Artificial Intelligence (AI), Financial Industry, Investment Consulting, Generative AI, Robo-Advisors.

1. Introduction

In today's financial landscape, intelligent investment advisers have emerged as a compelling solution for individuals seeking low-cost, automated investment opportunities. Within minutes, these robo-advisers can assist clients in constructing personalized, multi-allocation asset portfolios, granting access to investments previously exclusive to high net worth individuals.[1]The allure of these intelligent investment advisory products lies in their ability to cater to a wide range of needs while maintaining cost-effectiveness, leading to sustained high growth in the sector.A.T. Kearney, a renowned consulting firm, forecasts a remarkable 68% growth rate in assets managed by smart investment advisers over the next five years, potentially reaching trillion-dollar levels. Spearheading this trend is Betterment, the pioneer of intelligent investment advisors, boasting over $7 billion in assets under management. Notably, Betterment stands as the foremost and largest intellectual investment platform, managing in excess of $5 billion in assets.

Schwab Intelligent Portfolios, which predominantly invests in ETFs, imposes no annual fees but mandates an initial investment of at least $5,000. Wealthfront, with a minimum investment threshold of $500, offers fee-free management for the initial $10,000, with a key emphasis on tax optimization. Therefore, this paper aims to explore the application of financial robo-advisors based on generative artificial intelligence as investment advisors. By reviewing the current state of the global and domestic market for intelligent investment advisors, as well as introducing its characteristics and key players, this article aims to show the potential and prospects of this field [2]. At the same time, the paper also points out the challenges and problems faced by intelligent investment advisers, and discusses the solutions to these problems. By looking at the current state of development and prospects of intelligent investment advisors, this article aims to provide readers with a comprehensive understanding and insight into this emerging field.

2. Related work

2.1. The principle of Robo-Advisor

It is in this context that Robo-Advisors were born in the United States. The English name of the Robo-Advisor is robo-advisor, which should be called robo-advisor from the literal translation. According to Betterment and Wealthfront, smart advisors are based entirely on Modern Portfolio Theory (MPT), which combines an investor's financial situation, risk appetite, financial goals, and more. The data model and background algorithm built by cloud computing, big data, machine learning and other technologies are used to provide investors with relevant asset allocation suggestions [3-4]. Therefore, it can be seen that intelligent investment adviser takes the automation of wealth service process described above as its service model, modern portfolio theory as its algorithm basis, and artificial intelligence as its development goal. This paper and model can be said to be the cornerstone of the modern portfolio theory system, and Markowitz is therefore regarded as the founding father of modern finance.

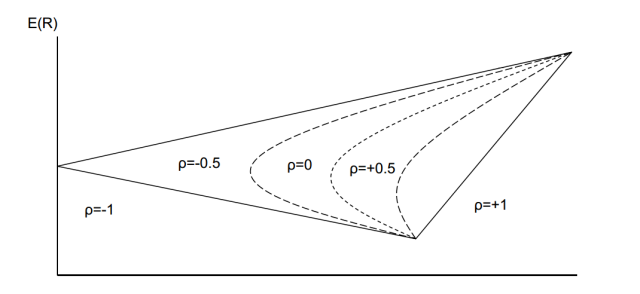

The core assumptions of the mean-variance model (Figure 1) include:

1) Investors are risk averse;

2) All investors strive to achieve maximum returns at a given level of risk;

3) There are two parameters that affect investors' decision, expected rate of return and variance.

Based on these assumptions, the model discusses and deduces in detail how to maximize the expected rate of return of the portfolio under the given risk level, or how to minimize the risk under the given expected rate of return. The core conclusion is that investors can reduce the non-systemic risk while maintaining the expected rate of return of the portfolio by constructing a portfolio with a small or even negative correlation coefficient. [5] Or in a portfolio, when the standard deviation of each security and the correlation coefficient of each two assets are fixed, the only way to reduce the risk of the portfolio is to include another asset and increase the size of the portfolio.

Figure 1. Intelligent investment "mean-variance" model

In the model, within the triangle, the correlation between the two assets is different, and the combination may appear in different locations.

2.2. Robo-Advisor and Machine Learning

The combination of artificial intelligence technology and Robo-Advisors has developed rapidly in recent years, which is mainly reflected in two aspects.

