1. Introduction

The landscape of financial management has undergone a profound transformation over the years, driven by the ubiquitous integration of technology into various aspects of financial accounting and decision-making processes. This paper offers a comprehensive overview of the evolution of financial accounting, tracing its path from its rudimentary beginnings to the current era characterized by algorithm-driven methodologies. In recent decades, advanced computational algorithms have revolutionized financial data management. These algorithms have not only redefined data processing capabilities but have also significantly improved the accuracy, reliability, and efficiency of financial reporting. Moreover, they have played a pivotal role in reshaping regulatory compliance in financial accounting. The impact of algorithms extends beyond data processing. They have become instrumental in forecasting financial trends, enabling data-driven investment decisions, and enhancing risk management. Algorithms can swiftly analyze vast datasets, identifying patterns and trends that would be challenging to discern through traditional methods. Furthermore, algorithms have permeated strategic planning in the financial sector. They are used to optimize portfolio management, asset allocation, and even the development of personalized financial plans for clients. This not only improves the efficiency of financial advisory services but also tailors investment strategies to individual goals and risk tolerances. This paper aims to explore the various facets of financial management influenced by algorithmic methodologies, highlighting the profound changes these technologies have brought to the field. It also considers the potential implications of this transformation for the future of financial management and the broader financial ecosystem. In sum, this paper provides a comprehensive understanding of the intricate relationship between algorithms and financial management, recognizing their pivotal role in shaping the present and future of this dynamic field [1].

2. The Evolution of Financial Accounting

2.1. Historical Context

The historical development of financial accounting has been a journey from simple record-keeping to complex financial management. Traditionally, financial accounting relied heavily on manual methods, with ledger books and handwritten records forming the backbone of the practice. Over the centuries, as commerce expanded and financial transactions became more intricate, the need for more efficient, accurate, and comprehensive accounting methods grew. The introduction of the double-entry bookkeeping system in the 15th century marked a significant advancement, laying the groundwork for modern accounting principles. In the 20th century, the advent of computers initiated a gradual shift, transforming accounting from paper-based to digital. This digitalization began with basic spreadsheet programs and evolved into sophisticated accounting software, enabling faster data processing and more accurate financial reporting [2].

2.2. Transition to Algorithmic Methods

The shift to algorithm-based accounting practices marks a pivotal change in financial accounting. This transition was driven by the increasing complexity of financial markets, the explosion of data, and the need for real-time analysis and reporting. Early adopters of algorithmic methods were primarily large corporations and financial institutions that recognized the potential for these tools to handle massive volumes of data with precision and speed. These entities started integrating algorithms for tasks like anomaly detection, fraud prevention, and predictive analytics. This shift was also influenced by the emergence of big data and machine learning, which offered unprecedented insights into financial trends and patterns [3]. Algorithmic accounting allowed for automated real-time data analysis, enhanced accuracy in financial predictions, and more efficient compliance with regulatory requirements. This transition represents a fundamental change from reactive to proactive financial management, where predictive models and data-driven insights lead decision-making.

2.3. Future Prospects

The future of algorithmic financial accounting holds immense promise, with emerging technologies and methodologies set to further revolutionize the field. Advancements in artificial intelligence (AI) and machine learning are expected to enhance the capabilities of financial algorithms, allowing for more sophisticated data analysis and interpretation. The integration of blockchain technology could introduce unprecedented levels of transparency and security in financial transactions and record-keeping. Furthermore, the rise of cloud computing is facilitating more scalable and accessible financial accounting solutions, enabling businesses of all sizes to leverage advanced algorithmic tools. Future developments may include the use of predictive analytics for more accurate financial forecasting, enhanced automation for routine accounting tasks, and the integration of cognitive computing to simulate human thought processes in complex financial decision-making. These advancements will not only streamline accounting practices but also enable more strategic financial planning and resource allocation.

3. Algorithms in Data Analysis and Reporting

3.1. Data Processing Capabilities

This section delves into the transformative power of algorithms when it comes to data processing within the realm of financial accounting. Algorithms have demonstrated remarkable capabilities in enhancing the efficiency of data processing tasks. Specific software and tools have emerged to exemplify this point.

