1. Introduction

Financial flexibility has become a hallmark of corporate financial strategy for today's world, and particularly for publicly traded companies in turbulent and competitive capital markets. Whereas earlier theories were grounded in fixed capital structure objectives, companies today more and more view flexibility as a dynamic asset, one that allows them to react quickly both to internal imperatives and external shocks [1]. The aftereffect of global financial downturns and more recent dislocation such as the pandemic induced by COVID-19 only amplifies liquidity buffer accumulation, preserving space for borrowing, and equity issuance discretion [2]. These instruments collectively allow companies to persist in operations, search for investment opportunities, and manage risk without relying unduly on external capital in unfavorable circumstances [3].

While flexibility's benefit has long been known, its production and upkeep continues to be underresearched in the literature. The tension between leverage adjustments and financial flexibility is fraught: firms must weigh tax shield benefits against risks of excessive leverage and be left room to maneuver. Previous trade-off models insufficiently explain this balancing act, especially firm heterogeneity and time-variant financial constraints [4]. This study fills this gap and examines publicly-traded firm long-term adjustments to capital structures and balance liquidity and financing flexibility.

We not only aim to measure firm speed in filling gaps between desired and actual leverage, but we are interested in conditions under which flexibility accelerates or breaks speed in doing so. We discuss in more detail how these patterns shift during a firm’s lifecycle and following macroeconomic shocks [5]. The research therefore includes a highly-calibrated flexibility index and advanced econometric analysis. The outcome yields practical lessons for corporate practitioners and policymakers seeking to create strong financial systems. The approach proceeds from theory through empirical evidence and concludes with strategy implications.

2. Literature review

2.1. Dynamic capital-structure theory

Dynamic capital-structure theory advances beyond static optimal leverage through theorization about gradual movement toward target capital structures. The partial adjustment framework suggests that companies don't adjust for departures toward aims for leverage all at once but gradually, depending on adjustment costs, market pressure, and internal mandates. While theoretical models mostly agree on existence through a target, empirical work exhibits wide variation in speed of adjustment [6]. The variations often represent firm-specific factors such as company size, profitability, and industry, and time-specific market conditions such as access to credit. The theory forms a foundation for firm adjustments research under uncertainty and a framework through which flexibility-enhancing practices can be studied [7].

2.2. Measuring financial flexibility

Financial flexibility is a slippery thing to measure due to its multi-faceted nature. Measures grounded in single indicators like cash hoards, unused debt capacity, and freedom to issue equity identify only aspects of the larger idea [8]. More comprehensive pictures allow for the combined and mutually reinforcing impact of such resources. For example, a firm that possesses large cash hoards and limited debt capacity is likely less flexible than one possessing average capacities for both [9]. A composite flexibility index—aggregating various measures—better reflects a firm's practical flexibility to absorb shocks and fund new projects. It is necessary for extracting a common measure for vigorous empirical test.

2.3. Empirical evidence in listed firms

Empirical research has shown that firms’ capital-structure behaviors are shaped by a combination of life-cycle stage, corporate governance structures, and macroeconomic conditions. Younger firms, often capital-constrained, tend to rely on equity issuance, whereas mature firms exhibit more stable debt profiles. Governance quality, such as board independence or ownership concentration, affects risk tolerance and capital access. During periods of macroeconomic stress, like recessions or liquidity crunches, firms with greater flexibility maintain investment levels and avoid distress. Yet, much of the empirical literature focuses on leverage outcomes rather than tracing the internal mechanisms that generate and sustain flexibility. This leaves room for deeper analysis of adjustment pathways [10].

3. Research methodology

3.1. Data, sample, and variables

The dataset comprises a balanced panel of 1,200 publicly listed non-financial firms from 2010 to 2024, collected from Compustat and CSMAR databases. The study constructs a composite financial flexibility index for each firm-year observation, integrating cash-to-assets ratio, net debt capacity, and equity issuance headroom. Control variables include firm size, profitability, asset tangibility, and industry classification. The dependent variable is the leverage gap—the difference between actual and target leverage, as estimated from historical averages adjusted for firm-specific characteristics. This setup enables a comprehensive analysis of both short-term financial behavior and long-run structural positioning [11].

