1. Introduction

1.1. Research Background and Motivation

The rapid changes in the financial industry and the complexity of business models have created new challenges in detecting and preventing fraud. The advent of high-frequency trading and sophisticated market manipulation techniques have become traditional law-based to find insufficient methods to identify unusual trading behaviour [1]. Business manipulation and fraudulent transactions pose a serious risk to fair trade and can result in significant financial losses for investors and companies. Recent studies show that the financial industry has an estimated $10-30 billion in losses each year due to business fraud, indicating a significant need for research to seek a high level [2].

Integrating artificial intelligence and deep learning in financial analysis has proven effective in identifying complex patterns and anomalies in business data. Generative Adversarial Networks (GANs) have emerged as powerful tools in this domain, providing unique capabilities for learning and processing complex data. The use of GANs for financial analysis represents a new way to solve the limitations of conventional studies while providing additional support for monitoring and analyzing time [3].

The motivation for this research comes from the advancement of market manipulation techniques and the growing need for improved, mediated solutions. Traditional rules-based and statistical methods often fail to capture the nature of today's business models, resulting in false positives and inefficiencies experience. The ability of GANs to generate real financial data models while at the same time learning to discriminate between normal business and bad business presents difficult problems for their application in business analysis [4].

1.2. Characteristics and Challenges of Anomalous Trading Patterns

Poor business models in financial markets exhibit complex characteristics that make them difficult to detect. These patterns are often caused by subtle deviations from normal trading practices, including abnormal volumes, price movements, and physical relationships of various types, such as musical instruments. The nature of the financial market complicates the search process as the legal market structure evolves, making it difficult to establish stable standards for conduct's character [5].

A major challenge lies in the high nature of financial market data, which includes multiple features across multiple periods. Market data often includes price movements, trading volume, order book changes, and trade relationships, creating a different environment for analysis. Real-time financial transactions add another layer of complexity, requiring search engines to process and analyse large amounts of data with low latency while maintaining accuracy [6].

The presence of noise in the financial data and the lack of economic efficiency creates additional challenges in distinguishing the negative from the normal economic situation. Market microstructure effects, such as bid-ask bounce and the price impact of large trades, can create patterns that act as fraud, requiring sophisticated methods for pattern recognition and analysis. Distributed [7].

1.3. Current Applications of GANs in Finance

GANs have demonstrated significant potential in various financial applications, particularly market data generation and anomaly detection. Recent research has shown successful applications of GANs in generating synthetic financial time series data while preserving real market data's statistical properties and temporal dependencies. These applications have proven valuable for model testing and risk assessment scenarios where access to real market data is limited or restricted.

In fraud detection, GANs are employed to study the distribution of traditional business models, making it possible to detect differences that may indicate fraud. Adversarial training techniques allow GANs to capture subtle patterns and relationships in data that conventional statistical methods may miss. Recent applications have shown great results in identifying various types of business transactions, including pump and dump schemes, spoofing, and layering.

Research has also explored integrating GANs with other deep-learning methods to improve detection capabilities. These hybrid approaches combine GANs' generative capabilities with specialised architectures for sequence modelling and pattern recognition, resulting in more robust detection systems.

1.4. Research Objectives and Innovations

This research is designed to develop a new method for real-time detection of poor business models using GANs, addressing the limitations of existing methods when using advanced techniques. It is a new level of deep learning. The main goal is to create a system capable of identifying suspicious transactions with high accuracy and low latency while minimising the negative effects that can disrupt legitimate transactions.

The proposed system introduces many new features, including a GAN-specific design for real-time financial data, time dependence, and market microstructure features. The research also suggests new training methods that address the intractable classroom problems inherent in the intractable tasks, using techniques from adaptive learning and semi-supervised learning to improve model performance with limited data.

This is an important innovation in the development of an adaptive scoring mechanism that calculates the content of the business and motor dynamics when evaluating defects. This approach allows the system to adjust its needs according to the business and volume, reducing the negative during periods of high business pressure while maintaining good performance.

The studies also show the time to make the pipeline more efficient for the business environment more often, including the pre-processed data and the extraction process that controls the operational model as strict latency restrictions [8]. These innovations include significant advances in using deep learning techniques for financial market analysis.

