1.Introduction

The signing of the "Plaza Agreement" in September 1985 was the beginning of a short-lived policy coordination between Japan, the Federal Republic of Germany, the United States, France, and the United Kingdom to solve the problem of the United States' huge trade deficit.[1] From September 1985 to the spring of 1987, Japan implemented loose monetary policy and fiscal stimulus measures in response to the recession caused by the yen's fast rise following the Plaza Agreement, which led to the formation of asset price bubbles and ultimately the early 1990s. The collapse triggered Japan's economic recession. Between January 1986 and February 1987, the Bank of Japan decreased the official discount rate five times for a total of 2.5 percentage points. The third reduction in the official discount rate was preceded by statements from policy committee chairs that made it clear that lowering the discount rate expanded domestic demand and reduced the current account surplus. This approach did not conflict with the central bank's basic objective of achieving price stability and it has largely constrained the implementation of the BOJ's monetary policy. Between the spring of 1987 and the spring of 1989, although the BOJ searched for the right time to tighten monetary policy, the policy shift was not easy. Consequently, the official discount rate that was the lowest at the time was sustained for an extended duration. The BOJ eventually changed its policy course to monetary tightening in the spring of 1989. To test if Japan’s monetary policy was at an ideal level, we can use a testing tool called Taylor rule. The statement of Taylor rule [2] is:

(1)

The inflation objective ( *) is assumed to be 2 percent, the output gap is measured as a percentage deviation of real GDP (yt) from a measure of potential output (yt *), and inflation (πt) is measured by the four-quarter growth rate of a price index where the implied nominal federal funds rate is denoted. We pay particular attention to the Taylor (1993) rule, where "a" and "b" both equal 0.5.

By transforming the expression of Taylor's rule, the estimation result can be expanded: Japan's monetary policy is inelastic to variates in the inflation rate, and the elasticity coefficient of its interest rate in relation to variations in inflation is only 0.66[3]. This coefficient means that the Japanese economy is in trouble with the monetary policy being too loose, too low interest rates, and serious asset bubbles.

Amidst the rising stock prices and the advancement of financial deregulation, bank borrowing and capital market financing experienced significant increases throughout the bubble era[4]. Consequently, about 1988, the finance of the household and business sectors began to rise quickly.