First, quantitative investment in technology. Current quantitative investment techniques rely primarily on financial models to select strategies and maximize returns, essentially making predictions. Big data-based machine learning technologies excel in this area.[6] For example, Q-Learning-based reinforcement learning combined with dynamic programming algorithms and graph-based optimal path selection planning are cutting-edge technologies in this field. Traditional financial models are mostly based on a single investment cycle, and while there are ways to solve multi-period problems, machine learning models inherently have the advantage of modeling multi-period data. It is foreseeable that breakthroughs will be made in this regard in the near future. Second, the user experience. Imagine an Robo-Advisory platform running a virtual robot for each client, handling wealth management and investment-related issues for the client. [7] This will involve many points of interaction with customers, and AI technology can solve these problems more efficiently, providing users with a better and more convenient service experience. For example, speech recognition technology, image recognition technology, and financial news recommendation technology can play an important role in this regard.

2.3. The analytical method used by Robo-Advisers

In the academic world, while there are reservations about the practical application of Robo-Advisers in regions such as China, from the perspective of big data and machine learning, it is possible to delve into strategies on how to deliver intelligent portfolios. This kind of topic is likely to receive attention for some time to come, and various strategy models will emerge.In the field of Robo-Advisers, there are many definitions of classic asset return rate, such as continuous compound return rate and portfolio return rate. For example, p is an asset portfolio, and if its weight on asset i is Wi, then the simple portfolio return of pat time t is:

\( {R_{p,t}}=\sum _{i=1}^{N}wi{R_{it}} \) (1)

Portfolio return rate should be one of the most basic analysis indicators, which can be analyzed in combination with time series data. Quantmod software package in R language can be used to run getSymbols to view financial time series data (for example, to view the time series of Shanghai Stock Exchange index, run getSymbols("^SSEC")) [8-10]. Specifically, the mean-variance method calculates the average return and variance of each factor, and then combines the objectives and risk appetite of the portfolio to determine the weight ratio of each factor in the portfolio. Typically, factors with a higher average return and lower risk will be given a higher weight to achieve a risk-optimized portfolio. By means of cluster analysis and mean variance method, the weight ratio of different factors in the portfolio can be reasonably allocated, so as to improve the benefit and stability of the portfolio.

3. Methodology

As an ensemble learning algorithm, random forest has a wide application prospect in the field of quantitative investment. First of all, we observed that our investment strategy achieved a higher return rate during the experiment period. The enhanced return rate of the CSI 500 index reached 75%, exceeding the index return rate of 45% during the same period. In quantitative investing, random forests can be applied in many ways. First, it can be used to predict stock price movements, using historical market data to build models that help investors capture stock price trends. Second, random forest can be used in stock selection strategies to analyze the fundamental and technical indicators of stocks and help investors pick individual stocks with potential growth room.

3.1. Method model

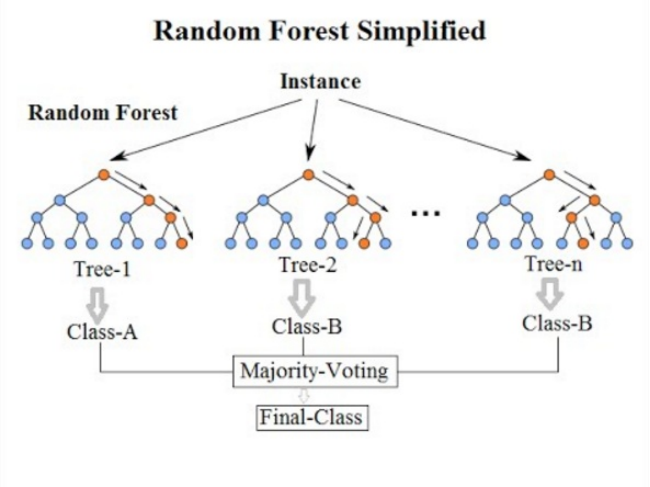

Random forest is an Ensemble Learning algorithm, which belongs to the Bagging type. By combining multiple weak learners (decision trees) and voting or averaging the results of the weak learners, the final result of the overall model is obtained, so that the results of the overall model have high accuracy and generalization performance. It can achieve good results, mainly thanks to "random" and "forest", one makes it have the ability to resist overfitting, one makes it more accurate.

Figure 2. Stochastic forest integration model

A random forest is an integration of multiple decision trees. So understanding random forests starts with understanding decision trees. In daily life, our cognition of things is based on the judgment and classification of features, such as judging mammals by viviparous or not, and selecting male and female crabs according to the navel tip circle. Decision tree is based on this idea to make classification decisions based on multiple features. At each node of the tree, leaf nodes of the next layer are split according to certain rules, and the final leaf node is the final classification result. The key of decision tree learning is to select the optimal partition attribute. With the division layer by layer, the sample categories contained in the branch nodes of the decision tree will gradually converge to get the final classification.

