1. Introduction

Tesla, Inc., founded in San Carlos, California in July 2003 by Martin Eberhard and Marc Tarpenning, was established with the ambitious mission to accelerate the world’s transition to sustainable energy [1]. Since the establishment especially the join of Elon Musk as CEO, Tesla’s innovative efforts swiftly redefined the automobile industry, advancing traditional car making towards global sustainable development goals [2]. Under Elon Musk’s leadership, the company has grown from a niche startup, who survived the financial crisis of 2008, into today’s leading force in the EV (electric vehicle) industry [2, 3]. Reviewing its successful history, Tesla launched its first Roadster in 2008, followed by its IPO on Nasdaq in 2010 then the launch of the groundbreaking Model S. Since then, Tesla’s product portfolio has grown significantly to encompass a series of high-performance EVs including the Model 3, Model X, Model Y, and the Cybertruck, along with green energy solutions such as home solar panels and Powerwall batteries [4]. This vertical model that integrates in-house product designing, manufacturing, selling, and services has enabled Tesla to keep control of its offerings and user experience [4].

One of the key factors behind Tesla’s rise is its “zero marketing strategy”, which means deliberately discarding traditional advertising methods. Instead, the company has successfully established a huge brand equity through relentless product innovation, Elon Musk’s highly influential and often bold persona, as well as viral marketing moments such as launching a Roadster into space [5]. This strategy, combined with a direct-to-consumer sales model that bypasses the traditional dealerships, has created a powerful and authentic brand image and established a prominent position in the global automobile industry [6]. Tesla has now become synonymous with technological progress and a forward-looking vision of transportation [7]. Such a strategy echoes with Keller’s customer-based brand equity (CBBE) model in nurturing a powerful brand identity [8]. Consumers contribute to the forming of positive judgements based on Tesla’s innovative attributes, seeing it as a leader in technology and sustainability [7]. The deep emotional connection created by Tesla via social media further turns into strong brand resonance that solidifies the loyalty of customers who would actively advocate for the brand through word-of-mouth and online community engagement [9].

2. Financial context

Tesla’s financial performance over the past few years tells a story of rapid growth accompanied by evident challenges. Although total revenues saw impressive increase from $53.8 billion in 2021 to $81.5 billion in 2022, $96.8 billion in 2023 and $102.0 billion in 2024, the company’s profitability has been affected by the pressure [4, 10-12]. According to its annual reports, within recent years, Tesla’s gross margin total automotive has declined from 29.3% in 2021 to 19.4% in 2023 [12]. Such a decline is primarily attributed to lower average selling price for its vehicles resulted from overall price reductions, changes in sales mix, and the strengthening U.S. dollar against other currencies [4, 12]. Despite this, alongside the total revenue growth, net income attributable to common stockholders has also increased owing to factors like a significant non-cash tax benefit [12].

However, the evident pressure in the automotive segment cannot be ignored. The impact on profitability metrics is significant. Article in The New York Times reported that, as a direct consequence of lower average price derived from fierce competition in EVs, despite Tesla’s profit in Q4, 2023 doubled to $7.9 billion from $3.7 billion of the previous year, $5.9 billion of it was from a tax benefit which was a one-time effect, and actual profit would have fallen without it [13].

Beyond the core business headwinds, Tesla has found relief in other segments. For example, in fiscal year 2024 there was a 54% increase in automotive regulatory credits and a 67% surge in revenue of energy generation and storage segment compared to 2023 [4]. Meanwhile, the company proactively invests in future growth, with Research and Development (R&D) expenses rising by 29% in 2023 and 14% in 2024 primarily driven by costs for AI, Cybertruck and other programs [4, 12].

