1. Introduction

The advent of blockchain and Web3 technologies has ushered in transformative changes across myriad industries, not least within the digital asset sphere. Foremost among these innovations is the rise of Non-Fungible Tokens. These unique digital tokens, tradable on blockchain platforms, have carved a significant niche in sectors such as art, gaming, and other virtual realms.

Historically, auctions have been a mainstay in the art market, a medium for transacting invaluable artworks. However, with NFTs taking center stage, these time-honored auction systems are adapting, now reflecting the distinct attributes and demands of digital assets. Hence, NFT auctions have come to the fore, offering a decentralized, transparent venue for digital collectible exchanges, redefining paradigms of ownership and value transfer. This study delves into the intricacies of NFT auction dynamics, pinpointing pivotal features, inherent challenges, and emergent opportunities of this novel trading method. Central to this inquiry is the exploration of smart contracts, tailored to bolster secure and streamlined auction operations. Through this research, there’s an endeavor to delineate the comparative advantages of NFT auctions vis-à-vis their traditional counterparts, to gauge their reverberations within the art industry, and to critically assess the efficacy, robustness, and scalability of platforms catering to NFT auctions. By dissecting the foundational technology and its tangible ramifications, this work aspires to enrich the current understanding and propel forward the evolution of NFT auction mechanisms.

In essence, this analysis illuminates the burgeoning promise of NFT auctions, offering a lens into their transformative potential within the art sector and beyond. By tackling salient research queries and dissecting real-world applications, this study aims to be a seminal contribution to the ongoing dialogue around blockchain-fueled auction systems and their resonance in the evolving digital landscape.

2. Background and Context

2.1. Blockchain and Web3 Technologies

Blockchain technology is a distributed ledger technology that records and verifies transactions in a decentralized, transparent and immutable manner. Since the Bitcoin cryptocurrency was created in 2008, the blockchain as a public distributed ledger for its transactions has gradually come into the public eye. But with the emergence of other cryptocurrencies such as Litecoin, Namecoin and Ethereum, blockchain is no longer exclusive to Bitcoin. The basic unit of the blockchain is the block, which grows as transactions are added and is linked and secured through cryptography [1]. Because the blockchain is a distributed computing system with high Byzantine fault tolerance, this provides conditions for the achievement of decentralized consensus [2].

As the research on blockchain continues to deepen, its technology can already be integrated into many fields. Its main purpose is still as a distributed ledger of cryptocurrency. On this basis, smart contracts have emerged to automate transactions, which also promotes the deepening of blockchain technology into financial services. At the same time, blockchain is also used in other fields such as games, supply chains, domain names, etc. The prosperous development and application of the blockchain make it possible to realize a decentralized and user-led Internet ecosystem, and the concept of Web3 came into being.

Web3 integrates concepts such as decentralization, blockchain technology and token-based economics, and is a new type of Internet ecosystem [3]. It achieves a more open, transparent and user-centered online environment by integrating blockchain technology with other decentralized technologies such as peer-to-peer networks and smart contracts [4]. Web3 emphasizes users’ control over data privacy, digital identity and online interactions, and encourages users to participate in interactions with decentralized applications (DApps) and smart contracts.

In Web3, the application range of blockchain technology is very wide. For example, through blockchain and smart contracts, decentralized financial services, digital asset trading platforms, supply chain management systems, identity verification and digital identity solutions, etc. can be built. In addition, NFT (non-fungible token), as part of Web3, uses blockchain technology to achieve the uniqueness and true ownership verification of digital assets.

2.2. The Rise of Non-Fungible Tokens

Non-Fungible Tokens have emerged as a unique form of digital asset that has gained.

widespread popularity and attention in recent years. Built on blockchain technology, an NFT is a data file that can be sold and traded [5]. NFTs as digital currency Unlike cryptocurrencies, NFTs are indivisible and represent unique items or digital assets.

The concept of NFTs revolves around the idea of tokenizing digital assets, such as artwork, music, videos, virtual real estate, and more [6]. By tokenizing these assets, they can be bought, sold, and traded on various blockchain platforms. Each NFT is assigned a unique identifier, typically stored as a digital token on the blockchain, which serves as a digital certificate of ownership and authenticity.

