1.Introduction

Enterprises' internationalisation through cross-border mergers and acquisitions (M&A) is a fast and effective way to improve their internationalisation when they have sufficient financial resources, and found that the main purpose of cross-border mergers and acquisitions is to increase the relative competitive advantage of their products in the international market in a short period of time and to compensate for the deficiencies of their innovative technologies through the importation of foreign talents[1,2]. Argued that cross-border M&As can enhance industrial exports and promote the internationalisation of industrial structure[1,2]. Through the study of Sany Group's cross-border M&A case, found that cross-border M&A can enhance the enterprise's international influence and technology research and development level, so that the domestic construction machinery brand is more valuable in the global market; within the enterprise, it can also improve the enterprise's operation level, management ability and financial performance, so cross-border M&A is the best of both worlds for the construction machinery enterprise[1-3].

Although cross-border mergers and acquisitions (M&A) is a fast and efficient way to improve the internationalisation level of enterprises, cross-border M&A is not perfect, and higher returns also mean higher risks exist. Some scholars believe that cultural differences are the fundamental problem of M&A, and found that the main reason for the failure of cross-border M&A is the cultural conflict within the enterprise [3-5]. Points out that cross-border M&A if there is a difference in nationality, then the cultural conflict between enterprises is more and more intense [5]. Most construction machinery enterprises are unable to integrate these differences after the M&A, resulting in the M&A ending in failure and causing irreparable losses. Management style is a secondary M&A issue, the construction machinery industry wants to introduce foreign talent to use foreign management style, between different countries, the management style of enterprises and thinking there will be differences, explains that if the management of the enterprise is not properly involved in the enterprise, it will lead to the dissatisfaction of employees to the management, which will deepen the disagreement between the enterprise mergers and acquisitions and the employees[3,5,6]. Finally, the value assessment of the acquired company is the main risk for enterprises in conducting M&A activities, which will directly affect the interests of the acquiring enterprise. From the internal viewpoint of the firm, argues that the cost of acquiring the firm is too high due to the lack of rigour and the concealment of information about the firm's risk data by the evaluators [3,5]. From the external environment, transnational political laws and financial markets are different from our country, and there is a lack of information that can easily cause risks.

2.Sany Heavy Industry's cross-border mergers and acquisitions case profile

Sany Group's M&A process has been very fast, starting with Putzmeister's invitation to Sany Heavy Industry to make a bid in December 2011, and then the two sides handled the delivery of equity transfer in April 2012, which took four months to reach an M&A deal of about RMB 3 billion.

The final merger and acquisition programme is, Sany Heavy Industry through the period of holding subsidiary SANY GERMANY GMBH joint CITIC fund company, with 360 million euros to the two major shareholders of the Putzmeister company to buy 100% of the shares, to obtain the Putzmeister company trademarks, franchises and know-how.

Table 1: The whole process of Sany Heavy Industry's acquisition of Putzmeister

|

Times |

Merger and Acquisition (M&A) process |

|

20 December 2011 |

Putzmeister visits Sany and expresses bid offer |

|

21 December 2011 |

Putzmeister visits Zoomlion to unify bid offers |

|

22 December 2011 |

Zoomlion submitted an official document to the Development and Reform Commission of the Hunan Provincial Party Committee for declaration. |

|

23 December 2011 |

Putzmeister sends out formal invitations to bid to the companies |

|

30 December 2011 |

Zoomlion receives approval from the National Development and Reform Commission for the acquisition of Putzmeister ahead of Sany Heavy Industries. |

|

January 2012 |

Sany Heavy Industries Chairman Liang Wengen writes to Putzmeister founder to express sincerity and determination to acquire the company |

|

21 January 2012 |

The parties announced the signing of a merger agreement |

|

30 January 2012 |

Sany Heavy Industry announced that Sany's controlling subsidiary, jointly with CITIC Fund Corporation, acquired 100% of the equity of Putzmeister with 360 million euros, of which Sany Heavy Industry acquired 90% of the equity, with a capital contribution of about 324 million euros |

|

July 2013 |

Trinity International acquired a 10 per cent stake held by CITIC Funds to achieve full control |

Source: Sany Heavy Industry Company Announcement, Internet

3.Analysis of post-merger effects

Sany Heavy Industry in the completion of the merger and acquisition of Putzmeister company for a period of time after the adjustment and integration, rectify the industrial chain as well as domestic and foreign management mode of mutual integration, in the domestic and international market complementary at the same time, the core competitiveness of the enterprise has been improved substantially.