3. Finance analysis

According to its recent annual reports, Tesla’s gross margin total automotive has declined from 28.5% in 2022 to 18.4% in 2024 (total gross margin has also fallen from 25.6% to 17.9% considering other segments), driven primarily by price reductions and costs of Cybertruck ramp-up [4, 11, 12]. It is clearly observed that the automotive gross margin slump to 19.4% in 2023 occurred consistently with wide-ranging price cuts [12]. Cost of automotive sales revenue is impacted by multiple factors such as materials, labor, FSD (Full Self-Driving) (Supervised) ongoing maintenance costs, electricity costs for free Supercharging programs, etc. [4]. While competitive pressures intensified as rivals constantly launching new EVs, Tesla has partially offset gross margin pressures by revenues from automotive regulatory credits and updatable features like FSD (Supervised) [4, 11, 12].

Furthermore, evident price elasticity can be seen in demand responsiveness to financing options and model updates. For example, Tesla’s provision of financing options since 2022, such as the 0% APR (annual percentage rate) financing deal for qualified buyers, has significantly driven sales (1.8 million vehicle unit sales in 2023, a 35% increase from 2022) despite the eroded profit margin [11-14]. Overall, dynamics in financial metrics highlight Tesla’s efforts to balance between retaining market share and increasing profitability.

4. Market challenges

The primary challenge faced by Tesla is the increasingly intensifying competition in the electric vehicle market. This industry is close to being saturated as automotive giants like BYD, General Motors, Ford, Volkswagen, and Hyundai are expanding their EV portfolios [13, 15]. These traditional manufacturers’ reduction in prices may compel Tesla to cut prices to defend its market share and increase investment in more affordable vehicles for the mass market [16].

Catering to the price war has made a clear and negative impact on profitability. As noted, Tesla’s gross margin total automotive slumped from 28.5% in 2022 to 19.4% in 2023 and remained 18.4% in 2024 [4]. This reflects the pressure brought by not only the U.S. competitors but also the international ones, especially Chinese EV companies who can benefit from government subsidies, tax relief and consumer incentives [3]. As an increasing number of new entrants join the market, Tesla has no choice but to compromise on pricing power and profit to win living room [3]. Overall, increasing competition and market saturation cause a substantial threat to the company’s long-term market share and financial performance.

5. Marketing analysis

Prioritizing innovation, sustainability, and customer experience, Tesla’s marketing can be examined by the STP (Segmentation-Targeting-Positioning) principles, which should be further applied to its new products in a more competitive setting [6, 17].

5.1. Segmentation

Tesla primarily bases its market segmentation on clear customer perceptions, demographic profiles, and lifestyle factors [6]. “Tesla enthusiasts” with strong positive perceptions and great interest in battery electric vehicles account for the largest proportion. Beyond this, the company also targets consumers with environmental consciousness and those keen on innovation and advanced technology, who reinforce its mission of accelerating the world’s transition to sustainable energy [1, 6, 18]. For instance, Tesla has successfully targeted thousands of environmentalists who have solid emotional connection and user stickiness with it by means of trendy brand orientation, not to mention its identification of early and late adopter segments for its strategic approach [18, 19].

5.2. Targeting

Tesla strives to maintain its leadership role in EV technology and renewable energy, building its brand identity around innovation, technology and environment [6]. As discussed, it primarily targets consumers who embrace sustainable technologies and environment-oriented ways of life. Residing its market strategy in unwavering commitment to these areas, Tesla is constantly introducing innovative features such as Autopilot and over-the-air software updates that extend the automotive technology boundaries and shape collective consciousness [6]. Moreover, Tesla’s direct-to-consumer selling model has given itself irreplaceable authority over customer experiences, cultivating a customer-centric culture that activates word-of-mouth marketing and community engagement [6]. The influential charisma of CEO Elon Musk, recognized as Tesla’s biggest asset, further contributes to building public awareness globally and is pivotal to the success of its “zero-dollar” marketing strategy [5].

