Volume 234

Published on October 2025Volume title: Proceedings of ICFTBA 2025 Symposium: Global Trends in Green Financial Innovation and Technology

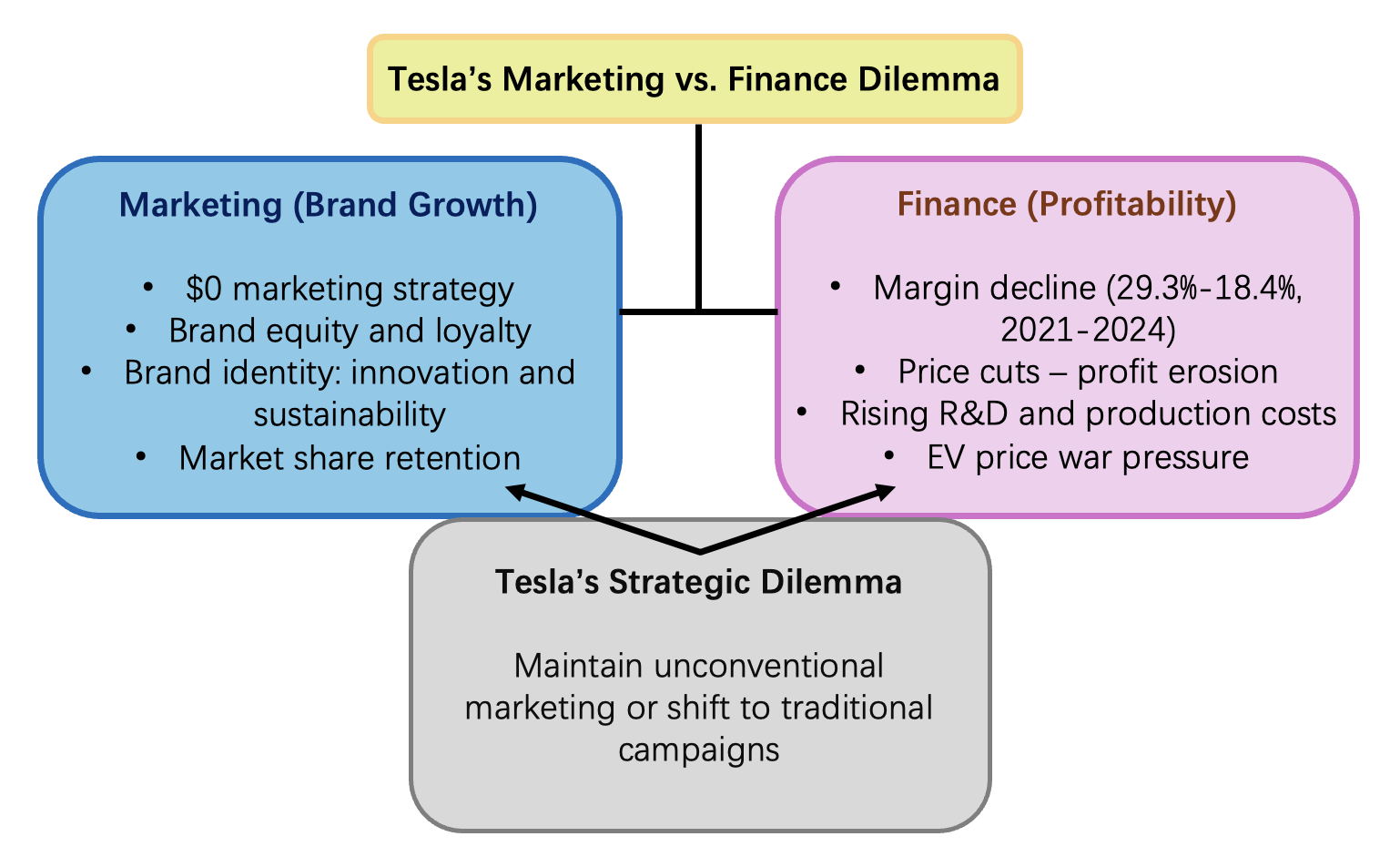

This paper examines the evolving dynamics of Tesla’s marketing strategy in the context of growing financial pressures and intensifying market competition. Tesla’s distinctive “zero-dollar marketing strategy”, driven by product innovation, commitment to sustainable energy, Elon Musk’s influence, and viral brand moments, has historically created strong brand equity without traditional advertising expenditure. However, declines in the company’s automotive gross margin of recent years reflect the significant impact of global EV (electric vehicle) price wars, heightened competition, and changing consumer demands. Focusing on the tradeoffs between maintaining unconventional marketing model and embracing more traditional approaches that align with the innovative brand identity, this paper delves into Tesla’s dilemma in balancing brand growth with financial health. Through an analysis of Tesla’s segmentation, targeting, and positioning, as well as multiple financial metrics, the study suggests that strategic recalibration is necessary. A series of initiatives are recommended, including prioritizing market share retention while increasing cost efficiency, structuring storytelling-based campaigns to communicate technological superiority and sustainability ethos, and closely monitoring balanced KPIs across finance and marketing. In summary, Tesla’s capacity to adapt its marketing efforts without compromising brand authenticity is vital for sustaining leadership in the EV industry and achieving long-term profitability.

View pdf

View pdf

Blockchain technology is reshaping economic activities globally, with significant potential across healthcare, finance, and supply chain management. Despite regulatory and adoption challenges, it is a disruptive innovation. According to IDC's "2021 V1 Global Blockchain Spending Guide," the global blockchain market is projected to reach $18.95 billion by 2024, with a CAGR of approximately 48.0% during 2020-2024. This study explores the current application status of blockchain technology in the global economy. It integrates SWOT analysis models with case studies and market reports to examine the strengths, weaknesses, opportunities, and challenges of blockchain technology. Based on economic competition theories such as effective competition theory and Porter's competitive theory, the research analyzes how blockchain can gain advantages in intense market competition. It identifies potential opportunities in the global blockchain market over the next five years from technology, industry, and application scenario perspectives. The study provides a holistic assessment of blockchain's application status, offering valuable insights for policymakers and entrepreneurs.

