1. Introduction

As an end consumer product, the tire industry has an extensive industrial system. The upstream of the industrial chain is mainly related to links such as domestic and foreign natural rubber plantations, synthetic rubber production by chemical enterprises, and the manufacturing of steel cords and carbon black; the midstream includes tire manufacturing enterprises at various levels, including Michelin, Bridgestone, Triangle, and Linglong; the downstream connects the original equipment manufacturer (OEM) market for complete vehicles and end users. In terms of global competition, the total tire sales volume has continued to rise. International brands such as Michelin and Bridgestone still take the lead in the high-end sector relying on their technological accumulation and brand value; Chinese tire enterprises mainly adopt the strategy of "high cost-effectiveness and localized services" to expand markets in emerging regions such as Southeast Asia, the Middle East, and Africa. China is currently the world's largest tire producer and consumer, accounting for a significant share in the global market. Its industrial structure presents the characteristic of "two parallel development paths": first-tier enterprises such as Zhongce, Linglong, and Sailun have gradually entered the mid-to-high-end market by virtue of scale effects and transnational operations; numerous small and medium-sized manufacturers, however, remain concentrated in the mid-to-low-end sector and maintain their operations relying on price advantages.

Nevertheless, the severe industry situation of "revenue growth without corresponding profit increase" for Chinese tire enterprises can be clearly perceived from the latest 2025 interim reports of listed companies. According to data from Securities Daily [1], in the first half of 2025, the total operating revenue of 10 listed companies in the tire sector of the A-share market increased by more than 50% year-on-year, while the total net profit decreased by more than 100% year-on-year. Tire enterprises need to recognize the situation clearly and take effective measures in a timely manner to continuously stabilize and expand the downstream market. In recent five years, many domestic experts, scholars, and consulting institutions have conducted analyses and researches on the current situation, risks, and response measures faced by China's tire industry, and have proposed a number of effective solutions. Liu Zhao [2] pointed out that the severe problem of structural overcapacity in China's tire industry has not been fundamentally solved, and low-end tire companies have adopted price wars, which have indirectly compressed the overall profit margin of the entire tire industry. Xu Wenying [3] believed that in the face of increasingly intensified international trade barriers, Chinese tire enterprises should continuously increase R&D investment, develop differentiated products, and improve product added value. Zhang Minmin [4] proposed that in terms of global layout, enterprises should pay more attention to localized operations to reduce policy risks, and at the same time, rationally plan the layout of overseas production capacity to avoid regions with concentrated trade barriers. Yang Xiaoyan [5] held that Chinese tire enterprises are faced with huge capital gaps and technical difficulties in environmental protection transformation, and the harmful substances generated in the production process are difficult to handle and involve high disposal costs. The editorial department of Rubber Science and Technology [6] stated that Linglong Tire optimized its supply chain and cost control by building a factory in Brazil, effectively expanding its production scale, reducing trade barriers in raw material imports and product exports, and better realizing corporate profitability and long-term development. Stetsiv [7] pointed out that the competition in China's tire industry mainly stems from the homogeneous competition among tire enterprises, leading to the gradual dilution of profits. Borowska [8] believed that after the establishment of multinational enterprises and supply chains, it is necessary to adapt to different cultural differences and economic environments in international marketing. Kannan P.K [9] argued that the product homogeneity in China's auto parts market (including tires) also reflects the lack of differentiated development capabilities among various enterprises. Compared with existing literatures, this paper systematically sorts out the current situation and causes of China's tire industry, macro and micro industry risk factors, and future development trends from multiple aspects. Based on the aforementioned literatures and the research ideas of this paper, it specifically proposes that Chinese tire enterprises should make key breakthroughs in difficulties from the perspectives of overseas factory construction, technological upgrading and transformation, and seizing the new energy market, so as to achieve the healthy, orderly, and steady development of Chinese tire enterprises.