One of the key features of NFTs is their ability to establish provenance and scarcity. The blockchain records the entire transaction history of an NFTs, from its creation to subsequent transfers, providing an immutable and transparent record of ownership. It is this characteristic that provides the conditions for NFTs auctions.

2.3. Traditional Auctions and NFT Auctions

Traditional auctions have long been a popular method for buying and selling various goods and assets. Auctions provide a dynamic marketplace where participants can competitively bid on items, with the highest bidder winning the item at the end of the auction.

While traditional auctions have proven effective, they also have certain limitations. Physical auctions require participants to be physically present at a specific location, which may limit participation by potential bidders. Additionally, the process can be time-consuming, especially for large auctions with a large number of items. These limitations have led to the exploration of alternative auction formats, including online auctions and electronic bidding systems.

NFT auction is to use smart contracts on the blockchain platform to implement traditional auctions in the context of non-fungible coins (NFT). By leveraging the advantages of blockchain technology to create a decentralized and secure auction environment, participants can bid for NFT in a transparent and efficient manner [7]. This digital approach to traditional auctions has the potential to overcome the limitations of physical auctions, provide wider participation opportunities for participants, and expand the possibilities for NFT trading and ownership.

3. Key Features

3.1. Decentralization in NFT Auctions

3.1.1. Ownership and Control. Decentralization ensures that the ownership and control of NFTs belong to individual users, rather than centralized in the hands of a central authority [8]. Through NFT, artists and creators can directly create and sell their digital assets without relying on intermediaries.

3.1.2. Peer-to-Peer Trade. The decentralized NFT auction platform facilitates peer-to-peer transactions, allowing buyers and sellers to interact directly without intermediaries. By eliminating intermediaries, decentralization reduces transaction costs and increases transparency.

3.1.3. Trust and Authenticity. Decentralized NFT auctions solve the issues of trust and authenticity. By leveraging blockchain technology, NFTs can be uniquely identified and verified to ensure their authenticity and origin. Buyers can have confidence in the ownership and scarcity of the NFT they purchase.

3.1.4. Governance and Consensus. Some decentralized NFT auction platforms incorporate governance mechanisms that allow participants to have a say in the platform’s rules and decision-making process. These platforms often employ decentralized governance models such as token-based voting to ensure community participation and collective decision-making.

3.1.5. Interoperability. A decentralized NFT auction platform can facilitate interoperability by allowing NFTs from different blockchains to be bought, sold and traded. This enables users to access a wider range of NFTs and participate in cross-chain interactions.

3.2. The Role of Smart Contracts

The NFT auction studied in this paper is itself a smart contract. A smart contract is essentially a computer program or transaction agreement whose main function is to automatically execute, control or record events according to the terms of the contract or agreement [9, 10]. Smart contracts are self-verifying, self-executing, and tamper-proof, enabling code execution without a third party. In current blockchain technology, there are many blockchain platforms that support smart contracts, among which Ethereum is the most well-known. Contract creators can write smart contracts using the solidity language and deploy them on Ethereum. After the contract passes testing and verification, users on the blockchain can interact with the contract by sending transactions. The composition and functions of smart contracts enable them to play many important roles in the blockchain:

Smart contracts are able to automatically enforce the terms and conditions set in the contract. Once the pre-set conditions of the contract are met, the contract will automatically trigger the relevant operations without third-party intervention or trust.

The execution of smart contracts is distributed across multiple nodes in the blockchain network, rather than centralized in a single centralized institution [11]. This means that the execution of smart contracts is decentralized without a single point of control, increasing the security and reliability of the system.

Smart contracts can store data and manage state on the blockchain. The data in the contract is stored in the blocks of the blockchain, permanently stored and accessible to all participants. Contracts can also maintain and modify their own state, and these state changes are also recorded on the blockchain.

The execution of smart contracts needs to be verified by the consensus algorithm of the blockchain. Validation nodes in the blockchain network verify the legitimacy of transactions and contracts and ensure that they comply with pre-set rules and constraints.

Smart contracts are one of the core components for building decentralized applications (DApps). Through smart contracts, developers can implement various functions such as asset trading, voting, crowdfunding, digital identity verification, etc., thereby building applications with automated and programmable functions.

Smart contracts solve the trust problem in traditional contracts by providing higher trust and reliability. Since the execution of smart contracts is open, transparent and tamper-proof, participants can safely rely on the execution results of the contract without relying on the trust of an intermediary or third party.