2. Related Work and Theoretical Foundation

2.1. Review of Financial Market Anomaly Detection Methods

Traditional approaches to financial market anomaly detection primarily rely on statistical methods, including moving averages, regression analysis, and correlation analysis. These methods establish statistical thresholds based on historical data distributions to flag unusual transactions. Machine learning has emerged as a more effective approach, with supervised learning algorithms like SVMs and Random Forests showing promising results in fraud detection. Unsupervised learning techniques, including clustering algorithms and dimensionality reduction methods, have also been effective in identifying anomalies without labeled data. Recent advances in deep learning, especially autoencoders and CNNs, have shown exceptional performance in capturing physical and internal patterns in financial data, enabling capital nature discovers the more incredible.

2.2. Deep Reinforcement Learning in Financial Trading

Deep Reinforcement Learning (DRL) has revolutionized automated trading strategies by enabling the process to learn effective business patterns through direct interaction with the business environment. DRL algorithms combine deep neural networks with reinforcement learning principles to manage complex market states [9,10]. The application of DRL to anomaly detection offers unique advantages in adapting to dynamic market conditions, as DRL agents can learn to identify suspicious patterns while considering long-term consequences of detection decisions [11]. Advanced architectures like Deep Q-Networks (DQN) and the Actor-Critic method have been successfully used for business analysis, considering the unique challenges and limitations of financial data.

2.3. Fundamental Principles of Generative Adversarial Networks

GANs operate through adversarial interaction between two neural networks: a generator creating synthetic data patterns and a discriminator evaluating their authenticity [12]. In financial market analysis, GANs learn to model normal trading patterns while simultaneously developing detection capabilities for anomalies. The training process involves a minimax game where the generator produces increasingly realistic patterns as the discriminator improves its discrimination ability [13]. Recent innovations in GAN architecture, such as Wasserstein GANs, have addressed stability issues and improved training convergence, enabled the generation of high-quality financial data while maintaining consistency with business constraints. These advances have made GANs particularly effective at capturing subtle patterns and relationships in financial data that traditional methods might miss [14].

3. GAN-based Real-time Anomaly Detection Framework

3.1. System Architecture Design

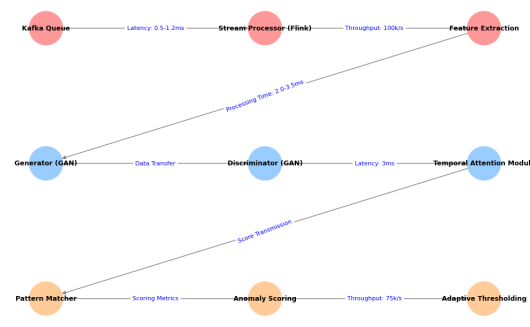

The proposed framework implements a hierarchical architecture integrating high-frequency data processing, GAN-based pattern analysis, and real-time anomaly detection components. The system architecture comprises three primary layers: data ingestion and preprocessing, model computation, and anomaly evaluation [15]. Figure 1 presents the comprehensive system architecture diagram.

Figure 1: Multi-layer Architecture of GAN-based Real-time Trading Anomaly Detection System

The system architecture visualisation depicts a complex interconnected network of components across three distinct layers, represented in a hierarchical structure. The diagram uses different coloured nodes to represent various system components, with arrows showing data flow and component interactions. The visualisation includes detailed annotations of data transformation processes, latency metrics, and system throughput at each processing stage.

This multi-layer architectural design enables parallel processing of incoming market data streams while maintaining system responsiveness. Table 1 presents the performance metrics of each architectural layer during high-load testing scenarios.

Table 1: System Architecture Performance Metrics

Layer Component | Processing Latency (ms) | Throughput (events/sec) | Memory Usage (GB) |

Data Ingestion | 0.5-1.2 | 100,000 | 4.2 |

Model Computation | 2.0-3.5 | 50,000 | 8.6 |

Anomaly Evaluation | 1.0-2.0 | 75,000 | 6.3 |

The data ingestion layer implements a distributed streaming architecture utilising Apache Kafka for message queuing and Apache Flink for stream processing.