2. Current situation of China's tire industry and brief account of its causes

Recently, the tire industry has faced high trade barriers in the international market and worsening overcapacity in the domestic market, and China's tire industry has been struggling in the dilemma of "revenue growth without corresponding profit increase". Through the research and analysis of the list of Chinese tire companies in the 2025 Global Top 75 Tire Manufacturers released by the authoritative American media Tire Business, the performance reports of major domestic tire companies in the first half of 2025, and the industry research reports of well-known industry research institutions, it is found that the operating revenue of most Chinese tire enterprises showed an upward trend in 2025, while their profits all decreased year-on-year. Tracing back to the data of previous years, this industry trend has long shown signs.

2.1. Current situation of China's tire industry

In terms of operating revenue, based on the collated interim performance data of key domestic tire enterprises in 2025, as shown in Table 1, the revenue of most enterprises increased compared with the same period of the previous year, and the growth rate of more than half of the companies was higher than 10%. Specifically, Zhongce Rubber achieved a revenue scale of 21.86 billion yuan, with a year-on-year growth of 18.02% and a month-on-month increase of 5.39%; Sailun Tire achieved an operating revenue of 17.59 billion yuan, with a year-on-year growth of 16.05% and a month-on-month increase of 9.08%. The expansion of overseas production capacity layout, the contribution of newly commissioned production capacity, and the upgrading of product portfolios have jointly promoted the growth of operating revenue. However, this growth actually relies on "lowering prices to boost sales volume", and the actual profitability of enterprises has shown a declining trend.

In terms of net profit, according to the profit data disclosed by some tire listed companies in the first half of 2025, the net profit of all enterprises decreased year-on-year. Leading enterprises such as Zhongce, Sailun, and Linglong had relatively smaller profit declines, ranging from 7.66% to 14.9%, while the net profit of other enterprises decreased by more than 35%. The decline in profitability is mainly affected by the continuous high prices of raw materials and the increased threshold of international trade. The contrast between the growth of revenue and the contraction of profits reflects the in-depth challenges faced by the current domestic tire industry.

|

Company Name |

Revenue (100 million yuan) |

YoY Growth of Revenue (%) |

Net Profit (100 million yuan) |

YoY Growth of Net Profit (%) |

|

Zhongce Rubber |

218.6 |

18.02 |

23.22 |

-8.56 |

|

Sailun |

175.9 |

16.05 |

18.31 |

-14.90 |

|

Linglong Tyre |

118.1 |

13.8 |

8.54 |

-7.66 |

|

Guizhou Tyre |

51.93 |

0.362 |

2.52 |

-41.26 |

|

Triangle Tyre |

47.78 |

-4.505 |

3.96 |

-35.29 |

|

Sentury Tire |

41.19 |

0.237 |

6.72 |

-37.60 |

|

General Tire |

40 |

30.39 |

0.64 |

-77.70 |

|

Aeolus Tyre |

35.18 |

11.71 |

1 |

-55.40 |

|

SST Giti Tire |

22.87 |

4.769 |

1.16 |

-35.20 |

|

Qingdao Doublestar |

22.72 |

-0.306 |

-1.8 |

-130.77 |

Source: 2025 Interim Reports of Listed Companies

2.2. Brief account of the causes of the industry situation

By consulting and analyzing the literature on the tire industry, the annual reports of listed companies, and the industry research reports of well-known consulting institutions, the causes of the "revenue growth without corresponding profit increase" situation faced by China's tire industry mainly include four aspects: the rising prices of raw materials in the upstream of the tire industry chain compressing profit margins, international trade barriers indirectly squeezing profit margins, overcapacity and frequent price wars in the domestic tire market, and the technical and price disadvantages of domestic tires in the high-end market.

2.2.1. Rising prices of raw materials in the upstream of the industry chain compressing profit margins

In recent years, the domestic tire industry has been under significant pressure from rising raw material costs. The prices of natural rubber and synthetic rubber have continued to rise, while the selling prices of end tires have not increased correspondingly, resulting in a significant compression of the overall profit margin of the industry. This phenomenon is caused by a combination of multiple factors, including supply chain instability, weather changes, and international market fluctuations. Tire production is a typical industry highly dependent on raw materials, with raw materials accounting for more than 60% of the total cost. Natural rubber alone accounts for more than 50%, and its price changes have the most direct impact on the gross profit level of enterprises. From 2024 to 2025, the rising price of natural rubber directly increased production costs and significantly reduced the profitability of tire enterprises.