Web3 technology provides support for the development of decentralized applications, and smart contracts are a key element in building decentralized applications. Smart contracts are the core components of Web3 technology. They jointly promote the development of decentralized applications and provide users with a more open, transparent and trusted Internet experience [12]. Smart contracts realize the core functions of decentralized applications and services by automatically executing code logic on the blockchain.

3.3. Ensuring Transaction Transparency

In the NFT auction contract, the smart contract acts as an intermediary and executor, ensuring the transparency and fairness of the transaction. The following key aspects can be used to ensure the transparency of transactions through smart contracts:

Traceability of Transaction Records: Smart contracts record the details and results of each auction transaction on the blockchain, forming a non-tamperable transaction history. This means that anyone can view and verify the details of the auction, including the start and end events of the auction, the description and metadata of the items being auctioned. This traceability ensures the transparency of transactions and eliminates the possibility of misconduct and fraud.

Public Auction Rules and Conditions: The NFT auction contract clarifies the rules and conditions of public auction, including the start and end events of the auction, the way of bidding, the qualification requirements of bidders, etc. These rules and conditions are programmed in the form of smart contracts and executed automatically during contract execution.

Automated bidding and auction process: Through the smart contract NFT auction, the automated bidding and auction process is realized, and the possibility of human intervention and manipulation is eliminated. The contract can set the rules of increasing bids, auction deadline and automatically determine the highest bidder and other functions to ensure the transparency and fairness of the auction process. Participants can track the auction progress in real time on the blockchain and verify each bid and auction result.

Decentralized verification and settlement: The execution of the NFT auction contract depends on the verification and confirmation of multiple nodes in the blockchain network. This decentralized verification mechanism increases the transparency and security of the transaction, because no single centralized institution can manipulate or change the transaction results. Once the auction ends, the smart contract will automatically perform the settlement process, transfer the NFT to the highest bidder, and ensure the safe transfer of the transaction funds.

The NFT auction contract ensures the transparency of the transaction, so that the auction process and results are visible and verifiable to all participants. This transparency increases the trust of the transaction and provides a solid foundation for the future development of the NFT trading market.

4. Implementation Details

4.1. Pre-requisites and Setup

In order to successfully deploy and test the NFT auction contract, this paper uses the Solidity language to write the contract code in the Remix IDE, and deploys the test in the virtual Ethereum environment. Since the virtual Ethereum environment does not provide ready-made NFT use cases, in order to ensure the integrity of the test, it is necessary to design a smart contract to create NFT use cases in advance to create test cases.

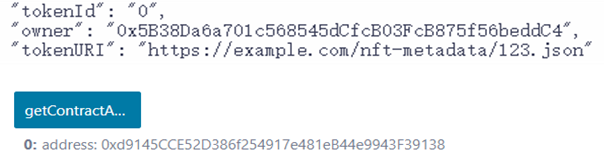

Figure 1. NFT Information (Photo/Picture credit: Original).

Figure 1 is the information about the created NFT use cases obtained from the Remix terminal. where ‘tokenId’ identifies the ID of the NFT in the contract, because it was first created here as ‘0’. The address of the holder of the NFT is stored in ‘owner’, where the first holder designated by contract is ‘0x5B38Da6a701c568545dCfcB03FcB875f56beddC4’. According to the Opensea metadata standard, ‘tokenURI’ stores an HTTP or IPFS URL, and this URL will return a JSON blob data containing the NFT metadata when it is queried. In order to successfully determine the NFT for auction, it is also necessary to obtain the address of the contract in which the NFT is located. Through the getContractAddress () method written in the contract, the contract address can be obtained as ‘0x9145CCE52D386f254917e481eB44e9943F39138’.

“tokenID” specifies the unique identifier of the NFT used for testing, and is used in the auction to mark the NFT being auctioned. And can get the owner’s address. However, it should be noted that the so-called unique identification only refers to NFT issued in the same contract, and their Token IDs are unique. NFT issued by different contracts are likely to have the same Token ID. Therefore, the real unique identifier of an NFT is actually the contract address + Token ID.

4.2. Smart Contract Architecture

The main structure of the NFT auction contract deployed in this paper includes the following parts:

Defines the interface ‘IERC721’ for token interaction.

