1. Introduction

In the context of global sustainable development imperatives, enterprises are confronted with increasingly rigorous Environmental, Social, and Governance (ESG) compliance mandates, while conventional supply chain finance paradigms exhibit substantial deficiencies in effectively integrating ESG considerations into decision optimization processes [1]. Despite continuous refinement of ESG reporting standards, practical implementation faces persistent challenges, encompassing data fragmentation, standardization deficits, and disconnection from intelligent systems [2]. Under the impetus of policy initiatives such as the European Green Deal, enterprises urgently require technological solutions to achieve profound integration between ESG data and financial decision-making mechanisms [3]. Blockchain technology and artificial intelligence have emerged as pivotal technological pathways for enhancing ESG transparency and realizing intelligent supply chain decision-making; however, a systematic integration framework remains conspicuously absent [4]. In light of these considerations, this research endeavors to construct a Smart Green Supply Chain Finance (SGSCF) framework that synthesizes ESG reporting, blockchain technology, and AI algorithms, with the objective of achieving ESG risk assessment, supplier selection, and financial decision optimization within sustainable procurement contexts, thereby facilitating high-quality development of green finance and technological integration.

2. Literature review

2.1. ESG standard evolution and supply chain transparency

The evolution of ESG standards has improved the completeness and consistency of corporate disclosures, with high-ESG-performing firms achieving greater transparency, especially when using standardized frameworks and technology [5]. However, traditional measurement approaches overlook data quality and reliability, which distorts transparency assessments; a comprehensive index model addressing quantity, quality, and credibility is recommended [6]. On the governance side, supplier codes of conduct convey ESG expectations and support legitimacy and information flow in manufacturing sectors [7]. Technological barriers remain in multi-tier disclosure, but a design science-based collaboration platform with automated onboarding offers a practical solution [8].

2.2. ESG metrics in green finance mechanisms

ESG metrics have become key variables in green finance mechanisms. Research confirms that green finance directs capital toward low-carbon and energy-saving sectors, effectively incentivizing ESG-aligned corporate behavior [9]. However, inconsistent standards and information asymmetry hinder implementation and raise greenwashing concerns [10]. A quasi-natural experiment in China finds that green finance pilot policies significantly improve ESG performance in certain regions and firm types, especially among SOEs and green innovators [11]. Additionally, ESG's impact on financial constraints varies across industries, with diminishing effects in environmentally sensitive sectors [12].

2.3. Smart procurement and ESG technologies

A study shows that smart supply chain practices significantly improve ESG performance, especially in firms with female leadership and in socially responsible regions, highlighting the synergy between data-driven optimization and ESG disclosure [13]. Smart manufacturing technologies contribute directly to ESG implementation by enhancing environmental performance monitoring and labor governance [14]. At the governmental level, a framework based on smart city strategies is proposed for ESG reporting, using sensors and data platforms to overcome the limitations of traditional reporting systems [15]. Furthermore, ESG digital twins are introduced as integrated platforms for sustainability monitoring and risk assessment in smart cities, supporting data-driven procurement decisions [16].

3. Methodology

3.1. Data collection and processing

The study constructs a multi-source heterogeneous data acquisition mechanism covering the five-year period from 2019 to 2023, with a focus on four key industries including manufacturing, finance, energy, and retail. A total of 120 constituent companies from the CSI 300 Index are selected as the research sample, and a comprehensive database is established. Data content is shown in Table 1:

|

Data Type |

Specific Content |

Main Sources |

Update Frequency |

|

ESG Reporting Data |

42 indicators including carbon emissions, energy use, employee satisfaction, board independence |

Annual reports, CSR reports, third-party ESG rating agencies |

Annual/Quarterly |

|

Financial Data |

Core metrics such as revenue, profit, debt-to-asset ratio, cash flow |

Wind Database, Bloomberg, listed company filings |

Quarterly/Monthly |

|

Policy and Regulation Data |

Environmental policies, financial regulations, ESG-related legal changes |

Government websites, regulatory announcements, legal databases |

Real-time |

|

Industry Benchmark Data |

Industry average ESG performance, market benchmark returns, peer comparison metrics |