In terms of the natural rubber market, the global market showed a pattern of sufficient supply but weak demand in 2024, yet the price trend was unusually strong. As shown in Figure 1 (the domestic natural rubber market transaction price trend in China in 2024), especially in the fourth quarter, the purchase price once exceeded 16,000 yuan per ton. According to relevant statistics, the spot price of natural rubber once rose to a high of 15,000 yuan per ton in 2025. The main factor driving this price increase is the abnormal climate in major producing areas. Major rubber-producing countries in Southeast Asia such as Thailand and Vietnam were successively hit by typhoons, and the domestic producing areas experienced excessive rainfall, which hindered rubber tapping and the output of new rubber. The market generally expects that future supply will still be affected by precipitation, so the price of raw materials has remained at a high level.

The synthetic rubber sector is also facing pressure from rising costs. Its market performance is closely related to the supply and demand of butadiene, a raw material. Regarding the trend of butadiene in 2025, many analyses suggest that the long-term supply-demand contradiction is not prominent, and the annual average price may be slightly lower than that in 2024, but there are still many uncertainties. In addition, the production of synthetic rubber is also restricted by the poor efficiency of ethylene cracking. Due to the continuous low profitability, enterprises have low willingness to start production, resulting in limited growth in butadiene supply.

Source: 100ppi (Bulk Commodity Data Provider)/Shanghai Futures Exchange/Natural Rubber Standard Rubber (Unit: yuan/ton)

2.2.2. International trade barriers indirectly squeezing profit margins

In recent years, China's tire exports have faced an increasing number of trade restrictions. High tariffs and anti-dumping measures have directly compressed corporate profits. In addition to tax costs, trade frictions have also increased the operational pressure of enterprises in other aspects, leading to the widespread "revenue growth without corresponding profit increase" in the industry in the first half of 2025.

The United States has imposed high tariffs on Chinese tires since 2018, and announced a new tariff policy in April 2025, with some tire products facing a tax rate of over 125%. In addition, the United States has imposed a 25% tariff and a 10% basic reciprocal tax on automobiles and auto parts worldwide, resulting in an increase of more than 35% in the cost of Chinese enterprises even when exporting through Southeast Asian bases. The European Union launched an anti-dumping investigation into Chinese-made new passenger car and light truck tires in May 2025; South Africa made a preliminary anti-circumvention ruling on Chinese-made bus and truck tires, imposing a six-month provisional anti-dumping tax on the involved products imported from Cambodia, Thailand, and Vietnam, and accusing Chinese enterprises of transshipping through Southeast Asia to evade tariffs.

Trade barriers have significantly pressured the gross profit margin of Chinese tire enterprises, and most of the tariff costs are absorbed by the enterprises themselves, which cannot be fully passed on to the downstream. Enterprises are also facing the dual pressures of rising comprehensive costs and increased market uncertainty. For example, if the European Union, as an important export market, finally rules on a high tax rate, it will severely impact China's direct exports to the EU. Affected by policies and the decline in the prices of some raw materials in the second quarter, enterprises also need to make provisions for inventory write-downs on high-priced inventories. For instance, Sailun Tire made a provision for asset impairment losses of 170 million yuan in the second quarter of 2025. In addition, international trade frictions often trigger exchange rate fluctuations, which may lead to foreign exchange losses and further reduce profits.