The constructor function is used to determine the parameters that need to be entered to deploy the smart contract.

The start ( ) function is used to open the auction, binds the start event, and only the seller can call

The bid ( ) function is used to bid for NFT, and the bid price is the value set by the bidder when participating in the auction contract. Binding the Bid event, only the bidder can call it after the auction starts and does not end.

The withdraw () function allows bidders to retrieve the funds they previously used to bid from the auction contract when their bids are exceeded.

The end ( ) function is used to end the auction, which is only called by the seller when the time condition permits. When the function is invoked, the highest bidder will get the ownership of the auction NFT, and the seller will get the highest bid corresponding money from the auction contract.

Related pseudo-code:

Function start ():

1. Require the auction is open and the seller is the owner of the NFT.

2. Transfer ownership of the NFT to the auction smart contract.

3. Set the end time of the auction according to unix timestamp.

Function bid () payable:

1. Require the auction started and not end, and the value is greater than the highestBid.

2. Store the last highest bidder’s bid in the map for subsequent retrieval.

3. Set the current highest bidder and bid.

Function withdraw ():

Get back the ETH paid by the bidder from the auction contract.

2. Set the value of the bidder mapping to 0.

Function end ():

Require the auction started and not end.

If HighestBidder! = address(0)

3. NFT transfer to the highest bidder.

4. Seller get the highest.

5. else

6. The seller gets back the NFT.

4.3. Testing and Results

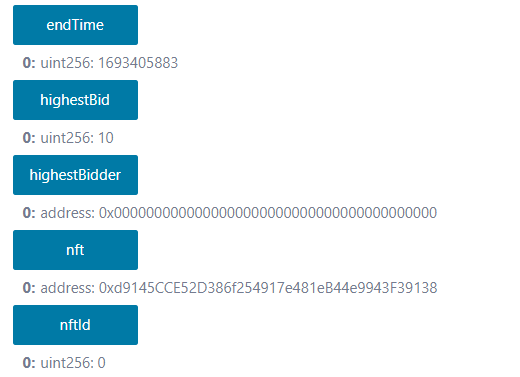

Start the auction: Auction started by seller, the owner of NFT change from Seller to Auction Contract, the highestBid will be set as startingPrice, the highestBidder’s address is 0x0000000000000000000000000000000000000000, and can check the end time and information about the NFT. As shown in Figure 2.

Figure 2. Start auction (Photo/Picture credit: Original).

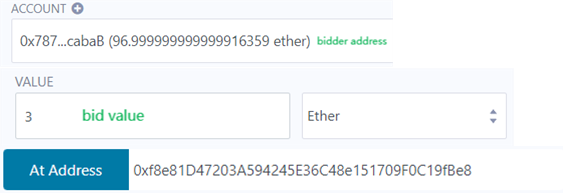

Join the auction: Bidder can set the value he want to bid and join the contract And click the “bid” button to bid and the highestBid and highestBidder will change. The last highestBid will be storage in the map. As shown in Figure 3.

Figure 3. Join auction (Photo/Picture credit: Original).

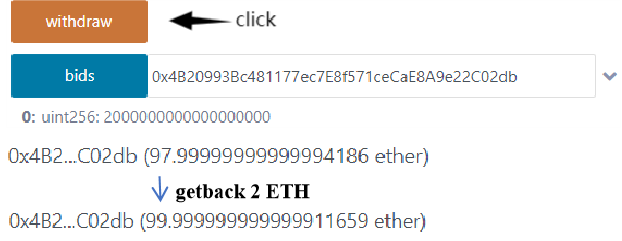

Withdraw money: Non-highest Bidder can check the value they use to bid before in bids and withdraw their money. As shown in Figure 4.

Figure 4. Withdraw money (Photo/Picture credit: Original).

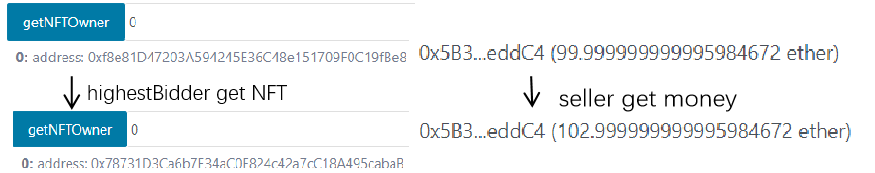

End the auction: Seller can end the auction when the time up. The highestBidder will get the ownership of the NFT from the auction contract. The seller will get the highestBid from the auction contract. As shown in Figure 5.