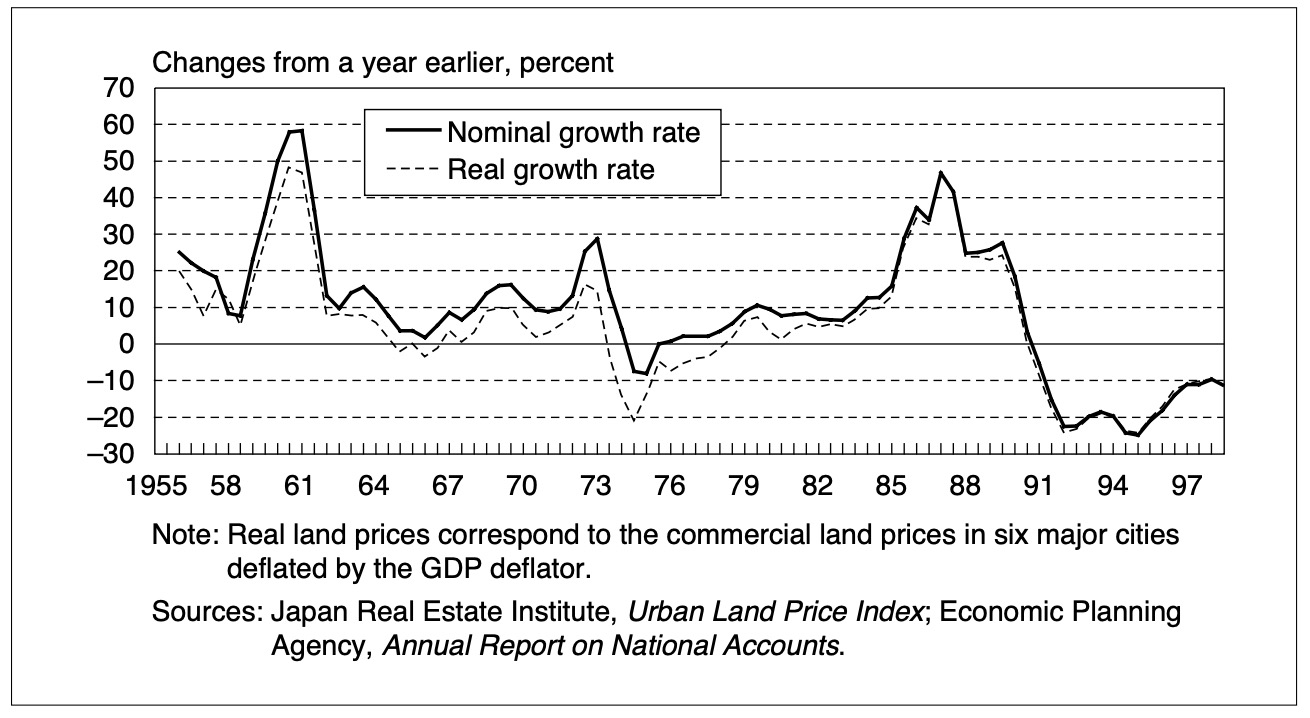

From 1986, the Nikkei 225 Index rose at an accelerated pace and reached a peak of ¥38,915 at the end of 1989. The Nikkei 225 Index rose to ¥14,309 in August 1992, more than 60% below its peak. Subsequently, stock prices plummeted to ¥14,309 in August 1992. As a matter of fact, asset values started rising around 1983, and they really picked up speed about 1986. Rising land prices have been accompanied by rising stock prices, so land prices in Japan have risen sharply many times since the end of World War II, but with a time lag.[5].

However, as Figure 1 shows, the growth rate adjusted for inflation as well as the length of the climb were at their highest during the bubble period since data started to become accessible in the mid-1950s. With respect to changes in asset values, capital gains from stocks and land together accounted for 452% of nominal GDP during the 1986–1989 decade—a significantly bigger proportion than the 193% during the 1972–1973 period—while capital losses during the 1990–1993 period were 159% of nominal GDP. In addition, the household sector's investment in housing and spending on consumer durables increased significantly.

Figure 1: Real Land Prices: The fluctuations in nominal interest rate and real growth rate are the same, and the fluctuation is the largest during the period from 1985 to 1992.

2.The Causes of The Housing Bubble

Firstly, from the perspective of global trends, the oil crisis broke out in the early 1970s. Japan, which was overly dependent on oil imports, was hit hard by the crisis and its economy fell into a stagflation stage. The long-term economic downturn after the crisis has forced the Japanese government to move closer to the field of new energy innovation. However, due to the long-term sluggish domestic demand, output was not optimistic, so the Japanese government adjusted from a model of stimulating economic growth through domestic investment to one that focuses on exports. economic model and vigorously develop resource-saving, energy-saving and knowledge-intensive industries. In contrast, this crisis brought high inflation to the United States. The foreign exchange rate of the US dollar increased as a result of the government adopted tightening monetary policies and. The impact of Japan's export industry on the United States increased the trade surplus for Japan from the United States, and the trade friction between the two countries became increasingly serious.[6] Due to the imbalance in trade, the American manufacturing industry was increasingly depressed. To save the situation, many manufacturing tycoons and members of Congress strongly demanded that the government to implement intervention in the external market to curb the pressure of yen appreciation brought about by the high economic development. In this context, in the early 1980s, the "Plaza Agreement" was signed by the US, Japan, the Federal Republic of Germany, France and the UK. In the following 10 years, the value of the yen rose by more than 5% per year on average. [7] The rise in the yen exchange rate brought a serious blow to Japan's exports, resulting in a decline in international competitiveness and a shrinking export volume.

Investment capital flows were one of the factors that create real estate bubbles.[8] As a result of the 1985 Plaza Agreement, which led to the depreciation of the US dollar against other major currencies, the rapid appreciation of the Japanese yen, the prolonged period of low interest rates, and the financial liberalization reformed, a large amount of investment capital poured into the real estate market.[9] In response to unfavorable international economic trends, Japan intends to implement an easing monetary policy. Monetary easing could facilitate funding for speculators by lowering the cost of financing. Large-scale investors often develop positions larger than their own financial resources, so when they trade a range of financial assets, they often require money to fill a settlement gap. The prolonged period of monetary loosing that throughout the second part of the 1980s lowered the cost of capital borrowing and thus facilitated the creation of such investment positions. The rise in equity prices, partly supported by easy monetary policy, lowered the cost of capital and facilitated capital market financing, including the issue of additional shares at market prices and convertible and warrant bonds. Because the value of land and stock holdings held by businesses grew due to rising land and equity prices, the financing capacity of firms by raising the collateral value of these assets.