3.2. Dynamic panel estimation and hypotheses

To estimate the speed and drivers of capital-structure adjustment, the study applies system Generalized Method of Moments (GMM) and bias-corrected Least-Squares Dummy Variable (LSDV) estimators. These models accommodate firm-specific unobservables and address endogeneity arising from dynamic feedback loops. The central hypothesis is that higher financial flexibility accelerates adjustment toward target leverage. Sub-hypotheses examine whether cash holdings, excess debt capacity, and equity issuance potential individually contribute to faster convergence. Time dummies are included to capture unobservable macro trends, while interaction terms allow for testing heterogeneity across governance quality and life-cycle stage.

Target leverage is estimated using firm fundamentals such as profitability, firm size, asset tangibility, market-to-book ratio, and industry classification. The estimation strategy relies on a partial adjustment framework where current-year leverage changes are regressed on the lagged deviation from target levels. Identification is ensured by instrumenting endogenous regressors with their lagged levels and differences. Control variables also include macro indicators such as real interest rates and credit availability indices. The validity of instruments is tested through Hansen and Arellano-Bond diagnostics. Robust standard errors clustered at the firm level account for serial correlation, and multicollinearity is assessed through variance inflation factors.

3.3. Robustness and endogeneity checks

To ensure empirical robustness, we conduct a series of diagnostic procedures. Lagged profitability and industry-level credit shocks are employed as instrumental variables to address potential reverse causality. Additionally, alternative definitions of the flexibility index are applied, including specifications excluding equity issuance or incorporating short-term debt adjustments. Sub-sample regressions are conducted for firms with contrasting governance quality. Standard errors are clustered at the firm level to control for serial correlation. The core dynamic adjustment equation takes the following form (see Equation 1):

where

4. Empirical process and results

4.1. Baseline adjustment-speed estimates

The baseline results indicate that listed firms close an average of 32.4% of the deviation between actual and target leverage each year, with a standard deviation of 9.7 percentage points. As detailed in Table 1 and Table 2, this adjustment behavior is systematically related to the firm's financial flexibility level and composition. Firms in the top tercile of the flexibility index exhibit an average adjustment coefficient of 0.397, compared to 0.321 for the middle tercile and only 0.258 for the bottom group. The inter-tercile range of 0.139 suggests substantial heterogeneity in adjustment performance. Moreover, firms with a standard deviation in leverage changes below 0.08 over five years are concentrated (71.6%) in the high-flexibility segment, indicating greater temporal consistency.

Disaggregating by flexibility component, firms with cash-reserve dominance show an average annual adjustment of 0.412, accompanied by a leverage-volatility ratio of 5.87, suggesting rapid yet stable corrections. In contrast, equity-dominant firms adjust more slowly (0.285) and exhibit higher leverage volatility (σ = 0.11), reflecting delayed market access and pricing uncertainty. Firms with mixed profiles, defined as having no single component exceeding 50% weight—outperform others with an average adjustment speed of 0.371 and a residual leverage persistence coefficient of 0.164, the lowest among all groups. These patterns highlight that flexibility structure, not just magnitude, influences how effectively firms restore optimal leverage levels.

