1. Introduction

In today's era, a new round of technological revolution and industrial transformation has brought new development opportunities. The development momentum of the digital economy is relatively strong, becoming an important force in promoting economic recovery in various countries. The digital economy refers to a series of economic activities that use digital knowledge and information as key production factors, modern information networks as important carriers, and the effective use of information and communication technology as an important driving force for efficiency improvement and economic structure optimization [1,2]. The digital economy is experiencing rapid growth, innovation, and widespread application in other economic fields. In 2022, in terms of total volume, the digital economy of 51 major economies worldwide reached a scale of $41.4 trillion, compared to a year-on-year scale of $38.6 trillion; in terms of proportion, the 51 major digital economies worldwide accounted for 46.1% of GDP, compared to 44.3% on a year-on-year basis [3]. The digital economy is emerging as a vital driver of economic expansion, fostering innovation in economic endeavors [4]. On July 2, 2024, the 2024 Global Digital Economy Conference was held in Beijing, China, which is a platform for achieving digital-friendly international exchanges and cooperation, and is the source of global digital economy development [5].

Research in digital economics investigates whether and how digital technologies transform economic activities [6]. Both academic circles and governmental institutions hold significant expectations regarding the development of the digital economy as a driver of high-quality economic growth. However, concurrently, the phenomenon of 'shifting from the real economy to the virtual economy' has emerged as a critical concern among many observers. As the cornerstone of the national economy, the real economy constitutes the primary source of wealth creation and serves as the essential foundation for a nation's development [7]. Conventionally, the real economy is defined as economic activities encompassing sectors or industries engaged in the production and distribution of material goods, which are integral to both national economic stability and societal well-being. A more comprehensive interpretation posits that the real economy includes not only the production and circulation of tangible goods and services but also extends to intellectual and cultural outputs. Specifically, this encompasses material production sectors such as agriculture, industry, transportation, telecommunications, commerce, and construction, as well as knowledge- and service-based domains, including education, culture, information, arts, and sports [8].

The digital economy is inherently grounded in the real economy, evolving in tandem with its progression. Its development must ultimately serve to enhance the real economy. An imbalance between these two economic systems may precipitate autonomous expansion within the digital sector, which in extreme cases could constrain the developmental capacity of the real economy and diminish societal welfare. Given that the digital economy bears upon national development strategy while the real economy constitutes the fundamental bedrock of China's economic advancement [9], the deep integration between these two spheres has emerged as a prominent scholarly focus in recent years. 《14th Five Year Plan for the Development of Digital Economy》 [10] emphasizes taking the integration of digital technology with the real economy as the main line, optimizing and expanding China's digital economy, and providing strong support for building a digital China.

Regarding the concept and connotation of the integrated development of the digital economy and real economy, different scholars have provided some textual summaries. Hong and Ren [11] believe that the integration of the digital economy and the real economy is the digitization of the real economy, mainly involving a series of new concepts and categories brought by the digital economy, including data elements, digital technology, platform economy, sharing economy, etc. They emphasize that data has become a new factor of production, triggering the deep integration of the digital economy and the real economy; the integration of digital technology and technological innovation has promoted the integration of digital economy and real economy in research and development innovation; the integration of innovation chain and industrial chain has led to the integration of digital economy and real economy at the industrial level; the integration of platform economy and enterprise organization has led to the integration of digital economy and real economy at the enterprise level. Ouyang and Gong [9] hold the view that the integration of the digital economy and real economy is defined as, the interaction, cycle, and iteration between data elements, digital technology, and digital platforms, and their deep integration with scenarios, promoting the integration and innovation of digital technology, scenario applications, and business models, forming a "dual cycle" system of the digital economy and real economy, and promoting the process of business logic reconstruction, organizational form transformation, and value model innovation in the real economy following the evolution path of "new physical enterprise-digital ecology-new physical economy".

The digital economy and the real economy represent two distinct yet interconnected components of the national economy, collectively forming a vital part of its structure. These two sectors have already established a closely interdependent relationship [12]. The integration of the digital economy with the real economy aligns with the inherent evolutionary trends of digital economic development. Furthermore, this convergence facilitates the digital transformation of the real economy, offering more efficient production methods, higher-quality development paradigms, and more advanced governance models to enhance the growth of traditional real economy sectors [13]. By leveraging digital technologies—including artificial intelligence, blockchain, big data, and cloud computing—it becomes feasible to restructure the factor allocation and innovation systems within the real economy. This technological integration further enables the optimization of the real economy’s structural composition and organizational frameworks, while simultaneously transforming its developmental paradigms and business models [14]. Against the backdrop of robust digital economic growth and stable real economic performance, China is currently undergoing a critical phase of economic structural transformation. This context necessitates an in-depth examination of the integrated development between the digital and real economies, along with their determinant factors, to formulate targeted policy recommendations—an endeavor that holds substantial theoretical and practical significance. The integrated development of the digital economy and real economy (abbreviated as DEREID in the rest of this paper) facilitates digital transformation across sectors: IoT enables smart, precision agriculture; connected technologies enhance industrial efficiency; AI/IoT optimize transportation systems; GPS/sensing automate logistics; and medical IoT integrates healthcare workflows via electronic records. These applications advance digital agriculture, manufacturing, transportation, logistics, and healthcare [15].

Current research on DEREID predominantly emphasizes theoretical discourse, with empirical investigations remaining limited. Key unresolved issues include: (1) evaluation methodologies for digital and real economy development levels; (2) measurement frameworks for their integrated development; (3) identification of influencing factors contextualized to current conditions; and (4) existence of factor thresholds. This study addresses these gaps by constructing a provincial-level integration index, employing regression analysis to determine influencing factors and their economic thresholds, and deriving evidence-based policy recommendations.

2. Literature review

There are many studies on the digital economy and the real economy, involving various directions. Goldfarb and Tucker [6] emphasize the reduction in five distinct economic costs associated with digital economic activity. Singh, Chaudhuri and Chatterjee [16] analyze how digital transformation initiatives influence the effectiveness of green supply chain practices to achieve carbon neutrality as well as to accelerate circular economy practices. Eichel [17] investigates the relationship between the real economy and stock prices in the context of momentum strategies. Ngene and Tah [18] conduct a disaggregated tripartite inquiry into policy uncertainly-real economy-financial sector nexus by analyzing inter- and intra-variable shock transmissions. Ahnert, Hoffmann and Monnet [19] propose a model of lending, payments choice, and privacy in the digital economy. They hold the view that while new technologies can reduce the privacy concerns associated with digital payments, they also redistribute surplus from the lender to merchants.

In recent years, research on DEREID has proliferated rapidly. In the theoretical analysis aspect, Guo and Zhao [20] study the logic mechanism and implementation path of DEREID, and find that there are constraints such as insufficient core technology reserves, uneven industry integration, insufficient degree of transformation and innovation, inadequate governance system, and lack of linkage mechanisms in the process of DEREID, and put forward suggestions such as strengthening technology research and development, building a diversified digital industry chain, accelerating digital construction, and strengthening market orientation. Shi and Cao [21] discuss the trends, challenges, and countermeasures of DEREID, and they suggest that it is important to break the data silos, release the value of data events in depth, make every effort to overcome key core technologies, improve talent training and reduce the employment impact of digital and real integration, expand international cooperation, and so on. Similar research is also conducted by Ren and Miao [22]. Zhang, Tang and Zhang [23] propose that DEREID is mainly reflected in technology integration and industry integration, and the integration and development of new-generation digital technology and traditional industry technology is the primary manifestation of technology integration. In the empirical testing aspect, Zeng, Liu, and Li [24] construct evaluation indicators for the development level of the digital economy and real economy, calculate the coupling coordination between China's digital economy and real economy, and conduct spatiotemporal evolution analysis on the coupling coordination degree. They find that the development of the coupling and coordination between the digital economy and the real economy is still unstable, and the problem of uneven coupling and coordination development within the Northeast region needs to be addressed. Hu and Zhang [25] believe that after the development from 2011 to 2020, various provinces in China have made significant progress in the digital economy, real economy, and their deep integration level. Similar research is also conducted by Guo and Quan [26]. Wang and Xiang [12] find that the establishment of the big data comprehensive experimental zone can significantly improve the integration level of the digital economy and the real economy. Xu and Shi [27] find that the integration of the digital economy and the real economy has a promoting effect on the total factor productivity of 'SRDI’ enterprises.

In addition to examining integration issues comprehensively, scholars also concentrate on the manufacturing sector, as a representative of the real economy, to investigate its digital transformation. Through the analysis of transformation effects, bottlenecks, mechanisms, and influencing factors, relevant conclusions on the digital transformation of the manufacturing industry are drawn [28]. Dong and Chen [29] find that digital transformation can play a positive empowering role in enhancing the innovation resilience of high-tech manufacturing industries, and compared to other sub-dimensions of high-tech innovation resilience, digital transformation has a stronger positive driving effect on the recovery of innovation resilience. Jiang, Han and Qin [30] study the long-term dynamic relationship between digital transformation and green transformation in the manufacturing industry through the PVAR model and find that both are dependent on their own development level. The manufacturing industry has not fully utilized the driving role of digitalization in green transformation and the supporting role of green transformation in digitalization during the transformation process.