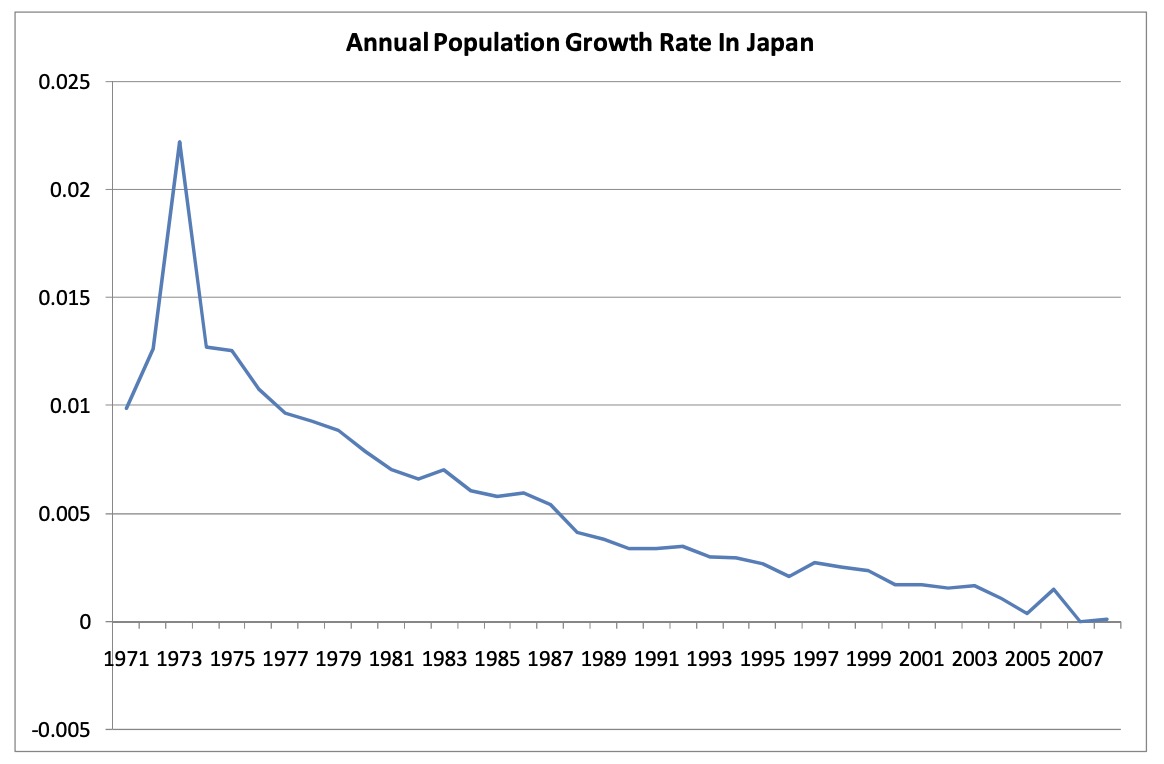

In addition, the population's aging was also one reason for accelerating the real estate bubble. Because if the land area remains unchanged, a decrease in population will lead to a decrease in land demand. As shown in Figure 2, Japan's population growth rate has been slowing since 1973.[10] The percentage of the population that is elderly is increasing due to population aging, while the proportion of young people in the population is declining, which will lead to a decline in the number of households in society. The demand for housing is weaker among the elderly, while young and middle-aged people are the main buyers. Therefore, against the background of an aging population, there is a decline in the demand for housing. Under the influence of Confucianism, Japanese people, especially the elderly, tend to be frugal. Therefore, at the beginning of the accelerated population aging, Japan also had obvious characteristics of high savings: from 1970 to 1977, Japan's national savings rate was ranked first among the world's major countries.[11] People have become much more savings-oriented and less motivated to consume, with a consequent reduction in the demand for homeownership.

Figure 2: Japan population growth rate: Between 1985 and 1991, Japan's population growth rate was low and leveled off.

3.Conclusion

Based on the analysis above, people can learn some lessons from this history.

First, risks in financial and macroeconomic instability build up during asset price booms and accumulate with the decline of asset price and funding.[12] In addition, the root cause of the collapse of the bubble economy was over-investment and over-borrowing. Therefore, during the period of central bank policy easing, we must monitor economic data more closely to prevent overheating in advance; when planning to implement easing policies, we must also carefully consider the intensity of easing, so that we can avoid a bubble economy to a certain extent.

Secondly, we need to strengthen regulation and risk management to prevent banks from falling into a crisis because banks provided a large number of loans to the real estate and stock markets during the bubble economy, but many of these loans eventually turned out to be non-performing loans. However, the positive effect of lowering interest rates can be effective, although this easing effect is offset by the negative effect of corporate and bank balance sheet deterioration.[13]

The collapse of a bank is likely to have a big impact on the market at one time. Ensuring that the bank does not fail can temporarily buy time for the policy to play out, but excessive protection of the bank will make investors too relaxed, which will backfire and increase the bubble.

References

[1]. Ito, T. (2015). The Plaza Agreement and Japan: Reflection on the 30th year Anniversary, James A. Baker III Institute for Public Policy of Rice University.

[2]. Taylor, J.B., 1993. Discretion versus policy rules in practice. Carnegie-Rochester Conference Series on Public Policy 39, 195–214.

