1. Introduction

Society at times incurs a cost or enjoys a benefit as a consequence of the products and services provided. This is referred to as externality, which is the social/individual costs and benefits that are associated with a product/service that is not reflected in the market price of the commodity [1]. For instance, pollution from the transportation sector is a social cost that is not reflected in the cost of the transportation service. Pearce et al. [2] observe the trend on climate change is prompting developments on policies to deal with the costs. The essay focuses on the third question on externality and this is specifically in the transportation sector which is notable for huge carbon emissions. Over the years, the level of carbon has been on the rise and this is blamed for the increasing global warming and climate change, as noted by Johnsson et al. [3]. Therefore, it is paramount for policymakers across the world to focus on policies to reduce the level of pollution from the transportation sector.

The first section of this essay describes the externality problem of pollution from the transportation sector. This section also describes the current solutions. The second section proposes the policies ideal for the externality in the transportation sector while the third section highlights the effectiveness of the proposed policies using evidence from empirical studies and similar policies in other jurisdictions. The fourth and fifth sections evaluate the effectiveness of the policies and limitations of the policies, respectively, while the last section provides the conclusion.

2. Description of the externality problem and current solutions

The transport sector is a huge contributor to the economic growth and output in an economy. This is the case due to its role in ferrying material, goods, and workers, which is an important aspect of production and trade. In the United States, the transportation sector is projected to contribute 9% of the gross domestic product [4]. This is also the case in other countries and economic regions.

Despite the positive contribution of the transportation sector to the economy, it is faced with externality problems. One of the major externalities of the transportation sector is the huge contribution of carbon and its ultimate impact on global warming and climate change. According to a report published by the World Bank [5], domestic and international transport contributes 20% of greenhouse house gases. If the trend is unchecked, it is projected the greenhouse gases from the transportation sector will increase by 60% by 2050. In another report by the United Nations [6], the transport sector is linked with 57% global demand for fossil fuels and consumption of approximately 28% of the total energy produced. The gigantic nature of the transport sector and its embedding in the economy magnifies the pollution externality.