Figure 5. Final result (Photo/Picture credit: Original).

5. Analysis

5.1. Security Considerations

Reentrancy Attack: The withdraw and end functions in this contract involve the transfer of funds and the call of external contracts, which may have the possibility of re-entry attacks. According to static analysis, there are no obvious reentrancy attack vulnerabilities, but to ensure the security of the contract, more comprehensive and in-depth auditing and testing are required, including dynamic testing and assessment of attack vectors [13].

Timestamp Dependence: The contract uses block.timestamp to determine when the auction ends. This could lead to an attacker changing the behavior of the contract by manipulating the timestamp of the block. There may be inaccuracies in using the block.number method to determine time, but this can be improved by using an external trusted time source or adding timestamp verification.

Unauthorized Access: Some functions in the contract do not have appropriate access control modifiers. Although some require functions exist, any of them may cause unauthorized users to access sensitive functions or modify the contract state. OnlySeller and OnlyBidder modifiers can be created for access control.

The above is the security analysis of the relevant parts of the contract code. In addition, some security issues need to be considered from the NFT auction itself. In addition to code security, NFT auction also involves security considerations such as the credibility of contract deployment, secure asset exchange, transparent auction process, prevention of fraud and malicious behavior, secure fund management, and user interaction security. By comprehensively considering these aspects and taking corresponding security measures, the security and credibility of NFT auction can be improved [14].

5.2. Assessing Scalability

This paper provides a simple NFT auction smart contract sample, which mainly realizes the basic auction function. On this basis, there are many extensible aspects of the contract in the future to make the NFT auction more efficient and perfect.

First, the smart contract can extend its functions by adding more functions and modules. For example, you can add an auction timer to limit the validity of each bid, or introduce a mechanism to automatically extend the auction time to prevent last-minute bidding wars. In addition, a multi-round auction function can be introduced to allow new rounds of auctions to continue after the end of the auction, thereby providing more flexibility and opportunities.

Secondly, the smart contract can support multiple types of NFT auctions. The current implementation assumes that only a single NFT is auctioned, but can be extended to support batch auctions or auctions of the entire collection. Through appropriate modifications and extensions, the contract can handle multiple NFT auctions and provide different types of auctions, such as fixed-price auctions, highest bid auctions, or sealed-bid auctions.

In addition, the smart contract can support more participant roles and permissions. The current implementation assumes that there is only one seller and multiple bidders, but other roles, such as arbitrator or auction administrator, can be considered. These roles can play different roles in the auction process, such as handling disputes, ensuring fairness and transparency of the auction, or performing special operations (such as revoking the auction, suspending the auction, etc.).

These scalable aspects show that there is still a lot of room for future NFT auctions, which also provides greater flexibility and adaptability for future NFT auctions to meet changing needs and innovations.

6. Challenges and Limitations

Although NFT auction smart contracts have shown great potential and innovation in the current market, they may still face some limitations and challenges in the future.

First of all, as the NFT market grows and the number of users increases, dealing with large-scale auction activities and high concurrent transactions can lead to performance issues such as delays and congestion in contracts. Therefore, the design and implementation of contracts need to consider efficient data structures and algorithms to ensure scalability in the face of growing user needs.

Secondly, the user experience and availability of NFT auction smart contracts is an important consideration. Although blockchain technology provides advantages for decentralization and non-tamperable transactions, the current user interface and interaction methods are still relatively complex and lack ease of use and affinity. In order to promote wider adoption, smart contracts need to improve the user interface, provide friendly interaction, and address issues related to blockchain interaction, such as transaction speed and handling fees.

At the same time, NFT auction involves the transaction of digital content and artwork, which may raise legal and intellectual property issues [15]. For example, issues such as copyright disputes, piracy and infringement may have a negative impact on NFT auctions. Smart contracts need to consider these legal and intellectual property issues and cooperate with relevant legal experts and rights protection agencies to ensure the legitimacy and compliance of auction activities.