3.1.Core competence enhancement

Putzmeister is a "Made in Germany" product label representing the world's top technology and a leading brand in the global construction machinery industry. Through the acquisition of Putzmeister, Sany Heavy Industry can further increase its market share in overseas markets by leveraging on its part of the market share in the high-end markets of Europe and the United States and its existing resources in the relevant fields. Increase market share.

M&A of Putzmeister not only enables Sany Heavy Industry to get the right to use Putzmeister's advanced technology, at the same time, because Putzmeister has accumulated rich experience in international operation and management, Sany Heavy Industry's management organisation can quickly adjust and optimise its own structure, so as to enable Sany Heavy Industry to avoid trade barriers in sales in overseas markets, to expand its scale, to develop the layout of the international market, and to continuously improve the structure of product exports.

3.2.Enhancing overall technological innovation capacity

The acquisition of Putzmeister is not only to get the brand value and supply chain, but also to be able to absorb more advanced technology resources, and provide better products and services through the technology complementarity between Sany and Putzmeister. The rapid acquisition of high-end technology patents will enable Sany to reduce the cost and time on the research and development of high-end products, so that the cost savings can be invested in the conversion of product results and sales methods.

Sany accelerated its technological innovation by rapidly acquiring technology patents, effectively reducing R&D costs. Within two years of completing the acquisition (2012-2013), Sany Heavy Industry developed a number of high-performance concrete machinery products, expanding its products from low-end to high-end. As of 30th June 2013, after Sany Heavy Industry fully merged with Putzmeister, the total number of patents applied for by Sany Group reached 6,710, with 4,438 patents authorised, which ranked first in the industry.

4.Post-merger analysis of corporate financial performance and internationalisation levels

Table 2: Relevant data of Sany Heavy Industry and construction machinery industry

|

vintages |

Sany Heavy Industry Operating Income (RMB billion) |

Net profit for the year ($ billion) |

Overseas revenue ($bn) |

Global market share |

Total sales revenue of China's construction machinery industry (billion yuan) |

|

2013 |

373.28 |

29.03 |

108.74 |

3.70 % |

5663 |

|

2014 |

303.65 |

7.09 |

98.22 |

3.40 % |

5175 |

|

2015 |

233.67 |

1.39 |

100 |

2.50 % |

4570 |

|

2016 |

232.8 |

2.03 |

92.86 |

2.80% |

4795 |

|

2017 |

383.35 |

20.92 |

116.18 |

3.70% |

5403 |

|

2018 |

558.22 |

61.16 |

136 |

4.60 % |

5954 |

|

2019 |

756.65 |

112.07 |

141.67 |

5.40 % |

6681 |

|

2020 |

993.42 |

154.31 |

141.04 |

7.50 % |

7751 |

|

2021 |

1061.13 |

120.33 |

248.46 |

7.50 % |

9065 |

|

2022 |

808.22 |

42.73 |

365.71 |

7% |

8353 |

Source: Sany Group's financial report, KHL Group, China Construction Machinery Industry Association.

From Table 2, it can be found that after the cross-border merger and acquisition, due to the shrinkage of global market demand as well as the use of a large amount of cash payments after the merger and acquisition and the industry downturn, so it led to Sany Heavy Industry's operating income as well as the annual net profit fell off a cliff. From the above table analysis can be found, operating income fell from 37.328 billion yuan in 2013 to 30.365 billion yuan in 2014, while the annual net profit fell from 2.903 billion yuan in 2013 to 709 million yuan in 2014, a drop of 75.58%. This is only just mergers and acquisitions within a year, in the past two years in 2015 and 2016, Sany Heavy Industry's operating income and net profit fell to the bottom of the decade, indicating that Sany Heavy Industry in the mergers and acquisitions in the three years are in the friction and exploration stage. With the rebound of the industry, and the company's continuous integration of resources and the improvement of the supply chain, Sany Heavy Industry achieved a 930.54% increase in net profit within 2017, but also in 2020 reached the highest net profit in the past decade, and in 2021 reached the highest operating income. Accompanied by the liberalisation policy of the new crown epidemic, the recovery of the global construction machinery market until the first half of 2023, Sany Heavy Industry released on 31 August The half-yearly performance report said that the operating income of the first half of the year was about 39.49 billion yuan, and the net profit was about 3.4 billion yuan. This also shows that Sany Heavy Industry has a strong regulating ability, and can achieve the re-improvement of the operating capacity in a year's time.