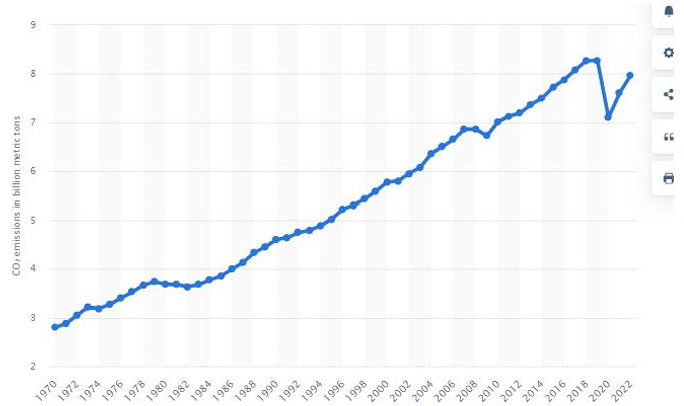

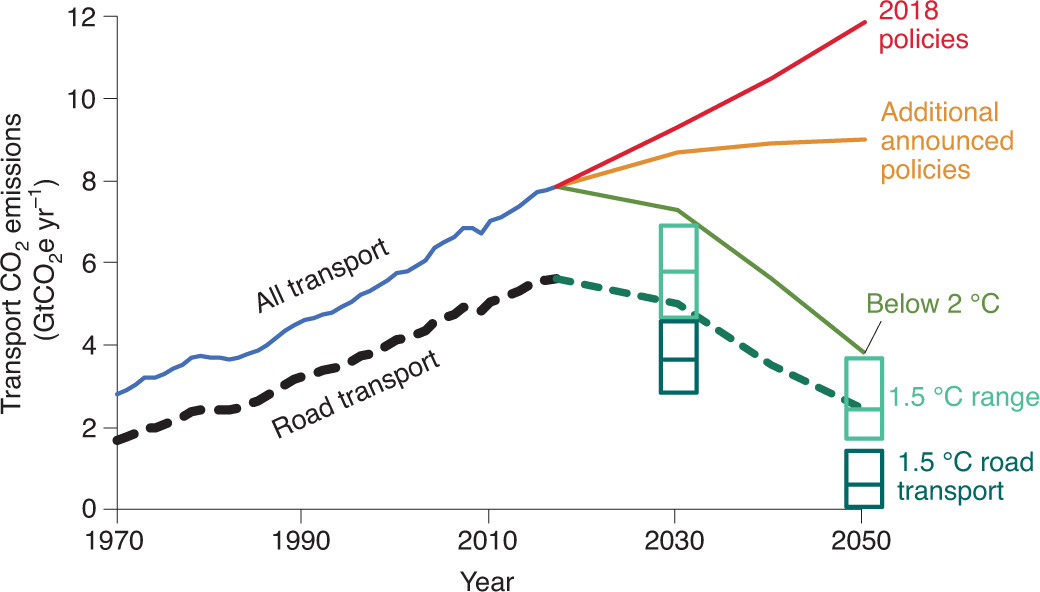

It is also critical to look at the trend in the externality of pollution from the transportation sector; this is illustrated in the Figure 1 below.

Source: Tiseo [7].

From the Figure 1 above, there is general positive growth in the volume of carbon dioxide from the transportation sector; the volume grew from 2.8 billion metric tons in 1970 to 7.97 billion metric tons in 2022.

The long-term impact of the pollution from the transport sector includes global warming and climate change. Climate change is further associated with increased frequency of drought, excessive rainfall, hurricanes and heat waves. Therefore, it is paramount to incorporate effective policies to deal with the externality of pollution from the transportation sector.

The transportation sector is a huge part of the economy and also an important contributor to the growth and development of the economy, as noted earlier. Therefore, the current solutions to reduce the externality are mainly market-based solutions that aim to influence the prices and demand for automobiles. These solutions include the use of taxes and subsidies, as discussed below.

2.1. Taxes

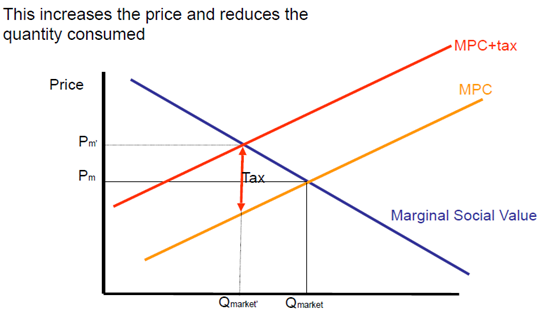

The solution of a tax aimed at products with negative transactions is referred to as the Pigouvian tax to deal with externalities [8]. The effect of tax on the transportation elements creating pollution is expected to increase costs and thus reduce the demand. This is illustrated in the Figure 2 below.

Source: [9].

From the Figure 2 above, the quantity and prices before the taxation is Q market and Pm, respectively. However, after the incorporation of the tax, the prices increase from Pm to Pm' while the quantity reduces from the Q market to Q market'. This implies the introduction of such taxes as a carbon tax would reduce the demand for vehicles that use fossil fuels and this is motivated by the taxes. It is important to highlight demand is inversely related to prices; an increment in the price of the unit product would result in a decline in the quantity demanded. With the reduction in the number of vehicles that consume fossil fuel the pollution and rise of the carbon gases will decline. The approach is also expected to increase tax revenue for the government, which can be directed to other efforts to reduce carbon from the transportation sector.

Taxes have been employed in countries like China and the have shown effectiveness in reducing emissions. China is a leader in reducing the level of pollution and it has made extensive headway using taxes. There are multiple empirical studies documenting the effectiveness of the carbon tax in the Chinese transportation sector. A study by Zhou et al. [10] estimated the carbon tax in the transportation sector was 60 RMB/ton-CO2 and this focused on the road sector. The study argued that an effective and appropriate carbon tax helps in reducing the level of emissions from the transportation sector, which is evident in China. A different tax is used for other sectors in China; for instance, Zhou et al. [10] noted the carbon tax targeting urban transportation, airlines, railways, and water transport is 60 RMB/ton-CO2. The tax covers different systems of transportation and this ensures there is extensive reduction of pollution from the transportation sectors.

2.2. Subsidies

The use of subsidies for the abatement of carbon emissions from the transportation sector is another current solution that has widely been adopted. This solution can take multiple forms; for instance, the government can subsidize the materials used in the production of efficient engines that will reduce the demand for fossil fuels. This is an effective approach as it would increase the research and development of efficient engines for automobile manufacturers.