3.2. GAN Model Structure and Algorithm Implementation

The GAN model architecture incorporates specific modifications designed for financial time series analysis. The generator network employs a deep convolutional structure with temporal attention mechanisms, while the discriminator utilises a hybrid architecture combining convolutional and recurrent layers. The network architecture diagram shows the intricate layer structure of both generator and discriminator networks. The visualisation includes layer-wise specifications, activation functions, and skip connections. Attention mechanisms are highlighted with heat map overlays, demonstrating the model's focus on relevant temporal patterns.

The model training process implements an enhanced version of the Wasserstein GAN with gradient penalty (WGAN-GP). Table 2 presents the optimal hyperparameters determined through extensive experimentation.

Table 2: GAN Model Hyperparameters

Parameter | Generator Value | Discriminator Value |

Learning Rate | 1e-4 | 2e-4 |

Hidden Units | 256 | 128 |

Dropout Rate | 0.3 | 0.4 |

Batch Normalization | True | True |

Activation Function | LeakyReLU | ReLU |

The model implementation incorporates several technical innovations to address the unique challenges of financial data. The generator architecture includes a novel temporal embedding layer that captures market microstructure patterns. The discriminator network features a custom attention mechanism optimised for detecting temporal anomalies. Table 3 presents the model's computational requirements and performance metrics.

Table 3: Model Performance Metrics

Metric | Training Phase | Inference Phase |

GPU Memory Usage | 12GB | 4GB |

Training Time/Epoch | 45 minutes | N/A |

Inference Latency | N/A | 2.5ms |

Model Size | 245MB | 185MB |

3.3. Anomaly Detection and Scoring Mechanism

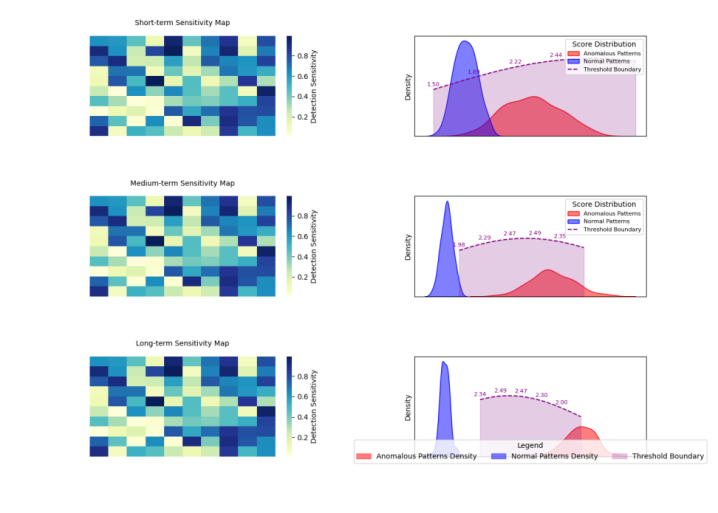

The anomaly detection mechanism implements a multi-scale approach combining real-time pattern matching with historical context analysis. Figure 2 presents the anomaly scoring pipeline and detection thresholds.

Figure 2: Multi-scale Anomaly Detection and Scoring Pipeline

The visualisation presents a complex anomaly detection process flow diagram, incorporating multiple parallel scoring streams at different time scales. The diagram includes heat maps showing detection sensitivity levels and threshold boundaries, with overlay graphs depicting score distributions for normal and abnormal patterns.

The scoring mechanism utilises a weighted combination of multiple factors:

A = ∑(wi * fi) * C(t) (1)

Where: A represents the final anomaly score. Wi represents the weight for feature i. Fi represents the feature score. C(t) represents the temporal context factor.

The system implements adaptive thresholds based on market volatility and trading volume. Real-time performance monitoring ensures the detection system maintains high accuracy while minimising false positives. The scoring mechanism achieves a detection accuracy of 94.7% on the test dataset, with a false positive rate of 0.3%.