5.3. Positioning

Tesla has been cultivating its distinct brand identity, positioning its EVs as embodying the “futuristic transportation” concept [6]. Beyond mere utility of a traditional car maker, Tesla positions itself as a leading automotive technology and sustainable energy innovator. This position is consolidated by its unwavering emphasis on innovation and commitment to product quality and user experience [6, 15]. Aligning itself with the EV movement, Tesla has grown into a go-to choice for electric vehicles [6]. Thanks to its superior technologies in battery and autonomous driving, Tesla holds a relatively monopolistic position in the EV market [15]. To drive growth, it continuously invests in R&D and new products, maintaining its core competencies while diversifying product portfolio and market reach [20]. Despite the success of its unconventional marketing, intensifying competition is leading to the rethink of its strategy and the actions including price cuts, launching new products like home solar energy systems, and extending services like personalized automobile insurance, to targets broader segments [4, 15, 20].

6. Marketing vs. finance dilemma

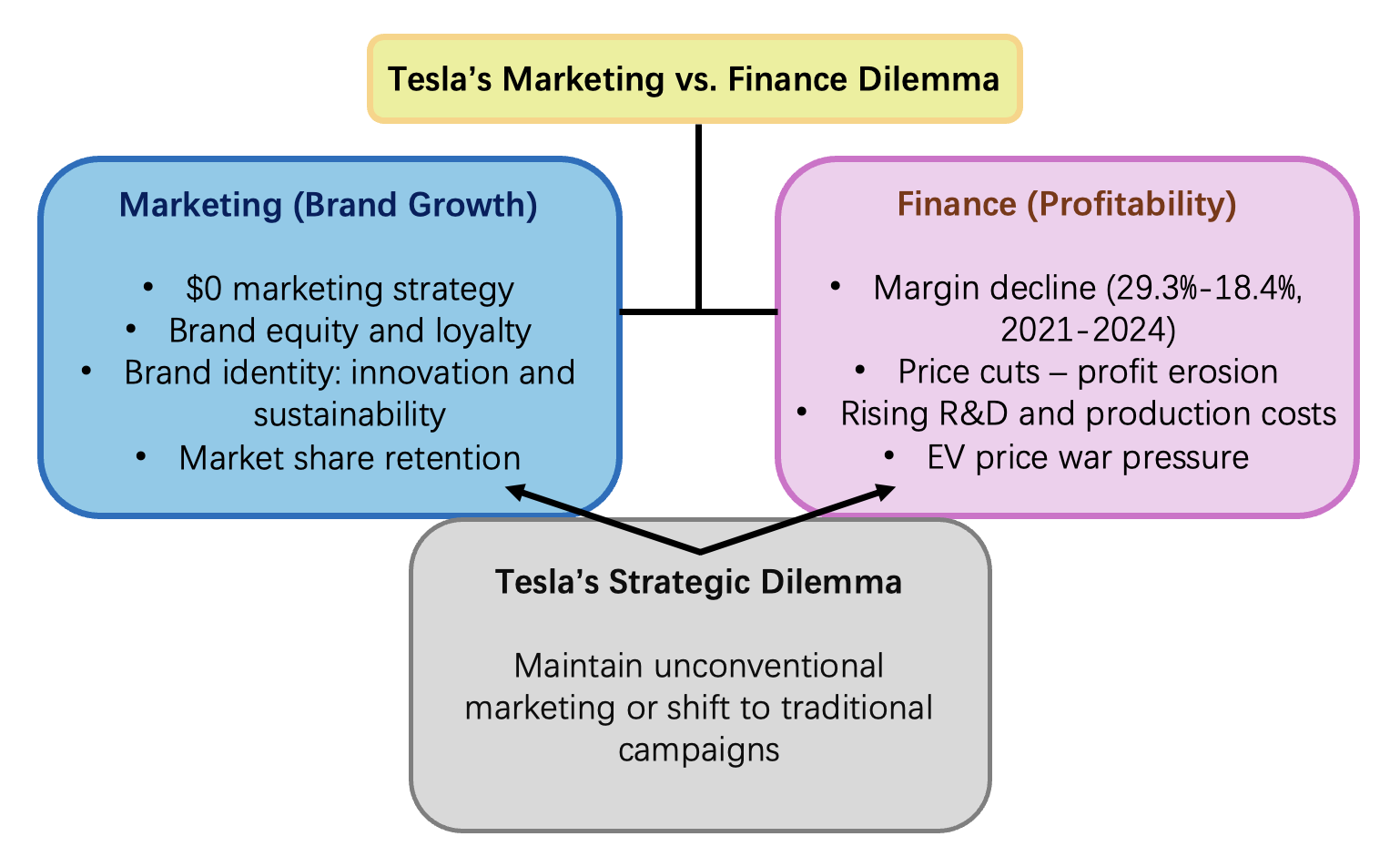

Tesla’s operation is now standing at a crossroads, which urges proactive actions to ease the tension between its unconventional marketing approach and the demands of financial health. Historically, its “$0 marketing strategy” was remarkable, successfully driving market demand and building a visionary brand on product innovation and Elon Musk’s personal charisma without paid advertising like its rivals [5]. This approach gave opportunity to increased investment in R&D and production improvement that fuel its growth.

However, the current market situation is challenging this model. To maintain its competitiveness, Tesla must implement price cuts which is a financial measure with direct marketing implications. On the other hand, it will erode the profitability that was designed to be protected by the company’s unique marketing strategy [15, 18]. This put Tesla in an obvious dilemma, as illustrated in Figure 1. Should Tesla abandon its unconventional way of brand-building and invest in conventional marketing to defend its position against aggressive competitors, or should it insist on its organic growth with novel marketing and flexible pricing actions, facing the risk of further undermined profit margins or loss of market dominance [4, 5]? The tricky point is the difficulty in tradeoffs between short-term financial growth with higher margins and long-term market share of brand [3]. The mention of “tailor our marketing efforts accordingly……through investments in customer education and advertising as necessary” in its annual reports reveals the company may already be prepared to make changes to its long-standing strategy [4, 12].