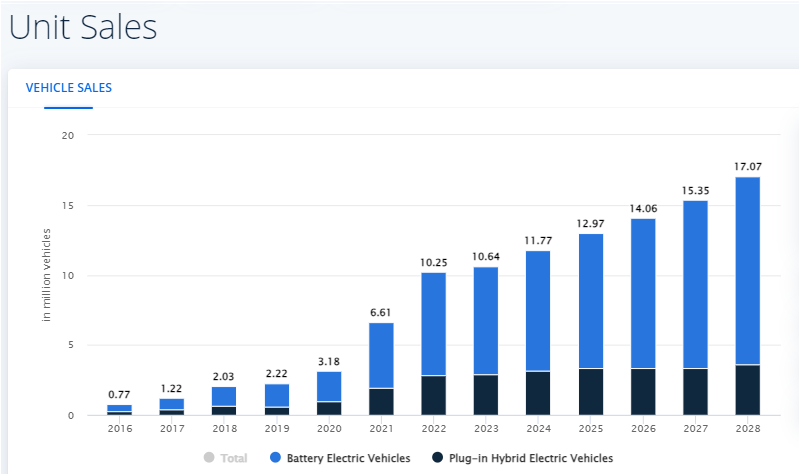

Additionally, the government can subsidize electric vehicles and this has gained traction around the world as the impact of carbon emissions before increasingly apparent with climate change. There is an emergent of new automobile companies that are solely focused on the production of electric vehicles such as Tesla in the United States and BYD in China. The market for EVs is also growing and this shows the effectiveness of subsidies in some markets around the world. The trend in the sales unit of EVs and hybrid vehicles is depicted in the Figure 3 below.

Source: Statista Market Insights [11].

From the Figure 3 above, there is a year-on-year increment in the number of EVs and hybrids from 0.77 million units in 2016 to 10.64 million units in 2023. The trend is forecasted to grow in the future with a huge increment in EVs; the units sold are projected to reach 17.07 million in 2028. With the increment in the affordability of EVs, which is largely influenced by subsidies and the efficiency of the manufacturers, the high level of emissions from the transportation sector can be reduced.

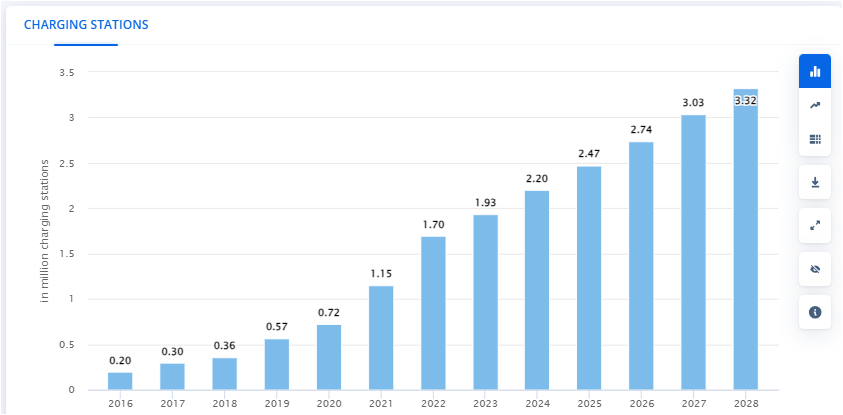

Similarly, the government can subsidize the construction of EV charging stations to improve the convenience of the owners of the vehicles. With an increased and reliable network of EV charging stations, the demand for EVs will increase and this will serve the ultimate goal of eliminating the externality of pollution in the transportation sector. The trend in the number of EV charging stations is displayed in the Figure 4 below.

Source: Statista Market Insights [11].

The number of EV charging stations increased year on year from 0.20 million units in 2016 to 1.93 million units in 2023. The units are projected to continually grow annually and reach an estimated 3.32 units by 2028. The trend can be increased through subsidies for the inputs used in the construction of the charging stations. Governments around the world can also provide tax breaks to the dealers of the charging stations to prompt the growth of EVs in the transportation sector in the future.

3. Proposed policy solution

The section highlights the proposed policy to deal with the huge emissions from the transportation sector. The proposal is also supported by similar policies from other countries and empirical studies evaluating similar policies as way of ascertaining the viability of subsidy solution to deal with the externality of pollution from the transportation sector.