3.2. Experimental design

In the process of building a quantitative investment strategy, we follow the steps in the Quantitative Investment Strategy: Multi-factor to Artificial Intelligence data. First, we chose the RandomForestClassifier algorithm as the basis for the machine learning model because random forests perform well when dealing with classification problems and have advantages in dealing with high-dimensional data and large-scale datasets. We chose the strategy of monthly exchange, and adopted the method of rolling back test to ensure that the model learned the changes of market characteristics in time, and took into account the computational efficiency. [11] At the end of each month, we can get the predicted value of the probability of all stocks rising in the next period, and evaluate and adjust the model according to the accuracy rate, AUC and other indicators as well as the results of the strategy backtest, so as to optimize the effect and return rate of the investment strategy.

3.3. Data set and results

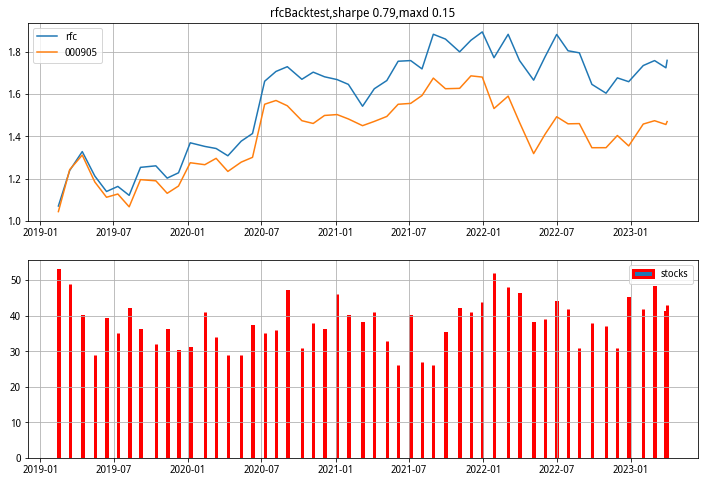

We used data sets from January 1, 2019 to April 1, 2023 for model building and testing in our experiments. At the end of each month, we rebuild the model once and test it the following month to evaluate the model's predictive performance.

Figure 3. Curve of test results

For the enhanced return of the CSI 500 index, we observe the following results: During the experiment period, the enhanced return of the CSI 500 index was 75%, while the index return of the same period was 45%. As a result, our investment strategy achieved an excess return of 30%. In our experiment, the investment strategy had a sharpe ratio of 0.79, which indicates that our strategy achieved a higher return for unit risk. In the experiment, we observed that the maximum retracement of the investment strategy was 15%, which means that the investor could experience a loss of up to 15% at some time.. However, we also need to pay attention to the risk level of the strategy to ensure the robustness and sustainability of the portfolio.

3.4. Experimental result

In this experiment, we have obtained a series of remarkable experimental results by constructing a random forest model and applying it to the design and implementation of quantitative investment strategy. First of all, we observed that our investment strategy achieved a higher return rate during the experiment period, and the enhanced return rate of the CSI 500 index reached 75%, exceeding the index return rate of 45% during the same period. This shows that our quantitative investment strategy can effectively capture the rising trend of the market to a certain extent, and create rich returns for investors. This result highlights the benefits of our quantitative investment strategy in risk management, providing investors with a more robust and sustainable portfolio.

In the experiment, we observed that the maximum retracement of the investment strategy was 15%, which indicates that investors may experience some degree of loss during certain periods. Nevertheless, through reasonable risk management and strategic adjustments, we have been able to maintain the robustness and sustainability of our portfolio. In summary, this experiment demonstrates the strong application potential of random forest in the field of quantitative investment, and by using machine learning algorithms to optimize investment decisions, we are able to achieve more intelligent and efficient investments and bring robust and sustainable investment returns to investors.

4. Conclusion

The regulatory environment for smart advisers is still unclear, but there are still indications from existing laws and regulations. For intellectual investment platforms that have already made achievements in this field or are preparing to enter this industry, compliance risks cannot be taken lightly, and it is recommended to obtain professional advice before implementing relevant businesses. This paper has delved into the realm of intelligent investment advisors, focusing particularly on Generative AI-based Financial Robot Advisors, known as Robo-Advisors. With forecasts predicting a significant growth rate in assets managed by smart investment advisors, the potential for trillion-dollar levels in the near future, the impact of Robo-Advisors on the financial industry is undeniable. Moreover, the paper has discussed the principle of Robo-Advisors, highlighting their reliance on Modern Portfolio Theory (MPT) and the integration of AI technology. Through the application of machine learning techniques, Robo-Advisors can accurately predict market movements and asset performance, optimizing portfolios and maximizing returns. Additionally, the analytical methods used by Robo-Advisors, such as multi-factor analysis and machine learning algorithms, have been explored, showcasing their ability to provide investors with effective investment decision support. Finally, the experimental results have demonstrated the efficacy of Random Forest, an ensemble learning algorithm, in the field of quantitative investment. With a focus on predicting stock price movements, assessing portfolio risk, and analyzing market sentiment, Random Forests offer a powerful tool for achieving smarter and more effective investment decisions. Overall, this paper underscores the transformative potential of Artificial Intelligence in reshaping the financial landscape, offering investors enhanced efficiency, service quality, and investment experiences.