7. Recommendations

To effectively address the current challenges, Tesla should adopt a multi-faceted approach that considers innovation, strategic marketing, and financial health in a balanced way. This requires a nuanced calibration of priorities between market share and profitability, empowered by targeted measures and consistent performance monitoring.

7.1. Prioritizing market share with an eye on profitability

Over the next three years, Tesla should strategically prioritize market share retention, as its long-term influence and economies of scale depend on this. The dramatic decline in gross margin total automotive throughout 2023 underscores the financial implications of the price war in the EV market [12, 13]. However, in a rapidly evolving market, ceding ground to competitors could have more adverse effects in the long run [4, 13].

This strategy should involve accepting slightly lower margins in the short term to secure its leading position, while simultaneously seeking new growth opportunities through deliberated branding strategies for new products and pursuing aggressive cost reductions through upgraded battery technology, increased commonality of parts, improved production innovation and efficiency, better logistics management, and appropriate operating leverage [3, 4, 15, 20].

7.2. Adapting the market strategy

As noted, Tesla’s brand identity is one of its most valuable assets. If it plans to implement more conventional marketing strategy, it should make the actions align with its innovative image.

Instead of imitating traditional car advertising, Tesla should feature its campaign on storytelling, highlighting its technological superiority (e.g. Autopilot, FSD, battery cells), commitment to sustainability, and the unique user experience [1, 4]. Leveraging endorsements by influencers with technology expertise or inviting credible technology and automotive reviewers to conduct and disseminate transparent, data-driven tests on social media would be consistent with the brand’s identity of engineering excellence [6].

Marketing can also establish deeper emotional connections by linking the brand to memorable cultural moments and values [21]. Creating unique product messages and designs that resonate with diverse audiences can enable a clearer brand ethos that goes beyond just product technical parameters and becomes deeply ingrained in people’s minds, being particularly important for emerging products like electric motorcycles and humanoid robots [20].