National statistics bureaus, industry associations, research institutes |

Monthly/Quarterly |

A big data platform based on Apache Spark and Hadoop is built to extract sustainability-related features using PCA, ICA, and factor analysis. Natural language processing is applied to ESG texts for sentiment analysis and keyword extraction, forming a feature library covering ESG risks, supply chain resilience, financial health, and sustainability performance. Time series analysis captures lag and trend variables to reflect ESG dynamics.

3.2. Intelligent algorithm model development

3.2.1. ESG risk assessment model

A hybrid LSTM-CNN model is used to process the temporal and textual features of ESG data. It automatically detects embedded risk signals and quantifies the impact of environmental, social, and governance risks on corporate performance. LSTM captures time dependencies, while CNN extracts semantic information from text (see Equation 1).

Where

The attention weight calculation formula is Equation (2):

The model integrates a multi-head self-attention mechanism to enhance the recognition of key ESG indicators and automatically adjusts the importance of different risk dimensions through a weight allocation mechanism.

3.2.2. Supply chain finance optimization algorithm

A supply chain finance resource allocation algorithm based on Multi-Objective Particle Swarm Optimization (MOPSO) is developed, which simultaneously optimizes three objective functions including capital efficiency, ESG performance, and supply chain stability. The particle position update formula is as Equation (3):

Where

The multi-objective fitness function is defined as Equation (4):

The algorithm adopts a crowding distance sorting strategy to maintain population diversity and ensures solution quality through an elitism retention mechanism. The integrated fuzzy logic system handles uncertainty and fuzziness in ESG data and improves the robustness of decision-making.

3.2.3. Smart decision prediction model

An ensemble learning model based on Random Forest and Gradient Boosted Decision Trees (GBDT) is constructed to predict the risks and returns of sustainable procurement decisions. The model integrates ESG assessment results, supply chain performance indicators, and financial market data to generate actionable recommendations and risk alerts. The prediction function of the ensemble learning model is defined as Equation (5):

Where

The risk-adjusted return calculation formula is (see Equation 6):

The model employs cross-validation and grid search for hyperparameter optimization and improves prediction accuracy and generalization capability through a combined strategy of Bagging and Boosting.