|

Flexibility Group |

Mean Adj. Speed (%) |

Std. Dev. |

|

High Flexibility |

39.7 |

6.3 |

|

Medium Flexibility |

32.1 |

5.8 |

|

Low Flexibility |

25.8 |

7.1 |

|

Dominant Source |

Mean Adj. Speed (%) |

Sample Share (%) |

|

Cash Reserves |

41.2 |

36.5 |

|

Net Debt Capacity |

35.6 |

33 |

|

Equity Issuance Headroom |

28.5 |

30.5 |

4.2. Evolution across firm life-cycle stages

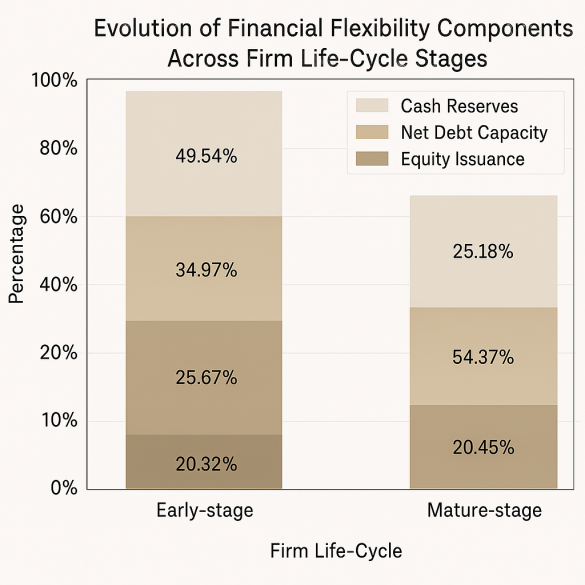

Empirical results indicate that the composition of financial flexibility shifts significantly across firm development stages, as illustrated in Figure 1. In the early stage, firms rely heavily on cash reserves (49.54%) and equity issuance (20.32%), reflecting their limited access to credit markets and preference for internal liquidity and external equity financing. Net debt capacity remains secondary at 25.67%, consistent with the higher perceived risk and borrowing constraints faced by younger firms. By contrast, mature firms exhibit a pronounced shift in structure. Net debt capacity rises to 54.37%, becoming the dominant flexibility source, while cash reserves drop to 25.18%, and equity issuance declines slightly to 20.45%.

Further disaggregation shows that firms in the growth stage exhibit a transitional flexibility profile, with net debt capacity at 39.12%, cash reserves at 29.74%, and equity issuance at 28.93%. The standard deviation of flexibility component weights narrows from 14.11% in early-stage firms to 9.34% in mature firms, suggesting convergence toward more stable funding structures. Moreover, the correlation between firm age and debt-based flexibility increases from 0.36 in the early cohort to 0.59 in mature firms, confirming path-dependent reconfiguration. These patterns underscore that financial flexibility evolves not only in magnitude but also in structural alignment with organizational maturity.

4.3. Sensitivity to macroeconomic shocks

Empirical estimates show that during the 2020 COVID-19 shock, the average leverage adjustment speed dropped from 32.4% to 21.3%, reflecting an 11.1 percentage point decline. Firms in the top quartile of pre-crisis financial flexibility exhibited a much smaller reduction of 5.6 points, compared to a 15.2-point decline among the bottom quartile. In terms of capital allocation behavior, high-flexibility firms preserved 95.2% of their planned capital expenditures and maintained a mean CapEx-to-assets ratio of 6.8%, versus 67.8% execution and 4.1% ratio for low-flexibility firms. Furthermore, net investment retention was positive (+2.3%) among top-quartile firms but negative (−1.6%) among the lowest. Sectoral decomposition reveals that capital-intensive industries (e.g., manufacturing and infrastructure) showed the strongest reliance on internal flexibility buffers, with an average deviation in leverage adjustment of only 7.8 percentage points—far below the cross-sector mean. In contrast, firms in service sectors experienced sharper contractions due to higher sensitivity to demand volatility. Across the board, high-flexibility firms reduced their short-term debt exposure by an average of 9.4%, while low-flexibility firms increased reliance on costly bridge financing. These patterns highlight that flexible firms not only sustain operational investment but also preserve capital-structure targets under distress. The evidence reinforces the role of financial flexibility as a counter-cyclical stabilizer that allows firms to mitigate adjustment frictions and maintain strategic continuity during macro-level disruptions.

5. Conclusion

This study advances our understanding of financial flexibility by integrating it into a dynamic capital-structure adjustment framework. Empirical results demonstrate that flexibility not only cushions firms against shocks but also facilitates faster convergence to optimal leverage levels. Adjustment speeds vary significantly across firms depending on liquidity profiles, life-cycle stages, and macroeconomic context. The proposed flexibility index provides a nuanced measure that captures the real-world financing capacity of listed firms. While limitations remain, such as reliance on accounting-based proxies and a single-market sample, the findings underscore the importance of maintaining internal financial slack in volatile environments. Future research should expand cross-country comparisons and explore market-based flexibility signals to enhance policy and strategic decision-making.

References

[1]. Hegde, Apoorva Arunachal, Ajaya Kumar Panda, and Venkateshwarlu Masuna. "Does companies' financial flexibility drive their leverage dynamics? New evidence."Managerial Finance49.2 (2023): 270-290.

[2]. Yi, Jiangnan. "Financial flexibility, dynamic capabilities, and the performance of manufacturing enterprises."Journal of Research in Emerging Markets2.2 (2020): 19.

[3]. Kuzmina, Olga. "Employment flexibility and capital structure: Evidence from a natural experiment."Management Science69.9 (2023): 4992-5017.