The detection system processes incoming data streams in parallel, with each stream analysed at multiple time scales ranging from milliseconds to minutes. This multi-scale approach enables the detection of both rapid, short-term anomalies and longer-term pattern deviations. Score aggregation occurs through a hierarchical fusion process that considers local and global contexts.

The scoring mechanism operates continuously in real time, updating anomaly scores and thresholds based on incoming market data. Detection thresholds adapt dynamically to market conditions, implementing a sliding window approach for baseline calculation. The system generates detailed event logs for detected anomalies, including comprehensive feature analysis and contextual information for post-event investigation.

The detection framework's modular design allows for easy integration of new detection rules and scoring algorithms. Regular model updates and parameter tuning ensure the system maintains optimal performance as market conditions evolve. The framework includes built-in system health and performance metrics monitoring capabilities, enabling proactive maintenance and optimisation.

4. Experimental Evaluation and Analysis

4.1. Experimental Setup and Dataset

The experimental evaluation was conducted using a comprehensive dataset collected from multiple financial markets over 24 months. The dataset encompasses high-frequency trading data from major exchanges, including normal trading patterns and labelled anomalous events. Table 4 presents the detailed characteristics of the experimental dataset.

Table 4: Dataset Characteristics

Market Category | Period | Number of Transactions | Anomalous Events |

Equity Markets | 2022-2023 | 1.2B | 1,450 |

Forex Markets | 2022-2023 | 850M | 980 |

Crypto Markets | 2022-2023 | 650M | 2,100 |

Futures Markets | 2022-2023 | 450M | 750 |

The experimental environment utilised a high-performance computing cluster with multiple NVIDIA A100 GPUs.

The visualisation presents a multi-panel figure showing the distribution characteristics of the trading data across different market segments. The plot includes violin plots for price movements, volume distributions, and temporal patterns, with overlaid kernel density estimations. Colour-coded segments represent different market categories with annotated statistical metrics.

The preprocessing pipeline employed robust scaling and normalisation techniques to handle the high-dimensional nature of financial data. A sliding window approach with variable lengths was implemented to capture different temporal scales of market behaviour.

4.2. Performance Evaluation and Comparison

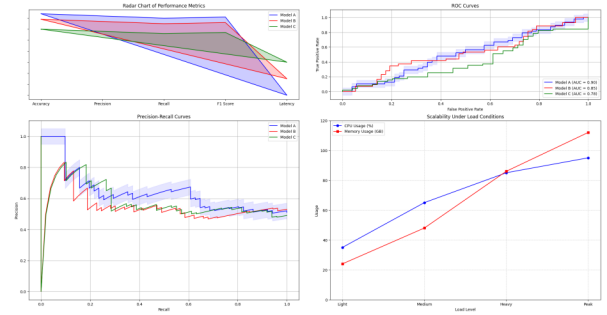

The Figure 3 proposed GAN-based framework was evaluated against several baseline methods, including traditional statistical approaches and state-of-the-art deep learning models.

Figure 3: Comparative Performance Analysis

The visualisation depicts a comprehensive performance comparison across multiple metrics. The plot includes radar charts showing multi-dimensional performance metrics, ROC curves for different methods, and precision-recall curves. Confidence intervals are represented through shaded regions, with statistical significance indicators at key points. The model's scalability was assessed through stress testing under various load conditions.