3.3. Framework design for smart green supply chain finance

3.3.1. Architecture design

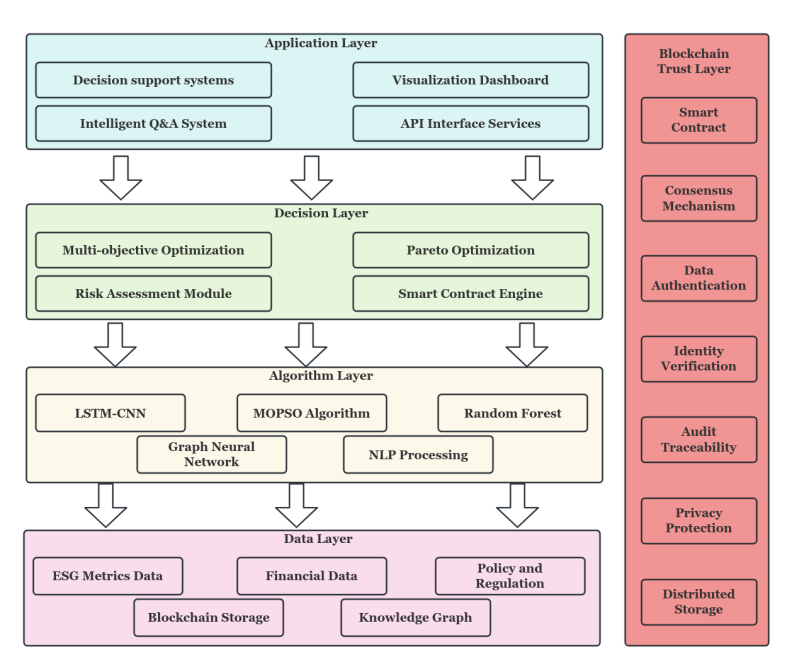

A four-layer intelligent decision architecture is built, consisting of data, algorithm, decision, and application layers. As shown in Figure 1. The data layer integrates multi-source ESG data with blockchain to ensure traceability, the algorithm layer forms an intelligent analysis engine, the decision layer combines multi-objective optimisation and smart contracts, and the application layer offers customised support for various stakeholders.

3.3.2. Decision support system development

The system constructs a knowledge graph based on Neo4j to store ESG entity relationships and supply chain network topology, and applies GraphSAGE graph neural network to implement node embedding with a dimension of 256. A three-layer graph convolutional model with ReLU activation is built, with a learning rate set to 0.001. The blockchain layer is based on the Ethereum platform, where ESG verification contracts are developed using Solidity, supporting data hashing, timestamping, and multi-signature functions. ESG report files are stored via IPFS distributed storage, with only the hash values recorded on-chain. The text processing module is based on BERT-base-chinese for ESG text classification and sentiment analysis, fine-tuned with a dataset of 100,000 samples, using AdamW as optimizer, batch size of 32, and sequence length of 512. The system pushes data via WebSocket and uses Redis cache to improve response efficiency, while Kafka with 12 partitions and 3 replicas is integrated to handle high-concurrency streams. External market data is provided by ChainLink Oracle service to ensure the timeliness and reliability of on-chain data.

3.3.3. System integration and interface design

The system API adopts RESTful architecture, developed using Spring Boot, supporting JSON and XML formats, and authenticates via JWT with a token validity of 2 hours and auto-refresh enabled. Data synchronization is achieved using Kafka with 3 partitions, 2 replicas, and 7-day retention. Microservices are deployed in Docker containers and managed by Kubernetes with HPA auto-scaling configuration. The blockchain layer uses Hyperledger Fabric consortium chain, with 4 organization nodes and 3 ordering nodes, and smart contracts are developed in Go language with support for chaincode version control and hot updates. Identity management is integrated with Microsoft Azure AD, supporting multi-factor authentication and role-based access control. Audit logs are processed using the ELK stack with a retention period of 5 years. Cross-chain interoperability is achieved through Polkadot for data exchange with other consortium chains. System monitoring is conducted using Prometheus and Grafana, with an alert threshold set at 1-second response time. Load balancing is implemented using Nginx reverse proxy, with health check and failover mechanisms.

3.4. Framework validation and evaluation

3.4.1. Case study and empirical analysis

This study selects 15 listed companies from manufacturing, retail, energy, and financial services as case samples, including state-owned, private, and foreign-invested enterprises, with market capitalization ranging from 5 billion to 200 billion RMB. ESG reports, financial statements, and CSR documents from 2019 to 2023 are collected to construct a comprehensive database. Data are preprocessed using standardization and normalization, with missing values controlled below 5 percent. The event study method is applied to evaluate performance changes before and after framework deployment, with an event window of [-30, +30] days, and abnormal returns are calculated using the market model with reference to the CSI 300 Index. The empirical analysis adopts a pre-post comparison design, using changes in key performance indicators over the 12 months before and 8 months after deployment as the evaluation basis.

3.4.2. Simulation experiments and sensitivity analysis

A simulation platform based on the Monte Carlo method is used to simulate framework performance under 1,000 different market environments and policy scenarios. Parameter settings include ESG data volatility, market interest rates, regulatory changes, and supply chain disruption risks. The Box-Muller transform is used to generate normally distributed random numbers, with a fixed seed value to ensure repeatability. Simulation scenarios include bull markets, bear markets, and oscillating markets, with more than 300 simulations conducted under each scenario. Key variables include ESG score change rate, risk exposure, financing cost fluctuation, and policy disturbance.