7.3. Monitoring Key Performance Indicators

To ensure evolved marketing efforts contribute to financial health, the company should monitor a balanced set of Key Performance Indicators (KPIs), which are as shown in Table 1.

|

Category |

Indicator |

Explanation |

|

Financial KPIs |

Gross Profit Margin |

To track the direct effects of pricing and cost-saving measures |

|

Customer Acquisition Cost |

Crucial for evaluating the efficiency of any paid marketing campaigns |

|

|

Return on Equity and Earnings per Share |

To assess the overall profitability from a holistic view |

|

|

Marketing and Brand KPIs |

Market Share |

The primary criterion for measuring competitiveness |

|

Brand Awareness and Reputation |

Can be monitored through public surveys and media sentiment analysis |

|

|

Customer Engagement and Loyalty |

Can be measured by repeat purchase rate, the success of referral programs, and interactions in the online community |

8. Conclusion

In conclusion, Tesla is standing at a critical juncture that urges it to navigate the inherent tension between its unconventional zero-marketing strategy and the pressure to defend financial health amidst the intensifying market competition. While its unique marketing approach has succeeded in building a powerful brand and loyal customer community, price wars in the EV market and consequent profit erosion suggest quick actions in strategic recalibration. Recommended initiatives involve an integrative focus on market share retention through competitive pricing and cost-efficiency improvement, while adapting marketing efforts subtly to highlight its innovative ethos without compromising brand authenticity. By conducting targeted campaigns and closely monitoring selected KPIs, Tesla will be on the right track to maintain its leadership role in the global marketplace and achieve its long-term vision. This strategic agility, in a word, is essential to support Tesla’s mission of accelerating the global transition to sustainable energy.

References

[1]. Tesla. (n.d.). About us. Tesla Official Website. https: //www.tesla.com/about

[2]. Liu, C., Boothman, S.G. and Graham, J.D. (2025) The rise and recent decline of Tesla’s share of the U.S. electric vehicle market. World Electric Vehicle Journal, 16(2), 90. https: //doi.org/10.3390/wevj16020090

[3]. Zhang, Z. (2025) An analysis of Tesla’s development and profitability. In: Proceedings of the 8th International Conference on Economic Management and Green Development. Advances in Economics, Management and Political Sciences, 131, 108-113. https: //doi.org/10.54254/2754-1169/2024.18426

[4]. Tesla. (2025). Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2024. Tesla, Inc. https: //www.sec.gov/Archives/edgar/data/1318605/000162828025003063/tsla-20241231.htm

[5]. Agarwal, V. and Bangeja, H. (2022) Analysing Tesla’s $0 marketing strategy. International Journal for Multidisciplinary Research, 4(6), 1-8. https: //doi.org/10.36948/ijfmr.2022.v04i06.1080

[6]. Li, Y. (2023) Analysis of Tesla’s marketing strategy model. In: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis. Advances in Economics, Management and Political Sciences, 54, 33-39. https: //doi.org/10.54254/2754-1169/54/20230873

[7]. Long, Z. et al. (2019) What does Tesla mean to car buyers? Exploring the role of automotive brand in perceptions of battery electric vehicles. Transportation Research Part A, 129, 185-204. https: //doi.org/10.1016/j.tra.2019.08.006

[8]. Teodorovic, M. (2015) Impact of sustainability on brand positioning and value. In: Stakic, A.J., Kovsca, V. and Bendekovic, J. (Editors). Varazdin Development and Entrepreneurship Agency, Varazdin, Croatia and University North, Koprivnica, Croatia, Megatrend University, Belgrade, Serbia, Economic and Social Development (Book of Proceedings), 5th Eastern European Economic and Social Development Conference on Social Responsibility, 291-300.