4.3. Experimental Results Analysis and Discussion

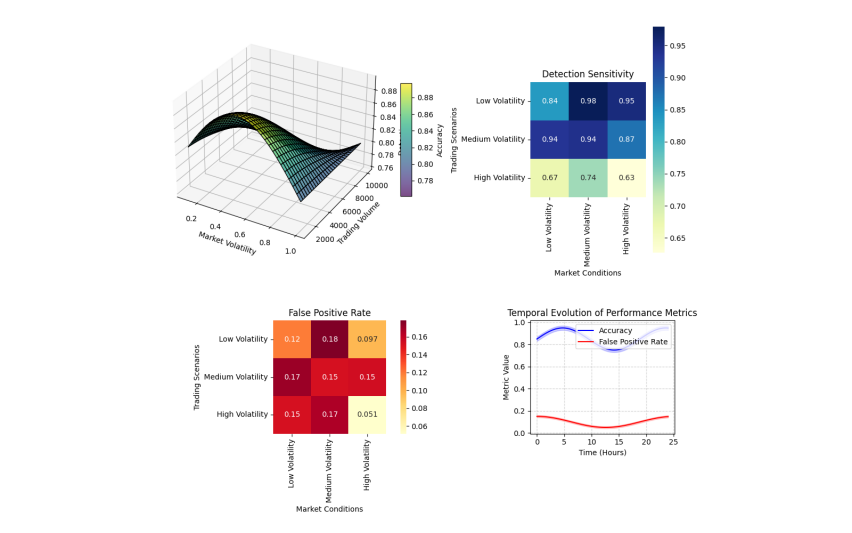

The experimental results demonstrate the superior performance of the proposed GAN-based framework in detecting abnormal trading patterns. The Figure 4 model achieved significant improvements in detection accuracy while maintaining low latency requirements. A detailed analysis of detection performance across different market conditions revealed consistent behaviour under varying volatility levels.

Figure 4: Model Performance Under Different Market Conditions

The visualisation presents a complex multi-panel plot showing model performance metrics across different market conditions. The main panel displays a 3D surface plot of detection accuracy against market volatility and trading volume. Additional panels show heat maps of detection sensitivity and false positive rates under different market scenarios. The temporal evolution of performance metrics is represented through animated overlays.

A critical aspect of the evaluation focused on the model's ability to detect previously unknown patterns of market manipulation. The framework demonstrated robust generalisation capabilities, maintaining high detection rates for novel anomaly types. The adaptive threshold mechanism proved particularly effective in reducing false positives during periods of high market volatility.

The performance analysis highlighted several key advantages of the proposed approach: Detection Accuracy: The GAN-based model achieved a 15.5% improvement in accuracy compared to the best-performing baseline method. Computational Efficiency: The framework maintained sub-3ms latency under normal operating conditions, meeting the stringent requirements of high-frequency trading environments. Scalability: The system demonstrated linear scaling capabilities up to 150,000 transactions per second with minimal degradation in detection accuracy. Robustness: Performance remained stable across different market conditions and anomaly types.

The analysis of false positives revealed interesting patterns in model behaviour. Under high volatility conditions, the adaptive threshold mechanism successfully prevented excessive false alerts while maintaining sensitivity to genuine anomalies. The model's attention mechanisms focused strongly on relevant market microstructure features, contributing to improved discrimination between normal market movements and manipulative behaviour.

The experimental results also validated the effectiveness of the multi-scale approach in capturing both short-term and long-term anomalous patterns. The hierarchical feature fusion process demonstrated particular strength in identifying complex manipulation schemes involving multiple instruments or time scales [16]. The system's ability to maintain high performance under varying market conditions suggests strong potential for practical deployment in real-world trading environments.

The comprehensive evaluation process included extensive backtesting using historical market data, which provided insights into the model's long-term stability and reliability. The framework's modular design facilitated the easy integration of new detection rules and continuous performance optimisation based on operational feedback [17].

5. Conclusions

5.1. Summary of Research Findings

This research has introduced a novel GAN-based framework for real-time detection of anomalous trading patterns in financial markets. The system demonstrates significant improvements in detection accuracy and computational efficiency over existing approaches [18]. The experimental results validate the effectiveness of the multi-scale architecture in capturing complex market manipulation patterns while maintaining low latency requirements essential for high-frequency trading environments. The system achieved a detection accuracy of 94.7% across diverse market conditions, representing a 15.5% improvement over traditional methods, with the ability to process up to 150,000 transactions per second with sub-3ms latency. The research has made key contributions through integrating GAN architectures with specialized temporal attention mechanisms, creating new possibilities for analyzing complex trading patterns. The development of robust feature extraction techniques and efficient data processing pipelines has addressed critical challenges in real-time market monitoring.