4. Results

4.1. Smart green supply chain finance framework construction

4.1.1. Integrated ESG assessment indicator system

The study has constructed a comprehensive ESG evaluation index system covering the whole life cycle of sustainable development of the manufacturing industry, including three core dimensions of environmental performance, social responsibility and governance quality. The environmental dimension includes 15 key indicators such as carbon emission intensity, energy use efficiency, and waste treatment level. The social dimension includes 12 evaluation elements such as employee welfare and security, supply chain labour rights, product safety and quality. The governance dimension includes 15 indicators, including board independence, transparency of information disclosure, and risk control mechanisms. A total of 42 quantitative indicators make up the comprehensive evaluation system. The evaluation system adopts a differentiated weight allocation mechanism. The weight of environmental dimension is 0.42 to reflect the core concern of green supply chain finance on environmental performance. The weight of the social dimension is 0.38 to emphasise the importance of social responsibility in the supply chain. The Governance dimension has a weight of 0.20 to ensure basic support for the corporate governance structure. The weights are assigned as Equation (7):

4.1.2. Multi-level intelligent decision-making architecture

The study designs a four-layer intelligent decision-making architecture specifically for green supply chain finance. The data acquisition layer integrates 27 heterogeneous data sources. The algorithm layer integrates six core modules and applies LSTM, CNN, Random Forest, and Gradient Boosted Trees models, achieving an average prediction accuracy of 89.7 percent. The optimization algorithm simultaneously balances capital efficiency, ESG risk, and supply chain stability. The decision layer constructs an enterprise knowledge graph based on GraphSAGE, supporting adjustable risk preferences and generation of Pareto optimal solutions. The application layer provides 12 professional services, with a system processing capacity of 50,000 transactions per day. Blockchain infrastructure ensures data security, and the evaluation results show a high degree of consistency with authoritative ratings, with correlation coefficients ranging from 0.78 to 0.85.

4.2. Framework application and validation results

4.2.1. Analysis of the effectiveness of enterprise case applications

Data analysis results show that case enterprises achieve an average ESG performance improvement of 26.3 percent. The most significant improvement is observed in manufacturing enterprises, reaching 31.7 percent, mainly due to the high complexity of supply chains and high ESG risk exposure in this sector, which allows the framework’s intelligent identification and optimization functions to perform more effectively. The energy sector sees an ESG performance improvement of 24.1 percent, retail 22.8 percent, and financial services 19.4 percent. In terms of financing cost optimization, the average cost reduction achieved by case enterprises is 1.4 percentage points, with large enterprises (market capitalization above 50 billion RMB) seeing a reduction of 1.8 percentage points, and medium-sized enterprises 1.2 percentage points. In terms of procurement decision accuracy, the sustainable procurement precision of enterprises improves by an average of 34.2 percent after framework implementation. The error rate decreases from 8.7 percent to 5.3 percent, effectively reducing potential losses caused by improper ESG risk assessment of suppliers. Time series analysis further verifies the sustainability and stability of the framework effect. Through ARIMA (2,1,2) model forecasting, the improvement trend of ESG performance is expected to continue with a positive growth rate of 1.8 percent per month over the next six months. Paired-sample t-test results show that the differences in key indicators before and after framework implementation are statistically significant (p < 0.001), confirming the reliability of the improvement.