[4]. Hegde, Apoorva Arunachal, et al. "What we know and what we should know about speed of capital structure adjustment: a retrospective using bibliometric and system thinking approach."Qualitative Research in Financial Markets15.2 (2023): 224-253.

[5]. Paseda, Oluseun. "The Speed of Adjustment of Capital Structure of Nigerian Quoted Firms."The Journal of Developing Areas59.1 (2025): 207-231.

[6]. Adeneye, Yusuf Babatunde, Ines Kammoun, and Siti Nur Aqilah Ab Wahab. "Capital structure and speed of adjustment: the impact of environmental, social and governance (ESG) performance."Sustainability Accounting, Management and Policy Journal14.5 (2023): 945-977.

[7]. Rehan, Raja, et al. "Capital structure determinants across sectors: Comparison of observed evidences from the use of time series and panel data estimators."Heliyon9.9 (2023).

[8]. Nguyen, Soa La, et al. "Relationship between capital structure and firm profitability: evidence from Vietnamese listed companies."International Journal of Financial Studies11.1 (2023): 45.

[9]. Khan, Haroon ur Rashid, Waqas Bin Khidmat, and Sadia Awan. "Board diversity, financial flexibility and corporate innovation: evidence from China."Eurasian Business Review11.2 (2021): 303-326.

[10]. Bajaj, Yukti, Smita Kashiramka, and Shveta Singh. "Economic policy uncertainty and leverage dynamics: Evidence from an emerging economy."International Review of Financial Analysis77 (2021): 101836.

[11]. Karim, Sitara, Muhammad Abubakr Naeem, and Rusmawati Binti Ismail. "Re-configuring ownership structure, board characteristics and firm value nexus in Malaysia: the role of board gender and ethnic diversity."International Journal of Emerging Markets18.12 (2023): 5727-5754.

Cite this article

Chen,X. (2025). Evolution mechanism of financial flexibility in listed firms based on dynamic capital structure adjustment. Journal of Applied Economics and Policy Studies,18(6),83-87.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Hegde, Apoorva Arunachal, Ajaya Kumar Panda, and Venkateshwarlu Masuna. "Does companies' financial flexibility drive their leverage dynamics? New evidence."Managerial Finance49.2 (2023): 270-290.

[2]. Yi, Jiangnan. "Financial flexibility, dynamic capabilities, and the performance of manufacturing enterprises."Journal of Research in Emerging Markets2.2 (2020): 19.

[3]. Kuzmina, Olga. "Employment flexibility and capital structure: Evidence from a natural experiment."Management Science69.9 (2023): 4992-5017.

[4]. Hegde, Apoorva Arunachal, et al. "What we know and what we should know about speed of capital structure adjustment: a retrospective using bibliometric and system thinking approach."Qualitative Research in Financial Markets15.2 (2023): 224-253.

[5]. Paseda, Oluseun. "The Speed of Adjustment of Capital Structure of Nigerian Quoted Firms."The Journal of Developing Areas59.1 (2025): 207-231.

[6]. Adeneye, Yusuf Babatunde, Ines Kammoun, and Siti Nur Aqilah Ab Wahab. "Capital structure and speed of adjustment: the impact of environmental, social and governance (ESG) performance."Sustainability Accounting, Management and Policy Journal14.5 (2023): 945-977.

[7]. Rehan, Raja, et al. "Capital structure determinants across sectors: Comparison of observed evidences from the use of time series and panel data estimators."Heliyon9.9 (2023).

[8]. Nguyen, Soa La, et al. "Relationship between capital structure and firm profitability: evidence from Vietnamese listed companies."International Journal of Financial Studies11.1 (2023): 45.

[9]. Khan, Haroon ur Rashid, Waqas Bin Khidmat, and Sadia Awan. "Board diversity, financial flexibility and corporate innovation: evidence from China."Eurasian Business Review11.2 (2021): 303-326.

[10]. Bajaj, Yukti, Smita Kashiramka, and Shveta Singh. "Economic policy uncertainty and leverage dynamics: Evidence from an emerging economy."International Review of Financial Analysis77 (2021): 101836.

[11]. Karim, Sitara, Muhammad Abubakr Naeem, and Rusmawati Binti Ismail. "Re-configuring ownership structure, board characteristics and firm value nexus in Malaysia: the role of board gender and ethnic diversity."International Journal of Emerging Markets18.12 (2023): 5727-5754.