3.1. Subsidies targeting electrification of the transportation sector

Subsidies are effective solutions to the externality of pollution in the transportation sector. This is the case as subsidies reduce the prices of transportation system that abates carbon emissions. With the reduction in prices, the demand for the efficiency transportation increases. The argument on the effectiveness of subsidies to abate carbon emissions in the transportation sector has shown positive results in multiple countries. For instance, a study by Zheng et al. [12] reported the increment in the production and sales of EVs in China is largely attributed to the subsidies. The overall goal is to achieve electrification of the transportation sector, which will help the country achieve a near-zero-emission economy. In light of this goal, the Chinese government focused on the implementation of an extensive subsidy program to boost the sale of EVs. The study by Zheng et al. [12] used data on EV sales in China from 2009 to 2018 and concluded the huge growth in the sale of EVs is attributed to the subsidies. Based on the evidence from China, it can be concluded the solution of subsidies has the potential to drastically reduce the pollution from the transportation sector and its negative impacts.

A study by Sheldon et al. [13] also shows the effectiveness of the subsidies in dealing with the pollution from the transportation sector. The study focused on nine European countries and also the United States. The introduction of the subsidies reduced the number of high-emission vehicles in the sampled countries, which shows the subsidies are effective. With subsidies, the price of hybrid cars and EVs fell, which led to replacement of the high-emission vehicles. The findings by Sheldon et al. [13] align with those by Zheng et al. [12] who noted subsidies increase demand for EV vehicles and help in replacing the vehicles that contribute huge amounts of carbon emissions.

The positive impact of subsidies on reducing pollution from the transportation sector is also evident in the UK. According to a study by Zhao and Baker [14], electrification of the transportation sector is an important step in the UK to build sustainability in the energy sector. The results of the analysis indicated subsidies would help in swapping the fossil fuel battery with EV batteries, which is core to the overall objective of reducing climate change and global warming from emissions by the transportation sector.

There is sufficient empirical evidence to support the proposal of subsidies as a solution to deal with the externality of pollution from the transportation sector. China, EU countries, the United States, and the UK has leveraged the subsidies to increase the electrification of the transportation through reduced prices and expanding supply of sustainable systems.

3.2. Evaluating the effectiveness of the proposed subsidies for electrification of the transportation

The evidence on the effectiveness of the proposed subsidies of the transport electrification are need further evaluation to ascertain its viability in dealing with emissions. The section evaluates the effectiveness of policies on electrification of the transportation sector.

An increment in the intervention policies is projected to reduce the amount of carbon, as noted by Axsen et al. [15]. This is the case as public policies such as subsidies focusing on the electrification of the transportation sectors significantly reduce carbon emissions. This is illustrated in the Figure 5 below.

Source: Axsen et al. [15].

From the Figure 5 above, additional policies aiming to reduce carbon emissions from the transportation sector are projected to reduce the emissions from road transport. There is a downward projection in emissions expected to continue until 2050.

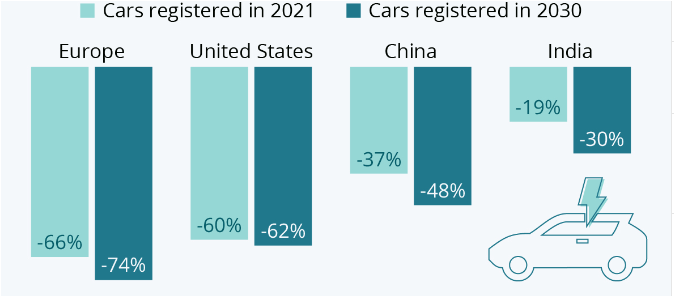

The subsidies are projected to cut the amount of carbon emissions; this proposal should be evaluated based on the projected reduction in the emissions. This is illustrated in the Figure 6 below which compares the reduction in emissions from registered EVs in 2021 and 2030.

Figure 6. Lifecycle greenhouse gases emissions

Source: Richter [16].

The reduction in emissions in Europe, the United States, China, and India due to EVs in 2030 is higher compared to 2021, as illustrated in the Figure 6 above. This implies the proposal on subsidies to electrify the transportation sector would drastically reduce the level of carbon emission and reduce the effects of carbon on global warming and climate change. The projections on the effectiveness of the electrical vehicles on reducing the carbon emission support the proposed policy on subsidies focusing on fast-tracking the electrification of the transportation sector.