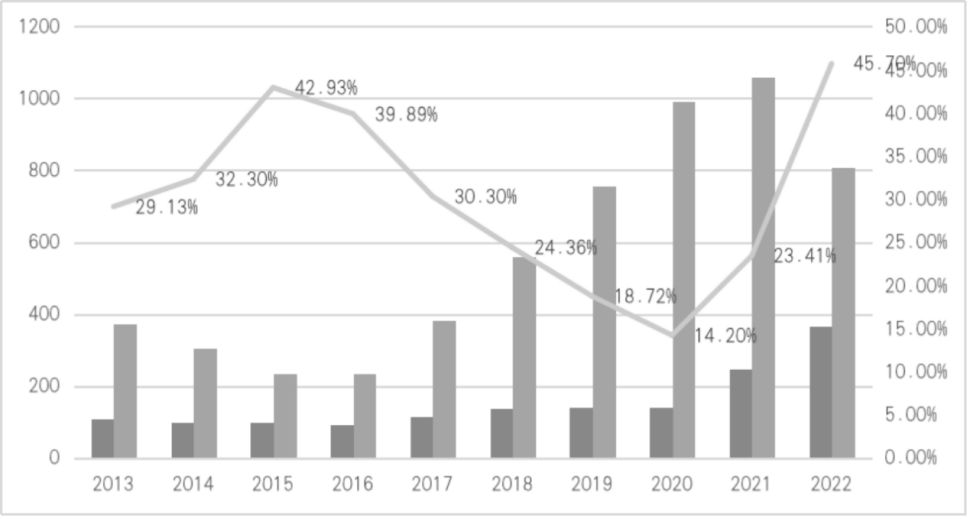

Figure 1: Trends in the degree of internationalisation

(The dark line represents international income, the light line represents total operating income, and the broken line represents the international income ratio)

Source: Sany Group of Companies Financial Reports, KHL Group, UK

In the above Table 2 and Figure 3, it can be seen that Sany Heavy Industry's internationalisation trend has obvious fluctuations, from 2013 to 2015 into an upward trend, followed by a slow decline in the following year, and then a sharp decline within 2016-2020, and then a sharp increase in 2020-2022. In the year of the merger and acquisition of Putzmeister, in 2013, Sany Heavy Industry's overseas revenue accounted for 29.13%, in the international market share reached 3.70%, after that, overseas revenue accounted for an increase year by year, to 2015, Sany Heavy Industry in the three years after the merger and acquisition of overseas revenue accounted for the highest value of 42.93%, after that overseas revenue accounted for a continuous decline. With the continuous adjustment of the international construction machinery market, Sany Heavy Industry's overseas revenue share in 2020 reached a ten-year low of 14.20%, but the actual overseas revenue reached 14.104 billion yuan, and its share of the global market reached a ten-year high of 7.5%. On the contrary, during the period of 2014-2016, although the internationalisation level of Sany Heavy Industry increased, due to the consumption of a large amount of funds brought by cross-border mergers and acquisitions as well as the market downturn, Sany Heavy Industry's operating income during these three years was also the lowest level in a decade. After 2020, Sany Heavy Industry's overseas income and the proportion of overseas income have increased substantially, and in 2022 overseas income reached 36.571 billion yuan, accounting for 45.70%.

Combined with the comparison of the data during and after the cross-border merger and acquisition, it can be found that the internationalisation level of Sany Heavy Industry has increased substantially. After acquiring Putzmeister, Sany Heavy Industry got Putzmeister's international market share, absorbed Putzmeister's advanced technology and excellent management experience, and the enterprise's international competitiveness was greatly enhanced while reducing costs.