7. Conclusion

This paper delves into the intricacies of NFT auction smart contracts, starting with a comprehensive backdrop on blockchain and web3 technologies and an exploration into the pivotal role of non-fungible tokens within the digital asset landscape. A juxtaposition of classical auctions with their NFT counterparts underscores the distinct attributes and benefits inherent to the latter’s smart contracts. Central to the allure of NFT auction smart contracts are its pillars of decentralization, the elegance of smart contracts, and an unerring transparency in transactions. This positions them as a beacon for orchestrating transparent and impenetrable auctions in the digital domain. The discussion on implementation offers a window into the foundational groundwork, architectural nuances of the contract, and empirical results—affirming their practicability and operational finesse.

Security, the lifeblood of blockchain-centric endeavors, takes center stage, emphasizing the cardinal need to craft and rigorously assess NFT auction smart contracts. This ensures they stand resilient against latent vulnerabilities, safeguarding participant assets and transactional sanctity. As NFTs surge in ubiquity, scalability emerges as a formidable challenge, necessitating innovative solutions that accommodate burgeoning participants and transactions.

Yet, the journey of NFT auction smart contracts isn’t without its hurdles. Striking a balance between safeguarding user confidentiality and adhering to regulatory edicts, elevating user interaction dynamics, navigating the maze of legal and intellectual property quandaries, and staying abreast of technological flux are paramount. To encapsulate, the advent of NFT auction smart contracts marks a transformative epoch in digital asset trading, championing a decentralized, lucid, and adept mechanism for auctioneering. To harness their zenith of potential, it’s imperative to surmount the challenges spotlighted in this discourse. By relentlessly refining security protocols, scalability paradigms, user-centric design, and regulatory adherence, NFT auction smart contracts stand poised to solidify their stature in the digital assets arena.

References

[1]. Narayanan, A., Bonneau, J., Felten, E., Miller, A., & Goldfeder, S. (2016). Bitcoin and cryptocurrency technologies: A comprehensive introduction. Princeton University Press.

[2]. Iansiti, M., & Lakhani, K. R. (2017). The truth about blockchain. Harvard Business Review, 95(1), 118-127.

[3]. Fenwick, M., & Jurcys, P. (2022). The contested meaning of Web3 and why it matters for (IP) lawyers. SSRN Electronic Journal. https://doi.org/xxxx (Assuming there’s a DOI).

[4]. Wang, Q., Li, R., Wang, Q., Chen, S., Ryan, M., & Hardjono, T. (2022). Exploring web3 from the view of blockchain. arXiv preprint. https://arxiv.org/abs/2206.08821.

[5]. Wilson, K. B., Karg, A., & Ghaderi, H. (2022). Prospecting non-fungible tokens in the digital economy: Stakeholders and ecosystem, risk and opportunity. Business Horizons, 65(5), 657-670.

[6]. Belk, R., Humayun, M., & Brouard, M. (2022). Money, possessions, and ownership in the Metaverse: NFTs, cryptocurrencies, Web3 and wild markets. Journal of Business Research, 153, 198-205.

[7]. Milionis, J., Hirsch, D., Arditi, A., & Garimidi, P. (2022, November). A framework for single-item NFT auction mechanism design. In Proceedings of the 2022 ACM CCS Workshop on Decentralized Finance and Security (pp. 31-38).

[8]. Murray, M. D. (2022). NFT ownership and copyrights. Ind. L. Rev., 56, 367.

[9]. Röscheisen, M., Baldonado, M., Chang, K., Gravano, L., Ketchpel, S., & Paepcke, A. (1998). The Stanford InfoBus and its service layers: Augmenting the Internet with higher-level information management protocols. Springer Berlin Heidelberg.

[10]. Savelyev, A. (2017). Contract law 2.0: ‘Smart’ contracts as the beginning of the end of classic contract law. Information & Communications Technology Law, 26(2), 116-134.

[11]. Alabdulwahhab, F. A. (2018, April). Web 3.0: The decentralized web blockchain networks and protocol innovation. In 2018 1st International Conference on Computer Applications & Information Security (ICCAIS) (pp. 1-4). IEEE.