View pdf

View pdf

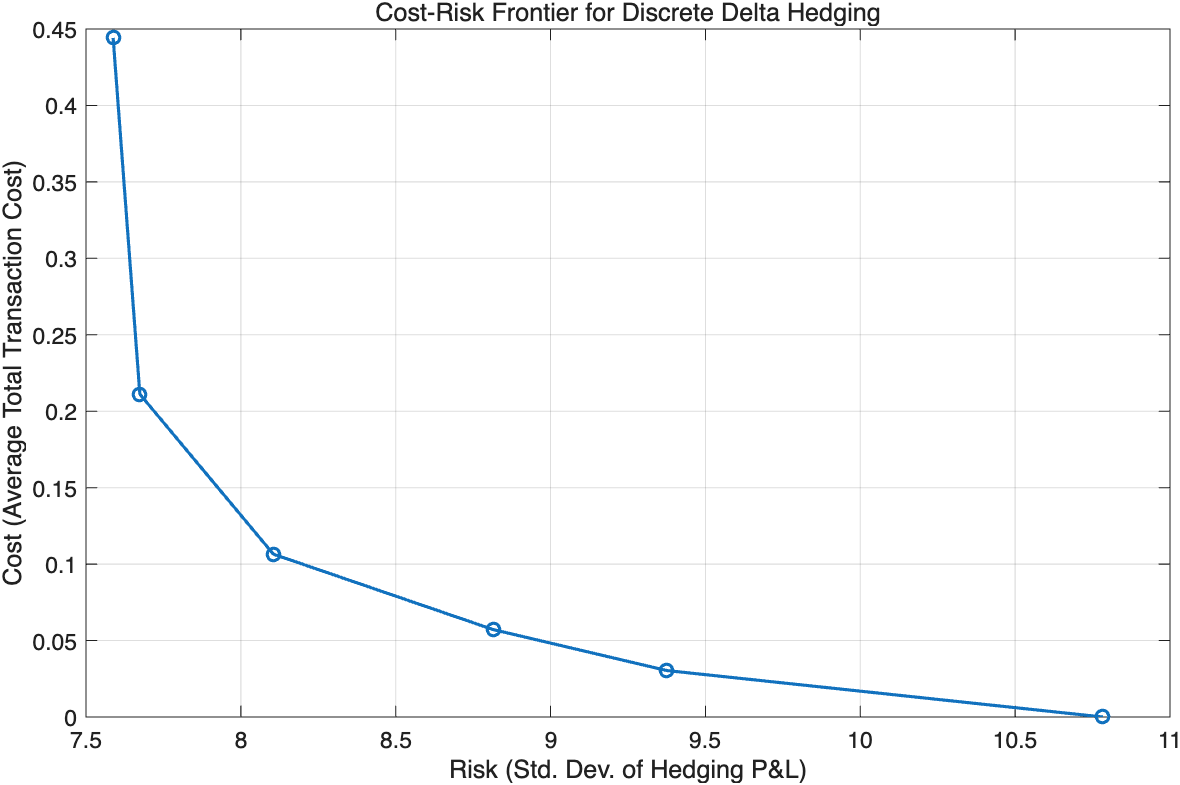

Delta hedging is a fundamental strategy in options risk management, relying on continuous adjustment of a replicating portfolio to eliminate risk. However, real markets exhibit features such as stochastic volatility and jumps that violate the assumptions of the Black–Scholes model, rendering perfect replication impossible and the market incomplete. In such cases, hedging can only reduce risk at best, and frequent rebalancing incurs significant transaction costs. This article investigates discrete delta hedging under stochastic volatility and jump-diffusion dynamics, quantifying the trade-off between hedging cost and risk reduction via Monte Carlo simulation. We construct a cost–risk frontier, analogous to an efficient frontier, that shows the minimal achievable risk for a given cost (and vice versa). The results demonstrate that increasing the hedge frequency (trading more often) generally lowers the variance of hedging errors but at a rapidly diminishing rate and with higher accumulated costs. Even with very frequent rebalancing, a residual risk remains due to jumps and unhedgeable volatility fluctuations. We discuss how this frontier can inform optimal hedging policies, balancing transaction costs against risk appetite, and we compare our findings with prior theoretical and empirical studies.

View pdf

View pdf

In the VUCA era, supply chain disruptions are increasingly frequent and severe, posing significant challenges to global manufacturing industries. This study investigates the application and challenges of emerging technologies, particularly digital twin (DT) technology, in supply chain risk management through a qualitative case study approach. Focusing on six manufacturing enterprises, three of which have deployed DT and three still rely on traditional models, this research aims to reveal the practical effectiveness and implementation obstacles of DT technology in risk identification, assessment, and response stages. Traditional risk management methods, often based on periodic assessments and static contingency plans, have proven inadequate in addressing sudden global crises, as exemplified by