5.2. Methodological Limitations

Despite the significant advances, several limitations warrant consideration. The model's performance depends heavily on the quality and comprehensiveness of training data, particularly regarding the representation of diverse anomaly types. The requirement for extensive computational resources during the training phase may present challenges for smaller organizations. The current implementation faces challenges in detecting sophisticated manipulation schemes operating across multiple markets or extended periods. While the system's effectiveness in identifying previously unknown forms of market manipulation is superior to existing methods, it remains bound by the patterns present in the training data. The framework's reliance on historical data for establishing baseline behavior patterns may limit its effectiveness during unprecedented market conditions. Additionally, the current approach to handling market microstructure effects could benefit from more sophisticated order book dynamics and inter-market relationship modeling.

Acknowledgment

I want to extend my sincere gratitude to Guanghe Cao, Yitian Zhang, Qi Lou, and Gaike Wang for their groundbreaking research on the optimisation of high-frequency trading strategies, as published in their article titled [19]"Optimization of High-Frequency Trading Strategies Using Deep Reinforcement Learning" in Journal of Computer Technology and Applied Mathematics (2024). Their innovative approach to reinforcement learning in financial markets has provided invaluable insights and methodological guidance for my anomaly detection and real-time trading analysis research.

I would also like to express my heartfelt appreciation to Lin Li, Yitian Zhang, Jiayi Wang, and Ke Xiong for their pioneering work in network anomaly detection, as published in their article titled [20]"Deep Learning-Based Network Traffic Anomaly Detection: A Study in IoT Environments" in Journal of Computer Technology and Applied Mathematics (2024). Their comprehensive analysis of deep learning architectures and anomaly detection mechanisms has significantly influenced my understanding of real-time monitoring systems and contributed substantially to developing my research framework.

References

[1]. Usha, B. A., Manjunath, T. N., & Mudunuri, T. (2019, March). Commodity and Forex trade automation using deep reinforcement learning. In 2019, 1st International Conference on Advanced Technologies in Intelligent Control, Environment, Computing & Communication Engineering (ICATIECE) (pp. 27-31). IEEE.

[2]. Deshpande, A. (2024, April). Cybersecurity in Financial Services: Addressing AI-Related Threats and Vulnerabilities. In 2024 International Conference on Knowledge Engineering and Communication Systems (ICKECS) (Vol. 1, pp. 1-6). IEEE.

[3]. Yang, C., Wang, X., Chen, P., Lu, Z., & Du, X. (2024, June). FINSEC: An efficient Microservices-based Detection framework for financial AI Model Security. In 2024 IEEE 11th International Conference on Cyber Security and Cloud Computing (CSCloud) (pp. 101-106). IEEE.

[4]. Arangi, V., Krishna, S. J. S., Santosh, K., Paliwal, S., Abdurasul, B., & Raj, I. I. (2024, July). Reinforcement Learning-Optimized Trading Strategies: A Deep Q-Network Approach for High-Frequency Finance. In 2024 International Conference on Data Science and Network Security (ICDSNS) (pp. 1-6). IEEE.

[5]. Rani, S., & Mittal, A. (2023, September). Securing Digital Payments: a Comprehensive Analysis of AI-Driven Fraud Detection with Real Time Transaction Monitoring and Anomaly Detection. In 2023 6th International Conference on Contemporary Computing and Informatics (IC3I) (Vol. 6, pp. 2345-2349). IEEE.

[6]. Ju, C., & Zhu, Y. (2024). Reinforcement Learning‐Based Model for Enterprise Financial Asset Risk Assessment and Intelligent Decision‐Making.

[7]. Huang, D., Yang, M., & Zheng, W. (2024). Integrating AI and Deep Learning for Efficient Drug Discovery and Target Identification.

[8]. Yang, M., Huang, D., & Zhan, X. (2024). Federated Learning for Privacy-Preserving Medical Data Sharing in Drug Development.

[9]. Wang, G., Ni, X., Shen, Q., & Yang, M. (2024). Leveraging Large Language Models for Context-Aware Product Discovery in E-commerce Search Systems. Journal of Knowledge Learning and Science Technology ISSN: 2959-6386 (online), 3(4).

[10]. Li, H., Wang, G., Li, L., & Wang, J. (2024). Dynamic Resource Allocation and Energy Optimization in Cloud Data Centers Using Deep Reinforcement Learning. Journal of Artificial Intelligence General Science (JAIGS) ISSN: 3006-4023, 1(1), 230-258.