[12]. Sheridan, D., Harris, J., Wear, F., Cowell Jr, J., Wong, E., & Yazdinejad, A. (2022). Web3 challenges and opportunities for the market. arXiv preprint. https://arxiv.org/abs/2209.02446

[13]. Samreen, N. F., & Alalfi, M. H. (2020, February). Reentrancy vulnerability identification in ethereum smart contracts. In 2020 IEEE International Workshop on Blockchain Oriented Software Engineering (IWBOSE) (pp. 22-29). IEEE.

[14]. Rouhani, S., & Deters, R. (2019). Security, performance, and applications of smart contracts: A systematic survey. IEEE Access, 7, 50759-50779.

[15]. Valeonti, F., Bikakis, A., Terras, M., Speed, C., Hudson-Smith, A., & Chalkias, K. (2021). Crypto collectibles, museum funding, and OpenGLAM: Challenges, opportunities and the potential of Non-Fungible Tokens (NFTs). Applied Sciences, 11(21), 9931.

Cite this article

Xiao,B. (2024). NFT auction: Implementing smart contracts for decentralized transactions. Applied and Computational Engineering,53,9-18.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Signal Processing and Machine Learning

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Narayanan, A., Bonneau, J., Felten, E., Miller, A., & Goldfeder, S. (2016). Bitcoin and cryptocurrency technologies: A comprehensive introduction. Princeton University Press.

[2]. Iansiti, M., & Lakhani, K. R. (2017). The truth about blockchain. Harvard Business Review, 95(1), 118-127.

[3]. Fenwick, M., & Jurcys, P. (2022). The contested meaning of Web3 and why it matters for (IP) lawyers. SSRN Electronic Journal. https://doi.org/xxxx (Assuming there’s a DOI).

[4]. Wang, Q., Li, R., Wang, Q., Chen, S., Ryan, M., & Hardjono, T. (2022). Exploring web3 from the view of blockchain. arXiv preprint. https://arxiv.org/abs/2206.08821.

[5]. Wilson, K. B., Karg, A., & Ghaderi, H. (2022). Prospecting non-fungible tokens in the digital economy: Stakeholders and ecosystem, risk and opportunity. Business Horizons, 65(5), 657-670.

[6]. Belk, R., Humayun, M., & Brouard, M. (2022). Money, possessions, and ownership in the Metaverse: NFTs, cryptocurrencies, Web3 and wild markets. Journal of Business Research, 153, 198-205.

[7]. Milionis, J., Hirsch, D., Arditi, A., & Garimidi, P. (2022, November). A framework for single-item NFT auction mechanism design. In Proceedings of the 2022 ACM CCS Workshop on Decentralized Finance and Security (pp. 31-38).

[8]. Murray, M. D. (2022). NFT ownership and copyrights. Ind. L. Rev., 56, 367.

[9]. Röscheisen, M., Baldonado, M., Chang, K., Gravano, L., Ketchpel, S., & Paepcke, A. (1998). The Stanford InfoBus and its service layers: Augmenting the Internet with higher-level information management protocols. Springer Berlin Heidelberg.

[10]. Savelyev, A. (2017). Contract law 2.0: ‘Smart’ contracts as the beginning of the end of classic contract law. Information & Communications Technology Law, 26(2), 116-134.

[11]. Alabdulwahhab, F. A. (2018, April). Web 3.0: The decentralized web blockchain networks and protocol innovation. In 2018 1st International Conference on Computer Applications & Information Security (ICCAIS) (pp. 1-4). IEEE.

[12]. Sheridan, D., Harris, J., Wear, F., Cowell Jr, J., Wong, E., & Yazdinejad, A. (2022). Web3 challenges and opportunities for the market. arXiv preprint. https://arxiv.org/abs/2209.02446

[13]. Samreen, N. F., & Alalfi, M. H. (2020, February). Reentrancy vulnerability identification in ethereum smart contracts. In 2020 IEEE International Workshop on Blockchain Oriented Software Engineering (IWBOSE) (pp. 22-29). IEEE.

[14]. Rouhani, S., & Deters, R. (2019). Security, performance, and applications of smart contracts: A systematic survey. IEEE Access, 7, 50759-50779.

[15]. Valeonti, F., Bikakis, A., Terras, M., Speed, C., Hudson-Smith, A., & Chalkias, K. (2021). Crypto collectibles, museum funding, and OpenGLAM: Challenges, opportunities and the potential of Non-Fungible Tokens (NFTs). Applied Sciences, 11(21), 9931.