3.3. Potential problems of the proposed subsidies for electrification of the transportation

Despite the evidence of the effectiveness of the subsidies as policies to reduce carbon emissions from the transportation sectors, there are limitations to adopting the policies. Multiple empirical studies point out there are economic problems associated with large-scale subsidies like those proposed in the electrification of the transportation sector. Freebairn [17] agrees the use of subsidies to increase the production of EVs reduces the level of pollution; however, this approach causes a deficit in government revenues due to loss of tax revenue. This leads to high social costs as the decline in tax revenues would result in low social welfare. The lost government revenue is also expected to prompt an overall increment in the taxes to recover for the lost revenues. Hence, subsidies are not a long-term solution, especially in countries where the government has deficiencies in the budgets.

Another limitation of the use of subsidies is that it affects the cost and price of electrification of the transportation sector, but does not influence the willingness among the buyers to purchase and use EVs. This is highlighted in the study by Liu and Wang [18] who noted subsidies are not sufficient to promote demand for EVs; the policies make have to focus on improving the willingness to use the electric means of transport to substantially cut emissions.

3.4. Mitigations for the potential problem

Carattini et al. [19] advocate for public participation in policies such as the subsidies and taxation aimed to reduce emissions from the transportation sector. The essence of public participation is to under the attitude of the public among other key stakeholders on the policy. The approach is essential in improving the acceptance of policies in the long run. The argument for public participation in public policy regarding the subsidies is supported by Chu et al. [20]; this is expected to improve the level of compliance and acceptance.

The subsidies should also be in phases to reduce overburdening of the government resources. As noted earlier, the subsidies are often followed by taxes in other sectors to make up for the lost government revenue. Therefore, phasing out subsidies over time will ensure the sustenance of the public policy and attainment of the minimal externality from the transportation sector without contracting the economy and government activities.

4. Conclusion

The essay noted there is an externality from the transportation sector that is negative and this is pollution. Of note, there is heavy consumption of fossil fuel in the transportation sector and this has led to growth in the volume of carbon emissions. The pollution has accumulated over the years leading to global warming and climate change. The trend poses risks of excessive rainfall, heat waves, and droughts. The externality and its negative impact have prompted policymakers around the world to adopt policies to abate emissions from the transportation sector. The two most prevalent current solutions are the carbon tax and subsidies to promote the production and sale of automobile vehicles and transportation systems that are sustainable.

The essay proposes adoption of subsidies to improve the electrification of the transportation sector. The subsidies have been effective in China have been instrumental in promoting the sales of EVs in the country. The proposal is also projected to drastically reduce emissions based on empirical studies using actual data from multiple markets with sizable EVs such as China, the US, and India. However, there are limitations to the policies proposed on subsidies for electrification of transportation. The policy reduces government revenue and social welfare due to reduced revenues. The subsidies do mean willingness among the customers to use and own EVs will increase. To deal with the limitations, it is prudent to promote public participation is also instrumental in improving the level of policy acceptance and growth in ownership and usage of EVs. This will ensure there is long-term sustenance of the sector targeted by the public policies to deal with the externality of carbon emission in the transportation sector.

References

[1]. Nguyen, T. L. T., Laratte, B., Guillaume, B., & Hua, A. (2016) 'Quantifying environmental externalities with a view to internalizing them in the price of products, using different monetization models’,Resources, Conservation and Recycling, 109, pp.13-23.

[2]. Pearce, D., Atkinson, G., & Mourato, S. (2015).Cost-Benefit Analysis and the Environment: Recent Developments

[3]. Johnsson, F., Kjärstad, J., & Rootzén, J. (2019) 'The threat to climate change mitigation posed by the abundance of fossil fuels’,Climate Policy, 19(2), pp.258-274.