[9]. Aeternus. (2025). Driving innovation: Tesla’s marketing strategy and its impact on electric vehicle adoption. Aeternus Website. https: //www.aeternus.rs/driving-innovation-teslas-marketing-strategy-and-its-impact-on-electric-vehicle-adoption/

[10]. Tesla. (2022). Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2021. Tesla, Inc. https: //www.sec.gov/Archives/edgar/data/1318605/000095017022000796/tsla-20211231.htm

[11]. Tesla. (2023). Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2022. Tesla, Inc. https: //www.sec.gov/Archives/edgar/data/1318605/000095017023001409/tsla-20221231.htm

[12]. Tesla. (2024). Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2023. Tesla, Inc. https: //www.sec.gov/Archives/edgar/data/1318605/000162828024002390/tsla-20231231.htm

[13]. Ewing, J. (24 Jan 2024). Tesla profit from car sales falls as price cuts hurt. The New York Times. https: //www.nytimes.com/2024/01/24/business/teslas-electric-vehicles-profit-price-cuts.html

[14]. Tesla. (n.d.). Current offers. Tesla Official Website. https: //www.tesla.com/current-offers

[15]. Lu, Z. (2025) An analysis of Tesla’s market position and future prospects. In: Proceedings of the 2025 International Conference on Financial Risk and Investment Management. Advances in Economics, Business and Management Research, 333, 919-928. https: //doi.org/10.2991/978-94-6463-748-9_100

[16]. Shi, M., Zhang, Y. and Zhu, C. (2022) A review of factors affecting Tesla’s profitability. BCP Business & Management, 26, 18-24. https: //doi.org/10.54691/bcpbm.v26i.1821

[17]. Sharp, B., Dawes, J. and Victory, K. (2024) The market-based assets theory of brand competition. Journal of Retailing and Consumer Services, 76, 103566. https: //doi.org/10.1016/j.jretconser.2023.103566

[18]. Liu, H. and Li, Z. (2023) Analysis and recommendation of Tesla’s marketing strategy. In: Proceedings of the 2023 International Conference on Management Research and Economic Development. Advances in Economics, Management and Political Sciences, 25, 187-193. https: //doi.org/10.54254/2754-1169/25/20230496

[19]. Moons, I. and De Pelsmacker, P. (2016) The effect of evoked feelings and cognitions, parent brand fit, experiences and brand personality on the adoption intention of branded electric cars for early and late adopter segments. In: Verlegh, P., Voorveld, H. and Eisend, M. Springer Gabler, Wiesbaden, Advances in Advertising Research (Vol. VI), 395-406.

[20]. Sawhney, M. (2025) Tesla: branding strategies for new products. Northwestern Kellogg, Case Study, KE1368 (KE1368).

[21]. Shimul, A.S. (2022) Brand attachment: a review and future research. Journal of Brand Management, 29(4), 400-419. https: //doi.org/10.1057/s41262-022-00279-5

Cite this article

Du,X. (2025). Balancing Brand Growth with Financial Health: The Prospective Evolvement of Tesla’s Marketing Strategy. Advances in Economics, Management and Political Sciences,234,1-7.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2025 Symposium: Global Trends in Green Financial Innovation and Technology

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Tesla. (n.d.). About us. Tesla Official Website. https: //www.tesla.com/about

[2]. Liu, C., Boothman, S.G. and Graham, J.D. (2025) The rise and recent decline of Tesla’s share of the U.S. electric vehicle market. World Electric Vehicle Journal, 16(2), 90. https: //doi.org/10.3390/wevj16020090

[3]. Zhang, Z. (2025) An analysis of Tesla’s development and profitability. In: Proceedings of the 8th International Conference on Economic Management and Green Development. Advances in Economics, Management and Political Sciences, 131, 108-113. https: //doi.org/10.54254/2754-1169/2024.18426

[4]. Tesla. (2025). Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2024. Tesla, Inc. https: //www.sec.gov/Archives/edgar/data/1318605/000162828025003063/tsla-20241231.htm

[5]. Agarwal, V. and Bangeja, H. (2022) Analysing Tesla’s $0 marketing strategy. International Journal for Multidisciplinary Research, 4(6), 1-8. https: //doi.org/10.36948/ijfmr.2022.v04i06.1080