the 2023 Red Sea crisis's impact on the European automotive industry. This study employs document analysis of enterprise risk reports, audit records, and emergency response plans to demonstrate how DT technology can transform risk management into a proactive, predictive strategy. The findings show that DT technology enhances supply chain resilience by enabling real-time risk perception, dynamic simulation, and automated response. However, the adoption of DT technology also faces challenges such as organizational division, financial barriers, and human resistance to change. This research provides actionable guidelines for enterprises to navigate the complex path of digital transformation and offers a low-tech threshold risk management upgrade path, especially for small and medium-sized manufacturers.

View pdf

View pdf

Prior research on human–algorithm interaction has largely highlighted algorithm aversion, showing that consumers often resist algorithmic advice due to insufficient trust and skepticism about algorithms’ capabilities in complex and subjective tasks. In contrast, evidence on algorithm appreciation is relatively limited and primarily observed in functional contexts, where algorithms are valued for superior accuracy or efficiency. Little is known about whether algorithm appreciation may also emerge in non-functional consumption contexts, particularly in symbolic–spiritual consumption. Such consumption is process-oriented, uncertain, and highly subjective, often occurring in low social visibility and introspective situations. In these settings, consumers seek instrumental utility, psychological comfort, and emotional reassurance. This study investigates whether consumers prefer AI advice over humans in symbolic–spiritual consumption and examines the underlying psychological mechanisms. A survey-based experiment demonstrates that AI enhances consumers’ psychological safety, increasing advice adoption intention. These findings highlight that algorithm appreciation can also arise from psychological mechanisms beyond functional advantages, while offering practical implications for the application of AI in symbolic consumption contexts.

View pdf

View pdf