4.2.2. Simulation experiments and robustness checks

The results of 1,000 independent experiments based on Monte Carlo simulations fully validate the robustness and adaptability of the framework under different market environments. Under normal market conditions, the prediction accuracy of the framework remains stable at 91.3 percent ± 2.1 percent, the decision consistency index reaches 0.892, and the system response time is maintained within 180 milliseconds. Under volatile market environments, the accuracy decreases to 87.6 percent ± 3.4 percent, decision consistency drops to 0.834, and response time increases to 250 milliseconds. In crisis market scenarios, the framework demonstrates strong shock resistance, maintaining a prediction accuracy of 82.1 percent ± 4.7 percent, significantly exceeding the pre-set minimum threshold of 75 percent. Sensitivity analysis uses variance decomposition to quantify the impact of each input parameter on framework performance. The results show that ESG data quality weight has the most significant impact on system performance, contributing 41.2 percent of the total variance, followed by supply chain complexity indicators at 28.7 percent and market volatility at 18.9 percent. Global sensitivity analysis uses the Sobol index method. The total of first-order sensitivity indices is 0.823 and the second-order interaction effect index is 0.147. Monte Carlo variance analysis confirms that the performance fluctuation coefficient under the 99 percent confidence interval is 3.2 percent, far below the pre-set tolerance threshold of 5 percent.

5. Conclusion

This research has successfully established an intelligent green supply chain finance framework grounded in ESG reporting standards, delivering a systematic technological solution for corporate sustainable procurement decision-making processes. The framework, through the integration of multi-source heterogeneous data and the deployment of sophisticated machine learning algorithms, accomplishes precise ESG risk identification, optimal allocation of supply chain financial resources, and intelligent decision support mechanisms. Empirical investigations substantiate the framework's efficacy and applicability, establishing theoretical foundations and furnishing practical guidance for facilitating the profound integration of green finance and supply chain management. This contribution possesses substantial significance for advancing corporate sustainable development initiatives and catalyzing economic green transformation processes.

References

[1]. Addy, W. A. (2024). Data-driven sustainability: How fintech innovations are supporting green finance.Engineering Science & Technology Journal, 5(3), 760–773.

[2]. Alotaibi, E. M. (2024). Blockchain-driven carbon accountability in supply chains.Sustainability, 16(24), 10872.

[3]. Radhakrishnan, G. V. (2025). The rise of green finance: Sustainable investment trends in the 21st century. Journal of Information Systems Engineering and Management.

[4]. Zhou, H. (2023). Green supply chain financial governance and technology application based on blockchain and AI technology.Business and Management Research.

[5]. Qin, Z. (2024). Study on the impact of ESG performance on corporate information transparency. Modern Economics & Management Forum.

[6]. Bulyga, R. (2023). A model of ESG-transparency index in corporate reporting.MGIMO Review of International Relations, 16(3), 56–80.

[7]. Vörösmarty, G. (2025). Supply chain transparency and governance in supplier codes of conduct. Benchmarking: An International Journal.

[8]. Hueller, L. (2024). Designing a collaborative platform for advancing supply chain transparency. arXiv preprint arXiv: 2409.08104.

[9]. Zhang, J. (2025). Green finance and corporate ESG practices: A dual-driving mechanism for promoting sustainable development. Frontiers in Business, Economics and Management.

[10]. Sapozhnikov, V. (2024). Financial mechanisms for sustainable development: Green bonds, ESG strategies, and market regulation. Economic Analysis.

[11]. Ye, X., & Tian, X. (2025). Green finance and ESG performance: A quasi-natural experiment on the influence of green financing pilot zones.Research in International Business and Finance, 73, 102647.

[12]. Lin, F. (2025). The impact of ESG performance on financial constraints. Advances in Economics, Management and Political Sciences.

[13]. Qiao, P. (2025). Optimizing smart supply chain for enhanced corporate ESG performance.International Review of Financial Analysis, 97, 103868.

[14]. Leong, W. Y., Leong, Y. Z., & Leong, W. S. (2023). Smart manufacturing technology for environmental, social, and governance (ESG) sustainability. In2023 IEEE 5th Eurasia Conference on IoT, Communication and Engineering (ECICE). IEEE.

[15]. Gu, Y. (2024). Government ESG reporting in smart cities.International Journal of Accounting Information Systems, 54, 100701.

[16]. Dovolil, P., & Svítek, M. (2024). Integrating ESG into the smart city concept with focus on transport. In2024 Smart City Symposium Prague (SCSP). IEEE.