3. Theoretical mechanism and research hypothesis

DEREID is manifested in the mutual influence and co-evolution of the digital and real economies. The development of the digital economy will be characterized by innovation, with data serving as a fundamental resource and infrastructure acting as an intermediary, thereby expanding the developmental scope of the real economy and transforming its growth paradigm. At the micro level, digital technology is deeply embedded in the production processes of real enterprises, data emerges as a critical production factor, and real enterprises progressively intensify their integration with the digital ecosystem. Concurrently, the advancement of the real economy ensures a sustained provision of data elements to the digital economy, fostering continuous innovation within the digital economic domain. The data generated by real enterprises serves as a direct foundation for the digital economy to evaluate its own developmental progress and identify future priorities. Furthermore, real enterprises drive the advancement and innovation of digital technologies by imposing higher demands on existing digital solutions. With China’s rapid economic take-off, the real economy has achieved steady growth, while the digital economy has exhibited vigorous development. Given this trajectory, it can be inferred that the integrated development of these two sectors is progressing continuously, that is, the level of integrated development between the digital and real economies is increasing over time. However, China’s vast geographical and economic diversity means that regional disparities in integrated development may arise due to variations in factors such as geographic location, developmental stages, resource endowments, and policy implementation. Thus, it can be inferred that the level of integrated development varies across regions. Since integration refers to the convergence of the digital and real economies, the developmental stages of both sectors are likely to exert significant influence on the integration process. Consequently, this study posits Hypothesis 1.

H1. The development levels of the digital economy and the real economy serve as core determinants of integrated development.

To isolate the net effects of these core variables, several control variables are incorporated into the regression model, including economic development level, demographic structure, government support, foreign investment, and environmental conditions.

Beyond linear relationships, threshold effects may exist in the influence of the digital and real economies on integration. For instance, excessive growth in the digital economy could lead to self-reinforcing cycles that hinder integration, suggesting a potential decline in marginal returns beyond a critical threshold. This leads to the Hypothesis 2.

H2. The impact of the digital economy and the real economy on integrated development exhibits a threshold effect.

Similarly, control variables may also demonstrate nonlinear effects. For example, structural optimization in population or innovation capacity could amplify the real economy’s role in fostering integration once surpassing a critical level. Hence, the Hypothesis 3 is proposed.

H3. Control variables also exhibit threshold effects in moderating the relationship between the digital-real economy integration and its determinants.

4. Methods and data

4.1. The construction of DEI and REI

The measurement of DEREID necessitates prior assessment of the developmental levels of both the digital economy and the real economy. The measurement of the digital economy constitutes a particularly challenging endeavor, primarily attributable to the current lack of a universally standardized definition within the academic community [31]. Table 1 shows the measurement indicators used to calculate the index of digital economy development level (abbreviated as DEI in the rest of this paper) [7,12,24].

|

First level indicator |

Second level indicator |

Third level indicator (unit of measurement) |

Influence direction |

|

The index of digital economy development level (DEI) |

Digital Infrastructure |

1 Length of optical cable lines (km) 2 Mobile phone penetration rate (units/100 people) 3 Internet broadband access ports (10000 units) 4 Internet broadband access users (10000 households) 5 Number of web pages (10000 units) |

+a + + + + |

|

Digital Industrialization |

1 Number of enterprises in the information transmission, software, and information technology service industries (unit) 2 Software business revenue (10000 yuan) 3 Employment of urban units in the information transmission, software, and information technology services industry (10000 people) 4 Total telecommunications business volume (100 million yuan) |

+ + + + |

|

|

Industrial Digitalization |

1 Enterprise e-commerce sales revenue (100 million yuan) 2 Number of computers used per 100 people (unit) 3 Number of websites per hundred enterprises (unit) 4 Number of enterprises engaged in e-commerce transactions (unit) 5 Proportion of enterprises engaged in e-commerce transactions (percentage) |

+ + + + + |

|

|

Technical Environment |

1 Technology market transaction volume (100 million yuan) 2 Number of research and experimental development projects of industrial enterprises above a certain scale (unit) 3 Number of personnel in research and experimental development institutions established by industrial enterprises above a certain scale (10000 people) 4 Expenditure on research and experimental development funds for industrial enterprises above a certain scale (10000 yuan) 5 Education budget (10000 yuan) 6 Number of full-time teachers in regular higher education institutions (10000 people) |

+ + + + + + |

a+ indicates the positive influence of a certain indicator on the measurement of the digital economy development level.

Table 2 shows the measurement indicators used to calculate the index of real economy development level (abbreviated as REI in the rest of this paper) [12,25,27].

|

First level indicator |

Second level indicator |

Third level indicator (unit of measurement) |

Influence direction |

|

The index of real economy development level (REI) |

Agricultural |

1 Total output value of agriculture, forestry, animal husbandry and fishery (100 million yuan) 2 Value added of agriculture, forestry, animal husbandry, and fishery (100 million yuan) 3 Total power of agricultural machinery (10000 kilowatts) |

+a + + |

|

Industrial |

1 Number of industrial enterprises (unit) 2 Total assets of industrial enterprises (100 million yuan) 3 Industrial added value (100 million yuan) |

+ + + |

|

|

Construction |

1 Number of construction enterprises (unit) 2 Total output value of the construction industry (100 million yuan) 3 Value added of the construction industry (100 million yuan) |

+ + + |

|

|

Transportation and postal industry |

1 Railway operating mileage (10000 kilometers) 2 Highway mileage (10000 kilometers) 3 Value added of transportation, warehousing, and postal services (100 million yuan) |

+ + + |

|

|

Wholesale and retail |

1 Number of retail legal entities (unit) 2 Number of employees in the retail industry at the end of the year (person) 3 Total sales of retail goods (100 million yuan) 4 Number of legal entities in wholesale industry (unit) 5 Number of employees in wholesale industry at the end of the year (person) 6 Total sales of wholesale goods (100 million yuan) 7 Value added of wholesale and retail industry (100 million yuan) |

+ + + + + + + |

|

|

Accommodation and catering |

1 Number of legal entities in the catering industry (unit) 2 Number of employees in catering industry enterprises (person) 3 Revenue of catering enterprises (100 million yuan) 4 Number of legal entities in the accommodation industry (unit) 5 Number of employees in accommodation industry enterprises (person) 6 Revenue of accommodation industry enterprises (100 million yuan) 7 Value added of accommodation and catering industry (100 million yuan) |

+ + + + + + + |

a+ indicates the positive influence of a certain indicator on the measurement of the real economy development level.

The entropy weight method for calculating DEI and REI is arranged in the following three steps.

(i) Standardization of the positive and negative indicators

while xij indicates the values of indicator j in year i, min(xj) indicates the minimum value of indicator j in all years, and max(xj) indicates the maximum value of indicator j in all years.

(ii) Calculation of indicator weights

(iii) Calculation of the index of digital or real economy development level

while DEI and REI are calculated indexes, used to represent the development level of the digital economy and the real economy. Its value is between 0 and 1, and the closer it is to 1, the higher the development level of the digital or real economy. The development characteristics of the two economies can be analyzed through DEI and REI.

4.2. Coupling coordination degree model

The coupling coordination degree model is used to analyze the level of coordinated development of things, which includes three indicators: coupling degree, coordination index, and coupling coordination degree. Coupling degree refers to the dynamic relationship in which two or more systems interact and affect each other, reflecting coordinated development. Coordination degree refers to the degree of benign coupling in the coupling interaction relationship [32]. The coupling coordination between the real economy and the digital economy studied in this paper is to investigate the degree of correlation and dynamic evolution trend between the real economy and the digital economy. This study constructs the following coupling coordination degree model [26, 32].

while DEIij indicates the index of the development level of the digital economy, REIij indicates the index of the development level of the real economy, Cij indicates the coupling degree, and Tij indicates the comprehensive harmonic index of the digital economy and real economy, reflecting the overall synergy effect between the digital economy and real economy, and DEREIDij indicates the coupling coordination in year i for province j. α and β equal 0.5 for the same importance of two economies. Based on previous references, the coupling coordination level between two economies can be determined into different levels, as shown in Table 3.

|

DEREIDij |

Level |

The relationship between the digital and the real economy |

|

[0,0.3] |

Low coordination |

The integrated development of two economies is hindered |

|

(0.3,0.5] |

Moderate coordination |

The integrated development of two economies is in the stage of adaptation |

|

(0.5,0.8] |

High coordination |

The integrated development level of two economies is relatively high, and coordinated development has been initially achieved |

|

(0.8,1] |

Extreme coordination |

The integrated development level of two economies is very high, achieving coordinated development |

4.3. Panel regression

The core determinants of integrated development are the developmental levels of both the digital economy and the real economy. Integrated development can only be sustainably enhanced when these two sectors achieve coordinated and synchronous advancement. Consequently, this study employs the digital economy and the real economy as core explanatory variables to examine their respective impacts on integrated development. Additionally, multiple supplementary factors may influence integrated development outcomes. This study employs the following five control variables to characterize their impacts on the integration process: the level of economic development (ED), population structure (PS), the role of the government (GR), foreign investment (FI), and environmental conditions (EC). The annual provincial GDP is selected to represent ED. The proportion of individuals aged 15-64 in the sampled population is adopted as the method for measuring PS. Provincial general budget expenditure of local finance is used to represent GR [33]. The annual provincial foreign direct investment is selected to represent FI. The annual provincial sulfur dioxide emissions are selected to represent EC.