2.2.3. Overcapacity and frequent price wars in the domestic tire market

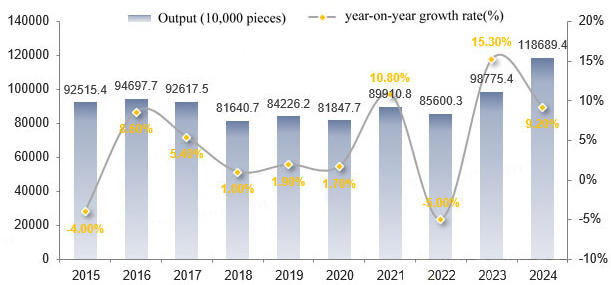

In recent years, the domestic tire industry has witnessed an obvious phenomenon of disorderly expansion of production capacity. As shown in Figure 2 (the statistics of national rubber tire outer tube output and growth rate from 2015 to 2024), the tire output has continued to rise in the past three years, with the total production capacity reaching 1.187 billion pieces in 2024. According to data from the National Bureau of Statistics, in the first half of 2025, the cumulative output of national rubber tire outer tubes reached 592 million pieces, a year-on-year increase of 2.0%; among which, the output in June was 103 million pieces, a year-on-year decrease of 1.1%. Under the dual pressures of overcapacity and weak demand, enterprises often adopt aggressive pricing strategies to maintain cash flow and market share, and the wholesale prices of some categories have dropped to below 100 yuan.

Enterprises have fallen into the "prisoner's dilemma" of expansion and are deeply bound to the financial system. Many enterprises rely on bank credit to expand production capacity. In order to recover funds to repay debts and maintain operations, they continue to produce and sell at low prices even when suffering losses; otherwise, they may face the risk of banks recalling or cutting off loans. Export restrictions have also intensified domestic pressure. China's tire industry has a dependence on exports of over 50%. In recent years, international trade barriers have been continuously heightened, such as the European Union imposing high anti-dumping duties on truck and bus tires, and the United States launching anti-dumping and countervailing investigations on production capacity in Southeast Asia. These have led to the narrowing of export channels, and a large number of products have flowed back to the domestic market, further intensifying the competition in domestic sales.

Source: Huajing Industrial Research Institute/National Bureau of Statistics/Rubber Tire Outer Tubes

2.2.4. Technical and price disadvantages of domestic tires in the high-end market

From the perspective of product structure, domestic tires have long faced structural imbalance of "overcapacity in low-end products and shortage in high-end products". In the low-end market with low technical requirements, such as truck tires, domestic brands occupy a certain market share relying on cost advantages, but the competition is fierce, product homogeneity is serious, and they are trapped in a vicious cycle of price competition, resulting in a significant compression of profits. In the high-end original equipment (OE) market for passenger cars, international brands such as Michelin and Bridgestone have built significant technical barriers relying on their profound technical accumulation and continuous R&D investment. The high-performance rubber formulas they master make their tires significantly superior to domestic products in core indicators such as grip, wear resistance, and quietness; advanced design and manufacturing processes ensure the consistency and stability of product quality, meeting the strict standards of high-end auto brands for OE tires, and they have long occupied about 80% of the high-profit share. In contrast, domestic tire enterprises have weak high-end innovation capabilities, and most products are still concentrated in the mid-to-low-end market for competition, making it difficult to break through the profit bottleneck.

In terms of raw material utilization and cost control, backward technology also puts domestic tire enterprises at a disadvantage. As the main raw materials, the price fluctuations of natural rubber and synthetic rubber have a significant impact on costs. Relying on advanced material technology, international brands can optimize formulas, improve material utilization, and even develop alternative new materials while ensuring performance, effectively alleviating the pressure of rising raw material prices. Restricted by technology, domestic enterprises, on the one hand, are unable to adjust formulas flexibly and have weak buffering capacity against fluctuations in raw material costs; on the other hand, due to relatively backward production processes, the raw material loss rate is relatively high, which further increases production costs and reduces profitability.

3. Risk analysis of China's tire industry

3.1. Macro-level factors

3.1.1. The international trade environment is becoming increasingly severe

China's tire industry is facing increasingly severe challenges from trade barriers and tariffs in the international market, which have a direct impact on the stability of enterprise exports and profitability. In recent years, with the continuous spread of international trade disputes, the number of countries implementing tire-related trade restrictions has expanded from Europe and the United States to more regions.

In the early stage, the economies that imposed restrictive measures on Chinese tires were mainly the European Union and the United States. For example, the European Commission officially launched an anti-dumping and countervailing (AD/CVD) investigation into Chinese-made passenger car and light truck tires in May 2025. The United States has imposed more stringent restrictions, levying a tariff of over 125% on Chinese tires, which is superimposed with the previous AD/CVD duties, essentially blocking the path of direct exports of Chinese tires to the United States.