[4]. Bureau of Transportation Statistics. (2022). Contribution of Transportation to the Economy: Final Demand Attributed to Transportation. U.S Department of Statistics [online]. Available at: https: //data.bts.gov/stories/s/Transportation-Economic-Trends-Contribution-of-Tra/pgc3-e7j9/#: ~: text=In%202021%2C%20the%20demand%20for, for%208.4%20percent%20of%20GDP. [Accessed on 1st December, 2023]

[5]. The World Bank. (2023). Transport [online]. Available at: https: //www.worldbank.org/en/topic/transport/overview [Accessed on 1st December, 2023]

[6]. United Nations. (2021). Fact Sheet Climate Change [online]. Available at: https: //www.un.org/sites/un2.un.org/files/media_gstc/FACT_SHEET_Climate_Change.pdf [Accessed on 1st December, 2023]

[7]. Tiseo, I. (2023). Carbon dioxide emissions from the transportation sector worldwide from 1970 to 2022(in billion metric tons). Statista [online]. Available at: https: //www.statista.com/statistics/1291615/carbon-dioxide-emissions-transport-sector-worldwide/#: ~: text=Global%20transportation%2Drelated%20emissions%20totaled, dioxide%20(GtCO%E2%82%82)%20in%202022. [Accessed on 1st December, 2023]

[8]. The Economist. (2017). Externalities: Pigouvian taxes

[9]. Andersson, J. J. (2019) 'Carbon taxes and CO2 emissions: Sweden as a case study’,American Economic Journal: Economic Policy, 11(4), pp.1-30.

[10]. Zhou, Y., Fang, W., Li, M., & Liu, W. (2018) 'Exploring the impacts of a low-carbon policy instrument: A case of carbon tax on transportation in China’,Resources, Conservation and Recycling, 139, pp.307-314.

[11]. Statista Market Insights. (2023). Electric Vehicles – Worldwide. Statista [online]. Available at: https: //www.statista.com/outlook/mmo/electric-vehicles/worldwide#unit-sales [Accessed on 1st December, 2023]

[12]. Zheng, X., Menezes, F., Zheng, X., & Wu, C. (2022) 'An empirical assessment of the impact of subsidies on EV adoption in China: A difference-in-differences approach’, Transportation Research Part A: Policy and Practice, 162, pp.121-136.

[13]. Sheldon, T. L., Dua, R., & Alharbi, O. A. (2023) 'How cost-effective are electric vehicle subsidies in reducing tailpipe-CO2 emissions? An analysis of major electric vehicle markets’,The Energy Journal, 44(3).

[14]. Zhao, G., & Baker, J. (2022) 'Effects on environmental impacts of introducing electric vehicle batteries as storage-A case study of the United Kingdom’,Energy Strategy Reviews, 40, 100819.

[15]. Axsen, J., Plötz, P., & Wolinetz, M. (2020) 'Crafting strong, integrated policy mixes for deep CO2 mitigation in road transport’,Nature Climate Change, 10(9), pp.809-818.

[16]. Richter, F. (2021). Electric Cars Found to Cut Emissions Drastically. Statista [online]. Available at: https: //www.statista.com/chart/25412/life-cycle-emissions-savings-of-electric-cars/ [Accessed on 4th December, 2023]

[17]. Freebairn, J. (2022) 'Economic Problems with Subsidies for Electric Vehicles’,Economic Papers: A journal of applied economics and policy, 41(4), pp.360-368.

[18]. Liu, X. F., & Wang, L. (2021) 'The effects of subsidy policy on electric vehicles and the supporting regulatory policies: Evidence from micro data of Chinese mobile manufacturers’,Frontiers in Energy Research, 9, pp.642467.

[19]. Carattini, S., Carvalho, M., & Fankhauser, S. (2017). How to make carbon taxes more acceptable. London School of Economics [online]. Available at: https: //www.lse.ac.uk/granthaminstitute/wp-content/uploads/2017/12/How-to-make-carbon-taxes-more-acceptable.pdf [Accessed on 1st December, 2023]

[20]. Chu, Z., Bian, C., & Yang, J. (2022) 'How can public participation improve environmental governance in China? A policy simulation approach with multi-player evolutionary game’,Environmental Impact Assessment Review, 95, 106782.

Cite this article

Hou,K. (2025). Description of pollution externality in the transportation sector, current solutions and recommendation of a policy solution. Journal of Applied Economics and Policy Studies,18(6),57-63.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Nguyen, T. L. T., Laratte, B., Guillaume, B., & Hua, A. (2016) 'Quantifying environmental externalities with a view to internalizing them in the price of products, using different monetization models’,Resources, Conservation and Recycling, 109, pp.13-23.

[2]. Pearce, D., Atkinson, G., & Mourato, S. (2015).Cost-Benefit Analysis and the Environment: Recent Developments

[3]. Johnsson, F., Kjärstad, J., & Rootzén, J. (2019) 'The threat to climate change mitigation posed by the abundance of fossil fuels’,Climate Policy, 19(2), pp.258-274.