Incorporating the core variables and control variables described above and referring to Simionescu and Cifuentes-Faura (2024) [34], the panel regression model established in this paper is as follows:

while DEREIDij indicates the coupling coordination, DEIij indicates the index of the development level of the digital economy, REIij indicates the index of the development level of the real economy, Xij indicates other variables considered affecting DEREIDij in year i for province j, μj indicates individual fixed effect, λi indicates time fixed effect, and ϵij indicates random term. The positive or negative direction of the regression coefficient βs (s=1,2,3) will indicate whether the growth of a certain explanatory variable promotes or inhibits the integrated development of two economies.

4.4. Threshold model

Hansen [35] and Lv, Wang and Chen [36] have established the following threshold model. The observed data are from a balanced panel {yij, qij, xij: 1≤ i ≤T,1≤ j ≤n}. The subscript j indexes the individual and the subscript i indexes time. The dependent variable yij is scalar, the threshold variable qij is scalar, and the regressor xij is a k vector. The structural equation of interest is:

where I (•) is the indicator function. The observations are divided into two groups depending on whether the threshold variable qit is smaller or larger than the threshold γ. The groups are distinguished by differing regression slopes, α1 and α2. The error eit is assumed to be independent and identically distributed with mean zero and finite variance σ2.

This study refers to the concept of this model and P. and Ashraf [37], conducts tests in the sequence from the three-threshold model to the single-threshold model, and incorporates control variables in the regression process, striving to analyze the net effect of the core explanatory variables on the explained variable after considering the threshold effect.

4.5. Data

This study examines the 31 provinces, municipalities, and autonomous regions of China. For detailed provincial-level information, see Table 4. Due to data collection challenges, the research dataset excludes Hong Kong, Macao, and Taiwan, China. All statistical data in this research are obtained from China's National Bureau of Statistics. With the exception of missing values, the dataset is accessible through the National Bureau of Statistics official website (http://www.stats.gov.cn). For specific missing data points, we implement linear regressions and moving average methodologies to ensure data continuity.

5. Empirical results

5.1. The results of coupling coordination degree model

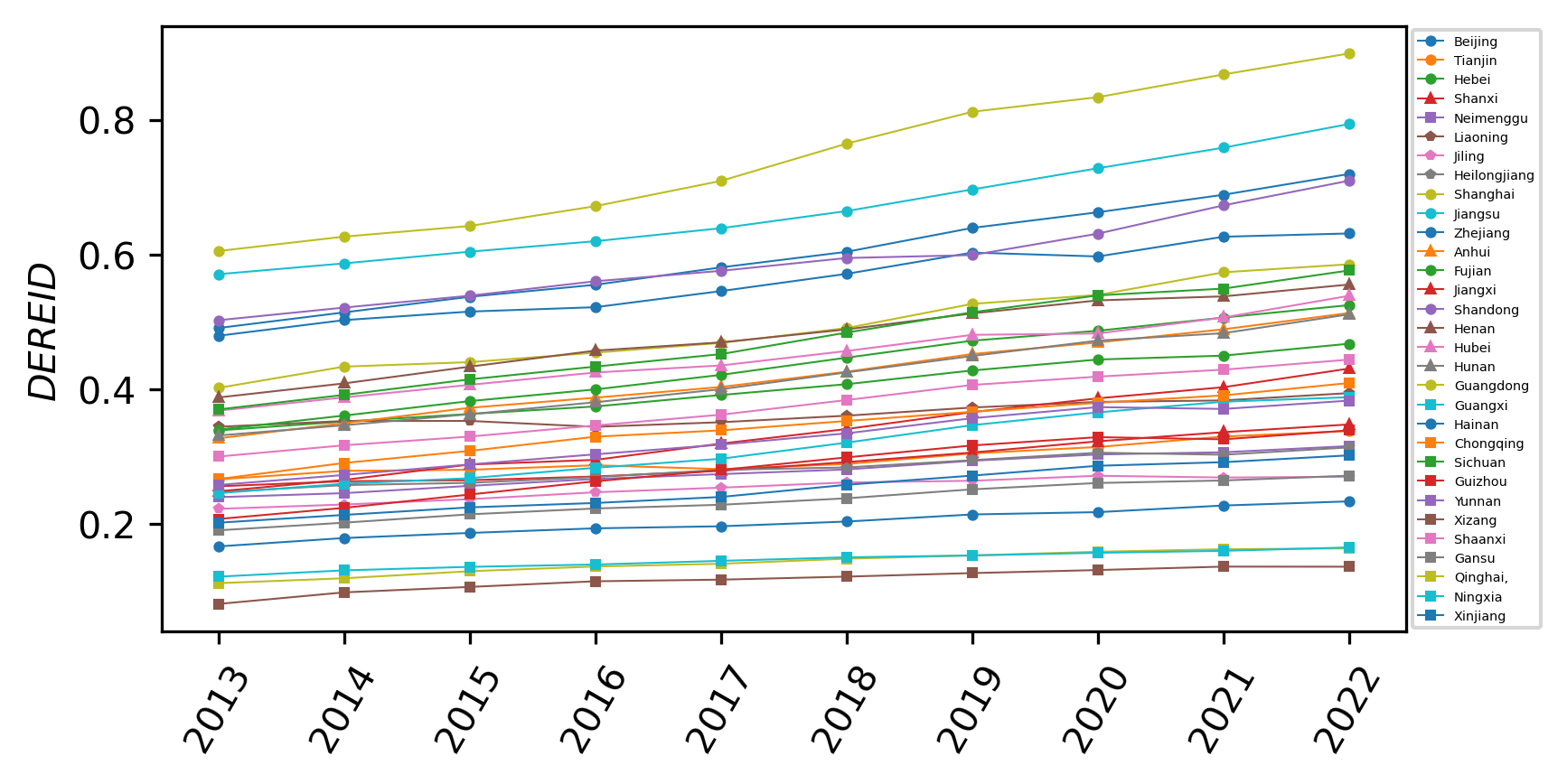

DEREID is calculated with Python 3.11 in Spyder 5.4.3. From Table 4 and Fig 1, it is clear that the coupling coordination degree between the digital economy and the real economy in 31 provinces, municipalities, and autonomous regions continues to rise from 2013 to 2022. From a national perspective, the level of integrated development has increased from 0.3059 to 0.4408 in the past decade, that is to say, the integrated development of the digital economy and the real economy has improved from the state of low coordination to moderate coordination. Specifically, the following results can be drawn. First, the top five with higher coupling coordination degrees are as follows, Beijing, Jiangsu, Zhejiang, Shandong and Guangdong, which are provinces or municipality directly under the Central Government located in the eastern region. This result has not changed from 2013 to 2022. It can be seen that the integrated development in the eastern region, especially in the coastal areas, is better compared to the other regions. The reason can be considered as their high-quality policy environment and superior geographical location in those provinces. Second, the integrated development of Xizang is the worst, and this situation has not changed from 2013 to 2022. Xizang is located in the southwest of China and has rich land resources, animal resources, plant resources, and energy resources, but due to its own environmental limitations, it has not been able to join the ranks of the economies with high-speed development. Third, in terms of the average annual integrated development speed, the top five in terms of the average annual development speed in the past ten years are, Anhui, Jiangxi, Guangxi, Guizhou and Xizang, of which there are two from the eastern region and three from the western region. It is obvious that although the eastern region has a high level of development, its development has reached a plateau period, while the central and western regions are catching up and there is still a lot of room for improvement. Fourth, the province with the slowest development speed is Liaoning. In recent years, the economic development problems in Northeast China have mainly focused on factors such as geographical distance from developed areas and trade channels, severe cold climate, single industrial structure, slow development of emerging industries, and talent loss. These problems are also important factors contributing to the slow development and poor integrated development of the digital economy and the real economy. Fifth, there is regional heterogeneity in the integrated development among different regions, and except for the northeast region, the development within the other regions is becoming increasingly uneven. The level of integrated development from high to low is as follows, eastern (0.4161 in 2013, 0.5901 in 2022), central (0.3196 in 2013, 0.4827 in 2022), northeast (0.2711 in 2013, 0.3258 in 2022), and western (0.2160 in 2013, 0.3243 in 2022). The degree of uneven integrated development in 2013, from high to low, is as follows, eastern (0.1388), western (0.0828), northeast (0.0644) and central (0.0572). By 2022, the situation had slightly changed, with the unbalanced development in the central region surpassing that in the northeast region. However, the uneven development in all three regions has increased. By 2022, the uneven development levels in the eastern, western and central regions are 0.2054, 0.1289 and 0.0789 respectively.