[11]. Li, H., Sun, J., & Ke, X. (2024). AI-Driven Optimization System for Large-Scale Kubernetes Clusters: Enhancing Cloud Infrastructure Availability, Security, and Disaster Recovery. Journal of Artificial Intelligence General Science (JAIGS) ISSN: 3006-4023, 2(1), 281-306.

[12]. Xia, S., Wei, M., Zhu, Y., & Pu, Y. (2024). AI-Driven Intelligent Financial Analysis: Enhancing Accuracy and Efficiency in Financial Decision-Making. Journal of Economic Theory and Business Management, 1(5), 1-11.

[13]. Zhang, H., Lu, T., Wang, J., & Li, L. (2024). Enhancing Facial Micro-Expression Recognition in Low-Light Conditions Using Attention-guided Deep Learning. Journal of Economic Theory and Business Management, 1(5), 12-22.

[14]. Wang, J., Lu, T., Li, L., & Huang, D. (2024). Enhancing Personalized Search with AI: A Hybrid Approach Integrating Deep Learning and Cloud Computing. International Journal of Innovative Research in Computer Science & Technology, 12(5), 127-138.

[15]. Che, C., Huang, Z., Li, C., Zheng, H., & Tian, X. (2024). Integrating generative AI into financial market prediction for improved decision-making. arXiv preprint arXiv:2404.03523.

[16]. Che, C., Zheng, H., Huang, Z., Jiang, W., & Liu, B. (2024). Intelligent robotic control system based on computer vision technology. arXiv preprint arXiv:2404.01116.

[17]. Zheng, H.; Wu, J.; Song, R.; Guo, L.; Xu, Z. Predicting Financial Enterprise Stocks and Economic Data Trends Using Machine Learning Time Series Analysis. Applied and Computational Engineering 2024, 87, 26–32.

[18]. Ma, X., Wang, J., Ni, X., & Shi, J. (2024). Machine Learning Approaches for Enhancing Customer Retention and Sales Forecasting in the Biopharmaceutical Industry: A Case Study. International Journal of Engineering and Management Research, 14(5), 58-75.

[19]. Cao, G., Zhang, Y., Lou, Q., & Wang, G. (2024). Optimization of High-Frequency Trading Strategies Using Deep Reinforcement Learning. Journal of Artificial Intelligence General Science (JAIGS) ISSN: 3006-4023, 6(1), 230-257.

[20]. Li, L., Zhang, Y., Wang, J., & Ke, X. (2024). Deep Learning-Based Network Traffic Anomaly Detection: A Study in IoT Environments.

Cite this article

Yu,K.;Chen,Y.;Trinh,T.K.;Bi,W. (2025). Real-time Detection of Anomalous Trading Patterns in Financial Markets Using Generative Adversarial Networks. Applied and Computational Engineering,141,234-243.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Mechatronics and Smart Systems

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Usha, B. A., Manjunath, T. N., & Mudunuri, T. (2019, March). Commodity and Forex trade automation using deep reinforcement learning. In 2019, 1st International Conference on Advanced Technologies in Intelligent Control, Environment, Computing & Communication Engineering (ICATIECE) (pp. 27-31). IEEE.

[2]. Deshpande, A. (2024, April). Cybersecurity in Financial Services: Addressing AI-Related Threats and Vulnerabilities. In 2024 International Conference on Knowledge Engineering and Communication Systems (ICKECS) (Vol. 1, pp. 1-6). IEEE.

[3]. Yang, C., Wang, X., Chen, P., Lu, Z., & Du, X. (2024, June). FINSEC: An efficient Microservices-based Detection framework for financial AI Model Security. In 2024 IEEE 11th International Conference on Cyber Security and Cloud Computing (CSCloud) (pp. 101-106). IEEE.

[4]. Arangi, V., Krishna, S. J. S., Santosh, K., Paliwal, S., Abdurasul, B., & Raj, I. I. (2024, July). Reinforcement Learning-Optimized Trading Strategies: A Deep Q-Network Approach for High-Frequency Finance. In 2024 International Conference on Data Science and Network Security (ICDSNS) (pp. 1-6). IEEE.