Cross-border mergers and acquisitions to promote the ultimate goal of internationalisation is to increase the enterprise's operating income and net profit, Sany Heavy Industry's international income ratio increased significantly when the operating income is gradually reduced, this is due to the impact of the domestic fixed assets slowdown, resulting in Sany Heavy Industry's operating income and net profit began to decline. But because of the success of the internationalisation strategy of Sany Heavy Industry, it is able to ensure the continuous improvement of the global market share, and can make up for the decline of the domestic market operating income through the operating income of the international market when the domestic construction machinery market enters into a downturn. Combined with the operating income, net profit and global market share of Sany Heavy Industry in the past decade, the cross-border merger and acquisition is successful.

5.Conclusions

This paper reviews the cross-border M&A case of Sany Heavy Industry's acquisition of Pulsmeister in 2012, and concludes the pros and cons of improving the internationalisation of enterprises through the method of cross-border M&A by analysing and studying the case. Combined with the financial performance analysis of Sany Heavy Industry from 2013-2022, the main conclusions are as follows:

Sany owns Putzmeister's advanced technology, international management experience and global construction machinery market share after acquiring the company. Sany improves its core competitiveness by perfecting its global online sales network and realises complementary domestic and international markets through Putzmeister's brand value.

In terms of internationalisation, Sany Heavy Industry's international revenue has risen significantly, with international revenue accounting for 29.13% at the time of the merger and acquisition, and peaking at 45.70% in 2022 within ten years after the merger and acquisition, providing a boost to the company's development of the overseas market, which can also provide a boost to the company's ability to make up for the decline in sales revenues of the domestic market through the international market when the sales of the domestic market are in the doldrums and to enhance the enterprise's ability to regulate in a counter-cyclical manner, and to Reduce the operating pressure of the enterprise in the counter-cycle.

In terms of financial performance, in the three years after the acquisition of Putzmeister, the merger and acquisition did not bring Sany Heavy Industry to improve operating income but rather reduced, just the opposite of the increase in the degree of internationalisation. Because after the merger and acquisition, the enterprise needs to consume a lot of money to improve its own industrial chain, as well as a lot of manpower to grind and adjust the integration of the internal management of the enterprise. In a short period of time, a large number of manpower, material and financial resources consumption is very test of the enterprise's capital turnover rate, if the enterprise in this period of time does not deal with their own funds and debt problems, which will also lead to corporate bankruptcy.

References

[1]. Wang H.(2022). Research on the impact of cross-border mergers and acquisitions on internationalization and financial performance of Sany Heavy Industry (Master's thesis, Zhongnan University of Economics and Law).

[2]. Yu N. (2019). Research on the Influencing Factors of China's Export Trade of Construction Machinery Products (Master's thesis, University of International Business and Economics).

[3]. Yang M. (2021). Analysis and Implications of Sany Heavy Industry's Business Strategies in the Context of Economic Downturn (Master's thesis, Xinjiang University of Finance and Economics).

[4]. Gao G. (2021). Research on the Foreign Trade Potential of China's Construction Machinery (Master's thesis, Guangxi University for Nationalities).

[5]. He J. (2022). A Review of Research on the Motivation and Risk of Corporate Cross-border Mergers and Acquisitions. Mall Modernization (18), 74-76.

[6]. Li X. (2020). Study on the Influencing Factors of China's Export Trade of Construction Machinery Products (Master's thesis, Shenzhen University).

Cite this article

Jiang,C. (2024). The Impact of Mergers and Acquisitions on the Internationalisation Level of Enterprises--The Case of Sany Group. Advances in Economics, Management and Political Sciences,73,66-71.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wang H.(2022). Research on the impact of cross-border mergers and acquisitions on internationalization and financial performance of Sany Heavy Industry (Master's thesis, Zhongnan University of Economics and Law).

[2]. Yu N. (2019). Research on the Influencing Factors of China's Export Trade of Construction Machinery Products (Master's thesis, University of International Business and Economics).

[3]. Yang M. (2021). Analysis and Implications of Sany Heavy Industry's Business Strategies in the Context of Economic Downturn (Master's thesis, Xinjiang University of Finance and Economics).

[4]. Gao G. (2021). Research on the Foreign Trade Potential of China's Construction Machinery (Master's thesis, Guangxi University for Nationalities).

[5]. He J. (2022). A Review of Research on the Motivation and Risk of Corporate Cross-border Mergers and Acquisitions. Mall Modernization (18), 74-76.

[6]. Li X. (2020). Study on the Influencing Factors of China's Export Trade of Construction Machinery Products (Master's thesis, Shenzhen University).