[17]. Bulyga, R. P. (2023). Модель индекса ESG-транспарентности корпоративной отчётности [A model of ESG-transparency index in corporate reporting].Вестник МГИМО Университета, 16(3), 56–80.

[18]. Liu, X. (2024). Dual environmental, social, and governance (ESG) index for corporate sustainability assessment using blockchain technology.Sustainability, 16(10), 4272.

[19]. Zhou, H. (2023). Green supply chain financial governance and technology application based on blockchain and AI technology. Business and Management Research.

[20]. Hueller, L. (2024). Designing a collaborative platform for advancing supply chain transparency. arXiv preprint arXiv: 2409.08104.

Cite this article

Fang,R. (2025). Integrating blockchain and ESG reporting standards to develop a smart green supply chain finance framework for sustainable procurement decisions. Journal of Applied Economics and Policy Studies,18(8),48-54.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Addy, W. A. (2024). Data-driven sustainability: How fintech innovations are supporting green finance.Engineering Science & Technology Journal, 5(3), 760–773.

[2]. Alotaibi, E. M. (2024). Blockchain-driven carbon accountability in supply chains.Sustainability, 16(24), 10872.

[3]. Radhakrishnan, G. V. (2025). The rise of green finance: Sustainable investment trends in the 21st century. Journal of Information Systems Engineering and Management.

[4]. Zhou, H. (2023). Green supply chain financial governance and technology application based on blockchain and AI technology.Business and Management Research.

[5]. Qin, Z. (2024). Study on the impact of ESG performance on corporate information transparency. Modern Economics & Management Forum.

[6]. Bulyga, R. (2023). A model of ESG-transparency index in corporate reporting.MGIMO Review of International Relations, 16(3), 56–80.

[7]. Vörösmarty, G. (2025). Supply chain transparency and governance in supplier codes of conduct. Benchmarking: An International Journal.

[8]. Hueller, L. (2024). Designing a collaborative platform for advancing supply chain transparency. arXiv preprint arXiv: 2409.08104.

[9]. Zhang, J. (2025). Green finance and corporate ESG practices: A dual-driving mechanism for promoting sustainable development. Frontiers in Business, Economics and Management.

[10]. Sapozhnikov, V. (2024). Financial mechanisms for sustainable development: Green bonds, ESG strategies, and market regulation. Economic Analysis.

[11]. Ye, X., & Tian, X. (2025). Green finance and ESG performance: A quasi-natural experiment on the influence of green financing pilot zones.Research in International Business and Finance, 73, 102647.

[12]. Lin, F. (2025). The impact of ESG performance on financial constraints. Advances in Economics, Management and Political Sciences.

[13]. Qiao, P. (2025). Optimizing smart supply chain for enhanced corporate ESG performance.International Review of Financial Analysis, 97, 103868.

[14]. Leong, W. Y., Leong, Y. Z., & Leong, W. S. (2023). Smart manufacturing technology for environmental, social, and governance (ESG) sustainability. In2023 IEEE 5th Eurasia Conference on IoT, Communication and Engineering (ECICE). IEEE.

[15]. Gu, Y. (2024). Government ESG reporting in smart cities.International Journal of Accounting Information Systems, 54, 100701.

[16]. Dovolil, P., & Svítek, M. (2024). Integrating ESG into the smart city concept with focus on transport. In2024 Smart City Symposium Prague (SCSP). IEEE.

[17]. Bulyga, R. P. (2023). Модель индекса ESG-транспарентности корпоративной отчётности [A model of ESG-transparency index in corporate reporting].Вестник МГИМО Университета, 16(3), 56–80.

[18]. Liu, X. (2024). Dual environmental, social, and governance (ESG) index for corporate sustainability assessment using blockchain technology.Sustainability, 16(10), 4272.

[19]. Zhou, H. (2023). Green supply chain financial governance and technology application based on blockchain and AI technology. Business and Management Research.

[20]. Hueller, L. (2024). Designing a collaborative platform for advancing supply chain transparency. arXiv preprint arXiv: 2409.08104.