Although the trade protection measures of the European Union and the United States are individual cases, they have formed a pattern of policy coordination and joint pressure in practice. In recent years, in addition to Europe and the United States, countries such as India, Brazil, the United Kingdom, and Mexico have also introduced various trade restrictions on Chinese tires. For example, Mexico decided to impose long-term anti-dumping and countervailing duties on truck and bus tires imported from China; the United Kingdom also announced a preliminary ruling on AD/CVD measures for Chinese truck and bus tires, intending to increase tariffs on most Chinese exporters. Such global trade blockades have put China's tire exports under unprecedented pressure.

3.1.2. Domestic macroeconomic development

According to data from the National Bureau of Statistics, in 2024, there were 4,482 large-scale enterprises in the national rubber products industry, with a loss rate of 19%, and the total loss of loss-making enterprises increased by 12.5% year-on-year. Among them, there were 386 tire manufacturing enterprises, with a loss ratio of 22%, and the total loss increased by 55.4% significantly. The annual profit of tire manufacturing was 31.168 billion yuan, accounting for 56% of the total profit of the rubber products industry, but it decreased by 2 percentage points compared with 2023.

At present, the domestic economic growth rate has slowed down, and the overall demand is weak. The external environment is complex, and tariff policies and great-power games have brought pressure on exports and employment. Domestically, the economy is in the stage of transforming the driving forces of growth from old to new, and the effective demand is still insufficient, so the economic vitality needs to be enhanced. In the first three quarters of 2024, the retail sales of narrow-sense passenger cars in China increased by a slight 2.2% year-on-year, but the heavy truck market performed weakly, with a year-on-year decline of 32%, which dragged down the demand for all-steel radial tires. In the replacement market, although the number of customer orders has recovered to a certain extent, it is difficult to increase the average transaction price, and the overall sales volume is still not optimistic.

3.1.3. Changes in market demand

The structural transformation of market demand and the evolution of consumer preferences are important risk factors faced by the tire industry.

The domestic passenger car tire market has operated relatively stably, but the heavy truck market has remained weak. In September 2025, the sales volume of heavy trucks decreased by 7% month-on-month. The demand recovery in the replacement market is not obvious, car owners have low willingness to replace tires, and dealers are under great inventory pressure. An industry survey shows that about 67% of dealers believe that the current market "lacks the basis for price increases", mainly due to insufficient demand and fierce competition.

In terms of the international market, the United States, as the largest tire consumer market, is facing the restructuring of its price and supply system due to changes in tariff policies. The cost of Chinese tire enterprises exporting to the United States through Southeast Asia has increased by more than 35%, significantly weakening their price competitiveness. At the same time, affected by the frequent adjustments of the U.S. "reciprocal tariff" policy, problems have occurred in the customs system, leading to a significant increase in the shipping prices of U.S.-bound routes.

In the new product market, new energy vehicles (NEVs) have put forward new requirements for tire performance, such as low rolling resistance and high wear resistance. Although domestic enterprises have launched technologies such as "Liquid Gold Tires", which can reduce rolling resistance by 30%, improve wear resistance by 20%, and increase the driving range of NEVs by 5%-10%, the upgrading of such technologies relies on high R&D investment, which puts forward higher requirements for the capital and technical reserves of enterprises.

3.2. Industry-level factors

3.2.1. Fluctuations in raw material costs and supply risks

Tire manufacturing is highly dependent on raw materials such as natural rubber, synthetic rubber, carbon black, and steel cords. The price fluctuations and supply stability of these raw materials directly affect the production costs and profits of enterprises. Since 2025, the prices of major raw materials have remained at a high-level year-on-year, with significant fluctuations. This phenomenon is driven by multiple factors, including the impact of tense local situations in Southeast Asia on rubber tapping operations, global supply chain instability, and rising shipping costs.