|

Region |

Province Municipality Autonomous region |

DEREID (2013) |

DEREID (2018) |

DEREID (2022) |

Annual growth rate of DEREID |

|

Eastern region |

Beijing |

0.4792a |

0.5712 |

0.6312 |

0.0311c |

|

Tianjin |

0.2659 |

0.2888 |

0.3378 |

0.0269 |

|

|

Hebei |

0.3386 |

0.4073 |

0.4674 |

0.0365 |

|

|

Shanghai |

0.4018 |

0.4907 |

0.5854 |

0.0427 |

|

|

Jiangsu |

0.5706 |

0.6644 |

0.7937 |

0.0373 |

|

|

Zhejiang |

0.4907 |

0.6039 |

0.7195 |

0.0434 |

|

|

Fujian |

0.3399 |

0.4467 |

0.5247 |

0.0494 |

|

|

Shandong |

0.5023 |

0.5947 |

0.7095 |

0.0391 |

|

|

Guangdong |

0.6051 |

0.7645 |

0.8985 |

0.0449 |

|

|

Hainan |

0.1664 |

0.2033 |

0.2333 |

0.0383 |

|

|

Meand |

0.4161 |

0.5035 |

0.5901 |

0.0390 |

|

|

SDd |

0.1388 |

0.1719 |

0.2054 |

0.0066 |

|

|

Central region |

Shanxi |

0.2557 |

0.2916 |

0.3475 |

0.0347 |

|

Anhui |

0.3269 |

0.4258 |

0.5130 |

0.0513 |

|

|

Jiangxi |

0.2482 |

0.3407 |

0.4305 |

0.0631 |

|

|

Henan |

0.3876 |

0.4887 |

0.5553 |

0.0408 |

|

|

Hubei |

0.3680 |

0.4566 |

0.5386 |

0.0432 |

|

|

Hunan |

0.3311 |

0.4248 |

0.5110 |

0.0494 |

|

|

Mean |

0.3196 |

0.4047 |

0.4827 |

0.0471 |

|

|

SD |

0.0572 |

0.0741 |

0.0789 |

0.0099 |

|

|

Western region |

Neimenggu |

0.2395 |

0.2807 |

0.3154 |

0.0311 |

|

Guangxi |

0.2455 |

0.3205 |

0.3880 |

0.0522 |

|

|

Chongqing |

0.2664 |

0.3527 |

0.4091 |

0.0488 |

|

|

Sichuan |

0.3698 |

0.4840 |

0.5762 |

0.0505 |

|

|

Guizhou |

0.2071 |

0.2986 |

0.3387 |

0.0562 |

|

|

Yunnan |

0.2576 |

0.3343 |

0.3829 |

0.0450 |

|

|

Xizang |

0.0810b |

0.1215 |

0.1362 |

0.0595 |

|

|

Shaanxi |

0.2999 |

0.3838 |

0.4438 |

0.0445 |

|

|

Gansu |

0.1903 |

0.2379 |

0.2715 |

0.0403 |

|

|

Qinghai |

0.1118 |

0.1482 |

0.1635 |

0.0431 |

|

|

Ningxia |

0.1215 |

0.1502 |

0.1649 |

0.0345 |

|

|

Xinjiang |

0.2016 |

0.2579 |

0.3016 |

0.0458 |

|

|

Mean |

0.2160 |

0.2809 |

0.3243 |

0.0460 |

|

|

SD |

0.0828 |

0.1063 |

0.1289 |

0.0083 |

|

|

Northeast region |

Liaoning |

0.3441 |

0.3605 |

0.3941 |

0.0152 |

|

Jilin |

0.2222 |

0.2614 |

0.2699 |

0.0218 |

|

|

Heilongjiang |

0.2470 |

0.2837 |

0.3134 |

0.0268 |

|

|

Mean |

0.2711 |

0.3019 |

0.3258 |

0.0213 |

|

|

SD |

0.0644 |

0.0520 |

0.0630 |

0.0058 |

|

|

All regions |

Mean |

0.3059 |

0.3787 |

0.4408 |

- |

|

SD |

0.1287 |

0.1544 |

0.1859 |

- |

aThe horizontal line below the number means that a certain indicator of a certain province has entered the top five of a certain year.

bNumbers in italics indicate that a certain indicator of a certain province is the lowest value in a certain year or in all individuals.

cThe annual growth speed is calculated by:

dMean and SD indicate the average value and the standard deviation of DEREID in a certain region in a certain year.

aThe provinces in the Eastern, Central, Western, and Northeastern regions are represented by marker symbols, specifically circles, triangles, squares, and pentagons, respectively.

Table 5 summarizes the number and proportion of provinces with different levels of integrated development each year. It is obvious that the proportion of provinces with low coordination are gradually declining and the proportion of provinces with high coordination is gradually increasing. Up till 2022, one province, Guangdong, reaches the level of extreme coordination of the digital economy and the real economy in China.

|

DEREID |

Level |

2013 |

2018 |

2022 |

|

[0,0.3] |

Low coordination |

17a 54.84% |

12 38.71% |

6 19.35% |

|

(0.3,0.5] |

Moderate coordination |

12 38.71% |

14 45.16% |

13 41.94% |

|

(0.5,0.8] |

High coordination |

2 6.45% |

5 16.13% |

11 35.48% |

|

(0.8,1] |

Extreme coordination |

0 0% |

0 0% |

1 3.23% |

aThe data in the first row of each cell in columns 2013, 2018 and 2022 represents the quantity. The data in the second row represents the proportion.

5.2. The results of panel regression

Double fixed panel effect regressions are carried out with Eviews 13. Table 6 summarizes the regression results of two scenarios, namely with (column (2), (4), (6), (8) and (10)) and without (column (1), (3), (5), (7) and (9)) control variables, for the whole country and different regions. From a national perspective, regardless of whether control variables are included, the development of the digital economy and the real economy will positively influence the integrated development level of the two economies. The influence effect of the real economy is greater than that of the digital economy. Among the five control variables, it is clear that the higher the economic development level, the greater the government fiscal expenditure, the lower the degree of environmental pollution, and the higher integrated development level. The demographic structure negatively affects the integrated development level but without significance. That is, from a national perspective, the optimization of the demographic structure (the proportion of the population aged 15-64 becomes larger) has not brought about a positive effect on integrated development. The regression conclusions of the four regions are largely the same as those of the entire country. Whether control variables are considered or not, both the digital economy and the real economy have a positive influence on the level of integrated development. A minor difference is that in the western region, the digital economy contributes more to the integrated development level than the real economy. Regarding the control variables, the economic development level in the eastern and western regions has a significant positive impact on integrated development. The conclusion regarding the demographic structure is divergent. The optimization of the demographic structure in the eastern region does not facilitate integrated development, while in the central and northeastern regions, it is conducive to it. For the eastern and central regions, government fiscal expenditure assists in integrated development. The increase in the level of foreign investment is not beneficial for the integrated development in the eastern region but is favorable for that in the western region. For the eastern and western regions, environmental optimization is conducive to promoting integrated development. The economic level of the eastern region has developed rapidly due to its geographical location and policy advantages, and has also attracted the aggregation of numerous technical talents. As a result, it can no longer profit from human capital. In recent years, the northeastern region, due to issues such as industrial structure adjustment, has been lacking in talents and urgently requires the support of high-tech talents for regional development. Similarly, the eastern region, which has a large amount of foreign investment, has reached the apex of its promotional effect, while in the western region, due to geographical factor and other factors, the optimization of foreign investment can still bring economic benefits. As for the central region, it is required to adjust the policy orientation, industrial structure, etc., to avoid getting trapped in the adverse cycle of sacrificing the environment for integrated development.