[6]. Li, Y. (2023) Analysis of Tesla’s marketing strategy model. In: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis. Advances in Economics, Management and Political Sciences, 54, 33-39. https: //doi.org/10.54254/2754-1169/54/20230873

[7]. Long, Z. et al. (2019) What does Tesla mean to car buyers? Exploring the role of automotive brand in perceptions of battery electric vehicles. Transportation Research Part A, 129, 185-204. https: //doi.org/10.1016/j.tra.2019.08.006

[8]. Teodorovic, M. (2015) Impact of sustainability on brand positioning and value. In: Stakic, A.J., Kovsca, V. and Bendekovic, J. (Editors). Varazdin Development and Entrepreneurship Agency, Varazdin, Croatia and University North, Koprivnica, Croatia, Megatrend University, Belgrade, Serbia, Economic and Social Development (Book of Proceedings), 5th Eastern European Economic and Social Development Conference on Social Responsibility, 291-300.

[9]. Aeternus. (2025). Driving innovation: Tesla’s marketing strategy and its impact on electric vehicle adoption. Aeternus Website. https: //www.aeternus.rs/driving-innovation-teslas-marketing-strategy-and-its-impact-on-electric-vehicle-adoption/

[10]. Tesla. (2022). Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2021. Tesla, Inc. https: //www.sec.gov/Archives/edgar/data/1318605/000095017022000796/tsla-20211231.htm

[11]. Tesla. (2023). Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2022. Tesla, Inc. https: //www.sec.gov/Archives/edgar/data/1318605/000095017023001409/tsla-20221231.htm

[12]. Tesla. (2024). Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2023. Tesla, Inc. https: //www.sec.gov/Archives/edgar/data/1318605/000162828024002390/tsla-20231231.htm

[13]. Ewing, J. (24 Jan 2024). Tesla profit from car sales falls as price cuts hurt. The New York Times. https: //www.nytimes.com/2024/01/24/business/teslas-electric-vehicles-profit-price-cuts.html

[14]. Tesla. (n.d.). Current offers. Tesla Official Website. https: //www.tesla.com/current-offers

[15]. Lu, Z. (2025) An analysis of Tesla’s market position and future prospects. In: Proceedings of the 2025 International Conference on Financial Risk and Investment Management. Advances in Economics, Business and Management Research, 333, 919-928. https: //doi.org/10.2991/978-94-6463-748-9_100

[16]. Shi, M., Zhang, Y. and Zhu, C. (2022) A review of factors affecting Tesla’s profitability. BCP Business & Management, 26, 18-24. https: //doi.org/10.54691/bcpbm.v26i.1821

[17]. Sharp, B., Dawes, J. and Victory, K. (2024) The market-based assets theory of brand competition. Journal of Retailing and Consumer Services, 76, 103566. https: //doi.org/10.1016/j.jretconser.2023.103566

[18]. Liu, H. and Li, Z. (2023) Analysis and recommendation of Tesla’s marketing strategy. In: Proceedings of the 2023 International Conference on Management Research and Economic Development. Advances in Economics, Management and Political Sciences, 25, 187-193. https: //doi.org/10.54254/2754-1169/25/20230496

[19]. Moons, I. and De Pelsmacker, P. (2016) The effect of evoked feelings and cognitions, parent brand fit, experiences and brand personality on the adoption intention of branded electric cars for early and late adopter segments. In: Verlegh, P., Voorveld, H. and Eisend, M. Springer Gabler, Wiesbaden, Advances in Advertising Research (Vol. VI), 395-406.

[20]. Sawhney, M. (2025) Tesla: branding strategies for new products. Northwestern Kellogg, Case Study, KE1368 (KE1368).

[21]. Shimul, A.S. (2022) Brand attachment: a review and future research. Journal of Brand Management, 29(4), 400-419. https: //doi.org/10.1057/s41262-022-00279-5