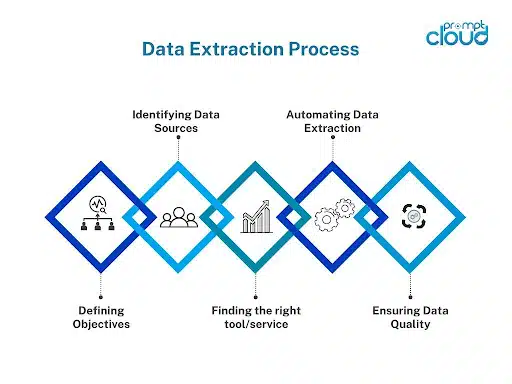

One notable example is the adoption of automated data extraction algorithms that streamline the process of collecting and organizing financial data from various sources. Figure1 shows us data extraction process for efficient information gathering. These algorithms can sift through vast datasets, identify relevant information, and present it in a structured manner. The integration of optical character recognition (OCR) technology, natural language processing (NLP), and machine learning algorithms has been instrumental in this regard. Such tools not only expedite data processing but also significantly reduce the potential for human error in data entry and extraction [4]. Furthermore, algorithms have found application in reconciling discrepancies and detecting anomalies in financial data. They can swiftly identify inconsistencies and flag them for further investigation. Advanced algorithms can even learn from historical data, allowing for continuous improvement in identifying irregularities.

Figure 1. Data Extraction for Efficient Information Gathering

3.2. Accuracy and Reliability

Algorithms play a pivotal role in elevating the accuracy and reliability of financial reports. The inherent precision of algorithmic calculations significantly reduces the margin for error in financial data analysis. This is particularly crucial in complex financial transactions, where accuracy is paramount. For instance, algorithms can perform intricate financial modeling and simulations, enabling organizations to assess the potential impact of various financial decisions with a high degree of accuracy. This empowers decision-makers with data-driven insights and helps mitigate risks associated with financial planning and forecasting. Moreover, the automation of routine data entry and calculations through algorithms minimizes the risk of human errors that can lead to inaccuracies in financial reports [5]. As a result, stakeholders, including investors, regulators, and shareholders, can have greater confidence in the reliability of the financial information presented to them.

3.3. Regulatory Compliance

The adoption of algorithms in financial accounting also has significant implications for regulatory compliance. Financial reporting standards and regulations often require strict adherence to specific guidelines and principles. Algorithms can help ensure compliance in several ways. Firstly, algorithms can be programmed to enforce regulatory rules during data processing and reporting. They can flag potential violations and ensure that financial statements adhere to the required standards. This proactive approach minimizes the risk of non-compliance and the associated legal and financial consequences. Additionally, algorithms can assist in automating the documentation and record-keeping processes necessary for regulatory compliance [6]. They can maintain an audit trail of financial transactions and changes, making it easier to demonstrate compliance during regulatory audits. In conclusion, the integration of algorithmic methodologies in financial accounting has the potential to revolutionize data processing efficiency, enhance the accuracy and reliability of financial reports, and facilitate compliance with regulatory requirements. The following sections of this paper will delve deeper into these aspects, providing a quantitative analysis of the impact of algorithms in these domains.

4. Impact on Financial Decision-Making

4.1. Enhanced Forecasting Techniques

Algorithmic methods play a pivotal role in revolutionizing the landscape of financial forecasting and trend analysis. By harnessing the power of advanced algorithms, financial professionals can achieve a level of accuracy and insight that was previously unattainable through traditional methods. One of the key advantages of algorithmic forecasting is its ability to process vast amounts of historical financial data quickly and efficiently. This enables analysts to identify intricate patterns and trends that might have gone unnoticed using manual techniques. For instance, machine learning algorithms can discern subtle correlations and nonlinear relationships within financial datasets, helping forecasters make more precise predictions. Additionally, algorithms can adapt to changing market conditions in real-time. They can factor in a wide range of variables, including economic indicators, market sentiment, and geopolitical events, to continually refine and adjust forecasts. This adaptability is particularly crucial in today's fast-paced financial environment, where sudden market fluctuations and unexpected events can have significant impacts. Furthermore, algorithmic forecasting can enhance scenario analysis and stress testing [7]. By simulating various financial scenarios and their potential outcomes, financial decision-makers can better prepare for a range of contingencies and make informed choices that mitigate risks and optimize opportunities.