|

China |

Eastern region |

Central region |

Western region |

Northeastern region |

||||||

|

DEREID |

||||||||||

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

(10) |

|

|

C |

0.2484*** (0.0035)b |

-0.1905***c (0.0719) |

0.3244*** (0.0058) |

-0.2319 (0.1452) |

0.2050*** (0.0092) |

-0.4795*** (0.1008) |

0.1829*** (0.0039) |

-0.2131** (0.0883) |

0.1730*** (0.0060) |

0.1690 (0.0966) |

|

DEI |

0.2118*** (0.0187) |

0.2092*** (0.0181) |

0.2422*** (0.0189) |

0.2161*** (0.0157) |

0.2915*** (0.0433) |

0.3636*** (0.0306) |

0.4841*** (0.0580) |

0.5776*** (0.0533) |

0.4838*** (0.0469) |

0.6835*** (0.0893) |

|

REI |

0.4733*** (0.0256) |

0.4394*** (0.0250) |

0.3574*** (0.0249) |

0.3199*** (0.0241) |

0.7014*** (0.0499) |

0.5961*** (0.0387) |

0.5118*** (0.0620) |

0.3515*** (0.0599) |

0.7831*** (0.0344) |

0.8066*** (0.1383) |

|

EDa |

- |

0.0833*** (0.0178) |

- |

0.1229*** (0.0354) |

- |

0.0091 (0.0195) |

- |

0.0621*** (0.0200) |

- |

-0.0080 (0.0185) |

|

PS |

- |

-0.0696 (0.0472) |

- |

-0.1240** (0.0579) |

- |

0.2118*** (0.0505) |

- |

0.0258 (0.0462) |

- |

0.1462* (0.0775) |

|

GR |

- |

0.0353** (0.0163) |

- |

0.0428** (0.0179) |

- |

0.1369*** (0.0273) |

- |

0.0247 (0.0204) |

- |

-0.0285 (0.0204) |

|

FI |

- |

0.0027 (0.0023) |

- |

-0.0087*** (0.0027) |

- |

-0.0019 (0.0034) |

- |

0.0124*** (0.0026) |

- |

0.0024 (0.0023) |

|

EC |

- |

-0.0001*** (0.0000) |

- |

-0.0002*** (0.0000) |

- |

0.0001** (0.0000) |

- |

-0.0001*** (0.0000) |

- |

0.0001 (0.0001) |

|

Cross-section effect |

Fixed |

Fixed |

Fixed |

Fixed |

Fixed |

Fixed |

Fixed |

Fixed |

Fixed |

Fixed |

|

Period effect |

Fixed |

Fixed |

Fixed |

Fixed |

Fixed |

Fixed |

Fixed |

Fixed |

Fixed |

Fixed |

|

R2 |

0.9979 |

0.9984 |

0.9988 |

0.9993 |

0.9987 |

0.9995 |

0.9985 |

0.9989 |

0.9997 |

0.9997 |

|

Observations |

310 |

310 |

100 |

100 |

60 |

60 |

120 |

120 |

30 |

30 |

aED, PS, GR, FI and EC indicate the level of economic development, demographic structure, the role of the government, foreign investment and environmental conditions respectively.

bThe data in parentheses is the standard deviation.

c*, **, and *** indicate the significance level of 0.1, 0.05, and 0.01 respectively.

5.3. The results of threshold model

Threshold regressions are conducted with Stata 18. Table 7 summarizes the regression results of the number of thresholds and the coefficients of the core explanatory variables when the digital economy, the real economy, and various control variables are respectively taken as the threshold variables. Apparently, from a national perspective, the threshold effect exists significantly. When the digital economy is regarded as the threshold variable, the regression results indicate the existence of three thresholds. All the coefficients of the core explanatory variables are significant, and the conclusion reveals that as the digital economy progresses, its positive influence on integrated development initially decreases and then increases. Conversely, the positive impact of the real economy on integrated development first rises and then drops. This finding suggests that the initial development of the digital economy enables the rapid integrated development of two economies. Once the digital economy reaches a certain stage of development, its advancement causes the role of the digital and real economies in promoting integration to stabilize at a certain level. When the development level of the digital economy takes another leap forward, it can enhance the positive promoting effect of the core variables. When the real economy is considered the threshold variable, the regression results show the presence of two thresholds. All the core explanatory variables are significant, and the results demonstrate that as the real economy develops continuously, its positive impact on integrated development of the two economies keeps rising. Meanwhile, the ability of the digital economy to promote integrated development declines. When the economic development level is the threshold variable, the regression results reveal the existence of one threshold. The results show that as the economic development level continuously improves, the promoting effect of the digital economy on integrated development steadily decreases, while that of the real economy continuously increases. When the population structure is the threshold variable, the regression results show the presence of one threshold. Moreover, the results indicate that as the population structure optimizes, the promoting effects of the digital economy on integrated development increase while that of the real economy declines. When government support and foreign investment are the threshold variables, the regression results show the existence of two thresholds. The influence of the digital economy on integrated development decreases as the value of the threshold variable increases, while the influence of the real economy increases. When the environmental conditions are the threshold variable, the regression results show the presence of one threshold. The results suggest that when the emissions of sulfur dioxide increase, the promoting effect of the digital economy on the integrated development becomes greater, while that of the real economy becomes smaller. Therefore, in the process of developing the digital economy, attention should also be paid to environmental protection issues. The regression results vary slightly across regions, but the overall conclusions are generally consistent with the national findings.

|

Threshold variable |

DEI |

REI |

ED |

PS |

GR |

FI |

EC |

|

|

Number of thresholds |

3 |

2 |

1 |

1 |

2 |

2 |

1 |

|

|

Threshold value |

0.0491 |

0.2329 |

4.8621 |

0.6738 |

3.8244 |

5.5298 |

34.9000 |

|

|

0.2010 |

0.4780 |

4.1100 |

6.1366 |

|||||

|

0.4861 |

||||||||

|

Kernel independent variable |

DEI |

0.6689*** (0.1494) |

0.5981*** (0.0857) |

0.2829*** (0.0344) |

0.2082** (0.0857) |

0.5163*** (0.0916) |

0.5185*** (0.0432) |

0.2298*** (0.0185) |

|

0.6337*** (0.0421) |

0.3157*** (0.0357) |

0.3433*** (0.0338) |

0.2896*** (0.0183) |

|||||

|

0.2709*** (0.0140) |

0.1160* (0.0576) |

0.1181** (0.0485) |

0.2412*** (0.0216) |

0.1889*** (0.0374) |

0.1989*** (0.0407) |

0.5249*** (0.0599) |

||

|

0.3094*** (0.0148) |

||||||||

|

REI |

0.1963*** (0.0662) |

0.3082*** (0.0800) |

0.5161*** (0.0613) |

0.4455*** (0.0755) |

0.3166*** (0.0672) |

0.3035*** (0.0538) |

0.4246*** (0.0450) |

|

|

0.3019*** (0.0580) |

0.4696*** (0.0669) |

0.4234*** (0.0474) |

0.4361*** (0.0442) |

|||||

|

0.5128*** (0.0514) |

0.5849*** (0.0983) |

0.5872*** (0.0869) |

0.3826*** (0.0464) |

0.4906*** (0.0612) |

0.4697*** (0.0627) |

0.2553*** (0.0384) |

||

|

0.4345*** (0.0309) |

||||||||

6. Conclusions and suggestions

6.1. Conclusions

With the sustained advancement of China's digital economy and real economy, their integration has emerged as a prominent area of academic inquiry. This study employs the entropy weight method to assess the developmental levels of China's digital economy and real economy, evaluating their integrated development status. Subsequently, panel regression analysis is conducted to elucidate the direction and magnitude of factors influencing this integration. Furthermore, a threshold model is constructed to investigate the nonlinear threshold effects of these determinants. The empirical findings yield several key insights. First, from 2013 to 2022, China witnessed a consistent upward trajectory in the integration of its digital and real economies, albeit with pronounced regional disparities. Second, the developmental levels of both the digital economy and the real economy exhibit statistically significant positive effects on integration, a result robust across all four regions. Third, threshold regression analysis reveals the presence of nonlinear effects when the following variables serve as threshold parameters, digital economy development level, real economy development level, regional economic development, demographic structure, government support, foreign investment, and environmental conditions. Notably, as these threshold variables optimize, both sectors demonstrate promotional effects on integration—however, the marginal contribution of the digital economy exhibits diminishing returns, whereas that of the real economy displays increasing returns.

6.2. Suggestions

Based on the conclusions drawn above, this paper provides the following policy recommendations [9,13,22,38].

6.2.1. Prioritize coordinated development between the digital and real economies

The integrated development of the digital economy and the real economy represents an inevitable outcome of their co-evolution, wherein their prior independent development serves as a necessary precondition for integration. To facilitate this process, governments and relevant regulatory bodies should prioritize the following measures: accelerating the development of digital economic infrastructure, optimizing the digital business ecosystem, and enhancing collaborative research with scientific institutions to advance foundational, general-purpose, and core technologies. Additionally, fostering the growth of digital platforms is essential to drive the high-quality development of the digital economy. Furthermore, fostering synergistic interactions among manufacturing, industry, and services is critical to constructing an innovation-driven, efficiency-oriented modern industrial system, thereby reinforcing the high-quality growth of the real economy.

6.2.2. Align talent cultivation strategies with contemporary developmental paradigms

Policymakers should prioritize talent cultivation strategies to facilitate convergence between these economic sectors. The proposed measures include: first, educational authorities must implement comprehensive reforms focused on integration, strengthening institutional capacities for cultivating digitally-skilled and innovative talent across higher education, research organizations, and corporate entities; second, establishing an industry-academia-research collaborative framework is essential to align talent development with innovation ecosystems and industrial requirements; third, policymakers should refine incentive mechanisms for interdisciplinary talent development to channel social investments toward cultivating versatile human capital, while simultaneously reforming social security systems to accommodate digital economy-induced labor market transformations.

6.2.3. Strengthen governmental support for economic transformation

First, governments must proactively invest in advanced digital infrastructure to establish the technological foundation for ubiquitous connectivity and intelligent systems. Second, in accordance with market-oriented, legalized, and internationalized principles, authorities should establish a comprehensive digital economy governance framework, develop world-class intelligent government services, and implement a regulatory environment conducive to economic integration. Third, policymakers should allocate targeted support for research and development of integration-enabling technologies, enhance funding mechanisms for innovative enterprises, optimize fiscal subsidy policies, and foster shared technology and data ecosystems. Fourth, as previously established, government agencies should implement dynamic adjustments to talent cultivation programs to ensure alignment with current socioeconomic development requirements and evolving industry needs.

