: Social Sciences Academic Press.

[12]. Rousseau, L. (2024). Research on the valuation of mergers and acquisitions in the pharmaceutical industry: A case study of China Resources Sanjiu’s acquisition of Aonuo Pharmaceutical. China Township Enterprise Accounting, (05), 6–8.

[13]. Xie, W. (2024). A study on value creation in consecutive M&A behavior of enterprises from the perspective of resource arrangement (Doctoral dissertation, Jimei University). https://doi.org/10.27720/d.cnki.gjmdx.2024.000300

[14]. Dongfang Caifu Net. (2024, October 26). China Resources Sanjiu - Financial Analysis. Dongfang Caifu Net [EB/OL]. Retrieved November 23, 2024, from https://emweb.securities.eastmoney.com/pc_hsf10/pages/index.html?type=web&code=SZ000999&color=b#/cwfx

[15]. Dongfang Caifu Net. (2024, October 26). Tianshili - Financial Analysis. Dongfang Caifu Net [EB/OL]. Retrieved November 23, 2024, from https://emweb.securities.eastmoney.com/pc_hsf10/pages/index.html?type=web&code=SH600535&color=b#/cwfx

[16]. Dongfang Caifu Net. (2024, August 7) China Resources Sanjiu analysis report: Plans to acquire 28% of Tianshili’s shares, expected to strengthen capabilities in traditional Chinese medicine innovation [EB/OL]. Retrieved November 24, 2024, from http://www.eastmoney.com

[17]. Dongfang Caifu Net. (2024, October 25). Boya Biotech - Financial Analysis. Dongfang Caifu Net [EB/OL]. Retrieved November 24, 2024, from https://emweb.securities.eastmoney.com/pc_hsf10/pages/index.html?type=web&code=SZ300294&color=b#/cwfx

[18]. Dongfang Caifu Net. (2024, June 25). Boya Biotech - Review Report: 2024 Q1: Divesting non-blood products business, significant profit increase. Dongfang Caifu Net [EB/OL]. Retrieved November 24, 2024, from https://data.eastmoney.com/report/info/AP202406251636856554.html

[19]. Dongfang Caifu Net. (2024, June 25). Boya Biotech - Initial Coverage Report: China Resources continues to empower, promising future for blood product business. Dongfang Caifu Net [EB/OL]. Retrieved November 24, 2024, from https://data.eastmoney.com/report/zw_stock.jshtml?encodeUrl=CJDlMxeHVFlgnlk1Svze2UX7dZ8V3uqV0dN4AQLhaM8=