References

[1]. Brynjolfsson, Erik, Danielle Li, and Lindsey R. Raymond. Generative AI at work. No. w31161. National Bureau of Economic Research, 2023.

[2]. Baidoo-Anu, D., & Ansah, L. O. (2023). Education in the era of generative artificial intelligence (AI): Understanding the potential benefits of ChatGPT in promoting teaching and learning. Journal of AI, 7(1), 52-62.

[3]. Jo, A. "The promise and peril of generative AI." Nature 614.1 (2023): 214-216.

[4]. Hackethal, A., Haliassos, M., & Jappelli, T. (2012). Financial advisors: A case of babysitters?. Journal of Banking & Finance, 36(2), 509-524.

[5]. Golubov, A., Petmezas, D., & Travlos, N. G. (2012). When it pays to pay your investment banker: New evidence on the role of financial advisors in M&As. The Journal of Finance, 67(1), 271-311.

[6]. Ismail, A. (2010). Are good financial advisors really good? The performance of investment banks in the M&A market. Review of Quantitative Finance and Accounting, 35, 411-429.

[7]. De Prado, M. L. (2018). Advances in financial machine learning. John Wiley & Sons.

[8]. Henrique, B. M., Sobreiro, V. A., & Kimura, H. (2019). Literature review: Machine learning techniques applied to financial market prediction. Expert Systems with Applications, 124, 226-251.

[9]. Dixon, M. F., Halperin, I., & Bilokon, P. (2020). Machine learning in finance (Vol. 1170). New York, NY, USA: Springer International Publishing.

[10]. Tauchert, Christoph, and Neda Mesbah. "Following the Robot? Investigating Users' Utilization of Advice from Robo-Advisors." ICIS. 2019.

[11]. Xu, Z., Gong, Y., Zhou, Y., Bao, Q., & Qian, W. (2024). Enhancing Kubernetes Automated Scheduling with Deep Learning and Reinforcement Techniques for Large-Scale Cloud Computing Optimization. arXiv preprint arXiv:2403.07905.

Cite this article

Jiang,W.;Qian,K.;Fan,C.;Ding,W.;Li,Z. (2024). Applications of generative AI-based financial robot advisors as investment consultants. Applied and Computational Engineering,77,265-270.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Software Engineering and Machine Learning

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Brynjolfsson, Erik, Danielle Li, and Lindsey R. Raymond. Generative AI at work. No. w31161. National Bureau of Economic Research, 2023.

[2]. Baidoo-Anu, D., & Ansah, L. O. (2023). Education in the era of generative artificial intelligence (AI): Understanding the potential benefits of ChatGPT in promoting teaching and learning. Journal of AI, 7(1), 52-62.

[3]. Jo, A. "The promise and peril of generative AI." Nature 614.1 (2023): 214-216.

[4]. Hackethal, A., Haliassos, M., & Jappelli, T. (2012). Financial advisors: A case of babysitters?. Journal of Banking & Finance, 36(2), 509-524.

[5]. Golubov, A., Petmezas, D., & Travlos, N. G. (2012). When it pays to pay your investment banker: New evidence on the role of financial advisors in M&As. The Journal of Finance, 67(1), 271-311.

[6]. Ismail, A. (2010). Are good financial advisors really good? The performance of investment banks in the M&A market. Review of Quantitative Finance and Accounting, 35, 411-429.

[7]. De Prado, M. L. (2018). Advances in financial machine learning. John Wiley & Sons.

[8]. Henrique, B. M., Sobreiro, V. A., & Kimura, H. (2019). Literature review: Machine learning techniques applied to financial market prediction. Expert Systems with Applications, 124, 226-251.

[9]. Dixon, M. F., Halperin, I., & Bilokon, P. (2020). Machine learning in finance (Vol. 1170). New York, NY, USA: Springer International Publishing.

[10]. Tauchert, Christoph, and Neda Mesbah. "Following the Robot? Investigating Users' Utilization of Advice from Robo-Advisors." ICIS. 2019.

[11]. Xu, Z., Gong, Y., Zhou, Y., Bao, Q., & Qian, W. (2024). Enhancing Kubernetes Automated Scheduling with Deep Learning and Reinforcement Techniques for Large-Scale Cloud Computing Optimization. arXiv preprint arXiv:2403.07905.