6.2.4. Incorporate environmental sustainability into digital economy development initiatives

First, government authorities must consistently advance green finance initiatives, directing capital flows toward industries engaged in resource-efficient technology development and ecological conservation, while simultaneously guiding enterprises to prioritize environmentally sustainable production practices and fostering green consumption patterns among consumers. Second, in advancing green credit systems, policymakers should establish comprehensive policy frameworks to support green credit development, facilitate the implementation of green assessment mechanisms, and provide guidance for financial institutions including commercial banks to develop credit management systems tailored to the unique characteristics of green enterprises and projects. Third, regarding green bond market development, regulatory bodies should refine relevant legal provisions and operational guidelines governing green bonds, investigate standardized rating criteria for green financial instruments, and support the innovation of related financial products such as green bond indices. Fourth, while maintaining robust risk management protocols, government institutions should promote broader societal engagement in green financial cooperation, enhance public awareness and acceptance of green finance principles, and thereby establish a solid foundation for the sustainable advancement of green financial systems.

Funding

This paper is supported by Scientific Research Program Funded by Education Department of Shaanxi Provincial Government: Research on the Deep Integration of Shaanxi's Digital Economy and Real Economy (Program No.23JK0199).

References

[1]. Cyberspace Administration of China. (2016). G20 Digital Economy Development and Cooperation Initiative, Office of the Central Cyberspace Affairs Commission. Available from: https: //www.cac.gov.cn/2016-09/29/c_1119648520.htm

[2]. Javaid M, Haleem A, Singh RP, Sinha AK. (2024). Digital economy to improve the culture of industry 4.0: A study on features, implementation and challenges.Green Technologies and Sustainability. Volume 2, Issue 2, 100083. doi: 10.1016/j.grets.2024.100083.

[3]. China Academy of Information and Communications Technology. (2023).Global Digital Economy White Paper. Available from: http: //www.caict.ac.cn/kxyj/qwfb/bps/202401/P020240326601000238100.pdf

[4]. Dogan B, Nketiah E, Ghosh S, Nassani A A. (2025). The impact of the green technology on the renewable energy innovation: Fresh pieces of evidence under the role of research & development and digital economy.Renewable and Sustainable Energy Reviews. 210: 115193. doi: 10.1016/j.rser.2024.115193.

[5]. Conference Handbook of Global Digital Economy Conference. (2024). Available from: https: //gdec-oss1.oss-cn-beijing.aliyuncs.com/2024/file/2024全球数字经济大会会刊.pdf?v2

[6]. Goldfarb A, Tucker C. (2019). Digital economics.Journal of Economic Literature. 57(1): 3-43. doi: 10.1257/jel.20171452

[7]. Li ZP, Wang H. (2024). Digital New Quality Productivity and High-quality Development of Real Economy: Theoretical Analysis and Empirical Test.Statistics and Decision making. 10: 12-16. doi: 10.13546/j.cnki.tjyjc.2024.10.002.

[8]. Liu ZB. (2015). Rethinking the Interactive Relationship between the Real Economy and the Virtual Economy.Study & Exploration. 09: 82-89. Available from: https: //kns.cnki.net/kcms2/article/abstract?v=_W1AupcyYgZ2jUiF8FSQfmaawrvvygz83UU0MSfs2_hrTixEnWlS9j6Mq6R-ESvNSeI_c8CvWt9rGoitLwRol30D7lRUWo1E1DC4hym03fPoIk6z-Kaj7z5csmATxXzCmMGi4Fmeb5c696l-jn4Wjah2gO3kGybjDGks-jLulI7EB3HQ1fm7RD_3_whXim4E38bwvQb0gjA=& uniplatform=NZKPT& language=CHS

[9]. Ouyang RH, Gong W. (2023). Promoting the deep integration of the digital economy and the real economy: mechanism and path.Journal of Beijing Technology and Business University (Social Sciences). 38(4): 10-22 Available from: https: //kns.cnki.net/kcms2/article/abstract?v=Ep7N7zfewyS_M3mOEoPpx4Fjpzg1AI9f9I0588wi3SUSzbWroV5Yb5fqqYZQ1hqeC0XRvG0OVxeny3Ym8rso8vFXmPAcOyYaI-dWZ9mQSnQLPM9_jrzmtgYLtGhk2AsNHeQXsHAlS8pZCegj7jcGAYjwscb3sq54sb2ZsPINfS3Mzc9xSP4IyVbTn7iMHXRHisnJvbqhGJ4=& uniplatform=NZKPT& language=CHS

[10]. The State Council of The People’s Republic of China,14th Five Year Plan for the Development of Digital Economy. (2021). Available from: https: //www.gov.cn/gongbao/content/2022/content_5671108.htm

[11]. Hong YX, Ren BP. (2023). Connotation and Approach of Deep Integration of the Digital Economy and the Real Economy.China's Industrial Economy. 02: 5-16. doi: 10.19581/j.cnki.ciejournal.2023.02.001.

[12]. Wang ZG, Xiang M. (2024). Path Analysis of Digital-real Economy Integration: A Quasi-natural Experiment Based on Big Data Comprehensive Pliot Zone.Exploration of Economic Issues. 09: 95-112.Available from: https: //kns.cnki.net/kcms2/article/abstract?v=_kvDxI8xRKlOidwDiARjPBcCryalJNskqN3tvmGDGoyud1o24TR-CM8F6x7A-xXpVKT0mqGCqxjElLKUXPmkGaCLC3z5iFrwlw_zTNAwueYmL4B5gsq7m3EWLC8poehW-BiV_bU_sdgsxuDXhv3RFK9qEP3HH99y_U0-d6ReFaunn58_FYg9z5OamQLY-Mqm& uniplatform=NZKPT& language=CHS

[13]. Xue D, Li XM. (2023). Empowering the high-quality development of the real economy with the digital economy: practical challenges and path choices.Qinghai Social Sciences. 04: 81-90. doi: 10.14154/j.cnki.qss.2023.04.009.

[14]. Jiang S, Sun YX. (2020). An empirical study on the effect of digital economy on real economy.Science Research Management. 05: 32-39. doi: 10.19571/j.cnki.1000-2995.2020.05.004.

[15]. Jing RZ. Digital Economics [M].Beijing: CHINA MACHINE PRESS; 2024.

[16]. Singh K, Chaudhuri R, Chatterjee S. (2025). Assessing the impact of digital transformation on green supply chain for achieving carbon neutrality and accelerating circular economy initiatives.Computers & Industrial Engineering. 201: 110943. doi: 10.1016/j.cie.2025.110943.

[17]. Eichel R. (2021). Momentum in real economy and industry stock returns.Journal of Behavioral and Experimental Finance. Volume 32, 100576. doi: 10.1016/j.jbef.2021.100576.

[18]. Ngene G M, Tah K A. (2023). How are policy uncertainty, real economy, and financial sector connected?.Economic Modelling. Volume 123, 106291. doi: 10.1016/j.econmod.2023.106291.

[19]. Ahnert T, Hoffmann P, Monnet C. (2025) Payments and privacy in the digital economy.Journal of Financial Economics. Volume 169, 104050. doi: 10.1016/j.jfineco.2025.104050.

[20]. Guo LJ, Zhao CY. (2023). Logic Mechanism and Implementation Path of Promoting Further Integration of Digital and Real Economy.Economic Problem. 11: 33-39. doi: 10.16011/j.cnki.jjwt.2023.11.004.

[21]. Shi YP, Cao AJ. (2023). Deep Integration of Digital Economy and Real Economy: Trends, Challenges and Countermeasures.Economist. 06: 45-53. doi: 10.16158/j.cnki.51-1312/f.2023.06.006.

[22]. Ren BP, Miao XY. (2024). The micro connotation, development mechanism and policy orientation of the deep integration of the digital economy and the reality economy.Journal of Central South University (Social Sciences Edition). 30(3): 88-98. Available from: https: //kns.cnki.net/kcms2/article/abstract?v=_kvDxI8xRKlTkO2fjOr9TB27F5UxwbybTP4nLOKYIuxEcDzrTVyRncF8H1flltg-SxVQWDpyOIt16gdw_kNMvM1OsimRqAv1f7_TIJ20QcqXC9f3hBhZNLPAgCLlqsyBSTaEBEaNmYbe9DaOx8ParPlNI4tkxv-TpVKV0gBREb-w2SvD-k0_zl59wSC1K7zG-eJmmQow7Tc=& uniplatform=NZKPT& language=CHS

[23]. Zhang MZ, Tang YX, Zhang H. (2024) Financial support for deep integration of digital economy and real economy: approaches, mechanisms, and strategies.Macroeconomic research. 04: 22-23. doi: 10.16304/j.cnki.11-3952/f.2024.04.001.

[24]. Zeng AH, Liu BB, Li ZQ. (2024). Research on the Coupling and Coordination of Digital Economy and Real Economy.Statistics and Decision making. 16: 106-111. doi: 10.13546/j.cnki.tjyjc.2024.16.019.

[25]. Hu RD, Zhang T. (2024). Deep Integration of Digital Economy and Real Economy in China’s Provinces: Dynamic Evolution Trend and Obstacle Factor Identification. Jilin University Journal Social Sciences Edition. 04: 172-188+239. doi: 10.15939/j.jujsse.2024.04.jj2.