4.2. Risk Assessment and Management

Algorithms have emerged as indispensable tools in identifying and managing financial risks. They excel in their ability to process large datasets, detect anomalies, and assess the potential impact of various risk factors. Risk assessment algorithms can evaluate market volatility, credit risk, liquidity risk, and operational risk, among others. They can provide timely alerts and risk scores based on real-time data, enabling financial professionals to respond proactively to potential threats. Moreover, algorithms can facilitate portfolio optimization and asset allocation strategies that consider risk tolerance and investment objectives. They help construct diversified portfolios that seek to maximize returns while minimizing exposure to specific risks. This not only safeguards investments but also enhances overall portfolio performance. To quantitatively assess and manage these risks, the Value at Risk (VaR) formula is a pivotal tool, providing a clear metric for estimating the potential maximum loss in a portfolio over a specific time frame, based on statistical analysis of market conditions and portfolio volatility:

\( VaR=P×σ× \) \( Z \) (1)

Where: P is the portfolio value (total value of the portfolio). \( σ \) is the standard deviation of the portfolio returns (a measure of risk or volatility). Z is the Z-score corresponding to the desired confidence level (obtained from standard normal distribution tables) [8].

For example, for a 95% confidence level, the Z-score is typically 1.645. This means there is a 5% chance that the portfolio will lose more than the VaR amount in the specified time frame.

4.3. Strategic Planning

Algorithmic insights are increasingly shaping strategic financial planning and long-term decision-making. These algorithms can process a multitude of data sources, including historical financial performance, market trends, competitor analysis, and economic forecasts, to provide actionable insights. Strategic planning algorithms assist in identifying growth opportunities, market entry points, and potential areas for cost reduction. Table 1 categorizes the key areas where algorithms contribute, along with specific examples or aspects under each category. They can simulate various strategic scenarios and their financial implications, aiding executives in making informed choices regarding resource allocation and corporate strategy. Additionally, these algorithms can contribute to sustainability and ethical considerations in strategic planning by evaluating the environmental, social, and governance (ESG) factors that influence financial performance and reputation [9]. This broader perspective allows organizations to align their strategies with responsible and sustainable practices. In conclusion, algorithmic methodologies have a profound impact on financial decision-making by enhancing forecasting accuracy, mitigating risks, and facilitating informed strategic planning. As financial professionals continue to embrace these tools, they are better equipped to navigate the complex and dynamic landscape of modern finance.

Table 1. Algorithmic Enhancement in Strategic Financial Planning and Decision-Making

Category | Description | Examples/Aspects |

Data Processing | Algorithms process diverse data sources for strategic insights. | Historical financial performance, market trends, competitor analysis, economic forecasts. |

Opportunity Identification | Identifying growth opportunities and market entry points. | Market analysis, growth forecasting, industry trends. |

Cost Reduction Strategies | Algorithms aid in identifying potential areas for cost reduction. | Operational efficiency, supply chain optimization, resource allocation. |

Scenario Simulation | Simulating various strategic scenarios and their financial implications. | Financial forecasting, risk assessment, strategic alternatives. |

Resource Allocation | Assisting in informed decision-making for resource distribution. | Budgeting, investment strategies, capital allocation. |

Sustainability and Ethics | Evaluating ESG factors in strategic planning. | Environmental impact analysis, social responsibility assessment, governance standards. |

5. Conclusion

In conclusion, the integration of algorithmic methodologies into financial management marks a monumental shift in how financial data is processed, analyzed, and utilized. This paper has outlined the evolution from traditional financial accounting practices to a modern, algorithm-driven approach, highlighting significant advancements in data processing, accuracy, risk assessment, and strategic planning. The transformative impact of these algorithms is evident in their ability to handle complex and voluminous data sets, providing insights with a speed and accuracy that surpass traditional methods. In financial forecasting and trend analysis, the use of algorithms has led to more precise predictions, adapting in real-time to market changes and unforeseen economic events. This adaptability is crucial in navigating today's volatile financial markets, where traditional methods may fall short. Furthermore, the role of algorithms in risk assessment and management cannot be overstated. With the capacity to evaluate a multitude of risk factors and provide timely risk scores, these tools enable a proactive approach to financial management. They enhance portfolio optimization, ensuring that investments are not only profitable but also aligned with the investor's risk tolerance. In strategic financial planning, algorithmic insights offer a comprehensive view, considering not only economic factors but also environmental, social, and governance (ESG) aspects [10]. This broader perspective is essential in today's world, where financial performance is increasingly linked with sustainable and ethical practices. Organizations that leverage these algorithmic tools can align their strategies with these important considerations, ensuring long-term success and resilience. As we look to the future, the role of algorithms in financial management is poised to grow even more significant. With advancements in AI, machine learning, and other emerging technologies, these tools will continue to evolve, offering even more sophisticated analysis and insights. Financial professionals and organizations that embrace and adapt to these changes will be better equipped to meet the challenges of a complex and dynamic financial landscape.