The difficulty in passing cost increases to the end market has continuously eroded corporate profits. Due to weak market demand, especially the sluggish performance of the all-steel tire sector, coupled with fierce industry competition and frequent price wars, enterprises are unable to fully pass on the increase in raw material prices to the downstream, resulting in the widespread dilemma of "revenue growth without corresponding profit increase".

3.2.2. Deterioration of the competitive ecosystem within the industry

China's tire industry is characterized by "leading scale but to-be-enhanced competitiveness". Overcapacity and low-level repetitive competition have led to the continuous intensification of internal competition in the industry.

Against the background of overcapacity, enterprises generally adopt price reduction strategies to survive and compete for market share. The utilization rate of production capacity in some industrial parks is less than 60%, and low-price competition has continuously compressed the industry's profit margin. Irrational competitive behaviors occur frequently, such as the widespread adoption of the credit sales model, which increases the capital pressure on dealers and even leads to their bankruptcy. The accounts receivable cycle of some enterprises is far longer than the manufacturing industry average. The problem of product homogeneity is prominent: most tires have limited differences in performance and technology, and competition is still concentrated at the level of channels and marketing, not yet shifting to a high-level model centered on technology, brand, and services. Although China's tire output ranks first in the world, its share in the high-end passenger car OE market is still less than 10%, and most of the profits are occupied by international brands such as Michelin and Bridgestone. In addition, with the decline in profits, some dealers have resorted to tax-related violations such as not issuing invoices or issuing false invoices to improve profitability, which has further disrupted the market order.

3.2.3. Lagging technological innovation

The relatively insufficient investment in technological R&D and changes in the external policy environment have continuously put pressure on China's tire industry. Although leading enterprises have gradually increased R&D investment, the industry as a whole has not shaken off the tendency of "valuing scale over innovation", resulting in limited progress in the high-end market. The lack of core technologies and brand premium capabilities has led to a significant price gap between domestic tires and international first-tier brands.

In the face of new demands and green barriers, the industry's response is still lagging. Due to their weight and torque characteristics, NEVs have higher requirements for tire wear resistance, grip, and quietness, and the traditional technology system cannot fully meet these requirements. At the same time, the European Union has continuously strengthened environmental protection regulations, such as carbon footprint accounting, requirements on the proportion of recycled materials, and restrictions on toxic substances, forming new green barriers. More than half of China's tire exports are to the European Union, and such standards are reshaping the competition rules and posing severe challenges to enterprises in realizing the full-life-cycle carbon tracking of products.

3.2.4. External challenges

In response to changes in the external environment, China's tire industry is facing profound challenges brought by intelligent and digital transformation. Although a number of leading enterprises such as Qingdao Double Star, Sailun Group, and Guizhou Tire have made substantial breakthroughs in the construction of intelligent production systems and industrial Internet platforms, initially realizing data-driven and flexible management of the manufacturing process, for the large number of small and medium-sized tire enterprises, intelligent transformation still faces significant obstacles. The high initial investment, shortage of professional talents, and complexity of system operation and maintenance have made their digital transformation a difficult process.

At the same time, important changes are taking place in the national energy and climate policies, which clearly shift from the "dual control" (control of both total energy consumption and energy intensity) to the "dual control of total carbon emissions and carbon intensity". This policy evolution means that during the "14th Five-Year Plan" period, tire enterprises not only need to focus on energy conservation and consumption reduction in the traditional sense but also systematically manage carbon emissions in the production process. Enterprises are facing the practical pressure of establishing full-chain carbon data monitoring and adopting low-carbon processes and materials. The tightening of policies has also set a new green threshold for the industry, further increasing the urgency and complexity of transformation.