[26]. Guo H, Quan QH. (2022). The Integrated Development of Digital Economy and Real Economy: Evaluation and Path.Economic Review. 11: 72-82. doi: 10.16528/j.cnki.22-1054/f.202211072.

[27]. Xu YP, Shi YM. (2024). The Integration of the Digital Economy and the Real Economy Empowers the High-Quality Development of the Specialized, Refined, Differential and Innovative Enterprises.Reform of Economic System. 04: 14-22. Available from: https: //kns.cnki.net/kcms2/article/abstract?v=_kvDxI8xRKnkplhCLwHvlYF-8yIcr7RVhr_V7p1AilMnmqz-WgxZmXZ65LkoyOl9azcPbSljnMHW6dja6CeBdmhjId09wWyUPjOaC_Qdmo8UL6ON8RHh8sFlLYn2FgLxMn6URe0Icg41DlnEuBLTDPgwoZT-d5VnihJhuAffHCGK5PIi4VqzEJ9_BEGCNpjYmskpwn_sUTc=& uniplatform=NZKPT& language=CHS

[28]. Liu YJ, Wang YN, Chang Y. (2023). The Impact of Industrial Internet on the Digital Transformation of Manufacturing Enterprises: Based on Multi time Point PSM-DID Verification.Enterprise Economy. 08: 83-92. doi: 10.13529/j.cnki.enterprise.economy.2023.08.008.

[29]. Dong XX, Chen R. (2024). Digital transformation, innovation driven and innovation resilience of high-tech manufacturing industry.Statistics and Decision making. 17: 167-171. doi: 10.13546/j.cnki.tjyjc.2024.17.029.

[30]. Jiang HY, Han YH, Qin Y. (2024). Research on the Interactive Relationship between Digital Transformation and Green Transformation in Manufacturing Industry.Ecological Economy. 11: 47-52.Available from: https: //kns.cnki.net/kcms2/article/abstract?v=Ep7N7zfewyR7X8ZOmIm45J36Et6ufOW2sJsOQ2ehIcy50sHmFBoMOu7DmWpt0HVkXA98TIILlt5IGjmzChxQz1R0K_A_aVtZo8K-SskbRavR_qJdHjZeMon79yszzxJE1-LcLAfXDy4A5cz5T7i7rKzXnEg_csIu2yZRxFmaRXAvUBzc9nDJ2dh4kohilB7H-NaOxhjLUec=& uniplatform=NZKPT& language=CHS

[31]. Vu K, Nguyen T. (2024). Exploring the contributors to the digital economy: Insights from Vietnam with comparisons to Thailand.Telecommunications Policy, Volume 48, Issue 1, 102664. doi: 10.1016/j.telpol.2023.102664.

[32]. Wu DK, Wang MC, Cheng YY. (2024). Research on the Coupling Mechanism of China’s High-quality Financial Development and the Real Economy.Journal of Statistics and Information. 07: 42-55. Available from: https: //link.cnki.net/urlid/61.1421.C.20240623.1729.004

[33]. Song LY, Guo M. (2019). Study on the Impact of Free Trade Zone (FTZ) Policy on Local Financial Power-Analysis Based on the Difference-in-Differences Methods and Synthetic Control Methods.Inquiry into Economic Issues. 11: 14-24. Available from: https: //kns.cnki.net/kcms2/article/abstract?v=Ep7N7zfewyRLKwOILYeFe5W--R_CvDpIdHZXqgjDLrzNrgi1lKnjBf9ej8JK-ys3g2ZIpMI9Y2n-XNVYyyYOIlu1N4NYHTSCPrO43EIeqHSOMDpVyXW38dlpWXw9fxQ_erhNfoYLSn6t0vmdh8xfc8u0gkLbNWcKKDOFx8J3k_3E9Zt_1zQTFiObF8U_4LZl92OXk953ekA=& uniplatform=NZKPT& language=CHS

[34]. Simionescu M, Cifuentes-Faura J. (2024). The digital economy and energy poverty in Central and Eastern Europe.Utilities Policy. Volume 91, 101841. doi: 10.1016/j.jup.2024.101841.

[35]. Hansen B E. (1999). Threshold effects in non-dynamic panels: estimation, testing, and inference.Journal of Econometrics. 93: 345-368. Available from: https: //users.ssc.wisc.edu/~bhansen/papers/joe_99.pdf

[36]. Lv YF, Wang D, Chen SW. (2015). Research on the Effect of China’s Foreign Trade on Productivity, Earnings and Environment: Based on the Threshold Panel Model.China Economic Quarterly. 02: 703-730. doi: 10.13821/j.cnki.ceq.2015.02.013.

[37]. P. J, Ashraf S. (2023). Global value chain participation and CO2 emissions: Does economic growth matter?. New evidence from dynamic panel threshold regression.Energy Economics. Volume 128, 107154. doi: 10.1016/j.eneco.2023.107154.

[38]. Huang QH. (2017). On the Development of China's Real Economy in the New Era.China's Industrial Economy. 09: 5-24. doi: 10.19581/j.cnki.ciejournal.2017.09.001.

Cite this article

Duan,G.;Zhang,H. (2025). Research on the integrated development of the digital economy and the real economy. Journal of Applied Economics and Policy Studies,18(9),12-27.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Cyberspace Administration of China. (2016). G20 Digital Economy Development and Cooperation Initiative, Office of the Central Cyberspace Affairs Commission. Available from: https: //www.cac.gov.cn/2016-09/29/c_1119648520.htm

[2]. Javaid M, Haleem A, Singh RP, Sinha AK. (2024). Digital economy to improve the culture of industry 4.0: A study on features, implementation and challenges.Green Technologies and Sustainability. Volume 2, Issue 2, 100083. doi: 10.1016/j.grets.2024.100083.

[3]. China Academy of Information and Communications Technology. (2023).Global Digital Economy White Paper. Available from: http: //www.caict.ac.cn/kxyj/qwfb/bps/202401/P020240326601000238100.pdf

[4]. Dogan B, Nketiah E, Ghosh S, Nassani A A. (2025). The impact of the green technology on the renewable energy innovation: Fresh pieces of evidence under the role of research & development and digital economy.Renewable and Sustainable Energy Reviews. 210: 115193. doi: 10.1016/j.rser.2024.115193.

[5]. Conference Handbook of Global Digital Economy Conference. (2024). Available from: https: //gdec-oss1.oss-cn-beijing.aliyuncs.com/2024/file/2024全球数字经济大会会刊.pdf?v2

[6]. Goldfarb A, Tucker C. (2019). Digital economics.Journal of Economic Literature. 57(1): 3-43. doi: 10.1257/jel.20171452

[7]. Li ZP, Wang H. (2024). Digital New Quality Productivity and High-quality Development of Real Economy: Theoretical Analysis and Empirical Test.Statistics and Decision making. 10: 12-16. doi: 10.13546/j.cnki.tjyjc.2024.10.002.

[8]. Liu ZB. (2015). Rethinking the Interactive Relationship between the Real Economy and the Virtual Economy.Study & Exploration. 09: 82-89. Available from: https: //kns.cnki.net/kcms2/article/abstract?v=_W1AupcyYgZ2jUiF8FSQfmaawrvvygz83UU0MSfs2_hrTixEnWlS9j6Mq6R-ESvNSeI_c8CvWt9rGoitLwRol30D7lRUWo1E1DC4hym03fPoIk6z-Kaj7z5csmATxXzCmMGi4Fmeb5c696l-jn4Wjah2gO3kGybjDGks-jLulI7EB3HQ1fm7RD_3_whXim4E38bwvQb0gjA=& uniplatform=NZKPT& language=CHS

[9]. Ouyang RH, Gong W. (2023). Promoting the deep integration of the digital economy and the real economy: mechanism and path.Journal of Beijing Technology and Business University (Social Sciences). 38(4): 10-22 Available from: https: //kns.cnki.net/kcms2/article/abstract?v=Ep7N7zfewyS_M3mOEoPpx4Fjpzg1AI9f9I0588wi3SUSzbWroV5Yb5fqqYZQ1hqeC0XRvG0OVxeny3Ym8rso8vFXmPAcOyYaI-dWZ9mQSnQLPM9_jrzmtgYLtGhk2AsNHeQXsHAlS8pZCegj7jcGAYjwscb3sq54sb2ZsPINfS3Mzc9xSP4IyVbTn7iMHXRHisnJvbqhGJ4=& uniplatform=NZKPT& language=CHS

[10]. The State Council of The People’s Republic of China,14th Five Year Plan for the Development of Digital Economy. (2021). Available from: https: //www.gov.cn/gongbao/content/2022/content_5671108.htm

[11]. Hong YX, Ren BP. (2023). Connotation and Approach of Deep Integration of the Digital Economy and the Real Economy.China's Industrial Economy. 02: 5-16. doi: 10.19581/j.cnki.ciejournal.2023.02.001.