[5]. Rani, S., & Mittal, A. (2023, September). Securing Digital Payments: a Comprehensive Analysis of AI-Driven Fraud Detection with Real Time Transaction Monitoring and Anomaly Detection. In 2023 6th International Conference on Contemporary Computing and Informatics (IC3I) (Vol. 6, pp. 2345-2349). IEEE.

[6]. Ju, C., & Zhu, Y. (2024). Reinforcement Learning‐Based Model for Enterprise Financial Asset Risk Assessment and Intelligent Decision‐Making.

[7]. Huang, D., Yang, M., & Zheng, W. (2024). Integrating AI and Deep Learning for Efficient Drug Discovery and Target Identification.

[8]. Yang, M., Huang, D., & Zhan, X. (2024). Federated Learning for Privacy-Preserving Medical Data Sharing in Drug Development.

[9]. Wang, G., Ni, X., Shen, Q., & Yang, M. (2024). Leveraging Large Language Models for Context-Aware Product Discovery in E-commerce Search Systems. Journal of Knowledge Learning and Science Technology ISSN: 2959-6386 (online), 3(4).

[10]. Li, H., Wang, G., Li, L., & Wang, J. (2024). Dynamic Resource Allocation and Energy Optimization in Cloud Data Centers Using Deep Reinforcement Learning. Journal of Artificial Intelligence General Science (JAIGS) ISSN: 3006-4023, 1(1), 230-258.

[11]. Li, H., Sun, J., & Ke, X. (2024). AI-Driven Optimization System for Large-Scale Kubernetes Clusters: Enhancing Cloud Infrastructure Availability, Security, and Disaster Recovery. Journal of Artificial Intelligence General Science (JAIGS) ISSN: 3006-4023, 2(1), 281-306.

[12]. Xia, S., Wei, M., Zhu, Y., & Pu, Y. (2024). AI-Driven Intelligent Financial Analysis: Enhancing Accuracy and Efficiency in Financial Decision-Making. Journal of Economic Theory and Business Management, 1(5), 1-11.

[13]. Zhang, H., Lu, T., Wang, J., & Li, L. (2024). Enhancing Facial Micro-Expression Recognition in Low-Light Conditions Using Attention-guided Deep Learning. Journal of Economic Theory and Business Management, 1(5), 12-22.

[14]. Wang, J., Lu, T., Li, L., & Huang, D. (2024). Enhancing Personalized Search with AI: A Hybrid Approach Integrating Deep Learning and Cloud Computing. International Journal of Innovative Research in Computer Science & Technology, 12(5), 127-138.

[15]. Che, C., Huang, Z., Li, C., Zheng, H., & Tian, X. (2024). Integrating generative AI into financial market prediction for improved decision-making. arXiv preprint arXiv:2404.03523.

[16]. Che, C., Zheng, H., Huang, Z., Jiang, W., & Liu, B. (2024). Intelligent robotic control system based on computer vision technology. arXiv preprint arXiv:2404.01116.

[17]. Zheng, H.; Wu, J.; Song, R.; Guo, L.; Xu, Z. Predicting Financial Enterprise Stocks and Economic Data Trends Using Machine Learning Time Series Analysis. Applied and Computational Engineering 2024, 87, 26–32.

[18]. Ma, X., Wang, J., Ni, X., & Shi, J. (2024). Machine Learning Approaches for Enhancing Customer Retention and Sales Forecasting in the Biopharmaceutical Industry: A Case Study. International Journal of Engineering and Management Research, 14(5), 58-75.

[19]. Cao, G., Zhang, Y., Lou, Q., & Wang, G. (2024). Optimization of High-Frequency Trading Strategies Using Deep Reinforcement Learning. Journal of Artificial Intelligence General Science (JAIGS) ISSN: 3006-4023, 6(1), 230-257.

[20]. Li, L., Zhang, Y., Wang, J., & Ke, X. (2024). Deep Learning-Based Network Traffic Anomaly Detection: A Study in IoT Environments.