[3]. Xu Q. (2015). Re-exploring the causes of Japan's economic bubble after the "Plaza Agreement"——A comparative analysis of Japan and Germany based on the Taylor rule. Journal of Japanese Studies (01), 109-125.

[4]. Okina, K., Shirakawa, M., & Shiratsuka, S. (2001). The asset price bubble and monetary policy: Japan’s experience in the late 1980s and the lessons. Monetary and Economic Studies (special edition), 19(2), 395-450.

[5]. Ito, T. (1994). Public policy and housing in Japan. In Housing markets in the United States and Japan (pp. 215-238). University of Chicago Press.

[6]. Li, J. (2014). Japan's economic recovery under the atmosphere of the Cold War. Journal of China University of Petroleum (Social Science Edition), 201-02

[7]. Chen, J. (2014). The impact of the Plaza Accord on the Japanese economy, China Finance.

[8]. Inamoto, Y., T. Hasegawa, T. Sudo & C. Shimizu (1995) “Chika Bubbles to Tochi Taisaku (Land price bubbles and land measures): 1985-1995,” University of Tokyo Institute of Social Science.

[9]. Kobayashi, M. (2016). The housing market and housing policies in Japan.

[10]. Kawaguchi, Y. (2009). Japan real estate crisis. Hong Kong Monetary Authority. Retrieved from Hong Kong Monetary Authority website: http://www.hkimr.org/uploads/conference_detail/465/con_paper_0_559_kawaguchi. pdf.

[11]. Chen, Y, Kuo, Y, Yao,Y. (2014). The impact of population aging on high savings in China. Financial Studies, 1, 71-84.

[12]. Jurgilas, M., & Lansing, K. J. (2013). Housing bubbles and expected returns to homeownership: Lessons and policy implications. Forthcoming in Property Prices and Real Estate Financing in a Turbulent World, M. Balling and J. Berg,(eds.).

[13]. Nagahata, Takashi and Toshitaka Sekine (2002). The effects of monetary policy on firm investment after the collapse of the asset price bubble: an investigation using Japanese micro data, Research and Statistics Department Working Paper, 02-3, Bank of Japan.

Cite this article

Tang,Y. (2024). Causes of Housing Bubble in Japan. Advances in Economics, Management and Political Sciences,74,288-292.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ito, T. (2015). The Plaza Agreement and Japan: Reflection on the 30th year Anniversary, James A. Baker III Institute for Public Policy of Rice University.

[2]. Taylor, J.B., 1993. Discretion versus policy rules in practice. Carnegie-Rochester Conference Series on Public Policy 39, 195–214.

[3]. Xu Q. (2015). Re-exploring the causes of Japan's economic bubble after the "Plaza Agreement"——A comparative analysis of Japan and Germany based on the Taylor rule. Journal of Japanese Studies (01), 109-125.

[4]. Okina, K., Shirakawa, M., & Shiratsuka, S. (2001). The asset price bubble and monetary policy: Japan’s experience in the late 1980s and the lessons. Monetary and Economic Studies (special edition), 19(2), 395-450.

[5]. Ito, T. (1994). Public policy and housing in Japan. In Housing markets in the United States and Japan (pp. 215-238). University of Chicago Press.

[6]. Li, J. (2014). Japan's economic recovery under the atmosphere of the Cold War. Journal of China University of Petroleum (Social Science Edition), 201-02

[7]. Chen, J. (2014). The impact of the Plaza Accord on the Japanese economy, China Finance.

[8]. Inamoto, Y., T. Hasegawa, T. Sudo & C. Shimizu (1995) “Chika Bubbles to Tochi Taisaku (Land price bubbles and land measures): 1985-1995,” University of Tokyo Institute of Social Science.

[9]. Kobayashi, M. (2016). The housing market and housing policies in Japan.

[10]. Kawaguchi, Y. (2009). Japan real estate crisis. Hong Kong Monetary Authority. Retrieved from Hong Kong Monetary Authority website: http://www.hkimr.org/uploads/conference_detail/465/con_paper_0_559_kawaguchi. pdf.

[11]. Chen, Y, Kuo, Y, Yao,Y. (2014). The impact of population aging on high savings in China. Financial Studies, 1, 71-84.

[12]. Jurgilas, M., & Lansing, K. J. (2013). Housing bubbles and expected returns to homeownership: Lessons and policy implications. Forthcoming in Property Prices and Real Estate Financing in a Turbulent World, M. Balling and J. Berg,(eds.).

[13]. Nagahata, Takashi and Toshitaka Sekine (2002). The effects of monetary policy on firm investment after the collapse of the asset price bubble: an investigation using Japanese micro data, Research and Statistics Department Working Paper, 02-3, Bank of Japan.