[12]. Wang ZG, Xiang M. (2024). Path Analysis of Digital-real Economy Integration: A Quasi-natural Experiment Based on Big Data Comprehensive Pliot Zone.Exploration of Economic Issues. 09: 95-112.Available from: https: //kns.cnki.net/kcms2/article/abstract?v=_kvDxI8xRKlOidwDiARjPBcCryalJNskqN3tvmGDGoyud1o24TR-CM8F6x7A-xXpVKT0mqGCqxjElLKUXPmkGaCLC3z5iFrwlw_zTNAwueYmL4B5gsq7m3EWLC8poehW-BiV_bU_sdgsxuDXhv3RFK9qEP3HH99y_U0-d6ReFaunn58_FYg9z5OamQLY-Mqm& uniplatform=NZKPT& language=CHS

[13]. Xue D, Li XM. (2023). Empowering the high-quality development of the real economy with the digital economy: practical challenges and path choices.Qinghai Social Sciences. 04: 81-90. doi: 10.14154/j.cnki.qss.2023.04.009.

[14]. Jiang S, Sun YX. (2020). An empirical study on the effect of digital economy on real economy.Science Research Management. 05: 32-39. doi: 10.19571/j.cnki.1000-2995.2020.05.004.

[15]. Jing RZ. Digital Economics [M].Beijing: CHINA MACHINE PRESS; 2024.

[16]. Singh K, Chaudhuri R, Chatterjee S. (2025). Assessing the impact of digital transformation on green supply chain for achieving carbon neutrality and accelerating circular economy initiatives.Computers & Industrial Engineering. 201: 110943. doi: 10.1016/j.cie.2025.110943.

[17]. Eichel R. (2021). Momentum in real economy and industry stock returns.Journal of Behavioral and Experimental Finance. Volume 32, 100576. doi: 10.1016/j.jbef.2021.100576.

[18]. Ngene G M, Tah K A. (2023). How are policy uncertainty, real economy, and financial sector connected?.Economic Modelling. Volume 123, 106291. doi: 10.1016/j.econmod.2023.106291.

[19]. Ahnert T, Hoffmann P, Monnet C. (2025) Payments and privacy in the digital economy.Journal of Financial Economics. Volume 169, 104050. doi: 10.1016/j.jfineco.2025.104050.

[20]. Guo LJ, Zhao CY. (2023). Logic Mechanism and Implementation Path of Promoting Further Integration of Digital and Real Economy.Economic Problem. 11: 33-39. doi: 10.16011/j.cnki.jjwt.2023.11.004.

[21]. Shi YP, Cao AJ. (2023). Deep Integration of Digital Economy and Real Economy: Trends, Challenges and Countermeasures.Economist. 06: 45-53. doi: 10.16158/j.cnki.51-1312/f.2023.06.006.

[22]. Ren BP, Miao XY. (2024). The micro connotation, development mechanism and policy orientation of the deep integration of the digital economy and the reality economy.Journal of Central South University (Social Sciences Edition). 30(3): 88-98. Available from: https: //kns.cnki.net/kcms2/article/abstract?v=_kvDxI8xRKlTkO2fjOr9TB27F5UxwbybTP4nLOKYIuxEcDzrTVyRncF8H1flltg-SxVQWDpyOIt16gdw_kNMvM1OsimRqAv1f7_TIJ20QcqXC9f3hBhZNLPAgCLlqsyBSTaEBEaNmYbe9DaOx8ParPlNI4tkxv-TpVKV0gBREb-w2SvD-k0_zl59wSC1K7zG-eJmmQow7Tc=& uniplatform=NZKPT& language=CHS

[23]. Zhang MZ, Tang YX, Zhang H. (2024) Financial support for deep integration of digital economy and real economy: approaches, mechanisms, and strategies.Macroeconomic research. 04: 22-23. doi: 10.16304/j.cnki.11-3952/f.2024.04.001.

[24]. Zeng AH, Liu BB, Li ZQ. (2024). Research on the Coupling and Coordination of Digital Economy and Real Economy.Statistics and Decision making. 16: 106-111. doi: 10.13546/j.cnki.tjyjc.2024.16.019.

[25]. Hu RD, Zhang T. (2024). Deep Integration of Digital Economy and Real Economy in China’s Provinces: Dynamic Evolution Trend and Obstacle Factor Identification. Jilin University Journal Social Sciences Edition. 04: 172-188+239. doi: 10.15939/j.jujsse.2024.04.jj2.

[26]. Guo H, Quan QH. (2022). The Integrated Development of Digital Economy and Real Economy: Evaluation and Path.Economic Review. 11: 72-82. doi: 10.16528/j.cnki.22-1054/f.202211072.

[27]. Xu YP, Shi YM. (2024). The Integration of the Digital Economy and the Real Economy Empowers the High-Quality Development of the Specialized, Refined, Differential and Innovative Enterprises.Reform of Economic System. 04: 14-22. Available from: https: //kns.cnki.net/kcms2/article/abstract?v=_kvDxI8xRKnkplhCLwHvlYF-8yIcr7RVhr_V7p1AilMnmqz-WgxZmXZ65LkoyOl9azcPbSljnMHW6dja6CeBdmhjId09wWyUPjOaC_Qdmo8UL6ON8RHh8sFlLYn2FgLxMn6URe0Icg41DlnEuBLTDPgwoZT-d5VnihJhuAffHCGK5PIi4VqzEJ9_BEGCNpjYmskpwn_sUTc=& uniplatform=NZKPT& language=CHS

[28]. Liu YJ, Wang YN, Chang Y. (2023). The Impact of Industrial Internet on the Digital Transformation of Manufacturing Enterprises: Based on Multi time Point PSM-DID Verification.Enterprise Economy. 08: 83-92. doi: 10.13529/j.cnki.enterprise.economy.2023.08.008.

[29]. Dong XX, Chen R. (2024). Digital transformation, innovation driven and innovation resilience of high-tech manufacturing industry.Statistics and Decision making. 17: 167-171. doi: 10.13546/j.cnki.tjyjc.2024.17.029.

[30]. Jiang HY, Han YH, Qin Y. (2024). Research on the Interactive Relationship between Digital Transformation and Green Transformation in Manufacturing Industry.Ecological Economy. 11: 47-52.Available from: https: //kns.cnki.net/kcms2/article/abstract?v=Ep7N7zfewyR7X8ZOmIm45J36Et6ufOW2sJsOQ2ehIcy50sHmFBoMOu7DmWpt0HVkXA98TIILlt5IGjmzChxQz1R0K_A_aVtZo8K-SskbRavR_qJdHjZeMon79yszzxJE1-LcLAfXDy4A5cz5T7i7rKzXnEg_csIu2yZRxFmaRXAvUBzc9nDJ2dh4kohilB7H-NaOxhjLUec=& uniplatform=NZKPT& language=CHS

[31]. Vu K, Nguyen T. (2024). Exploring the contributors to the digital economy: Insights from Vietnam with comparisons to Thailand.Telecommunications Policy, Volume 48, Issue 1, 102664. doi: 10.1016/j.telpol.2023.102664.

[32]. Wu DK, Wang MC, Cheng YY. (2024). Research on the Coupling Mechanism of China’s High-quality Financial Development and the Real Economy.Journal of Statistics and Information. 07: 42-55. Available from: https: //link.cnki.net/urlid/61.1421.C.20240623.1729.004

[33]. Song LY, Guo M. (2019). Study on the Impact of Free Trade Zone (FTZ) Policy on Local Financial Power-Analysis Based on the Difference-in-Differences Methods and Synthetic Control Methods.Inquiry into Economic Issues. 11: 14-24. Available from: https: //kns.cnki.net/kcms2/article/abstract?v=Ep7N7zfewyRLKwOILYeFe5W--R_CvDpIdHZXqgjDLrzNrgi1lKnjBf9ej8JK-ys3g2ZIpMI9Y2n-XNVYyyYOIlu1N4NYHTSCPrO43EIeqHSOMDpVyXW38dlpWXw9fxQ_erhNfoYLSn6t0vmdh8xfc8u0gkLbNWcKKDOFx8J3k_3E9Zt_1zQTFiObF8U_4LZl92OXk953ekA=& uniplatform=NZKPT& language=CHS

[34]. Simionescu M, Cifuentes-Faura J. (2024). The digital economy and energy poverty in Central and Eastern Europe.Utilities Policy. Volume 91, 101841. doi: 10.1016/j.jup.2024.101841.

[35]. Hansen B E. (1999). Threshold effects in non-dynamic panels: estimation, testing, and inference.Journal of Econometrics. 93: 345-368. Available from: https: //users.ssc.wisc.edu/~bhansen/papers/joe_99.pdf

[36]. Lv YF, Wang D, Chen SW. (2015). Research on the Effect of China’s Foreign Trade on Productivity, Earnings and Environment: Based on the Threshold Panel Model.China Economic Quarterly. 02: 703-730. doi: 10.13821/j.cnki.ceq.2015.02.013.

[37]. P. J, Ashraf S. (2023). Global value chain participation and CO2 emissions: Does economic growth matter?. New evidence from dynamic panel threshold regression.Energy Economics. Volume 128, 107154. doi: 10.1016/j.eneco.2023.107154.

[38]. Huang QH. (2017). On the Development of China's Real Economy in the New Era.China's Industrial Economy. 09: 5-24. doi: 10.19581/j.cnki.ciejournal.2017.09.001.