4. Research conclusions and future trends of China's tire industry

China's tire industry is currently trapped in the dilemma of "revenue growth without corresponding profit increase". The main causes of this situation can be summarized as follows: the significant increase in raw material costs—natural rubber, as a key raw material, accounts for more than 30% of the total production cost, and its price has fluctuated sharply due to factors such as drought in major producing areas in Southeast Asia and the operation of international speculative capital, which has significantly squeezed corporate profits; the increasingly severe international trade situation—many countries and regions such as the European Union, the United States, and Mexico have launched anti-dumping and countervailing investigations against Chinese-made tires and imposed high tariffs. In particular, the European Union, as China's largest export market for semi-steel tires, its anti-dumping measures may force enterprises to adjust their export layout; the existence of structural overcapacity in the domestic market—high homogeneity competition in low-end products, and some manufacturers are forced to sell at reduced prices to maintain market share, further narrowing the profit margin; and the relatively weak overall technical capabilities—although leading enterprises have continuously increased R&D investment, the entire industry has not shaken off the development inertia of "prioritizing scale expansion over innovation breakthroughs", resulting in insufficient penetration in the high-end market and limited improvement in brand added value. In the face of these challenges, tire enterprises should take comprehensive measures to actively respond.

First, Chinese tire enterprises can establish overseas factories to form multinational enterprises, optimize the industrial chain to reduce raw material and labor costs, and avoid international trade barriers and tariff restrictions. The key to the successful establishment of factories lies in site selection, which needs to comprehensively consider four factors: low labor costs, abundant and accessible raw materials such as natural rubber, proximity to the end consumer market, and the host country having signed free trade agreements or low-tariff agreements with Europe and the United States. Countries that meet these conditions are mainly distributed in Southeast Asia, North America, and Africa. For example, Brazil has a high-quality labor force, with lower labor and energy costs than most surrounding countries, lower tax rates, and strong support from trade policies. At present, major domestic tire enterprises such as Sailun, Sentury, Zhongce, and Linglong have all laid out overseas production bases. By promoting the localization of the supply chain, such as purchasing raw materials and parts locally, enterprises can effectively reduce costs and improve the profit margin of tire products. In addition, with the help of overseas bases, enterprises can flexibly allocate orders—if a certain market imposes high tariffs on Chinese tires, enterprises can switch to supply from overseas factories to avoid trade restrictions and respond more accurately to the needs of the local market.

Second, Chinese tire enterprises need to promote industrial technological upgrading, strengthen R&D and innovation, and increase the proportion of mid-to-high-end products. Enterprises should actively respond to national policies such as the Action Plan for Optimizing and Upgrading the Raw Material Industry Led by Standard Improvement (2025—2027), and promote green manufacturing and intelligent transformation. They should accelerate the elimination of backward processes and equipment, introduce advanced technologies such as liquid-phase mixing and low-temperature vulcanization, and adopt modern equipment such as high-energy-efficiency digital vulcanizers and high-precision material conveying systems. For example, they can build a tire industrial Internet platform with the help of artificial intelligence and the Internet of Things technologies to realize unmanned or minimally staffed operation in workshops, and connect the entire chain from upstream suppliers to downstream sales terminals, so as to improve the collaborative efficiency of the entire industrial chain and provide a technical foundation for upgrading. At the same time, they should increase investment in new technology R&D, focus on breaking through the long-standing "devil's triangle" balance problem that restricts the development of the industry, and comprehensively optimize rolling resistance, wet skid resistance, and wear resistance to achieve a significant improvement in the comprehensive performance of products, thereby gaining the ability to compete with international brands in the high-end market.

Third, Chinese tire enterprises should seize the opportunity of the rapid growth of the NEV market and actively expand high-value-added niche markets. Enterprises can share data with NEV manufacturers to obtain real-time information such as tire pressure, temperature, and wear during driving, which can be used to optimize tire formulas and structural designs; aiming at the characteristics of high torque of electric vehicles, they can jointly develop special tires, such as applying semi-hot-melt technology or racing-grade formulas to balance performance under high loads; they can also jointly establish laboratories to focus on R&D in areas such as low-temperature and low-rolling-resistance tires and intelligent tires, and promote the upgrading of the cooperation model from product supporting to technology co-creation. At the same time, by supplying tires for well-known NEV brands, they can enhance their own brand influence and credibility, and highlight the matching advantages between tires and complete vehicles. The two parties can achieve brand win-win through cooperation and accelerate technological iteration and market expansion with the help of each other's user ecosystems.