[4]. Bureau of Transportation Statistics. (2022). Contribution of Transportation to the Economy: Final Demand Attributed to Transportation. U.S Department of Statistics [online]. Available at: https: //data.bts.gov/stories/s/Transportation-Economic-Trends-Contribution-of-Tra/pgc3-e7j9/#: ~: text=In%202021%2C%20the%20demand%20for, for%208.4%20percent%20of%20GDP. [Accessed on 1st December, 2023]

[5]. The World Bank. (2023). Transport [online]. Available at: https: //www.worldbank.org/en/topic/transport/overview [Accessed on 1st December, 2023]

[6]. United Nations. (2021). Fact Sheet Climate Change [online]. Available at: https: //www.un.org/sites/un2.un.org/files/media_gstc/FACT_SHEET_Climate_Change.pdf [Accessed on 1st December, 2023]

[7]. Tiseo, I. (2023). Carbon dioxide emissions from the transportation sector worldwide from 1970 to 2022(in billion metric tons). Statista [online]. Available at: https: //www.statista.com/statistics/1291615/carbon-dioxide-emissions-transport-sector-worldwide/#: ~: text=Global%20transportation%2Drelated%20emissions%20totaled, dioxide%20(GtCO%E2%82%82)%20in%202022. [Accessed on 1st December, 2023]

[8]. The Economist. (2017). Externalities: Pigouvian taxes

[9]. Andersson, J. J. (2019) 'Carbon taxes and CO2 emissions: Sweden as a case study’,American Economic Journal: Economic Policy, 11(4), pp.1-30.

[10]. Zhou, Y., Fang, W., Li, M., & Liu, W. (2018) 'Exploring the impacts of a low-carbon policy instrument: A case of carbon tax on transportation in China’,Resources, Conservation and Recycling, 139, pp.307-314.

[11]. Statista Market Insights. (2023). Electric Vehicles – Worldwide. Statista [online]. Available at: https: //www.statista.com/outlook/mmo/electric-vehicles/worldwide#unit-sales [Accessed on 1st December, 2023]

[12]. Zheng, X., Menezes, F., Zheng, X., & Wu, C. (2022) 'An empirical assessment of the impact of subsidies on EV adoption in China: A difference-in-differences approach’, Transportation Research Part A: Policy and Practice, 162, pp.121-136.

[13]. Sheldon, T. L., Dua, R., & Alharbi, O. A. (2023) 'How cost-effective are electric vehicle subsidies in reducing tailpipe-CO2 emissions? An analysis of major electric vehicle markets’,The Energy Journal, 44(3).

[14]. Zhao, G., & Baker, J. (2022) 'Effects on environmental impacts of introducing electric vehicle batteries as storage-A case study of the United Kingdom’,Energy Strategy Reviews, 40, 100819.

[15]. Axsen, J., Plötz, P., & Wolinetz, M. (2020) 'Crafting strong, integrated policy mixes for deep CO2 mitigation in road transport’,Nature Climate Change, 10(9), pp.809-818.

[16]. Richter, F. (2021). Electric Cars Found to Cut Emissions Drastically. Statista [online]. Available at: https: //www.statista.com/chart/25412/life-cycle-emissions-savings-of-electric-cars/ [Accessed on 4th December, 2023]

[17]. Freebairn, J. (2022) 'Economic Problems with Subsidies for Electric Vehicles’,Economic Papers: A journal of applied economics and policy, 41(4), pp.360-368.

[18]. Liu, X. F., & Wang, L. (2021) 'The effects of subsidy policy on electric vehicles and the supporting regulatory policies: Evidence from micro data of Chinese mobile manufacturers’,Frontiers in Energy Research, 9, pp.642467.

[19]. Carattini, S., Carvalho, M., & Fankhauser, S. (2017). How to make carbon taxes more acceptable. London School of Economics [online]. Available at: https: //www.lse.ac.uk/granthaminstitute/wp-content/uploads/2017/12/How-to-make-carbon-taxes-more-acceptable.pdf [Accessed on 1st December, 2023]

[20]. Chu, Z., Bian, C., & Yang, J. (2022) 'How can public participation improve environmental governance in China? A policy simulation approach with multi-player evolutionary game’,Environmental Impact Assessment Review, 95, 106782.