References

[1]. Chakravarty, Satya R., and Palash Sarkar. An introduction to algorithmic finance, algorithmic trading and blockchain. Emerald Publishing Limited, 2020.

[2]. Hayes, Adam S. "The active construction of passive investors: roboadvisors and algorithmic ‘low-finance’." Socio-Economic Review 19.1 (2021): 83-110.

[3]. Hansen, Kristian Bondo. "The virtue of simplicity: On machine learning models in algorithmic trading." Big Data & Society 7.1 (2020): 2053951720926558.

[4]. Ben David, Daniel, Yehezkel S. Resheff, and Talia Tron. "Explainable AI and adoption of financial algorithmic advisors: an experimental study." Proceedings of the 2021 AAAI/ACM Conference on AI, Ethics, and Society. 2021.

[5]. Achim, Monica Violeta, et al. "The impact of covid-19 on financial management: evidence from Romania." Economic Research-Ekonomska Istraživanja 35.1 (2022): 1807-1832.

[6]. Bapat, Dhananjay. "Antecedents to responsible financial management behavior among young adults: moderating role of financial risk tolerance." International Journal of Bank Marketing 38.5 (2020): 1177-1194.

[7]. Yogasnumurti, Raras Risia, Isfenti Sadalia, and Nisrul Irawati. "The effect of financial, attitude, and financial knowledge on the personal finance management of college collage students." Proceedings of the 2nd Economics and Business International Conference-EBIC. 2021.

[8]. Zada, Muhammad, Cao Yukun, and Shagufta Zada. "Effect of financial management practices on the development of small-to-medium size forest enterprises: Insight from Pakistan." GeoJournal 86 (2021): 1073-1088.

[9]. Mölder, Felix, et al. "Sustainable data analysis with Snakemake." F1000Research 10 (2021).

[10]. Hamilton, R. H., and William A. Sodeman. "The questions we ask: Opportunities and challenges for using big data analytics to strategically manage human capital resources." Business Horizons 63.1 (2020): 85-95.

Cite this article

Chen,J. (2024). Revolutionizing financial management: The impact of algorithmic methodologies. Applied and Computational Engineering,74,123-128.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Software Engineering and Machine Learning

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Chakravarty, Satya R., and Palash Sarkar. An introduction to algorithmic finance, algorithmic trading and blockchain. Emerald Publishing Limited, 2020.

[2]. Hayes, Adam S. "The active construction of passive investors: roboadvisors and algorithmic ‘low-finance’." Socio-Economic Review 19.1 (2021): 83-110.

[3]. Hansen, Kristian Bondo. "The virtue of simplicity: On machine learning models in algorithmic trading." Big Data & Society 7.1 (2020): 2053951720926558.

[4]. Ben David, Daniel, Yehezkel S. Resheff, and Talia Tron. "Explainable AI and adoption of financial algorithmic advisors: an experimental study." Proceedings of the 2021 AAAI/ACM Conference on AI, Ethics, and Society. 2021.

[5]. Achim, Monica Violeta, et al. "The impact of covid-19 on financial management: evidence from Romania." Economic Research-Ekonomska Istraživanja 35.1 (2022): 1807-1832.

[6]. Bapat, Dhananjay. "Antecedents to responsible financial management behavior among young adults: moderating role of financial risk tolerance." International Journal of Bank Marketing 38.5 (2020): 1177-1194.

[7]. Yogasnumurti, Raras Risia, Isfenti Sadalia, and Nisrul Irawati. "The effect of financial, attitude, and financial knowledge on the personal finance management of college collage students." Proceedings of the 2nd Economics and Business International Conference-EBIC. 2021.

[8]. Zada, Muhammad, Cao Yukun, and Shagufta Zada. "Effect of financial management practices on the development of small-to-medium size forest enterprises: Insight from Pakistan." GeoJournal 86 (2021): 1073-1088.

[9]. Mölder, Felix, et al. "Sustainable data analysis with Snakemake." F1000Research 10 (2021).

[10]. Hamilton, R. H., and William A. Sodeman. "The questions we ask: Opportunities and challenges for using big data analytics to strategically manage human capital resources." Business Horizons 63.1 (2020): 85-95.