To sum up, China's tire industry is currently facing multiple pressures such as high export tariffs, internal overcapacity, continuous rise in raw material costs, insufficient technical competitiveness, and limited share in the high-end market, resulting in the dilemma of "revenue growth without corresponding profit increase". To address these challenges, relevant enterprises should establish overseas factories to form multinational enterprises, optimize the supply chain to reduce raw material and labor costs, and avoid international trade barriers and tariff restrictions. At the same time, they should promote the transformation and upgrading of the traditional tire industry, enhance technological R&D capabilities, and expand the market share of mid-to-high-end products. In addition, they need to seize the development opportunity of NEVs and expand high-value-added niche markets. Through these measures, it is expected to realize the sustainable growth of Chinese tire enterprises in domestic and foreign markets and promote the healthy and stable development of the entire industry.

References

[1]. China Rubber Industry Association. (2025). Tire production and sales in China from January to June 2025.China Rubber, 41(08), 62.

[2]. Liu, Z. (2025, September 5). Listed tire enterprises achieve revenue growth without corresponding profit increase in H1.Securities Daily, (B03).

[3]. Xu, W. Y., & Zhang, M. M. (2025). Impact of Sino-US trade frictions on China's rubber industry.China Rubber, 41(07), 10-15+89.

[4]. Zhang, M. M., & Liu, F. (2025). Under the heavy pressure of EU anti-dumping, China's tire foreign trade is in urgent need of a breakthrough.China Rubber, 41(07), 21-24+90.

[5]. Yang, X. Y., & Shan, J. H. (2025). Research on the path of high-quality development of the rubber tire industry empowered by new-quality productive forces.Industrial Innovation Research, (15), 73-75.

[6]. Editorial Department of Rubber Science and Technology. (2025). Linglong Tire plans to invest 8.7 billion yuan to build a factory in Brazil.Rubber Science and Technology,23(07), 372.

[7]. Setsiv, I. S. (2020). Formation of development strategies of transport and logistics companies under current conditions.International Journal of Management, (1), 257-266.

[8]. Borowska, S. M., Kowalski, M., Majewska, A., et al. (2022). Changes in costs incurred by car users of the local transport system due to the implementation of Sunday retail restrictions.Sustainability, 14(20), 1-12.

[9]. Kannan, P. K. (2022). Introduction: Global marketing strategy.International Journal of Research in Marketing, 39(2), 12-16.

Cite this article

Shang,H. (2025). Analysis of investment risks in China's tire industry. Journal of Applied Economics and Policy Studies,18(10),15-23.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. China Rubber Industry Association. (2025). Tire production and sales in China from January to June 2025.China Rubber, 41(08), 62.

[2]. Liu, Z. (2025, September 5). Listed tire enterprises achieve revenue growth without corresponding profit increase in H1.Securities Daily, (B03).

[3]. Xu, W. Y., & Zhang, M. M. (2025). Impact of Sino-US trade frictions on China's rubber industry.China Rubber, 41(07), 10-15+89.

[4]. Zhang, M. M., & Liu, F. (2025). Under the heavy pressure of EU anti-dumping, China's tire foreign trade is in urgent need of a breakthrough.China Rubber, 41(07), 21-24+90.

[5]. Yang, X. Y., & Shan, J. H. (2025). Research on the path of high-quality development of the rubber tire industry empowered by new-quality productive forces.Industrial Innovation Research, (15), 73-75.

[6]. Editorial Department of Rubber Science and Technology. (2025). Linglong Tire plans to invest 8.7 billion yuan to build a factory in Brazil.Rubber Science and Technology,23(07), 372.

[7]. Setsiv, I. S. (2020). Formation of development strategies of transport and logistics companies under current conditions.International Journal of Management, (1), 257-266.

[8]. Borowska, S. M., Kowalski, M., Majewska, A., et al. (2022). Changes in costs incurred by car users of the local transport system due to the implementation of Sunday retail restrictions.Sustainability, 14(20), 1-12.

[9]. Kannan, P. K. (2022). Introduction: Global marketing strategy.International Journal of Research in Marketing, 39(2), 12-16.